The Ultimate Rent Roll Sample Guide for Real Estate Investors

The Ultimate Rent Roll Sample Guide for Real Estate Investors

Unlock property performance with our rent roll sample. Learn to analyze deals, verify income, and master real estate syndication with our expert guide.

Domingo Valadez

Feb 18, 2026

Blog

If you're in real estate, you've heard the term "rent roll." But what is it, really? It’s a detailed report that breaks down the rental income from a specific property. Think of it as a financial scorecard, showing everything from tenant names and lease terms to monthly rent and payment status for every single unit.

To make this tangible, we have a downloadable rent roll sample you can grab to follow along.

What Is a Rent Roll and Why Is It Your Most Critical Tool?

Forget thinking of a rent roll as just a list of tenants. It’s the financial X-ray of an investment property. For anyone looking to buy, underwrite, or invest in a property, this document is ground zero. It gives you the raw, unfiltered data needed to see a property's true health and performance.

The real power of a rent roll is in its granularity. It takes you past the big-picture summaries and shows you exactly what’s happening on a unit-by-unit basis. This isn't just an administrative report; it's a foundational tool for any serious real estate deal.

The Strategic Importance of Rent Roll Data

Learning to read a rent roll isn't just a useful skill—it's essential. This one document lets you verify the seller's income claims, judge how well the property is being run, and uncover potential risks or opportunities that others might miss.

For example, you might read that national vacancy rates recently hit 6.9%, while the average rent for a two-bedroom apartment climbed 3.2% to $1,906 per month. A rent roll puts those numbers into context for a specific property. Is this building beating the market, or is it falling behind with high vacancy and below-market rents?

A rent roll tells a story. It reveals whether a property's income is stable and diversified or if it's reliant on a few high-paying tenants with expiring leases. This narrative is the foundation of any solid underwriting model.

One of the most immediate uses for this data is to accurately calculate cap rate, which is a core metric for valuing properties. Without a trustworthy rent roll, any cap rate calculation is just guesswork. The rent roll provides the verified income figures you need to get it right.

Anatomy of a Rent Roll: A Field-by-Field Breakdown

Think of a rent roll not as just a spreadsheet, but as the financial pulse of a property. It's a living document that tells you everything about who is living in your building and, more importantly, the income they’re generating. To really get it, you have to understand what each column is telling you.

Let’s pull it apart, piece by piece. Once you know what to look for, you can pick up any rent roll example and immediately start seeing the story behind the numbers.

Core Unit and Tenant Identifiers

First things first, you have to know what and who you're looking at. These basic details are the foundation for everything else.

- Unit Number: This is the unique address for each apartment—Unit 101, Unit 204, and so on. Keeping this consistent is crucial for making sure you’re tracking the right lease with the right space.

- Unit Type / Sq. Ft: Is it a "1 Bed / 1 Bath" or a "3 Bed / 2 Bath"? How big is it—750 sq. ft. or 1,400 sq. ft.? This information is gold because it lets you calculate rent per square foot, the universal metric for comparing your property's performance against the competition.

- Tenant Name: This connects the lease to a real person. During due diligence, this is your starting point—you'll match this name to the signed lease agreement to verify every other number on the sheet is legit.

The Financial Heart of the Rent Roll

This is where the money is. These columns show you the real performance of the property, revealing the gap between what a unit could be making and what it's actually bringing in.

An investor looking for a value-add opportunity lives for this section. It's where the potential is spelled out in black and white.

The gap between Market Rent and Actual Rent is what we call "loss-to-lease." A big gap isn't necessarily a bad thing—it's a bright, flashing sign that there’s a clear path to boosting revenue by raising rents to market levels as leases turn over.

- Market Rent: This is your benchmark. It’s what you could realistically charge for a unit if it were vacant and you leased it today at current rates.

- Actual Rent (or Base Rent): This is the simple, contractual amount the tenant pays every month according to their lease.

- Concessions: Did you offer "one month free" to get a tenant in the door? That's a concession. It’s a discount off the top, and when you subtract it from the Actual Rent, you get the Net Effective Rent—the true cash you’re collecting.

- Additional Income: This is where you track all the other little money-makers. Think pet rent, assigned parking spots, or utility reimbursements. These small streams add up and can significantly boost a property's bottom line.

To give you a clearer picture, here’s a quick look at how these columns come together for a few sample units.

Table: Sample Rent Roll Snippet Explained

This table breaks down the core financial and status columns for three fictional units, showing how each piece of data tells a small part of the property's bigger story.

As you can see, Unit 101 has a clear opportunity to raise rent to market. Unit 102's concession reduces the effective rent, and Unit 103 represents a pure vacancy loss that needs to be filled.

Critical Lease and Timing Information

Finally, the rent roll tells you when things are happening. The timing of lease expirations is absolutely critical for forecasting cash flow and spotting potential trouble on the horizon.

Having a huge chunk of your leases expire in the same month is a huge red flag. Imagine 15 leases all ending in July. If even a third of them move out, you're suddenly facing a massive drop in income and a scramble to fill units all at once. Smart property managers stagger their lease expirations throughout the year to avoid this exact scenario.

By analyzing these dates, you can build out a lease expiration schedule. This is one of the most powerful tools in your arsenal for predicting occupancy and planning your leasing strategy for the months ahead.

How to Stress-Test a Rent Roll for Smarter Underwriting

When a seller hands you a rent roll, think of it as a starting point, not the gospel truth. Simply accepting the numbers at face value is one of the quickest ways to get burned in an underwriting deal. The real work begins when you treat that document as a list of claims that need to be proven.

This is where you move from paper projections to hard facts. Your goal is to audit the data by comparing it directly against the source documents: the signed lease agreements. This audit is how you confirm that the income you're modeling is real and sustainable, not just an optimistic story the seller is telling.

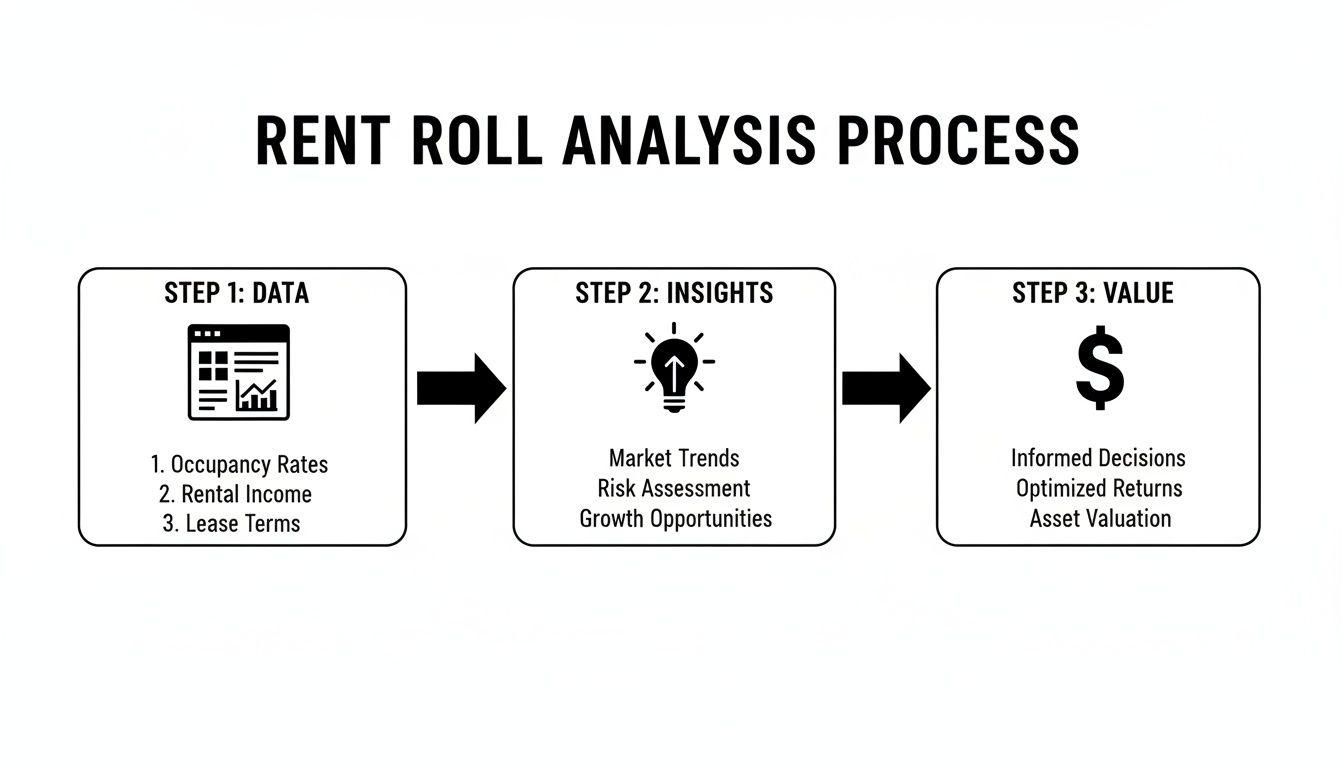

Ultimately, this process turns raw data into reliable insights that help you understand the property's true earning potential.

The flowchart above breaks down the workflow, showing how you can take a raw spreadsheet and transform it into actionable intelligence that defines a property's financial value.

Conducting a Lease File Audit

The single most important step in stress-testing a rent roll is the lease file audit. This isn’t about checking every single lease, but rather pulling a statistically significant sample—usually around 10-20% of the units. For smaller properties, you might want to look at a larger percentage.

The objective is simple: compare the lease agreements line-by-line against the rent roll to make sure everything matches up perfectly.

Here's what you're looking for:

- Verify Base Rent: Does the monthly rent on the signed lease match the "Actual Rent" column in the rent roll? Any difference here is an immediate red flag.

- Confirm Lease Dates: Check that the lease start and end dates on the paper agree with what's on the spreadsheet. This is critical for accurately forecasting turnover and vacancy.

- Identify Concessions: Carefully read the lease for any mention of specials, free months, or other hidden concessions. These absolutely must be factored in to calculate the true Net Effective Rent.

- Check Security Deposits: Make sure the security deposit listed on the rent roll matches the amount specified in the lease. Remember, this is a liability you’ll inherit at closing.

A thorough audit is non-negotiable. It’s the only way to be certain that the numbers you are plugging into your pro forma are grounded in contractual reality, protecting you from overpaying for an underperforming asset.

Spotting Critical Red Flags

Beyond a direct audit of the leases, a good analysis involves hunting for patterns that might signal hidden risk. A detailed rent roll tells a story that a high-level summary completely misses.

Keep an eye out for these warning signs:

- Excessive Concessions: If you see a high number of units with rent specials, it could mean weak market demand or that the seller is using an aggressive—and likely unsustainable—strategy just to inflate the occupancy numbers.

- Delinquency Patterns: Are the same tenants consistently late on rent? Even a few chronically delinquent tenants can seriously eat into your net operating income.

- Lease Expiration Concentration: A large chunk of leases all expiring in the same one or two months creates a huge income risk. If they all move out at once, you're left with a massive vacancy problem.

For example, typical tenant retention rates in multifamily properties hover between 50% and 60%. A real-world analysis of a 312-unit property uncovered $128,000 in monthly concessions—slashing the effective rent by 19%—and a dangerous cluster of leases all set to expire in March. This kind of deep dive can reveal critical insights and uncover risks that could otherwise derail your entire investment.

For real estate sponsors, the rent roll isn't just an internal document for tracking tenants. It's the lifeblood of your investor communications. If you want to build and keep investor trust, you need to deliver transparent, data-backed reports that show exactly how the property is performing against the original plan. The rent roll holds all the raw data you need to tell that story well.

But your job isn't to just forward a messy spreadsheet. It's to translate that dense data into clear, compelling highlights that investors can actually understand and appreciate. When you do this right, a boring report becomes a powerful story about your skill as an asset manager, which builds confidence and strengthens your relationships for the long haul.

Distilling Data into Key Performance Indicators

Investors don't have time to sift through every line item. What they need is the big picture. Your monthly or quarterly updates should boil the rent roll down to a handful of key performance indicators (KPIs) that track directly back to the business plan you sold them on.

Here are the must-have KPIs to pull from your rent roll for every investor update:

- Physical Occupancy: This is the most fundamental metric. A simple number, like 95% occupied, gives an immediate health check on the property's stability.

- Economic Occupancy: This one tells the real story. It goes beyond just who has a key and accounts for concessions, late payments, and vacant units. It’s the measure of actual income collected against what you could have collected.

- Average Rent Growth: Are you successfully pushing rents? Report the percentage increase on new leases and renewals. Showing a 4.5% blended rent growth is hard evidence that your strategy to boost revenue is working.

- Leasing Velocity: How many new leases did the team sign this month? This KPI proves there's healthy demand for your units and that your team is on the ball.

When you report these same KPIs consistently, investors can see real, tangible progress over time. It completely changes the conversation from "how are things going?" to "look at the value we're creating," all backed by objective data.

Crafting a Compelling Investor Narrative

Once you’ve pulled the KPIs, the next step is to weave them into a clear narrative. Your investor updates should connect the dots for them. Explain why the numbers are what they are and what your next moves are to keep pushing performance.

For instance, if occupancy dipped by a point, get ahead of the question. Explain that it was a strategic move to turn a few under-market units and bring in new tenants at a higher rent.

To really nail your communication, you have to fold these rent roll insights into solid financial reports. Taking some time to understand financial reporting best practices will make sure your updates are always professional, accurate, and credible. A well-put-together report built on verified rent roll data signals to investors that you're a sophisticated operator, which is absolutely critical when it's time to raise capital for your next deal.

Common Rent Roll Mistakes and How to Avoid Them

In real estate, the most expensive mistakes aren't always obvious. They’re often buried in the details of a spreadsheet, hiding in plain sight. A rent roll can seem simple enough, but a few small oversights can throw off your entire underwriting model and lead to some seriously flawed projections. I’ve seen it happen to even the most seasoned pros who let their guard down.

The sharpest investors know that a rent roll isn't a final report—it's a collection of claims that need to be proven. If you know what to look for, you can build a due diligence process that not only protects your capital but also reveals the property's real financial health.

Overlooking Hidden Concessions

One of the most common traps is taking the "Actual Rent" figure at face value without looking for concessions. A seller might offer a new tenant "one month free" on a 12-month lease to get a unit filled fast and boost the occupancy numbers. It looks great on paper.

But that $1,500 monthly rent isn't really $1,500. When you spread the free month across the whole lease term, the effective rent is actually $1,375. Miss that, and you've just inflated the property's real income.

Best Practice: You have to calculate the Net Effective Rent for every single unit. Dig into the lease agreements and look for any mention of "specials," "free rent," or other discounts. They won't always be listed on the rent roll sample itself.

Ignoring Non-Financial Data

Another big mistake is getting so focused on the numbers that you ignore the non-financial details tucked away in the lease clauses. Things like renewal options, caps on rent increases, or special tenant rights can completely change your business plan.

For example, a lease might give a long-term tenant the right to renew at a rate far below market, which means you can't raise the revenue from that unit like you planned.

This is exactly why the world’s largest asset managers, overseeing more than $1.9 trillion in assets, rely on incredibly detailed rent rolls for their projections. With U.S. markets seeing 85% of landlords push rents up by 6-10%, you absolutely need to know if you're contractually allowed to do the same. You can learn more about how to leverage this data in commercial real estate.

Common Pitfalls and Quick Fixes

Here are a few other classic blunders I see all the time:

- Relying on Outdated Documents: A rent roll is just a snapshot. A report from three months ago is already ancient history in this business.The Fix: Always demand a certified rent roll dated within the last week before you start your due diligence. Then, get another updated one right before you close.

- Forgetting Utility Bill-Backs (RUBS): If you don't verify the income from utility reimbursements, you're leaving money on the table in your underwriting.The Fix: Cross-reference the rent roll with the property’s actual utility bills and the T12 report. Make sure the RUBS income is accurate and consistent.

- Ignoring Delinquency Notes: Some property managers will list tenants who are behind on payments but still include their rent in the "total income" column. This is a huge red flag.The Fix: Manually subtract the rent from any tenant marked as late or delinquent. This will give you the true collected income, or what we call Economic Occupancy.

When you actively hunt for these common errors, you shift from being a passive reviewer to a sharp analyst. It’s how you make sure your investment is built on a foundation of facts, not just hopeful assumptions.

Answering Your Top Questions About Rent Rolls

As you get more comfortable with rent rolls, a few common questions always seem to pop up. Let's walk through them, because understanding these nuances is what separates a good deal from a great one. Think of this as the practical, real-world cheat sheet.

Rent Roll vs. T12 Report: What's the Difference?

It's a classic question, and the answer is simple: it's potential vs. reality.

A rent roll is a snapshot in time. It's a forward-looking document that shows you a property's income potential right now—who's living there, what they're supposed to pay, and when their lease is up. It’s what the property should be earning.

A Trailing 12-Month (T12) report, on the other hand, is a look in the rearview mirror. It’s a historical document detailing every dollar that actually came in and went out over the last year. It shows you what the property actually earned and spent.

You absolutely need both. The rent roll helps you project future income, while the T12 tells you if the seller's story about past performance holds water.

How Often Should I Update the Rent Roll During Due Diligence?

Timing is critical. A stale rent roll is a useless one. The best practice is to check in at three key moments during the deal.

- The First Look: You'll get the initial rent roll with the offering memorandum. This is what you'll use to build your first underwriting model and decide if the deal is even worth pursuing.

- Day One of Due Diligence: The moment your due diligence period starts, ask for a fresh, certified rent roll. This becomes your official baseline—the document you'll use to conduct your lease file audit.

- Right Before Closing: This one is crucial. A few days before you close, get one final update. This last look ensures there haven't been any surprise move-outs or new delinquencies that could sink your returns or cause issues with your lender.

Can a Seller Fake a Rent Roll?

You bet they can. That's exactly why you can't just take it at face value. A motivated seller might offer huge, off-the-books concessions just to get heads in beds before the sale. Or, they might conveniently forget to list tenants who are months behind on rent.

Your best defense is a meticulous lease file audit. This is non-negotiable. You sit down and compare the rent roll, line by line, against every single signed lease agreement in the filing cabinet. It’s the only way to prove the rents, deposits, concessions, and lease terms are real.

Skipping this step is basically taking the seller at their word. In a multimillion-dollar transaction, that's a risk you just don't take.

What Is "Loss to Lease" and Where Do I Find It?

Loss to lease is the money left on the table. It’s the difference between what tenants are currently paying and what you could be getting at today's market rates.

Finding it is straightforward—it’s simple math right on the rent roll. Just look at the "Market Rent" and "Actual Rent" columns for every occupied apartment. The difference between those two numbers is the loss to lease for that unit.

Add up that difference for all the units, and you've got the total loss to lease for the property. A big number here isn't necessarily a bad thing, either. For a value-add investor, a large loss to lease screams opportunity. It's a clear roadmap for how you can boost income by bringing rents up to market as leases turn over.

At Homebase, we've built an all-in-one platform to take the busywork out of real estate syndication. From fundraising and investor relations to deal management and distributions, our software helps you focus on closing more capital and building stronger investor relationships. Learn more about how Homebase can streamline your operations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Define Mezzanine Debt Your Guide to the Real Estate Capital Stack

Blog

Unlock bigger deals with less equity. Our guide helps define mezzanine debt, showing syndicators how to use it to bridge funding gaps and maximize leverage.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.