A Guide to Real Estate Financial Modelling for Syndicators

A Guide to Real Estate Financial Modelling for Syndicators

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Domingo Valadez

Feb 21, 2026

Blog

At its core, real estate financial modelling is simply building a detailed spreadsheet to predict how a property investment will perform financially. The best way to think about it is like a flight simulator for a real estate deal.

It lets you test-drive your investment thesis, running through different economic scenarios and navigating potential turbulence before you put millions of dollars of capital at risk. It’s an absolutely essential tool for projecting cash flows, stress-testing your assumptions, and ultimately, making a smart, informed decision.

The Strategic Blueprint for Raising Capital

For a real estate syndicator, a solid financial model is so much more than just a bunch of numbers in a spreadsheet. It’s the foundational document that turns your vision for a property into a clear, bankable forecast. It has to work as both a sharp analytical tool for you and a powerful communication device for your partners.

The process is all about forecasting every dollar that will come in and go out over the entire life of the deal, usually a five to ten-year hold period. By meticulously mapping out everything from rental income and property taxes to loan payments and roof repairs, your model paints a detailed picture of the investment’s financial journey.

To make sure your model is built on solid ground, a good grasp of core financial principles is key. Concepts from financial planning and analysis (FP&A) provide the framework for ensuring your assumptions are realistic and defensible.

Why Modelling is Non-Negotiable

In today’s market, a thoughtfully built model is what separates the pros from the amateurs. It’s a direct reflection of your diligence, your expertise, and how well you truly understand both the asset and the submarket.

This level of sophistication is more important than ever. The global real estate market is projected to climb from USD 4.13 trillion in 2024 to a staggering USD 5.85 trillion by 2030. In a market that big and competitive, back-of-the-napkin math just won’t cut it.

A well-crafted model helps a syndicator accomplish several critical goals:

* Secure Financing: Lenders won’t even look at a deal without comprehensive financial projections. Your model is the proof that you have a viable plan to pay them back.

* Attract Investors: Your Limited Partners need to see a clear and credible path to their target returns. The model is how you tell the investment's story with numbers, justifying the projected IRR and equity multiple.

* Guide Decision-Making: Long after you close, the model serves as your roadmap. It helps you make crucial decisions on everything from leasing strategy and capital improvements to refinancing or timing the perfect exit.

The table below breaks down the essential roles a financial model plays in the day-to-day work of a syndicator.

Core Functions of a Financial Model in Syndication

Each of these functions relies on the model being a credible and accurate source of truth for the project.

A great real estate financial model doesn't just predict the future; it creates a framework for making it happen. It aligns the sponsor's strategy with lender requirements and investor expectations, forming the bedrock of a successful syndication.

Ultimately, mastering real estate financial modelling isn’t just a technical exercise. It’s a core competency for anyone serious about raising capital and managing properties successfully. It delivers the clarity and confidence you need to take a deal from a promising idea all the way to a profitable exit.

The Anatomy of a Powerful Real Estate Model

To really get your head around real estate financial modelling, you’ve got to pop the hood and see what’s inside. A solid model isn’t just a giant spreadsheet of numbers. It’s a dynamic machine with interconnected parts, each telling a piece of the investment story. Think of it like a car engine: the fuel injectors, pistons, and transmission all have to work in perfect harmony to move you forward.

Let’s break down the four core sections that make up pretty much every institutional-quality real estate model you'll ever come across.

Inputs and Assumptions: The Driver's Seat

This is ground zero. It’s the control panel where your entire investment thesis comes to life. As the sponsor, this is where you input every key projection and decision, setting the course for the entire forecast. These variables are the DNA of your model, flowing through every other tab to ultimately generate your returns.

There's one unbreakable rule here: garbage in, garbage out. If your assumptions are flawed, your forecast will be too, no matter how fancy your formulas are. This is where your deep market knowledge and meticulous due diligence really pay off.

Key inputs you'll always find here include:

* Property Details: The basics like square footage, unit mix, and the acquisition price.

* Income Assumptions: Current average rents, your projections for market rent growth, and other income streams like pet fees or parking.

* Expense Assumptions: The big ones like property taxes, insurance, and management fees, plus your assumed rate of expense inflation.

* Capital Expenditures (CapEx): Your budget for property upgrades, renovations, and major system replacements.

* Exit Assumptions: Your projected exit cap rate and estimated costs of sale.

A conservative assumption, like projecting 2% annual rent growth in a market that historically supports it, builds a far more defensible and trustworthy model than an aggressive 5% projection pulled from thin air. Your assumptions tell investors how realistic you're being.

Sources and Uses: The Funding Blueprint

Once you've laid out your assumptions, the Sources & Uses statement gives you a simple but powerful snapshot of how the deal is capitalized. It crisply answers two fundamental questions: "Where is all the money coming from?" (Sources) and "Where is all the money going?" (Uses).

This table is all about balance—total sources must equal total uses. It’s a clean, high-level summary that shows lenders and investors the exact funding structure at a glance.

A typical Sources & Uses table might look like this:

This simple chart provides a transparent overview of the entire capital stack needed to get the deal done.

Financing: The Deal Engine

The financing section is the engine room of your model. This is where you map out the debt, which is the fuel for most real estate acquisitions. The specifics you detail here—from interest rates to amortization—directly impact your cash flow and ultimate returns.

This part of the model nearly always includes an amortization schedule that calculates your principal and interest payments over the life of the loan. Getting this right is absolutely critical for calculating the Debt Service Coverage Ratio (DSCR), a key metric every lender lives and dies by.

Important inputs for this section include:

* Loan-to-Value (LTV) Ratio: The percentage of the property's value the bank is willing to lend.

* Interest Rate: The annual cost of borrowing the money.

* Amortization Period: How long the loan payments are spread out over (e.g., 30 years).

* Loan Term: The period before the loan matures and any balloon payment is due (e.g., 10 years).

Operating Pro Forma: The Detailed Itinerary

Finally, we get to the heart of the model: the operating pro forma. This is a detailed, year-by-year (sometimes even month-by-month) forecast of the property’s financial journey over your entire planned hold period.

This is where everything comes together. All your inputs and assumptions from the first tab feed into this section to create the investment story. It starts with Potential Gross Income, accounts for vacancy and credit loss, and then subtracts all operating expenses to land on the all-important Net Operating Income (NOI).

From there, it subtracts debt service and capital expenditures to calculate the property’s unlevered and levered cash flows. This detailed itinerary shows investors exactly how you expect the asset to perform, forming the foundation for every key return metric they care about.

Decoding the Metrics That Win Over Investors

A powerful real estate financial model is more than just a spreadsheet; it’s your primary storytelling tool. But to get investors excited, it needs to speak their language—the language of returns. The most elegant pro forma is worthless if it can’t clearly answer the one question every investor has: “What’s in it for me?”

This is where we translate your model’s number-crunching into the key performance indicators (KPIs) that make or break a capital raise. We'll ditch the dry definitions and frame each metric as a direct answer to a crucial investor question. This is how you build trust and get those commitments signed.

Proving the Property's Financial Health

Before investors even glance at their potential returns, they need to know the asset itself is solid. Two fundamental metrics, pulled straight from your operating pro forma, prove the property’s day-to-day viability.

- Net Operating Income (NOI): Think of NOI as the property's pure, unadulterated profit before you factor in any mortgage payments. You simply take all the income (rent, fees, etc.) and subtract all the operating expenses. NOI is the single most important number for judging a property's ability to generate cash from its core business.

- Debt Service Coverage Ratio (DSCR): This metric answers a critical question for both lenders and investors: "Can this property actually afford its mortgage?" You calculate it by dividing the NOI by the total annual mortgage payments. A DSCR of 1.25x or higher is a common floor for lenders, as it shows the property brings in 25% more cash than needed to cover its debt.

These two metrics lay the foundation. Once you’ve shown investors the asset can stand on its own two feet, their attention immediately pivots to what the deal means for their own pocketbook.

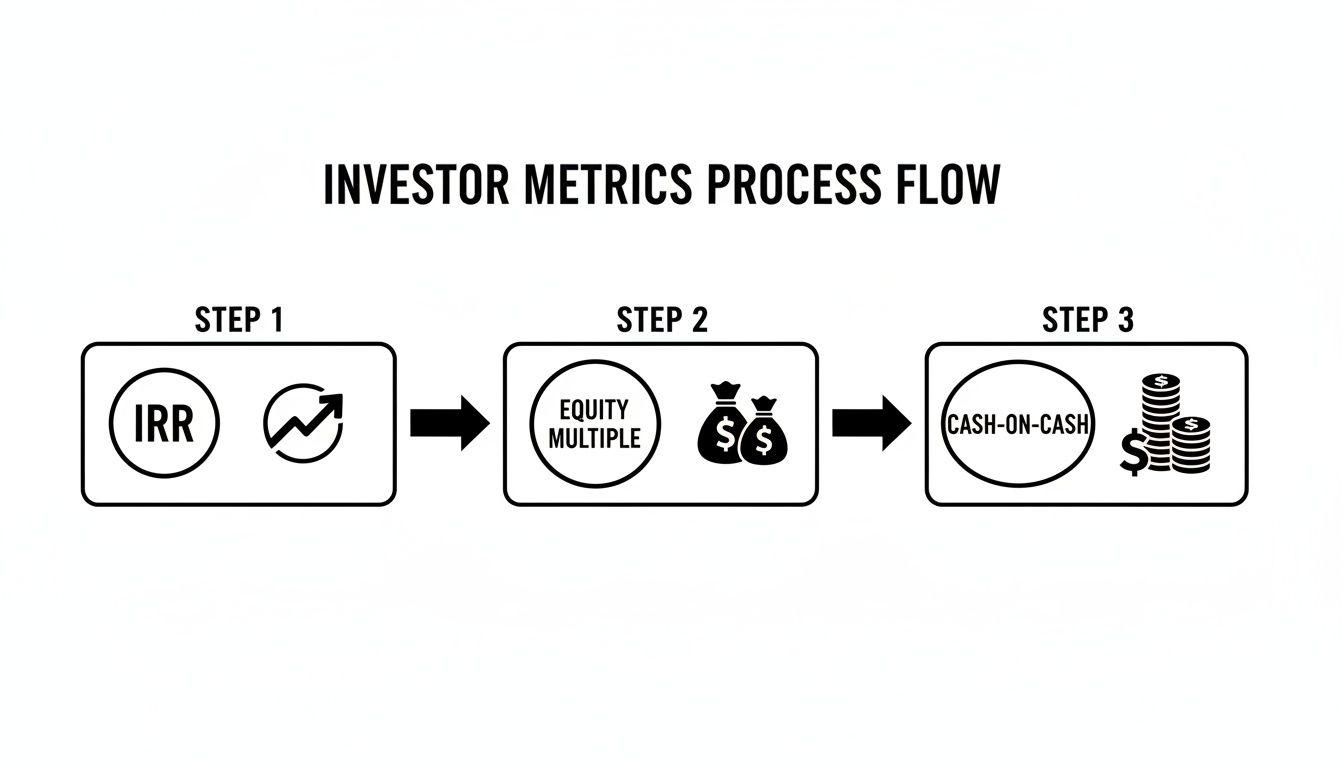

Answering the Ultimate Investor Questions

When sizing up a deal, seasoned investors are really just asking a few core questions. Your financial model's job is to provide clear, compelling answers using these essential metrics.

Investor Question #1: "How hard will my money be working each year?"

The Metric: Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is the classic, time-sensitive measure of an investment’s performance. It tells you the annualized rate of return, but its real power is in how it weights cash flows. A dollar you get back in year one is worth more than a dollar in year five, and IRR captures that nuance perfectly. It’s the go-to metric for comparing the profitability of different deals on an apples-to-apples basis.

A strong projected IRR shows that your deal is an efficient use of capital throughout the entire hold period.

Investor Question #2: "If I put in $100,000, what’s my total take-home at the end?"

The Metric: Equity Multiple (EM)

The Equity Multiple is beautifully straightforward. It tells an investor exactly how many times their original investment will be multiplied by the time the deal is done. If someone invests $100,000 and your model projects a 2.0x Equity Multiple, they know to expect $200,000 back in total (their $100,000 principal plus $100,000 in profit). While IRR is about the speed of returns, the Equity Multiple is all about the total magnitude.

Investor Question #3: "How much cash can I expect in my bank account each year?"

The Metric: Cash-on-Cash Return (CoC)

The Cash-on-Cash Return measures the annual cash distributions relative to the initial equity invested. You calculate it by dividing the annual pre-tax cash flow by the total cash invested. This metric is king for investors who are looking for consistent, predictable income during the hold period, not just a big payday when you sell.

The world of financial modeling has gotten incredibly complex. In fact, the complexity of models has tripled over the last decade, driven by market volatility and better analytical tools. For today's multifamily syndicators, this means stress-testing thousands of potential outcomes. An Accenture report from 2024 notes that 83% of models are now "rolling forecasts," allowing for nimble monthly adjustments. On top of that, 69% of REITs now rely on sophisticated cash flow waterfall models to navigate profit splits with various hurdles and promotes. This makes a rock-solid grasp of these metrics more critical than ever. Discover more insights about financial modeling trends on businessmodelling.au.

To help you keep these straight, here is a quick-reference table that breaks down the most important metrics at a glance.

Key Performance Indicators at a Glance

By framing your model’s outputs around these core metrics, you stop talking at your investors and start having a conversation with them. You directly address their biggest concerns, turning a complex spreadsheet into a clear and persuasive story they can get behind.

A Step-by-Step Workflow for Building Your Model

Staring at a blank spreadsheet can feel intimidating, but building a solid financial model is a lot more approachable when you break it down into a clear, repeatable process. Think of it less like writing a novel from scratch and more like assembling a piece of furniture with a good set of instructions.

A methodical workflow isn't just about avoiding errors; it’s about creating a model that’s logical, easy to follow, and can stand up to tough questions from investors. The whole process actually starts long before you even open Excel. It begins with data. The old saying ‘garbage in, garbage out’ is the golden rule here—your model is only as good as the information you put into it.

Stage 1: Gather Your Raw Materials

Before you can build anything, you need to collect all your components. This is the research phase, where you gather detailed data from reliable sources to form the bedrock of your assumptions. The goal is to ground every single input in reality, not wishful thinking.

Your data-gathering checklist should include:

- Property-Specific Data: Get your hands on the current rent roll and the last 12-24 months of operating statements (the T12 or T24). This historical data is your baseline.

- Market-Level Data: Dig into comparable rental rates, vacancy rates, and recent sales in the submarket. Services like CoStar or local broker reports are your best friends here.

- Financing Quotes: Talk to lenders and get current term sheets. This gives you real numbers for interest rates, LTV, and amortization schedules.

- Vendor Bids: If it’s a value-add project, get actual quotes from contractors for your planned capital improvements.

This upfront work is what separates a professional model from a back-of-the-napkin guess. It protects you from overly optimistic projections.

Stage 2: Construct the Model Architecture

With your data in hand, it’s time to structure your spreadsheet. A clean, organized layout is crucial for you and anyone else who looks at it. A messy, confusing model is an instant red flag for investors.

Here are a few best practices for structuring your model:

- Separate Tabs: Keep things neat by dedicating individual tabs for different components—one for ‘Assumptions,’ one for the ‘Pro Forma,’ one for ‘Sources & Uses,’ and so on.

- Color-Coding: Use a consistent color scheme to distinguish cell types. A common convention is blue for inputs (hard-coded numbers), black for formulas (calculations), and green for links to other sheets.

- Clear Labels: Label every single row and column. Someone should be able to open the file and understand what they're looking at without you having to explain it.

This clear separation and visual organization makes the model flow logically, from the core calculations to the key metrics that matter most.

As you can see, metrics like IRR, Equity Multiple, and Cash-on-Cash are the ultimate outputs of a well-built financial model—they're the finish line.

Stage 3: Input Assumptions and Build Forecasts

Now for the fun part. You start populating your structured model, beginning with the ‘Assumptions’ tab. This is where you translate all that diligent research into the concrete inputs that will drive the entire forecast.

For example, while industrial property values have shot up 250% since 2000, multifamily has seen a +226% increase in deal volume and a +241% jump in prices. You have to ground your rent growth projections in reality. Sticking to a 2-3% local average, rather than an inflated 4-5%, is what keeps your IRR projections credible over a typical 7-year hold. You can learn more about how historical data shapes commercial real estate trends on blog.corecastre.com.

Once your assumptions are locked in, you build out the operating pro forma. This is where you connect all the dots, creating a forecast that flows logically from one year to the next.

Pro Tip: Always build your model to be dynamic. This means linking your pro forma back to the assumptions tab. If you need to tweak your rent growth from 3% to 2.5%, you should only have to change it in one place, and the entire model should update automatically.

Finally, you construct the cash flow waterfalls and calculate the key return metrics. This is the payoff, where you see all your work translate into the IRR, equity multiple, and cash-on-cash returns that will ultimately help you pitch the deal to investors. Following a structured process like this is the best way to develop an accurate, professional-grade model. For those looking for a head start, you can explore our real estate pro forma template in Excel.

Common Modelling Pitfalls and How to Avoid Them

In real estate, your financial model is your flight plan. A single flawed assumption can send the entire projection off course, leading to a dangerously misleading forecast. Even the most complex spreadsheet will fall apart if it's built on a weak foundation.

I've seen it happen time and again. Knowing where syndicators typically go wrong is the first step to building a model that can stand up to scrutiny from the sharpest investors and lenders.

One of the most common traps is overly optimistic rent growth. It's easy to get caught up in the excitement of a booming market and pencil in aggressive, hockey-stick growth. But that rosy outlook often ignores the reality of market cycles and the potential for a downturn, setting a deal up for failure when the real world doesn't cooperate.

Another classic mistake is underfunding the Capital Expenditure (CapEx) budget. Many syndicators get laser-focused on the initial acquisition and renovation, but they forget to budget for the big-ticket replacements that are inevitably down the road. Forgetting to account for a new roof in year five or a property-wide HVAC overhaul can absolutely wreck your cash flow and turn a great deal into a money pit.

Hard-Coding Numbers and Ignoring Dynamic Formulas

A static model is a fragile model. One of the biggest technical mistakes I see is "hard-coding" key inputs directly into formulas. This is when an analyst types a number—like a 3% rent growth figure—right into a cell on the pro forma instead of linking to a centralized assumptions tab.

This creates a maintenance nightmare. If you need to tweak that assumption, you have to manually hunt down every single cell where you typed that number. It’s a recipe for human error. The professional standard is a dynamic model where all calculations flow from a single, clearly labeled assumptions tab.

A financial model should be a living document, not a static snapshot. Building it with dynamic links allows you to test scenarios instantly, making it a powerful tool for analysis rather than a brittle spreadsheet that breaks every time a variable changes.

Miscalculating Debt Service

You absolutely have to get the debt calculations right, yet errors here are surprisingly common. A simple mistake in an amortization formula or using the wrong interest rate can have massive ripple effects. This directly impacts your Debt Service Coverage Ratio (DSCR), which for most lenders is a non-negotiable, pass/fail metric.

So, how do you steer clear of these landmines? You build defensibility into your process.

- Underwrite Conservatively: Base your rent and expense growth assumptions on solid historical data and third-party market reports, not just a gut feeling.

- Get a Property Condition Report: During due diligence, hire a professional to inspect the property. This gives you a realistic, long-term CapEx budget. Don’t guess what a new boiler costs.

- Double-Check Your Formulas: Manually calculate the first few months of your loan amortization or expense inflation to make sure your Excel formulas are doing what you think they are. A quick spot-check can save you a world of hurt.

- Stress-Test Everything: Run sensitivity analyses on your most critical assumptions. What happens to the IRR if interest rates jump by 1%? What if vacancy spikes to 10%? A truly solid model holds up even when you poke holes in it.

By catching these common errors before they happen, your real estate financial modelling becomes a true asset—a reliable tool that builds investor confidence and helps you make smarter decisions.

Beyond the Spreadsheet to a Streamlined Workflow

A meticulously crafted financial model is the blueprint for a successful deal, but it’s not the finish line. Far from it. The real test for any syndicator is turning those compelling projections into a successful capital raise and, ultimately, a seamless, professional experience for every single investor.

This is where your work has to move beyond the spreadsheet. The goal is to bring your deal’s story to life. Instead of emailing messy Excel files and chasing down signed PDFs, modern syndication platforms handle the administrative grunt work. They let you present your model’s key findings in a secure, professional online deal room where investors can review documents, ask questions, and commit capital.

This shift from static analysis to active deal management is how you scale a syndication business.

From Model to Momentum

The moment an investor says "I'm in" based on your financial model, a whole new kind of work begins. An optimized workflow takes over, automating the tedious, error-prone tasks that can easily bog down a capital raise.

Think about what this looks like in practice:

- Automated Subscriptions: Investors can fill out subscription documents, complete accreditation checks, and sign electronically—all through a single, easy-to-use portal. No more printing, scanning, or overnighting packages.

- Centralized Communication: All investor updates, K-1s, performance reports, and important notices are sent from one place. This ensures everyone gets the same information at the same time, building trust and transparency.

- Effortless Distributions: When it's time to pay out returns, you can manage the calculations and execute ACH payments to all investors with just a few clicks. What used to take days now takes minutes.

A streamlined workflow does more than save time; it builds investor confidence. When every touchpoint, from the initial commitment to the first distribution, is handled professionally and efficiently, it reinforces the competence and diligence you demonstrated in your financial model.

Leveraging Technology for Growth

To truly move past juggling spreadsheets, it pays to explore software built for the job. For instance, understanding the capabilities of the best property management apps can dramatically improve your operational efficiency, which in turn feeds better, more accurate data into your financial model.

Ultimately, weaving technology into your syndication process is about reclaiming your most valuable resource: time. By letting a dedicated platform handle the repetitive administrative tasks, you free yourself up to focus on the high-value activities that actually grow your portfolio.

That means more time spent finding great deals, analyzing new opportunities, and building the strong investor relationships that are the lifeblood of this business. The model starts the conversation, but a great workflow closes the deal and keeps that relationship strong for years to come.

Frequently Asked Questions About Financial Modeling

Once you’ve got the basics down, you’ll find that the real world of financial modeling is full of nuances. Let's tackle some of the most common questions that pop up when syndicators start building their own models.

What's the Difference Between a T12 and a Pro Forma?

This is a classic one, and it's all about looking backward versus looking forward.

A T12, or Trailing 12-Month report, is a look in the rearview mirror. It shows you the property’s actual income and expenses over the last year, straight from the seller's books. Think of it as the property's financial report card—it shows you exactly how it has performed, warts and all.

A pro forma, on the other hand, is your look through the windshield. It's a forecast of how you expect the property to perform under your ownership. You'll use the T12 as your starting point, but then you'll layer in your own assumptions about things like rent growth, operational improvements, and market changes.

So, the T12 tells you where the property has been. The pro forma is your business plan that shows investors where you're going to take it.

How Do You Model a Value-Add Strategy?

Modeling a value-add deal is where things get interesting. You're not just projecting the status quo; you're building a financial story around a transformation.

It starts with a detailed Capital Expenditure (CapEx) budget. This isn't a back-of-the-napkin number; it’s a line-by-line plan for every renovation, outlining both the cost and the schedule. This CapEx budget becomes a major line item in the "Uses" section of your Sources & Uses table.

Next, you have to translate those improvements into dollars and cents on the income side. If you're renovating units, you'll project a "rent premium" for those upgraded apartments. You also have to be realistic and factor in the disruption—like a temporary spike in vacancy while units are offline for construction.

The golden rule for modeling a value-add plan is simple: every dollar you spend must be tied to a specific, measurable return. If you're budgeting $10,000 for a new kitchen, your model better show exactly how much extra rent you expect to get to justify that cost.

Which Assumptions Need the Most Stress-Testing?

Look, every assumption in your model matters. But some have way more leverage than others and can make or break a deal if you get them wrong. These are the numbers you absolutely have to beat up with sensitivity analysis.

Here are the big three that demand the most scrutiny:

- Exit Cap Rate: This is the heavyweight champion. A tiny tweak to your exit cap rate—even just a quarter of a percent—can create a massive swing in your final sale price, which directly hammers your IRR and equity multiple.

- Rent Growth: Your assumptions about annual rent growth compound year after year. A small overestimation here can paint a wildly optimistic picture of your final Net Operating Income that just isn't realistic.

- Interest Rates: If you're using floating-rate debt, this one is huge. An unexpected jump in interest rates can chew through your cash flow and seriously damage profitability, so you need to know how the deal holds up in a rising-rate environment.

Running scenarios with less-than-ideal outcomes for these variables is what separates the pros from the amateurs. It gives you a clear-eyed view of a deal's real risk profile and builds a much more resilient financial model.

Ready to move beyond the spreadsheet? Homebase is the all-in-one platform that streamlines fundraising, automates investor relations, and helps you manage your deals from start to finish. Stop chasing signatures and start closing more capital by visiting the Homebase website to see how it works.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Being an LP in Private Equity Real Estate

Blog

Discover what it means to be an LP in private equity. This guide explains capital calls, distributions, and the key terms for real estate investors.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.