Download the Best Real Estate Pro Forma Template Excel

Download the Best Real Estate Pro Forma Template Excel

Create accurate financial models with our real estate pro forma template Excel. Expert tips and step-by-step guide for better investment analysis.

Domingo Valadez

Jun 30, 2025

Blog

A good real estate pro forma template in Excel isn't just a spreadsheet. I've seen too many investors treat it that way, and it's a critical mistake. Think of it less as a calculator and more as a dynamic financial story—one that transforms a pile of raw numbers into a clear narrative about a property's true potential. It's the tool that bridges the gap between hopeful guesswork and data-driven confidence.

Why A Pro Forma Is More Than Just A Spreadsheet

Newer investors often fall into a trap: they take the seller's provided numbers, maybe tweak them a little, and assume their work is done. This approach completely misses the point and can lead to some painful miscalculations down the road. A professional-grade real estate pro forma template in Excel is meant to be a living, breathing document.

Its story starts with historical data but certainly doesn't stop there. You use past performance to build a solid, defensible baseline, and then you start projecting. A well-built template is designed to model different futures. What if rents grow slower than you hope? What if a surprise capital expense pops up in year three? The idea isn't to perfectly predict the future—that’s impossible. It's about understanding the range of possibilities and the risks that come with them.

The Shift from Calculation to True Analysis

This is where the real value kicks in. Your pro forma becomes powerful when it stops being a simple arithmetic tool and starts facilitating genuine analysis. It's built to answer the crucial "what-if" questions that separate seasoned pros from amateurs.

For example, instead of just listing out your operating expenses, a great pro forma lets you stress-test them. You can instantly see how a sudden 15% jump in insurance premiums or property taxes would ripple through your model and hammer your cash-on-cash return.

A basic spreadsheet can tell you the potential gross income. But a robust financial model helps you dig into the nuances, like:

- Lease Expirations: How will your income change as various leases come up for renewal at new market rates?

- Vacancy Cycles: Modeling the real-world gaps between tenants is essential for calculating an accurate effective gross income.

- Capital Expenditures: You have to account for major, "below-the-line" costs like a new roof or HVAC system. These don't affect Net Operating Income (NOI), but they absolutely crush your actual cash flow if you ignore them.

A truly effective pro forma template must integrate several key components to provide a full picture. Each part serves a distinct function, from initial assumptions to long-term return metrics.

Core Components of an Effective Pro Forma Template

By ensuring your template includes and connects these elements, you move from simple calculations to a comprehensive financial analysis that informs your decisions.

Telling a Complete Financial Story

Ultimately, your pro forma needs to tell a compelling story. It should clearly show how your initial purchase price, financing structure, and operational assumptions all flow together to produce year-over-year cash flow. From there, it projects forward to a logical exit, calculating the crucial metrics like Internal Rate of Return (IRR) that define the investment's success over its entire life.

This complete, long-term view is what turns a list of numbers into a powerful decision-making tool. It’s what gives you the hard evidence and confidence to know when to pull the trigger on a deal—or when to walk away.

Building Your Pro Forma Foundation in Excel

Any powerful real estate pro forma template in Excel begins with a rock-solid foundation. Forget the impulse to cram everything into one giant, confusing spreadsheet. The best, most professional way to build a model is by using dedicated tabs to create a clean separation between your assumptions, your calculations, and the final summary.

This compartmentalized approach makes your model far more intuitive and, crucially, easier to debug. When a number looks off, you’ll know exactly which tab to check instead of getting lost hunting through a tangled mess of formulas.

Think of it like building a house—you wouldn't run plumbing and electrical wires through the same wall cavity. You keep them separate for safety and simplicity. The same logic applies here. A clean, organized structure is non-negotiable for a professional-grade analysis tool you can trust and reuse across multiple deals.

Organizing Your Key Sections

With your tabs in place, the next move is to organize the information within those tabs logically. Over on your "Inputs" or "Assumptions" sheet, group related data points together. This isn't just about making it look pretty; it actually streamlines your workflow when you're under pressure trying to analyze a new property.

I’ve found that a standard professional setup almost always includes distinct sections for:

- Property Details: This is where you'll put your Purchase Price, Closing Costs, Square Footage, and Number of Units.

- Financing Assumptions: Group everything related to the loan here, like the Loan Amount, Interest Rate, Amortization Period, and any Loan Fees.

- Operating Figures: This covers your Gross Potential Rent, Vacancy Rate, and all the individual expense line items like Taxes, Insurance, Repairs, Management Fees, and so on.

When you create this clear framework from the start, you establish a repeatable process for every deal. To really get this right, it's worth understanding the broader principles of how to build financial models in Excel, as those skills will help you create more dynamic and reliable templates.

Professional Techniques for a User-Friendly Template

Once the basic structure is set, a few simple techniques can elevate your template from just okay to truly great. These small details drastically improve usability and help prevent costly mistakes, which is critical when big money is on the line.

Pro Tip: I always color-code my input cells. A common convention, and one I stick to, is using a light blue fill for any cell that requires manual data entry. This creates an immediate visual cue, telling you or anyone else using the template exactly which numbers are assumptions you can tweak to test different scenarios.

Another incredibly useful tool is Excel's Data Validation. Use this feature to create dropdown lists for certain inputs (like property type) or to set limits on what can be entered. For example, you can restrict the vacancy rate input to a value between 0% and 100%. This simple step prevents a typo from throwing off your entire analysis. These kinds of safeguards are the hallmark of a thoughtfully constructed, professional real estate pro forma.

Ground Your Projections in Reality with Historical Data

A pro forma is only as good as the numbers you feed it. I've seen too many investors make the classic mistake: they take the seller's Trailing Twelve (T12) financials, slap on a generic growth rate, and assume they've done their due diligence. Honestly, that's just a recipe for a bad deal. To really understand a property's potential, you have to look into its past.

The seller’s marketing package is exactly what it sounds like—marketing. Its job is to make the property look as attractive as possible. To build a truly solid real estate pro forma template in Excel, you need to get your hands on more than just the T12. I always insist on at least two additional years of historical operating statements. This gives you a much clearer, more reliable dataset to work with.

With three years of data, you can start to see real trends, not just one-off events. Was that surprisingly low maintenance cost on the T12 a fluke, or has it been that low for years? Did the recent jump in income come from solid rent growth or just a temporary occupancy boost? This historical context is your best defense against a seller's overly rosy projections.

Building a Baseline You Can Defend

Your first task is to build a defensible baseline for every single projection. Let's start with Gross Potential Rent (GPR). Never just accept the current rent roll at face value. Dig into the historical rent growth, year over year. If the seller is claiming 5% annual growth, but the property’s history shows an average of only 2% over the last three years, your model needs to reflect that more conservative, historically proven number.

This same logic applies to every expense. Let's look at a critical line item like Repairs & Maintenance as an example:

- Year 1: $15,000

- Year 2: $18,000

- Year 3 (T12): $11,000

If you're moving too fast, you might just plug in that $11,000 figure. But a seasoned analyst would immediately ask why it dropped so sharply. Did the owner put off a bunch of necessary repairs to make the T12 look good for the sale? A much more defensible number would be the three-year average of $14,667, or you might even use the Year 2 figure and adjust it for inflation to be safe.

Seeing the Real Story Beyond the T12

Using historical data in your real estate pro forma template in Excel is all about distinguishing real trends from short-term blips. For instance, seeing a steady 5% increase in Effective Gross Income (EGI) year after year is a powerful sign of sustainable growth. It’s far more believable than a sudden 10% jump that only appears on the most recent T12. Grounding your analysis in at least three years of financial history is fundamental to making smart investment decisions. You can find more insights on how financial data directly impacts pro forma accuracy on our blog.

A pro forma will never perfectly predict the future, but it's your best tool for setting realistic expectations. The historical data you use is the very foundation of those expectations.

When you pressure-test every line item against its own history, you turn a simple spreadsheet into a powerful analytical tool. This detailed, evidence-based method is what gives you the confidence to know your numbers are rooted in reality, not just wishful thinking. It's how you build an investment case you can truly stand behind.

Modeling Long-Term Projections And Cash Flow

With a solid foundation of historical data in place, it's time to look ahead. This is where your pro forma truly comes alive, transforming from a simple report into a powerful forecasting tool. The real work—and the real insight—comes from building out a detailed 5- to 10-year projection that maps out the entire financial journey of your investment.

This isn’t about pulling numbers out of thin air. It’s about making educated, defensible assumptions about future growth and inflation. For example, to model how your rent will increase over time, you can use a simple Excel formula that compounds annually. If your Year 1 rent is in cell C10, the formula for Year 2 in cell D10 might look something like this: =C10*(1+$B$2). Here, cell B2 contains your annual rent growth assumption, say 3%. The beauty of this is you can change that one cell, and your entire forecast updates instantly.

You can apply the same thinking to your operating expenses. It's smart to project a general inflation rate for most costs but give special attention to more volatile line items. Things like insurance or property taxes often have their own unique growth rates based on market trends, so you'll want to model those separately for a more accurate picture.

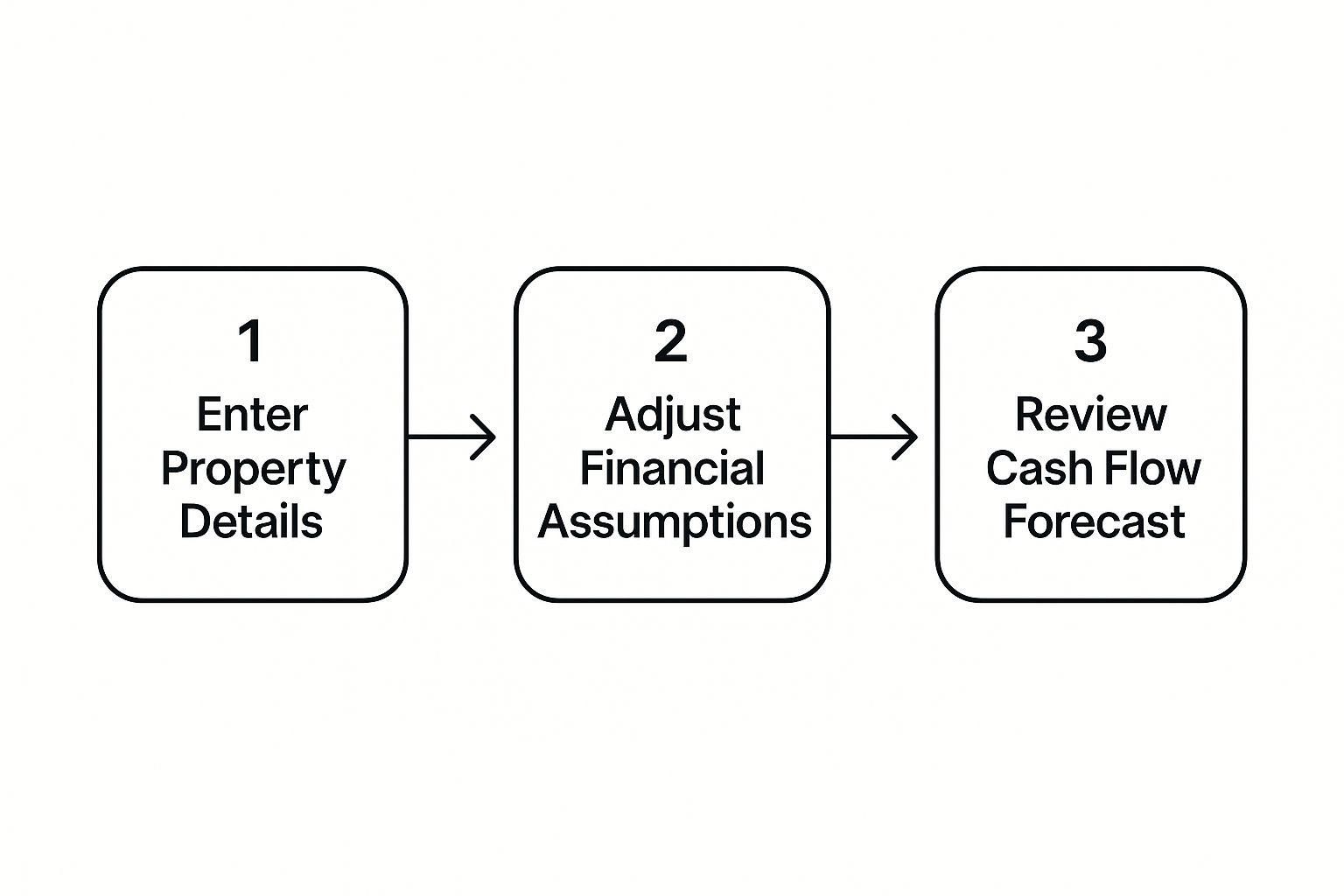

This workflow visualizes how all the pieces fit together, from the initial setup to the final, detailed forecast.

Following a structured approach like this ensures your long-term cash flow projections are built on a solid foundation of accurate property details and well-researched financial assumptions.

Handling Advanced Scenarios

A basic forecast is a good start, but a truly professional-grade model needs to account for the complexities of the real world. For any multi-unit property, this means modeling vacancy. It’s just not realistic to assume 100% occupancy year after year. A sharper approach is to project specific months of vacancy for different units as leases turn over, which gives you a far more accurate calculation of your Effective Gross Income (EGI).

Another critical piece of the long-term puzzle is planning for major repairs and replacements. This is where capital expenditures come in. Properly understanding reserve funds for future expenses is essential for accurate forecasting and protecting the long-term health of your investment.

The best pro forma models I've used offer this kind of granularity. They don't just give you an annual summary; they break down cash flow month by month. This lets you see exactly when your investment is projected to pay for itself—a huge milestone for any investor.

Modern templates built in Excel can stretch out a decade or more, tracking everything from revenue and operating expenses to financing details for multiple units. These tools allow you to set unique rent escalations and inflation rates for different expense categories, which is crucial for a realistic long-term forecast. They also help you manage vacancy by letting you plug in specific unoccupied months to see the financial impact.

Illustrating Pre-Tax Cash Flow

When you bring all these projections together, the result is a clear, year-by-year cash flow statement. This statement should always highlight two of the most important metrics in real estate analysis:

- Net Operating Income (NOI): This is your EGI minus all your operating expenses. It shows the property's raw profitability before you factor in any debt.

- Pre-Tax Cash Flow: You get this by subtracting your annual debt service (both principal and interest payments) from the NOI. This is the actual cash you can expect to have in your pocket at the end of each year.

This annual cash flow breakdown, combined with your other projections, is also the foundation of your tax strategy. If you want to go deeper on that topic, you can check out our guide on real estate investment tax benefits. By laying these numbers out clearly over a 10-year horizon, your pro forma paints a vivid and compelling picture of the property’s performance and its true potential to build wealth.

Calculating Key Metrics To Guide Your Decision

A pro forma packed with projections is just a spreadsheet full of numbers until you turn them into real intelligence. This is the crucial step where your analysis shifts from simple data entry to genuine decision-making. The whole point of using a real estate pro forma template in Excel is to calculate the key performance indicators (KPIs) that scream "good deal" or whisper "walk away."

Your long-term cash flow projections are the bedrock of your analysis. But metrics like the Cap Rate and Cash-on-Cash Return give you those critical, at-a-glance insights into a deal's potential profitability. These are the numbers that will shape your strategy and give you the confidence to pull the trigger.

Core Profitability Metrics

First on the list is the Capitalization Rate, or Cap Rate. This is arguably one of the most fundamental metrics in the world of commercial real estate. It’s a clean, simple way to measure a property’s unlevered annual return, assuming you bought it with all cash.

Inside your Excel template, the formula is straightforward:

Cap Rate = Net Operating Income (NOI) / Purchase Price

Generally, a higher Cap Rate can signal a higher potential return but often comes with more risk. A lower Cap Rate usually points to a more stable, established asset with lower risk.

Next up, you have to calculate the Cash-on-Cash (CoC) Return. I always pay close attention to this one because it tells you the return you’re getting on the actual cash you pulled out of your pocket. Unlike the Cap Rate, the CoC Return takes your financing into account.

Here's the formula:

CoC Return = Annual Pre-Tax Cash Flow / Total Cash Invested

Your "Total Cash Invested" isn't just your down payment; it needs to include all your closing costs and any upfront fees. This metric gives you a crystal-clear picture of how effectively your capital is working for you year after year. Beyond just projected cash flows, a solid pro forma is essential for calculating all the crucial Return on Investment (ROI) metrics in real estate that every investor needs to consider.

Measuring Total Return With IRR

While Cap Rate and CoC Return are fantastic for a yearly snapshot, they don’t tell the whole story of an investment over its entire lifespan. For that, you need the Internal Rate of Return (IRR). IRR calculates the total annualized return across your entire holding period, factoring in everything—the initial investment, all the annual cash flows, and the final profit you make from the sale.

Why is IRR so important? It accounts for the time value of money, which is the fundamental concept that a dollar today is worth more than a dollar tomorrow. IRR essentially finds the discount rate that makes the net present value of all your cash flows equal to zero.

Thankfully, you don't have to dust off a financial calculator or do this by hand. Excel has powerful built-in functions that do all the heavy lifting for you:

- IRR Function: Just type =IRR(values). The "values" are your series of cash flows, starting with your initial investment as a negative number, followed by all your positive annual cash flows.

- XIRR Function: If your cash flows come in at irregular intervals, use =XIRR(values, dates). It's even more precise.

The best modern real estate pro forma Excel templates come with these kinds of robust financial modeling features already built-in. Many now automate a 5-year IRR analysis, allowing you to project returns with a high degree of precision. They integrate monthly income and expense tracking, which then feeds into detailed operating expense breakdowns and helps you visualize equity build-up through loan paydown—a critical component for assessing long-term wealth creation.

Answering Common Pro Forma Questions

Even with a great template, you'll inevitably hit a few head-scratchers once you start digging into a real deal. These aren't abstract problems; they're the practical, in-the-weeds issues that determine whether your analysis is sharp or just wishful thinking. Let's walk through some of the questions I hear most often.

One of the first hurdles is nailing your operating expense growth. Simply slapping a flat 3% inflation rate on everything is a classic rookie mistake, and it can really burn you. A much smarter way to do it is to blend historical data with real-world intel. If the property's books show maintenance costs have crept up 5% every year for the past three years, that’s your baseline. Don't ignore it.

But you can't stop there. You have to look at what's happening right now. For example, insurance premiums have been on a tear lately, sometimes jumping 10-20% in a single year depending on the market. The only way to know for sure is to pick up the phone. Call a local insurance broker, get a real quote for Year 1, and then bake a more aggressive growth rate into that specific line item for the future.

The Single Biggest Mistake to Avoid

If I had to point to one fatal flaw I see over and over, it's letting optimism cloud your judgment. It's incredibly easy to fall in love with a potential acquisition and let your numbers become a fantasy wish list. Thinking you’ll immediately hit top-of-market rents with zero vacancy? That's a fast track to a bad deal.

The best antidote to this is relentless stress testing. Your real estate pro forma template in Excel should be a living, breathing tool, not some static report you create once. You need to build out different versions of the future to see just how fragile your deal is.

- Base Case: This is your most likely, most defensible set of projections.

- Pessimistic Case: What happens if rent growth stalls, vacancy climbs, and a big-ticket capital expense lands in Year 2?

- Aggressive Case: This is your best-case scenario, where your value-add strategy plays out perfectly.

When you run these scenarios, you're not just hoping for the best; you're actively preparing for reality. If the deal only pencils out in your most aggressive, blue-sky scenario, it’s a clear signal to walk away.

Keeping Your Pro Forma Fresh for Existing Properties

A pro forma isn't just a tool for buying real estate; it's a critical part of managing what you already own. So, how often should you be updating the forecast for a property in your portfolio?

I recommend a full, soup-to-nuts update at least annually. This usually lines up perfectly with your yearly budgeting process. It’s your chance to compare a full year of actual numbers against your projections and recalibrate for the year ahead.

On top of that, you should be doing quicker, high-level check-ins on a quarterly basis. This is more of a pulse check on your key income and expense lines. For instance, if you see after Q1 that your utility costs are already running 15% over budget, you can dig in and fix the problem right away. If you wait until the end of the year, the financial damage is already done. This proactive approach turns your pro forma from a simple acquisition model into a powerful dashboard for managing your investment.

Ready to move past spreadsheets and streamline your entire investment process? Homebase is the all-in-one platform designed for real estate operators to manage deals, raise funds, and handle investor relations with ease. Ditch the manual work and focus on what you do best: growing your portfolio. Learn more and get started today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.