Top Real Estate Investor CRM Picks 2025

Top Real Estate Investor CRM Picks 2025

Discover the best real estate investor crm solutions of 2025 to streamline lead management and close deals faster.

Domingo Valadez

May 3, 2025

Blog

Level Up Your Real Estate Investing

In the fast-paced real estate world, staying organized and efficient is crucial for success in syndication, multifamily investing, and sponsorships. The old ways of spreadsheets, sticky notes, and endless emails are simply no longer sufficient. While these tools once served a purpose, they lack the power of today's digital solutions.

The shift from manual processes to digital platforms has significantly changed how investors identify, analyze, and close deals. What was once a time-consuming and error-prone process is now streamlined and automated. This frees up valuable time and resources for other important tasks. An effective modern approach relies on centralizing information, automating key tasks, and enabling seamless communication. This ultimately leads to better decisions and increased profitability.

Embracing Technology for Growth

Just as the real estate industry has evolved, so too have the tools available to investors. In 2025, technology is no longer just an advantage; it's essential for growth. This discussion explores the critical role of a Real Estate Investor CRM (Customer Relationship Management) system. We will see how the right CRM can transform your investment strategy.

A robust CRM empowers you to build stronger investor relationships. It helps you manage complex deals efficiently and maximize your returns. We'll delve into seven leading Real Estate Investor CRMs that can revolutionize your investment approach. These platforms can propel you toward success in the dynamic real estate landscape of 2025 and beyond.

Homebase: A Comprehensive Platform for Real Estate Syndication

Homebase is a valuable tool specifically designed for real estate syndicators, multifamily investors, and sponsors. It offers an all-in-one solution for managing the complexities of deal management, investor relations, and compliance reporting. Everything is centralized within a single platform, allowing you to oversee the entire syndication process from start to finish.

Think of it this way: you can manage fundraising, conduct KYC/AML verification, distribute documents, and communicate with investors, all from one convenient dashboard. This is especially useful for sponsors looking to scale their businesses efficiently. Imagine juggling multiple syndication deals simultaneously. Homebase enables you to create individual deal rooms for each project.

Streamlining Investor Relations

These deal rooms provide investors with transparent access to important documents, updates, and performance reports. This structured approach builds investor confidence and significantly reduces administrative work for your team. One area where Homebase truly shines is its automated workflows. Tasks like KYC/AML checks and accreditation verification, which are often time-consuming, are automated within the platform.

This not only saves you valuable time but also helps ensure compliance. Automated fundraising workflows and integrated reporting features give you a clear picture of your financial progress and investor commitments.

Key Features of Homebase

- Centralized Platform: Manage all aspects of your real estate syndication from a single dashboard.

- Automated Workflows: Streamlined processes for tasks like fundraising, KYC/AML, and reporting.

- Investor Deal Rooms: Secure spaces for sharing documents and updates with investors.

- Integrated Compliance Tools: Simplify compliance reporting and adhere to regulations.

- E-signatures: Speed up document execution and reduce administrative overhead.

Pros and Cons

Pros:

- All-in-one platform for managing real estate syndication.

- $250/month flat fee for unlimited deals and investors.

- Automated workflows for various key processes.

- Increased transparency through dedicated deal rooms.

- Premium support including migration services and 24/7 customer support.

Cons:

- The flat fee, while beneficial for active syndicators, might be less suitable for smaller operators.

- Limited information on advanced customization options.

Pricing and Technical Requirements

Homebase offers a simple pricing structure: a $350/month flat fee. As a cloud-based platform, Homebase is accessible through any web browser. While specific technical requirements are not publicly listed, the cloud-based nature minimizes local hardware dependencies.

Implementation and Setup

Homebase offers white-glove migration services, simplifying the transition from existing systems, such as spreadsheets or other CRM platforms. Their 24/7 customer support is available to assist with setup and ongoing usage. While many CRM solutions exist, few are tailored to the specific needs of real estate syndication. Homebase stands out with its comprehensive features, automated workflows designed for real estate transactions, and a flat-fee pricing model that scales with your business.

Find Out More

Homebase is a powerful tool for real estate syndicators, multifamily investors, and sponsors seeking to improve efficiency and investor relations. It's a solution worth considering if you need a dedicated platform to manage the complexities of real estate syndication.

REI BlackBook: An All-In-One Solution for Real Estate Investors

REI BlackBook stands out as a comprehensive platform built for real estate investors. It caters specifically to syndicators, multifamily investors, and sponsors. Going beyond simple contact management, REI BlackBook covers the entire investment lifecycle. This includes lead generation, deal analysis, property management, and investor reporting. While its price point is higher than generic CRM platforms, its specialized features make it a valuable tool for serious real estate professionals.

REI BlackBook simplifies complex processes for real estate syndicators. Imagine managing investor relationships and deal flow with ease. The platform allows for streamlined investor communication, automated reporting, and management of the entire syndication process all in one place. Multifamily investors can utilize robust property management tools, such as tenant tracking and rent collection, to enhance portfolio performance.

Real estate sponsors also benefit from REI BlackBook. Its integrated deal analysis calculator and document management features facilitate efficient due diligence and seamless transaction management.

Key Features and Benefits

REI BlackBook offers a wide array of features designed to streamline real estate investment processes:

- Automated Marketing Campaigns: Nurture leads and maintain consistent communication with automated email, direct mail, and text messaging campaigns. This is essential for building and maintaining investor relationships.

- Property Management Tools: Simplify property management tasks. Manage tenant tracking, rent collection, and maintenance requests within the same platform used for deal management.

- Deal Analysis Calculator: Quickly evaluate potential investments with the built-in deal analyzer. This feature saves time and improves decision-making.

- Document Management & E-signatures: Securely store and manage crucial documents, such as contracts and agreements. Integrated e-signature capabilities streamline closings.

- Lead Generation Websites & Landing Pages: Generate leads with the integrated website and landing page builder, eliminating the need for separate marketing tools.

Pros of Using REI BlackBook

- All-in-One Solution: Designed specifically for real estate investors, eliminating the need for multiple software solutions.

- Robust Automation: Streamlines marketing, follow-up, and other key processes, freeing up valuable time.

- Integrated Lead Generation: Includes website and landing page building tools, consolidating marketing efforts.

- Comprehensive Property Management: Handles a broad range of property management tasks, creating a true end-to-end solution.

Cons of Using REI BlackBook

- Higher Pricing: REI BlackBook has a higher price point than general CRM solutions. Pricing is tiered based on features and user count. Contact REI BlackBook for specific pricing details.

- Steeper Learning Curve: The extensive feature set can initially feel overwhelming. Dedicated time for training and onboarding is recommended.

- Interface Complexity: Some users find the interface complex, though this often improves with continued use.

- Limited Mobile App: While a mobile app exists, its functionality is less extensive than the desktop version, which could be a drawback for some users.

Implementation and Setup Tips

- Utilize Training Resources: Take advantage of REI BlackBook’s onboarding and training materials.

- Master the Core Features: Focus on essential functions like contact management, deal tracking, and marketing automation before exploring more advanced features.

- Customize Your Workflow: Tailor the platform to your specific business needs using its customization options.

Website

REI BlackBook is a powerful tool for enhancing efficiency and productivity for real estate investors. While the initial investment and learning curve might be higher than simpler CRM solutions, the comprehensive features and specialized functionality make it a worthwhile investment for serious real estate professionals. If you're a real estate syndicator, multifamily investor, or sponsor looking to streamline operations and scale your business, REI BlackBook is worth considering.

Realeflow: A Deep Dive for Real Estate Professionals

Realeflow is an all-in-one software solution built for real estate investors. It combines CRM capabilities with property analysis, marketing automation, and even funding resources. This makes it a compelling option for real estate syndicators, multifamily investors, and sponsors looking to manage their entire investment process efficiently. Unlike broader CRM platforms, Realeflow caters specifically to the real estate sector, offering specialized tools designed to enhance deal flow and overall ROI.

Key Features and Benefits for Real Estate Investors

Realeflow excels at bringing together the crucial elements of the real estate investment lifecycle. Here's a closer look:

- Comprehensive Property Analysis: Realeflow's analysis tools go beyond surface-level valuations. You gain access to comparable property data (comps) and an automated After Repair Value (ARV) calculator to accurately assess potential returns. This is particularly useful for syndicators and multifamily investors evaluating large projects.

- Streamlined Lead Management & Marketing Automation: Nurture leads with automated follow-up and targeted marketing campaigns. Realeflow offers direct mail, email marketing, and website building features specifically designed for real estate, helping sponsors connect with potential investors and effectively generate deal flow.

- Integrated Funding Network: Realeflow simplifies securing financing for investment deals by providing access to a network of funding sources. This feature is invaluable for syndicators and sponsors seeking capital for their projects.

- Centralized Document Management: Manage all your essential documents, such as offers and contracts, within the platform using customizable templates. This centralized approach helps maintain organization and minimizes the chance of misplaced paperwork, a vital aspect for managing complex multifamily deals.

- Property Lifecycle Management: Track deals from initial contact to closing and beyond, ensuring seamless oversight. This comprehensive view is especially helpful for sponsors juggling multiple projects concurrently.

Pros

- Robust property analysis tools, including comps and an ARV calculator

- Integrated marketing campaigns designed for real estate investors

- Direct access to funding sources

- Comprehensive deal tracking from lead to closing

Cons

- Higher cost compared to general CRM software

- Some reported data synchronization issues

- Steeper learning curve

- Customer support response times can be slow

Pricing and Technical Requirements

Realeflow’s pricing isn't publicly available on their website. A demo or contacting their sales team is usually necessary to obtain pricing details. Technical requirements are also not readily listed, so contacting Realeflow directly is recommended to discuss specific needs and system compatibility.

Comparison with Similar Tools

While platforms like Podio and Pipedrive offer customization, they often lack the specialized real estate investment analysis tools and funding access found in Realeflow. This targeted functionality sets Realeflow apart for serious real estate professionals.

Implementation and Setup Tips

- Dedicate Time for Training: Allocate enough time to fully learn Realeflow's powerful features.

- Data Migration Planning: Plan your data import strategy for a seamless transition if switching from another system.

- Customize Workflows: Adjust Realeflow's workflows to align with your unique investment process.

Why Realeflow Stands Out

Realeflow is a valuable tool for real estate investors due to its comprehensive suite of specialized features. It extends beyond basic CRM functionality, offering integrated property analysis, marketing automation, and funding access. This makes it a strong asset for syndicators, multifamily investors, and sponsors looking to optimize their deal flow and investment management.

Website: Realeflow

Propertybase: A Powerful CRM for Real Estate Professionals

Propertybase is a robust, enterprise-grade CRM built specifically for the real estate industry. Built on the Salesforce platform, it provides a comprehensive suite of tools for real estate syndicators, multifamily investors, and sponsors. Its advanced features are especially beneficial for those managing large portfolios and high lead volumes.

Propertybase streamlines the entire real estate syndication process. This includes everything from investor onboarding and communication to deal management and reporting. Multifamily investors benefit from dedicated property management tools and detailed reporting dashboards. These features allow for efficient performance tracking and tenant interaction management. Sponsors can also use the sophisticated lead distribution and marketing automation features to cultivate investor relationships and raise capital.

Key Features of Propertybase

Propertybase stands out in several key areas:

- Advanced Contact Management: Propertybase goes beyond basic contact information storage. It allows for detailed investor profiles, communication history tracking, and automated follow-ups. Investors can be segmented based on investment criteria, preferred communication methods, and other relevant data. This enables highly targeted outreach.

- Pipeline Management: Visualize and manage your entire investment pipeline from initial lead capture to deal closing. Track deal progress, assign tasks, and monitor key metrics to optimize your workflow.

- Marketing Automation: Automate repetitive marketing tasks such as email campaigns, SMS messaging, and social media posts. Nurture leads, keep investors informed, and build stronger relationships through automated communication workflows.

- Property Management: Track important property details, manage listings, and monitor key performance metrics. Integrate with other property management tools to maintain a centralized view of your portfolio.

Features at a Glance

- Salesforce-based architecture

- Advanced lead distribution and routing

- Comprehensive reporting and analytics

- Marketing automation with email, SMS, and social media integration

- Property management and listing tools

Pros and Cons

Here's a quick look at the advantages and disadvantages of Propertybase:

ProsConsEnterprise-grade security and reliabilityHigher price pointHighly customizableComplex setup and customizationExcellent integration capabilitiesExtensive feature set (potentially overwhelming)Robust reporting and analyticsUser interface could be more intuitive

Pricing and Technical Requirements

Pricing for Propertybase varies based on user needs and customization requirements. Contact Propertybase directly for a personalized quote. As a cloud-based solution, Propertybase is accessible through any web browser. Integrations with Salesforce and other third-party tools may require additional setup.

Implementation Tips

- Define Your Needs: Clearly outline your specific requirements before implementing Propertybase to avoid unnecessary customization and costs.

- Leverage Salesforce Expertise: Consider hiring a Salesforce consultant for initial setup and customization if you lack in-house expertise.

- Start with Core Features: Focus on implementing and mastering the core features before exploring more advanced functionalities.

- Train Your Team: Provide comprehensive training to your team to ensure they effectively use the platform's features.

Website

Final Thoughts

Propertybase offers a powerful solution for serious real estate investors seeking a comprehensive platform. While the higher price and complexity might not be suitable for smaller investors, the robust features, enterprise-grade security, and customization options make it an excellent choice for syndicators, multifamily investors, and sponsors looking to scale their operations and manage complex deals.

5. REIPro

REIPro is a dedicated CRM designed specifically for real estate investors, especially those working with off-market deals. Unlike more general CRMs, REIPro focuses on the core needs of real estate professionals like syndicators, multifamily investors, and sponsors: lead generation, property analysis, and deal management. Its specialized tools offer a streamlined workflow for identifying motivated sellers, evaluating investments, and overseeing the acquisition process from beginning to end.

For syndicators, REIPro’s robust lead generation tools, including its motivated seller finder and skip tracing features, can save significant time in deal sourcing. The platform also provides comprehensive property analysis tools, including comps, After Repair Value (ARV) calculators, and repair cost estimators, empowering multifamily investors to quickly assess potential investment profitability. Sponsors benefit from streamlined deal management features which simplify communication and collaboration with investors.

Key Features and Benefits

- Comprehensive Lead Generation: Find motivated sellers using pre-built search filters and public record data.

- Property Analysis: Analyze deals with precise comps, ARV calculations, and repair cost estimations.

- Skip Tracing and Owner Lookup: Access property owner contact information quickly, saving valuable research time.

- Direct Mail and Marketing Campaign Management: Execute targeted marketing campaigns directly within the platform.

- Mobile Accessibility: Evaluate properties and manage leads from anywhere.

Pros

- Strong Focus on Motivated Sellers: REIPro excels at identifying distressed properties and connecting investors with motivated sellers.

- Detailed Property Analysis Tools: Accurate comps and robust analysis tools support informed investment decisions.

- Built-in Skip Tracing: This feature streamlines research, saving time compared to separate skip tracing services.

- User-Friendly Interface: Designed for real estate investors, REIPro is easy to navigate and use.

Cons

- Limited Third-Party Integrations: Connecting REIPro with other business applications can present challenges.

- Data Accuracy Concerns: Some users have reported data accuracy issues within certain markets.

- Limited Automation: REIPro offers fewer automation features than some competitors.

- Customer Support Response Times: Support response times can be slow during peak hours.

Pricing and Technical Requirements

Pricing: REIPro offers a variety of subscription plans starting at approximately $99 per month. (Pricing can change, so check the REIPro website for current details.)

Technical Requirements: REIPro is a cloud-based platform accessible through any web browser with a stable internet connection.

Implementation/Setup Tips

- Target Market Focus: Define your investment criteria and focus your initial searches accordingly.

- Training Resources: Take advantage of REIPro’s tutorials and webinars to maximize the platform’s capabilities.

- Search Filter Experimentation: Refine your search criteria to locate the most promising leads.

- Marketing Strategy Integration: Use REIPro’s direct mail and marketing campaign management features to connect with potential sellers.

Website: REIPro

REIPro is a powerful tool for real estate investors seeking a dedicated platform for lead generation, property analysis, and deal management. While it has some limitations in third-party integrations and automation, its focused features and intuitive interface make it a valuable resource for those specializing in off-market acquisitions. Potential users should be mindful of possible data accuracy variations and carefully consider their specific needs and target market to determine if REIPro is the right CRM for their investment strategy.

Investor Fuse: A Customizable CRM for Real Estate Investors

Investor Fuse stands out for its highly customizable platform built on Podio, catering to real estate investors. Unlike generic CRMs, Investor Fuse streamlines acquisitions for wholesalers, flippers, and buy-and-hold investors. This focused approach benefits real estate syndicators, multifamily investors, and sponsors by improving lead management and potentially boosting conversion rates.

Investor Fuse leverages Podio's flexibility to create custom workflow automation. Imagine automating lead qualification, follow-up scheduling, and deal progress reports. This automation frees up time for crucial tasks like building investor relationships and sourcing deals.

Key Features and Benefits

- Customizable Podio-Based Workflow Automation: Tailor the system to your investment strategy, from lead capture to closing. This granular control is especially valuable for syndicators managing complex multifamily deals.

- SMS and Email Follow-Up Sequences with Templates: Nurture leads with automated communications. Pre-built templates save time and maintain professionalism.

- Call Tracking and Recording: Monitor lead conversations and review calls for quality control and training. This feature is essential for investor relations.

- Deal Pipeline Management with Status Tracking: Visualize your deal flow and track progress at every stage. This transparency is vital for multifamily investors managing multiple properties and commitments.

- KPI Dashboards: Monitor key performance indicators to identify improvement areas and measure marketing campaign effectiveness. This data-driven approach optimizes investment decisions.

Pros

- Highly Customizable: Adapts to specific investment strategies, especially multifamily or syndication projects.

- Strong Automation Capabilities: Streamlines lead nurturing and saves time.

- Excellent Phone System Integration: Includes call recording for enhanced communication tracking and training data.

- Regular Updates and Active Community: Provides ongoing support and access to best practices.

Cons

- Podio Knowledge Required: Advanced customization requires familiarity with the Podio platform.

- Initial Setup Time: Configuring the system requires an upfront time investment.

- Limited Property Analysis Tools: May require additional tools for in-depth property evaluation.

- Occasional Syncing Issues: Some users have reported syncing problems with the mobile app.

Pricing & Technical Requirements

Pricing is available on the Investor Fuse website, tiered based on features and users. The core requirement is a Podio account.

Implementation Tips

- Outline Your Current Workflow: Guide your customization process for alignment with existing processes.

- Utilize Training and Community Support: Maximize platform benefits through available resources.

- Start Small and Expand Gradually: Focus on core functionalities first, then add more features as needed.

Website

Investor Fuse is powerful for real estate investors seeking customization and automation. While it requires some initial setup and Podio knowledge, its potential to streamline acquisitions and improve conversions makes it valuable, especially for syndicators and multifamily investors managing complex projects and investor relationships.

Follow Up Boss for Real Estate Investors

Follow Up Boss is a real estate CRM originally designed for agents, but it's increasingly popular with investors. Its core strength lies in simplifying lead management, enhancing team collaboration, and automating follow-up communication. For real estate syndicators, multifamily investors, and sponsors, this translates to efficiently nurturing leads, managing investor relationships, and closing more deals.

Imagine a potential investor inquiring about your latest multifamily syndication. Follow Up Boss automatically routes the lead to the right team member, initiates a pre-defined follow-up sequence through email and SMS, and logs every interaction. This ensures prompt, consistent communication, maximizing your chances of converting that lead into a limited partner.

Key Features for Real Estate Investors

- Smart Lead Routing and Distribution: Distribute leads based on pre-set criteria like investment amount or property type, ensuring the right person on your team handles each lead.

- Action Plans and Automated Follow-Up Sequences: Create automated email and SMS campaigns to nurture leads, provide project updates to investors, and solicit investments, freeing up your time for deal sourcing and due diligence.

- Two-Way Email and Text Synchronization: Centralized communication within the platform provides a complete history of every interaction with each lead.

- Robust Mobile App: Manage your leads and communicate with investors from anywhere, at any time, essential for busy investors always on the go.

- Extensive Integrations: Connect with over 200 lead sources and other real estate tools, streamlining your workflow and consolidating data.

Pros of Using Follow Up Boss

- Intuitive Interface: Minimal training is needed, allowing your team to get up and running quickly.

- Excellent Mobile Experience: The mobile app offers full functionality for managing investor relationships effectively while on the go.

- Strong Focus on Communication and Follow-Up Automation: This is critical for building and maintaining strong investor relationships.

- Extensive Integration Capabilities: Connect seamlessly with your existing lead generation and marketing tools.

Cons of Using Follow Up Boss

- Less Focused on Investor-Specific Workflows: Follow Up Boss lacks features specifically for property analysis or property management, so you'll need other tools.

- Pricing Based on User Count: Costs can increase significantly for larger teams.

- Limited Document Management: While it handles some document storage, it's not a robust document management system.

- Not Designed for Property Management: You'll require a separate platform for tenant communication and other property management tasks.

For further guidance on choosing the right CRM, consider reading: How to Choose and Utilize a CRM for Real Estate Investing.

While Follow Up Boss isn't specifically designed for real estate investors, its robust communication tools, automation capabilities, and user-friendly interface make it a strong option, particularly for those prioritizing lead nurturing and investor relations. Its value lies in streamlining communication, ensuring no potential investor is overlooked. Learn more and explore pricing on their website: Follow Up Boss

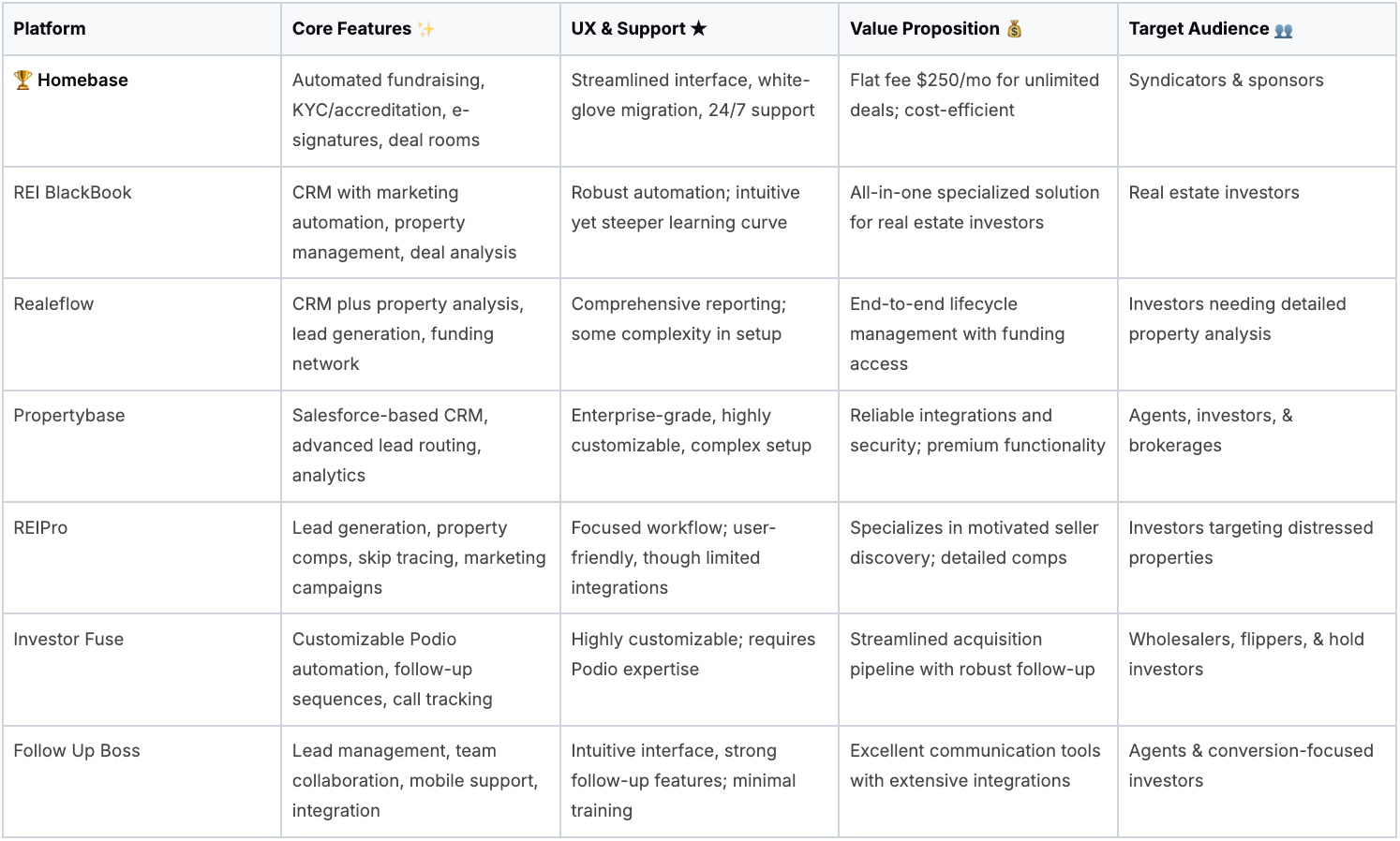

Top 7 Real Estate Investor CRM Tools Comparison

Choosing the Right CRM

The best real estate investor CRM (Customer Relationship Management) depends on your unique needs and investment approach. Whether you're a seasoned professional managing a large portfolio or just beginning with your first multifamily deal, the right CRM can significantly impact your efficiency and, ultimately, your success.

Consider key factors like your budget, team size, desired level of automation, and the types of properties you invest in (e.g., multifamily, commercial, single-family). Tools like Homebase, REI BlackBook, Realeflow, Propertybase, REIPro, Investor Fuse, and Follow Up Boss each offer different features and cater to various investor profiles.

Key Considerations When Evaluating CRMs

When evaluating CRM options, focus on these crucial aspects:

- Implementation and Getting Started: How simple is the CRM setup and data migration process? Look for platforms offering onboarding support or migration services to minimize disruption.

- Budget and Resource Considerations: CRMs range from free basic plans to premium subscriptions with advanced features. Factor in the ongoing cost and ensure it aligns with your budget and anticipated ROI. Consider your internal resources and whether you can manage the CRM effectively.

- Integration and Compatibility: Seamless data flow between platforms is essential for efficiency. Ensure the CRM integrates with other tools you use, like your email marketing platform, accounting software, or transaction management system.

By carefully assessing these factors and exploring the available options, you can select the CRM best suited to your real estate business. Take advantage of free trials or demos for hands-on experience before committing.

Streamline Your Real Estate Business

Choosing the right real estate investor CRM is a vital step for efficient deal management and streamlined investor relations, ultimately maximizing your returns. Instead of juggling spreadsheets and separate systems, consider a comprehensive platform. Homebase, for example, offers automated fundraising workflows and integrated investor reporting, allowing you to focus on growing your portfolio. Explore their flat-fee pricing and discover the impact a dedicated real estate CRM can have on your business. Visit Homebase to learn more and request a demo.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Syndicator's Guide to Commercial Real Estate Valuation

Blog

Master commercial real estate valuation with our syndicator's guide. Learn the income, sales, and cost approaches to build investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.