What Is ROI in Real Estate A Guide to Smart Investing

What Is ROI in Real Estate A Guide to Smart Investing

Struggling with what is ROI in real estate? This guide demystifies key metrics like cap rate and cash-on-cash return with clear, practical examples.

Domingo Valadez

Dec 24, 2025

Blog

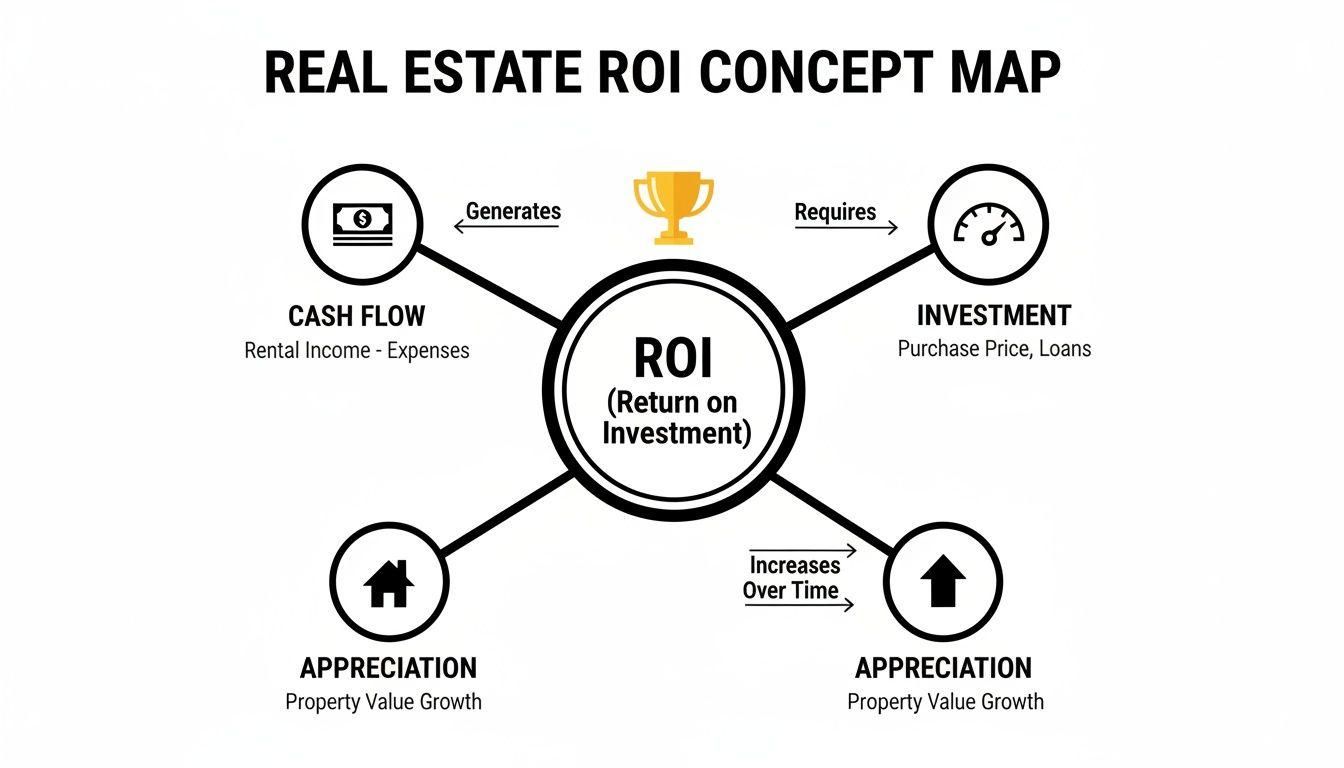

When you talk about Return on Investment (ROI) in real estate, you're really asking one simple question: "How hard is my money working for me?" It's the ultimate scorecard for any deal, boiling down your performance into a single, powerful percentage that shows how much profit you're making from your initial cash investment.

This profit can come from a few different places, like steady rental income, the property's value going up over time, or a combination of both.

What ROI in Real Estate Really Tells You

So, what is ROI? It's more than just a formula. Think of it as the financial dashboard for your property. It gives you a clear, data-driven picture of how your investment is performing, allowing you to stop guessing and start making smart, strategic moves.

But just like a car's dashboard isn't just a speedometer, real estate ROI isn't a single metric. It’s a story told through several key numbers. We can break it down like this:

- Cash Flow: This is your immediate, tangible return—the rental income hitting your bank account after all expenses are paid.

- Appreciation: This is the long-term gain you realize when the property’s market value increases over time.

- Loan Paydown (Amortization): As you or your tenants pay down the mortgage, your equity in the property grows. This is a subtle but powerful way your investment builds wealth.

- Tax Benefits: Things like depreciation can reduce your taxable income, putting more money back in your pocket. This is often an overlooked part of the total return.

Grasping these different components is the first step toward analyzing deals like a seasoned pro. It's how you compare an apartment building that generates steady cash flow with a fixer-upper that has huge appreciation potential.

The Four Pillars of Real Estate Returns

To really understand the full picture, it helps to see how these different elements work together to create your total return on investment.

Seeing ROI through this lens helps you understand that a great investment isn't just about one of these pillars—it's about how they combine to build wealth.

ROI transforms your investment analysis from an art into a science. It’s the difference between hoping for a good outcome and engineering one with calculated precision.

By truly understanding the different facets of ROI, you can confidently compare a high-cash-flow rental property against a development project with massive long-term potential. This foundational knowledge is absolutely critical for building a successful real estate portfolio and hitting your financial goals.

The Four Core ROI Metrics Every Investor Should Know

So, you understand the concept of ROI. Great. But to put that knowledge to work, you need the right tools. When you're sizing up a real estate deal, there’s no single magic number that tells you everything. Instead, smart investors rely on a handful of key metrics, each one telling a different part of the story.

Think of it like a diagnostic toolkit for your investment. Each metric is a different lens, letting you zoom in on immediate cash flow, compare different properties on a level playing field, or pull back to see the entire long-term picture. Let's walk through them, starting with the simplest and building up to a more complete framework.

Simple ROI: The Quick Health Check

The most basic metric is Simple ROI. It’s a high-level snapshot of your total return compared to what you put in. I like to think of it as a quick temperature check on a finished project, like a fix-and-flip. It’s perfect for answering the question, "After all was said and done, how did we do?"

The formula is as straightforward as it gets:

Simple ROI = (Net Profit / Total Investment Cost) x 100

Let's say you buy a property for $200,000, put $50,000 into renovations, and then sell it for $300,000. Your net profit is a clean $50,000 ($300,000 - $250,000). Your total investment cost was $250,000.

Plug that in, and you get a Simple ROI of 20%. It's a useful number, for sure. But its weakness is that it completely ignores how long it took to get that return, and it doesn't account for ongoing income. That's where our next metric shines.

Cash-on-Cash Return: The Pocket Money Metric

This is the one most rental property investors obsess over, and for good reason. Cash-on-Cash Return tells you exactly how much money your investment is putting back into your pocket each year, relative to the actual cash you had to pull out to buy it.

It's the "pocket money" metric because it cuts through the noise of appreciation and loan paydown to focus on one thing: annual cash flow. How hard is my invested cash working for me right now?

Here’s a great visual that shows how your initial investment, the property's cash flow, and its appreciation all work together to build your total return.

This map nails the relationship between the core components. Your investment is the seed, and the cash flow and appreciation are what make it grow. If you really want to get this one down, our guide offers a deeper look into calculating your cash-on-cash return.

Capitalization Rate: The Apples-to-Apples Comparison

When you're trying to compare different properties, especially commercial ones, you need a way to level the playing field. That’s what the Capitalization Rate, or Cap Rate, is for.

A Cap Rate measures a property's potential return as if it were bought with all cash. By taking financing out of the equation, you can compare two completely different buildings—one bought with a loan, one without—and see which one is fundamentally a better income-producer.

The formula hinges on a property's Net Operating Income (NOI):

- Cap Rate = (Net Operating Income / Current Market Value) x 100

If a building generates $50,000 in NOI and the market says it's worth $1,000,000, it has a 5% Cap Rate. As a rule of thumb, a higher cap rate often points to a higher potential return, but it can also signal higher risk.

Internal Rate of Return: The Big Picture Metric

Finally, we get to the most sophisticated of the bunch: the Internal Rate of Return (IRR). This is the heavyweight champion of ROI metrics. It calculates the total annualized return of an investment over its entire life, but with a crucial twist—it accounts for the time value of money.

In simple terms, IRR understands that a dollar you receive today is more valuable than a dollar you'll get five years from now. It’s complex and usually requires a spreadsheet, but it gives you the most complete picture of a deal's long-term profitability.

IRR considers every dollar that moves in or out of the project, and when it moves:

* The initial cash you put in.

* Every single annual cash flow, whether positive or negative.

* The final cash-out when you sell the property.

Because it factors in the timing of every cash flow, IRR has become the gold standard for analyzing complex, long-term investments like real estate syndications. Once you get a handle on these four metrics, you'll be able to look at any deal from every important angle.

How to Calculate Real Estate ROI with Step-by-Step Examples

Theory is one thing, but running the numbers on a real deal is where the rubber meets the road. This is how abstract formulas become tangible investment strategies. It’s time to put these ROI metrics to the test in a couple of common scenarios.

We'll kick things off with a classic single-family rental, which is often the first step for many new investors. From there, we'll dive into a more complex real estate syndication to see how the numbers look from a passive investor's viewpoint. These examples will show you exactly how to work through the calculations and, more importantly, what the results actually mean.

Example 1: The Single-Family Rental

Let’s say you’re buying a single-family house to rent out. The numbers here are pretty standard and do a good job of showing how quickly expenses can chip away at your profit margins and impact your real return.

Here’s a breakdown of the initial investment:

- Purchase Price:$300,000

- Down Payment (20%):$60,000

- Closing Costs (3%):$9,000

- Initial Repairs:$6,000

- Total Cash Invested:$75,000

Now, let's look at the property's annual income and expenses.

- Monthly Rent:$2,500 (for $30,000 annually)

- Annual Property Taxes:$3,600

- Annual Insurance:$1,200

- Maintenance & Repairs (5% of rent):$1,500

- Vacancy (5% of rent):$1,500

- Property Management (8% of rent):$2,400

- Annual Mortgage Payment (P&I):$16,000

First up, we need the Net Operating Income (NOI). We get this by subtracting all operating expenses—everything except the mortgage—from the gross rent. That gives us an NOI of $19,800.

Next, we find the annual cash flow by subtracting the mortgage from the NOI, leaving us with $3,800 for the year.

With those numbers, we can calculate our Cash-on-Cash Return for the first year.

Cash-on-Cash Return = (Annual Cash Flow / Total Cash Invested) x 100

Plugging in our numbers: ($3,800 / $75,000) x 100 = 5.07%.

This tells you that for every dollar of your own cash you put into the deal, you’re getting just over 5 cents back in profit that year. Of course, before you can calculate any ROI, you have to know what the asset is actually worth; understanding how to value commercial real estate is the essential first step to ensure your calculations are built on a solid foundation.

Example 2: The Real Estate Syndication Deal

Now let's switch gears and look at a passive investment in a real estate syndication. In this model, you’re pooling your money with other investors to acquire a large asset, like an apartment complex. Syndication sponsors typically focus on metrics that capture the total return over the life of the project.

For context, imagine an investor buys a rental apartment for $500,000 with a 20% down payment. Even with a gross rent of $36,000 a year, the operating costs and mortgage payments might result in negative cash flow at first.

But here’s the long game: if that property appreciates by just 3% annually over a five-year hold, the combination of eventual cash flow, appreciation, and the principal being paid down can generate a powerful annualized return. This is why you have to look beyond immediate cash yield.

Sponsors use metrics that show this complete picture.

- Equity Multiple: This is a straightforward metric showing how many times your initial investment is projected to be multiplied by the end of the deal. An Equity Multiple of 2.0x means you're expected to double your money.

- Internal Rate of Return (IRR): This is a more complex, time-sensitive calculation that figures out the total annualized return by considering when you receive cash flows—from annual distributions to the final payout at sale.

Let’s say you invest $50,000 into a syndication with a projected 5-year hold period.

The Deal Projections

Year 1-5 Distributions: A 6% annual preferred return ($3,000/year)

Total Distributions over 5 Years: $15,000

Projected Profit from Sale (Your Share): $45,000

Total Return of Capital + Profit: $50,000 + $45,000 = $95,000

Total Cash Received: $15,000 (distributions) + $95,000 (sale) = $110,000

Based on these projections, the Equity Multiple is $110,000 / $50,000 = 2.2x. The projected IRR, which accounts for the timing of all those payments, would likely land somewhere in the 17-19% range—a very strong total return.

Why a Single ROI Number Can Be Misleading

It’s one of the most common—and costly—mistakes an investor can make: falling in love with a single ROI metric. While numbers don't lie, one number by itself rarely tells the whole truth. The real story of a deal is hidden in the context around that number, and if you don't look closer, you could be walking into a trap.

Think about it. A property showing a fantastic cash-on-cash return might look like a home run. But what if that property is located in a shaky market with a shrinking job base? That impressive cash flow today could evaporate tomorrow, leaving you with a liability instead of an asset.

On the flip side, you might see a deal with low initial cash flow and immediately pass. But what if it's in a neighborhood on the verge of a renaissance, primed for massive appreciation? Sometimes, sacrificing a little cash flow now can set you up for a much bigger payday down the road when you sell.

Levered vs. Unlevered Returns

One of the most important distinctions to grasp is the difference between levered and unlevered returns. This is all about understanding how financing (debt) changes the game.

- Unlevered Return: This is the "pure" performance of the property itself, calculated as if you paid all cash. The cap rate is the classic example of an unlevered metric. It tells you how the asset performs on its own merits.

- Levered Return: This is your personal return on the deal after you factor in the mortgage. Cash-on-cash return is a levered metric because it’s based on the actual cash you put into the deal.

Financing is a double-edged sword. When a deal goes right, debt acts like a performance enhancer, amplifying your gains and turning a good return into a great one. But when things go wrong—if values drop or income falters—that same leverage magnifies your losses. It can turn a small stumble into a financial disaster.

Understanding the difference between levered and unlevered returns is non-negotiable. It’s the key to knowing whether you’re analyzing the property’s fundamental performance or the performance of your financing strategy.

Historical data paints a clear picture of this dynamic. An analysis of institutional commercial real estate from 1995 to 2024 showed an average unlevered return of around 9.6%, with the profits split almost evenly between rental income and appreciation. Now, add leverage—say, a 70% mortgage—and an investor's equity return could potentially double. But this also massively increases the risk during a downturn, a brutal lesson many learned during the 2008 financial crisis. You can get a much deeper look into these global private market dynamics and see the numbers for yourself.

Common Projection Pitfalls

Beyond the metrics, the assumptions you plug into your formulas can completely sabotage your projections. Overly optimistic forecasting is probably the number one reason investors get into trouble. You have to stress-test your numbers.

Here are a few of the most common traps to watch out for:

- Underestimating Vacancy: Assuming your property will be 100% occupied year-round is just not realistic. People move. A conservative vacancy rate (like 5-10%) will give you a much more grounded and accurate income projection.

- Ignoring Capital Expenditures (CapEx): Roofs, HVAC systems, and water heaters have a finite lifespan. If you aren't setting aside money for these big-ticket replacements, a single failure can wipe out your cash flow for an entire year and turn a profitable property into a money pit.

- Minimizing Repair Costs: Things break. That's a guarantee. From leaky faucets to broken appliances, routine maintenance and unexpected repairs are a constant. Lowballing this line item makes your spreadsheet look good but will drain your bank account in reality.

The goal here isn't to memorize formulas, but to develop the critical thinking needed to see the full picture. By understanding the context behind the numbers, the powerful effect of leverage, and the common projection traps, you can analyze deals with genuine confidence and make smarter decisions that actually align with your financial goals.

How Market Forces Shape Your Investment Returns

A brilliant property analysis is only half the battle. Your investment’s success is deeply connected to external factors you can't control but must absolutely understand. Calculating ROI in a vacuum is a recipe for surprise; you have to see the forest, not just the individual trees.

These bigger-picture dynamics, from national economic shifts to local job growth, can either supercharge your returns or undermine an otherwise solid deal. Getting a handle on them allows you to anticipate market changes, spot emerging opportunities, and protect your capital from nasty surprises down the road.

The Impact of Interest Rates and Financing

One of the most powerful external forces is simply the cost of money. Shifting interest rates have a direct and immediate impact on your bottom line in two big ways.

First, they hit your mortgage costs. Even a small hike in rates can add hundreds or thousands to your annual debt payments, which directly shrinks your cash flow and hammers your cash-on-cash return. The cost of financing is a massive piece of the ROI puzzle, and if you need help navigating your options, resources like Brokermap's network of mortgage professionals can be a good place to start.

Second, higher interest rates tend to cool buyer demand across the entire market, which can pump the brakes on property appreciation. On the flip side, when rates are low, borrowing is cheap. This often fuels buyer competition and sends property values climbing.

How Sector and Geography Dictate Performance

It’s an old saying, but it’s true: not all real estate is created equal. The sector your property sits in—be it industrial, multifamily, retail, or office—will perform very differently based on broad economic trends.

Just look at what’s happened recently. The explosion of e-commerce has created immense demand for industrial and warehouse space, while the shift to remote work has put a real strain on the traditional office sector.

Your property's zip code can be just as important as the building itself. Local economic health, population growth, and infrastructure development are powerful currents that can lift all boats in a strong market or drag them down in a weak one.

Recent market data tells this story loud and clear. After a market correction in 2022-2023, global real estate began to recover, but the comeback was far from uniform.

Through 2024, specialized sectors like data centers and manufactured housing delivered impressive total returns of 11.2% and 11.7%, respectively.

Geography was just as critical. By mid-2025, property sales in the Americas were up roughly 12% year-over-year. At the same time, Europe and Asia Pacific saw declines. This is a perfect example of why you can't have a one-size-fits-all ROI expectation; you have to adjust for regional conditions. It all comes down to aligning your investment strategy with the forces shaping the market right now.

Your Top Real Estate ROI Questions, Answered

Once you start digging into the formulas and running the numbers on actual deals, a few common questions always seem to pop up. Getting a handle on the finer points of real estate ROI is a journey, not a destination. These questions are often the final pieces of the puzzle that help everything click into place.

Let's walk through some of the most frequent questions investors ask when they move from theory to practice.

What Is a Good ROI for a Rental Property?

This is the million-dollar question, and the honest answer is: it depends. What one investor considers a home run, another might see as a base hit. A "good" ROI is deeply tied to your personal strategy, how much risk you're comfortable with, and the specific market you're investing in.

That said, most experienced investors use a few rules of thumb to quickly size up a deal:

- For Cash-on-Cash Return: A return of 8-12% or higher is often seen as a solid target for a rental property. Hitting this range means the property is generating strong positive cash flow compared to the actual cash you pulled out of your pocket.

- For Total Annualized Return: When you zoom out and factor in things like appreciation and the principal you're paying down on the loan, many investors shoot for a total return in the mid-to-high double digits over the life of the investment.

At the end of the day, a "good" ROI is one that aligns with your financial goals and gives you a better return than you could get elsewhere for a similar amount of risk.

How Is Cap Rate Different from ROI?

This is a big one, and it's a distinction that trips up a lot of new investors. Both are return metrics, but they look at the property through completely different lenses. The core difference boils down to one word: financing.

Cap Rate gives you the unlevered return on a property. Think of it as the property's raw, unfiltered earning power based on its income versus its market value, completely ignoring any mortgage. This is why it’s the perfect tool for an apples-to-apples comparison between different properties.

ROI, on the other hand, is a much more personal and comprehensive term. It measures the return on your specific deal structure, which absolutely includes the powerful effect of leverage (your loan). Because you used a mortgage, your personal ROI will be completely different from the property's Cap Rate.

Does ROI Include Property Appreciation?

It depends entirely on which ROI metric you're talking about—and this is why being specific is so critical when you're talking returns with partners or investors.

A metric like Cash-on-Cash Return is all about the immediate, liquid cash flow. By design, it does not include appreciation. Why? Because that value is just on paper; it’s locked up in the property until the day you sell or refinance.

However, when you're doing a full-cycle analysis with a metric like Internal Rate of Return (IRR) or calculating the total ROI for a sold property, you absolutely must include appreciation. It's a massive part of the overall performance story, from the day you buy to the day you cash out.

At Homebase, we build tools that help you manage your deals and investor relations with total clarity. Our platform is designed to take the manual work out of real estate syndication, so you can focus on what you do best: finding great deals and building lasting investor relationships. Learn more about how Homebase can help you manage your next deal.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.