A Guide to Financing Real Estate Investments for Syndicators

A Guide to Financing Real Estate Investments for Syndicators

Discover how to master financing real estate investments. Our definitive guide for syndicators covers the capital stack, deal structures, and underwriting.

Domingo Valadez

Jan 5, 2026

Blog

Putting together a real estate deal is one thing; financing it is a whole different ballgame. It's not just about filling out a loan application. To really succeed, especially in the market we're in today, you need a solid game plan. You have to know all the ways to bring money into a deal—from a straightforward bank loan to complex equity partnerships—and how to piece them together for the win.

This guide is that game plan.

Unlocking Your Real Estate Investment Potential

Let's be honest, figuring out real estate financing can feel like you're trying to solve a Rubik's Cube in the dark. This is especially true if you're a syndicator trying to buy bigger and better properties. The real challenge isn't just about finding the money. It's about structuring it smartly when interest rates are all over the place and lenders are looking at every deal under a microscope.

Getting a firm grip on the entire "capital stack"—every layer of financing in a deal—is no longer a "nice-to-have." It's a must-have skill for staying in the game and growing your business.

Think of this guide as your field manual. We're going to skip the high-level theory and get right into practical, actionable advice for general partners and anyone serious about investing. You’ll learn how to secure capital, keep your investors happy, and build a business that can weather any storm.

What This Guide Will Cover

My goal here is to give you the strategic thinking you need to become a master at financing your deals. We’ll break down the complicated stuff into simple, practical insights.

Here’s a look at what we’ll get into:

- The Capital Stack Explained: We'll peel back the layers of a deal's financing, from the senior debt that forms the foundation to the common equity that brings the highest risk and reward.

- Essential Underwriting Metrics: You'll learn to talk the talk. We'll master the key numbers like LTV, DSCR, IRR, and equity multiples that lenders and investors live by.

- Diverse Financing Sources: We’ll explore the good, the bad, and the ugly of getting money from banks, private funds, crowdfunding platforms, and your own network of investors.

- Syndication-Specific Tactics: I'll share modern strategies for raising equity, building a loyal investor base, and running your deals like a pro.

By the time you finish reading, you'll have a clear framework you can apply to any deal, big or small. You won't just know how to find the money—you'll know how to structure the financing to boost your returns, protect your downside, and build a lasting real estate portfolio.

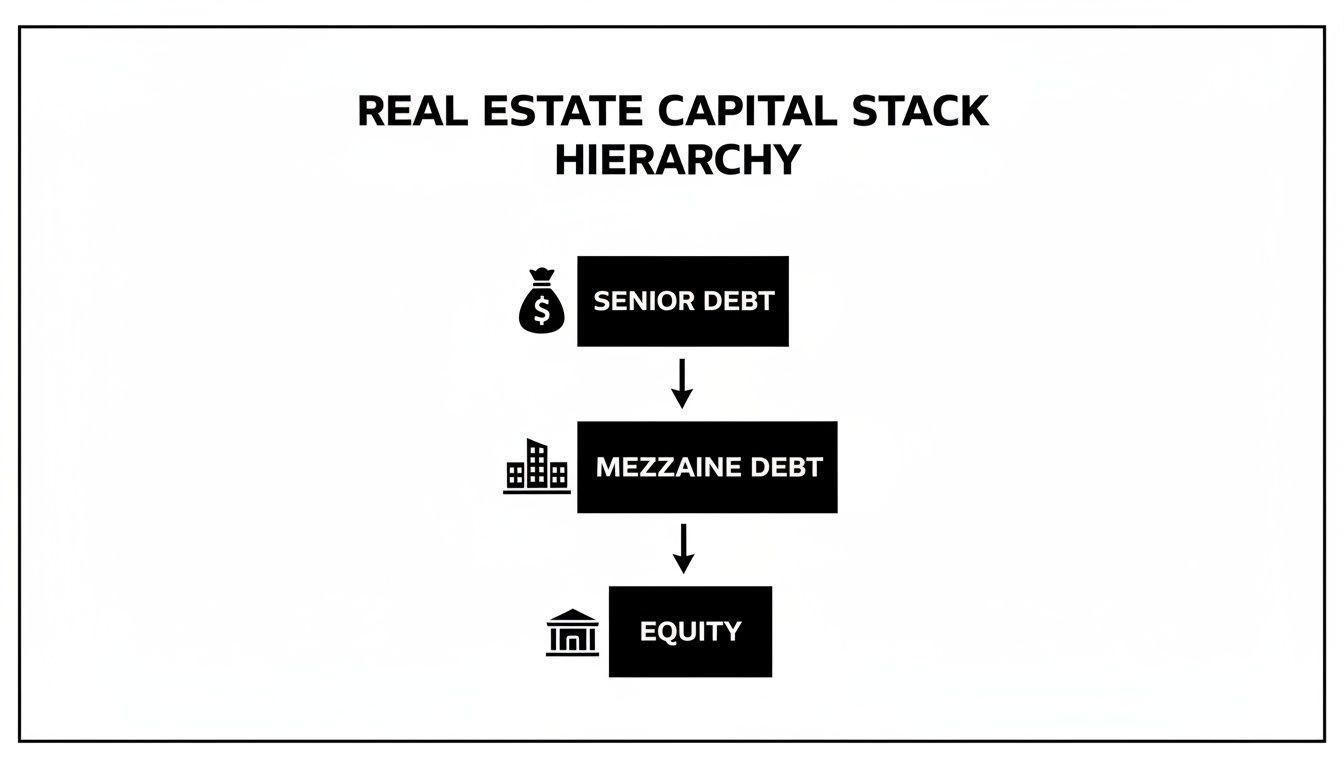

Deconstructing the Capital Stack

Every real estate deal is financed a bit like a skyscraper is built—from the ground up, with different layers serving very specific purposes. This structure is what we call the capital stack. It’s the combination of all the different financing sources used to buy or build a property, all neatly arranged in layers based on their risk and who gets paid back first.

Think of it this way: if a deal goes sideways and the property has to be sold off, the people who provided the capital at the bottom of the stack (the foundation) get their money back first. The investors at the very top (the penthouse) are last in line. This pecking order is everything, as it directly shapes the risk and potential return for each position. Mastering this concept is step one to financing any serious real estate investment.

The Foundation: Senior Debt

At the very bottom of every capital stack, you'll find senior debt. This is the most secure, and therefore the cheapest, money in the deal. It's simply the primary mortgage on the property, usually coming from a bank, credit union, or a major agency like Fannie Mae or Freddie Mac.

Because these lenders are first in line to be repaid in a foreclosure, their risk is incredibly low. This position is the bedrock of the entire deal, typically covering anywhere from 60% to 75% of the property's total cost or value.

The Middle Floors: Mezzanine Debt and Preferred Equity

Moving up the skyscraper, we find the middle layers. This is where things get interesting, as these pieces bridge the gap between what the bank will lend and the cash the sponsor brings to the table. You'll often see these in value-add or development projects where the senior loan just doesn't cover everything.

- Mezzanine Debt: This is a unique hybrid, acting like a loan but with an equity-like kicker. It’s subordinate to the senior mortgage but sits above all the equity investors. Instead of being secured by the property itself, a "mezz" loan is secured by the ownership shares of the LLC that owns the property. If the borrower defaults, the mezzanine lender can foreclose on those shares and take control of the project. It's a powerful tool.

- Preferred Equity: This isn't a loan at all, but an equity investment with special privileges. "Pref" equity investors are promised their return before the common equity investors see a single dollar. They usually get a fixed, cumulative return (a "pref") and sometimes a small piece of the profits on top. If the deal gets into trouble, they often have the right to step in and take over management.

Key Takeaway: Both mezzanine debt and preferred equity are used to fill a funding gap. The real difference is legal: one is a debt instrument with foreclosure rights on the company, while the other is an equity position with special control rights.

For a deeper look at how these layers fit together, our guide on the https://www.homebasecre.com/posts/real-estate-capital-stack breaks it down even further.

The Penthouse: Common Equity

Finally, at the very top of the capital stack, we have common equity. This is the classic high-risk, high-reward position. This is the money put in by the deal sponsors (the General Partners or GPs) and their passive investors (the Limited Partners or LPs).

These are the last folks to get paid when the property is sold or refinanced, and they are the first to lose their investment if the deal fails. The trade-off? Their upside is theoretically unlimited. After every other layer of the capital stack has been paid what they're owed, the common equity holders get to split all the remaining profits. A key part of managing this risk is understanding leverage, and a great starting point is properly calculating the Debt to Equity Ratio.

Comparing Capital Stack Components

To really see how this works in practice, it helps to put the pieces side-by-side. The table below compares the primary financing layers, showing how their position, cost, and risk all relate to one another.

As you move up the stack from senior debt to common equity, you can clearly see the cost of capital climb in direct proportion to the risk being taken. A savvy syndicator knows how to artfully blend these layers, creating a capital structure that funds the project efficiently while still delivering the returns investors expect.

Mastering the Metrics Lenders and Investors Demand

If you want to raise capital, you have to speak the language of the people writing the checks. When you bring a deal to the table, lenders and investors aren't just admiring the property—they're stress-testing your numbers to see if your story holds up. Getting these key underwriting metrics right isn't optional; it's how you prove your deal is a solid investment, not just a hopeful guess.

These numbers are the vital signs of your deal. They tell a clear story about its health, its risks, and its potential for profit. Knowing what they measure, and more importantly, why they matter, is often the difference between a quick "no" and a funded deal.

Gauging Risk with Loan-to-Value (LTV)

The first number any lender looks at is the Loan-to-Value (LTV) ratio. Just think of it as their risk gauge. It’s a simple percentage comparing the loan amount to the property's appraised value.

For instance, if you're buying a building for $1,000,000 and the bank is lending you $750,000, your LTV is 75%.

This tells the lender how much skin you have in the game. A lower LTV means you’re putting more of your own money on the line, which makes them sleep a lot better at night. For most conventional investment property loans, banks will cap the LTV at 75-80%, meaning you'll need to come up with at least 20-25% for the down payment.

Proving Viability with Debt Service Coverage Ratio (DSCR)

While LTV is about the risk at closing, the Debt Service Coverage Ratio (DSCR) is all about the property's ability to pay its own bills month after month. For any lender focused on cash flow, this is arguably the most important metric. It answers one simple question: does this property actually make enough money to cover the mortgage?

The math is pretty straightforward:

DSCR = Net Operating Income (NOI) / Total Debt Service

- Net Operating Income (NOI): This is all your income (rent, fees) minus your operating expenses (taxes, insurance, maintenance).

- Total Debt Service: This is the total of all your mortgage principal and interest payments for the year.

Lenders use metrics like the Debt Service Coverage Ratio (DSCR) to see if the property can support itself. A DSCR of 1.0x is the break-even point—the property generates just enough cash to cover its debt, which is a scenario that makes any lender nervous. That's why most banks want to see a DSCR of at least 1.25x. That 25% cushion means the property has a buffer for surprise vacancies or a broken water heater.

The image above shows how the capital stack is built. The senior debt is the most secure, foundational layer, while the equity at the top takes on the most risk for the chance at the greatest reward.

Attracting Investors with IRR and Equity Multiple

Once you've got the lender on board, you need to convince your equity investors. These partners aren't just looking for the return of their capital; they're focused on the return on it. You'll need two key metrics to tell that story: the Internal Rate of Return (IRR) and the Equity Multiple.

Internal Rate of Return (IRR)

The IRR is the annualized rate of return you expect from the investment. It's a bit more complex because it accounts for the time value of money—the idea that a dollar today is worth more than a dollar tomorrow. An IRR of 20% means the project is forecast to generate an average annual return of 20% over its lifetime, considering every dollar in and every dollar out.

Equity Multiple

The Equity Multiple is much simpler. It answers the question: "How many times will I get my money back?" If an investor puts $100,000 into a deal and gets $250,000 back over the project's life, the Equity Multiple is 2.5x.

Equity Multiple = Total Cash Distributions / Total Equity Invested

Here's the key difference: IRR tells you how fast you make your money, while the Equity Multiple tells you how much you make in total. Experienced investors always look at both. A quick flip might have a high IRR but a low Equity Multiple, whereas a long-term hold could have a more modest IRR but a much bigger multiple. Presenting both gives investors the full picture.

Where to Find the Money: A Guide to Financing Sources and Deal Structures

Knowing what the capital stack is and knowing where to actually find each slice of it are two completely different things. When it's time to fund your deal, you're stepping into a world filled with different kinds of money providers, and each one plays by its own rules, has a different tolerance for risk, and moves at its own pace. The real skill is matching your deal to the right source.

Think of it this way: the world of real estate capital is much bigger than just the bank down the street. You’ve got everything from slow-and-steady insurance companies to nimble private funds. The trick is to align your project’s specific needs—whether that’s speed, cost, or flexibility—with the right partner. Let’s break down who the main players are and where they fit into your financing puzzle.

Mapping the Capital Landscape

Not all money is created equal. The traditional bank that’s happy to offer you low-cost senior debt on a stabilized, cash-flowing apartment building is almost certainly the wrong place to go for a quick-turnaround renovation project. This is where understanding what motivates different capital sources becomes your secret weapon.

Here are the main players you’ll run into:

- Traditional Banks and Credit Unions: These guys are the foundation of real estate finance. They provide the lion's share of senior debt, and because of that, they offer the lowest cost of capital. The trade-off? They're conservative, with tough underwriting standards and longer closing times. They are the perfect fit for stabilized properties with predictable income.

- Life Insurance Companies: Often just called "life cos," these institutions are extremely risk-averse and are hunting for stable, long-term returns. They love financing high-quality, "trophy" assets with blue-chip tenants, and in return, they offer some of the most competitive long-term, fixed-rate loans you can find.

- Private Equity and Debt Funds: This is where things get more interesting. These are specialized funds that raise money from big institutions and wealthy individuals. They are much faster and more flexible than banks, and they’re willing to fund value-add projects, provide bridge loans, and even fill the gaps with mezzanine or preferred equity. That speed and flexibility, of course, come at a higher price.

- Crowdfunding Platforms: A newer player on the scene, online platforms like CrowdStreet or RealtyMogul pool money from a large group of accredited investors. They can be a fantastic source for both debt and equity, especially for sponsors who are still building out their personal network of investors.

Strategic Deal Structuring in Action

The real craft of real estate finance is in how you structure the deal. It's not just about finding one lender. It’s about creatively combining different types of capital to perfectly suit your business plan.

Let's walk through a real-world example. Imagine you’ve found a C-class multifamily property that's only 50% occupied and needs a major overhaul. A traditional bank will take one look at the current numbers and show you the door—the property isn't generating enough cash to cover the debt payments.

This is where you have to get creative.

Scenario: The Value-Add Multifamily Reposition

Instead of going to a bank, you approach a private debt fund for a bridge loan. This is a short-term, higher-interest loan that covers both the purchase price and your renovation budget. Crucially, it’s "interest-only," which keeps your monthly payments low while you get to work.

Over the next 18 months, you execute your plan: you renovate the units, bring in new tenants, and stabilize the property's income. Now, with a fully leased and cash-flowing asset, you can walk right back to a traditional bank and refinance that expensive bridge loan with cheap, long-term senior debt. You pay off the bridge lender, return capital to your investors, and hold a stabilized, profitable asset.

Matching Capital to What's Happening Now

Smart financing also means keeping an eye on market trends. Capital always follows opportunity, and right now, there's a huge focus on sectors getting a boost from technology. For instance, data centers have shot to the top of the list for real estate investment globally, all thanks to the explosive growth of AI. This has created a flood of financing for these assets and the energy infrastructure needed to run them.

Global power demand from data centers is expected to jump 21% this year alone. That’s a perfect example of how quickly capital pivots to support high-growth sectors. If you want to dig deeper, you can explore more about these global real estate trends and what they mean for financing in recent industry reports.

At the end of the day, mastering financing is about knowing all your options and figuring out how to piece them together creatively. Whether you're using a bridge loan to turn around an apartment complex or layering in preferred equity to reduce how much cash you need to bring to the table, the right structure can turn a deal that looked impossible into a home run.

Preparing Your Deal for a Successful Fundraise

If there's one secret to successfully financing a real estate deal, it's this: meticulous preparation. Before you even think about approaching a lender or an investor, you need to have your entire deal packaged and ready to go. You’re not just asking for money; you’re building an ironclad case for why your project is the one they should back.

A polished, comprehensive investment package immediately signals that you're a sophisticated operator who has done their homework. In a competitive environment where capital providers see dozens of deals a week, this is often the single biggest differentiator. Your job is to make it incredibly easy for them to say "yes."

This level of preparation is more important than ever. After a period where high interest rates put a damper on things, the market is picking up steam again. Global private real estate transaction volumes hit $739 billion over the last year, a 19% jump from the year before. That surge means more competition for capital, so a standout presentation is non-negotiable. You can find more great insights on current real estate investment trends on Nuveen.com.

Assemble Your Investment Package

Think of your investment package as the resume for your deal. It’s the collection of documents that tells the complete story—from the 30,000-foot view down to the nitty-gritty financial details. A sloppy or incomplete package is the fastest way to the "no" pile.

Your package needs to be professional, easy to follow, and genuinely compelling. It should be built to answer questions before they're even asked, building your credibility with every page.

Key Components of a Winning Deal Package

To make your deal irresistible, you need to include a few critical elements. Each one serves a purpose, working together to prove your deal’s viability and your competence as the sponsor.

- The Executive Summary: This is your one-page elevator pitch. It needs to grab their attention by concisely outlining the opportunity, property details, business plan, and projected returns. If this page doesn't hook them, they won't read the rest.

- Detailed Pro Forma: Here's the financial heart of the deal. This is a multi-year forecast that models all income, expenses, capital improvements, and debt service. Crucially, you must clearly state every assumption you've made, from rent growth and vacancy rates to expense inflation. Transparency is key.

- Business Plan: The numbers only tell half the story. The business plan explains how you're going to hit those numbers. Detail your value-add strategy, introduce your team, and explain what makes this a unique opportunity in this specific market.

- Due Diligence Documents: Get all your ducks in a row. This means compiling the current rent roll, trailing 12-month (T12) financial statements, property photos, and any third-party reports you have, like an appraisal or environmental site assessment.

Pro Tip: Don't just throw a spreadsheet at them. Use charts and graphs to visually represent key trends, like projected NOI growth or cash flow over the hold period. A well-organized, visually appealing package is far more likely to be read, understood, and funded.

When you assemble these materials thoughtfully, you’re doing more than just asking for a check. You’re showing potential partners that you're a detail-oriented professional they can trust with their capital. This approach not only gets your deal funded but also lays the groundwork for a strong, long-term relationship.

Modern Tactics for Raising Investor Equity

As a syndicator, your success often boils down to one thing: your ability to raise equity from private investors. This is where the rubber meets the road. It’s a delicate dance of building genuine relationships and executing flawlessly on the back end. The days of clunky spreadsheets and chasing down investors with endless emails are over. Today, it’s all about building trust at scale with clear communication and a professional, tech-forward process.

The heart of any good fundraising operation is your investor database. Think of this not as a static list of names, but as a living, breathing community. You cultivate this community by consistently providing value—sharing market insights, deal updates, and educational content. This is how you warm up a contact list and turn it into a group of engaged partners who are ready to jump on the right deal when it comes across their desk.

Mastering the Legal and Communication Framework

Before you even think about accepting a single dollar, you absolutely must get your legal house in order. A real estate syndication is a securities offering, which means it falls under specific regulations that require ironclad legal documents. This isn't the place to cut corners; doing so is a recipe for disaster that can put you and your investors at serious risk.

These two documents are the bedrock of your offering:

- Private Placement Memorandum (PPM): This is your deal's bible. It’s a comprehensive disclosure document that lays out everything an investor needs to know—the business plan, property details, potential risks, and the specific terms of the investment.

- Subscription Agreement: This is the official, legally binding contract between you (the sponsor) and your investor. It's the document they sign to formally commit their capital and confirm their accreditation status.

Once the legal framework is solid, your attention pivots to communication. In the world of private equity, trust is the only currency that matters. Your investors need to feel confident, and that confidence is built through clear, consistent, and transparent communication. That means sending out regular updates, being available to answer tough questions, and presenting your deal with professional materials that are easy to digest.

Using Technology for a Seamless Investor Experience

The most significant change in how capital is raised today is the shift away from manual, administrative-heavy processes. Technology has completely changed the game for how sponsors manage investor relations, making the entire journey smoother for everyone involved. The right platform isn't just an expense; it’s a powerful tool that fuels growth.

The old way of raising capital—tracking commitments on a spreadsheet, emailing PDFs for signatures, and mailing paper checks—is more than just inefficient. To a sophisticated investor, it screams that you might not be a sophisticated operator.

Modern syndicators rely on specialized platforms to create a seamless, professional experience from start to finish. This approach automates the grunt work and professionalizes every touchpoint.

- Professional Deal Rooms: Imagine a secure, branded online portal where investors can log in to review the PPM, watch your deal webinar, and access all documents in one organized place.

- Streamlined Commitments: Investors can make soft commitments or finalize their investment directly through the portal, which massively simplifies the chaotic final days of a fundraise.

- Automated Accreditation: The platform can handle the crucial compliance step of verifying an investor's accredited status, taking that burden off your plate.

- E-Signatures and Document Management: Subscription agreements and other paperwork are signed with secure e-signatures, ending the nightmare of chasing down physical documents.

- Investor Communications: From one central dashboard, you can send out professional updates, distribute K-1s, and process ACH distributions.

By adopting these modern tools, you project a level of professionalism that builds incredible trust. It shows investors that you respect their time and their capital, which not only helps you close the deal in front of you but also lays the groundwork for the long-term relationships you'll need for every deal that follows.

Got Questions About Financing? We've Got Answers.

When you're deep in the trenches of real estate investing, the same practical questions tend to pop up again and again. It doesn't matter if you're a seasoned syndicator orchestrating your tenth deal or a new investor just getting started—getting these details right can be the difference between a home run and a costly mistake.

Here are some straightforward answers to the questions we hear most often from sponsors.

Preferred Equity vs. Mezzanine Debt: What's the Real Difference?

It's easy to get these two mixed up. Both preferred equity and mezzanine debt live in that middle ground between your main bank loan (senior debt) and your own cash (common equity). But how they work and the risks they carry are worlds apart.

Think of mezzanine debt as a loan, but instead of being secured by the property itself, it’s secured by the ownership of the company that holds the property. If you default, the mezz lender can swoop in, foreclose on your ownership stake, and take control of the entire deal. It's powerful leverage, but it comes with serious teeth.

Preferred equity, or "pref," isn't a loan at all—it's an equity stake with VIP rights. Pref investors get a guaranteed, fixed return and get paid out before you and your common equity investors see a single dollar of profit. If things go south, they don't foreclose; instead, their agreement usually gives them the power to kick you out of the driver's seat and take over management.

So, the choice is yours: mezzanine debt adds leverage with the risk of foreclosure, while preferred equity brings in a partner who gets paid first and can take the wheel if you stumble.

Fixed-Rate vs. Floating-Rate Loans: How Do I Decide?

This one really boils down to your game plan for the property and how much uncertainty you can stomach.

A fixed-rate loan is all about stability. Your interest rate is locked in for the life of the loan, period. This is the go-to choice for stabilized properties that are already churning out consistent, predictable cash flow. You're essentially buying insurance against rising interest rates.

On the other hand, a floating-rate loan moves with the market, tied to a benchmark index. You'll typically see these on short-term deals, like a bridge loan for a value-add project. The strategy is to get in, renovate, stabilize the income, and then either sell or refinance into a long-term fixed-rate loan before rates can move against you. You might get a lower rate out of the gate, but you’re shouldering the risk that a rate spike could blow up your pro-forma.

What Are the Biggest Mistakes Sponsors Make When Raising Capital?

Even the pros can trip up when they're in front of lenders and investors. Steering clear of these common pitfalls is absolutely critical if you want to successfully finance your real estate deals.

- A Half-Baked Investment Package: Nothing screams "amateur" like a sloppy presentation with flimsy, back-of-the-napkin assumptions. Lenders and investors will assume you’ll manage their money with the same lack of care. This is the fastest way to get a "no."

- Forgetting the "Why": People don't just invest in a building; they invest in a business plan. You need a compelling story. Why is this property a great opportunity right now? And more importantly, how are you the right person to execute the vision?

- The Wrong Tool for the Job: Showing up to a lender and asking for the wrong kind of capital is a major red flag. If you're asking for a long-term, fixed-rate loan for a quick fix-and-flip project, it signals you don't understand the fundamentals of financing.

- Going Silent on Investors: Communication is everything. Failing to be clear, professional, and transparent during the fundraising process kills trust. It makes potential investors nervous and can grind your equity raise to a halt.

Ready to stop wrestling with spreadsheets and start building stronger investor relationships? At Homebase, we provide an all-in-one platform designed to take the busywork out of real estate syndication. Streamline your fundraising, manage investor relations, and close deals faster. Learn more about how Homebase can help you scale your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.