A Syndicator's Guide to the Sales Comparison Approach

A Syndicator's Guide to the Sales Comparison Approach

Master the sales comparison approach in real estate syndication. Learn to find comps, make data-driven adjustments, and build investor confidence.

Domingo Valadez

Feb 19, 2026

Blog

At its core, the sales comparison approach is all about figuring out what a property is worth by looking at what similar properties nearby have recently sold for. It's a valuation method grounded in a simple, real-world idea: a property's value is directly tied to what other buyers in the market were willing to pay for something just like it.

This approach is one of the most trusted and easy-to-understand commercial property valuation methods because it mirrors how we make decisions every day.

Decoding the Sales Comparison Approach

Imagine you’re shopping for a used car. You wouldn't just accept the first price you see. You'd research what similar models with comparable mileage and features have sold for recently. The sales comparison approach applies that same common-sense logic to real estate, giving you a clear, market-driven picture of a property's value.

The whole method is built on a foundational economic idea known as the principle of substitution. It’s a straightforward but powerful concept.

The principle of substitution states that a knowledgeable buyer will not pay more for a property than the cost of acquiring a similar substitute property with the same utility and desirability.

Put simply, if two nearly identical apartment buildings are for sale, a smart investor will naturally go for the one with the lower price tag. This principle is what makes the sales comparison approach work, keeping valuations firmly tethered to actual market transactions and buyer behavior.

Why This Method Matters for Syndicators

For real estate syndicators, this isn't just another box to check for the appraiser. It's a critical tool for building credibility and trust with investors. While other valuation methods focus on a property's potential income, the sales comparison approach provides an essential reality check.

It answers the one question every investor has: "Is our purchase price fair and in line with what others are paying for similar assets right now?" This market validation is non-negotiable for a few key reasons:

- Defensibility: Your valuation is backed by hard data from actual closed sales, making it easy to justify your numbers to investors and lenders.

- Market Insight: Digging into comps reveals current market trends, what investors are thinking, and where the real demand is in a submarket.

- Risk Mitigation: It’s your best defense against overpaying for an asset—one of the biggest risks in any real estate syndication.

Of course, the method is only as good as the data you use. Real estate markets move fast, so your "comps" need to be as recent as possible. Using old data is a surefire way to get your valuation wrong.

For a deeper look at the method, from picking the right comps to making adjustments, this guide on Mastering the Sales Comparison Approach is an excellent resource.

How to Find and Select the Right Comps

The entire sales comparison approach lives and dies by the quality of your comparable properties—your "comps." Think of yourself as a detective building a case for your property's value. The better your evidence (the comps), the stronger and more believable your conclusion will be. This means you have to be methodical, finding recently sold properties that are as close a match to yours as possible.

This process is definitely part art, part science. You need access to solid data, sure, but you also need the experience to know which properties are truly comparable and which ones just look similar on the surface. If you get this step wrong, your entire valuation will be skewed, and you’ll lose credibility with investors before you even start talking numbers.

Sourcing High-Quality Comp Data

First things first: where do you actually find reliable sales data? A quick Google search might give you a few breadcrumbs, but for a professional-grade analysis, you need to dig deeper. Seasoned syndicators almost always use a mix of public records and paid databases to get the full story.

Here are the go-to sources:

- Multiple Listing Service (MLS): Don't dismiss it just because it's known for residential. The MLS is a treasure trove for smaller multifamily deals and provides a huge volume of recent sales data.

- Public Records: County tax assessor and recorder offices are your source for ground-truth information. This is where you can verify sales prices, dates, and basic property details straight from the official source.

Remember, no single source is perfect. The best practice is to pull data from several places and cross-reference them. This helps you confirm the details, spot inconsistencies, and build your analysis on a rock-solid foundation.

Defining a Truly Comparable Property

Once you have the data flowing in, the real work begins. A "good" comp is so much more than just a similar-looking building down the street. It has to check several crucial boxes to be considered a legitimate substitute for your property. The goal is always to find an apples-to-apples comparison that keeps your later adjustments to a minimum.

The Sales Comparison Approach has become the leading valuation method in real estate, relied upon by professionals for its direct, market-based logic. Its accuracy is greatly improved when comps are in the same neighborhood, as location has a substantial impact on value. Typically, a credible valuation requires analyzing at least three recently sold comparable properties. You can explore more about this fundamental evaluation process in real estate to refine your own analysis.

This really drives home why a strict filtering process is so important. You have to look past the superficial similarities and focus on the details that genuinely drive value in your market.

Key Criteria for Vetting Comps

As you sort through dozens of potential comps, use a consistent checklist to make sure you’re comparing like with like. This disciplined approach is what makes your final valuation defensible when you present it to investors, partners, and lenders.

Here are the non-negotiable filters every comp must pass through:

- Date of Sale: Markets are dynamic. A sale from two years ago might as well be from another era. You have to prioritize sales from the last 6 to 12 months to get a true pulse on current values.

- Location and Submarket: A property five miles away is practically in another world if it’s across a major highway or in a different school district. The economic drivers can be completely different. Stick to the exact same submarket whenever you can.

- Property Class: You can't compare a brand-new, Class A luxury apartment building with your 1980s Class C value-add project. Their tenant profiles, rent potential, and operating costs are worlds apart.

- Unit Mix and Size: A building filled with one-bedroom units serves a totally different renter than one with mostly three-bedroom townhomes. Match the unit mix and average square footage as closely as possible.

- Deal Type: A sale of a stabilized asset at 95% occupancy is not a fair comparison for a distressed, half-empty building you’re buying to turn around. The circumstances of the sale matter—a lot.

The Art and Science of Making Adjustments

Once you've zeroed in on your comparable properties, the real detective work starts. It’s incredibly rare to find a comp that’s a perfect mirror image of your property. This is where adjustments come in—it's a critical process that blends hard data with experienced judgment to turn raw sales figures into a rock-solid valuation.

The whole point is to level the playing field, accounting for every meaningful difference between your building and the comps you’ve chosen.

Think of it like handicapping a horse race. You might have two similar horses, but one has a proven track record on a muddy field, and the other has a more experienced jockey. You’d adjust your expectations (and your bet) for each one based on those key differences. In the sales comparison approach, we do the exact same thing, making positive or negative tweaks to a comp's sale price to reflect how it truly stacks up against our property.

The Core Principle of Adjustments

The logic is simple but powerful. If a comparable property is better than yours in some way (say, it has a brand-new roof), you have to adjust its sale price downward. On the flip side, if the comp is inferior (maybe it's in a slightly less desirable part of the neighborhood), you adjust its price upward.

This process neutralizes the differences, giving you a much clearer picture of what that comp would have sold for if it were identical to your building.

Every adjustment tells a story. It's not just about subtracting $10,000 for an older roof; it's about proving how the market values that specific feature and using that data to justify your conclusion. This is what separates a wild guess from a professional valuation.

This methodical approach is absolutely essential for turning your observations into a defensible analysis, especially when you're presenting a deal to potential investors.

Common Adjustment Categories in Multifamily

When you're analyzing multifamily properties, most adjustments fall into a few key buckets. Thinking about them in categories helps you stay organized and ensures you don't miss anything important.

- Transactional Adjustments: These are all about the circumstances of the sale. Was it a distressed seller desperate to offload the property? Were the financing terms unusual? These things can easily skew a sale price.

- Timing Adjustments: Real estate markets are constantly moving. A building that sold six months ago probably doesn't reflect today's values. You have to account for market appreciation or depreciation.

- Locational Adjustments: Even properties on the same block can have meaningful differences. One might be on a quieter street or zoned for a better school district, which directly impacts its value.

- Physical Adjustments: This is the big one. It covers everything from the property’s age and condition to its specific unit mix, amenities (like a pool, gym, or in-unit laundry), and overall construction quality. You can see how these factors are applied across different property types to get a broader perspective.

Quantifying the Unquantifiable

Here’s where the "art" really meets the "science." How do you put a specific dollar value on each of these differences? While some adjustments are straightforward, others require a more nuanced touch. For instance, what’s the real value of a recently renovated lobby? It’s not just what it cost to build; it’s about how much more a buyer is willing to pay for a building with that modern, welcoming feature.

Analysts typically rely on a couple of trusted techniques to nail this down:

- Paired Sales Analysis: This is the gold standard. You find two comps that are identical in almost every way except for one single feature—for example, one has a pool, and the other doesn't. The difference in their final sale prices gives you a direct, market-backed value for that pool.

- Cost-Based Adjustments: When you can't find a perfect paired sale, you can fall back on this method. For things like a new roof or an HVAC system, you can use the depreciated cost of the feature as a pretty good proxy for its value.

Let's look at how this plays out in a simple adjustment matrix. This table gives you a clear, side-by-side view of how you might quantify these differences across several comps.

Sample Adjustment Matrix For A Multifamily Property

As you can see, the goal is to make adjustments to each comparable sale price to arrive at an "adjusted price" that reflects the value of the subject property. This methodical breakdown not only helps you reach a conclusion but also makes it easy to explain your reasoning to partners and investors.

Ultimately, every adjustment you make has to be backed by market evidence and sound logic. Without that justification, your valuation is just an opinion. When you ground every decision in data, you build a powerful, persuasive case for your property's value that builds confidence with everyone involved in the deal.

Valuing a Multifamily Property Step by Step

Okay, let's roll up our sleeves and put this into practice. Theory is great, but seeing the sales comparison approach in action with a real-world example is how you truly get a feel for it. We're going to walk through the valuation of a hypothetical multifamily property, step-by-step, to show you exactly how the moving parts—the adjustments and the final reconciliation—come together.

Think of this as a practical blueprint you can use for your own deals.

Setting the Stage: The Subject Property

First things first, let’s get acquainted with our subject property. This is the asset we’re trying to value, and it’s the benchmark against which every comparable sale will be measured.

- Property Name: The Sycamore Apartments

- Size: 50 units

- Unit Mix: 30 one-bedroom units, 20 two-bedroom units

- Age/Condition: Built in 1995. It’s in pretty good shape, but has some minor deferred maintenance that needs addressing.

- Location: Sits in a desirable submarket with good schools nearby.

- Amenities: Has a community pool but the fitness center is seriously outdated.

Our mission is to figure out what The Sycamore Apartments is worth today by looking at what similar properties have sold for recently.

Introducing the Comparable Properties

After digging through the data, we’ve pinpointed three solid comps. Each one is a little different, which is actually perfect for our analysis because it forces us to think critically about the adjustments.

- Comp 1 (The Oakwood): A 48-unit building that sold just last month for $5,000,000. It's in a similar area and condition but doesn't have a fitness center at all.

- Comp 2 (The Birchwood): A 55-unit building that traded six months ago for $5,600,000. It's a bit older (built in 1990) but it’s in a slightly better location, right next to a popular park.

- Comp 3 (The Redwood): A 50-unit building with an almost identical unit mix. It sold eight months ago for $4,800,000, but it had a ton of deferred maintenance, putting its condition a clear step below our property.

With our subject and comps lined up, it's time to get into the nitty-gritty of the adjustment process. This is the heart of the sales comparison approach—analyzing each comp, making smart, data-backed adjustments, and zeroing in on an indicated value for our property.

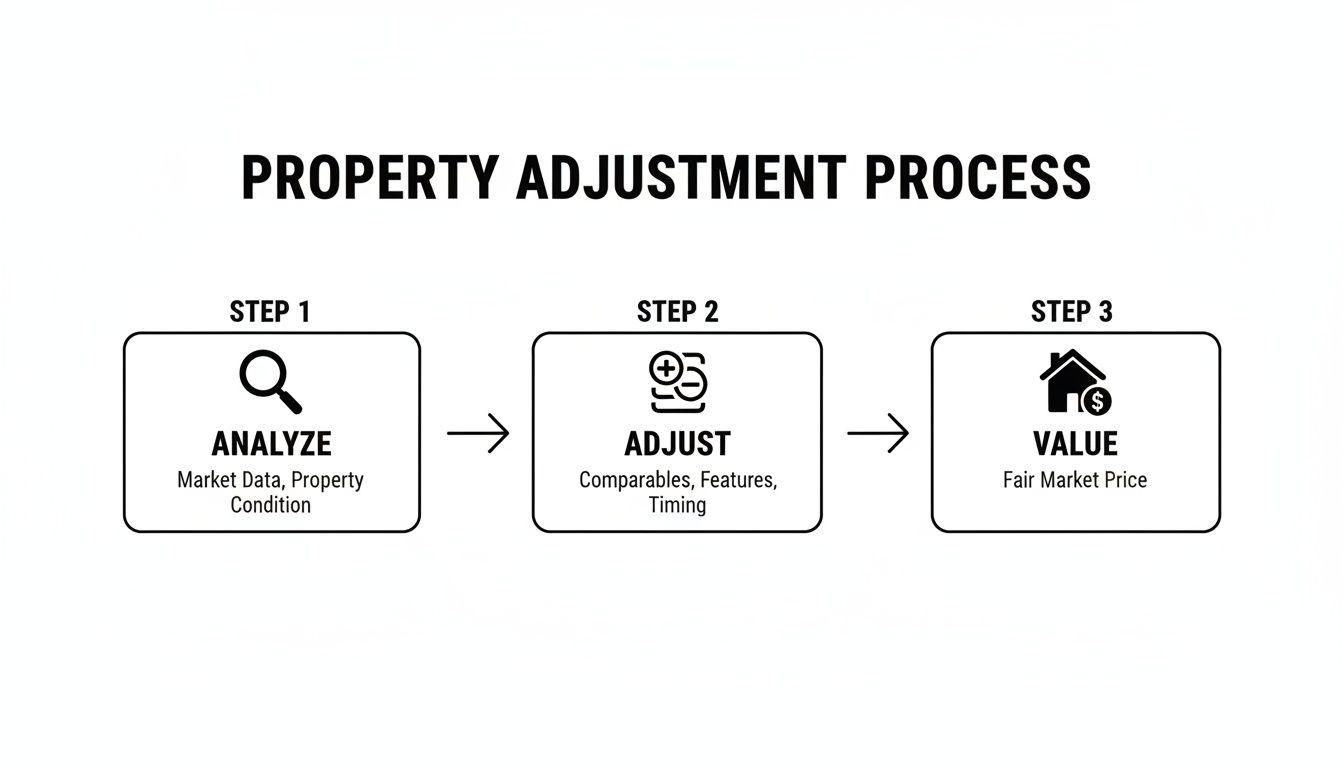

This flowchart nails the process we're about to follow: analyze, adjust, and then determine the final value.

Calculating the Adjustments

This is where we level the playing field. The goal is to adjust each comp’s sale price to estimate what it would have sold for if it were identical to our property, The Sycamore Apartments. We’ll use price per unit as our main metric to keep things consistent.

Analysis of Comp 1 (The Oakwood):

- Sale Price: $5,000,000 / 48 units = $104,167 per unit.

- Amenity Adjustment: The Oakwood has no fitness center. We’ve looked at other deals and found that a fitness center adds about $2,500 per unit in value. Since our property is better in this respect, we add that value back to the comp.

- Adjusted Price Per Unit: $104,167 + $2,500 = $106,667.

Analysis of Comp 2 (The Birchwood):

- Sale Price: $5,600,000 / 55 units = $101,818 per unit.

- Time Adjustment: The market has heated up since this sold. We’ve seen about 2% appreciation in the last six months, so we need to adjust the price up. ($101,818 * 1.02) = $103,854.

- Location Adjustment: That park-side spot is a real plus. Market data tells us this premium location is worth around $3,000 per unit. Since our property’s location isn’t quite as good, we have to adjust downward.

- Adjusted Price Per Unit: $103,854 - $3,000 = $100,854.

Analysis of Comp 3 (The Redwood):

- Sale Price: $4,800,000 / 50 units = $96,000 per unit.

- Time Adjustment: This sale was eight months ago. The market has climbed roughly 2.7% in that time, so we’ll bump the price up. ($96,000 * 1.027) = $98,592.

- Condition Adjustment: The Redwood was in rough shape. We estimate it would cost about $5,000 per unit to fix its deferred maintenance and bring it up to par with our property. So, we make a positive adjustment.

- Adjusted Price Per Unit: $98,592 + $5,000 = $103,592.

Reconciling to a Final Value

Now we have three different indicators of value: $106,667, $100,854, and $103,592 per unit. The last step is reconciliation, where we weigh the evidence from each comp to arrive at a single, final conclusion.

Reconciliation isn't just about taking a simple average. It’s an art as much as a science, where you give more weight to the comps you trust the most.

In this case, Comp 1 is our strongest indicator. It's the most recent sale and needed the smallest adjustment. Comp 3 is also quite strong because it's so similar in size and unit mix. Comp 2 is still useful, but the large location adjustment makes it a bit more subjective.

With that in mind, we'll lean most heavily on Comp 1. After weighing all three, we're comfortable concluding a final value of $105,000 per unit.

Final Value Estimate: 50 units * $105,000/unit = $5,250,000.

Of course, the sales comparison approach is just one tool in the toolbox. To get the full picture, investors need to be familiar with multiple valuation methods. To go deeper, learn more about how to value a commercial property and explore the income and cost approaches as well.

How to Present Comps to Build Investor Confidence

Your valuation is more than just a number in a spreadsheet. It's the story you tell investors to prove the purchase price makes sense. After all the hard work of finding comps and making adjustments, the final step is to present your analysis in a way that builds immediate credibility. A messy, confusing presentation can sink even the most solid sales comparison approach.

Investors are busy. They don’t have time to wade through a complex model or hunt for the information they need. Your job is to hand them a clean, professional summary that tells a clear and compelling story about the property's value. This is where you demonstrate your market expertise and underwriting discipline, turning your analysis into a powerful fundraising tool.

Crafting a Compelling Comps Summary

A great comps summary is both comprehensive and easy to scan. It should give investors everything they need to follow your logic without burying them in detail. The real goal is to anticipate their questions and answer them proactively with well-organized data.

A best-in-class summary should always include these key elements for each comparable property:

- High-Quality Photos: Give investors a visual feel for the properties you’re comparing. Exterior shots are a must, but images of amenities or common areas are even better.

- A Map of Comps: Show the geographic relationship between your property and the comps. A simple map instantly validates your claim that they are in the same submarket.

- Key Property Metrics: Present the essential data points in a simple table. This should always include the sale date, sale price, number of units, and the resulting price per unit.

- Narrative Justification: This is where you connect the dots. Briefly explain why you chose each comp and provide a clear rationale for your most significant adjustments.

Think of your presentation as a guided tour through your thought process. Don't just show the numbers; explain what they mean. A simple sentence like, "We adjusted Comp 2 upward by $5,000/unit because of its inferior condition, a figure based on contractor bids for similar repairs," builds immense trust.

This level of transparency proves you’ve done your homework and aren’t just pulling numbers out of thin air.

Using Technology to Boost Transparency

Manually building these summaries in PowerPoint or a PDF is a huge time sink, and the final product is static. Today, many syndicators are using platforms that plug this data directly into their investor portals, creating a much more dynamic and professional experience. This is where tools built specifically for real estate syndication can make a big difference.

Platforms like Homebase let you build a dedicated deal room where all this information lives. Instead of juggling email attachments, you give investors a single, secure link.

Here’s an example of how cleanly comps can be presented inside a professional deal room.

This layout makes it easy for investors to see everything at a glance—from photos and sale dates to price per unit—all in one organized view.

By centralizing your comps analysis, you not only save a ton of time but also create a far more transparent and engaging experience. Investors can access the data on their own terms, drill down into the details they care about, and come away feeling confident that your valuation is built on a solid, data-driven foundation. This level of professionalism substantiates your purchase price and helps you build the momentum you need to close your fundraise faster.

Common Pitfalls to Avoid in Your Analysis

Even the most seasoned investors can trip up when underwriting a new deal. On the surface, the sales comparison approach looks pretty simple, but a few common mistakes can completely derail your valuation and put an entire investment at risk. Knowing what these pitfalls are is the first step to building a rock-solid, defensible analysis.

One of the most common and costly errors is using old comps, especially when the market is moving quickly. A sale from twelve months ago might seem recent enough, but what if local values have shot up 10% since then? Suddenly, that comp is feeding you bad data. Your analysis will undervalue the property, and you might lose the deal by coming in with a low-ball offer that's not even in the same ballpark as reality.

Of course, the opposite is just as dangerous. In a market that’s starting to cool off, leaning on comps from six months ago can trick you into overpaying, setting your whole syndication up for a struggle from day one.

Mixing Apples and Oranges

Another classic mistake is comparing properties that aren't actually comparable. It can be incredibly tempting to use that brand-new, amenity-rich Class A building down the street as a comp for your Class C value-add project, especially if it just sold for a fantastic price. But this is a flawed comparison that will fall apart the second an investor or a lender looks at it.

Class A and Class C buildings are worlds apart. They attract different tenants, command wildly different rents, and operate on completely different expense structures. The prices they sell for reflect that. Using a much nicer property as a comp just gives you an inflated, fantasy valuation that has nothing to do with what your asset is actually worth.

A disciplined underwriting process is your best defense against emotional decision-making. By creating a standardized checklist for comp selection, you ensure every property is vetted against the same objective criteria, eliminating guesswork and strengthening your final analysis.

A methodical approach like this keeps you honest. It stops you from accidentally—or intentionally—cherry-picking the data that tells you what you want to hear instead of what the market is actually saying.

The Dangers of Unjustified Adjustments

Finally, a huge red flag is making adjustments without any real data to back them up. Every single adjustment you make, whether it’s for location, condition, or amenities, needs a clear, data-driven reason. You can't just say a property is in a "better" location and tack on $50,000 to its value.

You have to be ready to explain why it's better and show how you landed on that number. Did you run a paired sales analysis? Did you pull data showing a direct link between school ratings or crime rates and property values? Without that proof, your adjustments are just opinions, and they completely undermine the credibility of your valuation.

Here are a few pro tips to keep your analysis tight:

- Create a Standardized Checklist: Get your whole team on the same page with a clear set of criteria for picking comps. Your checklist should cover sale date, distance from the subject property, property class, and unit mix.

- Document Everything: For every adjustment, leave a note in your underwriting file explaining how you got to that number. This creates a paper trail and makes it easy to walk investors or lenders through your logic.

- Cross-Reference Your Value: Don't put all your eggs in one basket. Always sanity-check the value you get from the sales comparison approach against the income approach. If the two numbers are miles apart, it’s a major warning sign that you need to go back and check your assumptions.

Frequently Asked Questions

Even when you've got the basics down, putting the sales comparison approach into practice always brings up a few questions. Let's tackle some of the most common ones that pop up when you're deep in the underwriting trenches.

How Many Comps Are Truly Enough?

There's no single magic number, but the gold standard in the industry is to find at least three solid comparable sales. Think of this as the "rule of three." It gives you enough data to establish a reliable value range and helps prevent one oddball sale from throwing off your entire analysis.

But sometimes, three just isn't enough. If you're looking at a unique property or analyzing a market that's changing fast, you'll want to dig deeper. Expanding your search to five or more comps in these situations is a prudent move that builds a much more defensible valuation.

What if There Are No Recent Comps?

This happens all the time, especially if you're working in a smaller market or a specialized niche. Don't panic. When you can't find good comps from the last six months, you just need to widen your net methodically.

Here’s the typical progression:

- Widen the Timeframe: Start by pushing your search back from six months to nine, and then to twelve. Just remember, the older the sale, the more significant your time adjustment will need to be to account for market changes.

- Expand the Radius: If you're still coming up empty, gradually expand your geographic search into similar, nearby submarkets. Make sure these areas truly are comparable in terms of demographics and economic trends.

- Adjust for Property Type: This is your last resort. You might have to look at properties that are slightly different but still reasonably similar, but be prepared to make some significant and well-supported adjustments for those differences.

How to Weigh This Approach Against the Income Approach

For an income-producing asset like a multifamily property, the Income Approach is almost always the heavyweight champion. Investors are buying a future stream of cash flow, so what the property earns is paramount.

Think of the Sales Comparison Approach as your essential reality check. It confirms that the value you calculated based on income isn't out of sync with what other savvy buyers are actually paying for similar assets in the real world.

If your income-based value is way off from what the comps suggest, that’s a major red flag. It’s the market telling you to go back and double-check your assumptions.

Ready to streamline your underwriting and build investor confidence? Homebase provides all-in-one software for real estate syndicators to create professional deal rooms, manage investor relations, and accelerate fundraising. See how you can present your deals more effectively.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

The Ultimate Rent Roll Sample Guide for Real Estate Investors

Blog

Unlock property performance with our rent roll sample. Learn to analyze deals, verify income, and master real estate syndication with our expert guide.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.