KYC Verification Software for Real Estate Syndicators

KYC Verification Software for Real Estate Syndicators

Discover how KYC verification software streamlines investor onboarding, ensures compliance, and secures deals for real estate syndicators. Find your solution.

Domingo Valadez

Aug 23, 2025

Blog

Think of KYC (Know Your Customer) verification software as your digital gatekeeper. It’s a system that automatically confirms an investor's identity, ensuring you’re meeting legal requirements and protecting your deals from fraud. For syndicators, this means swapping out piles of manual paperwork for a quick, secure, and scalable process. It's the modern way to protect your business, build investor trust, and stay on the right side of regulations.

Why Modern Syndicators Need KYC Verification Software

As a real estate syndicator, you're constantly vetting new investors, and the stakes couldn't be higher. You have to know exactly who you're partnering with before deploying millions in capital. The old way—manually collecting IDs, poring over documents, and checking watchlists—is not just painfully slow. It's a recipe for human error and simply can't keep up as your business grows.

This is where KYC verification software becomes a game-changer. It takes what was once a bottleneck and turns it into a smooth, automated workflow. Instead of spending your days chasing down paperwork, you can onboard multiple accredited investors at once, confident that each one has been properly checked against global databases. That frees you up to do what you do best: find great deals and build strong investor relationships.

Manual Vs Automated KYC: A Syndicator's Comparison

The difference between wrestling with manual checks and implementing an automated system is night and day. One drains your resources, while the other gives you a competitive edge. Here's a quick breakdown of how the two approaches stack up for a syndicator.

Ultimately, automation removes the friction and risk, letting you scale your investor base without scaling your administrative headaches.

Moving Beyond A Regulatory Burden

It's easy to see KYC rules as just another box-checking exercise. But for a savvy syndicator, a solid verification process is a powerful signal of credibility and security. When potential investors experience a seamless and professional onboarding system, it builds instant trust and makes you stand out from the competition.

Adopting KYC software is a core part of implementing strong client onboarding best practices and locking down compliance from day one. This proactive approach doesn't just protect your deals from bad actors; it safeguards your reputation. A single compliance slip-up can have disastrous consequences, making automated verification an essential layer of armor for your business.

The market reflects this reality. The global KYC software market is on track to hit USD 15.81 billion by 2030, growing at a 20.8% compound annual rate. This isn't just a trend; it's a fundamental shift driven by stricter regulations designed to fight financial crime.

By automating investor verification, you're not just buying software; you're investing in scalability, security, and the long-term credibility of your syndication business. It transforms compliance from a defensive necessity into a competitive advantage that attracts sophisticated investors.

How KYC Verification Software Actually Works

So, how does this technology actually do its job? At its heart, KYC verification software is like a digital detective, working behind the scenes to confirm an investor’s identity in minutes. Forget the old days of manually chasing down documents and cross-referencing databases—the right software automates this whole dance for you. The experience is designed to be completely painless for your investors and incredibly straightforward for you.

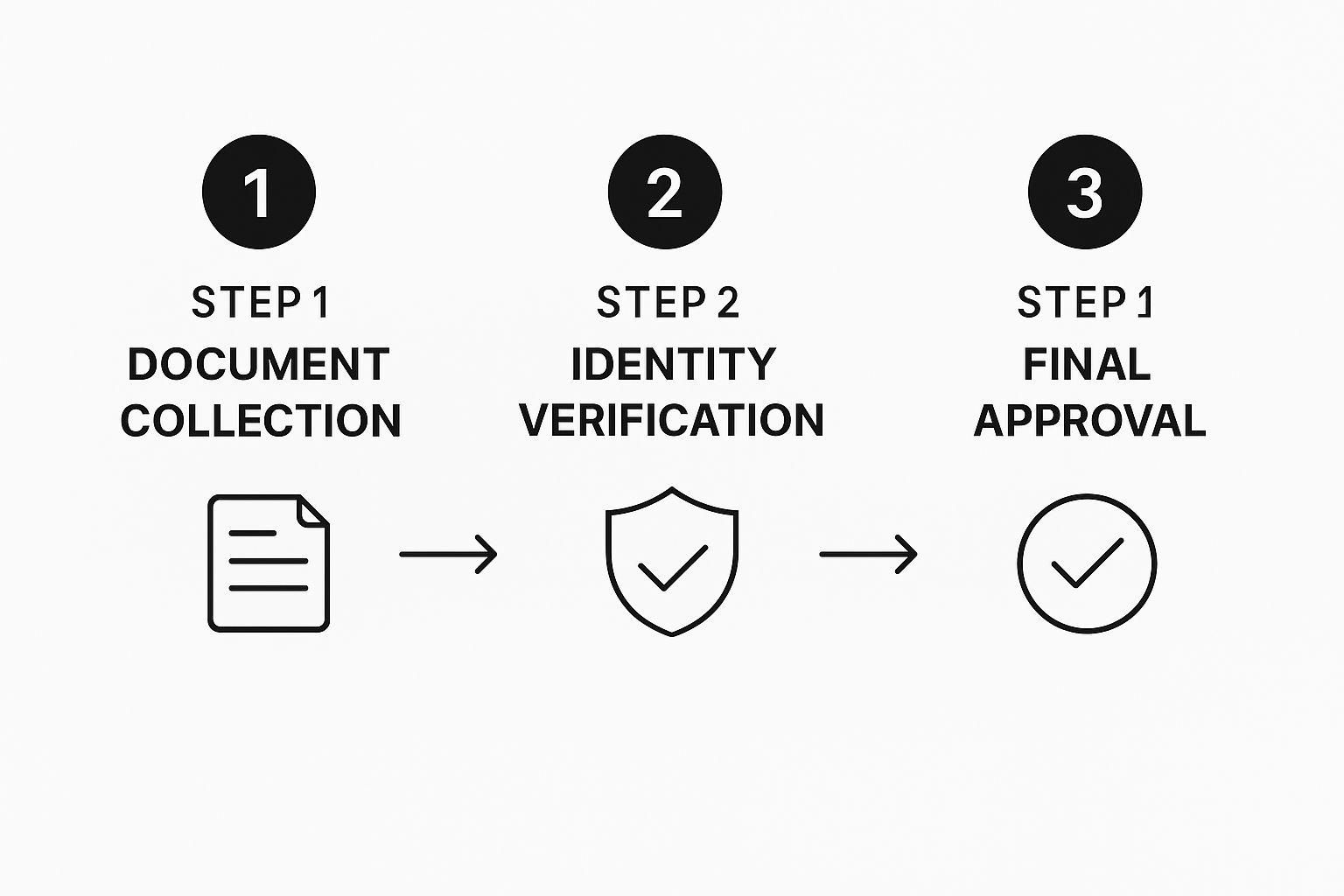

Think of it as a three-stage assembly line for building trust. First, an investor submits their information through a secure online portal. Next, the software digs in, meticulously checking that information against global sources. Finally, you get a clear, auditable result. It turns what was once a complex, headache-inducing compliance task into a simple, automated step that protects your deals and your reputation.

The infographic below really nails this simple, three-step flow, showing how a typical automated KYC process moves from document submission to the final green light.

As you can see, the software logically moves from collecting info to verifying it and then spits out a clear yes or no. This completely removes the guesswork and tedious manual effort from your workflow.

The Initial Data Capture

It all starts when an investor logs into your secure portal to upload an identity document, like their driver’s license or passport. This is where the first bit of magic happens, using a technology called Optical Character Recognition (OCR).

OCR scans the document and intelligently pulls out all the key information—the investor’s name, date of birth, address, you name it. It essentially "reads" the image and converts it into structured, usable data. This single step eliminates manual data entry, which not only saves time but also cuts down on the human errors that can creep in.

Identity Document Verification and Liveness Checks

Once the data is captured, the software gets down to the serious business of confirming the document is authentic. This isn't just a quick scan; it's a deep forensic analysis. The system is trained to spot the tell-tale signs of tampering, like altered text, manipulated photos, or faked security features like holograms.

But what about more sophisticated fraud, like someone using a stolen photo or even a deepfake video? That’s where liveness checks come in. This step asks the investor to do something simple in real-time, like turn their head or blink for the camera. By analyzing these live movements, the software confirms that a real, living person is on the other end, adding a powerful layer of biometric security.

This combination of document analysis and biometric verification is your best defense. It ensures you’re dealing with a legitimate individual, not a fraudster trying to sneak into your deal.

AML Screening and Background Checks

With the investor's identity locked down, the software then runs the all-important Anti-Money Laundering (AML) screening. This is where it cross-references your investor’s name against a massive network of global watchlists and databases, including:

- Sanctions Lists: These are the official "do not transact" lists from government bodies like the Office of Foreign Assets Control (OFAC).

- Politically Exposed Persons (PEP) Lists: This check flags individuals in prominent public roles who might carry a higher risk for things like bribery or corruption.

- Adverse Media Checks: The software even scours global news sources for negative press connecting the individual to financial crimes or other shady activities.

This automated screening is lightning-fast and incredibly thorough, giving you a level of due diligence that would be physically impossible to replicate by hand. It's no wonder the market for this tech is exploding; the identity verification software market was valued at USD 12.47 billion in 2024 and is projected to hit USD 41.96 billion by 2033. This massive growth, detailed in market analysis from Straits Research, just goes to show how essential these robust, data-driven tools have become.

Key Features for Real Estate Syndication

Not all KYC verification software is built the same, and this is especially true for the world of real estate syndication. A generic, off-the-shelf solution might be fine for basic ID checks, but it will quickly hit a wall when you need to verify an accredited investor or untangle the ownership structure of a family trust.

Choosing the right platform is all about focusing on features that solve your specific operational and regulatory headaches. Think of it like a mechanic's toolbox. You wouldn't use a standard wrench for a highly specialized engine part, right? For syndicators, this means finding software designed to handle the nuances of high-net-worth investors and their sophisticated legal entities.

To help you identify the right tools for the job, let's break down the essential features you should be looking for.

H3: Table of Essential KYC Software Features for Syndicators

Here’s a look at the critical features every syndicator should demand from their KYC platform, what they actually do, and why they are so important for keeping your deals moving forward smoothly and compliantly.

Ultimately, having a platform with these core capabilities means you’re not just checking a box for compliance; you’re building a professional-grade, scalable operation that sophisticated investors will trust.

H3: Accredited Investor Verification

For any syndicator raising capital under Rule 506(c) of Regulation D, this isn't just a nice-to-have; it's the absolute cornerstone of your compliance strategy. The software must do more than just confirm someone’s name matches their driver’s license; it needs a reliable way to validate their financial status. This isn't just a good idea—it's a direct SEC requirement to take "reasonable steps" to verify accreditation.

A top-tier platform will give investors multiple ways to get this done:

- Income Verification: Securely processing tax returns or W-2s to confirm they meet the income thresholds.

- Net Worth Verification: Analyzing bank statements, brokerage accounts, and other financial documents to calculate net worth.

- Third-Party Letters: Providing a simple, streamlined workflow for investors to upload verification letters from their CPA, attorney, or financial advisor.

The best systems use technology to automate the document analysis, pulling out key figures and flagging anything that looks off. This turns what was once a highly manual, sensitive, and time-consuming task into a fast, compliant, and fully auditable process.

H3: Support for Various Entity Types

In the real estate syndication world, you’re rarely just dealing with individual investors. Most high-net-worth individuals invest through more complex legal structures like trusts and LLCs to manage their assets and limit liability. Your KYC software has to be flexible enough to handle these different entities without causing a fuss.

Look for a solution that can confidently verify:

- Limited Liability Companies (LLCs): Digging past the corporate veil to identify the ultimate beneficial owners (UBOs).

- Trusts: Verifying the identity of the trustees and understanding the nature of the trust itself.

- Partnerships and Joint Accounts: Onboarding the multiple individuals tied to a single investment commitment.

If your software can only handle a simple driver's license for an individual, you’re going to create a massive bottleneck the moment a sophisticated investor wants to write a big check from their family trust.

The ability to smoothly onboard an LLC or trust isn't a luxury feature—it's a fundamental requirement for operating a professional real estate syndication business. Without it, you risk alienating your most valuable investors.

H3: Seamless Platform Integration

Your KYC process shouldn't feel like a clunky, separate chore. The best software integrates directly into your existing deal room or investor relations platform, like Homebase. This creates a single, unified experience for both you and your investors.

Imagine this: an investor expresses interest in your new deal. They should be able to flow directly from reviewing the offering documents to completing their verification, all within the same portal. This eliminates friction and dramatically improves the investor experience, sending a clear signal that you run a tight, professional operation. A disjointed process that forces investors to jump between different websites and create new logins can kill momentum and create doubt at a critical moment.

H3: Secure and Complete Audit Trails

Let’s say regulators ever come knocking on your door. You’ll need to prove you did your due diligence on every single investor. A non-negotiable feature of any serious KYC software is its ability to generate a comprehensive, unchangeable audit trail for every verification.

This trail needs to be more than just a "Verified" stamp. It should include:

- Timestamps of every single action taken.

- Secure copies of all documents submitted by the investor.

- A clear record of all the checks performed (ID verification, AML screening, accreditation).

- The final, definitive verification outcome.

This digital paper trail is your compliance armor. It shows you followed a consistent, documented, and defensible process for every investor, protecting your business and letting you sleep at night. A robust audit trail turns a potential regulatory nightmare into a simple reporting task.

Navigating SEC and FinCEN Compliance Rules

Knowing why you need to do KYC is just as important as knowing how. For real estate syndicators, this comes down to two big players: the Securities and Exchange Commission (SEC) and the Financial Crimes Enforcement Network (FinCEN). These aren't just suggestions; they’re hard-and-fast rules that protect the entire financial system.

Think of FinCEN as the financial world's security detail. Its main job is to stop money laundering and terrorist financing. Because of this, regulations like the Bank Secrecy Act demand you have a solid process for checking who your investors are. You have to be confident the money flowing into your deals is clean, and KYC verification software is your first and best line of defense.

The SEC, on the other hand, is all about protecting investors. When you raise capital for a deal, you're selling a security. That simple fact puts you squarely in the SEC’s territory, and they have very specific rules about who is allowed to invest and how you prove it.

Translating Rule 506c into Action

Most syndicators I know raise capital under a Rule 506(c) offering. This is a popular route because it lets you advertise your deal to the public. But there’s a major catch: you can only take money from accredited investors, and you must take “reasonable steps” to verify that they are.

That vague phrase—“reasonable steps”—is a minefield. Are you collecting tax returns? Brokerage statements? It's a clunky, insecure process that begs the question: did you do enough to satisfy the SEC? And more importantly, can you prove it if they ever ask?

This is exactly where KYC software earns its keep. It automates and standardizes the entire accreditation check, creating a perfect, time-stamped paper trail. It moves you from a place of hoping you did enough to knowing you have a defensible, repeatable process that meets the SEC’s requirements head-on.

An investment in KYC software isn't just about efficiency; it's about building a defensible compliance framework. It provides concrete evidence that you fulfilled your regulatory obligations, protecting your business from potential fines and legal challenges down the road.

The FinCEN Mandate and Anti-Money Laundering

But SEC compliance is only half the story. You also have to screen investors against global watchlists to satisfy FinCEN’s Anti-Money Laundering (AML) rules. This is all about keeping dirty money out of the U.S. financial system. In practice, it means checking if an investor is on a sanctions list or is a Politically Exposed Person (PEP), which signals a higher risk of corruption.

Trying to do this by hand is a fool's errand. These lists are massive, constantly changing, and span the globe. A good KYC platform, however, runs these checks automatically in seconds. It cross-references an investor’s name against hundreds of global sanctions lists, PEP databases, and negative news sources, flagging any risks immediately.

The pressure to get this right is only growing, which is why more and more firms are relying on these tools. Good software doesn't just check a compliance box; it also makes for a much smoother onboarding experience for your investors. For a deeper dive into the market forces at play, you can check out the full research from Verified Market Reports.

By building these checks right into your workflow, you're not just protecting your business—you're doing your part to fight financial crime. This dual compliance, meeting the demands of both the SEC and FinCEN, can feel overwhelming. But with the right software, it becomes a simple, automated step that lets you get back to what you do best: finding great deals and raising capital with confidence.

The Business-Boosting Benefits Beyond Just Compliance

Let's be honest, most people first look into KYC verification software to stay on the right side of SEC and FinCEN rules. But seeing it as just a compliance chore is a huge missed opportunity. Think of it less as an expense and more as a smart investment in your syndication’s reputation, speed, and overall growth.

A professional, secure, and modern onboarding process tells a story about your operation. It immediately signals to potential investors that you’re serious, sophisticated, and trustworthy. In a market flooded with deals, that first impression can be the one thing that makes an investor choose you over someone else. It builds instant confidence.

This initial wave of trust has a real, tangible impact on your capital-raising. When an investor sees a frictionless and secure system, they feel far more comfortable wiring a large sum of money. It’s a powerful, non-verbal cue that their investment—and their private data—is being handled with care.

Supercharge Your Operational Efficiency

The first and most obvious change you'll see is a massive improvement in speed. We've all been there: the endless email chains, the insecure document attachments, the painstaking manual checks. Manually verifying just one investor can take days, creating a frustrating bottleneck that holds up the entire deal.

Now, picture this: onboarding ten investors in the same amount of time it used to take for one. That's what automation brings to the table. Good KYC software turns that administrative headache into a simple, self-serve process for your investors.

This newfound efficiency creates a ripple effect across your entire business:

- Close Deals Faster: When you eliminate the verification logjam, you can close fundraising rounds in a fraction of the time.

- Slash Administrative Costs: Your team will spend less time chasing down paperwork and more time on tasks that actually make money.

- Scale Without the Headaches: You can bring on more investors without having to hire more back-office staff just to keep up.

This isn't just about saving a few hours. It’s about freeing up your team to focus on what matters most: finding great real estate deals and building lasting investor relationships.

Think about the true cost of manual verification. It's not just the hours spent on paperwork; it's the deals you might miss while you're bogged down in administrative tasks. Automation gives you back your most valuable asset: time.

Build Deeper Investor Trust and a Better Experience

The investor experience is everything, but it's often an afterthought. A clunky, confusing, or sketchy-looking onboarding process can create friction and sow seeds of doubt right when you need confidence the most. On the flip side, a smooth and professional experience reassures an investor they made the right choice.

Modern KYC platforms offer a seamless, white-labeled experience that feels like a natural part of your brand. Investors can quickly upload their documents from a phone or computer, finish a biometric check in seconds, and get verified almost instantly. Every positive interaction builds momentum and solidifies their trust in you from the very beginning.

In the end, KYC software does so much more than tick a compliance box. It polishes your professional image, puts your operations in the fast lane, and builds the kind of foundational trust you need to attract and keep high-quality investors. It’s a tool that pays for itself through both security and growth.

How to Choose the Right KYC Software

Picking the right KYC verification software is a huge decision. It's not just about buying a tool; it's about choosing a partner that will directly affect your efficiency, your investors' experience, and your ability to grow. Get it right, and your operations become smooth and secure. A poor fit, on the other hand, can create frustrating bottlenecks and a mountain of compliance headaches.

The trick is to look past the flashy marketing and focus on what actually works for your syndication business. You need a clear game plan for weighing your options. This means asking the tough questions, getting a handle on different pricing structures, and zeroing in on the features that will actually make a difference in your day-to-day workflow. It’s about finding a solution that doesn't just work today but can keep up as your deals and investor list expand.

Evaluate Pricing Models and Scalability

First things first, let's talk about cost. Most KYC software is priced in one of two ways: you either pay per check or you pay a flat subscription fee. Each has its pros and cons, and the right choice really depends on your deal flow.

- Per-Check Pricing: This model is perfect if you're just starting out or if your deal volume is a bit unpredictable. You only pay for what you use, which keeps costs manageable and easy to forecast. It's a low-commitment way to get started.

- Subscription Pricing: If you have a steady stream of deals and a growing roster of investors, a monthly or annual subscription is almost always more cost-effective. This approach gives you unlimited checks, letting you scale up without worrying that every new investor will add to your costs.

But pricing is only half the story. You also need to think about scalability. A system that works great for 10 investors needs to work just as seamlessly when you have 100 or more. The software has to handle a growing volume of verifications without slowing down or becoming a clunky mess.

Prioritize Integration and Investor Experience

Nothing kills an investor's enthusiasm faster than a clunky, disjointed onboarding process. Your KYC software absolutely cannot feel like a weird, separate step that shunts investors off to another website with a different login. Seamless integration with your investor portal is a must-have, not a nice-to-have.

When the KYC process is built right into your own branded portal, it creates a smooth, professional experience that builds trust from day one. It tells your investors that you’re buttoned-up and take their security seriously, which gives them the confidence to move forward. For a deeper dive into this workflow, check out our complete guide on KYC compliance software.

The goal is to make compliance invisible to the investor. A great KYC tool works quietly in the background, making the verification process fast and frictionless, which helps you convert interested parties into funded partners more effectively.

Key Questions to Ask Vendors During a Demo

Never, ever sign up for a platform without getting a live demo first. This is your chance to see the software in action and grill the vendor with questions that are specific to your real estate syndication business. Don't hold back—the answers will tell you everything you need to know.

Here are a few critical questions to have in your back pocket:

- How does your platform handle verifications for trusts, LLCs, and other complex legal entities?

- Can you verify international investors? Which countries do you cover?

- What’s the average turnaround time for a standard ID verification?

- Can we fully white-label the investor-facing experience with our own branding?

- What kind of support can we expect during setup and if we run into issues later?

- How easy is it to access detailed audit trails for our records?

Asking pointed questions like these helps you cut through the sales pitch and understand how the software will actually perform in the real world. A little due diligence upfront ensures you pick a KYC verification software that truly supports your business and protects your deals.

Your Questions, Answered

Jumping into the world of KYC verification software naturally brings up a few questions. Let's tackle some of the most common ones we hear from syndicators so you can get a clearer picture of how it all works.

How Long Does This Whole KYC Thing Actually Take?

Thankfully, we're not talking weeks anymore. While old-school manual verification could be a real drag on a deal's momentum, modern software is impressively quick. Most automated KYC checks are wrapped up in just a few minutes, giving your investors a smooth, professional onboarding experience from the get-go.

Is My Investors' Data Actually Safe With This Software?

Absolutely. Any reputable KYC provider worth its salt uses bank-grade security protocols. This means end-to-end encryption for all data, whether it's being uploaded or just sitting on a server. Your investors' sensitive documents are locked down tight, which is crucial for protecting their privacy and your reputation.

Choosing a platform with rock-solid security isn't just a "nice-to-have." It's the bedrock of investor trust for every single deal you run.

What If I Have Investors From Outside The US?

No problem at all. In fact, handling international investors is a core strength of good KYC software. The best platforms can tap into global databases to verify IDs and documents from hundreds of different countries. This means you can confidently bring in capital from around the world without getting bogged down in compliance nightmares.

I Keep Hearing KYC and AML. What's The Difference?

It’s a great question, and the distinction is pretty simple.

Think of KYC (Know Your Customer) as the first step: confirming someone is who they claim to be. It's the identity verification part of the puzzle. AML (Anti-Money Laundering) is what comes next. It takes that verified identity and screens it against government watchlists and sanctions lists to make sure the person isn't flagged for financial crime. A solid KYC verification software does both for you, all in one seamless motion.

Ready to automate your compliance and build a professional-grade syndication business? Homebase provides an all-in-one platform with integrated KYC, accreditation, and deal management tools designed specifically for real estate syndicators. See how it works by visiting our website.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Syndicator's Guide to Commercial Real Estate Valuation

Blog

Master commercial real estate valuation with our syndicator's guide. Learn the income, sales, and cost approaches to build investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.