What Makes a Legally Binding E Signature? Key Facts

What Makes a Legally Binding E Signature? Key Facts

Discover what makes an e signature legally binding. Learn how to ensure your electronic signature is valid and legally enforceable today.

Domingo Valadez

Jun 29, 2025

Blog

So, what exactly is a legally binding e-signature? It's not just a digital copy of your handwritten signature. Think of it as an electronic symbol, sound, or process that proves a person's clear intention to sign something. Thanks to federal law, these signatures are just as valid as the old-school wet ink ones, as long as they meet a few key requirements for intent, consent, and record-keeping.

What Makes an E-Signature Hold Up in Court?

When you sign a paper contract, it's not the ink itself that makes it official. It's the act of signing—your clear intention to agree to the terms. A legally binding e-signature works the exact same way, just in a digital environment that creates a secure, verifiable trail of that intent.

At its heart, a legally binding electronic signature is a digital handshake. It’s a way to capture that moment of agreement securely and in a way that can't be easily disputed. For an e-signature to be considered legally valid, it has to check a few specific boxes that prove it's authentic.

The Three Pillars of a Valid E-Signature

What turns a simple click into a legally enforceable action? It really boils down to three core elements that courts look for to confirm an agreement is solid.

- Demonstrable Intent: The signer has to do something deliberate—like typing their name, drawing their signature with a mouse, or clicking an "I Agree" button. The system must be crystal clear that this action is the equivalent of signing.

- Consent to Do Business Electronically: Before anyone signs, all parties have to agree to use electronic documents and signatures. This is a crucial first step, often handled with a clear disclosure statement that pops up before the signing process even starts.

- Verifiable Record and Attribution: The e-signature platform must create a secure, tamper-proof record of the entire signing event. This audit trail needs to show who signed, when they signed, and from where, linking the signature directly to the specific individual.

A proper electronic signature is so much more than a picture of your name. It’s a complete, auditable process that proves who signed what, when, and why. This verifiable data trail is what gives it legal muscle, often making it even more defensible than a simple pen-and-paper signature.

Let's quickly summarize these core requirements.

Key Elements of a Legally Binding E-Signature

Together, these elements create an electronic record that's both secure and legally sound.

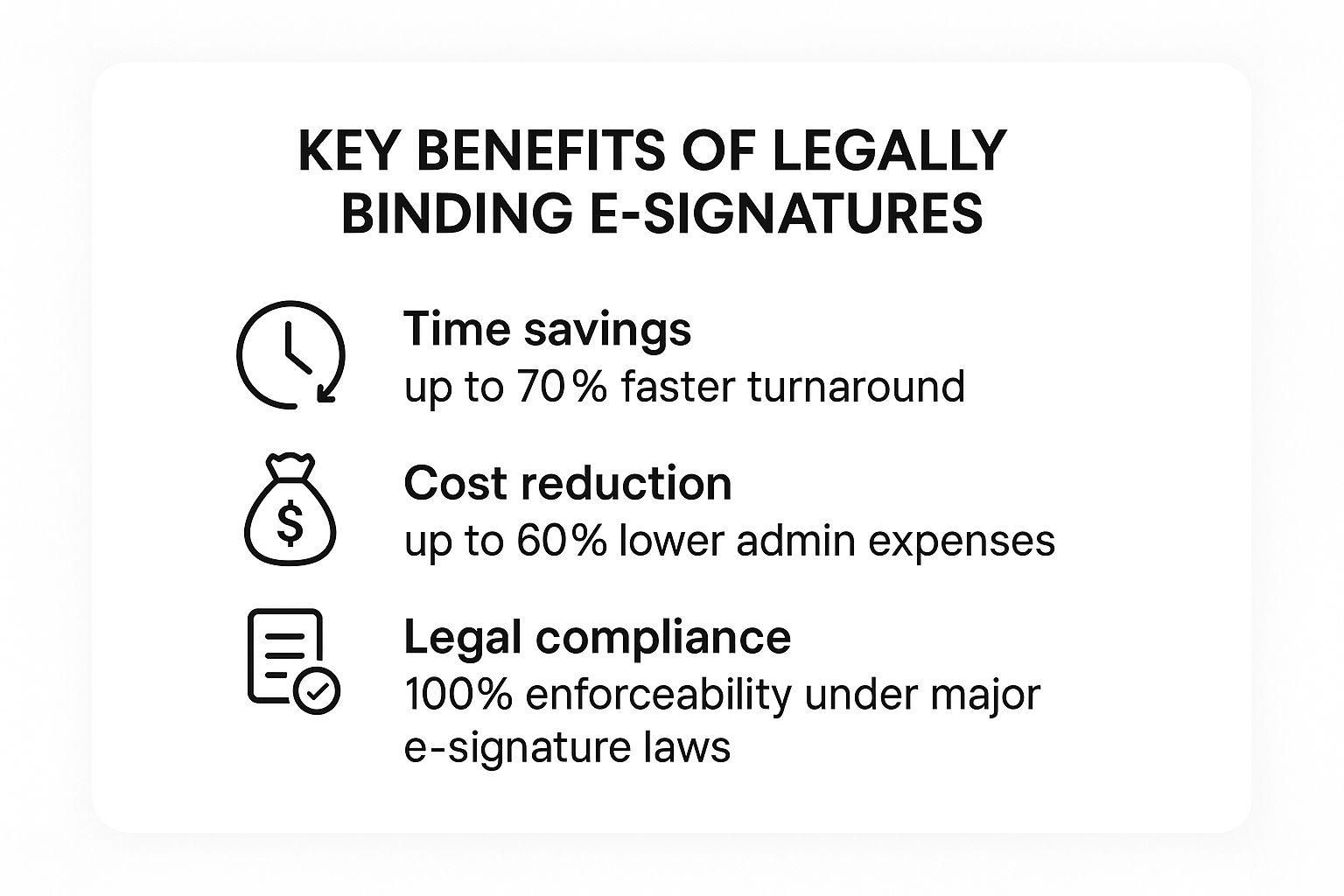

The operational perks of switching to e-signatures are huge. The infographic below breaks down the impressive time savings, cost reductions, and compliance benefits you can expect.

The numbers don't lie. Adopting e-signatures is a proven way to boost efficiency while staying fully compliant. It’s more than just a convenience; it’s a smart business decision. Companies often report an 83% increase in approval performance and an incredible 86% reduction in document-related expenses. Even better, administrative costs tied to paper processes can drop by up to 78%, proving the powerful return on this technology. You can find more key e-signature statistics on LLCBuddy.com to see the full picture.

The Legal Framework: What Makes an E-Signature Official?

What actually gives an electronic signature its legal teeth in the United States? It's not one single rule, but a powerful combination of two key pieces of legislation that dragged business into the digital age: the federal ESIGN Act and the state-level Uniform Electronic Transactions Act (UETA). Together, they form the foundation for every legally binding e signature we rely on today.

Before these laws, the digital world felt a bit like the Wild West. There was a ton of potential, but no clear, consistent rules. Businesses were understandably nervous about going all-in on digital contracts, worried they wouldn't actually hold up in court. This friction slowed everything down and kept us all chained to printers, paper, and fax machines.

Then, in 2000, the Electronic Signatures in Global and National Commerce (ESIGN) Act was passed, and it was a total game-changer.

The ESIGN Act: Setting the National Standard

You can think of the ESIGN Act as the national blueprint for digital agreements. Its core idea is powerful in its simplicity: a signature, contract, or record can't be thrown out or considered unenforceable just because it's electronic. That one rule gave e-signatures the exact same legal weight as a traditional "wet ink" signature, no matter where you were in the country.

This act created a baseline for validity, giving businesses the confidence that a contract signed electronically in California would be recognized in New York. But ESIGN wasn't meant to work alone; it was designed to harmonize with laws at the state level.

The ESIGN Act fundamentally leveled the playing field. It ensured that a business deal couldn't be invalidated just because the parties decided to use technology. This gave everyone the legal certainty they needed for digital commerce to finally take off.

While the federal law set the stage, it was a state-focused act that helped hammer out the details and really drive adoption.

UETA: Bringing Consistency to the States

A year before ESIGN, in 1999, the Uniform Electronic Transactions Act (UETA) was introduced. UETA isn't a federal law, but rather a model law that individual states could adopt to create a consistent framework for electronic business within their own borders. And they did—to date, 49 states, the District of Columbia, and the U.S. Virgin Islands have all adopted a version of UETA.

The whole point of UETA was to knock down the barriers to e-commerce by validating electronic records and signatures. It works hand-in-hand with ESIGN. The general rule is that if a state has adopted UETA without major changes, the state law is what governs. But if a state's law somehow conflicts with ESIGN, the federal act wins. This two-layer system creates a predictable and reliable legal environment across the country.

This legal recognition isn't just a U.S. thing, either. It’s now standard in major markets around the world. The UK's Law Commission, for example, formally confirmed the validity of e-signatures back in 2019. Whether a legally binding e signature is enforceable often comes down to proving things like who signed it, that they intended to sign, and that they consented to the process. This is where the digital audit trail from platforms like Homebase can actually provide stronger evidence than a simple pen-and-paper signature. You can learn more about their legal standing worldwide to see how widely accepted they've become.

For an e-signature to be legally binding under both ESIGN and UETA, a few key things must happen:

- Consent to Conduct Business Electronically: Everyone involved has to agree to use electronic methods. This is usually handled with a clear disclosure clause that you click to accept before signing.

- Intent to Sign: The person signing has to perform a clear action—like clicking a button, typing their name, or drawing their signature—knowing that this action represents their official agreement.

- Record Retention: The final, signed electronic document must be available to be saved and accurately reproduced by everyone involved. Any good platform has to provide a clean, accessible copy for all parties.

Building an Enforceable E-Signature Workflow

A legally binding e-signature is only as solid as the process you use to capture it. While laws like ESIGN and UETA give electronic signatures their legal weight, a court won't just take your word for it. They'll scrutinize the exact steps you took to get that signature, wanting proof that the person who signed is who they say they are and that the document they signed hasn't been touched since.

This is where your workflow is everything. Think of it as building a rock-solid case file for every single agreement before the ink—or the pixels—even dry. Every step, from how you first identify the signer to the final click that records their consent, adds another layer of evidence. This is how you make sure your agreements aren't just convenient, but legally bulletproof.

The Digital Evidence Locker: Your Audit Trail

Every good e-signature process automatically creates a comprehensive audit trail. This isn’t just a simple timestamp; it's your digital evidence locker. If one of your agreements is ever questioned, this audit trail becomes your star witness, detailing the entire signing ceremony from beginning to end. A weak or incomplete trail can sink the whole ship.

A strong audit trail essentially acts as a digital notary, impartially chronicling every single interaction someone has with the document. To hold up in court, it needs to capture specific data points that create an unbroken chain of evidence.

A powerful audit trail should always include:

- Detailed Timestamps: The exact date and time for every action, from the moment a document is sent to when it's viewed and ultimately signed.

- IP Addresses: Recording the signer's IP address gives you a good idea of the geographic location where the signing happened.

- Device and Browser Information: Documenting the nitty-gritty details, like whether the signer used a phone or a computer and which browser they used to sign.

- Complete Event History: A log of the entire journey—every email notification sent, every consent clause accepted, and the final signature action itself.

This level of detail makes it incredibly difficult for someone to later claim they never saw or signed the document—a legal concept known as repudiation. When you’re creating an enforceable workflow, you have to think about how all kinds of documents, like Arkansas divorce papers and forms online, can be handled digitally while maintaining this high bar for integrity.

The goal of an audit trail is simple: to reconstruct the entire signing event with such clarity that any independent third party can verify its authenticity and integrity. It answers the crucial questions of who, what, when, where, and how.

Matching Authentication to Risk

Let's be realistic: not all agreements are created equal. Signing up for a newsletter just doesn't carry the same weight as signing off on a multi-million dollar real estate investment. That’s why your workflow needs to use the right level of signer authentication—the process of proving a person is who they claim to be.

Choosing the right authentication method is a balancing act between airtight security and making things easy for your signers.

1. Basic Authentication (For Low-Risk Agreements)

This is the most common approach and works perfectly well for many day-to-day contracts. It usually just involves sending the document to a specific email address. The thinking here is simple: only the intended person has access to that inbox, which acts as a basic form of identity verification.

2. Intermediate Authentication (For Moderate-Risk Agreements)

When the stakes are a bit higher, you can add another quick security step. A common method is sending a one-time access code to the signer's phone via SMS. By requiring them to have both their email and their phone, you're using a simple form of two-factor authentication (2FA).

3. Advanced Authentication (For High-Risk Agreements)

For your most critical, high-value transactions, you need the strongest proof of identity you can get. This can involve methods like:

- Knowledge-Based Authentication (KBA): The platform asks the signer questions based on their personal credit history or public records (e.g., "Which of these is a previous address of yours?").

- ID Verification: The signer has to snap a picture of their government-issued ID (like a driver's license) and upload it for the system to verify.

A flexible e-signature platform lets you dial the authentication up or down depending on the deal, ensuring your process is both efficient and as secure as it needs to be. This adaptability is the key to building a workflow that is both practical and truly enforceable.

When E-Signatures Aren't the Answer

While the ESIGN Act and UETA have made the legally binding e-signature a powerhouse for modern business, it’s not a universal key for every legal door. Technology moves at lightning speed, but some corners of the law are steeped in tradition and demand a higher degree of formality. In these cases, nothing beats an old-fashioned physical, "wet ink" signature.

Think of it like this: for most of your day-to-day agreements, an e-signature works just like a debit card—it's quick, secure, and accepted almost everywhere. But for certain major life events, the law still insists on the deliberate, physical ceremony of putting pen to paper. This isn't a knock against the security of e-signatures. It’s simply that these specific documents often involve high stakes, complex legal advice, or the need for an in-person notary.

Where Wet Ink Still Rules

The ESIGN Act itself clearly carves out a few areas where electronic signatures just don't apply. While state laws can differ slightly, these exceptions typically cover situations where the potential for fraud, coercion, or a simple misunderstanding is just too high to risk. Knowing these boundaries is critical to staying compliant.

Here are the most common documents that are still off-limits for federal e-signature laws:

- Wills, Codicils, and Testamentary Trusts: These are deeply personal documents that transfer assets after death. They're governed by centuries of legal precedent that demands a formal signing, usually with witnesses present.

- Family Law Documents: Many states still require physical signatures for adoption papers, divorce decrees, and other sensitive family court matters.

- Official Court Orders and Notices: This covers formal court filings, judicial orders, and official notices that have to follow very specific procedural rules for service.

- Essential Public Notices: Think of product recalls that pose a threat to public health or safety. These notices must be sent in a non-electronic form to guarantee they reach everyone.

- Utility Service Cancellations: Notices for shutting off essential services like water, heat, and power often require physical documentation to be legally valid.

- Foreclosure and Eviction Notices: Given how serious these actions are, the law demands formal, physical delivery of these notices to ensure consumer rights are protected.

It's important to see these exclusions for what they are. They aren't a critique of e-signature technology. Instead, they represent a cautious legal stance on documents that carry incredible personal and financial weight, where the traditional signing ceremony itself acts as a vital safeguard.

The "Why" Behind the Exceptions

So, why are these documents treated so differently? It really boils down to two things: ceremony and certainty.

For something as monumental as a will, the law wants absolute assurance that the person signing is doing so with a clear mind and without any outside pressure. The physical act of signing a piece of paper, often with witnesses watching, creates a powerful, tangible record of that intent.

Likewise, for a foreclosure notice, requiring physical delivery ensures every reasonable step was taken to inform the homeowner. In these high-stakes situations, the chance that a crucial email might get lost in a spam folder or simply go unread is a risk the legal system isn't willing to take. Always double-check the specific rules in your state, as local laws ultimately have the final say on these sensitive documents.

E-Signatures in High-Stakes Real Estate Deals

To really see how these legal concepts work in practice, let's look at an industry where the stakes are incredibly high: real estate syndication. In this world, every document—from a subscription agreement to a private placement memorandum—is loaded with financial and legal significance. A platform like Homebase is a perfect example of how a legally binding e-signature process delivers security and speed to these complex deals.

Picture yourself as an investor ready to put capital into a new apartment complex. The deal sponsor invites you into a secure online portal powered by Homebase, where all the critical documents are laid out for you. This is where the path to a legally sound signature begins, long before you ever click "sign."

The Investor's Journey to a Secure Signature

A well-designed platform is built to meet all the legal requirements we've discussed. It starts by getting your clear consent to do business electronically. Before you can even open the subscription agreement, you’ll see a disclosure that you must accept, acknowledging you agree to use electronic records and signatures. That’s the first, crucial box to check.

Next, you dive into the agreement itself. The system is quietly tracking your activity, noting when you accessed the document. When you're ready to sign, the platform guides you to clearly marked fields. The action is unmistakable—you’re prompted to type or draw your signature, accompanied by a statement confirming this will legally bind you to the terms.

This screenshot shows the clean, intuitive interface an investor uses to execute documents within the Homebase platform.

The design is all about clarity, making sure you know exactly what you’re signing and what it means.

Behind the scenes, the system is compiling that bulletproof audit trail. It records your IP address, timestamps every single action, and captures your device information. Once you sign, the document is cryptographically sealed, making any future changes immediately obvious. Both you and the sponsor get a copy of the final, executed agreement right away, satisfying the record retention requirement.

This real-world example shows just how valuable a thoughtfully designed system can be. For real estate syndicators, it means closing deals faster, with greater security and the legal confidence they need.

The Growing Trust in Digital Workflows

This move to digital isn't just a niche trend; it shows a broad and growing trust in these secure processes. While adoption rates differ by industry, the direction is clear. In the legal field, for instance, about 78% of U.S. law firms are already using electronic signature tools. This shift was kicked into high gear by the recent need for remote and contactless ways of working.

The global e-signature market is expected to grow at an incredible compound annual rate of 26.7% between 2024 and 2030. This boom highlights just how much businesses rely on these tools for both efficiency and compliance. The growth is fueled by constant tech improvements and a deepening trust in the validity of a properly executed legally binding e-signature. If you want to dive deeper into the numbers, you can explore the full research on electronic signature use in 2025.

Ultimately, platforms like Homebase aren't just selling convenience. They are providing a purpose-built solution that transforms complex legal hoops into a simple, secure, and verifiable workflow for high-value real estate investments.

How to Choose the Right E-Signature Solution

Let's be honest—not all e-signature platforms are built the same. Picking the right one is a huge decision that directly affects how secure, efficient, and legally sound your agreements are. A simple, free tool might get the job done for a basic consent form, but when you're dealing with high-stakes transactions like real estate syndication, you need a system that's engineered for serious compliance and security.

Making the right choice means looking past the flashy marketing and digging into the details. You have to evaluate solutions based on what your business actually needs and the level of risk you're managing. It comes down to asking the tough questions about how a platform guarantees every signature is a legally binding e signature that will stand up in court if it ever comes to that.

Core Evaluation Criteria for Your Business

When you start comparing options, zoom in on the fundamentals that create a legally defensible signing process. A great platform really shines in three key areas: security, compliance, and ease of use. Don't get distracted by a slick design if the technology underneath can't protect your business.

Here’s what you should really be looking for:

- Security Standards: How is your data actually being protected? You want to see strong encryption, like AES 256-bit, for documents whether they’re just sitting on a server or being sent across the internet.

- Compliance and Audit Trails: Does the platform create a detailed audit trail for every single signature? This is your digital paper trail. It needs to capture everything—IP addresses, device information, and exact timestamps for every click and signature.

- Integration Capabilities: A tool is only useful if it fits into how you already work. Check how well it plays with your CRM, document storage, and other core systems. Most platforms are cloud-based, so having a basic grasp of the top cloud services for small business can give you some helpful context.

- User Experience: The platform has to be simple and intuitive for everyone involved. If signers get confused or frustrated, they might abandon the process, or worse, create a legal headache for you later on.

The real goal here is to find a solution that not only makes signing a breeze but also creates a rock-solid, tamper-evident record. Think of the platform as a silent, powerful witness that can vouch for the integrity of every single agreement you execute.

Comparing Basic vs Advanced Platforms

The market is full of options, from simple signature apps to all-in-one platforms built for specific industries. For general tasks, a basic tool might be enough. But for specialized fields like real estate syndication, you need something far more advanced. Our guide on the ultimate real estate transaction management strategies dives deeper into why these industry-specific features are so critical.

To help you see the difference, here’s a quick look at what you can expect from basic tools versus more sophisticated platforms.

E-Signature Solution Feature Comparison

At the end of the day, picking the right e-signature solution is about matching the platform's capabilities to your operational risks. If you focus on ironclad security, comprehensive audit trails, and a smooth user experience, you'll find a partner that truly protects your business and gives everyone confidence in the process. This kind of thoughtful decision-making ensures your digital agreements are built on a foundation of legal rock.

Frequently Asked Questions

Even when you have a good handle on the laws, practical questions always come up once you start using e-signatures in the real world. Let's tackle some of the most common ones I hear, so you can move forward with confidence.

Electronic vs. Digital Signature: What’s the Difference?

People often use these terms interchangeably, but they aren't the same thing. It helps to think of it like this:

An electronic signature is the broad legal idea. It's essentially any electronic symbol or process you use to show you agree to something. That could mean typing your name into a box, clicking an "I Agree" button, or even scribbling your signature on a tablet screen.

A digital signature, on the other hand, is a specific type of electronic signature—a highly secure one. It uses sophisticated cryptography to lock down the document with a unique digital "fingerprint." This technology makes the document tamper-evident, meaning if someone tries to alter it after it’s signed, the change is immediately obvious.

So, while every digital signature is an electronic signature, not every electronic signature has that heavy-duty cryptographic security.

Can a Legally Binding E-Signature Be Challenged in Court?

Absolutely. Just like a traditional pen-and-ink signature, an e-signature can be challenged. The real difference, though, is the evidence you have to back it up. A signature captured on a professional platform is much, much harder to successfully deny.

Why? Because of the digital audit trail. This detailed log provides far more proof than a simple squiggle on paper. It records who signed, their IP address, precise timestamps for every single action, and even device information. All of this creates a powerful, court-admissible record of the entire signing event.

There's a common myth that e-signatures are somehow weaker in court. In my experience, the opposite is often true. The detailed, impartial audit trail from a good platform provides stronger, more verifiable evidence than a handwritten signature, which can be forged without leaving nearly as many clues.

How Secure Are E-Signatures for Confidential Documents?

When you use a professional-grade platform, they are incredibly secure—often far more so than paper-based methods. The best solutions are built with multiple layers of security designed to protect your most sensitive agreements.

Look for these key security features:

* Data Encryption: Top-tier platforms use powerful protocols like AES 256-bit encryption to protect your documents whether they’re sitting on a server or being sent across the internet.

* Secure Access: Your account should be protected by more than just a password. Multi-factor authentication (MFA) is the standard, requiring a second step to prove it's really you.

* Tamper-Evident Seals: Once a document is signed, it should be cryptographically sealed. This ensures its integrity and makes any unauthorized changes stick out like a sore thumb.

With these technologies in place, e-signatures become a fortress for your most important business deals.

Ready to bring institutional-grade security and efficiency to your real estate deals? Homebase provides a complete, legally robust e-signature workflow designed for syndicators. Streamline your fundraising and investor management with the Homebase platform.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.