Real Estate Syndication Tax Benefits: Your Complete Guide

Real Estate Syndication Tax Benefits: Your Complete Guide

Discover powerful real estate syndication tax benefits that can transform your investment returns. Learn depreciation, 1031 exchanges, and strategies that work.

Domingo Valadez

Jun 11, 2025

Blog

Cracking the Code: How Syndication Tax Benefits Really Work

Think of real estate syndication as joining a special investment group with built-in tax perks. Unlike owning a rental property yourself, syndication makes you a business partner, opening up a world of tax strategies. The IRS sees your investment as part of a business, not just owning a property. This difference is key to understanding the benefits.

This unique setup gives you access to multiple tax breaks at the same time. One of the biggest is depreciation. Syndication allows you to deduct depreciation, which can significantly lower your taxable income.

Residential properties depreciate over 27.5 years, while commercial properties depreciate over 39 years under the General Depreciation System (GDS). This lets investors claim deductions every year, even if the property value is going up. Discover more insights. It's like claiming a loss on paper while your investment potentially grows in the real world.

When you invest in a syndication can also boost these benefits. Programs like bonus depreciation offer large first-year deductions. Understanding how taxes are reported is important for syndications. For more information, check out this article on Tax Reporting. This lets investors offset taxable income early on, particularly when tax laws are favorable. You might also be interested in Real estate investment tax strategies. Smart timing, combined with how syndications are structured for taxes, helps investors optimize their tax situation and potentially improve overall returns.

These tax advantages fit into your overall financial picture. They work with your income from other sources, potentially lowering your total tax bill. That's why seasoned real estate investors often highlight syndication's tax benefits as being just as important as cash flow.

The Depreciation Advantage: Getting Paid While Properties Appreciate

One of the most compelling tax benefits of real estate syndication is depreciation. Imagine the IRS letting you claim your property is losing value, even as its market value climbs! This "paper loss," called depreciation, becomes a powerful tool to lower your taxable income. A typical $100,000 syndication investment could yield $3,000-$4,000 in annual depreciation deductions. Think of these as "phantom losses" that can offset income from other sources, like your salary or other investments.

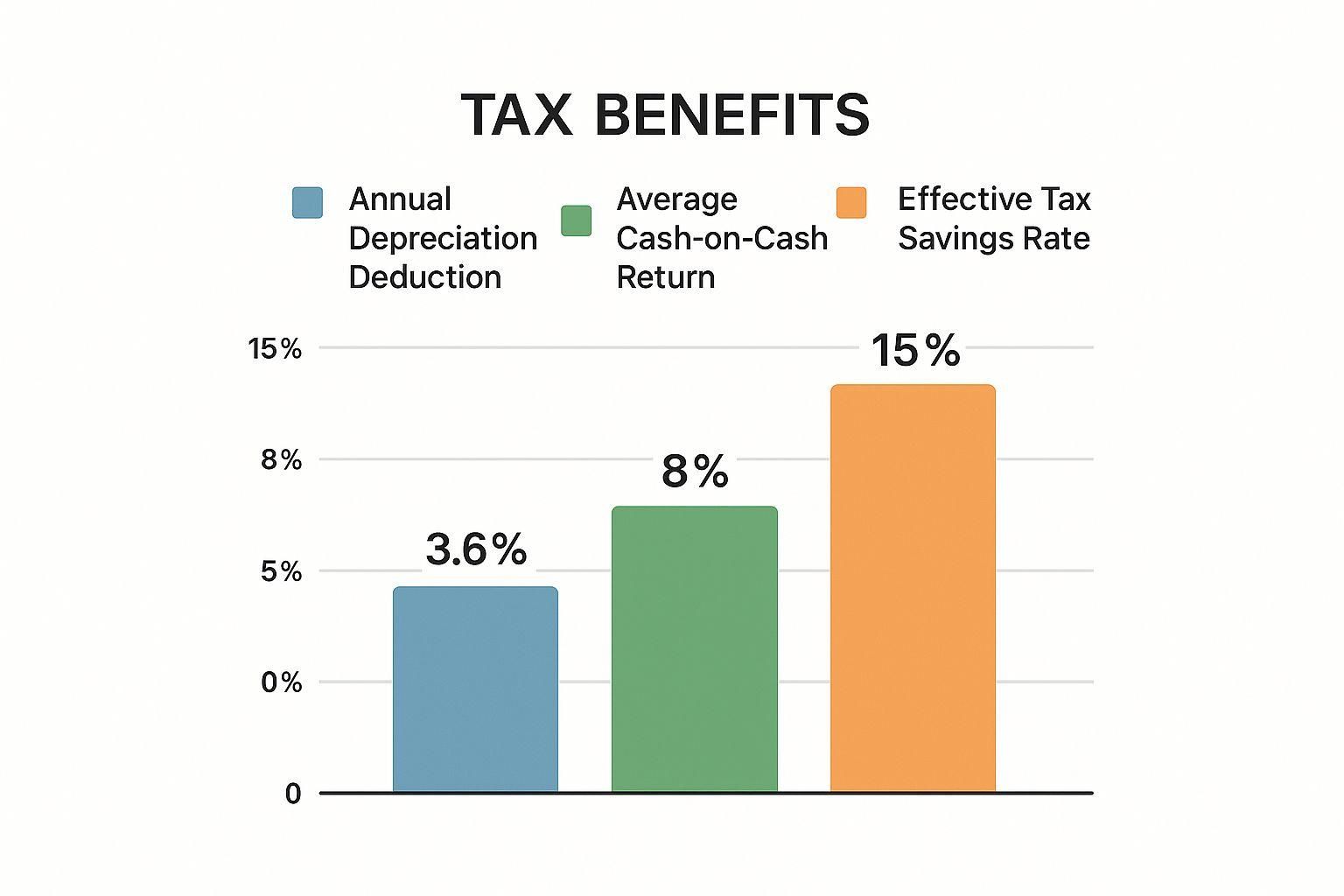

The infographic above illustrates how depreciation can impact a syndication. It compares the annual deduction, the average cash-on-cash return, and the resulting tax savings. You can see how depreciation deductions, by reducing your tax burden, can significantly boost your overall return. That's the power of real estate syndication tax benefits in action.

Why Commercial Properties Often Offer Better Depreciation

Why do commercial properties often offer better depreciation benefits than residential ones? The answer lies in the IRS depreciation schedules. Commercial properties typically depreciate over 39 years, while residential properties depreciate over 27.5 years. This longer depreciation period for commercial properties leads to potentially larger deductions, especially in the early years of ownership.

To better understand this, let's look at a comparison:

Depreciation Schedules Comparison: Residential vs Commercial Properties

Comparison of depreciation timelines, annual deduction amounts, and tax impact for different property types in syndications

Note: This table illustrates a simplified example. Actual depreciation benefits can vary based on several factors.

As you can see, while the annual deduction rate is lower for commercial properties, the longer depreciation period can result in a greater overall tax benefit over the life of the investment. It’s important to discuss these details with a financial advisor to fully understand the potential impact.

Understanding Depreciation Recapture

Syndication sponsors strive to maximize these deductions for all investors, distributing the benefits proportionally. But a common question arises: what happens when you sell the property? There's a misconception about depreciation recapture. While it's true you'll pay back some of the deferred taxes when you sell, this recapture is usually taxed at a lower capital gains rate than your ordinary income tax rate. Plus, strategies exist to minimize this impact. We'll delve into these strategies later. For now, understand that depreciation is a powerful tool. Grasping how it works within a syndication is crucial for realizing the full potential of real estate syndication tax benefits.

Cost Segregation: Turbocharged Depreciation For Serious Investors

Think of standard depreciation as a slow, steady drizzle watering your tax burden. Cost segregation, on the other hand? It's a full-blown thunderstorm. This powerful strategy is key to maximizing the tax benefits in real estate syndication. It lets you accelerate depreciation deductions by breaking down your property piece by piece.

Instead of depreciating an entire building over 27.5 years (for residential) or 39 years (for commercial), cost segregation identifies items with shorter lifespans. Then, it depreciates those faster.

Imagine a recently renovated apartment building. The main structure itself depreciates over the standard 39 years. But what about the new carpeting, appliances, and landscaping? Those depreciate much faster. Carpeting might be five years, appliances seven, and landscaping 15. This accelerated depreciation significantly increases your deductions, especially in the first few years. It frees up cash flow and boosts your overall return on investment.

How Cost Segregation Works In Syndication

Savvy syndication sponsors often work with engineering firms that specialize in cost segregation studies. These studies are a deep dive into every aspect of the property. Think everything from the roof and foundation down to the light fixtures and landscaping.

Often, these studies reclassify 25-40% of a property’s value into shorter depreciation categories. This translates to potentially receiving 30-50% of your total depreciation within the first few years – a substantial boost to your real estate syndication tax benefits.

This isn't about playing games with numbers. It's about accurately reflecting how different building components depreciate. It's like understanding that your car tires wear out faster than the engine. Both are important, but they have different lifespans. And the IRS recognizes this.

When Cost Segregation Makes Sense

Cost segregation studies aren’t always necessary. For smaller properties or those with minimal improvements, the cost of the study might outweigh the tax benefits. However, for larger commercial properties or substantial renovations, the potential tax savings can be significant.

Experienced syndication sponsors will carefully consider whether a cost segregation study is worth the investment. They'll then inform investors of the potential impact on their real estate syndication tax benefits. This detailed analysis ensures investors maximize their tax benefits without unnecessary costs. Understanding the intricacies of cost segregation gives investors a clearer picture of how these tax benefits can significantly enhance their returns.

Bonus Depreciation: The Ultimate First-Year Tax Strategy

Bonus depreciation is one of the most powerful tax strategies available to real estate syndication investors. Think of it as a supercharger for your depreciation deductions, a way to significantly amplify the tax benefits you receive.

Understanding the Power of Bonus Depreciation

Imagine you're furnishing a new apartment building. You buy new refrigerators, stoves, and dishwashers. Typically, you'd depreciate these appliances over several years, deducting a small portion of their cost each year. Bonus depreciation changes the game. It lets you deduct a large percentage of the cost right away, sometimes even 100%, all in that first year of ownership.

This creates significant "paper losses" – deductions on your tax return that reduce your taxable income, even if you haven't actually lost that cash. These paper losses can then offset other income you have, such as your salary or income from other investments. This reduces your overall tax bill, putting more money back in your pocket.

The power of bonus depreciation gets even bigger when you combine it with cost segregation. Cost segregation is a strategic way to categorize different parts of a property for depreciation purposes. By identifying and classifying short-lived assets, you maximize the impact of that first-year bonus depreciation deduction.

For example, let's say you invest $50,000 in a real estate syndication. Through a combination of bonus depreciation and a well-executed cost segregation study, you could potentially generate $75,000 in deductions in the first year alone. That extra $25,000 deduction can significantly reduce your overall tax liability.

Strategic Timing and IRS Considerations

The specific percentage you can deduct with bonus depreciation is subject to change depending on current tax laws. This makes the timing of your syndication investment crucial. Smart investors often look for syndications that allow them to maximize the benefits of bonus depreciation while the available percentages are high.

Understandably, significant deductions might attract the attention of the IRS. However, as long as your deductions are legitimate and backed up by the correct documentation, such as a thorough cost segregation study prepared by a qualified professional, you're on solid ground. Experienced syndication sponsors understand these IRS rules and ensure all the necessary documentation is in place.

This careful planning not only maximizes the tax benefits you receive from real estate syndication but also provides peace of mind, allowing you to invest confidently, knowing you're taking full advantage of legal and effective tax strategies. Understanding bonus depreciation and how to use it strategically is essential knowledge for any serious real estate syndication investor.

Smart Exit Strategies: Maximizing Your Gains at Sale Time

Exiting a real estate syndication is where smart tax planning really pays off. Think of it like this: instead of paying taxes on your profits like regular income (which could be over 37%!), syndication sales usually qualify for lower long-term capital gains rates. These rates are typically in the 15-20% range for most investors. That’s a big difference – you get to keep 80-85 cents of every dollar you make instead of just 63 cents.

One of the major perks of real estate syndication is this favorable capital gains treatment. When you sell your share, you typically benefit from these lower rates. In recent years, the highest rate on most net capital gains has been no more than 15% for most people, with some even qualifying for a 0% rate if their taxable income is low enough. For example, these thresholds are currently at $41,675 for single filers and $83,350 for married couples filing jointly. This advantage lets investors pocket a larger portion of their profits compared to other investments. Learn more about real estate syndication tax benefits.

Strategic Exit Planning for Maximum Tax Efficiency

Savvy sponsors don't just stop at capital gains treatment. They structure exits to be as tax-efficient as possible. Think of it like optimizing a race car – every tweak can improve performance. Some strategies include installment sales, which spread the gains (and the taxes) over several years, like making smaller, manageable payments instead of one huge lump sum. Another option is investing in opportunity zones, which can defer or even reduce capital gains taxes – it’s like getting a tax break for investing in designated areas. Finally, for high-income investors, charitable giving strategies can also help minimize the tax hit.

Let's paint a picture: Imagine you have a $200,000 gain from a syndication sale. If taxed as ordinary income, you might be looking at a $74,000 tax bill. Ouch. But with long-term capital gains, the tax would likely be between $30,000 and $40,000. That’s a significant chunk of change you get to keep.

To further illustrate the potential savings through capital gains treatment, let's look at a comparison of tax rates:

The following table compares tax rates for ordinary income and long-term capital gains at different income levels, and shows the potential tax savings on a $50,000 gain.

As you can see, the potential tax savings from capital gains treatment can be significant, especially for higher income earners. This highlights the importance of strategic tax planning in real estate syndication.

Timing Your Exit: Holding Periods and Coordinated Sales

When you sell also matters. Holding your investment for longer than a year qualifies you for the lower long-term capital gains rates. This is why holding periods are so important. A shorter holding period could mean your gains are taxed as ordinary income – and nobody wants that.

Professional syndication sponsors usually handle the sale process in a way that benefits all investors. This includes choosing the right time to sell to maximize returns and minimize the overall tax burden. It also means keeping investors informed throughout the process. This professional management is a key advantage of real estate syndication. Understanding these strategies helps you approach syndication exits with a clear plan, so you can maximize your profits and keep your tax bill low.

The 1031 Exchange Game: Rolling Profits Tax-Free

Think of a 1031 exchange as trading in your old car for a new one, but instead of cars, it's investment properties, and instead of paying sales tax on the difference, you get to defer paying taxes on your profit. This strategy, a cornerstone of real estate syndication tax benefits, lets you reinvest profits from a property sale into a new property, postponing capital gains taxes. It's like hitting the pause button on your tax bill as long as your money stays invested in real estate.

The process involves some deadlines – you have 45 days to identify potential replacement properties and 180 days to finalize the exchange. But the payoff can be significant. Imagine selling a property that's doubled in value. Instead of paying taxes on that gain, you reinvest those funds into a new property, effectively "rolling over" your profit and deferring the tax bill to a later date.

Diversifying with 1031 Exchanges

1031 exchanges offer real estate syndication investors flexibility in diversifying their portfolios. Perhaps you want to sell a property in one city and reinvest in a hotter market. Or maybe you want to switch from apartments to self-storage units. You could even decide to invest with a different syndication sponsor, all while keeping your tax-deferred status. This adaptability allows investors to respond to market changes and explore new opportunities without the burden of a large, immediate tax liability. Understanding the financial details of property ownership, such as potential special assessments, plays a vital role in maximizing returns upon sale. For more insights, check out this article on HOA Special Assessment Rules.

1031 Exchanges as a Wealth-Building Tool

Some investors see 1031 exchanges as a core wealth-building strategy. By continually reinvesting profits and deferring taxes, they can considerably increase their returns over the long term. Think of it like compounding interest, where the deferred taxes act as extra earnings that fuel further growth. This approach requires a long-term vision and meticulous planning to adhere to IRS regulations, but the potential rewards are substantial.

Navigating IRS Requirements and Cashing Out

The IRS has specific rules governing 1031 exchanges, and missteps can be expensive. That's why working with experienced syndication sponsors and qualified intermediaries is crucial. They can guide you through the complexities of the process and ensure a smooth, compliant exchange. But what about when you're ready to cash out entirely? Eventually, when you sell a property without reinvesting the proceeds through a 1031 exchange, you'll have to pay the deferred taxes. However, at that point, your investment will likely have grown significantly, thanks to the benefits of the tax deferral strategy.

Accessibility Through Modern Platforms

Modern syndication platforms are making 1031 exchanges more user-friendly for everyday investors. They streamline the process, offer educational resources and connect investors with qualified intermediaries. This increased accessibility is opening doors for more investors to take advantage of this valuable tax strategy.

Bringing It All Together: Your Real-World Tax Roadmap

Let's shift gears and explore how these real estate syndication tax benefits work together in real-life scenarios. Think of it like building with LEGOs: each brick, or benefit, connects to the others to create something bigger and more impressive than you could build with just one piece.

Case Study 1: The Busy Executive

Imagine a busy executive, pulling in $200,000 a year. They decide to invest in a real estate syndication. Through depreciation and cost segregation, they generate $10,000 in "paper losses." These losses, while not actual cash out of pocket, can offset their other income. This potentially lowers their tax bracket and reduces their overall tax bill. It's not about dodging taxes, it's about strategically using the tax code to your advantage.

Case Study 2: The Empty Nesters

Now, picture empty nesters wanting to turn their home equity into a stream of income, ideally without a huge tax hit. They sell their home and use a 1031 exchange to reinvest the profits into a real estate syndication. This clever maneuver allows them to defer paying capital gains taxes now and start earning passive income from the syndication's cash flow. It's a win-win: tax deferral and a new income source.

Case Study 3: The Young Investor

Let's say a younger investor is focused on building long-term wealth. They invest in a syndication and take advantage of bonus depreciation. This minimizes their initial tax burden, allowing their investment to compound and grow faster. It's like giving your investment a head start on the growth track.

Year-by-Year Examples and Common Mistakes

We'll also walk through year-by-year examples, showing exactly how syndication investments perform from a tax standpoint. We'll cover the initial benefits, the ongoing advantages, and even what happens when you eventually sell your stake. Having this timeline view empowers you to make smarter decisions.

It’s crucial to be aware of common pitfalls that can wipe out these tax benefits. For example, missing the 180-day deadline for a 1031 exchange can negate the tax deferral. Suddenly, that planned benefit transforms into an unexpected tax bill. Timing is everything.

Finding the Right Tax Professionals

Navigating these tax complexities can be challenging. We’ll provide guidance on finding qualified tax professionals who specialize in syndication investments. They can help you create a personalized strategy to maximize your tax benefits based on your specific financial goals. Think of them as your expert navigators through the tax code.

This practical, hands-on approach will help you evaluate each syndication opportunity strategically. By looking at potential investments through a tax lens, you’ll be better equipped to make informed decisions that align with your overall financial plan.

Ready to simplify your real estate syndication journey and make the most of these tax benefits? Homebase offers a comprehensive platform to streamline fundraising, investor relations, and deal management. Visit Homebase today to learn more and start optimizing your syndication investments.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

12 Essential Types of Real Estate Investment to Explore in 2026

Blog

Discover the 12 key types of real estate investment, from syndication to REITs. This guide covers risk, returns, and how to get started.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.