How Do You Calculate Cap Rate A Real Estate Investor's Guide

How Do You Calculate Cap Rate A Real Estate Investor's Guide

Learn how do you calculate cap rate with our guide. We cover the formula, NOI, and real-world scenarios to help you make smarter property investment decisions.

Domingo Valadez

Dec 23, 2025

Blog

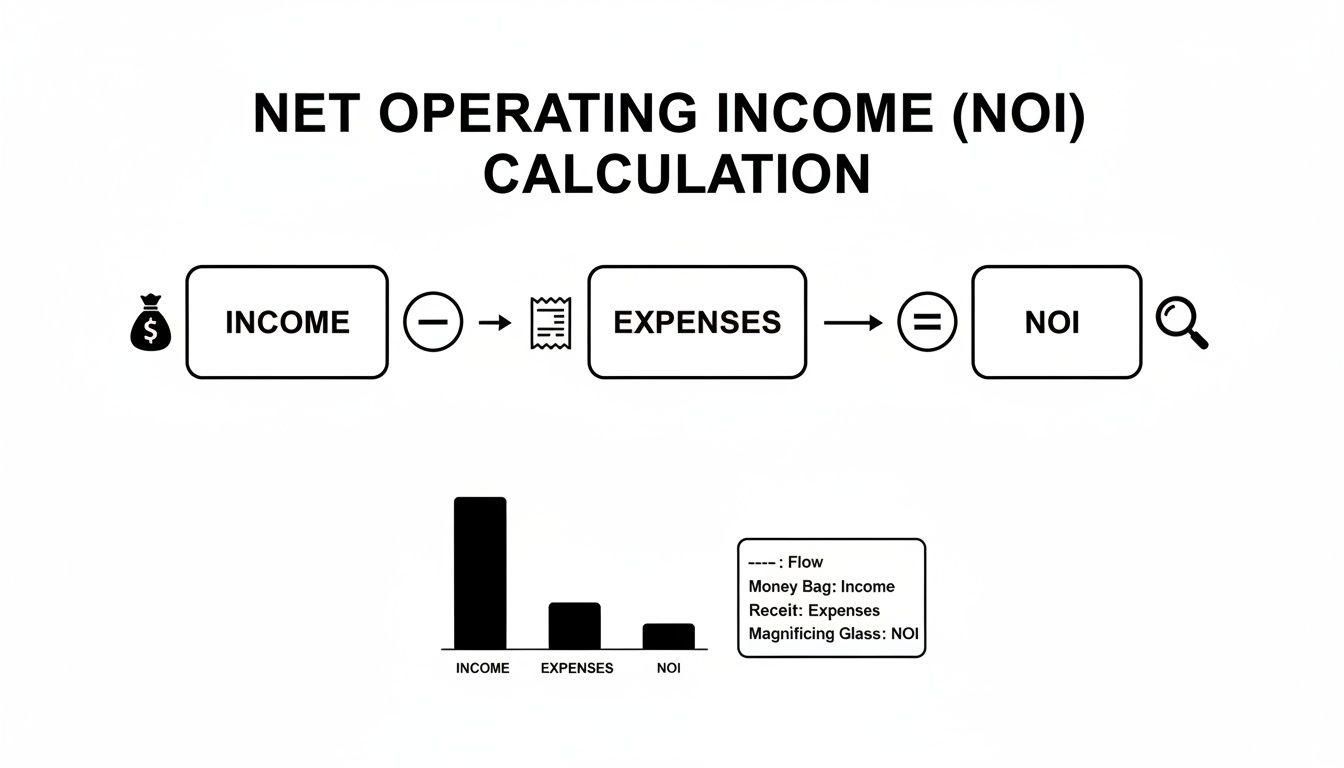

To figure out a property's cap rate, you just need a simple formula: divide its Net Operating Income (NOI) by its Current Market Value. The result is a percentage that shows you the unleveraged rate of return, making it a fantastic tool for quickly sizing up different investment opportunities.

What Cap Rate Reveals About a Property

Before you get lost in complex spreadsheets and financial models, you need a quick, reliable way to check a property's financial pulse. That's exactly what the capitalization rate, or cap rate, does.

It cuts through the noise of financing and debt to show you the raw, unleveraged return an asset is expected to kick off. Think of it as a quick financial health check.

This one number lets you make true apples-to-apples comparisons, even between wildly different properties. You could be looking at a downtown high-rise and a quiet suburban garden apartment complex, and the cap rate gives you a common yardstick to measure them by. It instantly tells you how the market is valuing each property's income stream.

Core Components of the Cap Rate Formula

The formula itself is straightforward, but the magic is in understanding its two key ingredients. Getting these right is non-negotiable for an accurate calculation.

Let's quickly break down the key terms in the cap rate formula to see how they fit together.

Cap Rate Formula Components at a Glance

Getting a handle on these two inputs is the first step to truly understanding what the final cap rate percentage is telling you about a potential deal.

Key Takeaway: A higher cap rate usually points to a higher potential return, but it often signals higher perceived risk. On the other hand, a lower cap rate typically means you're looking at a lower-risk, more stable asset that commands a premium price for its income.

Why This Metric Matters for Syndicators

For syndicators and multifamily investors, the cap rate isn't just another number—it’s the language of the industry.

When you're talking to brokers, lenders, or potential investors, throwing out the cap rate instantly frames the conversation and communicates the deal's profile. To really drive this home, it’s vital to first understand What Is Cap Rate in Real Estate and its role as a core benchmark.

For instance, if you're looking at a multifamily building valued at $2,000,000 that generates an NOI of $144,000, your cap rate is 7.2%. This simple math provides a standardized metric to evaluate its value and performance against other properties in the market.

How to Calculate Net Operating Income with Confidence

You can't get to a reliable cap rate without a rock-solid Net Operating Income (NOI). I like to think of NOI as the property's pure, unfiltered profit—what it earns before a single dollar of debt or taxes is considered.

Nailing this number is the single most important part of the cap rate formula. It all starts with the property's total potential income, and from there, you start chipping away at the operating expenses. This isn't just about plugging numbers into a spreadsheet; it's about painting an honest financial picture of how the asset actually performs day-to-day.

What Counts as a True Operating Expense?

The goal here is to include every single cost required to keep the lights on and the rent checks coming in. The list can get long, but there are a few heavy hitters you can never ignore.

At a minimum, your expense sheet must account for:

- Property Taxes: A non-negotiable and often one of your biggest line items.

- Insurance: You'll have hazard insurance, of course, but don't forget liability coverage.

- Maintenance and Repairs: This is the budget for everything from a running toilet to a hole in the drywall.

- Property Management Fees: Even if you plan to manage it yourself, you must underwrite for a professional third-party manager. Your time isn't free, and the next buyer will factor this cost in.

- Utilities: Any utilities paid by the landlord, like water, sewer, trash, or electricity for common areas.

These are the operational lifeblood of the property. Forgetting one of them will artificially inflate your NOI and lead you to a dangerously rosy cap rate. If you want to go deeper, our guide on what is Net Operating Income breaks this down piece by piece.

What to Leave Out of Your NOI Calculation

Knowing what to exclude is just as critical as knowing what to include. A classic rookie mistake is mixing in financing or capital costs, which completely skews the picture. NOI is meant to measure the property's performance, independent of who owns it or how they bought it.

Be absolutely sure to exclude these items from your calculations:

- Mortgage Payments (Principal & Interest): This is a financing cost, not an operating expense.

- Capital Expenditures (CapEx): Big-ticket items like a new roof, parking lot repaving, or a full HVAC replacement are capital investments, not day-to-day expenses.

- Depreciation: This is a "paper" expense for tax purposes; no actual cash leaves your account.

- Income Taxes: These are tied to the owner's personal financial situation, not the building's operational health.

By stripping these costs out, you're left with a clean, apples-to-apples metric. It lets any investor, regardless of their loan terms or tax bracket, see the asset's true earning power and calculate a meaningful cap rate.

A Quick Example: Putting It All Together

Let's make this real. Say you're looking at a small four-plex, and each unit rents for $1,300 a month.

Your gross potential income is $62,400 for the year ($1,300 x 4 units x 12 months).

Now, let's subtract your projected operating expenses. After doing your due diligence, you estimate they'll run about $15,000 for the year to cover taxes, insurance, management, and basic upkeep.

That simple math—gross income minus operating expenses—gives you a final NOI of $47,400.

If you're buying this property for $600,000, your purchase cap rate is 7.9%. This example really highlights why your expense forecast is so critical. For many properties, operating expenses fall somewhere between 35-45% of gross income. Underestimate them, and you'll end up with an inflated cap rate and a bad deal. For more on this, check out the expense estimation insights on andersonadvisors.com.

Applying The Cap Rate Formula In Realistic Scenarios

Knowing the formula is one thing, but applying it with confidence across different deal types is what separates novice investors from seasoned pros. The context of your analysis—whether you're buying, holding, or repositioning an asset—completely changes how you should approach the calculation.

Let’s walk through three distinct, real-world scenarios to see how this simple formula adapts to different strategic goals. The key difference in each example is which "value" you plug into the denominator, a critical distinction that can make or break a deal analysis.

At its core, every cap rate calculation is powered by the property's Net Operating Income (NOI). It’s the pure, unleveraged profit the asset generates before debt service.

Think of NOI as the engine of the property. It's simply the gross income left over after you’ve paid all the bills to keep the lights on—everything except the mortgage. This is the clean number you need for an accurate cap rate.

Scenario 1: Evaluating a Property for Purchase

When you're looking at a new deal, your cap rate calculation uses the seller's asking price or your own target purchase price. This gives you a snapshot of the unleveraged return you're being offered on day one.

Imagine a 20-unit apartment building is listed for $2,500,000. After tearing apart the financials and running your own underwriting, you land on a stabilized Net Operating Income of $150,000.

- Cap Rate = $150,000 (NOI) / $2,500,000 (Purchase Price)

- Result = 6.0%

This 6.0% is your "going-in" cap rate. It’s your baseline for comparing this deal to every other opportunity on the market.

Scenario 2: Assessing a Property You Already Own

For an asset already in your portfolio, the calculation shifts. Instead of what you paid for it, you use the property’s current market value to understand its real-time performance. This tells you what the market thinks your asset is worth today.

Let's say you bought that same building years ago. Thanks to smart management and market appreciation, its value has climbed to $3,200,000. On top of that, rent growth has pushed the NOI up to $180,000.

- Cap Rate = $180,000 (NOI) / $3,200,000 (Current Market Value)

- Result = 5.625%

This phenomenon is called cap rate compression. As the property's value goes up, the cap rate goes down, which is a great sign for your equity. This metric is crucial for deciding whether it's the right time to sell, refinance, or hold on.

Scenario 3: Projecting a Value-Add Deal

For a value-add project, you’re not looking at today’s numbers. You’re running a “pro forma” or "stabilized" cap rate calculation. This is all about projecting future performance after your improvements are done and the property is leased up.

You find a rundown property for $4,000,000. Its current NOI is only $200,000 (a sleepy 5.0% cap rate). Your business plan calls for a $500,000 renovation to modernize units and raise rents. Once the work is done, you project the stabilized NOI will jump to $315,000.

Key Takeaway: For pro forma analysis, you calculate the "yield on cost." This measures your future stabilized return against your total investment. It’s your projected NOI divided by the total cost (purchase price plus renovation budget).

Your all-in cost is $4,500,000. The stabilized cap rate, or yield on cost, is:

- Yield on Cost = $315,000 (Projected NOI) / $4,500,000 (Total Cost)

- Result = 7.0%

This 7.0% is the number that matters. It shows the massive upside you're creating and is the figure you'd present to investors to justify the risk of the renovation.

The context of your analysis dictates the numbers you use. To make this crystal clear, here’s a quick comparison of the three scenarios we just covered.

Scenario-Based Cap Rate Calculations

As you can see, the same formula produces vastly different results depending on whether you're evaluating a new purchase, an existing asset, or the potential of a future project. The precision of these calculations always hinges on accurate inputs, a concept you can explore with more real-world examples by learning about how the cap rate formula works on wallstreetprep.com.

Thinking Like a Pro: Advanced Cap Rate Insights

Getting a basic cap rate is a solid first step, but honestly, it’s just that—a start. Any seasoned investor will tell you that the seller's numbers are often a best-case scenario. To really underwrite a deal and protect your capital, you have to dig in and stress-test the financials for what they'll look like in the real world.

The first professional-grade adjustment every pro makes is accounting for vacancy and credit loss. No property, ever, stays 100% occupied and collects every dollar of rent. Tenants move out, units take time to turn, and unfortunately, sometimes people just stop paying. Ignoring this is one of the fastest ways to get into a bad deal.

A conservative and far more realistic approach is to immediately reduce your Gross Potential Income by a vacancy factor. This is usually somewhere between 5-10%, depending on the market's strength and the type of property. So, if a building could potentially bring in $100,000 a year, you should really start your analysis with an Effective Gross Income of $95,000 or less. This simple haircut gives you a critical buffer against the income gaps that will inevitably happen.

Factoring in Capital Expenditures

Next on the list is something rookies almost always forget: Capital Expenditures (CapEx). These are the big, expensive, but necessary replacements that keep a property from falling apart over the long haul. We're talking about new roofs, replacing HVAC systems, or repaving the entire parking lot.

Now, technically, CapEx isn't part of the standard Net Operating Income (NOI) formula. This is a critical distinction that trips people up. But ignoring it is one of the costliest mistakes you can make. Your building is a physical asset, and it wears down. You absolutely have to set money aside to deal with that decay.

Pro Tip: A good rule of thumb is to budget a CapEx reserve of $250-$350 per unit, per year. For a 50-unit building, that’s an extra $12,500 to $17,500 you need to account for annually. It won't show up in the NOI, but it will definitely hit your bank account.

If you don't budget for these eventual costs, you'll have a dangerously inflated idea of how profitable the property really is. The cap rate might look great on paper, but your actual returns will get crushed when a surprise $50,000 roof bill comes due that you never saw coming.

The Importance of Market Context

Finally, remember that a cap rate never tells the whole story on its own. It's a relative metric that only has meaning within a specific market context. A 5% cap rate might be an absolute home run in a booming primary market like Austin, but it could be a terrible deal in a small, shrinking town with no job growth. The number is just a number until you understand its environment.

Always ask these questions:

* What's the economic outlook? Are jobs and people moving into the area? A growing economy is the engine for rent growth and property appreciation.

* What's the competition look like? If developers are about to drop thousands of brand-new units on the market, your ability to raise rents could be severely limited.

* What are the local laws? Things like rent control or other landlord-unfriendly regulations can put a hard ceiling on a property’s financial upside.

It can also be helpful to compare real estate metrics to those in other asset classes. Understanding a concept like the earnings yield for stocks, for example, can give you a better perspective on relative value. In the end, knowing the formula is only half the battle; the real skill is in interpreting that number within the unique story of its market.

Costly Cap Rate Calculation Mistakes to Avoid

The cap rate formula looks simple on the surface, but its simplicity hides a few common traps that can lead to some truly disastrous investment choices. Knowing the formula is one thing; knowing how not to use it is what separates disciplined, successful investors from those who get burned. Most of these mistakes come from taking the numbers you're given at face value, without that healthy dose of professional skepticism you need in this business.

The single biggest error I see is blindly trusting a seller's "pro forma" financials. These numbers are a projection of a property's potential performance, almost always painted in the most optimistic light. They might assume 100% occupancy, wild rent growth, and suspiciously low operating expenses.

Your job as an investor is to treat a pro forma as a starting point for your own underwriting, not the gospel truth. Always, always build your own expense models based on the property's actual history, current market data, and your own conservative assumptions.

Ignoring True Operating Costs

Another frequent pitfall is underestimating a property's true expenses. It’s easy to remember the big-ticket items like property taxes and insurance, but the smaller, recurring costs can nickel-and-dime your Net Operating Income (NOI) to death.

Forgetting to budget for things like landscaping, pest control, administrative fees, or just routine maintenance will give you an artificially high NOI. That, in turn, spits out a deceptively attractive cap rate that has little connection to the property’s actual profitability.

Key Insight: Every dollar of missed expenses directly reduces your NOI and inflates the cap rate. A property marketed at a 7% cap rate might actually be a 6.5% deal once all operational costs are properly accounted for—a huge difference when it comes to valuation.

To get this right, you have to build a detailed expense sheet. Get the seller’s T12 (trailing 12 months) financial statement and scrutinize it for what’s missing. Even better, pull industry benchmarks for similar properties in the area to see if their numbers even make sense.

Making Flawed Comparisons

Finally, a really dangerous mistake is comparing cap rates without any context. A 6% cap rate on a brand-new Class A apartment building in a prime metro area is a completely different animal than a 6% cap rate on a 40-year-old Class C property in a tertiary market.

These two assets have entirely different risk profiles, growth potential, and future capital needs. A lower cap rate usually signals lower perceived risk and stronger investor demand, while a higher rate screams the opposite.

To make sure you're comparing apples to apples, you have to evaluate assets with:

* Similar Asset Classes: Don't compare a multifamily cap rate to a retail center's. It's a different game.

* Comparable Locations: A deal in Southern California will naturally have a different cap rate profile than one in the Midwest.

* Similar Property Quality: Always compare Class A to Class A, B to B, and so on.

When you don't contextualize the numbers, you risk overpaying for a high-risk asset or, just as bad, passing on a stable one. It’s a powerful reminder that the story behind the number is just as important as the calculation itself.

Answering Your Top Cap Rate Questions

Once you get the hang of the basic cap rate formula, the real questions start to pop up. These are the practical, "how does this actually work?" kind of questions that separate theory from on-the-ground reality. Let's dig into a few of the most common ones I hear from investors.

Getting these concepts straight is what builds the confidence you need to look at a deal and know what you're seeing.

What Is a Good Cap Rate for a Rental Property?

If only there were a single magic number! The truth is, a "good" cap rate is completely relative. It depends on the market, the asset class, and your own appetite for risk.

- Low Cap Rates (4-5%): You'll typically see these in prime locations with stable, low-risk assets. Think of a Class A apartment building in a gateway city. Investors are willing to pay a premium for that safety and stability, which pushes the cap rate down.

- High Cap Rates (8-10%+): These can signal a chance for higher returns, but they almost always come with more risk. We're talking about properties in secondary or tertiary markets, buildings that need a major facelift, or assets with shaky rent rolls.

A solid rule of thumb for many investors is to find a cap rate that’s higher than their mortgage interest rate. This is what's known as positive leverage. But at the end of the day, the best cap rate is the one that fits your specific investment strategy.

How Is Cap Rate Different From Cash-on-Cash Return?

This is a big one, and it's critical to understand the distinction. They measure two very different things.

Cap rate gives you the unleveraged return on the property itself, as if you bought it with all cash. The calculation—NOI / Property Value—intentionally ignores debt. It’s a pure measure of the asset’s standalone earning power.

Cash-on-cash return, however, is all about your specific return on the actual cash you've put into the deal. The formula is Annual Pre-Tax Cash Flow / Total Cash Invested. Because it factors in your mortgage payments, it tells you exactly how hard your down payment and closing costs are working for you.

Can You Use Cap Rate to Estimate a Property's Value?

Yes, and this is one of its most powerful applications. In the commercial real estate world, this is a fundamental valuation method known as the "income capitalization approach."

Just flip the formula around: Property Value = NOI / Cap Rate.

So, if a building is throwing off $50,000 in NOI and similar properties in the area are trading at a 5% cap rate, you can quickly estimate its value at $1,000,000 ($50,000 / 0.05). Brokers, appraisers, and investors do this all day long to get a quick read on what a property should be worth based on its income stream.

Ready to move beyond spreadsheets? Homebase is the all-in-one platform built to streamline fundraising, investor relations, and deal management for real estate syndicators. Focus on closing more capital, not chasing signatures. Learn more about how Homebase can help you scale your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.