How to Calculate Cap Rate for Rental Property: Simple Guide

How to Calculate Cap Rate for Rental Property: Simple Guide

Learn how to calculate cap rate for rental property easily. Our step-by-step guide helps you evaluate your investment’s profitability effectively.

Domingo Valadez

Aug 11, 2025

Blog

To figure out the cap rate for a rental property, you simply divide its Net Operating Income (NOI) by its current property value. The formula itself is straightforward: Cap Rate = NOI / Property Value. But don't let its simplicity fool you. This is a powerful metric that gives you a quick, reliable way to size up a property's profitability and compare different investment opportunities on a level playing field.

What Cap Rate Really Tells You About A Rental Property

Before you start crunching numbers, it’s crucial to get what the capitalization rate—or cap rate—truly represents. I like to think of it as a financial snapshot that measures a property's unlevered rate of return. In plain English, that’s its earning potential before you account for any mortgage payments or financing. This is exactly why it's a go-to tool for serious real estate investors and sponsors.

By focusing purely on the property's income versus its value, the cap rate cuts through the noise. It lets you make a true apples-to-apples comparison between two wildly different properties. For example, you could use it to objectively weigh a duplex in a quiet suburb against a small apartment building in a bustling downtown core, completely separate from how you might finance either deal.

The Core Components of the Formula

The formula is simple, but its strength lies in the accuracy of its inputs. The cap rate is just the ratio of a property's annual net operating income (NOI) to its current market value, shown as a percentage. For instance, if a building brings in $50,000 in NOI each year and is valued at $1 million, the cap rate is 5%. The multi-family market lives and breathes by this metric, and you can get a deeper sense of this by reviewing expert insights on real estate valuation.

Let's quickly break down what goes into the formula.

For a clearer view, here’s a quick-reference table that explains each part of the formula and why it matters.

Cap Rate Formula Components Explained

This simple calculation is the bedrock of professional real estate analysis.

Key Takeaway: A cap rate gives you an instant feel for a deal's profitability and risk. A higher cap rate often suggests a higher potential return but might come with more risk. A lower cap rate usually points to a safer, more stable asset with more modest returns.

Getting these fundamentals down is the first step. It's not just about plugging numbers into a calculator; it's about understanding what those numbers are telling you about your investment strategy and financial goals.

Projecting Your Total Potential Rental Income

Any cap rate calculation is only as good as the numbers you plug into it. Before you even think about your net income, you need to build an honest and realistic picture of your Gross Rental Income. Trust me, this is way more than just multiplying the monthly rent by twelve.

Seasoned investors know the devil is in the details. You have to account for every single way the property brings in money. Does it have paid parking spots? Coin-operated laundry machines in the basement? Do you charge pet fees or rent out small storage units? Each of these streams adds to your bottom line and is a crucial part of your total income picture.

Factoring in Realistic Occupancy

This is where a lot of new investors get into trouble: optimism. It's tempting to assume your property will be 100% occupied all year, but that’s a fantasy. It simply never happens in the real world.

To get a number you can actually rely on, you must factor in a vacancy loss. This is just a percentage of your potential income that you set aside to cover the inevitable gaps between tenants. Building in this buffer is one of the smartest things you can do for an accurate forecast.

A good rule of thumb for vacancy is between 5% and 8% of your total potential rent. Applying this buffer from the start keeps your entire financial projection from falling apart after just one or two unexpectedly empty months.

And for any units that are currently empty, you have to use the going market rate—not what you hope you can get for it. Do your homework. Look at what similar units are renting for right now in your specific neighborhood. This grounds your entire analysis in reality, not wishful thinking.

Calculating Effective Gross Income: A Duplex Example

Let's walk through how this works with a classic duplex scenario. Imagine one unit is already rented, and the other is currently vacant.

- Unit A (Rented): $1,600 per month

- Unit B (Vacant Market Rate): $1,600 per month

- Parking Fees: $100 per month (2 spots at $50 each)

Add it all up, and you get a Potential Gross Income (PGI) of $3,300 per month. Annually, that’s $39,600.

Now, let's apply a conservative 7% vacancy loss. We calculate that by multiplying the annual PGI by our vacancy rate: $39,600 x 0.07 = $2,772.

To find your Effective Gross Income (EGI), you simply subtract that vacancy loss from your potential income:

$39,600 (PGI) - $2,772 (Vacancy) = $36,828 (EGI)

This EGI of $36,828 is your real starting point. It’s the number that paints an accurate picture of what you can expect to collect, and it’s the first major piece of the puzzle when you calculate the cap rate for a rental property.

Nailing Down Your True Operating Expenses

This is where the rubber really meets the road in real estate analysis. It’s also where I see most new investors stumble. Your cap rate calculation is only as good as your Net Operating Income (NOI), and getting that number right means being brutally honest about your operating expenses.

Think of it this way: your Effective Gross Income (EGI) is the cash that actually lands in your bank account from rents. Operating expenses are all the bills you have to pay just to keep the property running professionally. The biggest mistake you can make is underestimating these costs. It leads to an inflated NOI and a cap rate that looks fantastic on paper but is pure fantasy in the real world.

The Essential Expense Checklist

Forget just jotting down property taxes and insurance. A seasoned investor digs much, much deeper. Your expense list needs to be comprehensive if you want a bulletproof NOI you can actually rely on.

A prime example is homeowners insurance, which is a non-negotiable cost that protects your entire investment from a world of potential risks. This has to be factored into your annual numbers from day one.

Here are the expenses you absolutely must account for:

- Property Taxes: The annual bill from your city or county. No getting around this one.

- Insurance: This covers more than just the building; think landlord and liability policies.

- Utilities: Even if your tenants pay for their own heat and electricity, you’ll likely cover costs for common areas like hallways, outdoor lighting, or a shared laundry room.

- Property Management Fees: The industry standard is 8-10% of the monthly rent. Even if you plan to manage it yourself, you must factor this in. Why? Because your time isn't free, and if you ever decide to hire a pro, the cost needs to be baked into your financial model from the start.

- Maintenance & Repairs: This is for the day-to-day stuff—fixing a leaky faucet, patching drywall after a tenant moves out, or servicing the HVAC system.

- Landscaping & Snow Removal: Keeping the property looking sharp and safe is a recurring operational cost.

- Pest Control: Proactive, regular treatments are far cheaper than dealing with a full-blown infestation later.

- HOA Dues: If your property is in a homeowners association, these monthly or annual fees are a fixed expense.

If you want an even more detailed look, our guide on how to calculate operating expenses for commercial real estate offers a comprehensive breakdown.

Pro Tip: Don't Forget Reserves!

One of the most common rookie mistakes is forgetting to budget for big-ticket items. Smart investors set aside a reserve fund—typically 5-10% of gross rent—for future capital expenditures. We're talking about a new roof, a full HVAC replacement, or a new water heater. While you aren't spending it today, funding this reserve is a critical part of your annual financial planning.

What You Must Exclude From Operating Expenses

Knowing what not to include is just as important. Tossing the wrong numbers into your NOI calculation will completely distort the property's true financial performance and make your cap rate useless for comparing deals.

Be sure to leave these items out:

- Mortgage Payments (Principal & Interest): This is the cardinal rule. Cap rate measures a property's performance independent of financing. Your loan terms are unique to you, not an inherent quality of the property itself.

- Capital Expenditures (CapEx): The actual cost of a major project, like that new roof or a full kitchen gut, is not a day-to-day operating expense. The reserve funds you set aside for them are part of your planning, but the large, one-time purchase itself is not.

- Income Taxes: These are specific to your personal tax situation, not a direct cost of running the building.

- Depreciation: This is an accountant's tool—a "non-cash" expense used for tax purposes. It doesn't represent real money leaving your pocket.

By meticulously tracking what you actually spend and carefully excluding these other items, you’ll arrive at a clean, accurate Net Operating Income. That’s the rock-solid number you need to calculate a cap rate you can trust.

Calculating Cap Rate with Real World Scenarios

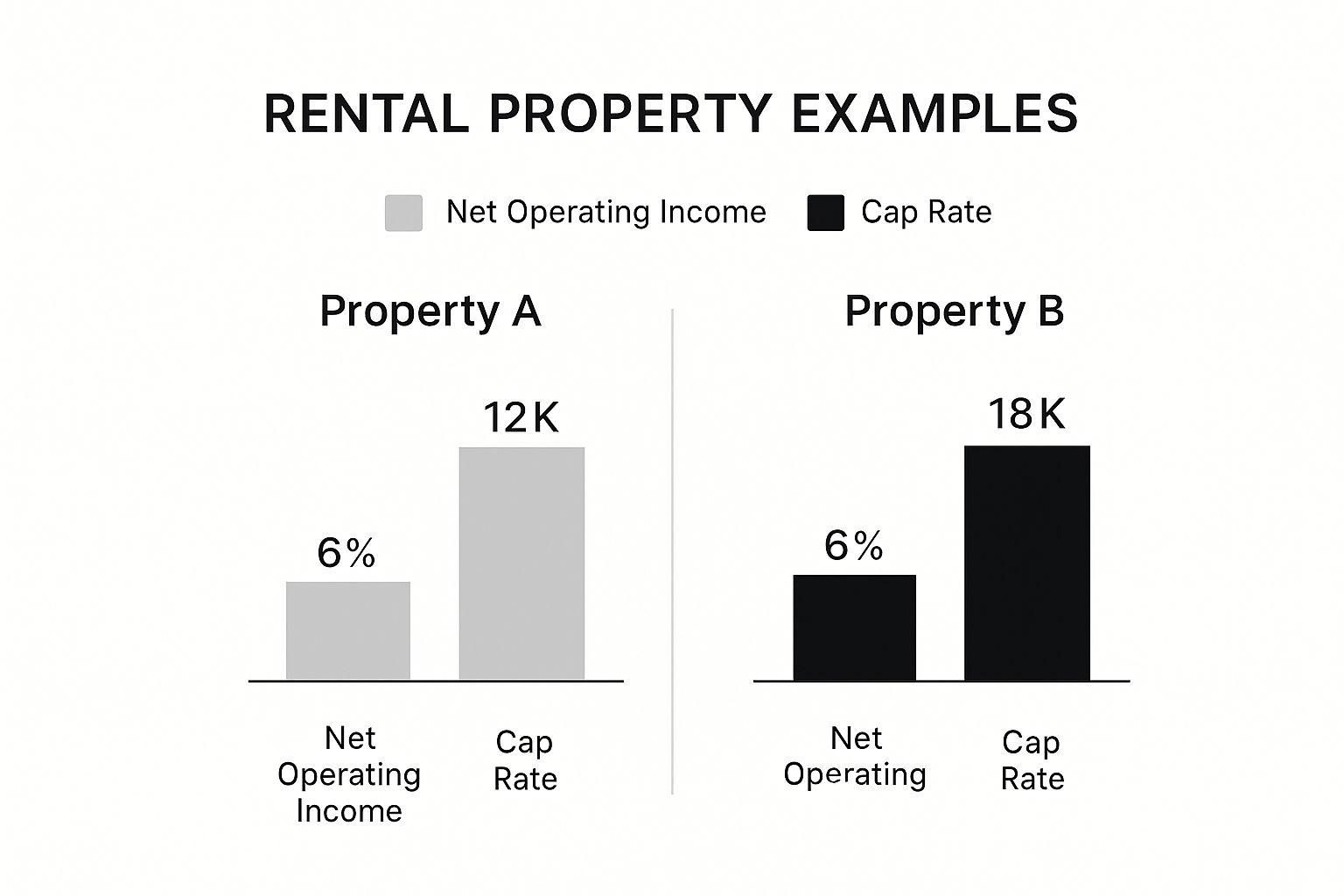

Alright, you've done the hard work of calculating your Net Operating Income (NOI). Now for the fun part: putting it all together. This is where the rubber meets the road, and we can see how the cap rate formula plays out with actual properties.

To really get a feel for this, let's look at two completely different investment scenarios. We'll start with a classic single-family home and then pivot to a small multi-family building—a four-plex—to see how the dynamics and numbers shift.

Example 1: The Suburban Single-Family Home

Let's say you're eyeing a nice single-family home in a desirable suburban neighborhood. It's in a great school district, the kind of place that always has rental demand.

- Purchase Price:$400,000

- Annual Gross Rent:$30,000 ($2,500/month)

- Total Annual Operating Expenses:$12,000 (This bundles up property taxes, insurance, a 5% vacancy buffer, and some funds for maintenance.)

First, we need the Net Operating Income (NOI).

$30,000 (Gross Rent) - $12,000 (Operating Expenses) = $18,000 (NOI)

With that number in hand, we can plug it into the cap rate formula:

Cap Rate = NOI / Property Value

$18,000 / $400,000 = 0.045

Multiply that by 100 to get a percentage, and you've got a cap rate of 4.5%.

A lower cap rate like this often points to a lower-risk, more stable investment. Homes in these high-demand suburbs usually have excellent appreciation potential, even if the immediate cash flow isn't spectacular relative to the purchase price. The real prize here is stability and long-term growth.

Example 2: The Urban Four-Plex

Next up, let's shift our focus to a four-unit building in an up-and-coming urban neighborhood. It's an older property, so you know it's going to demand a bit more of your time and attention.

- Purchase Price:$600,000

- Annual Gross Rent:$72,000 (Each of the four units brings in $1,500/month)

- Total Annual Operating Expenses:$28,800 (This number is beefier because you're dealing with more units, property management, common area utilities, and a bigger maintenance fund.)

Let's find the NOI for this building.

$72,000 (Gross Rent) - $28,800 (Operating Expenses) = $43,200 (NOI)

Now, let's run the cap rate calculation for this rental property:

Cap Rate = NOI / Property Value

$43,200 / $600,000 = 0.072

As a percentage, that gives us a cap rate of 7.2%.

To help you visualize how these numbers stack up, I've put together a side-by-side comparison of the two properties. It really clarifies how the math works out in each case.

Cap Rate Calculation Walkthrough: Single-Family vs Four-Plex

This table makes it crystal clear. The four-plex costs more upfront, but its income-generating power and resulting cap rate are significantly higher.

The 7.2% cap rate on the four-plex blows the single-family home's rate out of the water. From my experience, this usually means you're looking at a much stronger potential for cash flow, but it also comes with more perceived risk. An urban location might be more volatile, and managing four tenancies is a whole different ballgame than managing one. An investor here is essentially being paid a premium—in the form of a higher annual return—for taking on that extra risk and management headache.

So, What's a "Good" Cap Rate in Today's Market?

You’ve run the numbers and now you have a cap rate. Great. But what does that percentage actually tell you? On its own, it’s just a number on a spreadsheet. The real art is learning how to read between the lines and understand what that figure says about the property, the market, and your potential investment.

Let me be clear: there’s no universal "good" cap rate. A number that screams "home run" in one city could be a massive red flag in another. Thinking like a seasoned investor means appreciating this nuance. The key is to view the cap rate as a quick snapshot of risk versus reward. A higher cap rate isn't automatically better, and a lower one isn't a deal-breaker.

The Balancing Act: Risk and Return

At its core, the cap rate reflects an inverse relationship between risk and return. It’s a concept that clicks once you see it in action.

Think about a brand-new apartment building in a hot downtown neighborhood. It might trade at a low cap rate, say 4.5%. This tells you the market sees it as a rock-solid, safe bet. Demand is high, vacancies are low, and the building is likely to appreciate. Investors are willing to pay top dollar for that kind of stability, which pushes the property's price up and, as a result, the cap rate down.

Now, picture an older property in a neighborhood that's still finding its footing. It might have a cap rate of 8.5%. That higher number suggests investors perceive more risk. Maybe the tenant pool is less predictable, the property needs some work, or it requires more intensive management. To compensate for that extra uncertainty and hassle, investors demand a higher potential annual return.

My Take: The market essentially pays you to take on risk. A low cap rate means the collective wisdom of investors sees very little risk, so your immediate return is modest. A high cap rate means the market sees bumps in the road ahead and is offering a higher reward to whoever is willing to navigate them.

Comparing Apples to Apples

To figure out if a property's cap rate is truly compelling, you have to stack it up against similar properties in the same area. This is where your market knowledge becomes your biggest asset. You can't compare a single-family rental in the suburbs to an industrial warehouse by the port; their risk profiles and cap rates live in different universes.

Just look at how much these rates can swing across different asset types. Multifamily properties often trade in the 5.0% to 6.5% range, while you might see industrial buildings going for 5.5% to 7.5%. The spread on office buildings is even wider, from 6.5% to over 10%, which tells you a lot about the varying levels of risk in that sector. Interestingly, cap rates for single-family rentals recently hit 6.8%, the highest they've been since early 2018. If you want to dive deeper into these trends, PropertyMetrics has some great market data.

Ultimately, interpreting a cap rate isn't just about the math. It’s about zooming out and adding crucial context. You have to ask yourself:

- What kind of property is it? Multifamily, retail, and office all behave differently.

- What's the asset class? Is it a shiny, new Class A building or an older Class C property that needs some love?

- What's happening in the local market? Is the economy booming or are people moving away?

- What’s my own appetite for risk? Am I chasing stable, long-term appreciation or am I after higher cash flow right now?

When you start layering this kind of thinking over your calculations, the cap rate transforms from a simple percentage into a genuinely powerful tool for making smarter investment decisions.

Common Questions About Calculating Cap Rate

Getting the hang of the cap rate formula is one thing, but truly understanding the why behind the numbers is what separates a novice from a seasoned investor. It's completely normal for questions to pop up even after you've run the calculation a few times.

Let's walk through some of the most common points of confusion. Getting these concepts straight will give you the confidence to analyze deals like a pro.

Why Isn’t My Mortgage Payment an Operating Expense?

This is easily the biggest trip-up for new investors, and it's a critical distinction. Think of it this way: the cap rate is designed to measure the raw, unfiltered earning power of the property itself, completely independent of how you or anyone else chooses to finance it.

Your mortgage payment is a cost of your loan, not a cost of running the building. It reflects your personal financing decisions, your credit, and the terms you negotiated. By excluding it, the cap rate gives us a clean, apples-to-apples way to compare properties. A building bought with all cash can be judged on the same playing field as one bought with 80% financing because we're only looking at its operational performance.

The key takeaway: Cap rate is property-centric, not investor-centric. It answers the question, "How good is this asset at generating income on its own?" It doesn't care about your specific loan.

What's the Difference Between Cap Rate and Cash-on-Cash Return?

While both are measures of return, they tell you two very different—but equally important—stories about a deal.

We just established that the cap rate is a property-level metric. It shows the potential return if you were to buy the property with all cash.

Cash-on-cash return, however, is all about you and your specific deal. It measures the return you're getting on the actual cash you pulled out of your pocket.

Here’s the formula:

Annual Pre-Tax Cash Flow / Total Cash Invested

This metric is highly personal because it directly accounts for your down payment and loan terms. An investor who puts down 25% on a property will have a vastly different cash-on-cash return than someone who buys the same exact property with all cash—even though the cap rate is identical for both.

Which Property Value Should I Use in the Formula?

This is a great question, and the answer depends entirely on what you're trying to figure out. The quality of your analysis lives and dies by the inputs you use.

- When you're buying a property, you should use the asking price or the price you realistically expect to pay. This calculates the cap rate based on your potential acquisition cost, helping you decide if it's a good deal.

- When you already own a property, you need to use its current fair market value. Using the price you paid a decade ago won't tell you how the asset is performing for you today.

To pin down the current market value, you can look at recent comparable sales (comps) in the neighborhood, ask a real estate agent for a Broker's Price Opinion (BPO), or hire a professional appraiser for the most accurate number. For more great insights and tools, you can find a wealth of helpful Landlord Resources to guide you.

Beyond just calculating returns, managing investor relations, fundraising, and reporting can feel like a full-time job. Homebase brings it all together on one platform, so you can stop wrestling with spreadsheets and focus on what you do best: finding great deals. See how our all-in-one syndication tool can help you scale your business at Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking the Triple Net Lease Meaning for Syndicators

Blog

What is the true triple net lease meaning for investors? Our guide demystifies NNN leases, breaking down the benefits, risks, and underwriting for syndicators.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.