How to Calculate Debt Service Coverage Ratio: Step-by-Step Guide

How to Calculate Debt Service Coverage Ratio: Step-by-Step Guide

Learn how to calculate debt service coverage ratio easily. Our guide provides quick tips to understand and compute this vital financial metric.

Domingo Valadez

Sep 22, 2025

Blog

When you're underwriting a deal, it all boils down to one crucial question: can the property's income cover its mortgage payments with room to spare? The Debt Service Coverage Ratio, or DSCR, is the metric that gives you the answer.

The calculation itself is straightforward: you just divide the property's Net Operating Income (NOI) by its Total Annual Debt Service. If the number is over 1.0, you’re in the black. But in the real world, just barely covering your debt isn't enough—lenders need to see a healthy cushion.

What Exactly Is The Debt Service Coverage Ratio?

Think of DSCR as a financial stress test for an income-producing property. It’s a vital sign that tells you, your investors, and especially your lender how much cash flow is left to handle the mortgage after all other operating expenses are paid.

A DSCR of exactly 1.0x means that every single dollar of net income is going straight to the lender. That leaves zero margin for error, vacancies, or the inevitable surprise maintenance issue. It's a knife's edge no one wants to be on.

This is precisely why you'll almost never see a lender approve a loan with that tight of a ratio. They want to see a safety net. Typically, the minimum acceptable DSCR is around 1.25x. A 1.25x ratio tells the lender that the property generates 25% more income than it needs to pay its debt service, which is a much more comfortable position for everyone involved. For a deeper dive, check out this great resource on Understanding Debt Service Coverage Ratio (DSCR).

Why This Single Metric Matters So Much

For real estate syndicators, the DSCR is far more than just another number on a spreadsheet. It’s a core indicator of an investment's health and its ability to perform as projected. This one metric has a direct impact on whether you can even get a deal financed and what kind of terms you’ll get.

- Securing the Loan: A strong DSCR is a make-or-break requirement for nearly all commercial lenders. If your number doesn't hit their minimum, the conversation is over before it starts.

- Getting Better Terms: A high DSCR doesn't just get you approved; it gives you leverage. You can often negotiate for a lower interest rate or more favorable loan terms when you present a less risky deal.

- Comparing Apples to Apples: It gives you a standardized metric to quickly assess and compare the financial risk of different investment opportunities.

At the end of the day, the DSCR answers the most fundamental question for everyone at the table: can this property reliably pay its own way? A solid ratio gives both you and your lender the confidence to move the deal forward.

Nailing Your Net Operating Income Calculation

Before you even touch the DSCR formula, you have to get your Net Operating Income (NOI) right. Think of NOI as the engine of your entire financial analysis. If that number is off, your DSCR will be completely useless. Essentially, NOI shows you how profitable a property is before you account for loan payments and taxes.

Let's run the numbers on a real-world example: a 20-unit apartment building.

From Potential Rent to Real-World Income

First things first, we need the Gross Potential Rent (GPR). If all 20 units are renting for $1,500 a month, you’re looking at $30,000 monthly, which comes out to a GPR of $360,000 annually.

But let's be realistic—no property stays 100% full year-round. You have to factor in vacancies. I always pencil in a conservative vacancy rate, usually between 5-8% depending on the market, to get a much more accurate forecast.

Applying a 5% vacancy rate to our example means subtracting $18,000. This leaves us with an Effective Gross Income (EGI) of $342,000. This is the number that truly reflects your top-line revenue.

Pinpointing Your Actual Operating Expenses

Now, we subtract the property’s operating expenses from that EGI. This is a critical step, and frankly, it's where I see a lot of investors stumble. Operating expenses are simply the costs you incur to keep the lights on and the property running smoothly day-to-day.

These are the usual suspects:

* Property Taxes: Your annual bill from the city or county.

* Insurance: The policy that covers you for liability and property damage.

* Property Management Fees: If you hire a pro, this usually runs 8-10% of your EGI.

* Repairs & Maintenance: Your budget for all the little things—leaky faucets, landscaping, etc.

* Utilities: Any gas, electric, or water you cover for common areas.

For our 20-unit building, let's say the total operating expenses add up to $122,000 for the year. If you want a deeper dive into this, you can learn more about how to calculate NOI in our comprehensive guide.

Crucial Tip: Do not mix in capital expenditures (CapEx) like a new roof, or your loan's interest payments, or depreciation into your operating expenses. A lender will spot that immediately and toss out your calculation.

So, the math is straightforward:

$342,000 (EGI) - $122,000 (Operating Expenses) = $220,000 (NOI)

That $220,000 is the golden number—it's the figure that plugs directly into the DSCR formula. It's worth noting that tax rules can differ quite a bit depending on where you're investing. For some, understanding negative gearing is essential for a full financial picture. But no matter the market, a clean and accurate NOI is the absolute foundation of any solid real estate deal.

Nailing Down Your Total Debt Service

Alright, you've got your NOI pinned down. That’s the hard part. The other half of the DSCR equation is your Total Debt Service. This is simply the grand total of all the principal and interest payments you'll make on the loan over one full year.

Lenders think in annual terms, so we need to as well. The calculation is straightforward: take your monthly mortgage payment and multiply it by 12.

So, if your property’s monthly principal and interest (P&I) payment comes out to $10,000, your annual debt service is $120,000. That's the number that plugs into the bottom of the DSCR formula.

Don't Get Tripped Up by Loan Structures

Now, here’s where a lot of newer investors get into trouble. Your debt service isn't always a fixed, predictable number. The type of loan you get can drastically change your payments, especially early on. You absolutely have to account for these nuances in your underwriting.

- Interest-Only (IO) Periods: It's common for commercial loans to offer an IO period upfront. Your payments will be lower since you're only covering interest, which makes your DSCR look fantastic on paper. But it's temporary.

- Adjustable-Rate Mortgages (ARMs): With an ARM, your rate is locked in for a few years, but then it starts to float. If rates go up, so does your payment, and your annual debt service climbs right along with it.

This is crucial: Always stress-test your deal. When you're underwriting, run your DSCR calculation using the fully amortized P&I payment, not just the cushy interest-only number. You need to know if the property can still cover its debt once those full payments kick in. This is a non-negotiable step for any serious investor.

Overlooking these future payment shocks leads to a dangerously inflated DSCR. It paints a rosy picture that doesn't reflect the real, long-term risk you and your investors are taking on.

Let's Run the Numbers: A Real-World DSCR Calculation

Theory is great, but let's get our hands dirty and see how this plays out in a real deal. This is where we connect the dots between Net Operating Income (NOI) and Total Debt Service to find out if an investment truly holds up.

Let's say we’re looking at a 50-unit apartment building. We’ve gone through the underwriting process and determined the property throws off an annual Net Operating Income (NOI) of $150,000.

On the other side of the equation, we have our financing. We've talked to a lender and have a quote for a loan with a monthly principal and interest payment of $10,000. That works out to a Total Annual Debt Service of $120,000 ($10,000 x 12 months).

Now, we just plug those numbers into our simple formula:

- DSCR = Net Operating Income / Total Debt Service

- DSCR = $150,000 / $120,000

- DSCR = 1.25x

That 1.25x isn't just a number; it's the number that gets deals done in commercial real estate.

So, What Does a 1.25x DSCR Actually Mean?

A DSCR of 1.25x tells us the property generates 25% more cash flow than it needs to make its mortgage payments. Think of it as a financial cushion.

This buffer is everything. It's the safety net that covers you when you have an unexpected vacancy, a major HVAC unit dies, or property taxes jump. Without that cushion, any operational hiccup could put you in a position where you can't pay the lender.

For us as investors, it's a clear signal that the property can support itself and still generate positive cash flow. For a lender, it’s a sign of a lower-risk loan. You can actually see how these ratios tighten up during recessions by looking at historical commercial real estate DSCR trends, which underscores why lenders are so focused on this metric.

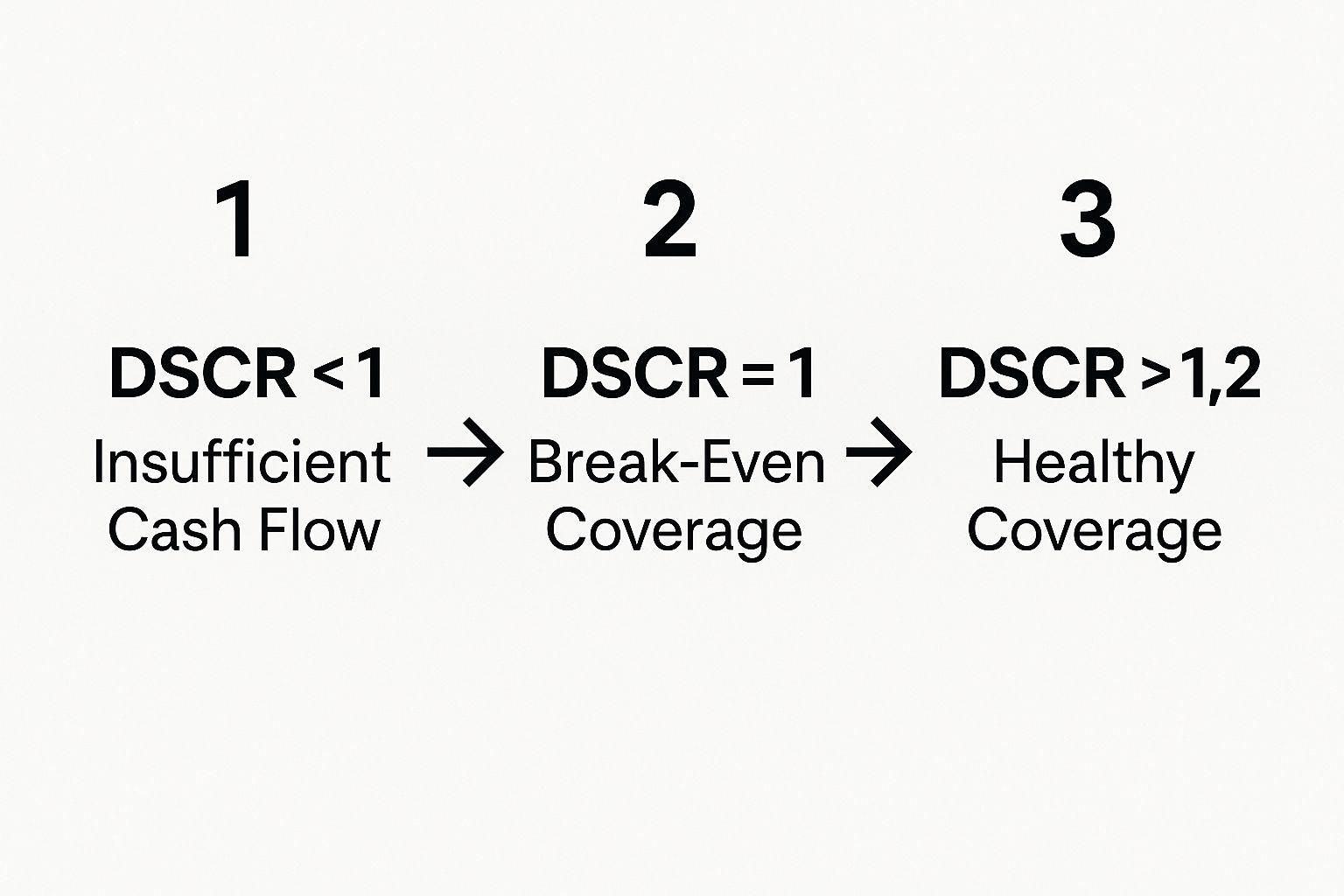

This image breaks down how lenders typically interpret DSCR values at a glance.

As you can see, once you clear that 1.20x mark, you're in the green zone. It makes the property a much more attractive, financeable asset.

The takeaway is simple: Our 1.25x DSCR tells everyone involved—from our investment partners to the bank—that this deal is standing on solid ground. It’s not just scraping by; it has a reliable margin of safety built in to handle the inevitable bumps in the road. That's what gives a deal the green light.

How Lenders See Your DSCR

Calculating your Debt Service Coverage Ratio is only half the battle. The real key is understanding what that number means to the person on the other side of the table—the lender. For them, your DSCR is a direct, unfiltered measure of risk.

A lender isn't just looking for a number that's barely above 1.0x. They're looking for a comfortable cushion, and how big that cushion needs to be depends entirely on the deal's risk profile.

That's why a stabilized apartment building in a great submarket might get funded with a 1.20x DSCR. The income is predictable and seen as low-risk. But bring them a hotel deal? That's a different story. With its nightly turnover and vulnerability to economic swings, it’s a much riskier bet. For an asset like that, a lender will likely demand a much higher ratio—think 1.40x or even more—before they can sleep at night.

The Power of a Strong Ratio

A solid DSCR doesn't just get you a "yes" from the loan committee; it gives you serious negotiating leverage. When you can walk in and prove your property has a healthy cash flow buffer, you immediately become a lower-risk borrower. This almost always translates into better loan terms.

With a strong ratio, you might be able to lock in:

- A lower interest rate, which directly reduces your debt service.

- A higher loan-to-value (LTV), letting you put less cash into the deal.

- More flexible terms, like a valuable interest-only period at the start of the loan.

On the flip side, a weak DSCR puts you on your back foot immediately. A lender might counter with a demand for a larger down payment to reduce their exposure, or they might just pass on the deal altogether.

Your DSCR is your property's financial resume. A strong one opens doors and saves you money, while a weak one closes them fast.

This intense focus on risk isn't just about individual deals, either. It's happening on a global scale. Major financial institutions are constantly watching these metrics. For instance, the Bank for International Settlements (BIS) tracks debt service ratios across entire economies to get ahead of systemic risks. They know that when ratios start creeping up, financial trouble often isn't far behind. You can learn more about how the BIS uses this data for global financial monitoring.

Common Questions About DSCR Answered

Even after you get the hang of calculating the debt service coverage ratio, some questions inevitably pop up. I see the same ones from syndicators all the time, so let's walk through the three most common sticking points.

What Is a Good DSCR?

This is the big one, and the honest answer is: it depends. There’s no universal "good" number because it's all relative to the asset class, the market, and the lender's risk appetite.

For a stabilized, bread-and-butter multifamily property in a strong market, a lender might be comfortable with a 1.20x DSCR. But for something with more operational risk, like a hotel or a spec development, they'll want to see a much bigger cushion—think 1.40x or even higher.

That said, if you're looking for a solid rule of thumb, 1.25x DSCR is the most common minimum benchmark you'll encounter with commercial lenders. Aim for that, and you'll be in the right ballpark for most deals.

How Can I Fix a Low DSCR?

So, what happens when you underwrite a deal and the DSCR comes in weak? Don't panic. You've got two main levers you can pull to get that number where it needs to be: either increase your Net Operating Income (NOI) or find a way to decrease your total debt service.

- Boost Your NOI: This is the operational side of the equation. Can you strategically raise rents to match the market? Are there bloated operating expenses you can trim without hurting the property? Every dollar you add to the NOI directly improves your DSCR.

- Reduce Your Debt Service: This is all about the financing structure. The most common moves here are to refinance into a loan with a lower interest rate or to extend the amortization period. A longer amortization spreads the principal payments out, lowering your annual debt burden.

Is DSCR the Same as Cap Rate?

Absolutely not, and it's crucial to understand the difference. These are two distinct metrics that tell you very different things about a potential investment.

DSCR is a lender's metric. It's all about cash flow and the property's ability to cover its specific loan payments. It measures the margin of safety for that particular debt.

A Cap Rate, on the other hand, measures a property's unleveraged return based on its market value. It's a way to compare the raw earning potential of different properties, assuming you paid all cash. You need both a solid Cap Rate and a healthy DSCR for a deal to pencil out.

Juggling investor relations, deal financing, and reporting can feel like a full-time job in itself. At Homebase, we've built an all-in-one platform to take the headache out of fundraising, compliance, and investor updates. This lets you get back to what you do best: finding and closing great deals, not fighting with spreadsheets.

Learn more about how Homebase can support your syndication business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

What is a dscr loan and how it fuels profitable real estate deals

Blog

Discover what is a dscr loan and how it unlocks financing for your next real estate deal.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.