Real Estate Investor Portal: The Smart Investor's Guide

Real Estate Investor Portal: The Smart Investor's Guide

Master real estate investor portal essentials with proven strategies. Discover how top investors leverage technology for smarter investing.

Domingo Valadez

Jun 16, 2025

Blog

Why Real Estate Investor Portals Are Game-Changers

Imagine managing a dozen different real estate investments. You're wading through a sea of emails, trying to keep track of each property’s performance. It’s a chaotic mess. That's the problem real estate investor portals solve. They act as a central hub, bringing order to the often-complex world of real estate syndication. Think of it like the conductor of an orchestra, bringing all the different instruments together to create a harmonious symphony.

The earliest versions of these platforms were simple. They were mainly used to store and share documents securely. But just like smartphones have evolved from simple call-and-text devices, investor portals have grown into sophisticated investment ecosystems. Modern portals offer features like automated reporting, direct communication tools for investors, and in-depth performance analytics.

This shift reflects the increasingly complex and demanding nature of the real estate investment world. The market is expected to reach $5.39 trillion by 2026, growing at a rate of 9.6% each year. This growth is fueled by investors diversifying their holdings across different markets and property types. Discover more insights on real estate market growth.

Benefits for Sponsors and Investors

A powerful investor portal benefits everyone involved, both sponsors and investors.

For sponsors, it's a huge boost to efficiency. Think about the time saved by automating tasks like distributing documents, sending investor updates, and tracking performance. That frees up sponsors to focus on finding new deals and building relationships with investors.

From the investor's perspective, portals offer increased transparency and engagement. They have access to real-time updates, performance data, and key documents, all in one easy-to-access location. This fosters trust and confidence in the sponsor. Plus, having all the information readily available allows investors to make smarter, more informed decisions.

From Amateur Hour to Professional Grade

Just like there's a difference between using a basic spreadsheet and professional financial software, there’s a big difference between basic and advanced investor portals. Some platforms offer only essential features, while others provide a comprehensive toolkit.

Professional-grade portals include crucial features like KYC/AML compliance tools, e-signature capabilities, and automated report distribution. These advanced features not only streamline operations but also project a more professional and trustworthy image. Choosing the right portal can dramatically impact both investor satisfaction and the sponsor's overall success.

Essential Features That Make Portals Actually Useful

What truly distinguishes a useful real estate investor portal from a mere digital filing cabinet? It's all about the features. A valuable portal empowers both sponsors and investors to manage their investments with ease and efficiency. This means moving beyond simple document storage and creating a dynamic hub for information and interaction.

Key Functionalities for a Powerful Portal

Think of a truly powerful real estate investor portal as the central nervous system of your syndication operations. It brings together essential functions into a single, seamless experience. But what exactly are these key functionalities?

- Document Management: Secure, organized, and centralized storage for all deal-related documents. Everything from offering memorandums to closing statements, readily available to authorized investors. No more sifting through email chains or physical files.

- Financial Reporting: Clear, concise, and current financial reports are essential. Think performance metrics, distributions, and capital account statements. Automated reporting features can significantly reduce the administrative burden.

- Communication Tools: Open lines of communication between sponsors and investors are crucial. This could include secure messaging, announcements, or even integrated video conferencing.

- Performance Analytics: Dashboards and visualizations that track key performance indicators (KPIs) offer investors a clear, at-a-glance view of their investment performance.

- Investor Self-Service: Empower investors with the ability to access information, update their profiles, and manage their investments independently. This not only reduces the workload for sponsors but also boosts investor satisfaction.

For instance, imagine an investor needing quick access to a K-1 tax form. With a robust portal, they simply log in and retrieve it instantly, eliminating the need to email the sponsor and wait for a reply. This self-service functionality saves everyone time and hassle.

From Basic to Advanced: Comparing Portal Features

Before we dive into the evolution of portals, let's compare the core features you can expect across different platform levels. The following table outlines how basic, intermediate, and advanced portals stack up.

Essential Portal Features Comparison

Comparison of core features across different portal types - basic, intermediate, and advanced platforms

As you can see, the sophistication of features increases significantly with each portal level, driving positive business impact. Choosing the right platform depends on your specific needs and resources.

The Evolution of Investor Portals

The difference between a clunky, outdated platform and a modern real estate investor portal is stark. Older platforms often function like digital filing cabinets, primarily focused on document storage.

Modern portals, however, have evolved into dynamic business intelligence hubs. They provide real-time data, interactive tools, and personalized experiences. This reflects a broader industry shift towards greater transparency and readily available information.

You might be interested in: Investor Portal Solutions

Emerging features like mobile optimization, automated reporting, and integrated e-signatures (DocuSign) are quickly becoming the norm. These advancements empower investors to access information on the go, receive automatic updates, and execute documents electronically. This signifies a move towards a more user-centric and efficient investment experience, leveraging technology to streamline real estate investing.

How Smart Sponsors Use Portals To Scale Operations

For real estate sponsors, a robust investor portal isn't just a helpful tool; it's the foundation of a well-oiled machine. It's the central nervous system of their operations, offering the potential to save hundreds of hours each year and significantly boost their professional image. Think of it as the difference between managing investor communications through a crowded town square with a megaphone, versus a personalized, direct line to each investor.

Automating the Mundane, Elevating the Experience

Successful sponsors use these portals to automate routine tasks, freeing up precious time. This translates to less time wrestling with administrative headaches and more time dedicated to finding promising deals and cultivating meaningful investor relationships. Think of tasks like distributing documents, sending performance updates, and collecting e-signatures—all seamlessly managed within the portal.

Imagine a sponsor juggling a large syndication. Instead of individually emailing updates to hundreds of investors, they can use the portal to instantly distribute reports and announcements. This not only saves time but ensures everyone receives consistent, timely information.

Maintaining Compliance Effortlessly

Compliance is paramount in real estate syndications. A well-designed real estate investor portal acts like a guardrail, helping sponsors stay on the right side of regulatory requirements. Resources like this list of the Best Software Platforms 2023 can be invaluable when comparing features. Key functionalities like KYC/AML checks, secure document storage, and comprehensive audit trails simplify compliance, minimizing the risk of penalties and legal tangles.

This peace of mind allows sponsors to focus on growth, confident their investor relations are handled securely and professionally. It’s like having a built-in compliance assistant working tirelessly behind the scenes.

Scaling Operations Without the Growing Pains

As a sponsor's portfolio grows, managing investor relationships can feel like juggling an increasing number of balls. An investor portal provides the infrastructure to scale smoothly, adapting to the expanding needs of the business. It's like having a team that effortlessly expands alongside your growth.

Consider adding a new investment to your portfolio. With a portal, onboarding new investors, distributing essential documents, and managing communications becomes a streamlined process. This eliminates the need to constantly revamp processes or scramble to hire additional staff just to keep up with increased investor activity. This inherent scalability empowers sponsors to handle multiple deals concurrently without becoming overwhelmed by administrative burdens. It helps maintain a polished, professional image, fostering trust and transparency with investors. These strong relationships are the cornerstone of every successful real estate syndication.

What Investors Really Want From Portal Experiences

Imagine getting a text message every time the value of your stocks changed. A bit much, wouldn’t you say? That constant barrage of information is similar to what investors experience with a poorly designed real estate investor portal. They don't want to be overwhelmed; they want useful information. A good portal empowers investors and builds their confidence.

The Power of Transparency and Control

The true benefit of a real estate investor portal is its ability to create transparency and control for investors. It’s like giving them a direct line of sight into their investments, allowing them to see exactly what's happening. This open access builds trust and strengthens the relationship between sponsors and investors. And a strong relationship is key to a successful investment experience. To scale your operations effectively using a real estate investor portal, think about incorporating proven lead-generation methods. Learn more about B2B lead generation strategies.

Intuitive Interfaces and User-Friendly Design

No one wants to wrestle with a complicated dashboard or spend ages searching for important documents. An intuitive interface is essential. Investors appreciate a clean, easy-to-navigate platform that presents information clearly and logically. Think about your online banking experience. The best platforms provide simple access to account balances, transaction history, and bill pay. A real estate investor portal should aim for that same level of user-friendliness.

Timely Communication and Relevant Updates

Just like any successful relationship, the sponsor-investor dynamic thrives on good communication. Investors want timely, relevant updates that keep them in the loop without drowning them in unnecessary details. A well-designed portal acts as a central hub for announcements, performance reports, and direct messaging, ensuring investors have the information they need, when they need it. No more lost emails or misplaced files – everything is readily available within the portal. Interestingly, smaller real estate investors have been particularly active this year. Small investors (those buying ten or fewer homes) made up 59% of all investor home purchases in 2024. This record high represents 361,900 homes and a 3.7% year-over-year increase. Find more details on investor market share.

Enhancing the Investment Journey

Ultimately, a real estate investor portal should make the entire investment journey smoother and more rewarding. It should give investors the tools and information they need to make smart decisions, stay actively involved, and feel confident in their partnership with the sponsor. This leads to higher investor retention, stronger referral networks, and a more successful syndication overall.

Build Vs Buy: Making The Smart Platform Decision

Choosing the right real estate investor portal is a critical decision. It's the bedrock of your investor relations, like the foundation upon which you build your entire syndication business. You have two main options: build a custom platform or buy an existing solution. Each has its own set of costs, timelines, and long-term implications. Understanding these is key to making a decision that aligns with your specific needs and resources.

Weighing the Pros and Cons of Building

Building a custom real estate investor portal gives you ultimate control. Think of it as designing your dream home – you decide on every detail, ensuring the platform perfectly matches your workflow. You control the features, the look, the feel, everything. However, this bespoke approach comes with a hefty price tag, both in terms of money and time. Development can take months, even years, and requires ongoing investment in maintenance and updates. Just like building a house from the ground up, it's a long and demanding process.

Exploring the Benefits of Buying

On the other hand, buying an existing real estate investor portal is a faster, often more affordable route. It’s like buying a move-in-ready home. You can settle in quickly, but you might need to compromise on some of your ideal features. While customization options might be limited, you benefit from features that are already built and tested, established security measures, and readily available customer support. This can be a huge advantage for sponsors wanting to get started quickly.

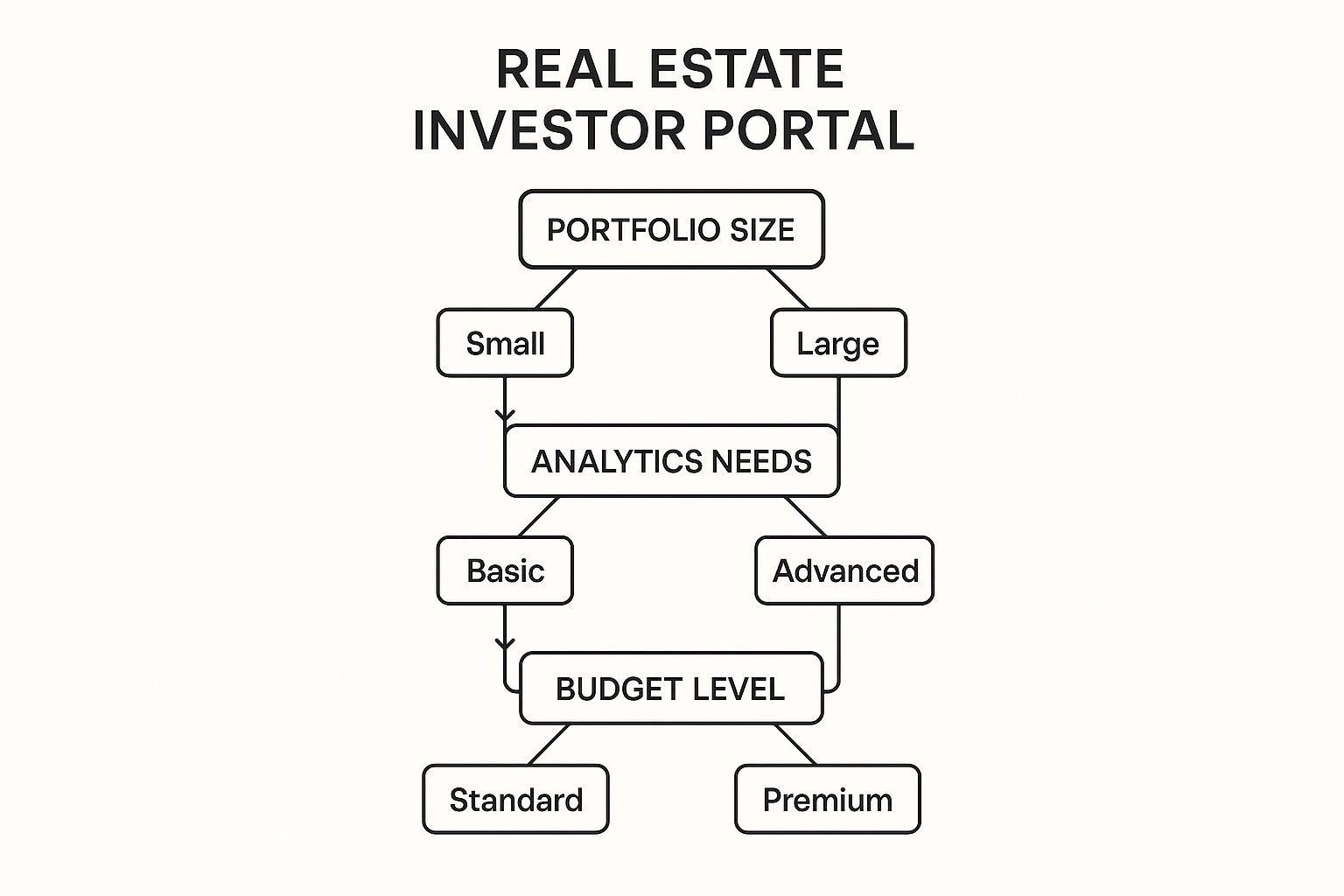

This infographic acts like a guide, walking you through the key factors to consider when choosing a portal: portfolio size, analytics needs, and budget. By weighing these elements, it helps you identify the best path—building, buying, or a hybrid solution. For example, a sponsor with a large portfolio and sophisticated analytics needs might favor a custom build or a hybrid approach. A smaller sponsor with more basic needs might find an existing platform perfectly adequate.

The Hybrid Approach: Blending the Best of Both Worlds

Some sponsors find the sweet spot in a hybrid approach. This involves combining an existing real estate investor portal with custom-built features. It’s like buying a house and then renovating it to fit your specific tastes. You get the basic structure and foundation, but you can customize key areas. This lets you take advantage of the speed and cost-effectiveness of an existing platform while still adding unique functionalities crucial to your business.

Carefully consider your technical skills and resources when evaluating the hybrid model. Overestimating your internal capabilities can lead to delays and cost overruns, undermining the benefits of this approach. An honest assessment of your tech expertise is vital for smart decision-making. The decision between building, buying, or going hybrid is a significant first step. The right path depends on your individual needs, your available resources, and your long-term vision for your syndication business.

To help you visualize the decision-making process, let's look at a comparison table summarizing the key factors.

Before we dive in, here’s a quick explanation: This table, titled "Build vs. Buy Decision Matrix," offers a comprehensive comparison of the costs, timelines, and crucial considerations for building a custom portal versus purchasing an existing one, along with exploring the hybrid approach.

Now that we’ve reviewed the table, let’s summarize the key takeaways. Cost and time are major differentiators, with building being the most expensive and time-consuming option. Buying provides a quick and affordable solution, but at the cost of some flexibility. The hybrid approach aims to balance these factors, offering moderate cost and time investment while retaining a degree of control. Your specific needs and resources should ultimately guide your choice.

Security And Compliance Without The Headaches

Security in real estate syndications isn't optional; it's the bedrock of investor trust and regulatory compliance. Think of it like the foundation of a skyscraper: a weak base jeopardizes the entire structure. This section breaks down the essentials of portal security—like data encryption and access controls—into practical concepts you can use.

Understanding the Importance of Data Protection

Imagine sending sensitive financial documents via email without password protection. That's essentially what sending data online without encryption is like. Data encryption scrambles information, rendering it unreadable without the proper key. This protects investor data, ensuring confidentiality and reinforcing trust.

Access controls, on the other hand, act like a vigilant security guard, controlling who can view and interact with specific information within the real estate investor portal. This granular level of control prevents unauthorized access, safeguarding sensitive data and maintaining compliance.

Navigating Compliance Requirements

Real estate investment compliance can feel overwhelming. Regulations like document retention policies, investor verification procedures, and reporting obligations can be tricky. A robust portal simplifies these processes with features designed to meet these specific requirements. Choosing between building and buying a portal requires careful consideration, much like planning a major home renovation. All aspects need to be accounted for, from initial planning to the final touches. For a deeper understanding of comprehensive project planning, consider this resource: Extension and Renovation Process.

For instance, imagine an auditor requests a specific investor document from five years ago. A portal with proper document retention makes retrieval quick and easy, eliminating frantic searches. Built-in KYC/AML (Know Your Customer/Anti-Money Laundering) checks also help sponsors meet regulatory requirements, minimizing legal and financial risks.

Learning From Real-World Examples

Real-world cases illustrate the significant impact of security breaches. Sponsors who’ve experienced breaches often face reputational damage, financial losses, and diminished investor confidence. These examples underscore the vital role of proactive security measures. Leading real estate investor portals prioritize security, investing heavily in safeguards like regular security audits and penetration testing. These measures protect sensitive data, build trust, and ensure investor confidence.

Keeping an eye on market trends is also crucial. The U.S. real estate market outlook for 2025 predicts a moderate recovery in investment activity despite economic uncertainties and higher interest rates. CBRE's 2025 Market Outlook research indicates that the office sector, having experienced a downturn, is expected to rebound by the end of 2025, continuing its upward trajectory.

Finally, security isn't a one-and-done task; it's an ongoing process. Regularly review your portal’s security features, stay informed about new threats, and partner with vendors who prioritize data protection. Prioritizing security and compliance builds a strong foundation for investor trust and operational success in the ever-changing world of real estate syndication.

Launch Strategy That Actually Works

Launching a real estate investor portal isn't like flipping a switch. It's more like orchestrating a grand opening for a new building. You want everything to be perfect, from the catered snacks to the perfectly positioned signage, ensuring a positive first impression. This means considering both the technical nuts and bolts and the human element, how your investors will actually experience the platform.

A Phased Approach to Implementation

Imagine trying to move an entire office building's worth of people all at once. Chaos! That's why a phased rollout is key. It minimizes disruption and allows you to adjust on the fly. Start with a pilot group of investors, your trusted “early adopters.” This lets you test the portal in a real-world setting, gather feedback, and fix any glitches before going wide. This initial phase is like a dress rehearsal, providing valuable insights and allowing you to fine-tune processes and address any unexpected hiccups.

Onboarding and Data Migration

Moving data from existing systems to the new real estate investor portal can be tricky. Think of it like moving to a new house. You want to pack and unpack methodically to avoid losing or damaging anything. Data migration requires a careful, planned approach to ensure data integrity and minimize disruption to your existing operations. Keeping your investors informed throughout this process is vital; clear communication builds trust and keeps everyone on the same page.

Training and Support

Training is crucial, both for your team and your investors. Your team needs to be experts on the portal’s functionalities, while investors need to know how to navigate the platform and access the information they need. Think of it like learning any new software. Training ensures everyone can use the tool effectively. Offering ongoing support and easy-to-find resources further enhances the user experience.

This screenshot from Appfolio's website showcases their investor portal features. The clean design and focus on key features like document management, financial reporting, and communication tools demonstrate the importance of a user-friendly interface. These elements contribute to a positive investor experience and encourage adoption.

Measuring Success and Iterating

After launch, keep a close eye on key metrics like portal usage, investor engagement, and support requests. This data is your compass, guiding you toward what's working and what needs tweaking. It’s like checking the building’s occupancy rates and tenant satisfaction scores after the grand opening. Regularly gathering feedback and adapting based on actual user behavior is critical for long-term success. This continuous improvement approach ensures your real estate investor portal remains a valuable resource for everyone.

Ready to improve your investor relationships and simplify your real estate syndication operations? Consider Homebase, an all-in-one platform designed for real estate sponsors.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.