Unlocking investor communication strategies for stronger partnerships

Unlocking investor communication strategies for stronger partnerships

Discover proven investor communication strategies to build trust, clarify your narrative, and attract lasting partnerships.

Domingo Valadez

Dec 17, 2025

Blog

An investor communication strategy is the game plan real estate sponsors use to build rock-solid trust, keep capital in their deals, and bring new partners into the fold. It's about more than just sending updates; it's a deliberate system for getting the right information to the right investors, at the right time, using the right channels. A great strategy is the difference between simply reporting and truly building a foundation of transparency and reliability.

Building Your Foundation for Investor Trust

Think of your real estate firm like a custom-built home. You can have the most stunning design, top-of-the-line materials, and a killer location, but if the foundation is cracked, the whole thing is compromised. Your investor communication strategy is that foundation. It's not the quarterly report you have to send; it’s the bedrock of every successful, long-term investor relationship you cultivate.

A proactive, thoughtfully designed communication plan is your single most valuable, non-physical asset. It’s what turns a first-time investor into a loyal partner who sticks with you, deal after deal. This guide will walk you through exactly how to construct that plan, piece by piece.

From Blueprint to Reality

Just as you wouldn't build a property without a detailed blueprint, you can't build lasting investor trust with haphazard communication. It’s time to stop sending reactive emails only when someone has a question and start building a strategic communication engine that fuels your firm's growth and reputation. We'll cover everything you need to build that unshakable trust:

- Defining Your Goals: Moving past vague ideas to set clear, measurable objectives for what you want your communications to achieve.

- Understanding Your Audience: Learning how to segment your investors so you can send them messages that actually matter to them.

- Crafting Your Message: Developing a clear, consistent story about your firm and your deals across every channel.

- Choosing the Right Tools: Using modern platforms to automate the tedious work and personalize your outreach.

- Navigating Compliance: Making sure your strategy follows all the rules to protect both your firm and your partners.

A well-informed investor is a confident investor. Your communication strategy is the primary tool for building that confidence, ensuring capital retention through market cycles and attracting sophisticated partners who value transparency as much as returns.

This is all about making a mental shift—from viewing communication as a chore to seeing it as a powerful competitive advantage. By the end of this guide, you’ll have a complete framework for a strategy that doesn’t just meet expectations but actively strengthens relationships, making your firm the obvious choice for savvy real estate investors. It all starts with laying that solid foundation.

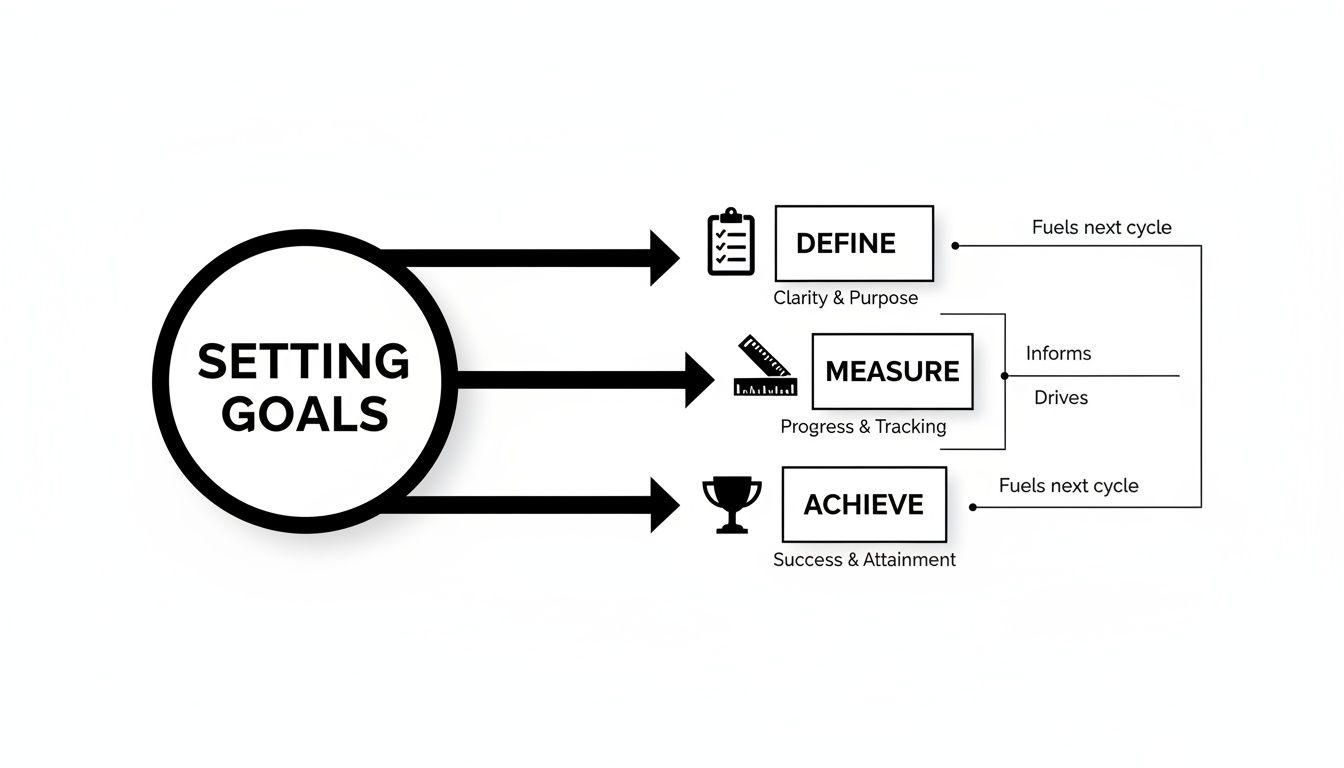

You Can’t Hit a Target You Can’t See: Setting Your Communication Goals

Before you type a single word of an investor update, you need to know what you’re trying to accomplish. Simply "keeping investors informed" isn't a strategy—it's a passive task. A powerful investor communication plan starts with sharp, well-defined goals that guide every email, report, and phone call.

Without this clarity, your communications become a series of random, disconnected updates that leave investors confused and wondering where the project is headed. The best way to get this right is by using the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. This isn't just corporate-speak; it's a practical blueprint for turning fuzzy ideas into concrete results.

Think of it like getting a property ready for development. You wouldn’t just show up with a bulldozer and start digging. You’d have a detailed site plan, architectural drawings, and a project schedule. SMART goals are the architectural drawings for your investor relationships.

Putting SMART Goals to Work in Your Real Estate Business

So, how does this translate to the real world of real estate syndication? Let's get specific.

Instead of a vague aspiration, you create a focused objective that has a real impact on your bottom line.

- Vague Goal: "We want to improve our investor relations."

- SMART Goal: "Increase the capital re-investment rate from our existing LPs by 15% over the next 12 months. We’ll do this by sending proactive quarterly project updates and hosting two exclusive investor-only webinars."

See the difference? This goal is specific (increase re-investment), measurable (by 15%), achievable (a realistic target), relevant (it’s all about retaining capital), and time-bound (12 months). Suddenly, your communication isn't just an update; it's a powerful tool for business growth.

Here’s another common one: getting your time back.

- Vague Goal: "Spend less time answering investor questions."

- SMART Goal: "Cut down on inbound investor email inquiries by 25% in the next six months. We'll achieve this by launching a centralized investor portal that includes a comprehensive FAQ section and monthly performance dashboards."

This objective ties a communication tool—the portal—directly to a measurable business outcome. The result? Your team is freed up to focus on finding the next great deal instead of answering the same questions over and over.

From Goals to Gauges: Tying It All to KPIs

Once your SMART goals are set, you need a way to know if you're actually on track. This is where Key Performance Indicators (KPIs) come in. KPIs are the specific metrics that prove your strategy is working. They're the gauges on your dashboard giving you real-time feedback.

Success isn't measured by the act of communicating, but by the tangible outcomes it produces. Your KPIs are the proof that your efforts are paying off in retained capital, stronger relationships, or streamlined operations.

For a real estate sponsor, your dashboard might include KPIs like:

- Capital Re-investment Rate: What percentage of investors from a sold deal roll their capital into your next one?

- Investor Portal Engagement: How often are investors logging in? Are they downloading K-1s and reading reports?

- Net Promoter Score (NPS): A simple survey score that tells you how likely your investors are to recommend you to others.

- Fundraising Velocity: How quickly are you able to close your next funding round?

This data-driven approach is proven. Public companies that implement structured, multi-channel investor communication see a direct impact. One program, for example, tracked over 127,000 investor hub views and 19,400 unique investor visits during a capital raise, helping them close a successful round despite a choppy market. You can read more about how structured communication drives results for investors here.

By connecting your SMART goals to these kinds of KPIs, your investor communication transforms from a simple to-do list into a data-driven engine that powers your business forward.

Tailoring Your Message to Different Investor Types

Sending the exact same email blast to every investor is a classic rookie mistake. It’s like a contractor using the same blueprint for a high-rise and a single-family home—it just doesn’t make sense. The best communication strategies are built on a simple, powerful truth: not all investors are the same.

Customizing your message for different groups is the only way to make each partner feel like you truly understand them and value their investment. This is where audience segmentation comes in. It’s the process of thoughtfully dividing your investor base into smaller, more specific groups based on what they have in common.

Think about it. A seasoned institutional investor wants to see the high-level market data. But a first-time passive investor? They're probably more interested in seeing a photo of the new roof going on the property they invested in. A one-size-fits-all message is guaranteed to be a one-size-fits-none reality for someone. Your goal is to shift from just broadcasting information to having a real, targeted conversation.

Key Ways to Segment Your Investor Audience

Don't overcomplicate it. You don't need a dozen different categories to get started. Most real estate sponsors can get massive value from segmenting their audience based on just a few practical criteria.

Here are the three big ones to start with:

- Experience Level: An investor making their first-ever syndication investment has completely different needs than a veteran who's been in 20 of your deals. Newcomers need more education, more reassurance, and clear explanations of the terms you use every day. The pro just wants the hard data—the bottom-line reporting without the fluff.

- Investment Size and Type: The person who wrote a check for $25,000 for a single deal has different expectations than the family office that has $2 million invested across your entire portfolio. Your largest investors, whether they're high-net-worth individuals or institutions, typically expect a higher-touch approach, like one-on-one calls and access to more detailed financial models.

- Project Involvement: What an investor needs to hear depends entirely on their relationship with a specific asset. A prospective investor checking you out for the first time? They need to see your track record and a compelling story about the deal's potential. A current investor in a ground-up development? They’re hungry for granular updates on construction timelines, leasing progress, and how you’re tracking against the budget.

This simple framework helps you define who you're talking to, measure what they care about, and ultimately, achieve your communication goals.

The process is cyclical. You define your segments, measure what works, and achieve better engagement, which in turn helps you refine your segments even further.

A Practical Framework for Investor Segmentation

Once you've mapped out your investor segments, you can start building a communication plan that speaks directly to their needs. This is how a simple communication strategy becomes a powerful relationship-building machine.

Here is a sample framework to help you think through how to approach each group.

This table isn't rigid—it's a starting point. The key is to be intentional and consistent with how you communicate with each of these vital groups.

Effective segmentation is really just about empathy. It’s about putting yourself in your investors' shoes and asking, "What information would be most valuable and reassuring to me right now?" Answering that question is the foundation of a world-class investor relations program.

By aligning your message with the right audience, you stop talking at your investors and start building a real dialogue. This focused approach not only boosts engagement but also shows a level of professionalism and care that sets you apart. The result? A more informed, confident, and loyal group of investors who are ready to jump into your next deal.

Crafting Your Message and Choosing Your Channels

Once you know who you’re talking to, it’s time to figure out what you’re going to say and how you’re going to say it. This is about more than just reporting numbers. It's about building a consistent, compelling story around your firm, your strategy, and every single deal you bring to the table. This narrative becomes your blueprint, making sure every email, report, and phone call reinforces the value you bring.

A solid messaging framework really boils down to three things: your unique value, what sets you apart, and how you handle risk. Think of it as your firm’s elevator pitch, but with more substance. It’s the story that answers the unspoken question in every investor's mind: "Why should I trust you with my capital over all the other options out there?"

When you get this right, you’re proactively answering the questions your investors are always thinking about, even if they never ask them out loud.

Building Your Core Messaging Framework

Your core message is the "why" behind your firm. It’s the central theme that ties together every project update, quarterly report, and market commentary you send out.

To build it, you need to nail these key pieces:

- Articulate Your Value Proposition: Get crystal clear on the specific value you deliver. Is it exclusive access to off-market deals? Maybe you’re the go-to expert in a niche like medical office buildings or have a proven track record of complex value-add renovations. This needs to be a simple, powerful statement of benefit.

- Highlight Competitive Differentiators: What makes you different? Maybe you’ve developed a proprietary underwriting model that’s more accurate than the rest. Perhaps your team has deep local relationships that give you an inside track. Or maybe your principals co-invest a significant chunk of their own money into every single deal. These are the proof points that build real credibility.

- Address Risk Transparently: Don't sweep risk under the rug. Being upfront about how you spot, mitigate, and manage potential downsides shows sophistication and builds tremendous trust. It tells investors you’re a careful, prudent steward of their capital, not just a promoter.

A great messaging framework isn't about hype; it's about clarity and consistency. It ensures that whether an investor is reading a quick email update or a detailed annual report, the story of your firm’s competence and integrity shines through.

This consistent story is what turns one-off updates into a cohesive narrative, building investor confidence with every interaction. Once your message is locked in, you can start thinking about the best ways to get it out there.

Selecting the Right Communication Channels

The channel you use to deliver a message is just as important as the message itself. The best update in the world is useless if it gets lost in the wrong inbox or fails to make an impact. The goal here is a multi-channel approach where each platform has a specific job.

A smart communication plan uses a mix of channels to match different investor preferences and message types. It’s no surprise that 73% of private equity firms now use advanced tools to personalize reporting—they know the one-size-fits-all approach just doesn’t cut it anymore.

Here’s a breakdown of the most common channels and where they shine for real estate sponsors:

- Secure Investor Portals: This is your digital headquarters. A portal like Homebase is the perfect place to keep all critical information in one secure, organized spot. Think official documents like K-1s, subscription agreements, and detailed quarterly financial reports. It’s your single source of truth.

- Email Newsletters: Email is fantastic for regular, less formal updates that maintain a connection. Use it for monthly progress reports on a renovation, sharing interesting market insights, announcing a new acquisition, or sending quick photo and video updates from a job site. It keeps you top-of-mind without being a bother.

- Webinars and Virtual Meetings: When you have big news or a complex topic to cover, nothing beats a live, interactive format. Webinars are perfect for kicking off a new fund, walking investors through an annual report, or breaking down a significant market shift. The Q&A session alone is worth its weight in gold for addressing concerns in real time.

- Personal Calls and One-on-One Meetings: This is the high-touch channel. Save it for your most significant investors or for sensitive conversations. A personal call to discuss portfolio performance or even just to check in after a major life event shows a level of care that builds unshakable loyalty.

By picking the right channel for the right message, you create a communication rhythm that investors can count on. This cadence builds confidence and reinforces your firm's professionalism, making sure your partners feel informed, respected, and valued every step of the way.

Using Modern Tools for Smarter Communication

Moving from the blueprint to the build site requires the right set of tools. For today's real estate sponsors, technology is the power tool that takes a good investor communication strategy and makes it truly great. It’s time to ditch the manual spreadsheets and cluttered inboxes. Modern platforms are designed to handle the heavy lifting—automating workflows, personalizing outreach, and delivering powerful insights at scale.

This isn’t just about being more efficient. It’s about shifting your communication from a reactive chore to a proactive, data-backed engine for building stronger relationships. The right tech helps you anticipate what your investors need, often before they even have to ask.

Centralize Everything with an Investor Portal

If there's one tool that can fundamentally change your investor relations, it's a dedicated investor portal. Think of it as a secure, branded digital headquarters for your investors. It’s the single source of truth that centralizes every critical piece of information and eliminates the back-and-forth emails.

An investor portal isn't just a document repository; it's a statement of professionalism and transparency. It signals to investors that you are organized, secure, and committed to providing them with a seamless experience, building confidence from day one.

A well-built portal becomes the indispensable core of your communication strategy, serving several key functions:

- Document Management: It securely hosts everything from subscription agreements and K-1s to quarterly reports and operating agreements. Your investors get 24/7 access without ever having to ping you.

- Performance Dashboards: Instead of digging through PDFs, investors can see key metrics and performance-to-projections at a glance, right on their dashboard.

- Communication Hub: You can post property updates, share new photos, and send announcements directly through the platform, ensuring everyone gets the same message at the same time.

By bringing all this under one roof, you claw back countless hours previously lost to administrative tasks. You can learn more about how to choose the right real estate investor portal and the features that matter most in our detailed guide.

Unlocking Insights with Data Analytics

The real magic of modern tools is the data they give you. Instead of guessing what your investors care about, you can actually know by tracking how they engage with your content. This data creates a powerful feedback loop, allowing you to fine-tune your strategy on the fly.

Data-driven personalization is quickly becoming the standard. One industry analysis found that 73% of private equity firms are already using advanced tools to personalize investor reporting. This makes sense, especially when you see that 47% of investors are asking for more clarity on strategic topics like innovation. Using analytics is how you meet these evolving demands.

Here are a few key metrics you should be watching:

- Email Open and Click-Through Rates: Which subject lines work? What content are people actually reading?

- Portal Login Frequency: This helps you identify your most engaged investors and those who might need a gentle nudge.

- Document Downloads: Know which reports are getting the most attention. A sudden spike in downloads of a specific financial statement could be a great topic for your next webinar.

- Webinar Attendance and Engagement: See who shows up for live sessions and which parts of the presentation spark the most questions.

Imagine you notice that a dozen investors have suddenly downloaded reports related to debt service. That’s pure gold. It’s a clear signal to proactively address refinancing options in your next update, showing them you’re not just managing a property—you're managing their investment with genuine foresight.

Navigating Compliance and Reporting Best Practices

In the world of real estate investing, trust is your most valuable currency. But that trust has to be built on a solid foundation of regulatory compliance. A great communication strategy isn't just about being open and transparent; it's about carefully balancing that openness with the rules that protect both your firm and your investors.

This means you have to look at every update, report, and email through a legal and regulatory lens. If you don't, you can create a huge amount of risk for your business, turning a simple communication mistake into a serious liability. The goal is to build a compliant framework that becomes a natural part of how you communicate, not a restrictive box you have to check at the end.

Maintaining Meticulous Records

The bedrock of any compliant communication strategy is documentation. Think of it as the official logbook for every investor relationship. It’s not just about what you said; it’s about having proof of when, how, and to whom you said it.

Keeping detailed records is your first line of defense. This is about more than just saving emails. Your documentation should be a complete, chronological history of your interactions with each investor, capturing every single touchpoint.

This isn’t just busywork; it's critical for a few key reasons:

- Audit Preparedness: If regulators ever come knocking, a clean, organized record of your communications shows them you’re diligent and professional.

- Dispute Resolution: In the rare case of a misunderstanding or dispute, documented conversations provide a clear, factual history of what was actually said.

- Consistency: A central record helps your entire team stay on the same page, ensuring everyone is working from the same information and delivering a consistent message.

"A well-documented communication history is non-negotiable. It transforms subjective recollections into an objective record, providing a critical layer of protection for your firm while reinforcing a culture of accountability and precision."

An Actionable Checklist for Mitigating Risk

Managing risk proactively just means having clear guardrails in place for everything you send out. To make it simple, we’ve put together a checklist of best practices. Use these to make sure every piece of content you share with investors is fair, balanced, and compliant.

- Use Clear Disclaimers: Any time you mention potential returns or project timelines, you absolutely must include a disclaimer. This language needs to make it crystal clear that these are projections, not guarantees, and that all investments carry risk.

- Ensure Fair and Balanced Information: Avoid the temptation to only highlight the good news. Compliant communication presents a balanced view, acknowledging potential risks and challenges right alongside the opportunities. This not only builds credibility but also meets disclosure requirements.

- Establish an Internal Review Process: No investor communication should ever go out without a second set of eyes on it. Ideally, a principal or your legal counsel should give it a final look. This simple step catches errors, ensures consistency, and reinforces your compliance standards.

- Manage Forward-Looking Statements Carefully: Be extremely cautious with speculative language. Ground all performance discussions in historical data and clearly label any projections for what they are—projections.

- Utilize Secure Platforms: Never, ever send sensitive documents like K-1s or subscription agreements through standard email. A secure investor portal like Homebase ensures that confidential information is protected and that all access is logged.

By systematically applying these checks, you create a robust compliance framework. This doesn't just protect your firm; it also shows investors that you operate with the highest standards of integrity. This disciplined approach is a cornerstone of any truly effective investor communication strategy.

Answering Your Top Investor Communication Questions

Even with a solid strategy in place, the real world of investor relations is full of tricky situations and practical questions. Let's tackle some of the most common ones we hear from sponsors on the ground.

How Often Should I Be Communicating?

There's no magic number here, but there is a magic word: predictability. Your investors should never have to wonder when they'll next hear from you.

A great starting point for most deals is a formal, detailed performance report at least quarterly. For a ground-up development or a heavy value-add project where things are changing fast, a brief monthly email update with a few photos or a quick video can work wonders to keep everyone engaged.

The goal is to strike a balance. You want to keep investors feeling informed and confident, not buried in emails. Too much communication about minor details can cause them to tune you out, while radio silence breeds anxiety and kills trust.

What’s the Best Way to Deliver Bad News?

Sooner or later, every project hits a snag. It's how you handle these moments that truly defines your relationship with your investors. When you have to deliver bad news, nail these three steps:

- Get Out in Front of It: The worst thing you can do is wait. As soon as you have a handle on the situation, be the one to break the news. Don't let your investors find out from someone else or by seeing a problem firsthand.

- Be Direct and Own It: Rip off the Band-Aid. Clearly explain what happened, what it means for the project, and why it happened. Don't use confusing jargon or try to soften the blow—your investors are sophisticated enough to handle the truth, and they'll respect you for it.

- Show Them the Plan: This is where you turn a problem into a trust-building opportunity. Immediately follow the bad news with the concrete steps you're taking to fix it. This shows you're in control and reassures them that their capital is in capable hands.

Delivering bad news is a defining moment. When you combine total transparency with a clear, confident action plan, you’re not just managing a crisis—you’re proving you’re a trustworthy steward of their capital. That builds a level of loyalty that good news never could.

Should I Use Social Media for Investor Communications?

Think of it this way: social media is for attracting investors, not for reporting to them.

Platforms like LinkedIn are fantastic tools for building your brand. Use them to share market insights, post photos of a stabilized property, or announce a successful exit. It’s all about establishing your firm as an expert and getting on the radar of potential new investors.

But for your current LPs? All official business—think financial reports, K-1s, or specific updates about a deal's performance—belongs on a secure platform like your investor portal. This creates a critical firewall, keeping sensitive data protected while letting you use public channels for what they do best: marketing.

Ready to transform your investor relations from a manual chore into a professional, automated engine for growth? Homebase provides an all-in-one platform to manage fundraising, centralize communications, and deliver an exceptional investor experience. See how Homebase can streamline your operations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.