What is kyc compliance? A Quick Guide to Investor Verification

What is kyc compliance? A Quick Guide to Investor Verification

Discover what is kyc compliance and why it matters for real estate syndication. This guide covers steps, requirements, and tools for investor verification.

Domingo Valadez

Dec 25, 2025

Blog

Let's be blunt: before you take a dollar from an investor, you need to know exactly who you're getting into business with. That's the entire idea behind Know Your Customer (KYC) compliance.

Think of it as a mandatory financial background check. It's the process you use to verify an investor’s identity, making sure the capital coming into your deal is legitimate and not tied to illicit activities like money laundering or terrorism financing. It might feel like a hurdle, but it's really the foundational layer of security for your entire operation.

The Bedrock of Financial Trust and Security

For a real estate syndicator juggling millions in investor equity, a solid KYC process isn't just a "nice-to-have"—it's your first line of defense. It establishes trust from the very beginning by proving you’ve done your homework on every single person in the deal.

This protects you, your legitimate investors, and the integrity of your syndication. It goes beyond just checking a driver's license; it’s about understanding your investors and spotting potential risks before they can blow up a deal.

Why KYC Compliance Is Not Optional

Regulators are watching, and they aren't messing around. The penalties for getting this wrong are severe and getting worse. In the first half of 2025 alone, global fines for financial crime compliance failures skyrocketed by an incredible 417%, jumping from $238.6 million to $1.23 billion.

The bulk of those fines were for failures in Anti-Money Laundering (AML), KYC, and sanctions screening. You can read more about these enforcement trends in Fenergo's research.

The message from regulators is crystal clear: do your due diligence, or pay the price. For a syndicator, ignoring KYC isn't just a business risk; it's an existential threat. A single compliance failure can result in crippling fines and completely shatter the investor confidence you worked so hard to build.

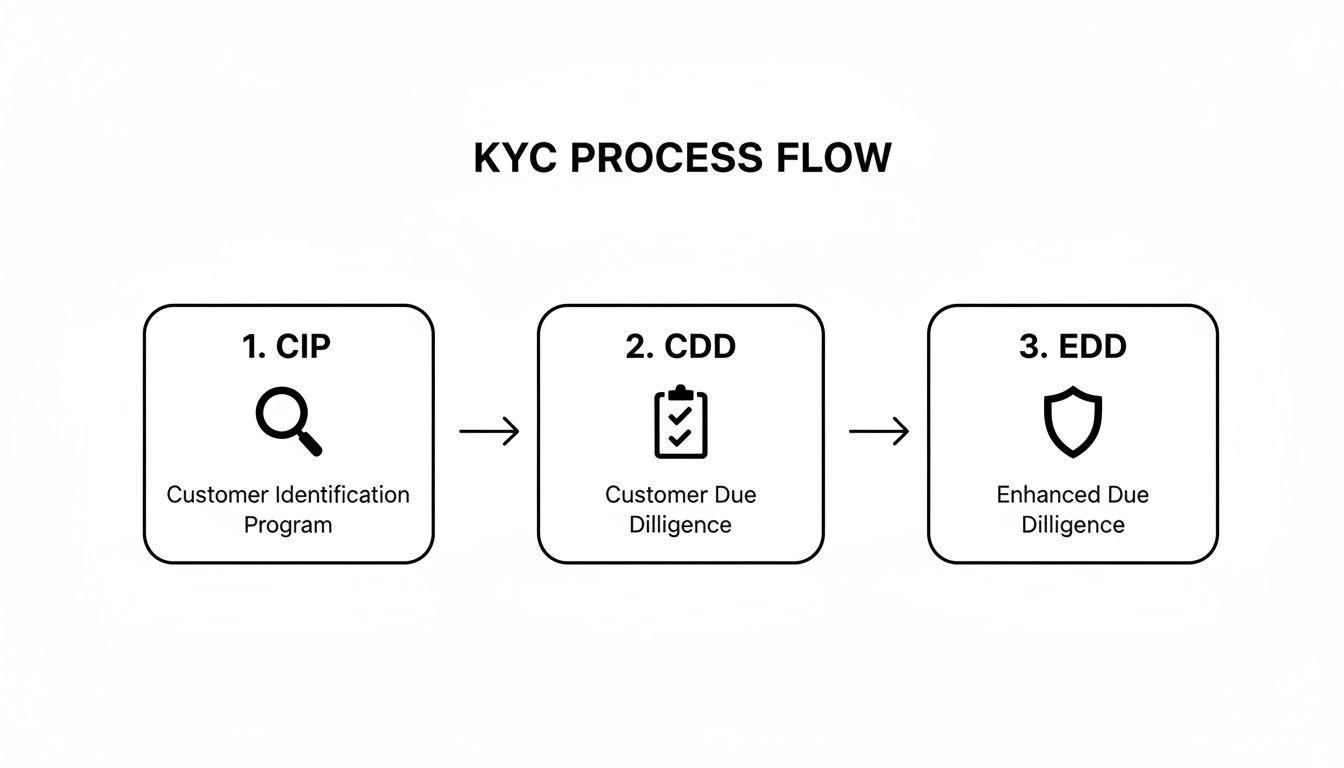

The Three Pillars of KYC Compliance

A truly effective KYC program isn't just a single action but a complete framework built on three core pillars. Each one handles a different part of the investor verification and monitoring process.

A solid KYC program isn’t a single checkbox but a continuous process. These three pillars work together to protect your business.

The Three Pillars of KYC Compliance

Getting these three pillars right is the key to building a compliant, resilient, and trustworthy real estate syndication business.

The High Stakes of KYC in Real Estate Syndication

It’s one thing to know the textbook definition of what is KYC compliance. It’s another thing entirely to grasp just how critical it is in the world of real estate syndication. In this game, where you’re pooling millions of dollars from all kinds of people, KYC isn’t just a regulatory hoop to jump through. It's the bedrock of a safe, successful deal.

Ignoring this step is a gamble that can bring your entire business crashing down. Think of it like building a skyscraper. Would you skip the foundational integrity checks just to save a little time? Of course not. In syndication, KYC is that same essential inspection for your capital stack.

Avoiding Catastrophic Financial Penalties

Let's get straight to the point: the penalties for non-compliance are real, and they can be business-ending. Regulators are cracking down hard across the board, and real estate is no longer flying under the radar. The trend is crystal clear—fines are getting bigger and more frequent.

Just look at the broader financial world for a preview. Since 2023, U.S. regulators have slapped companies with over $2 billion in penalties for sanctions violations alone, many of which came to light because of weak KYC checks. One slip-up, one investor you didn't properly vet, can trigger fines that vaporize a deal's profits and maybe your entire company along with it.

Key Takeaway: A weak KYC process is a massive financial liability waiting to happen. The cost of getting it right from the start is a tiny fraction of the penalty for getting it wrong.

And don't think this is just a problem for the big institutional players. Syndicators of every size are held to the same high standard. It’s no longer a matter of if you'll face scrutiny, but when.

Protecting Your Most Valuable Asset: Your Reputation

Even if you could stomach the fines, a KYC failure delivers a deeper, more lasting blow—it destroys your reputation. In real estate syndication, trust is the only currency that truly matters. Investors hand over huge sums of money based on their belief in you as the General Partner (GP).

A compliance breach broadcasts to the entire market that you’re either sloppy or, far worse, willing to play fast and loose with the rules. That perception is a death sentence.

- Investors Will Walk Away: High-net-worth individuals and family offices won’t touch a sponsor with a compliance black mark. A single incident can make it nearly impossible to raise money for your next deal.

- Partners and Lenders Will Back Out: Your reputation matters to banks, lenders, and JV partners. A spotty compliance history can lead to tougher lending terms or doors closing in your face.

- Bad News Travels Fast: Regulatory actions are public. That news will be attached to your name forever, branding you as a risky, unreliable operator.

Once that trust is gone, it’s almost impossible to get back. A solid KYC program is your best defense, proving you’re committed to running an ethical shop and protecting the long-term health of your business.

KYC as a Strategic Business Advantage

Instead of seeing KYC as a burden, the sharpest syndicators see it for what it is: a powerful strategic tool. A meticulous verification process does more than just keep you out of trouble; it actively strengthens your business and makes you more attractive to the best investors.

When done right, KYC acts as a quality filter. It ensures that only legitimate, credible investors are part of your deals, stopping questionable money from ever jeopardizing an acquisition or creating a legal nightmare later on. You know the capital you're accepting is clean.

This level of diligence sends a powerful signal to sophisticated investors that you run a tight, professional operation. It shows you're serious about protecting not just your own interests, but theirs, too. In the end, a rock-solid KYC process becomes a key differentiator, helping you attract and keep the best capital partners in a very competitive market.

Breaking Down the KYC Process for Syndicators

So, what exactly isKYC compliance? Forget the jargon for a moment. Think of it as a structured, multi-stage journey you take with every investor. This isn't about ticking a single box; it's a methodical way to verify who is bringing capital into your deal and why. Each step is like fitting a piece into a puzzle, giving you a clearer and more confident picture of your partners.

The process starts with the absolute basics—confirming someone is who they say they are—and then adds layers of diligence based on the investor's risk profile. It's designed to be thorough but not to create a wall of paperwork for every single person who wants to invest.

Let's walk through the essential stages you'll navigate.

The First Step: Customer Identification Program (CIP)

The Customer Identification Program, or CIP, is the foundation of your entire KYC effort. This is the "prove you are who you say you are" stage. Its goal is simple: collect and verify basic identifying information to establish, with reasonable certainty, that you know the true identity of your investor.

Imagine you're onboarding a new investor, Dr. Jane Smith. The CIP is where you gather her essential data. This isn't negotiable; you'll need:

- Her full legal name: It has to match what's on her government-issued ID.

- Date of birth: This helps confirm she's a unique individual.

- A residential address: It must be a physical location, not a P.O. Box.

- An identification number: Typically a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

A huge part of this is performing robust identity verification to check these documents against reliable, independent sources. You're not just collecting a scanned driver's license; you're confirming the document is legitimate and the information on it is accurate.

Moving On to Customer Due Diligence (CDD)

Once you've confirmed an investor's identity with CIP, you move to Customer Due Diligence (CDD). If CIP answers "who" an investor is, CDD helps you understand "what" their risk profile looks like. Here, you gather more information to get a sense of whether that investor could potentially be involved in financial crime.

For Dr. Smith, a straightforward individual investor, standard CDD is usually pretty simple. You'd want to understand the source of her investment funds and make sure her investment behavior seems normal for her profile.

But CDD gets more complicated when you're dealing with entities. Let's say another investor wants to commit funds through the "Smith Family Trust." Standard due diligence now requires you to understand the nature and purpose of that trust. You'll need to see its formation documents and get a clear picture of its activities to build a complete risk profile.

When to Kick It Up a Notch: Enhanced Due Diligence (EDD)

Sometimes, standard CDD just isn't enough. For investors who present a higher risk, you have to apply Enhanced Due Diligence (EDD). This is a much deeper, more intensive investigation reserved for situations where the potential for money laundering or other financial crimes is elevated.

What might trigger EDD?

- An investor who is based in a high-risk jurisdiction known for lax financial regulations.

- An investor identified as a Politically Exposed Person (PEP)—someone with a prominent public role that could make them a target for bribery or corruption.

- Unusually complex ownership structures that seem designed to hide the true source of funds.

If the "Smith Family Trust" happened to be based in a country on an international watchlist, you'd immediately escalate to EDD. This would mean scrutinizing the source of every dollar funding the trust and running deeper background checks on everyone involved.

Finding the Ultimate Beneficial Owner (UBO)

One of the most critical parts of due diligence, especially when working with entities, is identifying the Ultimate Beneficial Owner (UBO). A UBO is the actual person—the human being—who ultimately owns or controls an investment vehicle like an LLC or a trust. This rule exists to stop people from using shell companies to hide their identity.

For the "Smith Family Trust," you can't just stop with the trust's name. You have to dig deeper to find out which individuals truly benefit from it and control its decisions. This means identifying every trustee and beneficiary who owns 25% or more of the entity.

This focus on beneficial ownership is part of a global push for greater transparency. Failing to identify the real person behind an entity is one of the most common—and most penalized—compliance failures.

The complexity of these rules is only growing. In fact, a staggering 85% of executives agree that compliance demands have become more complex over the past three years. What's more, 77% of firms report this regulatory maze has negatively impacted growth in five or more key areas. You can discover more insights about these compliance challenges from PwC. Mastering these stages isn't just about following rules; it's about navigating the modern investment world safely.

Your Step-By-Step Guide to Implementing KYC

Knowing the theory behind KYC is one thing, but actually putting a solid program in place is a completely different ballgame. A smart KYC implementation isn't about throwing up roadblocks for your investors. It’s about building a repeatable, common-sense system that protects your business, builds investor trust, and keeps deals moving forward without a hitch.

Think of it like a blueprint for vetting your capital partners. You wouldn't start a construction project without a detailed plan, and you shouldn't onboard investors without a clear, documented framework either. This guide breaks that process down into practical, actionable steps any syndicator can follow.

Create a Formal KYC Policy

Before you even ask for a single driver's license, your first move should be to write down your KYC policy. This document is your internal playbook. It clearly defines your commitment to compliance and lays out the exact procedures your team will follow. It doesn’t need to be a massive, novel-length document, but it must be clear, consistent, and built for your specific business.

A good policy should clearly outline:

- Your Risk-Based Approach: How will you sort investors into risk tiers (low, medium, high)? This could be based on their location, the complexity of their investing entity, or the size of their check.

- Required Documents: Make a definitive list of the paperwork you'll need for different types of investors, like individuals versus LLCs or trusts.

- Verification Steps: What, specifically, will you do to confirm the information you receive is legitimate?

- Record-Keeping Rules: Define how you'll securely store investor data and for how long. The standard is at least five years after the business relationship ends.

Putting this in writing ensures everyone on your team is on the same page. It creates a consistent, defensible paper trail of your compliance efforts if regulators ever come knocking.

The Core KYC Workflow In Action

This flowchart breaks down the fundamental steps of a KYC process. It shows how you move from basic identification to deeper due diligence when a situation calls for it.

As you can see, the process is designed to escalate. This ensures that higher-risk profiles get the extra scrutiny they need without creating unnecessary friction for every single investor.

Collect and Verify Investor Documents

This is where the rubber meets the road. Following the rules you set in your KYC policy, you'll start collecting specific documents from each investor to verify who they are and where they live. A well-organized system here is non-negotiable—otherwise, you'll drown in a chaotic sea of emails and attachments.

The required paperwork will naturally differ depending on whether your investor is an individual or a business entity.

Pro Tip: Insist on clear, unexpired, and fully legible copies of all documents. A blurry photo or an expired ID is an instant red flag. Politely reject it and wait for a valid replacement.

When you're dealing with capital from overseas, the game gets a bit more complex. International entity structures can be intricate and require an extra layer of diligence. For those navigating this, some great resources exist for successfully navigating KYC for offshore entities that can provide much-needed clarity.

A simple checklist can help keep your document collection process organized and consistent for every investor you onboard.

KYC Document Verification Checklist for Syndicators

This table provides a starting point. Your final list should always align with your formal KYC policy and risk assessment for each investor.

Identifying Red Flags During Onboarding

A huge part of your KYC process isn't just checking boxes—it's knowing what to look for. Bad actors are experts at finding and exploiting weak onboarding procedures. Training your team to spot the warning signs is one of your most critical lines of defense.

Here are some common red flags to keep an eye out for:

- Inconsistent Information: The name on their ID doesn't quite match the name on the subscription agreement. Maybe the address they provided is a P.O. Box or a mail drop service, not a real residence.

- Reluctance to Provide Documents: If an investor stalls, makes excuses, or pushes back when asked for standard ID, it should immediately raise your eyebrows.

- Complex and Opaque Ownership: You see an LLC owned by a trust, which is then owned by another offshore entity. If it feels like a Russian nesting doll designed to hide who the real owner is, it probably is.

- Unusual Funding Sources: An investor wants to fund a $250,000 commitment with five separate $50,000 wire transfers from different, unrelated bank accounts.

- Location in High-Risk Jurisdictions: The investor or their funds are coming from a country known for weak anti-money laundering regulations or a high level of corruption.

Spotting one of these doesn't automatically mean you've found a criminal mastermind. But it absolutely means you need to hit pause and dig deeper with enhanced due diligence. Make sure you document every red flag and every step you took to investigate it. A strong process gives you the confidence to turn away suspicious capital, protecting your deal, your reputation, and your other investors.

Using Technology to Simplify Investor Onboarding

For too long, investor onboarding has been a messy, manual grind. We’ve all been there—endless email chains chasing down documents, the quiet panic of managing sensitive data in insecure spreadsheets, and the sheer hours burned on administrative busywork.

This old way of doing things isn't just clunky; it's a major operational bottleneck that slows down deals and introduces risks you can't afford.

Manual KYC compliance is a recipe for headaches. Every single step, from collecting a driver’s license to checking an investor’s name against a government watchlist, is a potential point of failure. This approach drains your most valuable resource: time that could be spent finding your next great asset or strengthening investor relationships.

Thankfully, the era of paperwork and spreadsheets is fading fast. Modern technology offers a much smarter way to handle this critical compliance task, turning a dreaded chore into a smooth, integrated part of your workflow.

The Shift to Automated KYC Verification

The real solution is found in specialized platforms that build KYC checks directly into the digital subscription process. Instead of treating verification as a separate, disjointed step, these tools make it a natural part of the investor’s journey.

It’s a huge win-win. For the investor, it’s a seamless, professional experience. For you, the syndicator, it’s a massive operational relief.

This automation is powered by a booming sector known as Regulatory Technology, or "RegTech." The growth here is a direct response to rising compliance demands. In fact, global spending on AML and KYC services is projected to hit a record $2.9 billion in 2025. You can discover more insights about this rapidly growing market from Traders Magazine. This investment is fueling tools that bring top-tier compliance within reach for syndicators of all sizes.

By bringing in the right tech, you can finally replace that clunky old process with a secure, efficient system that closes deals faster.

Core Benefits of a Tech-Driven Approach

Moving to a modern KYC platform is about more than just convenience. It brings real, tangible benefits that strengthen your entire operation and make your syndication far more attractive to investors. A quick look at the advantages makes it clear why manual methods are becoming obsolete.

- Enhanced Security and Accuracy: Automated systems can cross-reference investor data against thousands of global watchlists, sanctions lists, and databases of Politically Exposed Persons (PEPs) in seconds. That’s a job no human could do reliably. It cuts down on human error and delivers a much higher level of accuracy.

- A Clear and Defensible Audit Trail: If regulators ever come knocking, a technology platform gives you a clean, time-stamped digital record of every single verification step. This creates a rock-solid audit trail that proves you’ve done your due diligence.

- Significant Time Savings: Automating document collection, verification, and storage can literally save you hundreds of hours per deal. That’s time you and your team can now spend on high-value activities, like asset management and investor relations, instead of chasing paperwork.

- An Improved Investor Experience: A smooth, digital onboarding process signals professionalism and competence. It makes a fantastic first impression and builds confidence from day one, showing investors you run a modern, well-managed operation.

The right technology doesn’t just solve a compliance problem; it creates a competitive advantage. It allows you to operate with the efficiency and security of a large institution, regardless of your team's size.

Platforms like Homebase are built from the ground up to solve these exact challenges. They bring everything from initial document uploads and e-signatures to comprehensive background checks into one unified portal. Exploring the features of a dedicated KYC verification software can show you just how much these tools can streamline the fundraising lifecycle.

Ultimately, the goal is to let you focus on what you do best—finding and managing great real estate—while the technology handles the complexities of compliance.

Common Questions About KYC in Real Estate

Let's be honest—you're a real estate syndicator because you're great at finding deals and managing properties, not because you love navigating the maze of financial regulations. So, it’s completely normal to have questions about what is KYC compliance and how it actually impacts your day-to-day work.

We get these questions all the time. Here are some of the most common ones we hear from syndicators, answered in a way that’s clear, direct, and focused on what you’ll face when raising capital for your next deal.

Does KYC Apply to Every Single Investor?

Yes. Full stop. You should be running KYC checks on every single investor, no matter how small their check is. Think of it as a non-negotiable best practice that protects the integrity of your entire deal and aligns with broader Anti-Money Laundering (AML) rules.

Now, the level of scrutiny might vary. A simple investment from a local individual won't require the same deep dive as a complex international trust. But the basic step of verifying who they are? That’s universal. A consistent process not only prepares you for any regulatory questions but also shows your investors you run a tight, professional operation.

What Is the Difference Between KYC and Accreditation?

This is a big one, and it's where a lot of people get tripped up. KYC and investor accreditation are two different, but equally critical, verification steps. They are not interchangeable.

- KYC answers the question: "Who are you?" The goal is to verify an investor’s identity and make sure they aren’t on a watchlist for financial crimes like money laundering.

- Accreditation answers the question: "Are you financially qualified to invest in this deal?" This is about confirming an investor meets the SEC's income or net worth requirements.

If you're raising capital under a 506(c) offering, you have to verify accreditation status. Both checks are vital parts of a compliant onboarding process—think of them as two sides of the same compliance coin.

How Long Should I Keep KYC Records?

The Bank Secrecy Act (BSA) is very clear on this: you need to securely store all investor identity verification documents for at least five years after the business relationship is over. In real estate, that means five years from the day an investor is fully paid out and exited from the deal.

And just stuffing documents into a filing cabinet won't cut it. You have to keep them organized and secure. Using a centralized digital platform is the best way to manage these records properly over the life of the investment and create an audit trail you can rely on.

Losing these records or having a messy system can be seen as a major compliance failure, so having a solid record-keeping plan is non-negotiable.

Can I Do KYC Checks Myself or Do I Need a Service?

Trying to handle KYC checks manually to save a few bucks might seem tempting, but it’s an incredibly risky and difficult path. You'd have to personally verify documents and cross-reference them against global watchlists—a nearly impossible task to do correctly, and one that leaves you with all the liability.

Using a trusted third-party KYC service or a platform with built-in tools is the only practical way to go. Here’s why:

- Accuracy and Scope: Automated services can scan thousands of global databases, sanctions lists, and lists of Politically Exposed Persons (PEPs) in a matter of seconds.

- A Defensible Audit Trail: These services give you a time-stamped, digital record of your verification efforts. If anyone ever asks, you have a defensible paper trail to protect your business.

- Efficiency: Automating this frees you from chasing down paperwork so you can spend your time on what you do best—raising capital and managing your assets.

Going it alone exposes you to too much risk and is a massive time-drain. Technology gives you stronger compliance and a much smoother, more professional experience for your investors.

At Homebase, we built automated KYC and accreditation checks right into our platform, turning a huge compliance headache into a seamless part of investor onboarding. You can finally stop wrestling with spreadsheets and messy email threads. Our all-in-one portal helps you raise capital faster while ensuring every deal is secure and compliant. Learn how Homebase can streamline your entire syndication process.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.