Top 12 Best Deal Management Software for Real Estate Syndicators in 2025

Top 12 Best Deal Management Software for Real Estate Syndicators in 2025

Discover the best deal management software for real estate. We review 12 top platforms to help you streamline fundraising, manage investors, and close faster.

Domingo Valadez

Dec 20, 2025

Blog

In the world of real estate syndication, efficiency is your competitive edge. Managing a pipeline of deals, juggling investor communications, and navigating the complexities of subscription documents and distributions can quickly bog down even the most organized General Partner (GP). Spreadsheets, disjointed tools, and manual processes not only create friction but also introduce risks and project an unprofessional image to potential limited partners.

This guide is for GPs ready to operate like an institution. We will dive deep into the 12 best deal management software platforms designed to streamline your entire syndication lifecycle, from fundraising to investor payouts. A robust tech stack is essential, but it performs best when fueled by a consistent flow of opportunities. For real estate syndicators, having a solid strategy to generate targeted real estate leads is the first step in filling their deal pipeline and making the most of these powerful tools.

Our goal is to move beyond generic marketing copy and provide a comprehensive resource that helps you make a truly informed decision. We'll analyze core features, ideal use cases, and the practical considerations, like pricing and onboarding, that matter most. Each review includes screenshots and direct links to the platforms, giving you a clear view of what to expect. This list will equip you with the insights needed to select a platform that not only solves today's administrative headaches but also scales with your ambitions, allowing you to focus on what you do best: finding and closing great deals.

1. Homebase

Best All-in-One Platform for Real Estate Syndicators

Homebase earns its top spot as a premier choice for real estate syndicators seeking an institutional-grade, end-to-end deal management platform. Built by operators for operators, it directly addresses the fragmented workflows that often hinder capital raising and investor relations. The platform excels at centralizing every critical stage of the syndication lifecycle, from initial deal marketing to final investor distributions, into a single, intuitive dashboard. This integrated approach makes it one of the best deal management software solutions for lean general partnership (GP) teams aiming to scale efficiently.

The platform’s strength lies in its unified workflow. Sponsors can create professional, branded deal rooms to attract investors, then seamlessly transition them to soft commitments and live investments. From there, Homebase manages the entire subscription process with built-in e-signatures, accreditation checks, and KYC verification, significantly reducing administrative burdens and compliance risks.

Key Differentiators and Use Cases

A standout feature is Homebase's predictable, flat-rate pricing model, which deliberately avoids AUM-based fees. This is a significant advantage for growing syndicators, as costs remain fixed regardless of how many assets are under management. The subscription includes unlimited deals, investors, and team members, providing clear value and budget certainty.

Another key advantage is the company’s hands-on approach to client success. Homebase offers full-service data migrations and white-glove onboarding, a crucial benefit for GPs transitioning from spreadsheets or less comprehensive platforms. This high-touch support ensures a smooth implementation, allowing teams to leverage the software's full potential from day one. In a practical scenario, a syndicator can launch a new 506(c) offering, collect electronic subscription documents, verify investor accreditation, and manage all communications without ever leaving the platform. For a deep dive into the platform’s capabilities, you can explore more about Homebase's real estate investment management tools.

Pricing & Platform Focus

- Pricing: Homebase utilizes a flat, predictable subscription model. Specific pricing details are not public; prospective customers must schedule a demo to receive a customized quote.

- Best For: Real estate syndicators and fund managers who need a comprehensive, all-in-one system to raise capital faster and operate like an institution without incurring AUM-based fees.

- Limitations: The platform is highly specialized for real estate syndication. Sponsors in other alternative asset classes or those requiring complex, niche enterprise integrations should confirm the feature set meets their specific needs.

2. Intapp DealCloud

Intapp DealCloud is a powerful, purpose-built platform designed for the complex needs of capital markets, making it a strong contender for sophisticated real estate syndicators managing intricate, multi-party deals. Unlike generic CRMs adapted for real estate, DealCloud is engineered from the ground up for pipeline management, relationship intelligence, and deal execution tracking. This specialization is its key differentiator, providing industry-specific workflows that resonate with firms handling complex capital stacks or numerous intermediaries.

The platform excels at centralizing communication and activity through deep integration with Microsoft Office, particularly its Outlook plugin. This allows teams to capture critical interactions and relationship data without leaving their inbox, ensuring the "single source of truth" is always up-to-date. Its no-code configuration allows firms to tailor workflows, dashboards, and reports to their exact processes without needing a developer.

Key Features & Use Case

A syndicator managing a large, institutional-grade development project could use DealCloud to track every interaction with lenders, equity partners, legal counsel, and brokers in one place. The relationship intelligence features would automatically map connections between these parties, revealing previously unseen strategic opportunities or potential conflicts.

- Industry-Specific Workflows: Designed to manage counterparties, intermediaries, and complex deal stages.

- Relationship Intelligence: Automatically surfaces connections and history across your network.

- Deep Microsoft Office Integration: A robust Outlook plugin minimizes manual data entry.

- No-Code Configuration: Highly customizable to fit a firm’s unique deal lifecycle.

Pricing and Implementation

DealCloud is an enterprise-grade solution with quote-based pricing. It is best suited for established firms with larger teams, as the cost and implementation effort can be substantial. The onboarding process is comprehensive and requires significant change management, so it is not a plug-and-play tool for smaller operators.

- Pros: Purpose-built for complex financial deals; exceptional relationship mapping; highly configurable.

- Cons: High cost and significant implementation effort; may be overly complex for small teams or simple deal structures.

Learn more at Intapp DealCloud.

3. Affinity

Affinity positions itself as a relationship-intelligence CRM, making it a powerful tool for real estate syndicators whose deal flow is primarily driven by their network. Its core strength lies in automating the capture of relationship data from emails, calendars, and other sources, which it then uses to map connections and score relationship strength. This eliminates much of the manual data entry associated with traditional CRMs and provides immediate, actionable insights into who knows whom within your ecosystem.

Unlike all-in-one platforms, Affinity focuses intently on the front end of the deal lifecycle: sourcing and relationship management. The platform’s automated data capture enriches contacts and provides a clear view of your team's collective network, identifying the warmest introduction paths to potential partners or capital sources. This makes it some of the best deal management software for firms looking to supercharge their networking and sourcing efforts with data-driven intelligence.

Key Features & Use Case

A growing multifamily syndication firm could use Affinity to automatically track every touchpoint with brokers, lenders, and potential LPs. When evaluating a new off-market opportunity, the team could instantly see who has the strongest connection to the property owner's representatives, ensuring they leverage the warmest possible introduction. The platform's analytics would then help them prioritize outreach based on historical engagement and relationship scores.

- Automated Data Capture: Syncs with email and calendars to build a relationship graph automatically.

- Relationship Intelligence: Scores relationship strength and reveals warm introduction paths.

- Affinity Sourcing: AI-powered tools to help discover and prioritize new deal opportunities.

- Centralized Analytics: Provides insights into team activity, pipeline health, and network engagement.

Pricing and Implementation

Affinity offers transparent, tiered pricing on a per-user, per-year basis, which is a departure from the quote-based models common in the enterprise space. Implementation is relatively fast due to its automated data syncing. It is best suited for relationship-driven teams focused on deal sourcing and pipeline management. Firms with an existing CRM might find some feature overlap, though Affinity often serves as a specialized intelligence layer.

- Pros: Rapid time-to-value with automated network mapping; transparent pricing tiers; excellent for identifying warm introductions.

- Cons: Primarily focused on relationship-driven markets; add-ons can increase total cost; potential feature overlap with existing CRMs.

Learn more at Affinity.

4. 4Degrees

4Degrees is an intelligent CRM designed by former investors specifically for the private markets, making it a compelling alternative for real estate syndicators seeking a modern, relationship-driven platform. It combines deal pipeline management with powerful network intelligence, automatically enriching contact data and mapping connections to surface warm introduction paths. This focus on leveraging your team’s existing network is its core strength, positioning it as a more intuitive and specialized tool than a generic sales CRM.

The platform automates the tedious work of data entry by syncing with email and calendars to capture interactions and build a comprehensive relationship history for every contact. With its visual Kanban-style pipeline boards and customizable reporting, teams can get a clear, at-a-glance view of their entire deal flow. It is one of the best deal management software options for firms that prioritize network effects and efficient pipeline tracking without the enterprise-level complexity.

Key Features & Use Case

A growing real estate syndication firm could use 4Degrees to manage its pipeline of potential acquisitions and track interactions with brokers and property owners. The platform's relationship graph would automatically identify which team member has the strongest connection to a key decision-maker, suggesting the best path for an introduction. The system could also trigger reminders to follow up on a promising deal that has gone quiet.

- Relationship Intelligence: Automatically maps your network to find the warmest introduction paths.

- Automatic Data Enrichment: Syncs with email and calendars to reduce manual data entry.

- Kanban Pipeline Boards: Provides a clear, visual way to track deals through every stage.

- Private Market Focus: Workflows and analytics are tailored for deal-driven industries.

Pricing and Implementation

4Degrees does not publish its pricing publicly and requires a demo for a custom quote. It is generally positioned as a more accessible and affordable solution compared to enterprise-grade platforms. This makes it a strong fit for small to mid-sized firms that need specialized CRM capabilities but are not ready for the significant investment required by platforms like DealCloud.

- Pros: Purpose-built for private market workflows; strong relationship intelligence features; often cited as intuitive and more affordable.

- Cons: Pricing is not transparent and requires a sales call; has a smaller feature ecosystem than larger enterprise players.

Learn more at 4Degrees.

5. Altvia (AIM) on Salesforce

For real estate syndication firms already invested in or committed to the Salesforce ecosystem, Altvia (AIM) presents a highly integrated solution. It functions as a private capital operating stack built directly on the Salesforce platform, extending its native capabilities with workflows specifically designed for deal management, fundraising, and investor relations. This Salesforce-native approach is its core strength, offering unparalleled customization and access to the vast AppExchange ecosystem, a significant advantage over standalone systems.

Altvia transforms the standard Salesforce CRM into a specialized tool for managing the entire asset lifecycle. It centralizes Limited Partner (LP) data, deal pipeline activity, and all related communications within a single environment. The platform also includes an LP portal and virtual data room (VDR) for secure document sharing and reporting, ensuring investors have a seamless, professional experience from initial contact through distributions.

Key Features & Use Case

A syndicator using Salesforce as their company-wide CRM could adopt Altvia to add a dedicated deal management and investor relations layer without migrating data. They could leverage its workflows to track capital raising progress, manage investor onboarding through the LP portal, and use the AI assistant, AIMe, to automatically capture insights from meeting notes, all within their familiar Salesforce interface.

- Salesforce-Native Architecture: Leverages the security, scalability, and integration capabilities of the core Salesforce platform.

- LP Portal & VDR: Provides a secure, branded portal for investor communications and document management.

- End-to-End Workflows: Covers capital raising, deal management, and ongoing investor relations.

- AI-Assisted Insights: AIMe helps automate data capture and surface key information from interactions.

Pricing and Implementation

Altvia utilizes quote-based pricing and requires separate Salesforce licenses. It is best suited for established firms that need a deeply configurable solution and have access to Salesforce administration resources, either in-house or through a consultant. The implementation effort is variable and depends on the complexity of the firm’s processes, making it a more strategic investment than a simple off-the-shelf tool.

- Pros: Powerful customization within the Salesforce ecosystem; strong combination of deal CRM and investor relations tools.

- Cons: Requires existing Salesforce licenses and administrative expertise; complexity and cost may be prohibitive for smaller firms.

Learn more at Altvia.

6. Dynamo Software

Dynamo Software offers a comprehensive, front-to-back platform tailored for the alternative investment landscape, including real estate syndicators who need more than just a CRM. Its strength lies in its expansive functional coverage, extending from deal sourcing and pipeline management into fundraising, investor relations, and portfolio monitoring. This makes it an excellent choice for firms seeking a unified system to manage the entire investment lifecycle, not just the initial transaction.

The platform stands out by integrating with key third-party data providers like PitchBook and Preqin, allowing teams to enrich their proprietary data directly within the system. Automated workflows and relationship indicators help keep deal pipelines moving, while robust document management with auto-tagging simplifies compliance and due diligence. This makes it one of the best deal management software options for sponsors who value data enrichment and process automation across multiple business functions.

Key Features & Use Case

A real estate firm raising its third fund could leverage Dynamo to manage both new deal opportunities and communications with its existing limited partners. They could track potential acquisitions in the deal pipeline, while simultaneously using the fundraising module to manage capital calls and investor reporting, all from a single, integrated platform. The system would ensure data consistency from initial contact through the entire asset lifecycle.

- Broad Functional Coverage: Manages deals, fundraising, IR, and portfolio monitoring.

- Third-Party Data Integrations: Enriches internal data with providers like Preqin and PitchBook.

- Automated Workflows: Streamlines deal stages and communication tasks.

- Integrated Document Management: Features auto-tagging and advanced search capabilities.

Pricing and Implementation

Dynamo is an enterprise solution with pricing available only through a custom quote. It is designed for established alternative investment managers and real estate firms. The implementation process is comprehensive and can be complex, requiring significant planning and resources, making it less suitable for smaller teams or syndicators just starting out who need a simpler, more focused tool.

- Pros: All-in-one platform covering the full investment lifecycle; strong data integration capabilities; widely used by alternative asset managers.

- Cons: Enterprise-level pricing is not transparent; implementation can be complex and resource-intensive for smaller firms.

Learn more at Dynamo Software.

7. Navatar

Navatar leverages the power and familiarity of the Salesforce ecosystem to deliver a specialized CRM for firms focused on deal sourcing and relationship management. While not exclusively for real estate, its design for private equity and investment banking translates well for syndicators who are already standardized on Salesforce. The platform’s key strength lies in its ability to enhance the native Salesforce environment with features for sector intelligence and automated relationship tracking, making it an excellent choice for teams that want to build on their existing tech stack rather than adopt a new one.

The system excels at reducing manual data entry by automatically capturing emails, meetings, and notes and linking them to the appropriate contacts or deals. This ensures that all relationship history is centralized and accessible, providing a complete picture of every interaction. Its automated workflows and nudges help teams stay on top of key relationships, ensuring no potential investor or partner falls through the cracks.

Key Features & Use Case

A syndication firm heavily reliant on Salesforce could integrate Navatar to supercharge its deal origination efforts. They could use its AI-driven tools to identify new brokers or off-market opportunities and then use the platform's automated workflows to manage the outreach and follow-up process. All meeting notes and communications would be auto-logged, providing the entire team with real-time intelligence without leaving Salesforce.

- Salesforce-Native Solution: Built entirely on the Salesforce platform, offering deep integration.

- Auto-Capture of Interactions: Automatically logs emails, meetings, and notes to relevant records.

- Relationship Workflows: Provides nudges and automation to keep contacts and leads warm.

- AI Deal Origination Integrations: Connects with third-party tools to enhance deal sourcing.

Pricing and Implementation

Navatar operates on a quote-based pricing model and is intended for firms that have already committed to the Salesforce stack. Implementation requires Salesforce administration skills, and many firms opt for professional services to ensure the platform is configured to best-practice standards. This makes it a poor fit for teams without existing Salesforce expertise or the budget for a guided setup.

- Pros: Enhances and leverages an existing Salesforce investment; strong automation for relationship management.

- Cons: Requires the Salesforce platform and admin skills; pricing is not public; may require costly professional services for optimal configuration.

Learn more at Navatar.

8. SourceScrub

SourceScrub is not a traditional deal management platform but rather a powerful, AI-assisted intelligence tool focused exclusively on deal origination. For real estate syndicators, especially those targeting off-market or lower-middle-market commercial assets, it offers a distinct advantage by providing deep insights into private companies, potential sellers, and key decision-makers. It excels at feeding the top of the deal funnel with high-quality, data-driven opportunities.

The platform's strength lies in its ability to aggregate and score potential targets from over 290,000 sources, including conference attendee lists and trade publications. Its browser extension and bi-directional CRM integrations ensure that the valuable data uncovered during research flows seamlessly into your primary deal management software. This integration makes it a potent addition to, rather than a replacement for, a full-lifecycle CRM.

Key Features & Use Case

A syndicator looking to acquire a portfolio of privately-owned industrial properties could use SourceScrub to identify companies in a specific region with facility needs that suggest a potential sale-leaseback opportunity. They could use custom scoring to rank these targets based on company size, industry, and recent news signals, prioritizing outreach efforts and feeding the most promising leads directly into their CRM.

- Private Company Intelligence: Deep data on private companies to discover and qualify deal targets.

- Custom Scoring & Alerts: Ranks potential deals and provides signals on target company activity.

- Robust CRM Integrations: Feeds origination data directly into platforms like Salesforce or DealCloud.

- Conference Data Integration: Maximizes ROI from industry events by identifying key attendees.

Pricing and Implementation

SourceScrub operates on an enterprise pricing model, with costs available upon request. It is not an end-to-end deal management solution and must be paired with a CRM to manage deals past the origination stage. It is best suited for firms with dedicated acquisition teams that require a systematic and data-rich approach to sourcing new opportunities.

- Pros: Purpose-built for deal origination; excellent coverage of the U.S. lower-middle market; speeds up research significantly.

- Cons: Requires a separate CRM for full deal lifecycle management; enterprise-level pricing is not publicly listed.

Learn more at SourceScrub.

9. PitchBook

PitchBook is not a traditional deal management platform but rather a critical data and research tool that complements one. For real estate syndicators focused on sourcing off-market opportunities or conducting deep due diligence, PitchBook provides unparalleled private market intelligence. It excels at identifying potential limited partners (LPs), understanding competitor landscapes, and tracking capital flows, making it an essential component of a sophisticated origination strategy. Its power lies in its comprehensive datasets on companies, investors, and deals.

The platform’s strength is in its robust search and screening capabilities, allowing firms to build highly targeted lists of potential partners based on past investment activity, AUM, and location. Integrated plugins for Excel, Chrome, and other tools enable teams to pull data directly into their existing workflows, reducing manual research time. While it doesn't manage your deal pipeline, it provides the critical market intelligence needed to fill it with high-quality opportunities.

Key Features & Use Case

A syndicator looking to expand into a new geographic market could use PitchBook to identify all active LPs and family offices that have previously invested in similar real estate assets in that region. They could then use this data to inform their capital-raising strategy and populate their primary deal management software with a list of warm, well-researched leads.

- Broad Private Market Datasets: Extensive information on PE, VC, M&A, LPs, and key personnel.

- Powerful Screening Tools: Advanced search functionality to create highly targeted lists.

- Workflow Integrations: Plugins for Excel, PowerPoint, and Chrome streamline data gathering.

- Research & Analyst Support: Access to market research reports and dedicated analyst support.

Pricing and Implementation

PitchBook is a premium, enterprise-level data service with quote-based pricing that reflects its comprehensive coverage. It is best suited for firms that prioritize data-driven deal sourcing and have the budget for a specialized market intelligence tool. It's not a CRM replacement but a powerful data source that feeds into the best deal management software.

- Pros: Market-leading data for deal origination and validation; strong U.S. coverage; excellent workflow tools.

- Cons: Not a standalone deal management system; premium pricing may be prohibitive for smaller firms.

Learn more at PitchBook.

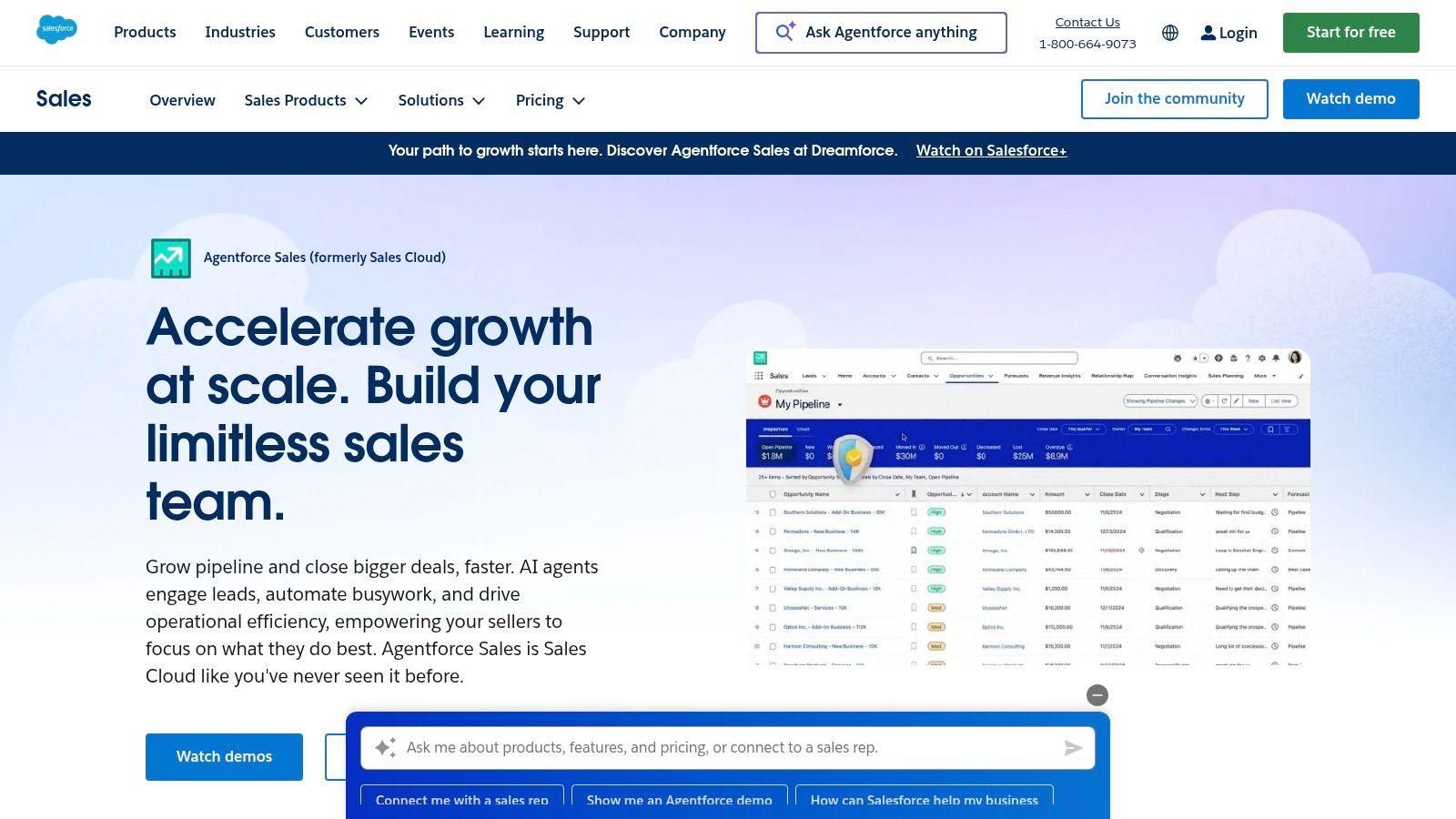

10. Salesforce Sales Cloud

Salesforce Sales Cloud is the world’s most recognized general-purpose CRM, offering a powerful and highly extensible platform for managing sales pipelines. While not purpose-built for real estate syndication, its immense flexibility and vast ecosystem of third-party apps on the AppExchange make it a viable option for firms that need a customizable deal management software solution. Its strength lies in its ability to scale from a small business to a global enterprise, supported by robust forecasting, automation, and analytics.

The platform’s core functionality revolves around pipeline management and advanced deal insights. For real estate syndicators, this translates to tracking potential acquisitions, managing broker relationships, and nurturing prospective investors through a defined sales cycle. The AppExchange marketplace allows firms to add specialized tools for document generation, e-signatures, and investor relations, effectively building a custom solution on a proven foundation.

Key Features & Use Case

A growing syndication firm could leverage Salesforce to manage its deal flow from initial sourcing to closing. They could track properties, conversations with brokers, and the status of offers in a centralized pipeline. Using the AppExchange, they could integrate a document management tool to handle purchase agreements and a marketing automation platform to communicate with their investor list, all within the same ecosystem.

- Customizable Pipeline Management: Adaptable stages to track deals from sourcing to closing.

- AppExchange Marketplace: Access thousands of third-party apps for CLM, e-signatures, and more.

- Advanced Analytics and AI: Robust reporting, forecasting, and conversation intelligence features.

- Enterprise-Grade Security: Comprehensive security controls, user roles, and permissions.

Pricing and Implementation

Salesforce offers tiered pricing, but the total cost of ownership can rise significantly as you add necessary modules (like Revenue Intelligence), customizations, and third-party apps. Implementation often requires a certified partner or an in-house administrator, making it a considerable investment in both time and money. It is best for firms that anticipate significant growth and require a highly tailored system.

- Pros: Highly scalable and customizable; massive ecosystem of integrations; large talent pool of administrators and developers.

- Cons: Can be complex and expensive to implement and maintain; not designed for real estate out of the box; total cost can be high with add-ons.

Learn more at Salesforce Sales Cloud.

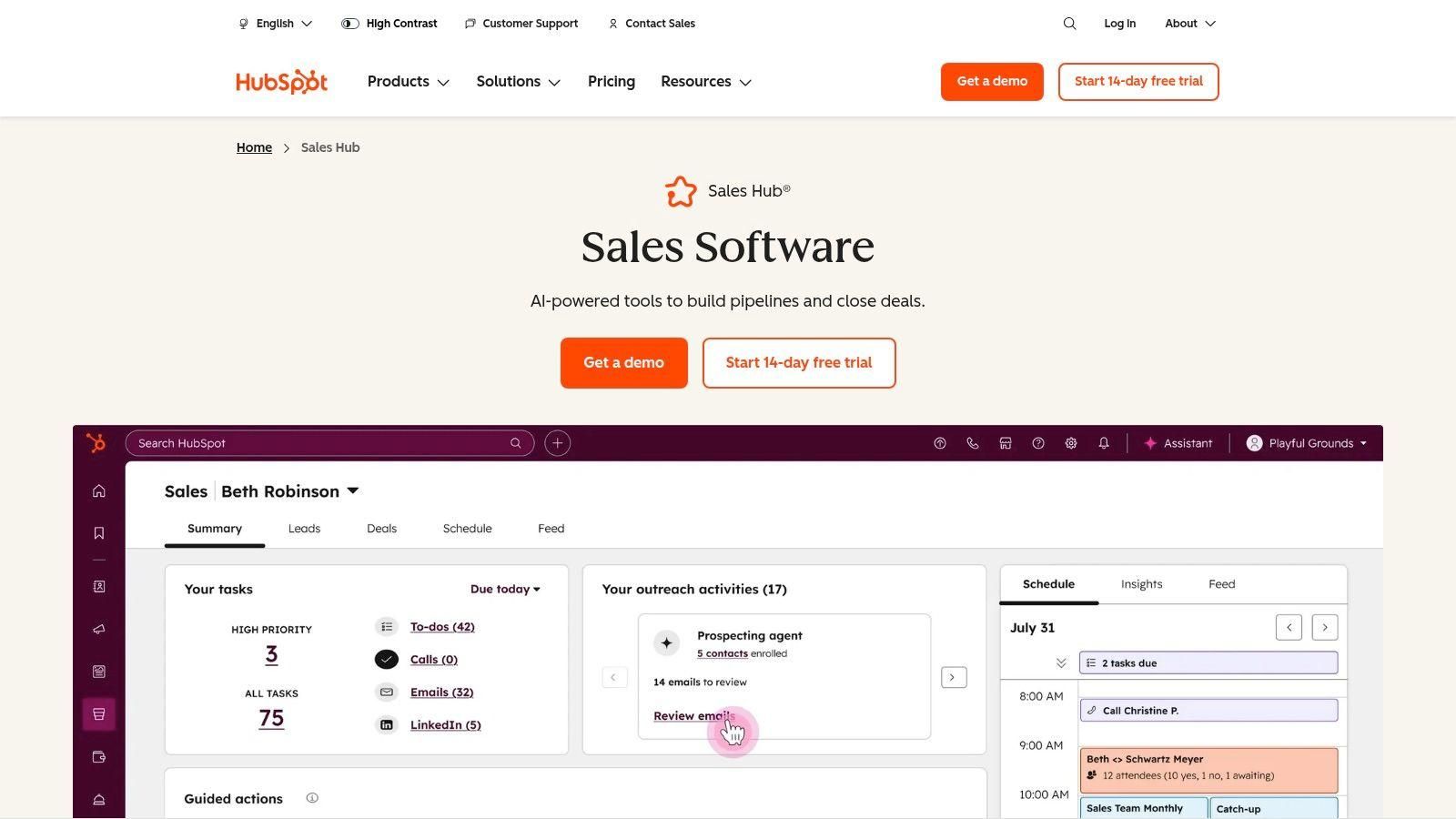

11. HubSpot Sales Hub

While not a dedicated real estate platform, HubSpot Sales Hub is an exceptionally accessible and powerful CRM that many emerging syndicators use as their initial deal management software. Its strength lies in its user-friendly interface, visual deal pipelines, and robust automation capabilities, all designed for small to mid-sized teams. For syndicators focused on building a strong investor acquisition and marketing funnel, HubSpot's seamless integration with its marketing tools is a significant advantage.

The platform makes it easy to set up custom deal stages, automate follow-up tasks, and track every investor interaction from the first touchpoint to a closed commitment. Its transparent pricing and extensive free educational resources via HubSpot Academy lower the barrier to entry, making it a practical choice for firms not yet ready for a niche, high-cost solution.

Key Features & Use Case

A syndicator scaling their investor relations could use HubSpot to create a pipeline tracking potential investors, moving them through stages like "Initial Contact," "Webinar Attended," and "PPM Sent." Automated workflows could send follow-up emails after a webinar or schedule a call, ensuring no lead falls through the cracks and freeing up the principal's time to focus on closing the deal.

- Visual Pipelines: Easy-to-use, drag-and-drop interface for tracking deal progress.

- Automation & Forecasting: Automate routine tasks and get insights into pipeline health.

- Integrated CRM: Natively connects sales activities with marketing and service data for a full investor view.

- Extensive Training: HubSpot Academy provides free, high-quality training for quick onboarding.

Pricing and Implementation

HubSpot offers transparent, seat-based pricing with free and low-cost starter tiers, making it highly accessible. Implementation is fast, with most teams able to get up and running within days, not months. While it excels at sales and marketing alignment, it is less specialized for the complex financial modeling or compliance workflows found in purpose-built platforms.

- Pros: Very fast adoption and intuitive interface; excellent marketing-sales integration; transparent pricing with free/low-cost options.

- Cons: Less specialized for complex private equity or real estate deal structures; advanced features are gated behind higher-priced tiers.

Learn more at HubSpot Sales Hub.

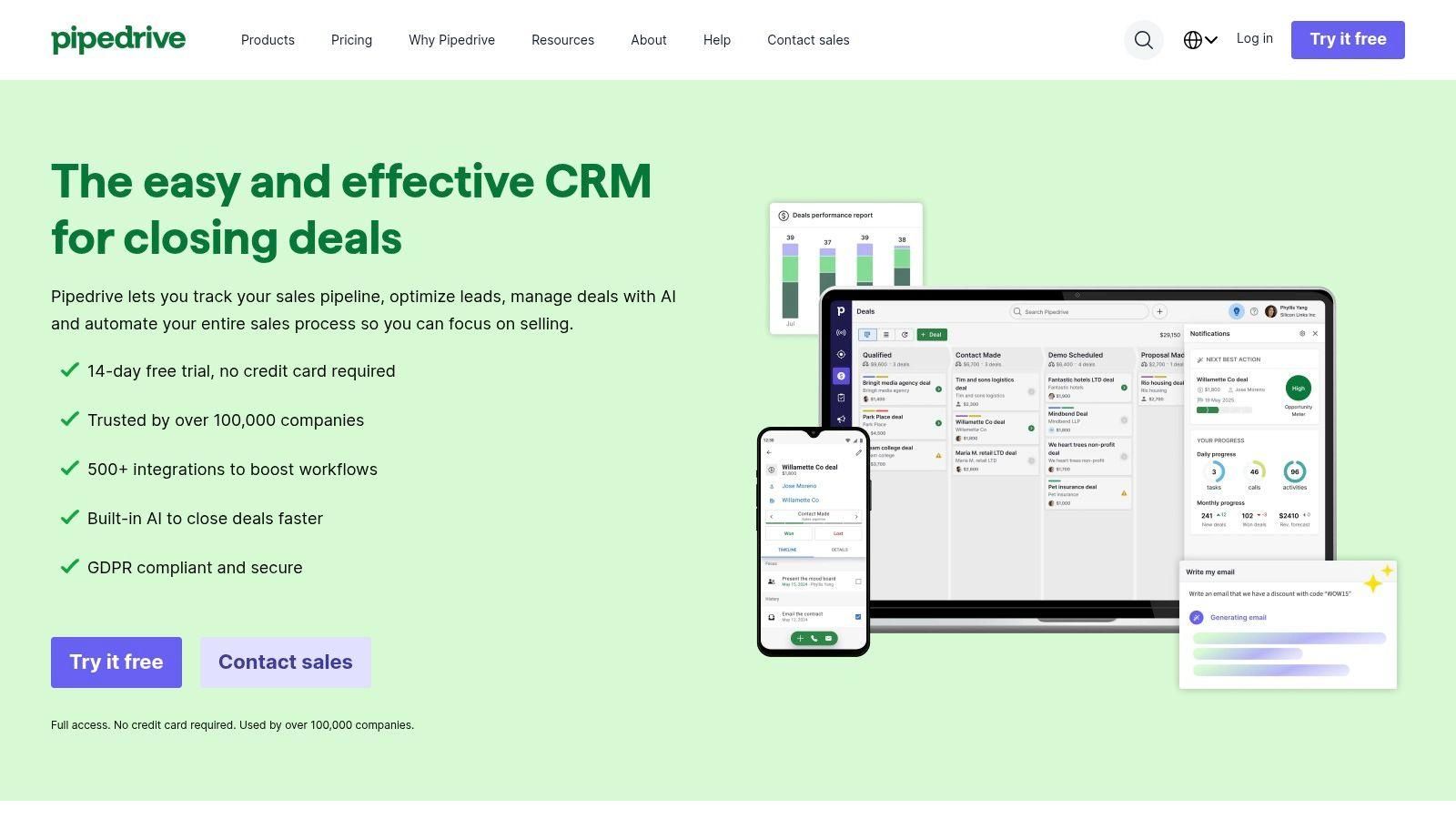

12. Pipedrive

Pipedrive is a sales-first CRM renowned for its simplicity and visual approach to pipeline management. While not purpose-built for real estate syndication like some platforms, its intuitive drag-and-drop interface and focus on deal progression make it an excellent choice for smaller syndication firms or those primarily focused on lead and investor acquisition. Its strength lies in its straightforward, activity-based methodology that pushes teams to focus on the next actions required to move a deal forward.

The platform's core is its visual pipeline, where deals are represented as cards that you can move across stages. This makes tracking potential investors from initial contact to a closed commitment incredibly easy. With strong mobile apps and a vast marketplace of over 500 integrations, Pipedrive can be connected to other essential tools, making it a flexible hub for managing investor relations and deal flow without the complexity of enterprise-grade software.

Key Features & Use Case

A growing multifamily syndicator could use Pipedrive to manage their investor acquisition pipeline. They can create custom stages like "Initial Contact," "Webinar Attended," "Soft Commit," and "Subscription Docs Sent." Automated reminders can be set for follow-ups, and the platform’s reporting features provide clear forecasts on potential capital raised, helping them prioritize their outreach efforts effectively.

- Drag-and-Drop Pipelines: Visual, Kanban-style boards to easily track deal stages.

- Analytics and Forecasting: Built-in reporting to monitor deal progress and predict outcomes.

- Extensive Integrations: Connects to hundreds of other apps for marketing, communication, and more.

- Mobile Apps: Fully-featured iOS and Android apps for managing deals on the go.

Pricing and Implementation

Pipedrive offers transparent, affordable pricing tiers, making it highly accessible for small to mid-sized teams. Setup is quick, and the user interface is one of the most intuitive on the market, requiring minimal training. However, it's a sales CRM at its core, so it lacks specialized features for investor portals or distribution management. Advanced document handling and lead generation tools are often sold as separate add-ons.

- Pros: Very intuitive UI and fast setup; affordable and transparent pricing tiers.

- Cons: Not designed for multi-party private equity workflows; some key features are paid add-ons.

Learn more at Pipedrive.

Top 12 Deal Management Software Comparison

Choosing Your Command Center: How to Pick the Right Deal Management Software

Navigating the landscape of deal management platforms can feel overwhelming, but making the right choice is one of the most impactful decisions you can make for your syndication business. We've explored a range of options, from enterprise-grade systems like Intapp DealCloud and Altvia to more accessible, sales-focused CRMs like Pipedrive and HubSpot. Each tool offers a unique approach to managing the complex web of relationships and workflows inherent in real estate investment.

The core takeaway is this: the best deal management software isn't the one with the most features, but the one that most accurately mirrors and streamlines your specific operational reality. A platform built for general sales or private equity might require extensive, costly customization to fit a syndicator's workflow of deal rooms, K-1 distribution, and investor accreditation. Conversely, a purpose-built solution addresses these unique challenges out of the box.

A Framework for Your Final Decision

Before you sign a contract, step back and critically assess your needs. Use this simple framework to guide your final evaluation and ensure you select a true partner for growth, not just another software subscription.

1. Map Your Current Process:

Get granular. Whiteboard every step of your deal lifecycle, from initial lead capture and due diligence to investor onboarding, funding, and ongoing communications. Identify the exact points where friction occurs. Is it tracking conversations, managing subscription documents, or calculating distributions? Your biggest pain points should be the primary problems your new software solves.

2. Prioritize Core Syndication Functions:

While a robust CRM is essential, syndicators have non-negotiable requirements that go beyond standard sales pipelines. Your evaluation checklist must prioritize:

* Secure Deal Rooms: Can you easily and securely share offering memorandums, financials, and due diligence documents?

* Investor Portals: Does the platform provide a professional, branded portal for investors to access documents and track their portfolio performance?

* Integrated E-Signatures: How seamless is the process for executing subscription agreements and other legal documents?

* Accreditation & KYC: Does the tool automate or simplify the verification process to ensure compliance?

* Distribution Management: Can the software handle complex waterfall calculations and streamline the payment process?

3. Analyze the Total Cost of Ownership:

Look beyond the monthly subscription fee. Many platforms, especially those built on Salesforce or charging AUM-based fees, come with hidden costs. Consider implementation fees, mandatory training, data migration charges, and the cost of third-party integrations. A transparent, flat-rate model can provide significant long-term savings and predictable expenses as your portfolio scales.

Implementation and Beyond: Setting Yourself Up for Success

Selecting your software is only half the battle; successful implementation is what generates ROI. Ask potential vendors about their onboarding process. Do they offer full-service data migration, or will your team be responsible for a painstaking manual import? A provider that offers white-glove onboarding can be the difference between a tool that’s adopted and a tool that’s abandoned.

Furthermore, consider the broader ecosystem of tools you use. For real estate syndicators, selecting software that specifically caters to property-related deals is crucial. Explore a list of the top real estate CRMs to understand how different platforms are tailored for the nuances of property investment and management, which can complement your deal management system.

Ultimately, your deal management software is your operational command center. It’s the engine that powers investor trust, operational efficiency, and scalable growth. Choose a partner that understands the unique DNA of real estate syndication and is committed to helping you build a more professional, streamlined, and profitable business.

Ready to see how a purpose-built platform can transform your syndication business? Homebase was designed by syndicators, for syndicators, to solve the exact challenges discussed in this guide. Schedule a demo today to discover how our all-in-one deal management software can streamline your operations from fundraising to distributions.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.