Choosing Fund Administration Software That Scales

Choosing Fund Administration Software That Scales

Discover how fund administration software streamlines operations, ensures compliance, and boosts investor trust. Find the right platform for your fund's growth.

Domingo Valadez

Aug 22, 2025

Blog

If you've ever managed an investment fund, you know it can feel like you're juggling a dozen different tasks at once. Fund administration software is designed to be the central hub for all those moving parts, giving you a single platform to manage your entire operation.

Think of it as the command center for your fund. Instead of wrestling with scattered spreadsheets, endless email chains, and manual calculations, everything is brought together in one place. You can handle investor communications, automate financial tasks, and maintain a crystal-clear audit trail for compliance without missing a beat.

So, What Is Fund Administration Software, Really?

Let’s use an analogy. Managing a real estate syndication is a lot like directing an orchestra. You have all your musicians—the investors—and each one needs the right sheet music (reports, updates, legal documents) at exactly the right time. Then you have the complex compositions themselves, like capital calls and distributions. Trying to do all of this manually is like conducting without a podium, frantically passing out notes and just hoping everyone stays in sync.

Fund administration software is your conductor's podium. It organizes every element into a single, cohesive system, ensuring everyone and everything works in harmony.

Bringing Order to Fund Management

At its core, this technology is built to take the chaos of manual, error-prone processes and replace them with smooth, automated workflows. To really get what that means, it’s helpful to understand what is workflow automation explained simply and how it works in business. Instead of spending your days chasing signatures or manually updating investor records in a spreadsheet, the software handles those repetitive, time-consuming tasks for you.

This simple shift frees you up to focus on what really matters: strategy, finding great deals, and growing the fund.

The market is certainly taking notice. The global fund management software market was valued at $3.5 billion in 2023 and is projected to climb to $6.5 billion by 2032. That's a huge jump, and it underscores just how essential these tools have become for firms looking to automate their portfolio management and make smarter, data-driven decisions.

Key Takeaway: The real goal of fund administration software isn't just to organize data. It's about building a scalable, professional, and trustworthy operational foundation that supports your growth and inspires confidence in your investors.

Ultimately, this software gives you a command center to manage three critical areas:

- Investor Communications: All contact info, communication history, and reporting are centralized in one place.

- Financial Operations: Complex tasks like capital calls, distributions, and tricky waterfall calculations are automated.

- Compliance and Reporting: Every action leaves an auditable trail, which makes generating tax documents and staying compliant much simpler.

What Does Fund Administration Software Actually Do? Key Features That Drive Efficiency

Good fund administration software isn't just a glorified digital filing cabinet. It’s an active part of your team, specifically built to solve the persistent headaches that keep fund managers buried in spreadsheets and email. These features work in concert to create a smooth, reliable, and transparent system for managing every moving part of your fund.

When you look under the hood, the most valuable tools usually address a few critical areas of fund management. Getting to know them will show you just how much the right platform can change your day-to-day reality.

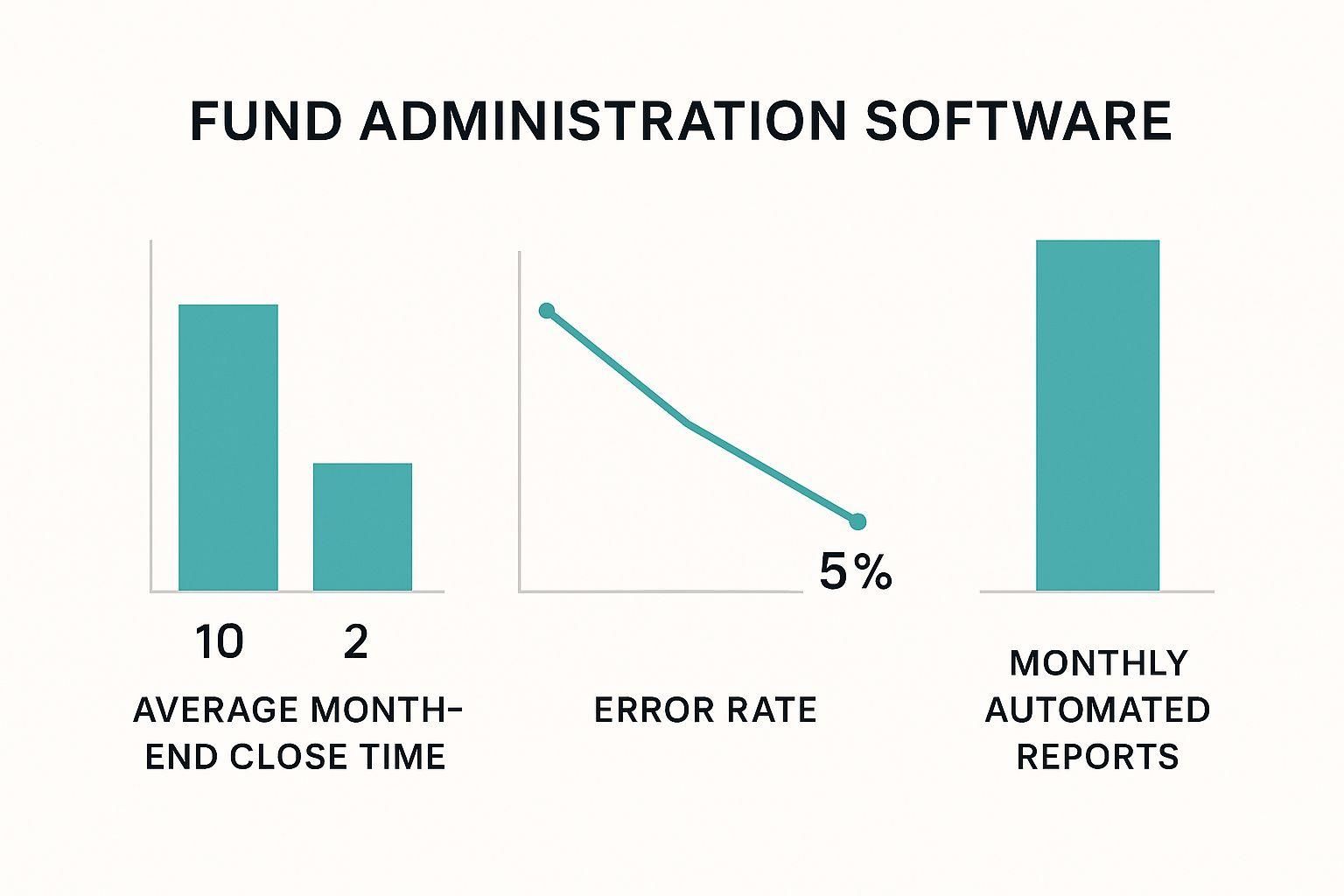

This image really drives home the point, showing the dramatic leap in performance funds see after they switch to specialized software.

The numbers don't lie. You're looking at a massive reduction in the time it takes to close the books each month and a near-elimination of manual errors. That’s the direct, tangible impact of automation.

Investor Relations and CRM

Think of a top-tier Investor Relationship Management (CRM) feature as the command center for all your investor communications. It pulls every piece of contact info, every email exchange, and every investment detail for each limited partner (LP) into one place. This means you can finally stop digging through old email threads or cross-referencing spreadsheets just to confirm an investment amount.

Instead, you get a single source of truth that lets you:

* Track the Entire Investor Journey: See every interaction at a glance, from their first expression of interest to the moment they fund and all the updates that follow.

* Communicate with Precision: Effortlessly segment your investors to send targeted updates, property reports, or capital calls without blasting your entire list.

* Deliver a Professional Investor Portal: Give your LPs 24/7, on-demand access to their investment documents, performance dashboards, and K-1s. This isn't just a convenience; it's a massive trust-builder.

Automated Capital Calls and Distributions

Handling capital calls and distributions manually is a high-wire act without a net. It’s slow, tedious, and incredibly risky. One misplaced decimal in a spreadsheet can create a cascade of financial errors that can seriously damage your reputation. Automation completely removes that danger.

With the right fund administration software, you can execute these complex financial workflows in a matter of minutes, not days. This is what it looks like in practice:

* One-Click Capital Calls: Draft and send professional capital call notices to all the right investors with a few clicks. The system knows who to contact and for how much.

* Flawless Waterfall Calculations: The platform’s engine automatically crunches the numbers on even the most complex distribution waterfalls, ensuring every partner gets paid out exactly according to the LPA.

* Direct ACH Payouts: Securely push distributions directly into your investors' bank accounts, eliminating the need for manual wire transfers or checks.

This hunger for automation is why the global fund accounting software market is on track to hit $2.5 billion in 2025. The demand is being fueled by a clear, industry-wide need for more efficient and accurate operations. You can read the full research about fund accounting market growth to see where the trends are heading.

The difference between the old way and the new way is night and day.

Manual vs Automated Fund Administration Tasks

As you can see, automation doesn't just make tasks faster; it fundamentally changes the nature of the work, reducing risk and freeing up your team for more valuable activities.

Integrated Fund Accounting

Modern platforms do so much more than just basic bookkeeping. Integrated fund accounting features give you a live, 360-degree view of your fund's financial health. By connecting directly to your fund’s bank accounts and pulling in property-level data, these systems deliver performance metrics that are always up-to-the-minute.

Key accounting capabilities you should look for include:

* A Clean General Ledger: The system maintains a perfect, auditable record of every single financial transaction automatically.

* Real-Time Performance Dashboards: Instantly check critical metrics like IRR, MOIC, and NAV without waiting for someone to update a spreadsheet.

* Scheduled Financial Reporting: Set up professional, accurate reports for investors and internal teams to be generated and sent out automatically.

This deep integration means your strategic decisions are always based on what's happening right now, not on reports that were outdated the moment they were created. It turns accounting from a backward-looking chore into a powerful tool for proactive fund management.

What This Means for Your Fund in the Real World

It’s easy to get lost in a list of software features. An investor portal and automated reporting sound great, but what do they actually do for you? Their real value is measured in the hours you get back, the trust you build with investors, and the risks you sidestep.

When you look past the technical jargon, you find that the right fund administration software delivers tangible results that become the bedrock of a successful fund. This isn't just about convenience; it’s about building a more professional, resilient, and ultimately, more profitable operation.

Let's break down the three biggest advantages you'll see.

Gaining True Operational Agility

Manual work is like quicksand—it sucks up your time and slows everything down. Just think about tax season. You might spend dozens of hours digging through spreadsheets, double-checking numbers, and chasing down documents just to get K-1s out the door. It’s a stressful, high-stakes marathon where one small mistake can be costly.

Now, picture this with the right software. The platform has been quietly collecting and organizing all the necessary data all year long. When it's time, generating accurate K-1s for every single investor takes just a few clicks. You’ve just reclaimed weeks of your life—time you can now spend finding your next deal or talking to your LPs. That’s what operational agility actually looks like.

By getting rid of manual bottlenecks, this software turns reactive, time-sucking chores into proactive, efficient workflows. It lets you move with the speed and precision that the modern investment world demands.

Building Unbreakable Investor Trust

Today's investors have high expectations. They want a professional and transparent experience, and a clunky, old-school process just won't cut it. An on-demand investor portal isn't a luxury anymore; it's a fundamental tool for building trust.

When your limited partners (LPs) can log in whenever they want to see performance dashboards, grab important documents, and track their investment's history, it speaks volumes. It shows them you're organized, you have nothing to hide, and you run a tight ship. This kind of self-service access cuts down on the constant back-and-forth emails and gives your investors the confidence that turns them from a one-time check into a long-term capital partner.

Fortifying Your Compliance Framework

Let's be blunt: compliance isn't optional. Trying to manage it with spreadsheets is like walking a tightrope without a net. The risk of a simple human error in your calculations or records is always there, and a mistake can lead to serious regulatory fines and a damaged reputation. Good software is your safety net.

It creates a robust, audit-ready system from the moment you start using it. Every single transaction, email, and document is logged in one central, unchangeable place. This builds a perfect audit trail that protects you and your fund. You're no longer just hoping you're compliant; you know you are. It turns compliance from a major source of anxiety into a genuine position of strength.

A Real Estate Syndication Case Study

Theory is one thing, but seeing fund administration software in the wild really brings its value to life. Let’s walk through a typical real estate syndication to see how this technology helps a deal sponsor at every critical stage, turning what used to be a mountain of manual work into a series of simple, automated steps.

Imagine a syndicator, let's call them "Apex Capital," is buying a 100-unit multifamily apartment building. They need to raise $5 million from their limited partners (LPs) to get the deal done.

Stage 1: Fundraising and Onboarding

Without the right tools, this is where the chaos usually begins. Instead of juggling a messy spreadsheet of interested investors and chasing down subscription documents via email, Apex uses its software's investor portal. They set up a secure, dedicated deal room for the new property, inviting potential investors to review the pitch deck, financials, and all the legal paperwork in one place.

When an LP decides to commit, they can do it all online.

* They fill out the subscription agreements digitally.

* The system runs the required KYC/AML checks automatically.

* All necessary documents are e-signed right from their phone or computer.

All the while, the software gives Apex a live dashboard showing who has committed, who has signed, and who needs a gentle nudge. This creates a polished, secure, and incredibly efficient process that shaves weeks off the fundraising timeline.

Here’s a glimpse of what a clean, professional investor dashboard looks like.

This kind of interface gives both the sponsor and the investor a clear, at-a-glance view of everything, building immediate trust through complete transparency.

Stage 2: Capital Calls and Closing

Once Apex has commitments for the full $5 million, it's time to bring the money in. With just a few clicks, the fund administration software calculates each investor's exact share and sends out professional capital call notices.

As LPs make their wire or ACH transfers, the platform tracks the incoming funds in real-time. No more manually checking the bank account and cross-referencing a spreadsheet. The dashboard gives Apex a live view of who has paid and who is still outstanding, ensuring the closing process is fast and, most importantly, free of errors.

Stage 3: Ongoing Operations and Reporting

The deal is closed, but the real work of managing investor relations is just beginning. This is where the software becomes the central hub for all communication. Apex can upload quarterly reports, photos of property renovations, and financial statements directly to the investor portal.

The moment new documents are uploaded, the system automatically notifies every investor. This self-service model is a game-changer, practically eliminating the constant stream of one-off email requests for information and freeing up countless hours for the Apex team.

Key Insight: A centralized investor portal doesn't just deliver information; it delivers a consistently professional experience. This level of organization and accessibility is what turns a one-time investor into a loyal partner for your future deals.

Stage 4: Distributions and Tax Season

A year down the road, the property is performing well and has generated solid cash flow. Apex decides it's time to make a distribution. The software's waterfall calculation engine kicks in, automatically running the numbers based on the deal's specific structure. This ensures every LP and the GP get paid exactly what they're owed. The distributions can then be sent out via ACH, right from the platform.

And when tax season rolls around? Forget the year-end scramble. The software has been tracking all the financial data throughout the year. Generating and distributing K-1s becomes a simple, button-click task, making sure everything is accurate and on time without the usual headache.

How to Choose the Right Software Solution

Picking the right fund administration software is a huge decision. It's one that will directly shape your fund's efficiency, your investors' confidence, and frankly, your own sanity. With the market valued at around $3.5 billion in 2023, there's no shortage of options, but they are far from equal. You need a way to cut through the marketing fluff and find a solution that fits where you are today and where you plan to go tomorrow.

This isn't just about comparing feature checklists; it’s about finding a true operational partner. Let's break down how to do that by focusing on four crucial questions.

Will It Grow With You?

Scalability is everything. The software that feels perfect for your first $5 million fund with a dozen investors might completely fall apart when you’re managing multiple funds and a hundred LPs. You need a platform that can grow with you, not one that forces a painful and expensive migration in a few years.

When you’re talking to vendors, get specific. Ask them:

- How does your pricing model work as our assets under management (AUM) and investor numbers increase?

- Can your platform handle more complex structures down the road, like feeder funds or multi-asset funds?

- What’s the actual process for adding a new fund or a new deal? Is it straightforward or a headache?

Think of it this way: you wouldn't build a single-family home on a foundation poured for a skyscraper. Your software is your operational foundation—make sure it’s built to support your ambitions.

Does It Connect to Your Existing Tools?

Your fund doesn't operate in a silo. You rely on a suite of tools for accounting, banking, and communication. The right software acts as a central nervous system, connecting these different systems so data flows smoothly between them. This is how you kill the soul-crushing manual data entry that leads to costly mistakes.

Look for key integrations with the tools you already use:

- Accounting Software: Does it sync with platforms like QuickBooks or Xero to keep your general ledger clean?

- Banking: Can it connect directly to your fund’s bank accounts to automate transaction reconciliation?

- Email and Calendars: How well does it play with your existing communication stack to streamline investor relations and team workflows?

Without these connections, your new software is just another isolated island of data. The goal is to create a single command center, not another password to remember. Our guide on real estate fund administration dives deeper into how to build this kind of efficient tech stack.

The Big Idea: The best software doesn't force you to abandon every tool you love. It makes the tools you already rely on even more powerful by weaving them into a single, cohesive system.

Is the Investor Experience Flawless?

Your limited partners are the lifeblood of your business, and their experience with your firm is paramount. The investor portal is their window into your operation. If that window is smudged, cracked, or hard to see through, it reflects poorly on everything you do.

You’re aiming for a portal so intuitive that your least tech-savvy investor can navigate it without a single phone call to you.

When a vendor gives you a demo, put on your "LP hat." Is it genuinely easy to find K-1s and quarterly reports? Is the performance dashboard clear and easy to grasp in a few seconds? A frictionless user experience is non-negotiable for building and maintaining investor trust.

How Strong Is the Security?

Last but certainly not least: security. As a fund manager, you are the custodian of incredibly sensitive financial and personal data. Top-notch security isn't just a "nice-to-have" feature; it's a foundational requirement.

You have to dig into how a potential partner protects your data. Ask about their security protocols, their data encryption standards, and any third-party certifications they hold (like SOC 2). If a vendor gets fuzzy or evasive when you ask about security, that’s an immediate, giant red flag.

A Framework for Your Decision

Choosing the right software is a strategic process. To help you organize your thoughts and compare different platforms side-by-side, we've put together a checklist of key evaluation criteria. Use this table during your demos and discussions with vendors to ensure you're covering all the critical bases.

Key Evaluation Criteria for Fund Administration Software

By systematically working through these questions, you move beyond the sales pitch and focus on what truly matters: finding a platform that will be a long-term asset to your firm. This thoughtful approach will pay dividends in operational efficiency and investor satisfaction for years to come.

Your Top Questions About Fund Software, Answered

Even when you see the benefits, I get it—moving away from the spreadsheets you know and trust can feel like a big step. It’s only natural to have practical questions about the cost, the time it will take to get started, and how it will actually affect your team.

Getting straight answers to these common questions is the best way to feel confident you're making the right call for your fund's future. Let's dig into what sponsors ask me most often when they're thinking about fund administration software.

How Much Does Fund Administration Software Cost?

There's no single price tag, and the cost can vary quite a bit. What you'll pay usually comes down to a few key things: your total assets under management (AUM), how many investors you have, and which specific features you actually need.

Most platforms price their services in one of a few ways:

* A simple flat subscription fee, paid monthly or annually.

* A tiered price that goes up as your number of active investors grows.

* A fee based on a small percentage of your AUM.

For a new or smaller fund, you might find simple platforms that start in the low hundreds of dollars per month. On the other end of the spectrum, enterprise-level systems built for massive institutions can run into several thousand. The key is to get detailed quotes and always ask about the hidden stuff—one-time setup fees, data migration costs, and what their support packages include. That's how you see the whole picture.

Can This Software Replace My Accountant?

Not really. A better way to think about it is that the software makes your professional team better, not obsolete. The whole point of the technology is to automate the tedious, repetitive tasks where mistakes happen, like generating K-1s for everyone, calculating distributions, and keeping track of investor emails.

This frees up your accountants and third-party admins to do what you actually pay them for—the high-value work that needs a human brain. They can finally spend their time on strategic financial planning, navigating tricky compliance issues, and talking to your investors instead of getting buried in manual data entry. For nearly every fund, the software and the people work together to create a workflow that’s both hyper-efficient and incredibly accurate.

The software takes care of the "what" and the "when," so your expert team can focus on the "why" and "what's next." It's a partnership that elevates what everyone brings to the table.

Is Switching from Spreadsheets a Huge Pain?

Look, any new system is going to have a bit of a learning curve. But modern software companies have poured a ton of resources into making the switch as painless as possible. The upfront effort to move your data over is a small price to pay for the long-term wins in efficiency, accuracy, and the professional image you project to investors.

The best platforms have dedicated onboarding specialists who will practically hold your hand through the data migration. This usually means helping you import all your historical data—investor contacts, old transactions, fund documents—straight from your Excel files. If you want the transition to be a success, find a provider that offers great customer support and plenty of training to get your team comfortable and quick.

What Size Fund Is This Software For?

You can find a platform built for every stage of a fund's journey. There are tools for emerging managers launching their very first deal and massive systems for institutions managing billions in AUM. Many providers offer tiered plans that grow right along with your business, so you don't have to worry about switching again in a few years.

For a smaller fund, the big win is setting up professional, scalable systems from day one. It builds instant credibility with those first crucial investors. For a larger, established fund, the software becomes the backbone for managing complexity, ensuring bulletproof compliance, and handling a ton of LPs and transactions without breaking a sweat. The right software meets you where you are and gives you the tools to get where you want to go.

Ready to stop juggling spreadsheets and start scaling your real estate business? Homebase provides an all-in-one platform for a flat, predictable fee, giving you the power to manage unlimited deals and investors. See how Homebase can streamline your operations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.