How to Calculate Operating Expenses: Simple Steps for Business Success

How to Calculate Operating Expenses: Simple Steps for Business Success

Learn how to calculate operating expenses accurately with our easy guide. Discover key tips to manage your business costs effectively and optimize profits.

Domingo Valadez

Aug 7, 2025

Blog

When you're trying to figure out if a real estate deal makes sense, one of the most critical numbers you need to nail down is the operating expenses. It's not just a single number on a spreadsheet; it represents the real, day-to-day cost of keeping a property running. Getting this right is fundamental to understanding a property's true profitability.

So, What Exactly Are Operating Expenses?

Before you start adding up numbers, you need a solid grasp of what operating expenses—often called OPEX—truly are.

Think of OPEX as all the costs required to keep the lights on and the business functioning, completely separate from the direct costs of creating a product. Those direct costs are what we call the Cost of Goods Sold (COGS). This distinction is absolutely vital for a clear picture of your financial health.

If you blur the lines between OPEX and COGS, your financial reports can get seriously distorted, which almost always leads to poor business decisions. OPEX is much more than just the obvious things like rent and utilities.

The Core OPEX Categories You Can't Ignore

To get an accurate total, you have to be meticulous and account for a whole range of costs. These usually fall into a few key areas that every business, no matter its size, will have to deal with.

Here are the common operating expenses you'll see:

- Administrative Costs: This is a big one. It includes salaries for your non-production team (like admin staff, accounting, and HR), office supplies, and professional fees for lawyers or accountants.

- Sales & Marketing: Any money you spend to attract and retain tenants or buyers falls here. Think advertising, social media campaigns, sales commissions, and even your CRM software subscription.

- Rent & Utilities: This is the monthly cost of your office or building, plus the essential services like electricity, water, gas, and internet.

- Maintenance & Insurance: Keeping the property in good shape isn't free. Regular repairs, landscaping, and preventative maintenance are all OPEX. So are your business liability and property insurance premiums.

To help clarify the difference, let's quickly compare OPEX and COGS.

Operating Expenses (OPEX) vs. Cost of Goods Sold (COGS)

This table is a quick cheat sheet, but the core idea is simple: if the cost isn't directly part of creating the final product or service you sell, it's almost certainly an operating expense.

Key Takeaway: If a cost isn't directly used to create the product you sell, it's almost certainly an operating expense. Nailing this concept is the first step toward an accurate calculation.

Don't underestimate these expenses; they can be massive. For large organizations, workforce costs are often the single biggest line item. For example, one major global fund projected its operating expenses at US$ 1,025 million over three years, with salaries alone accounting for roughly 59% of that budget. You can dig into the full details of this organizational budget) to see a real-world breakdown.

Getting Your Financial Ducks in a Row

Before you can even think about calculating your operating expenses, you need to play detective. The quality of your final numbers is only as good as the data you start with, so your first task is to hunt down every document that paints a picture of where your money is going.

This isn't just about grabbing the big reports. It’s about building a solid, reliable foundation for your entire analysis. Your income statement is a great starting point, as it directly lists many of the usual suspects: salaries, utilities, and marketing spend. Your job is to pull out every expense that isn't a direct cost of goods sold (COGS).

From there, you’ll need to dig deeper into the day-to-day records to get the granular detail that high-level statements often miss.

Your Document Checklist

To get a truly accurate OPEX number, you need to collect a variety of documents. Don’t just rely on a single report; the real story is often found in the smaller, everyday records.

Here's the essential paperwork you'll need to round up:

- Bank and Credit Card Statements: These are your ground truth. They give you a raw, chronological feed of every dollar that has left your accounts, which is perfect for catching expenses that might have been overlooked.

- Payroll Records: Don't just look at the total salary figure. You need the detailed reports that break down gross wages, payroll taxes, and any company contributions to benefits like health insurance or retirement plans.

- Receipts and Invoices: This is where the real work comes in. Track down every vendor invoice and receipt you can find, from your monthly software-as-a-service (SaaS) bills to that one-time plumbing repair. These are your undeniable proof of an expense.

- Lease and Loan Agreements: For fixed costs like rent or equipment financing, these documents will clearly lay out your monthly payment obligations. No guesswork needed.

If your inbox is constantly flooded with invoices and receipts, learning some email parsing best practices can be a game-changer. Automating this can save you countless hours of manual data entry and cut down on errors.

Once you have everything in hand, get organized. It doesn't matter if you're using sophisticated accounting software or a simple system of spreadsheets and digital folders—what matters is that you have a system. A little organization now not only makes this calculation easier but also sets you up for much smoother financial reviews down the road.

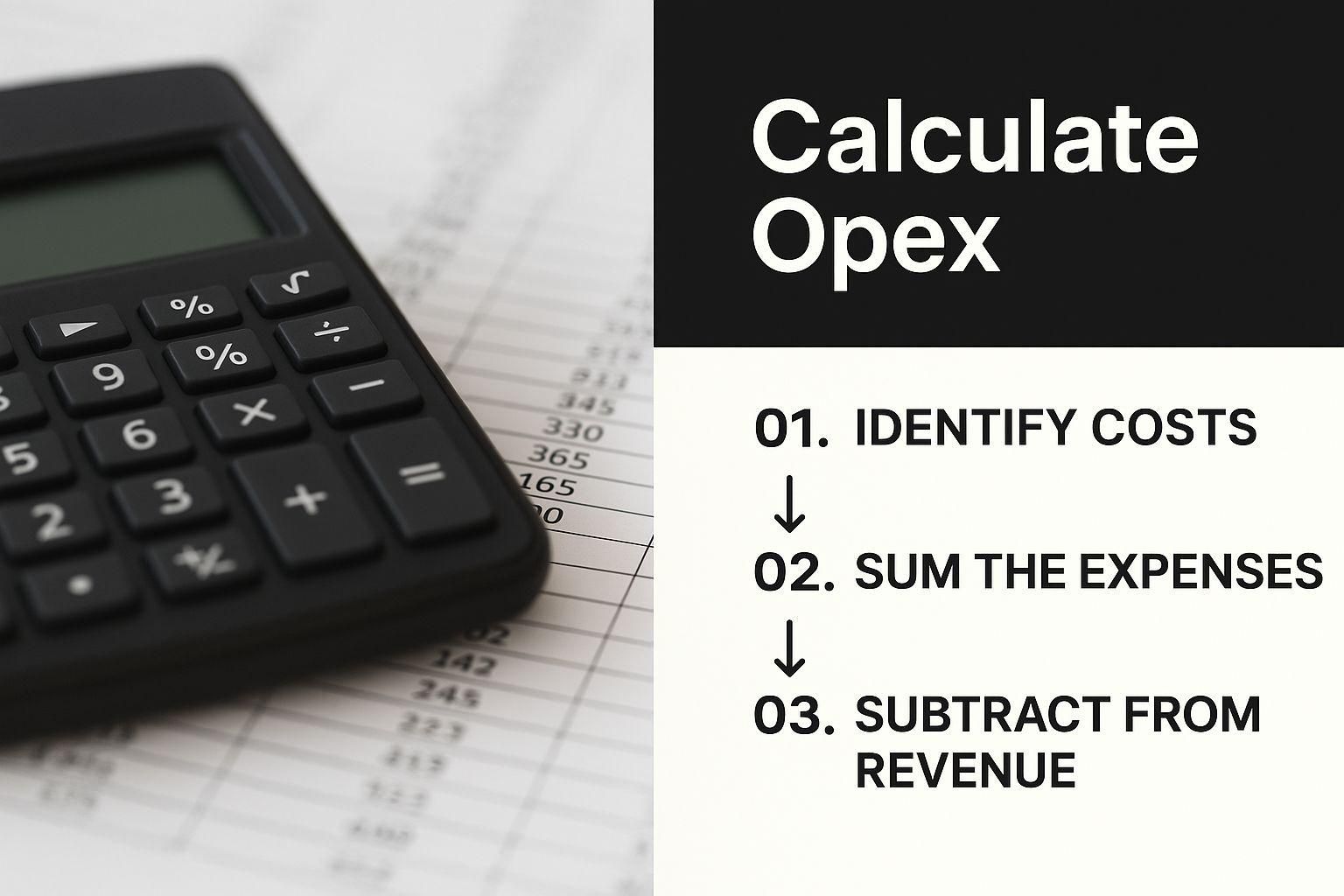

Putting the Operating Expense Formula to Work

Alright, you've got your financial documents in front of you. Now comes the satisfying part: putting it all together to see what it really costs to run your property.

The core idea is simple. You’re just adding up all the costs of keeping the lights on and the property running smoothly. In accounting terms, this is often broken down like this:

OPEX = Sales, General & Administrative (SG&A) Expenses + Other Operating Expenses

This formula forces you to look at every single line item, from the predictable costs like your property manager's salary to the more variable ones like a sudden marketing push.

A Practical Walkthrough

Let's make this real. Imagine you own a small commercial property and you're trying to figure out your operating expenses for the month. After pulling your invoices, payroll stubs, and bank statements, your list might look something like this:

- Property Management & Admin Salaries: $15,000

- Office Rent: $4,000

- Utilities (Electric, Water, Internet): $850

- Marketing & Advertising: $1,200

- Software (CRM, Accounting Tools): $300

- Office Supplies: $250

- General Liability Insurance: $400

- Professional Fees (Legal Retainer): $500

When you add all of that up, you get a total monthly OPEX of $22,500. That number isn't just a random figure; it’s the true, hard cost of your operation for that month.

Getting to this number is a methodical process. You’re essentially taking a messy pile of financial data and turning it into one clear, powerful number.

I can't stress this enough: understanding your operating expenses is far more than just an accounting exercise. It's a fundamental part of your investment strategy.

When you can accurately track and manage your OPEX, you gain incredible control over your cash flow. This allows you to stay resilient and keep investing, even when the market gets shaky. It's the bedrock of a solid, long-term real estate portfolio.

From OPEX to NOI

Once you have a firm grip on your total operating expenses, you’re just one step away from calculating another critical real estate metric: Net Operating Income (NOI).

Think of it this way: calculating OPEX is a foundational skill. You absolutely need it to do the more advanced analysis that separates successful investors from the rest. To see exactly how these two numbers fit together, check out our guide on how to find net operating income.

Ultimately, this process gives you a clear, repeatable way to get an exact OPEX figure for any period—monthly, quarterly, or annually. That consistency is what allows you to track performance over time and make sharp, data-driven decisions for your property.

Taking Your Analysis to the Next Level with the Operating Expense Ratio

Knowing your total operating expenses is one thing, but that number doesn't tell you the whole story. To really understand how your property is performing, you need to put those expenses into context. That’s where the Operating Expense Ratio (OER) becomes an indispensable tool in your arsenal.

The OER is a key performance indicator (KPI) that shows you exactly what percentage of your property's income is being eaten up by operating costs. Think of it this way: for every dollar your property brings in, how many cents have to go right back out the door to keep it running? Answering that question is how you move from just tracking numbers to making smart, strategic decisions.

How to Calculate the Operating Expense Ratio

The beauty of the OER is its simplicity. It’s a clean, direct formula that gets straight to the point.

Here's the calculation:

Operating Expense Ratio (OER) = Total Operating Expenses / Gross Operating Income

Let's run through a quick example. Imagine your apartment building generated $450,000 in gross income last year and your total operating expenses came to $225,000.

Your OER would be 50% ($225,000 / $450,000).

This means that for every single dollar of rent you collected, 50 cents went directly toward paying for things like maintenance, insurance, and property management.

A rising OER can be an early warning sign of trouble—a signal that your expenses are getting out of control or that your revenue is lagging. On the flip side, a stable or declining OER is a great indicator that your management strategies and cost-saving efforts are paying off.

Using the OER to Spot Trends

Looking at your OER for a single month or quarter is helpful, but the real magic happens when you track it over time. A 50% OER might be fantastic for an older, high-maintenance property but concerning for a brand-new building. The trend is what truly matters.

Did your OER suddenly jump from 48% to 55% this quarter? That’s a red flag. It forces you to dig in and find the cause.

* Was there a major, one-time repair, like a new boiler?

* Did your local municipality hike up property taxes?

* Have utility rates in your area skyrocketed?

By regularly calculating and comparing your OER, you can catch these issues early. This allows you to proactively adjust rents, budget more accurately for future capital expenditures, or pinpoint which of your cost-cutting measures are actually working.

To illustrate how this works in practice, here’s a look at how a property owner might track their OER over a few quarters to identify trends and make informed decisions.

Example OER Calculation and Trend Analysis

As you can see from the table, tracking the OER provides a clear narrative of the property's financial health, helping to distinguish between one-off events and persistent problems.

From Numbers to Strategy: Making Your OPEX Data Work for You

Figuring out your operating expenses is one thing, but the real magic happens when you start using those numbers to make smarter decisions. In my experience, the most successful businesses don’t just see OPEX as a line item on a spreadsheet. They treat it as a powerful tool to steer the company toward growth and keep it stable. When your calculations are spot on, your forecasting gets better, which naturally leads to more intelligent budgeting.

This isn’t just an internal navel-gazing exercise, either. For public companies, solid forecasting is how they manage investor expectations and project a sense of financial control.

A great real-world example is Cboe Global Markets. They projected their adjusted 2025 operating expenses to fall between $832 million and $847 million. This wasn't a back-of-the-napkin guess; it was the result of meticulous adjustments designed for transparency. You can see the level of detail they provide in their rigorous financial reporting.

When you operate with this level of clarity, your OPEX data transforms from a simple historical record into a forward-looking roadmap for whatever the economy throws at you.

Putting Your OPEX Analysis into Action

Once you have a firm grip on your operating costs, you can start making decisions that are backed by actual data, not just gut feelings. The goal is to get proactive and manage these costs to give yourself a real competitive edge. A solid analysis will shine a light on exactly where you can make improvements.

So, how do you turn these findings into real-world action? It usually comes down to a few key areas:

- Surgical Cost Reductions: Forget about clumsy, across-the-board cuts that often hurt more than they help. With detailed OPEX data, you can pinpoint specific inefficiencies. After your analysis, putting specific plans in place, like implementing IT cost-saving strategies, is what actually moves the needle on your bottom line.

- Wiser Resource Allocation: When you know precisely where every dollar is going, you can make much better calls about where it should be going. This lets you confidently move funds away from low-return activities and pour them into initiatives that will truly drive growth.

- Building a Rock-Solid Investment Case: A detailed OPEX analysis is your best evidence when you need to justify a major investment. Whether you're making the case to hire new people or buy new tech that promises long-term savings, a data-driven argument is always going to be more compelling than a hunch.

Still Have Questions About OPEX?

Even when you know the formula, figuring out operating expenses can get tricky. The details matter, and getting them right is what separates a good deal from a great one. Let's walk through some of the questions I hear most often from investors.

Are Employee Salaries Part of OPEX?

Mostly, yes. Any salaries for employees who aren't directly building your product or delivering your service are considered operating expenses. This typically includes your administrative staff, the marketing team, accountants, and even the leadership team.

The important distinction here is their role. For example, the wages for a construction crew on a new build would be a Cost of Goods Sold (COGS), not OPEX. It all comes down to whether they're supporting the day-to-day business operations or directly involved in creating the asset you sell.

My Two Cents: This is one of the easiest places to make a mistake. Always separate support staff salaries (OPEX) from production staff (COGS). If you lump them together, you'll get a skewed view of your gross profit and might think a project is more or less profitable than it really is.

What’s the Difference Between OPEX and CapEx?

This is a cornerstone concept for any serious investor.

Operating expenses (OPEX) are the routine, ongoing costs to keep the lights on and the business running. Think rent, utilities, property management fees, and marketing budgets. These are expensed on your income statement as they happen.

Capital expenditures (CapEx) are different. These are major, one-off purchases of significant physical assets that you’ll benefit from for years. We’re talking about buying a building, replacing an entire HVAC system, or repaving a parking lot. Instead of hitting your books all at once, CapEx is depreciated over the asset's useful life.

How Often Should I Calculate My Operating Expenses?

For tight financial control and a real-time pulse on your investment's health, you absolutely should be calculating operating expenses monthly.

Running the numbers this frequently gives you a few key advantages:

* Spot Trends Early: You can catch rising utility costs or unexpected maintenance fees before they snowball into a major issue.

* Make Quick Adjustments: It allows you to be nimble, making smart, informed tweaks to your budget on the fly.

* Forecast with Confidence: A solid history of monthly data is the best foundation for accurately predicting future expenses.

At the very least, you need to run the numbers quarterly and annually for investor reporting and bigger-picture strategic planning. But if you're waiting three months to look at your expenses, you're already behind.

Is It Possible to Have Zero Operating Expenses?

In a word, no. For any active business trying to turn a profit, it's pretty much impossible to have zero operating expenses.

Even a one-person operation has costs. There’s always something—internet bills, software subscriptions, insurance, or marketing costs. You have to spend money to make money; some level of OPEX is just the cost of doing business.

Trying to manage all these financial details across different properties and investors can quickly feel like you're drowning in spreadsheets. Homebase is designed to centralize everything, from fundraising and deal management to investor reporting, putting all your critical data in one place. You can learn more about streamlining your real estate syndication with Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking the Triple Net Lease Meaning for Syndicators

Blog

What is the true triple net lease meaning for investors? Our guide demystifies NNN leases, breaking down the benefits, risks, and underwriting for syndicators.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.