How to Invest in Real Estate Syndication: Expert Guide

How to Invest in Real Estate Syndication: Expert Guide

Learn how to invest in real estate syndication with our expert guide. Find deals, vet sponsors, and grow your wealth effectively.

Domingo Valadez

Jul 1, 2025

Blog

Investing in a real estate syndication means you get to own a slice of a large commercial property, like an apartment complex or a self-storage facility, without ever having to deal with tenants or toilets. It's a team sport. You pool your money with other investors, an experienced operator (the "sponsor") runs the show, and you collect your share of the profits.

This model opens doors to high-dollar assets that are typically out of reach for individual investors.

Your Guide to Investing in Real Estate Syndication

So, you're thinking about diving into real estate syndication. Good. This is where you can move beyond single-family rentals and own a piece of a 200-unit apartment building run by seasoned pros. The concept is straightforward: a group of people combines their cash to buy a big-ticket asset none of them could afford on their own.

Every deal revolves around the sponsor, also known as the general partner (GP). This is the person or company with the track record and the team to find a promising property, secure the financing, and execute the business plan.

As an investor, you become a limited partner (LP). Your job is to provide capital in exchange for equity. Once you've done your homework and wired the funds, you get to be passive. The sponsor does all the heavy lifting.

Understanding the Key Players

Knowing who is responsible for what is absolutely critical before you invest a single dollar. The sponsor's job is to make the investment successful—whether that means renovating units to boost rents, cutting operational waste, or refinancing at the right time. Their success is your success.

You, the investor, are responsible for vetting the sponsor and the deal itself. This leads to the most important document you'll receive: the Private Placement Memorandum (PPM).

Think of the PPM as the investment’s rulebook. It’s a dense legal document, but it lays out everything you need to know: the property details, the sponsor’s strategy, all potential risks, and the financial structure of the deal. Reading it from cover to cover isn't just a suggestion; it's essential due diligence. The PPM will also clarify if the deal is open only to accredited investors, a status defined by the SEC based on specific income or net worth thresholds.

To break it down further, here’s a look at the main roles in a typical deal.

Key Players in a Real Estate Syndication Deal

The table below summarizes the core responsibilities and compensation structures for the parties involved. Getting this straight helps you understand where your money is going and whose interests are aligned with yours.

Each role is distinct but interconnected, creating a system where professionals are incentivized to perform at their best, which ultimately benefits you as the passive investor.

Why Syndication is a Powerful Wealth-Building Tool

Before jumping into a syndication, it's wise to get a sense of the entire investment landscape. There are many different types of real estate investments, but syndication offers a unique combination of benefits that's hard to find elsewhere.

The real power of syndication lies in its ability to offer passive investors access to professionally managed, institutional-quality assets. It effectively democratizes commercial real estate investing.

This model is particularly attractive for a few key reasons:

- Access to Bigger Deals: You can invest in large-scale multifamily, office, or industrial properties that would otherwise be inaccessible.

- Passive Income: You receive a share of the rental income without the landlord headaches. This creates a steady cash flow stream.

- Professional Management: You're banking on an expert's ability to maximize the property's value, which is a much better bet than trying to do it all yourself.

- Significant Tax Advantages: Benefits like depreciation can help shelter your investment income, a huge perk for wealth accumulation.

In the end, learning how to invest in real estate syndication comes down to understanding this powerful partnership between a skilled operator and smart, passive capital. It's a proven strategy for building a diversified portfolio with tangible assets, all without taking on a second job as a landlord.

Finding and Vetting Your First Syndication Deal

Alright, you understand the theory behind syndication. Now comes the exciting part: moving from theory to action. This means rolling up your sleeves to find and scrutinize real-world deals.

The best opportunities rarely just fall into your lap. From my experience, they’re almost always the result of deliberate effort and solid networking. Finding a great deal is every bit as important as analyzing the numbers. So, where do you even start looking?

Where to Source Quality Deals

Your search for the right investment can happen in a lot of places, both online and off. Honestly, casting a wide net usually works best, since different channels attract different kinds of sponsors and opportunities.

Here’s where I’ve seen investors have the most success:

- Online Investment Platforms: Websites dedicated to real estate crowdfunding have opened up this world to so many people. They act as a marketplace, vetting sponsors and presenting deals in a fairly standard format, which makes it much easier to compare your options side-by-side.

- Professional Referrals: Don't underestimate your existing network. The CPAs, attorneys, and financial planners you already trust often have deep connections with reputable real estate sponsors. A warm introduction from one of them can be a golden ticket.

- Local Real Estate Meetups: There’s no substitute for face-to-face interaction. Attending local Real Estate Investor Association (REIA) meetings or similar events lets you meet sponsors and other active investors. It's a fantastic way to learn the local pulse and hear about deals straight from the source.

The scale of this market is massive, which is great news for investors. Top-tier syndicators are managing huge portfolios, a clear sign of investor trust. Just look at the latest industry rankings: the leading firm, Raymond James Affordable Housing Investments, syndicated 170,615 units last year alone—a 6% jump from the previous year. Other big players like Boston Financial and PNC Multifamily Capital each syndicated over 130,000 units. This shows you the sheer volume of capital flowing into these deals. You can dig into the specifics in the 2025 NMHC rankings of top LIHTC syndicators.

Vetting the Sponsor Is More Important Than Vetting the Property

I can’t stress this enough. A beautiful building in a hot market looks great on paper, but the success of your investment almost entirely depends on the sponsor. A great operator can make a mediocre property shine, while a bad one can drive a perfect property into the ground.

Your due diligence has to be laser-focused on the team running the show. Think of it this way: you aren't just buying a piece of real estate; you're investing in a business plan and the team responsible for making it happen.

The property is the "what," but the sponsor is the "who." In real estate syndication, the "who" is always more important. A sponsor's integrity, experience, and communication define the investment journey.

It’s time to look past the glossy marketing materials and start asking the tough questions.

Critical Questions to Ask Every Sponsor

Your mission is to get a feel for the sponsor’s real track record, see if your interests are truly aligned, and understand how they communicate. Before you even think about writing a check, you need clear answers to these questions:

- What's your full-cycle track record? Ask for case studies on past deals, especially those they’ve already sold (gone "full cycle"). You need to see tangible proof that they can execute a business plan from start to finish.

- How much of your own money is in this deal? This is the ultimate test of their conviction. When a sponsor has significant "skin in the game"—5-10% of the total equity is a very strong sign—you know their interests are aligned with yours.

- How do you communicate with investors? Will you get monthly updates? Just a quarterly report? Ask to see examples of past investor communications. This will tell you everything about their commitment to transparency.

- What are the biggest risks here, and what’s your plan to mitigate them? Every investment has risks. A sponsor who is upfront about them and can clearly articulate their strategies for managing those risks is one you can trust.

By focusing your vetting process squarely on the operator, you get past the sales pitch and can properly assess the foundation of the investment. A top-tier sponsor is the single most reliable indicator of a successful syndication experience.

How to Analyze a Syndication Deal Like a Pro

Alright, you’ve done your homework and found a sponsor you trust. They’ve just sent over a new investment opportunity, and it looks promising. Now the real fun begins. This is where you roll up your sleeves and really dig into the numbers to see if the deal holds up.

Learning how to properly vet a syndication deal is probably the single most important skill you can develop as a passive investor. It's what separates a confident, informed decision from a hopeful gamble.

You don't need an accounting degree, but you absolutely need to speak the language of real estate finance. The sponsor will provide an investment summary, often called a pro forma, which is essentially their financial blueprint for the property's future. Your job is to read between the lines and decide if that blueprint is built on a solid foundation or a fantasy.

Decoding the Core Financial Metrics

Every deal summary is going to be loaded with acronyms and projections. It can feel overwhelming at first, but you can cut through the noise by focusing on a few key metrics that tell the most important parts of the story.

Let's break them down:

- Cash-on-Cash (CoC) Return: This one’s straightforward. It's the annual cash you get back divided by the total cash you put in. For example, if you invest $100,000 and receive $7,000 in distributions that year, your CoC return is 7%. It’s a clean, simple snapshot of how much cash the investment is spinning off.

- Equity Multiple (EM): Think of this as the "total payback" metric. It tells you how much money you'll get back over the entire life of the investment, compared to what you started with. An equity multiple of 1.8x means for every dollar you invest, you can expect to get $1.80 back in total—your original dollar plus $0.80 in profit.

- Internal Rate of Return (IRR): This is easily the most complex of the bunch, but it's critical. IRR measures the total annualized return, but it also accounts for the time value of money. In other words, it knows that a dollar today is worth more than a dollar five years from now. A higher IRR signals that your capital is working harder and more efficiently throughout the project.

These numbers give you a great overview, but remember, they are just projections. The real skill is in pressure-testing the assumptions behind them.

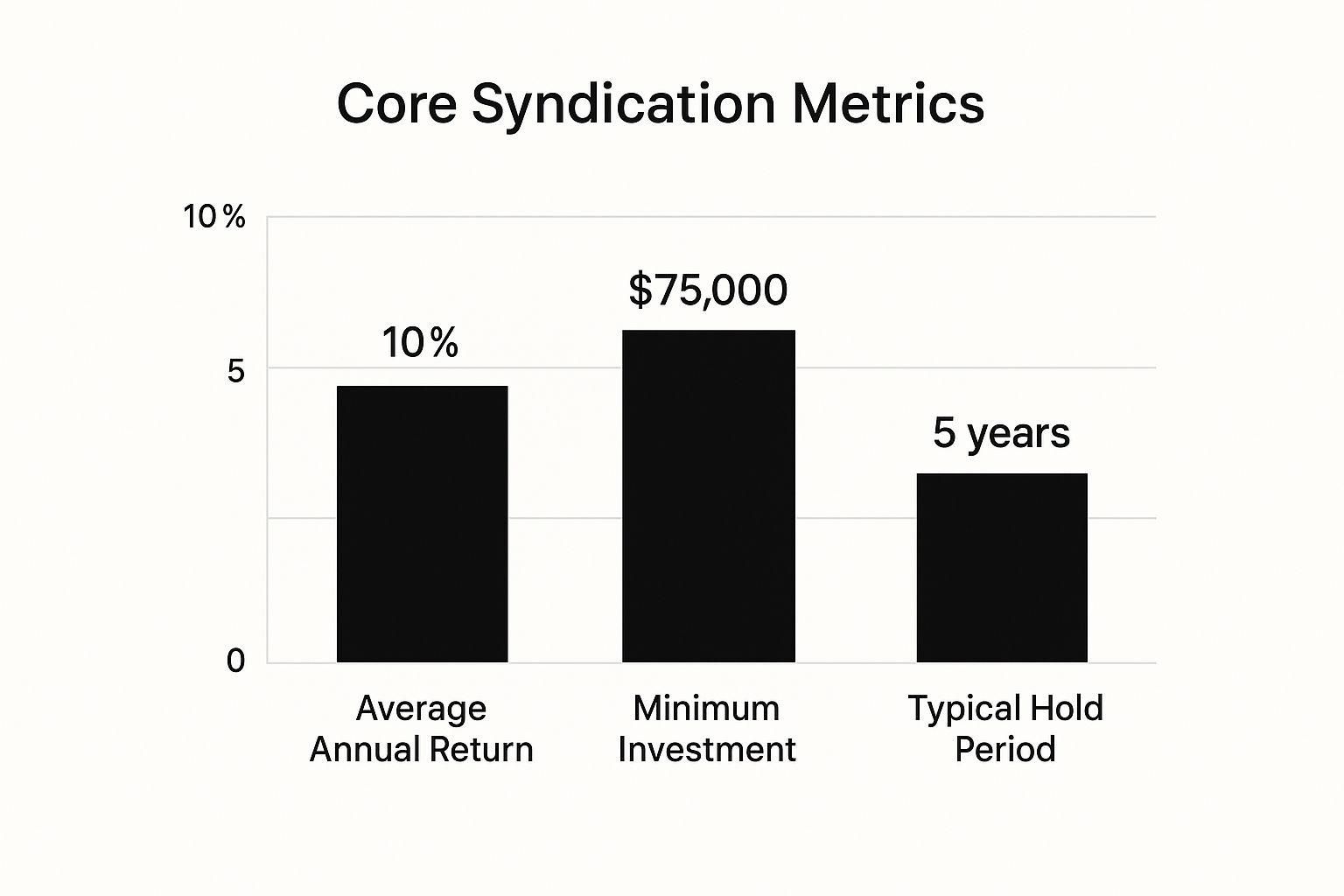

This gives you a good visual for the kind of metrics you might see in a typical value-add syndication. These figures are pretty standard for a multifamily deal, showing that balance between the investment size, the holding period, and the projected returns.

Comparing Syndication Investment Profiles

Not all syndication deals are created equal. The strategy—whether it's a stable, income-producing property (Core) or a fixer-upper (Value-Add)—dramatically changes the risk and return profile. Here's a quick look at what you can generally expect.

This table helps frame your expectations. If a sponsor is pitching a Value-Add deal with a 9% IRR target, you should question if the return is high enough for the risk involved. Conversely, an Opportunistic deal promising a 10% cash-on-cash return from day one might be based on overly optimistic assumptions.

Spotting Conservative vs. Aggressive Projections

A sponsor's pro forma is entirely built on assumptions. Are they projecting an aggressive rent growth of 5% every year when the local market has only averaged 2%? Do their budgeted repair costs seem suspiciously low for an older building? These are the kinds of questions that should pop into your head.

The numbers in a pro forma are only as reliable as the assumptions used to create them. A deal with a projected 20% IRR based on wishful thinking is far riskier than a deal with a 15% IRR built on conservative, well-supported data.

A good sponsor will happily show their work. They should be able to point to market reports that support their rent growth figures and provide realistic operating expense numbers based on the property's history or similar buildings in the area. When you're running your numbers, don't forget that understanding potential tax deductions for rental property can also have a big impact on your net returns.

Evaluating the Market and Business Plan

A great property in a dying market is still a bad investment. Your analysis has to go beyond the building itself and look at the health of the surrounding city and neighborhood.

Look for positive signs in key economic indicators:

- Job Growth: Are new companies moving in? Are existing ones expanding?

- Population Growth: Is the area attracting new residents, or are people leaving?

- Rental Demand: What are the vacancy rates? Are they stable or falling?

A strong business plan will connect directly to these market trends. If it's a value-add project, the sponsor needs a clear, detailed plan for the renovations—complete with a budget, timeline, and examples of "comps" (comparable renovated units) that are already getting the rents they're projecting.

By combining a deep dive into the financials with a critical review of the sponsor’s assumptions and the market itself, you can build the confidence to make a sound decision. This is how you learn to invest in real estate syndication like a seasoned pro.

Getting to the Finish Line: Legal and Financial Commitments

So, you’ve done the hard work. You’ve found a sponsor you trust and a deal that looks promising on paper. Now comes the moment of truth—the final step before you actually write a check. This is where you shift your mindset from "Is this a good deal?" to "Do I fully understand and agree to the legal terms of this partnership?"

This phase is all about the legal and financial commitment, where all the marketing promises and pitch deck numbers get formalized into legally binding documents. It’s the least glamorous part of the process, but it’s arguably the most critical.

Diving Into the Private Placement Memorandum (PPM)

At the center of this stage is the Private Placement Memorandum, or PPM. Let's be clear: this is not a sales brochure. It's a dense, comprehensive legal document that spells out every single detail about the investment—including all the ways it could potentially go south. Reading it cover to cover is absolutely non-negotiable.

The PPM is really your ultimate source of truth, designed to protect both you and the sponsor by laying everything out on the table. While its size can be intimidating, you can zero in on a few key sections to get to the heart of the deal's structure and risks.

You'll find these crucial documents bundled inside the PPM:

- The Subscription Agreement: Think of this as your official contract. It’s where you formally agree to buy a certain number of shares or units in the LLC, locking in your investment amount and confirming your role as an investor.

- The Operating Agreement: This is the rulebook for the business. It governs how the property's LLC will run, detailing the rights and responsibilities of the general partners (the sponsor) and the limited partners (you). Pay very close attention to sections covering voting rights, sponsor fees and compensation, and how major decisions are made.

- Risk Factors: Every PPM has a section dedicated to everything that could go wrong. This isn't meant to scare you off; in fact, a transparent sponsor will have a thorough risk factor section. It might cover market-level risks (like a local recession) or property-specific ones (like unexpected renovation costs). Take it seriously.

Your single most important job here is to ensure the terms in these legal documents perfectly match what the sponsor told you and what was in the investment summary. If you spot any discrepancies, you must get them clarified in writing before moving forward.

Are You an Accredited Investor?

Your ability to even participate in certain deals hinges on your investor status, as defined by the SEC. This is a critical distinction you need to understand.

Generally, your status is based on your income or net worth.

- Accredited Investors can access a much broader range of deals, especially those under SEC Rule 506(c), which lets sponsors advertise their offerings to the public.

- Non-Accredited Investors might still be able to join some deals, typically under Rule 506(b). However, these deals can't be publicly advertised, and the sponsor is limited to including a maximum of 35 non-accredited investors.

Knowing your status is essential because it dictates which opportunities are legally open to you. The sponsor will require you to verify this as part of the subscription process.

How to Fund Your Investment

Once you're comfortable with the legal side, it's time to figure out the cash. You have a few common paths for funding your investment, each with its own pros and cons.

The most straightforward way is using personal, after-tax money from a savings or brokerage account.

A popular alternative, however, is using retirement funds. A Self-Directed IRA (SDIRA) is a powerful tool that allows you to invest in alternative assets like real estate syndications. The huge advantage here is the tax-deferred or even tax-free growth on your returns, depending on whether it's a Traditional or Roth SDIRA.

Be warned, though—using an SDIRA comes with strict IRS rules. For instance, all money must flow through the IRA custodian, not your personal bank account, and you’re prohibited from receiving any personal benefit from the property.

No matter how you choose to fund the deal, don't make this final decision in a silo. Before you sign that subscription agreement, it is absolutely essential to consult with your own legal and financial advisors. They can provide an invaluable final check, reviewing the PPM to ensure the investment truly aligns with your personal financial goals and risk tolerance.

So, The Deal Is Closed. What's Your Role Now?

You've done the hard work. You vetted the sponsor, dissected the deal, and navigated a mountain of legal documents. Your funds are in, the property has closed, and you're officially a limited partner.

So, what happens next? This is where the "passive" part of passive investing really kicks in, but don't be mistaken—your job isn't completely over. It just changes.

While you won't be fielding tenant calls or overseeing construction crews, your primary responsibility now shifts to staying informed. A top-tier sponsor knows that consistent, transparent communication is the foundation of a healthy partnership. From here on out, your inbox is your main connection to the asset's performance.

What to Expect From a Great Sponsor

A professional sponsor won't make you chase them for information. They should have a clear communication plan from day one. You can and should expect a steady rhythm of updates that let you see exactly how the property is performing against the business plan you bought into.

Here’s what that communication typically looks like:

- Monthly or Quarterly Reports: These are your regular check-ins. They’ll give you a snapshot of the property's health, covering key metrics like occupancy rates, rent collections, and progress on any value-add plans.

- Financial Statements: On a quarterly basis, you should receive detailed profit and loss (P&L) statements and balance sheets. This is your chance to see exactly where the money is coming from and where it's going.

- Major Event Updates: A good sponsor is proactive. They’ll let you know about the big stuff—good or bad—as it happens. This could be anything from landing a major commercial tenant to an unexpected roof repair or an update on a potential refinance.

Your role is no longer about active due diligence; it's about active monitoring. The sponsor handles the daily grind. Your job is to read the reports, understand what the numbers are telling you, and ask smart questions.

This consistent flow of information is what separates the pros from the amateurs. It’s what gives you peace of mind that your capital is in good hands.

Tracking Performance and Getting Paid

Those reports are your window into the investment's real-time progress. Your main task is to compare the actual numbers to the pro forma projections you studied before investing. Are occupancy levels hitting their targets? Are expenses staying in line with the budget?

This diligence leads to the part everyone looks forward to: cash flow distributions. These are your share of the property's profits, usually paid out monthly or quarterly once the asset is stabilized. These checks are the tangible proof that the investment is working as it should.

To keep a clear view of how this syndication fits into your larger financial picture, using one of the modern investment portfolio tracker tools can be a game-changer. They help you see all your assets in one place, giving you a holistic view of your wealth.

Don't Forget About Taxes (The Good Part)

Each year, you’ll receive one of the most important documents from the sponsor: the Schedule K-1. This is the IRS form that breaks down your share of the partnership’s income, deductions, and credits for the year.

The K-1 is critical. First, it's what you or your accountant will use to file your personal income taxes.

More importantly, it’s where you’ll see one of the biggest perks of real estate—depreciation—at work. It’s very common for a K-1 to show a "paper loss" for tax purposes, especially in the early years, even while you’re receiving real cash flow distributions. This can dramatically lower your overall tax bill. A good sponsor will get this form to you with plenty of time before the tax deadline.

The Grand Finale: Cashing Out

Every syndication has a finish line. The investment journey typically culminates in a "capital event," which is just a fancy term for selling or refinancing the property. This usually happens after the planned hold period, which is often around 3 to 7 years.

When the property sells, you get your initial investment back, plus your cut of the profits from the property's appreciation.

This is the ultimate test of the sponsor’s strategy. A successful exit proves their business plan was sound, from the initial acquisition and value-add execution to a well-timed sale. That final payout is the culmination of your journey as a passive—but engaged—investor.

Common Questions About Real Estate Syndication

Even after you've got the basics down, it’s completely normal to have some lingering questions. We're talking about investing your hard-earned money, after all. Feeling truly confident means getting clear on the details.

Let’s tackle some of the most frequent questions we hear from investors who are new to the syndication world. Consider this your final gut-check before you dive in.

What’s a Typical Minimum Investment?

This is usually one of the first questions people ask. The truth is, minimum investments can be all over the map. It really depends on the sponsor, their strategy, and the size of the deal they're putting together.

As a general rule of thumb, you can expect the minimum check size for a syndication to be somewhere between $25,000 and $100,000. Some deals might offer a lower buy-in to open the door to more investors. On the other hand, a deal for a premier, institutional-quality property might demand a much higher commitment. You'll always find the exact number spelled out in the Private Placement Memorandum (PPM) for that specific deal.

How Liquid Is a Syndication Investment?

This is a big one, and you need to be crystal clear on it before you commit a single dollar. Investments in real estate syndications are highly illiquid. This isn't like trading stocks where you can just click a button and sell your shares.

When you invest, you're locking in your capital for the entire life of the project. That typically means 3 to 7 years, sometimes longer. Most syndication agreements have no provisions for an early exit or a buyout.

You should only ever invest money you are absolutely certain you won’t need for the entire investment period. This lack of liquidity is the fundamental trade-off you make for getting access to large, professionally managed real estate deals that would otherwise be out of reach.

What Happens If the Property Underperforms?

Every investment has risks, and real estate is no different. A property can underperform for any number of reasons—the market takes an unexpected downturn, renovation costs come in way over budget, or rent growth just isn't what was hoped for.

If a property doesn't hit its pro forma numbers, you'll feel the impact in a couple of key ways:

- Smaller Distributions: Your regular cash flow checks will be lower than what was projected.

- Reduced Profit at Sale: The big payday when the property is sold could be less than anticipated, or in a worst-case scenario, result in a loss.

This is exactly why doing your homework on the sponsor is the single most important part of this process. A seasoned sponsor has seen it all before. They'll have backup plans and, crucially, will communicate proactively about any bumps in the road and what they're doing to manage them.

Are My Distributions Guaranteed?

In a word: no. Distributions from a syndication are never guaranteed. They hinge entirely on the property's actual performance—specifically, its net operating income (NOI).

Sponsors build their projections based on meticulous research and analysis, but they are still just that: projections. The property has to bring in enough cash to cover its mortgage, taxes, insurance, and all other operating costs before there's anything left to send to investors. Getting a handle on the various financial mechanics, including the powerful real estate syndication tax benefits, is key to understanding how these returns are really created.

Once you start building a portfolio of syndication deals, keeping everything organized can become a real headache. Homebase is an all-in-one platform built to simplify deal management, investor relations, and fundraising. It frees you up to focus on what you do best—finding great properties—instead of getting bogged down in administrative work. See how we help sponsors scale their business at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.