Top KYC Compliance Software for Secure Business Operations

Top KYC Compliance Software for Secure Business Operations

Discover the best KYC compliance software to streamline onboarding, enhance security, and ensure regulatory compliance effortlessly.

Domingo Valadez

Jun 28, 2025

Blog

Imagine you have a digital bouncer for your business. This bouncer doesn't just check IDs at the door; it instantly cross-references every new customer against global watchlists, assesses their risk profile, and confirms they are who they say they are. In a nutshell, that’s what KYC compliance software does. It automates the entire ‘Know Your Customer’ process, which is critical for preventing fraud and meeting strict legal requirements.

What Is KYC Compliance Software, Really?

Trying to handle compliance manually is like being a librarian in a massive, chaotic library with no card catalog. Your team is buried in paperwork, flipping through endless books (watchlists) to cross-reference names, and painstakingly checking every detail by hand. It’s slow, tedious, and mistakes are almost guaranteed.

Now, think of KYC software as a brilliant digital librarian. It scans, verifies, and organizes all that information in a matter of seconds, instantly flagging anything that looks out of place.

This technology is all about automating identity verification, a non-negotiable part of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. Instead of your team chasing down ID documents and squinting at grainy photos, the software manages everything—from secure document uploads to authenticity analysis and even biometric checks. This isn't just a move for efficiency; it's a fundamental strategic shift for any modern business.

The Problem With Manual KYC

Before these automated tools became widely available, the KYC process was a huge operational headache. It created a handful of serious problems, especially for businesses trying to scale.

- Human Error: Manually typing in names and dates is a recipe for typos and slip-ups, which can easily lead to costly compliance failures.

- Slow Onboarding: A long, clunky verification process is a major turn-off for new customers. Many will simply give up and go elsewhere.

- High Operational Costs: Paying staff to perform repetitive, manual compliance checks is a major drain on resources and budget.

- Inconsistent Application: Without a standardized system, different team members might interpret verification rules differently, creating dangerous gaps in your compliance.

How Automation Provides the Solution

KYC software tackles these pain points head-on, swapping out manual guesswork for digital accuracy and speed. The market data tells the story of just how critical these tools have become. The global KYC software market, valued at USD 1.48 billion, is expected to skyrocket to USD 16.01 billion as regulatory pressures intensify.

To give you a better sense of how this works in practice, let's look at the common friction points in manual compliance and how software solves them.

Common Compliance Problems and Software Solutions

Ultimately, KYC software transforms a reactive, burdensome task into a proactive, seamless part of your operations.

For a platform like Homebase, which helps manage real estate syndication deals, this kind of automation is a game-changer. It ensures every potential investor is vetted quickly and thoroughly, keeping the deal pipeline moving without compromising on security.

This screenshot gives you a glimpse of how a clean, investor-friendly portal makes it easy to participate in a deal. Integrated KYC verification is a crucial background step that makes this smooth experience possible. By automating it, platforms can bring investors on board securely and keep the momentum going. This is a core component of good governance and, more broadly, a key part of any essential due diligence checklist.

What Really Makes KYC Software Tick?

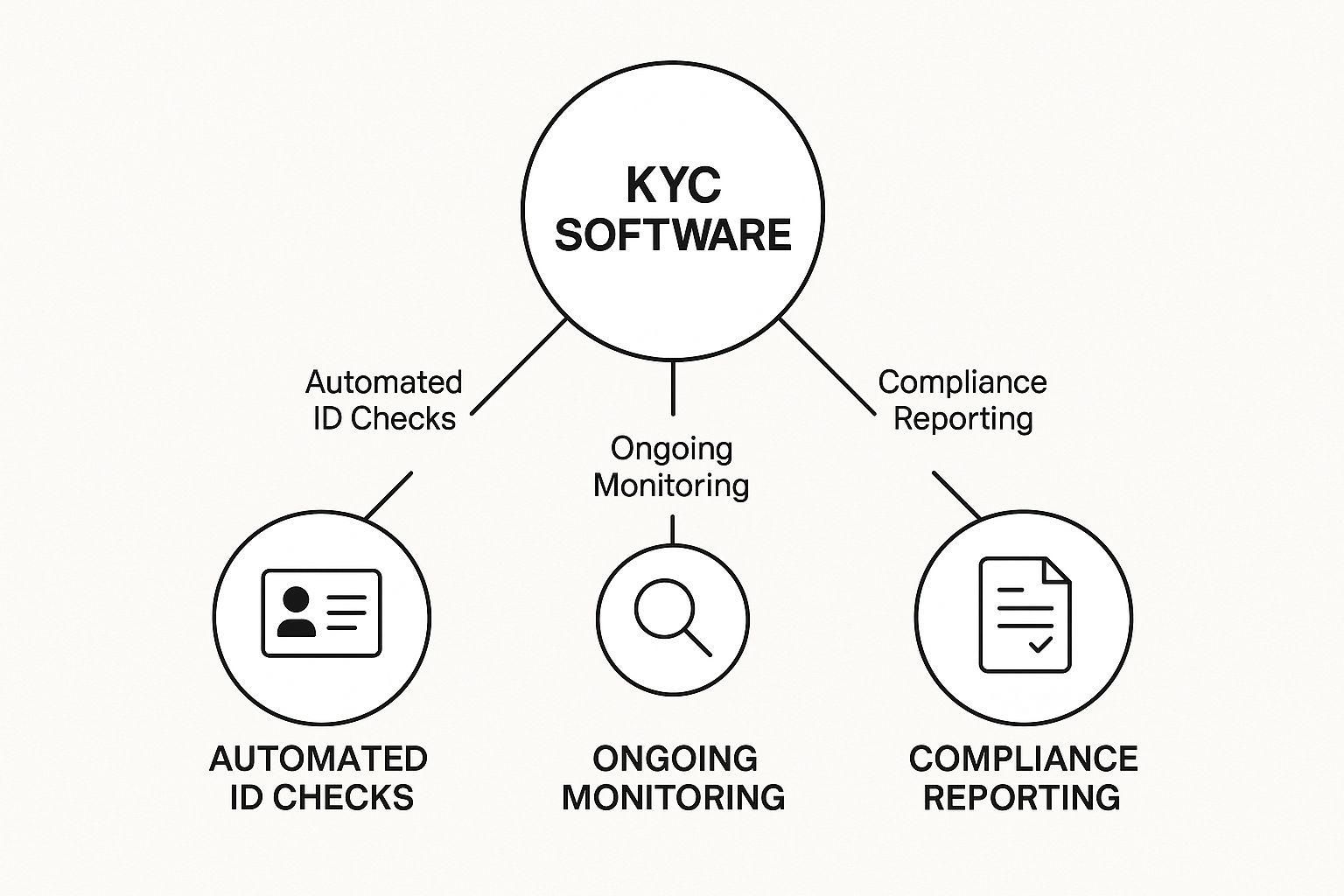

To get a real feel for KYC compliance software, you have to pop the hood and see what makes it run. Think of it less like a single tool and more like a high-performance engine, where every component works together to give you speed, accuracy, and peace of mind. But instead of pistons and gears, this engine is powered by data verification, risk screening, and ongoing monitoring.

Each feature is built to handle a specific task that, in the past, was a manual, error-prone headache. The goal is to transform a slow, clunky process into a slick, scalable, and—most importantly—accurate operation. When these features work in concert, they create a powerful shield against financial crime and the steep penalties that come with non-compliance.

Automated Document and Identity Verification

First things first, KYC software has one primary job: to answer the basic question, "Is this person really who they say they are?" This is where automated identity verification steps in, acting like a digital bouncer for your business.

- AI-Powered Document Analysis: The process usually starts with an investor uploading a photo of their government-issued ID, like a driver's license or passport. The software’s AI gets to work immediately, scanning the document for security features—holograms, microprinting, and other markers—to spot fakes that a person might easily miss.

- Biometric and Liveness Checks: Next, the system asks the user for a selfie or a short video. It uses biometric analysis to confirm the face matches the ID photo. Critically, it also runs a liveness check, which might involve a simple action like turning their head. This simple step ensures you're dealing with a real, live person, not just a photo or a sophisticated deepfake.

This infographic gives a great visual breakdown of how a solid KYC system operates from start to finish.

As you can see, the software doesn't just stop at the initial check. It blends that first verification with continuous monitoring and reporting to manage the entire compliance lifecycle.

Real-Time Global Watchlist Screening

Once an identity is locked in, the software kicks into high gear, screening the individual against a massive web of global databases. It’s like running an instant, worldwide background check that never sleeps.

It's crucial to understand this isn't a one-and-done check. The software is always on, constantly cross-referencing your customer list against updated watchlists. This ensures that someone who is low-risk today doesn't become a high-risk problem tomorrow without you ever knowing.

The system checks an individual’s name against a whole host of sources, including:

- Sanctions Lists: These are official lists from government bodies like the Office of Foreign Assets Control (OFAC) and the United Nations. They name individuals and companies that are off-limits for financial transactions.

- Politically Exposed Person (PEP) Lists: This check flags individuals in positions of public power, who inherently carry a higher risk of being involved in bribery or corruption.

- Adverse Media: The software also scours news articles and public records for any negative press associated with the person, giving you a much fuller picture of their potential risk.

This powerful screening capability relies on pulling data from many different places. These connections are often managed through what are known as API integration platforms, which help different software systems talk to each other seamlessly.

By automating all these checks, KYC compliance software acts as a dynamic, 24/7 guard for your syndication business, protecting you from unknowingly dealing with risky individuals and keeping you on the right side of regulations.

Strategic Gains from Automating Your KYC

Adopting KYC compliance software isn't just about ticking a regulatory box. It's a smart business decision that pays real dividends. Think of it less as a mandatory expense and more as a direct investment in making your entire operation run better. The most immediate win? A massive jump in efficiency.

When you automate investor verification, you're freeing up your team from the tedious, manual grind of checking documents. Suddenly, they have more time for what really matters—cultivating investor relationships, sourcing new deals, and analyzing performance. Those are the activities that actually grow your business.

This move toward automation is happening across the board, and the numbers tell the story. The KYC market is projected to expand from USD 6.73 billion to USD 14.39 billion as global regulations tighten and businesses see the clear advantages. This growth shows that solid identity verification is no longer a "nice-to-have" but a core part of secure, modern business. You can dive deeper into these market dynamics to see how your own strategy stacks up.

Creating a Superior Onboarding Experience

Let's be honest: first impressions count, especially with new investors. A clumsy, paper-heavy KYC process that drags on for days—or even weeks—is a terrible way to start a relationship. All that friction and back-and-forth can frustrate even the most patient person, causing high-value investors to walk away before you've even started.

Automated KYC software completely changes that initial interaction. It provides a slick, modern, and self-guided verification that investors can knock out in minutes on their phone or computer. This speed and simplicity show that you're professional and, more importantly, that you respect their time. It sets the perfect tone for a long-term partnership.

Real-World Example: A mid-sized real estate syndication firm was taking over two weeks to onboard investors. It was a deal-killer. After bringing in KYC software, they slashed that verification time to an average of just 15 minutes. Not only did this speed up their capital raising, but investors loved the smooth experience, giving the firm a major leg up on the competition.

Mitigating Risk and Reducing Financial Loss

Beyond making things faster, automation is your best defense against financial and regulatory nightmares. Manual checks, no matter how careful your team is, are susceptible to human error. It only takes one slip-up to onboard a bad actor or miss a crucial red flag, and the fallout can be devastating—from direct fraud losses to hefty fines.

A good KYC compliance software acts as a shield by implementing systematic, data-driven checks.

- Reduced Fraud: Sophisticated tools like biometric scans and liveness detection make it extremely tough for criminals to slip through using fake or stolen IDs.

- Insulation from Fines: The software automatically generates a detailed, tamper-proof audit trail for every single verification. If regulators ever ask questions, you have concrete proof of your due diligence right at your fingertips.

When you integrate automated KYC, you're doing more than just streamlining a process. You're building a more secure, efficient, and investor-friendly business from the ground up.

How to Choose the Right KYC Solution

Picking the right KYC compliance software feels like a high-stakes decision because, frankly, it is. But it doesn't have to be overwhelming. The secret is to have a clear game plan that puts your specific business needs front and center.

Think of it less like buying software and more like hiring a critical digital team member. This isn't just a tool; it's the gatekeeper for your security, the engine for your operational efficiency, and the very first impression your investors will have of your professional standards.

The first question you should ask is how it will play with your existing setup. If a KYC solution can't integrate smoothly with the tools you already rely on—like your CRM or investor management portal—you're just signing up for more manual work and headaches. A platform that operates in a vacuum is a liability, not an asset.

Assess Your Core Technical Needs

Before you even start looking at demos or pricing pages, take a step back and map out your non-negotiables. A slick user interface is great, but it’s the engine under the hood that will make or break your compliance efforts. The perfect, complex solution for a global bank is almost certainly overkill for a real estate syndicator. Focus on what truly matters for your deals.

Start by getting answers to these fundamental questions:

- Integration Capabilities: Does it have a well-documented API or, even better, pre-built connections for your existing tech stack? You're aiming for a single, reliable source of investor data, not another silo.

- Scalability: Can the platform grow with you? You need a system that handles 100 investors just as gracefully as it handles 1,000, without the price skyrocketing or the performance taking a nosedive.

- Jurisdictional Coverage: Does the software check against the right watchlists? You need to be confident it's screening against global lists like OFAC, UN, and EU sanctions, plus any PEP lists relevant to where your investors are located.

Getting any of these wrong can create major problems later, from glaring compliance gaps to expensive operational bottlenecks.

Choosing the right software is a balancing act. The goal is to find a system powerful enough to protect your firm but simple enough that your team will actually use it. The best tool is one that melts seamlessly into your daily workflow.

Prioritize the User Experience

Remember, compliance isn't just an internal task—it involves your investors directly. The software has to be simple for your team to manage on the back end, but it absolutely must provide a smooth, professional experience for your investors on the front end.

Nothing scares a high-value investor away faster than a clunky, confusing verification process. If it's frustrating, they'll simply give up.

Look for a platform that nails both sides of the coin. Your internal dashboard should be intuitive, giving you clear risk scores and an easily accessible audit trail. For your investors, the verification process should be quick, mobile-friendly, and self-explanatory. We're talking minutes, not hours. If a vendor offers a free trial, use it. Walk through the entire flow as an admin and as an investor to see how it really feels.

To keep your evaluation organized, a simple checklist can help you compare potential vendors head-to-head.

Vendor Evaluation Checklist for KYC Software

Making a good decision comes down to comparing your options against a consistent set of criteria. This checklist is designed to help you do just that, moving beyond the sales pitch to see how each vendor stacks up against your real-world needs.

By systematically scoring each potential KYC compliance software against these core requirements, you can cut through the marketing noise. This approach helps you make a clear-headed decision that truly supports your business goals, fits your budget, and strengthens your security posture.

A Blueprint for Successful KYC Implementation

Buying KYC compliance software is just the first step. The real work—and where you’ll see the return on your investment—is in getting it up and running smoothly. Success depends on a smart, well-executed implementation plan. Without one, even the most powerful software will just sit there, becoming a frustrating expense rather than a valuable asset.

This isn't just about flipping a switch. It’s a project that demands careful management, clear communication, and some technical groundwork. Think of it like a property renovation: you wouldn’t start swinging a sledgehammer without a detailed blueprint. The same principle applies here. You need to define your goals, set a realistic timeline, and prepare your team for what's coming.

Plan Your Rollout and Data Migration

Your implementation journey begins with a rock-solid plan. The first major hurdle is migrating all your existing investor data into the new system. This step is absolutely critical. A botched data migration can create a mess of compliance gaps, lost information, and endless headaches down the road.

Start by creating a step-by-step timeline for the whole process:

- Data Cleanup: Before you move a single byte of data, clean up your current records. Get rid of duplicates, correct typos, and make sure every piece of information is up to date. This ensures you’re not bringing old problems into a new system.

- Phased Rollout: Don't try to do everything at once. A phased approach is usually best. You could start by onboarding all new investors through the software first. Once that's working well, you can begin migrating your existing investors in manageable batches. This minimizes disruption and risk.

- Testing Phase: Carve out time to test everything with a small, controlled group of users. This is your chance to find any bugs, confusing workflows, or integration issues before they impact your entire investor base.

Successful adoption is about minimizing friction for everyone involved. A smooth implementation ensures your team feels confident using the new tool and your investors barely notice the change—except for how much easier it is to work with you.

Configure and Communicate Effectively

With a plan in hand, it’s time to configure the software and communicate the upcoming changes. Your KYC compliance software is not a one-size-fits-all solution. You have to fine-tune the settings to match your syndication’s specific risk profile and operational workflows. This means defining your risk-scoring rules and deciding what kind of activity should trigger an automated alert for your team.

Communication is just as crucial as configuration. Give your team a heads-up long before the system goes live and make sure they get proper training. For your investors, a simple, professional announcement goes a long way. Explain that you're introducing a new, more secure onboarding process designed to better protect their information and streamline their experience. A little proactive communication builds trust and sets the stage for a seamless transition.

KYC Software in Real Estate Syndication

Theory is one thing, but where does this rubber really meet the road? Let's talk about a high-stakes arena where KYC compliance software isn't just a nice-to-have, but an absolute must: real estate syndication. Here, sponsors pool capital from many different investors to buy large assets, a complex dance that has to follow strict SEC rules.

Think about what it used to be like for an investor wanting to get into a new multifamily deal. The old way was a slog. You’d be emailing sensitive documents back and forth, waiting for someone to manually review them, and holding your breath for days or even weeks. This kind of friction not only created a frustrating experience for the investor but could actually jeopardize time-sensitive deals. For the syndicators managing the deal, it was a huge operational headache and a compliance nightmare waiting to happen.

An Investor’s Journey with Modern KYC

Thankfully, things have changed. Specialized platforms like Homebase now build KYC software right into the investment process, turning what was once a weeks-long ordeal into a smooth and secure digital experience.

The investor's journey is now refreshingly simple.

- Express Interest: An investor finds a deal they like and clicks "Invest Now."

- Guided Verification: Right there in the portal, they're prompted to upload an ID and snap a quick selfie. The software gets to work immediately, analyzing the ID's authenticity and using biometrics to make sure the investor is who they say they are.

- Automated Checks: Behind the scenes, the system is instantly running the investor’s name against global watchlists and verifying their accredited status. Every step is documented, creating a perfect audit trail.

- Cleared to Invest: In just a few minutes, the investor gets the green light. They can move straight to signing documents and wiring their funds.

This isn't just about moving faster; it's about building a foundation of trust and security from the very first click. Syndicators get ironclad proof that they’ve done their homework, protecting them from regulatory heat while showing their investors they’re running a professional, modern operation.

This shift isn't just a niche trend. The growing dependence on these tools is fueling massive market growth. The KYC software industry is already valued at around USD 3.81 billion, but it's expected to rocket to USD 12.69 billion over the next ten years. That explosion in value tells you everything you need to know about the crucial role KYC compliance software now plays in securing high-value deals. If you're curious, you can learn more about the trends driving this market expansion.

Answering Your Key KYC Questions

Diving into the world of compliance often kicks up more questions than answers. Let's tackle some of the most common points of confusion around KYC compliance software head-on, so you can move forward with clarity.

KYC vs. AML: What Is the Difference?

It’s incredibly common to hear KYC (Know Your Customer) and AML (Anti-Money Laundering) used interchangeably, but they aren’t the same thing. They're related, but one is a strategy and the other is the overarching mission.

Think of AML as the big picture: the entire effort to prevent financial crimes like money laundering and terrorist financing. KYC is one of the most critical tools in that fight. It’s the hands-on process of actually verifying an investor’s identity to understand who you’re dealing with and assess any potential risks they might pose.

In short, AML is the why, and KYC is a big part of the how.

How Does This Software Actually Work?

So, what’s going on under the hood? Modern KYC platforms are far more than simple databases. They are sophisticated systems driven by artificial intelligence and machine learning.

These aren't just buzzwords; they're the engines that make near-instant verification possible. The software can scan a government-issued ID, analyze its security features, perform a biometric “liveness” check to ensure the person is real, and cross-reference their name against thousands of global watchlists—all in a matter of seconds. This kind of automation provides a level of speed and accuracy that manual checks just can't match.

For a more granular breakdown, we walk through the entire KYC verification process in our detailed guide.

The core value is simple: KYC software benefits businesses of all sizes, not just large banks. It levels the playing field, giving smaller firms access to enterprise-grade security and efficiency, which is essential for building trust with investors and partners.

Ready to see how Homebase can secure and simplify your real estate deals? Our all-in-one platform integrates KYC and investor management, freeing you to focus on what matters most—growing your portfolio. Learn more about Homebase and get started today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Define Mezzanine Debt Your Guide to the Real Estate Capital Stack

Blog

Unlock bigger deals with less equity. Our guide helps define mezzanine debt, showing syndicators how to use it to bridge funding gaps and maximize leverage.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.