How Do I Find Investors for Real Estate? Proven Strategies

How Do I Find Investors for Real Estate? Proven Strategies

Wondering how do I find investors for real estate? Discover effective techniques to build your network and secure funding quickly. Read more!

Domingo Valadez

Aug 24, 2025

Blog

Before you even think about asking for a single dollar, you need to build an operation that screams "confidence." The best investment opportunities aren't just about the property itself; they're built on a solid foundation of professionalism, a crystal-clear vision, and obsessive preparation.

It's about having your entire house in order long before you start looking for investors.

Build a Foundation That Attracts Investors

Let's be blunt: investors aren't just buying into a building. They're buying into you. How you present yourself and your business is the very first test, and if you don't pass, the conversation is over before it begins. A great deal is table stakes; a credible, well-run operation is what gets you funded.

Think about it from their perspective. They see countless deals. A messy approach, a fuzzy strategy, or incomplete financials are glaring red flags. The sponsors who get the checks are the ones who have clearly done their homework and built a business that can handle real scrutiny.

Define Your Investment Niche

Don't try to be everything to everyone. In real estate, specialization is your superpower. Focusing on a specific niche doesn't just make you an expert; it makes you a magnet for investors who are already looking for exactly what you're offering.

Pick a lane and own it. For example:

* Multifamily Properties: You could become the go-to expert for B-class apartment buildings in up-and-coming suburban markets.

* Commercial Real Estate: Maybe your sweet spot is small-bay industrial warehouses that serve last-mile e-commerce businesses.

* Fix-and-Flips: You could specialize in cosmetic rehabs on single-family homes within a top-rated school district.

* Short-Term Rentals: Your focus might be on acquiring and managing properties in high-demand vacation spots.

When you know your niche, you know your ideal investor. Someone chasing the steady cash flow of multifamily isn't the same person looking for the high-octane returns of a fix-and-flip. Nailing your focus allows you to find and speak their language from the get-go.

Craft a Bulletproof Business Plan

Your business plan is the most important document in your arsenal. It’s your roadmap, showing investors exactly how you plan to turn their capital into profit. A half-baked plan suggests you haven't really thought through the risks, and that makes you the risk.

A great deal with a bad business plan will almost always lose to a good deal with a great business plan. Investors fund certainty and strategy, not just assets.

Your plan needs to be packed with data but still easy to follow. It’s not just about the property; it's about proving you have a deep understanding of the market forces at play. To build a truly compelling case, you have to show you can effectively analyze market trends and have done the due diligence to protect their investment.

Before you even start networking, you need to have your key documents and strategies locked down. This checklist covers the essentials that investors will expect to see.

Investor Readiness Checklist

Having these elements buttoned up isn't just about looking professional—it's about respecting the investor's time and money. It's the price of entry.

Prepare Your Legal and Financial House

This part is non-negotiable. Walking into a meeting without your legal and financial ducks in a row signals that you're an amateur. Serious operators get this done first.

- Establish a Legal Entity: Forming an LLC (Limited Liability Company) or a similar structure is fundamental. It separates your personal assets from the business, which is a basic requirement for most investors.

- Organize Your Finances: Open a dedicated business bank account. Never co-mingle personal and business funds. Clean, organized books are absolutely essential when they start their due diligence.

- Build Your Track Record: Don't have one? Create one. Document every relevant project you've done, even a major renovation on your own home. If you're brand new, your best move might be to partner with a seasoned pro to borrow their credibility for your first deal.

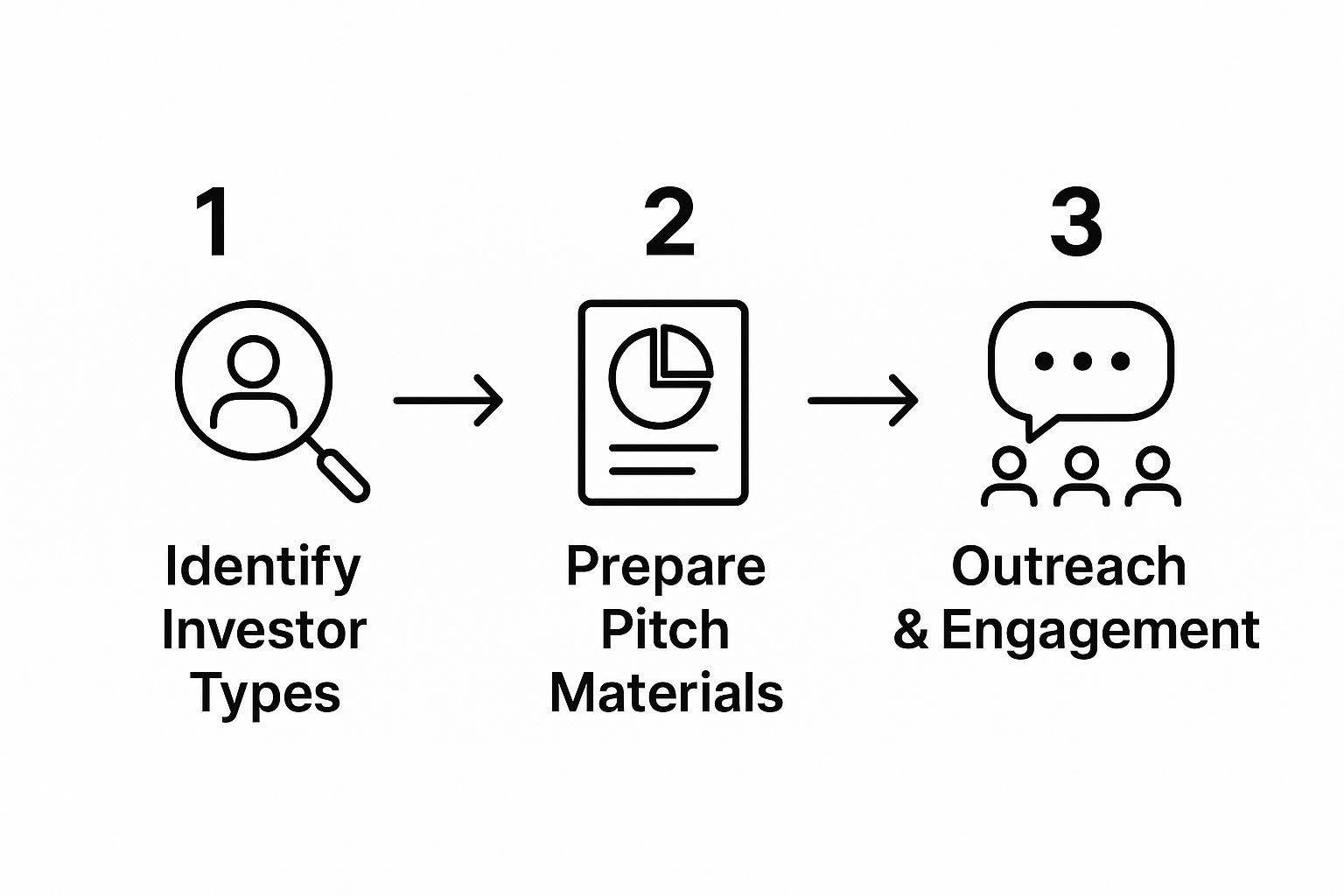

As this shows, finding investors isn't a single action but a structured process. Each step, from identifying the right people to engaging them with a solid plan, builds on the last to create an undeniable case for investment.

Tap Into Your Personal and Professional Networks

When you're trying to figure out how to find investors for real estate, the biggest mistake is looking too far, too soon. Your first investor is often hiding in plain sight—a part of a circle of people who already know you, trust your judgment, and believe in your work ethic. These "warm" connections are your single greatest asset when you're just getting started.

This isn't about making an awkward pitch for cash at the next family barbecue. It's about systematically and professionally tapping into your existing relationships and turning those personal ties into strategic partnerships. The foundation of trust is already there; your job is to build a solid business case on top of it.

Map Out Your Inner Circle

Before you pick up the phone, sit down and actually map out your network. Don't just make a mental list. This is a strategic exercise to pinpoint not only potential investors but also the crucial "connectors" who can open doors for you.

Start by breaking your contacts down into a few key groups:

- Friends & Family: These are the people who have seen your drive and character up close. They're often the most willing to give you their time and hear you out.

- Colleagues (Past & Present): This group has witnessed your professional skills firsthand. They already respect your business acumen and understand how you operate.

- Professional Acquaintances: Think about your accountant, your lawyer, your financial advisor—even your dentist. These people work with high-net-worth individuals every single day.

Once you have this list, you can start thinking strategically about who might be a good fit, either as a direct investor or as someone who can make a powerful introduction. The goal is to walk into these conversations with a clear, professional purpose, not just a casual ask.

The Right Way to Approach People You Know

Reaching out to personal connections requires a bit of finesse. You have to maintain the personal relationship while clearly framing the conversation in a professional business context. Awkwardness creeps in when things are ambiguous, so clarity is your best friend.

When you make contact, don't lead with the investment pitch. Frame the conversation as you seeking their expert advice or wanting to share an exciting new venture you're working on. This simple shift lowers the pressure and invites them into a collaborative discussion.

My Two Cents: Never write someone off because you assume they can't invest or wouldn't be interested. You have no idea who has capital sitting on the sidelines or who has been actively looking for a solid opportunity to get into real estate.

Here’s a simple script framework you can adapt:

"Hi [Name], hope you're doing well. I'm reaching out because I'm putting together a real estate project that I'm really excited about. Given your experience in [their field], I'd genuinely value your perspective on it. Would you have 15 minutes sometime next week to chat? I'd love to walk you through what I'm building."

This approach is respectful, it’s professional, and it positions them as a knowledgeable peer, not just a potential check. It opens the door for a real business discussion without making anyone feel uncomfortable. For a deeper dive, our guide on how to find private investors offers even more frameworks and tips.

Unlock the Power of Your Professional Network

Your professional circle is an absolute goldmine of potential introductions. Your CPA, for example, has a whole client list of people who might be looking to diversify their portfolios with real estate. The same is true for financial planners and attorneys. These professionals are gatekeepers to entire networks of accredited investors.

The trick is to ask for introductions, not money. Present your deal clearly and concisely. Make it so easy for them to understand that they can, in turn, easily explain it to their contacts.

Here's how to ask for introductions:

- Get a One-Page Summary Ready: Create a clean, professional "teaser" that outlines the deal, your strategy, and the projected returns.

- Book a Quick Meeting: Ask for a short meeting to present your project and explain the exact type of investor profile you're looking for.

- Make a Specific Ask: Be direct. "Based on what I've shown you, does anyone in your network come to mind who might be a good fit for this kind of real estate opportunity?"

This approach positions them as a valuable connector and shows that you respect their client relationships. A warm introduction from a trusted professional is worth a hundred cold emails. By systematically working through your personal and professional networks, you can often secure your first few investors and build the momentum you need to attract capital from well beyond your immediate circle.

Connect with Investors in the Digital World

If you're still wondering "how do I find investors for real estate," the answer has moved far beyond local meetups and country clubs. These days, your next funding partner is probably just a click away. Taking your search online opens up a global pool of capital, letting you connect with accredited investors well outside your immediate neighborhood.

This isn't about blasting out generic connection requests on social media. It's a strategic shift. You’re building an online presence that establishes you as an authority and actually pulls investors toward you. Done right, your search transforms from a constant, active hunt into a more passive, automated machine for attracting capital.

Master LinkedIn for Investor Outreach

So many people see LinkedIn as just an online resume, but for us, it's a goldmine for identifying and engaging with high-net-worth individuals. The goal isn't just racking up connections; it's about methodically building a reputation as a savvy and trustworthy real estate operator.

First things first, get your own profile in order. It needs to scream expertise. Clearly state your real estate niche, show off your track record, and highlight the types of deals you're known for. Think of it as your digital business card—it has to make a strong first impression.

Then, dive into the community. Actively participate in groups where your ideal investors are hanging out. Search for terms like:

* Real Estate Investing

* Multifamily Investors

* Private Equity Real Estate

* Commercial Real Estate Network

But don't just join and lurk. You have to contribute. Share compelling articles, weigh in on discussions with thoughtful comments, and offer your expert take on market trends. This consistent, value-first engagement positions you as a go-to expert, making investors far more receptive when you eventually reach out with a specific opportunity.

Explore Online Investor Portals and Crowdfunding

The digital world has also spawned dedicated marketplaces designed to connect deal sponsors with investors. These platforms can be a powerful bridge, giving you access to a pre-vetted audience that is actively searching for real estate opportunities. Just know that they are not all created equal.

Real Estate Crowdfunding Platforms: Sites like CrowdStreet or RealCrowd can give your deal massive exposure to accredited investors looking for fractional ownership. The major benefit is the sheer volume of eyeballs. The catch? You'll face a ton of competition and have to clear their very high bar for underwriting standards.

Online Investor Portals: These services are more about managing and communicating with your network of both current and potential investors. Exploring services like Fundpilot's platform, for instance, can help you organize and streamline your entire fundraising process.

My Two Cents: On any of these platforms, your project profile is your pitch. Don't skimp here. High-quality photos, detailed financial projections, a compelling story, and a crystal-clear explanation of your risk mitigation plan are non-negotiable if you want to stand out from the crowd.

Build Your Own Digital Ecosystem

While third-party platforms have their place, the real long-term play is to build an audience you own. Having your own digital channels gives you total control over your message and, more importantly, your relationships. This ecosystem really boils down to two key pieces: a professional website and a targeted email list.

Your website is your home base. It should be a polished showcase of your portfolio, a detailed explanation of your investment thesis, and feature a simple, clear call-to-action for investors to join your mailing list. This isn't just an online brochure; it's a lead-generation engine.

That email list is where you turn those leads into capital partners. By regularly sending out market insights, case studies on past deals, and educational content, you build trust over time. When you finally have a live deal, you're not pitching a cold list. You're presenting it to a warm, engaged audience that already sees you as a credible expert. This is, hands down, one of the most effective ways to ensure you always have a pipeline of potential capital ready to go.

The global reach of these digital channels is a massive advantage. To put it in perspective, direct real estate transaction volumes worldwide recently hit approximately US$179 billion in a single quarter—a 14% jump from the previous year. This growth proves that finding international real estate investors is more viable than ever, especially with U.S. cross-border capital seeing a 26% increase. Understanding these global trends is key to shaping a successful capital-raising strategy.

Master Your Pitch and Secure the Capital

Finding potential investors is one thing; getting them to actually write a check is another game entirely. This is where the real work starts. A powerful pitch does more than just present facts and figures—it tells a story that turns a simple property into an opportunity they can't afford to miss.

You have to bridge the gap between a great deal on paper and a fully funded project. Your ability to sell your vision, handle tough questions, and build unshakeable confidence in your plan is what separates the pros from the amateurs.

Deconstruct a Winning Pitch Deck

Think of your pitch deck as your visual script. It’s the hard evidence of your strategy, and it needs to be polished, packed with data, and dead simple to follow. Every slide should build on the last, guiding an investor logically toward a confident "yes."

Clutter is your enemy here. Forget dense walls of text. You want a clean design that spotlights the most important information, making your case with absolute clarity and punch.

So, what goes into a deck that actually works?

* A Powerful Executive Summary: This is your elevator pitch on a slide. Hook them immediately with a summary of the opportunity, the key numbers, and why your team is the one to pull it off.

* Clear Deal Structure: Investors need to see exactly where their money is going and how they get paid. Be completely transparent about equity splits, preferred returns, and any fees involved.

* Risk Mitigation Plan: Every deal has risks. Acknowledge them upfront and show investors exactly how you’ve planned to manage them. This is a massive credibility builder.

* Realistic Projected Returns: Don’t inflate your numbers. Use conservative, well-researched projections for IRR, cash-on-cash return, and the equity multiple. Back everything up with solid market comps and your underwriting.

The Art of Storytelling in Your Pitch

Numbers are only half the battle. They inform, but they don't inspire. People invest in stories they can get behind. Your job is to frame the deal as a compelling narrative about growth, opportunity, and smart execution. Why this property? Why this neighborhood? And why right now?

For example, instead of just saying you're buying a B-class apartment building, paint a picture. Talk about the up-and-coming submarket flooded with young professionals who are priced out of downtown. This creates a huge demand for the exact kind of quality, affordable rentals you're about to provide.

Your pitch isn't just a presentation; it's a performance. Investors are evaluating your conviction, your expertise, and your ability to navigate challenges just as much as they are evaluating the deal itself.

This narrative approach makes the opportunity feel real, tangible, and urgent. It connects the dots for the investor, showing them not just the asset as it is today, but what it will become in your hands.

Navigating Due Diligence and Tough Questions

After the pitch comes the real test: the Q&A. Investors are paid to poke holes in your plan, so don’t get defensive—get prepared. You should know the tough questions before you even walk in the door.

Common Questions to Prepare For:

1. What are the biggest risks here, and what's your contingency plan?

2. Walk me through your assumptions for rental growth and the exit cap rate.

3. What's "Plan B" if your primary exit strategy falls through?

4. Tell me about a past deal that went sideways and what you learned from it.

Answering these questions with confidence and data proves you’ve done the work and aren't afraid of a little scrutiny. It's also vital that you can clearly explain your investment approach. Knowing how to explore various property investment strategies and arguing why yours is the perfect fit for this specific deal will make you stand out.

You also have to show you understand the bigger picture. In the current market, for example, even with some dips in capital values, rental growth has been surprisingly strong. Pointing out this trend shows you're not just selling a property; you're selling a resilient income stream that aligns with today's market realities.

At the end of the day, securing capital is about building a partnership so compelling that investors feel like they'd be foolish to pass it up. A great pitch, backed by meticulous preparation, is exactly how you get there.

Find Niche Investors in Specialized Markets

When most people think about finding real estate investors, their minds jump to familiar deals—multifamily apartments, maybe a portfolio of single-family homes. And while those are the industry's bread and butter, there's a huge, often overlooked pool of capital flowing into less conventional, high-growth niche markets.

If you’re willing to look beyond the usual suspects, you can tap into a completely different class of investor. These aren't your typical local high-net-worth individuals; they're often more sophisticated, have deeper pockets, and are searching for strategic partnerships, not just a simple property flip.

Target Thematic and High-Growth Sectors

The secret to attracting this kind of capital is understanding the powerful economic and technological shifts happening around us. Instead of focusing only on a property's location, think about its role in a bigger story. The explosive growth in AI and e-commerce, for instance, isn't just a tech trend—it’s a real estate trend. It's creating massive, long-term demand for specialized assets like data centers and modern logistics facilities.

Investors in these spaces are often playing a different game. They're less concerned with traditional real estate cycles and more focused on structural demand that will last for decades. This approach definitely requires more specialized knowledge on your part, but it opens the door to institutional players and family offices that have very specific investment mandates. They are actively hunting for operators who truly get these unique asset classes.

Some of the most compelling niches right now include:

- Data Centers: Fueled by the AI boom, these buildings are the physical backbone of our digital world.

- Sustainable Infrastructure: Projects focused on renewable energy, grid modernization, and green logistics are attracting enormous institutional interest.

- Specialized Hospitality: Think modern branded residences or next-gen extended-stay properties that cater to new work-life dynamics.

Understand the Unique Investor Profile

Let's be clear: the investor who funds a $100 million data center is not the same person funding a fourplex renovation. Niche investors are typically far more sophisticated and bring a ton of their own expertise to the table. They aren't just passive money; they're strategic partners who understand the operational nuts and bolts of their chosen sector.

Data centers, for example, have been ranked as a top asset class for expected returns across the Americas, Asia Pacific, and Europe, thanks in large part to the AI surge. But these high-tech properties demand huge capital outlays and deep technical know-how, which naturally narrows the investor pool to more serious players. You can get the full outlook on emerging real estate trends from PwC's report.

When you pitch a niche deal, you're not just selling projected returns. You're selling your expertise in a complex market with high barriers to entry. That's your real advantage.

To connect with these investors, you have to speak their language. Your pitch needs to go beyond generic real estate metrics. It should focus on the specific drivers of that niche—things like power availability and latency for data centers, or demographic shifts driving demand for branded residences.

How to Align Your Project with Niche Capital

Finding these investors requires a targeted, research-heavy approach. You won't bump into them at your local real estate meetup. You need to immerse yourself in their world.

Here’s how to start:

- Go to Their Conferences: Don't just attend real estate events. Go to tech, energy, or hospitality conferences. That’s where the real experts and capital allocators for these sectors gather.

- Identify Specialized Funds: Do some digging on private equity firms and investment funds that have a stated mandate for your target niche. Their websites are a goldmine and will often detail their exact investment criteria.

- Build a Hyper-Targeted Network: Use platforms like LinkedIn to connect with executives at companies operating within your chosen niche. The goal isn't just to pitch them, but to build genuine relationships based on shared industry knowledge.

- Develop a Niche-Specific Pitch: Your presentation and materials have to prove you understand the unique risks and opportunities. A generic real estate pitch deck will get you shown the door almost immediately.

By focusing on a specialized market, you change the entire conversation. It goes from "Why should you invest in my deal?" to "How can we partner to capitalize on this massive trend?" This strategic shift is exactly how you unlock access to a whole new level of investment capital.

Answering the Tough Questions Investors Will Ask

Let's be honest, even with the best deal in the world, you're going to get questions. It's just part of the process. Walking into the world of private capital means you need to speak the language, manage expectations, and understand the unwritten rules of the game.

Getting these common questions squared away doesn't just prepare you for meetings; it builds your credibility. When you can answer confidently, investors see a capable operator they can trust with their money.

What’s the Difference Between an Accredited and a Sophisticated Investor?

You absolutely have to know this one—it’s not just industry jargon, it's a legal requirement. The law is very clear about who you can and can't solicit for certain types of deals, and messing this up can land you in serious trouble.

An accredited investor is defined by their wealth. Regulators have set clear financial thresholds for this. In the U.S., that typically means someone who meets one of these criteria:

* An individual earning over $200,000 a year ($300,000 with a spouse) for the past two years.

* Someone with a net worth over $1 million, not including the value of their primary home.

A sophisticated investor, however, is all about experience. The assumption is they have enough financial savvy to understand the risks of an investment without needing all the standard protections. They’ve been around the block and can evaluate a deal on its merits.

The simplest way to think about it is that an accredited investor passes a financial test, while a sophisticated investor passes an experience test. Your legal documents and how you approach fundraising have to be tailored for each.

How Much Equity Should I Give Away?

Ah, the million-dollar question. There’s no magic number here. How you split the equity really comes down to the specifics of the deal, how much money you’re raising, and who’s doing what. The real goal is to strike a balance that feels fair to everyone. Your investors need to be compensated for their risk, and you need to be rewarded for finding the deal and making it happen.

One of the most common structures you'll see is a preferred return, or "pref." Think of it as investors getting first dibs on the profits. They might get paid an 8% return on their money before you, the sponsor, see a dime.

Once that pref is hit, you start splitting the remaining profits. A 70/30 split is pretty standard—70% to the investors, 30% to the sponsor. But that can swing dramatically depending on the deal’s risk and your own experience.

What If I Don't Have a Track Record?

This is a big one for anyone starting out, but it’s a hurdle you can clear. At the end of the day, investors are just trying to mitigate risk, and a sponsor with no history is a big question mark. So, your job is to give them other reasons to feel secure.

Here are a few things that actually work:

* Team Up with an Expert: Find a partner or co-sponsor who has the track record you lack. You bring a great deal to the table, and they bring the credibility that gets it funded. It's often the quickest path to getting that first deal done.

* Start with People Who Know You: Your friends and family are investing in you, not just your deal. They already trust you. A smaller, successful project funded this way is the perfect first notch on your belt.

* Put More of Your Own Cash In: Having more of your own "skin in the game" speaks volumes. It shows you’re not just playing with other people’s money—you believe in the project enough to risk your own.

There’s no doubt about it, the first deal is always the toughest. You just have to get creative and find other ways to build the confidence that a long track record would normally provide.

Juggling investor questions, sending out documents, and keeping everyone in the loop can get chaotic fast. This is where a tool like Homebase can be a lifesaver. It gives you one central place to manage everything—from setting up a professional deal room to handling investor distributions down the line. It helps you streamline the backend work so you can focus on finding great deals. Check out what they offer at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Syndicator's Guide to Commercial Real Estate Valuation

Blog

Master commercial real estate valuation with our syndicator's guide. Learn the income, sales, and cost approaches to build investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.