How to Calculate NOI for Real Estate Investors

How to Calculate NOI for Real Estate Investors

Learn how to calculate NOI with this practical guide. We break down the formula, income, and expenses to help real estate investors analyze property value.

Domingo Valadez

Sep 15, 2025

Blog

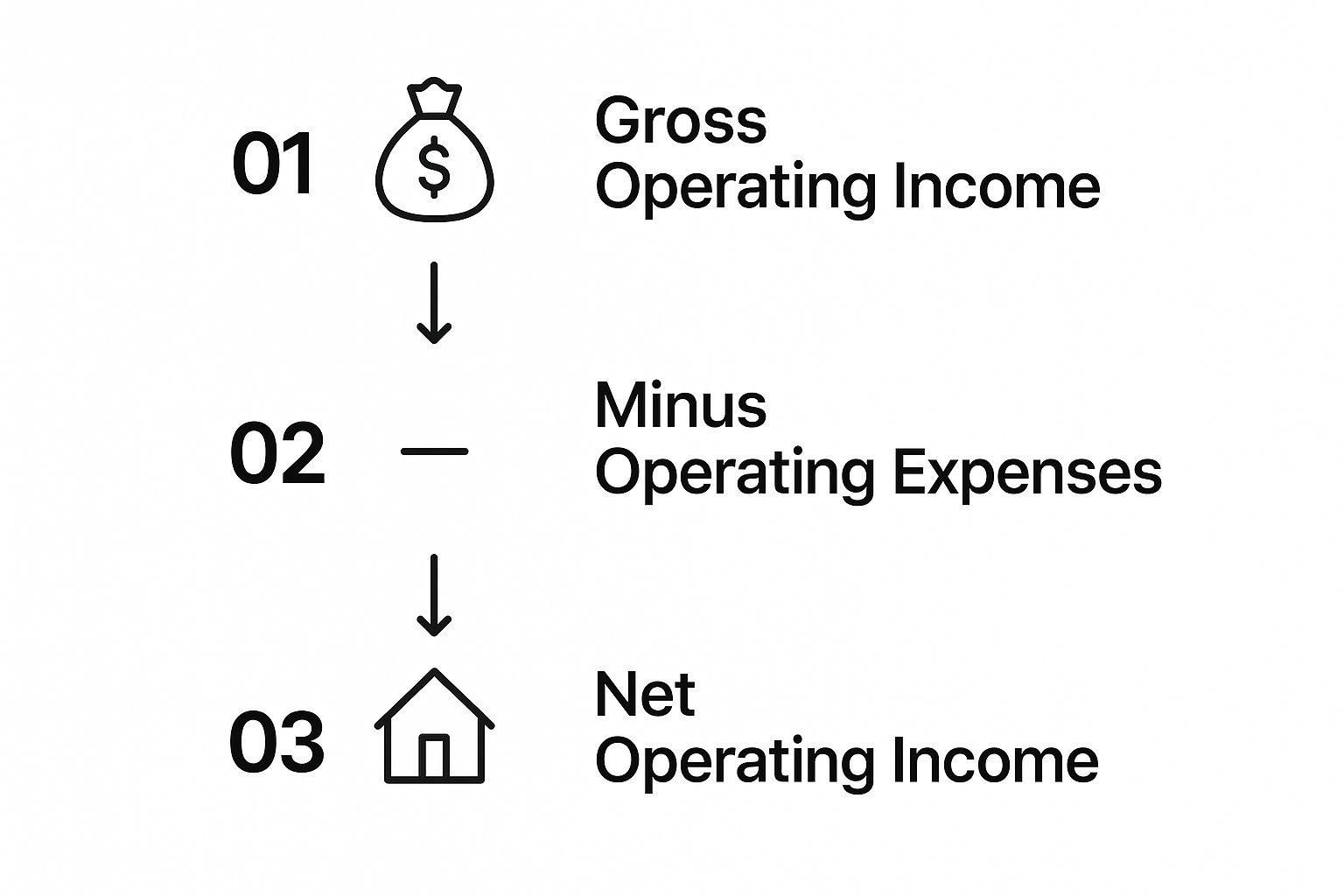

To calculate Net Operating Income (NOI), you simply subtract a property's total operating expenses from its gross operating income.

The formula looks like this: Gross Operating Income - Operating Expenses = NOI. This gives you a pure, unfiltered look at a property's profitability before you start thinking about debt payments or income taxes. For investors, it's the go-to metric for judging an investment's raw performance.

What Net Operating Income Actually Tells You

Before you even open a spreadsheet, it’s critical to grasp why NOI is the absolute cornerstone of real estate analysis. Think of it as the property's financial heartbeat. It shows you exactly how much cash a property generates from its day-to-day operations, completely independent of the owner’s financing choices or tax circumstances.

That separation is what makes NOI so incredibly powerful. It lets you compare the operational efficiency of two completely different properties on a true apples-to-apples basis. It doesn't matter if one was bought with all cash and the other with a high-leverage loan; NOI cuts through the noise.

To help clarify what goes into the formula, here’s a quick breakdown of what you need to track.

Key Components of the NOI Formula

Essentially, the calculation is about what the property itself earns and costs, not what the owner's financial structure looks like.

Key takeaway: By focusing only on income and operational costs, NOI provides a clear, unbiased snapshot of a property’s financial health. It intentionally ignores financing and taxes, which can vary wildly from one investor to the next.

A Quick Real-World Example

Let's put this into practice. Imagine you're looking at a small apartment building.

The property brings in $150,000 in annual rental income. After digging through the books, you find that the operating costs—things like management fees, maintenance, utilities, insurance, and property taxes—add up to $50,000 for the year.

The calculation is straightforward: $150,000 (GOI) - $50,000 (OpEx) = $100,000 (NOI).

That $100,000 figure represents the property's pure profit from its operations. This is the number lenders will pore over to decide if you qualify for a loan, and it’s the metric seasoned investors use to determine what an asset is truly worth.

Ultimately, NOI is a foundational metric used to help calculate rental property value, especially for income-producing properties. It's the starting line for nearly every major financial decision you'll make in real estate syndication.

Calculating Your Gross Operating Income Accurately

Getting to a solid NOI starts with one thing: a realistic picture of your property's total income. This number is your Gross Operating Income (GOI), and it’s the sum of all revenue the property pulls in before you start subtracting expenses. It's more than just rent, and nailing this figure is the first and most critical step in your analysis.

The first number you need to find is the Gross Potential Rent (GPR). Think of this as the absolute best-case scenario—what you’d make if every single unit was rented out, every single day of the year, at full market rent. So, for a 10-unit building where market rent is $1,500 per unit, your GPR would be $15,000 a month, or $180,000 for the year.

Of course, we don't live in a perfect world. No property stays 100% full all the time. This is where we need to bring our projections back down to earth.

Accounting for Vacancy and Credit Loss

The gap between that perfect-world GPR and what you actually collect comes down to two things: vacancy and credit loss. Vacancy loss is simply the rent you don't collect because a unit is empty. Credit loss is the rent you should have collected but didn't because a tenant failed to pay. Most experienced investors just bundle these together as a single percentage loss.

For example, if you look around and see the vacancy rate for similar properties in the area is 5%, you need to apply that to your GPR. For that $180,000 GPR we just calculated, a 5% loss means docking $9,000. That brings your realistic rental income down to $171,000. Whatever you do, don't skip this step. Using GPR alone is a surefire way to over-inflate your NOI and make a bad deal look good.

Identifying All Other Income Sources

Rent is the main event, but it's rarely the whole show. Most multifamily properties have other ways of making money, and forgetting to include this "other income" is a classic rookie mistake. These ancillary streams can seriously beef up your GOI.

Some of the most common sources of other income include:

- Parking Fees: Charging for reserved spots, carports, or garages.

- Laundry Facilities: The quarters and card swipes from on-site machines really add up.

- Pet Fees: This could be a one-time fee or, even better, monthly "pet rent."

- Storage Units: Renting out small on-site storage closets to tenants.

- Utility Reimbursements: Using a system like RUBS to bill back tenants for water, sewer, and trash.

- Late Fees: The extra charges collected from tenants who pay rent past the due date.

It's easy to dismiss these as small-fry items, but that's a huge oversight. I was underwriting a deal once where the income from laundry and a few storage closets came out to over $12,000 a year. Based on the 6% cap rate in that market, that "small" income stream added over $200,000 to the property's valuation.

Let's finish our example. Say that 10-unit property also brings in $7,500 a year from laundry, parking, and pet fees. To get our final, realistic GOI, we add that to our vacancy-adjusted rent:

$171,000 (Effective Gross Rent) + $7,500 (Other Income) = $178,500 (Gross Operating Income)

This $178,500 is the number that matters. It’s the true top-line figure you’ll use for the rest of your NOI calculation. It’s a real, defensible income projection that reflects how a property actually performs in the wild, not just on a spreadsheet.

Nailing Down Your True Operating Expenses

Getting an accurate NOI calculation really boils down to how well you identify the true costs of running the property day-to-day. If you get this part wrong, your entire financial model is built on a house of cards. We're talking about your Operating Expenses (OpEx)—the necessary, recurring costs that keep the property running and the tenants happy.

Think of OpEx as the property's metabolism. It's the constant energy burn required just to keep things functioning. I find it helpful to split these into two main buckets, especially when forecasting for the future.

Fixed Versus Variable Costs

First, you have your fixed costs. These are the predictable, almost set-in-stone expenses that don't really change whether the property is 100% full or has a few vacancies. They're the easiest part of your budget because of their consistency.

- Property Taxes: The annual bill from the city or county. It’s unavoidable.

- Insurance: Your coverage for liability, fire, and other potential disasters.

Then you have the variable costs. As the name suggests, these can fluctuate based on occupancy, season, or just plain old wear and tear. These require a sharper pencil when you're building out your proforma.

- Utilities: Think water, sewer, trash, and electricity for common areas.

- Repairs & Maintenance: This covers everything from a leaky faucet to patching drywall after a tenant moves out.

- Property Management Fees: Usually calculated as a percentage of the rent you actually collect.

Making this distinction is more than just an accounting exercise. Lenders scrutinize your expense ratio. As a general rule of thumb, operating expenses in the US multifamily space have historically landed somewhere between 35% and 45% of gross rental income. This is a key benchmark lenders use to gauge if a property can comfortably cover its debt.

The All-Important CapEx Distinction

Now for the single biggest mistake I see new investors make: confusing an operating expense with a Capital Expenditure (CapEx). Get this wrong, and you’ll completely torpedo your NOI calculation.

Key Takeaway: Operating expenses are the routine costs to maintain the property's current condition. Capital expenditures are major investments to improve the property or replace a major system at the end of its useful life.

Think of it this way: OpEx is like getting an oil change for your car. CapEx is replacing the entire engine. One is a regular cost of doing business, while the other is a significant, infrequent investment that adds long-term value. For this reason, CapEx is never included when you calculate NOI.

Let's put them side-by-side to make it crystal clear:

Why is this so critical? If you miscategorize a $20,000 roof replacement as an operating expense, you’ll artificially crush your NOI for that year. It would make a perfectly healthy property look like a financial train wreck on paper.

On the flip side, ignoring future CapEx needs because you're focused on a rosy NOI figure is a classic recipe for disaster. The pros always set up a separate "CapEx reserve" fund, socking away money specifically for these big-ticket items. This keeps them completely separate from the property’s day-to-day operational budget. If you want to dig deeper, you can learn more about how to calculate operating expenses in our guide.

Putting the NOI Formula Into Practice

Okay, enough with the theory. Let's get our hands dirty and walk through a real-world example. It's one thing to know the formula, but seeing it in action with actual numbers is where the concept really clicks.

We’ll underwrite a hypothetical 10-unit apartment building from top to bottom, showing you exactly how the numbers flow. This is the same process I use every time I evaluate a potential deal.

Compiling the Gross Operating Income

First things first, we need to figure out how much money the property is actually bringing in. We start with the absolute maximum potential, then work our way down to reality.

Let's say each of the 10 units commands a market rent of $1,500 per month. That gives us a Gross Potential Rent (GPR) of $180,000 for the year (10 units x $1,500/month x 12 months).

But let's be realistic—no building is ever 100% full, 100% of the time. You have to account for vacancies and tenants who don't pay. Based on the local market comps, a 5% vacancy and credit loss factor feels right. This knocks $9,000 off our top line ($180,000 x 0.05), landing our Effective Gross Rent at $171,000.

Don't forget the other streams of income! This property has coin-operated laundry and a few reserved parking spots, generating an extra $5,000 a year. That brings us to our final Gross Operating Income (GOI).

GOI Calculation:

$171,000 (Effective Gross Rent) + $5,000 (Other Income) = $176,000 (GOI)

This $176,000 is our true starting point. It's the total cash the property is expected to collect in a year. Now, let's look at what it costs to keep the lights on.

Totaling the Operating Expenses

For our 10-unit building, we need to track every legitimate operating cost. Remember, this is all about the day-to-day—no mortgage payments or big-ticket capital improvements allowed here.

Here’s a realistic breakdown of the annual expenses:

- Property Taxes: $20,000

- Insurance: $6,000

- Utilities (for common areas): $8,500

- Repairs & Maintenance: $9,000 (a crucial, and often underestimated, line item!)

- Property Management Fees: Typically a percentage of collected rent. We’ll use 8% of GOI, which comes out to $14,080 ($176,000 x 0.08).

- Landscaping & Snow Removal: $3,000

- General & Administrative: $2,000

When we add it all up, our Total Operating Expenses land at $62,580.

The Final NOI Calculation

We’ve done the heavy lifting. We have our true income and our total operational costs. The final step is just simple subtraction, as this visual breakdown shows.

Think of it as a funnel. We start with all potential revenue at the top and strip away everything that isn't pure operational profit until we're left with the core financial performance of the asset itself.

Let's plug in our numbers:

$176,000 (GOI) - $62,580 (Operating Expenses) = $113,420 (NOI)

And there you have it. The Net Operating Income for our 10-unit apartment building is $113,420. This powerful number represents the property's annual profit before we factor in any debt payments or capital projects. It’s the figure you’ll use to calculate the cap rate, show to lenders, and ultimately decide if this is a deal worth pursuing.

To make this even clearer, let's lay out the entire calculation in a simple table. This is a format you'll see (and use) constantly in underwriting.

Sample NOI Calculation for a 10-Unit Apartment Building

Seeing all the numbers laid out like this demystifies the process. It's just a logical flow from top-line revenue to bottom-line operational profit. Master this, and you've mastered the fundamental building block of real estate analysis.

Common Mistakes That Skew Your NOI

The NOI formula looks simple enough on paper, but your final number is only as solid as the data you plug into it. I’ve seen small, seemingly innocent errors snowball into huge problems, painting a dangerously misleading picture of a property’s real performance. Honestly, knowing the common pitfalls is just as crucial as knowing the formula itself.

One of the most frequent blunders is confusing operating expenses with capital expenditures. It’s an easy mistake to make. But if you accidentally toss a major roof replacement or a parking lot repaving into your annual operating costs, you’ll artificially tank your NOI. A healthy asset will suddenly look like a dog. Just remember the simple rule: OpEx maintains, CapEx improves.

Pro Tip: I always keep two separate budgets. One is the annual operating budget used for the NOI calculation. The other is a long-term capital reserve budget, which we fund separately to handle the big-ticket replacements down the road. This creates a clean financial firewall and keeps the numbers honest.

Ignoring Reality in Your Projections

Another classic trap is getting seduced by the seller's "pro forma" numbers. These documents are marketing materials, plain and simple. They often paint a rosy picture assuming things like 100% occupancy and conveniently low-balling future expenses. You have to build your own analysis from the ground up, starting with the property’s actual trailing 12-month (T-12) financials and your own diligent market research.

This isn't just a real estate quirk; it's a fundamental concept in business operations. Think of a coffee shop pulling in $27,000 a month with $18,000 in expenses—its NOI is $9,000. That figure is only trustworthy if those inputs reflect actual, historical performance, not just wishful thinking. You can dig into this broader business application of NOI over on Salesforce.com.

Underestimating vacancy and credit loss is another deal-killer. Sure, a property might be full today, but what if a major local employer shuts down next year? You have to stress-test your assumptions.

Here’s what I do:

- Run multiple scenarios: I'll calculate NOI with a conservative 5% vacancy rate, but then I'll immediately rerun it at 8% and maybe even 10%. You need to see how sensitive your cash flow is to market shifts.

- Verify market rents: Don't take the current rent roll at face value. Are those rents at, above, or below the current market rate? If they’re artificially high, you're looking at future vacancy as tenants jump ship for a better deal.

- Dig for concessions: Did the seller give away two months of free rent just to get leases signed? That’s a gimmick that inflates the "effective" rent and, by extension, the NOI. You have to account for that.

When you scrutinize every line item and challenge every assumption, your NOI transforms from a simple math problem into a powerful tool. It becomes a defensible number you can actually take to the bank and use to make genuinely smart investment decisions.

Answering Your Top Questions About NOI

Once you have the NOI formula down, you start bumping into real-world questions that aren't always so black and white. Let's tackle some of the most common points of confusion I see when investors are putting NOI to work on actual deals.

What's the Real Difference Between NOI and Cash Flow?

This is the big one. Getting this right is fundamental.

NOI shows you how profitable the property is on its own, completely ignoring any mortgage. Think of it as the building's raw earning power. Cash flow, on the other hand, is the actual money that hits your bank account after all the bills are paid—including the mortgage and any money you set aside for big-ticket repairs.

A property can have a healthy, positive NOI but still be a cash-flow negative deal. I see this happen all the time when a deal is loaded up with too much debt. The massive mortgage payment eats up all the profit and then some.

The relationship is simple:

NOI - Debt Service - CapEx Reserves = Cash Flow

So, remember: NOI tells you about the health of the asset. Cash flow tells you about the health of your specific investment in that asset.

How Does NOI Actually Help Me Value a Property?

NOI is the absolute heart of the "Income Approach," which is the standard way commercial properties are valued. You use it to find the Capitalization Rate (Cap Rate)—a simple metric that shows the relationship between a property's income and its market value.

Here’s the formula: Cap Rate = NOI / Property Value

This is how you can quickly compare different investment opportunities on an apples-to-apples basis. For example, if you know the going Cap Rate for similar buildings in the area is 6%, and you're looking at a property with an NOI of $60,000, you can quickly back into an estimated value of $1,000,000 ($60,000 / 0.06).

Getting your NOI calculation right is the essential first step. Mess that up, and your valuation will be way off.

NOI is the engine that drives property valuation. Without a precise NOI, your Cap Rate calculation is meaningless, and you risk drastically overpaying for an asset. It's the starting point for almost every serious investment analysis.

Can I Use This for a Single-Family Rental?

You absolutely can, and you should. The principle is identical, just with a simpler P&L. Your Gross Operating Income is your total rent collected (minus an allowance for when it's empty), and your operating expenses are things like property taxes, insurance, routine maintenance, and maybe a property management fee.

Applying the NOI framework to a single-family home forces you to think like a professional. It helps you see the asset's performance objectively, separating the property's business from your personal financing situation.

Why Aren't My Loan Payments and Taxes Included?

This is by design. NOI is meant to be a universal yardstick for a property's performance, regardless of who owns it.

Every investor has a different financial situation. One might get a great interest rate and a 30-year loan, while another has a higher rate on a 20-year term. Their loan payments will be completely different for the exact same property. The same goes for income taxes, which vary based on an individual's or a company's tax bracket.

By stripping out debt service and income taxes, NOI gives us a pure, unbiased look at the property itself. It allows a syndicator, a lender, or a potential buyer to compare the operational efficiency of two different buildings without getting tangled up in the owner's personal finances. It answers one critical question: how well does this asset run on its own?

Juggling investor relations, fundraising, and reporting can feel like a full-time job, pulling you away from what you do best: finding the next great deal. Homebase is an all-in-one platform built by syndicators specifically for syndicators to make your operations seamless. From automated fundraising to a professional investor portal, we give you the tools to scale your business with confidence.

Discover how Homebase can streamline your real estate syndication business today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

NOI Real Estate Explained A Guide for Syndicators

Blog

Master NOI real estate with our definitive guide. Learn how to calculate net operating income, increase property value, and drive investor returns.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.