Real Estate Capital Stack: Smart Investment Moves

Real Estate Capital Stack: Smart Investment Moves

Use the real estate capital stack to boost returns. Learn strategies to invest smartly and manage risk.

Domingo Valadez

Mar 28, 2025

Blog

Navigating the Real Estate Capital Stack: A Foundation

The real estate capital stack is the underlying structure of real estate project financing. This hierarchical framework dictates the financial arrangement, outlining how funds are raised and how returns are distributed among the involved parties. It essentially defines who gets paid what, when, and the risks each party takes on. This structure is crucial for all real estate projects, from small renovations to large developments.

Understanding the Layers

The capital stack can be visualized as a layer cake, with each layer representing a different financing source. The most secure layer, at the bottom, is senior debt. This debt is typically provided by traditional lenders like banks and usually makes up the largest percentage of the financing. Above senior debt are mezzanine debt and preferred equity, offering a balance of risk and return. These hybrid options bridge the gap between debt and pure equity. At the top, representing the highest risk and highest potential return, is common equity.

Debt vs. Equity: A Balancing Act

The real estate capital stack balances debt and equity to create an optimized financial structure. A typical structure often combines debt and equity to achieve this balance. Senior debt commonly covers 70-80% of project costs, mezzanine debt covers 5-15%, and equity covers the remaining 5-10%.

As an example, a $200 million development could be financed with $140 million in senior debt, $20 million in mezzanine debt, and $40 million in equity. This balanced approach allows developers to manage risk and maximize potential returns for investors across the capital stack. The specific ratios depend on market conditions, project risk, and the developer’s equity contribution. Learn more about how these pieces fit together: Learn more about capital stack structure

This blended approach is critical for risk management and return maximization. Debt provides leverage, amplifying potential returns for developers, while equity acts as a cushion against potential losses. A well-structured capital stack aligns all parties' interests, contributing to project success.

Importance for Investors

Understanding the real estate capital stack is crucial for investors. This knowledge enables them to evaluate the risk-return profile of different investment opportunities and make well-informed decisions. By understanding the details of each layer, investors can strategically position themselves for both downside protection and upside potential. This allows investors to align their investments with their specific risk tolerance and financial goals. A thorough understanding of the real estate capital stack empowers investors to identify potentially profitable opportunities and build a diversified investment portfolio. In the following sections, we'll explore each layer of the capital stack in detail, examining their characteristics, benefits, and risks.

Senior Debt: The Safety-First Layer That Drives Projects

Senior debt is the foundation upon which most real estate projects are built. This essential financing layer makes projects feasible and provides stability for all involved. It's often considered the "safe" investment within the real estate capital stack.

Understanding the Role of Senior Lenders

Senior lenders, typically banks or life insurance companies, prioritize preserving their capital. They conduct thorough underwriting processes to assess key risk factors. These include the borrower's creditworthiness, the property's value, and the overall project feasibility.

This meticulous approach allows them to minimize risk and confidently invest capital. Their returns typically come from fixed or, more commonly, floating interest rates.

This emphasis on security benefits the stability of the entire capital stack. A strong senior debt position, with favorable terms, can attract additional investment in the mezzanine and equity layers, ensuring full project funding.

Loan-to-Value (LTV) Ratios and Market Cycles

A critical aspect of senior debt is the loan-to-value (LTV) ratio. This figure represents the percentage of the property's value that the lender is willing to finance. LTV ratios shift with market cycles.

In thriving markets, lenders may offer higher LTVs, reflecting greater confidence in property values. Conversely, during market downturns, LTVs typically decrease as lenders exercise more caution.

Understanding these fluctuations is essential for borrowers. Strategic borrowers anticipate these shifts and plan their financing based on current market conditions. They also recognize the importance of negotiating favorable terms like lower interest rates and flexible repayment schedules.

Senior Debt's Importance in Project Financing

Within the real estate capital stack, senior debt usually funds approximately 75% of a project’s total cost. This makes it a significant component of the overall financing structure. Because it's secured by a mortgage on the property, senior debt is considered the most secure investment. Lenders have first priority on payouts if the property generates cash flow.

Due to its lower risk profile, senior debt lenders receive lower interest rates, often between 4% and 8% annually. This rate depends on current market conditions and project-specific factors. Because senior debt is prioritized for repayment, it's a more stable investment compared to other layers of the capital stack.

For example, in a $100 million project, senior debt might secure $75 million, forming the foundation of the project’s financing. Explore this topic further.

Why Investors Choose Senior Debt

Despite lower returns compared to other layers, senior debt remains attractive to many investors. This is due to its lower risk and predictable income stream. Institutional investors often favor senior debt to balance their portfolios and provide a stable return.

This consistency can be particularly valuable in volatile market conditions. Sophisticated investors use senior debt to enhance overall portfolio performance. They may diversify their holdings with it, reducing overall risk exposure while maintaining a steady income component. The predictable cash flow from senior debt can also provide a stable base for more aggressive investments in other asset classes.

Navigating Interest Rate Changes

Understanding how fluctuating interest rates impact senior debt is critical. Rising interest rates can increase borrowing costs, affecting project feasibility and potentially reducing returns.

Astute investors anticipate these changes and adapt their strategies. They might seek fixed-rate loans to lock in borrowing costs or explore alternative financing options.

Mezzanine & Preferred Equity: The Versatile Middle Ground

Real estate financing involves a complex structure known as the capital stack. Within this structure, mezzanine debt and preferred equity occupy a unique middle ground between senior debt and common equity. These hybrid instruments offer a flexible way to bridge funding gaps and tailor investments to specific risk-return profiles. While often misunderstood, savvy developers and investors frequently use them to optimize their real estate deals.

Bridging the Gap: How Mezzanine and Preferred Equity Work

These middle layers of the capital stack play a vital role in project financing. Imagine a developer secures senior debt covering 70% of the project cost. They might still need additional funds before turning to common equity. This is where mezzanine debt or preferred equity steps in, providing the necessary capital to move the project forward.

Mezzanine debt resembles traditional debt in its structure, featuring scheduled interest payments and principal repayment. However, its position subordinate to senior debt in the capital stack increases the risk for mezzanine lenders. In a default scenario, senior debt takes priority, leaving mezzanine lenders further down the repayment line. This added risk is typically reflected in a higher interest rate compared to senior debt.

Preferred equity, also subordinate to senior debt, represents an equity investment, not a loan. Preferred equity investors receive a fixed preferred return, often paid before distributions to common equity holders. Unlike common equity, preferred equity generally doesn't share in the property's appreciation beyond a predetermined limit.

Key Differences: Mezzanine Debt vs. Preferred Equity

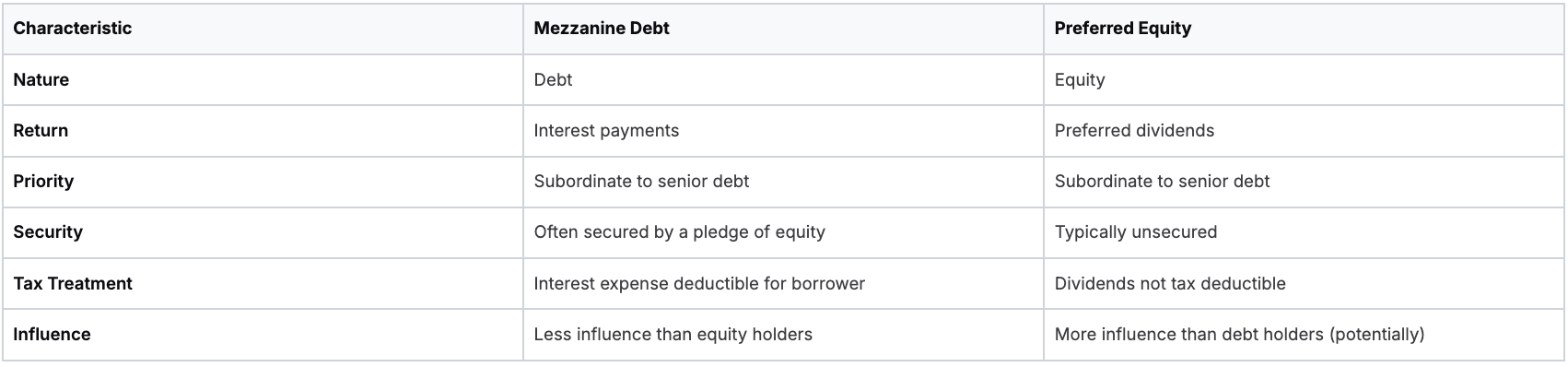

While both mezzanine debt and preferred equity reside in the middle layer of the real estate capital stack, crucial legal distinctions set them apart. These differences influence an investor's choice between the two options. The following table summarizes key characteristics:

To better understand the nuances between mezzanine debt and preferred equity, let's examine a detailed comparison.

As this table demonstrates, each instrument offers a distinct combination of risk, return, and control. Mezzanine lenders, prioritizing interest income, often emphasize security. Preferred equity investors, seeking potential returns and some appreciation, may accept less security for greater influence over project decisions.

Structuring, Pricing, and Negotiating

The terms of mezzanine debt and preferred equity are highly negotiable, depending on the specific project and prevailing market conditions. Security mechanisms, intercreditor agreements, and covenant packages play a critical role in these negotiations. Carefully structured agreements can align all parties' interests, promoting both debt repayment and project success.

A mezzanine lender might negotiate for warrants (options to buy equity) along with their debt, providing potential upside participation. Preferred equity investors could negotiate for board seats or other control mechanisms to align the project with their investment goals.

Performance and Workouts

Understanding how these middle layers perform in both successful and distressed scenarios is essential. In successful projects, mezzanine lenders receive their agreed-upon interest, and preferred equity investors receive their preferred return and potentially additional upside.

However, if a project encounters challenges, these middle layers face greater risk than senior debt. During workouts (restructuring distressed projects), mezzanine lenders and preferred equity investors navigate complex negotiations to minimize losses and potentially recover their investment.

Common Equity: Where Real Wealth Is Created

Common equity sits at the top of the real estate capital stack. While this position presents the highest risk, it also offers the greatest potential reward. In the world of real estate development, this is where significant fortunes are made—and sometimes lost.

Evaluating Opportunities: An Equity Investor's Perspective

Equity investors evaluate opportunities differently than debt providers. Debt providers prioritize predictable cash flow and strong collateral, focusing primarily on loan repayment. Equity investors, on the other hand, seek capital appreciation and long-term growth.

Equity investors carefully analyze market trends, assess a property's potential, and evaluate the overall development vision. The experience and expertise of the development team are also key considerations. Their goal isn't just stable income; it's to significantly increase the property's value over time. This requires a deep understanding of a project's long-term potential and its ability to generate substantial returns upon sale or refinancing.

Waterfall Distributions and Control Mechanisms

Savvy equity investors utilize waterfall distributions to align the interests of all parties. A waterfall distribution dictates how profits are shared among investors after the project achieves specific performance benchmarks.

This structure incentivizes the developer to maximize project returns, ultimately benefiting all equity holders. Control mechanisms are also essential. These mechanisms protect investor interests and provide project oversight.

Control mechanisms can include board representation, approval rights for major decisions, and regular performance reporting. This ensures investors have a voice in the project's direction and management.

The equity portion of the capital stack, encompassing both preferred and common equity, is essential for providing the risk capital necessary to propel real estate projects forward. Preferred equity investors typically receive a preferred return before common equity holders, but their investment still carries more risk than debt. Common equity investors, bearing the highest risk, stand to gain substantial returns through capital appreciation. For example, in a $25 million equity investment split between preferred and common equity, the $10 million preferred equity portion might receive a priority return of 8%. The remaining $15 million in common equity would then target higher potential returns linked to the project’s overall performance. This structure attracts a diverse range of investors with varying risk tolerances. Find more detailed statistics here: Champagne Inc. Capital Stack

Managing Risk and Maintaining Conviction

Equity investing requires a thorough understanding of market cycles and the ability to manage risk effectively. Experienced equity investors analyze various scenarios, anticipate potential challenges, and implement strategies to mitigate downside risk.

However, managing risk doesn’t equate to avoiding it entirely. Equity investing inherently involves calculated risks to achieve potentially outsized returns. Successful equity investors maintain conviction in their investment thesis, even in challenging markets. They adapt to changing conditions while remaining focused on the project’s long-term potential.

Equity Structures: Joint Ventures and Crowdfunding

Different equity structures cater to various investor profiles and project types. Joint ventures represent a traditional approach where two or more parties combine resources and expertise for a real estate project, sharing both risks and rewards.

Crowdfunding, a more recent approach, allows developers to raise capital from numerous smaller investors via online platforms. This democratizes access to real estate investment, enabling individuals to participate in larger-scale projects. Choosing the right structure depends on factors like project size, investor preferences, and regulations. Understanding these nuances is crucial for informed decision-making.

Mastering Risk-Return Across the Capital Stack

This section moves beyond the theoretical structure of the real estate capital stack and explores its practical application and performance across different market cycles. By analyzing historical data and real-world investment outcomes, we can uncover the true risk-adjusted returns delivered by different positions within the stack. We'll also explore how experienced investors strategically blend positions across multiple layers to achieve specific portfolio objectives.

Economic Conditions and Their Impact

The real estate market is constantly in flux, influenced by fluctuating interest rates, credit availability, and property fundamentals. This dynamic environment creates both challenges and opportunities for investors across the capital stack. Understanding how economic conditions impact each layer of the stack is crucial for making informed investment decisions.

For example, during periods of economic expansion and low interest rates, senior debt becomes more readily available, often with higher loan-to-value ratios. This allows developers to leverage more debt and potentially boost returns for equity investors. However, in a downturn, lenders become more cautious, tightening lending standards and potentially reducing loan amounts. This can put pressure on projects and impact returns across all layers of the capital stack.

What happens when projects underperform? The equity layer typically absorbs the initial losses, acting as a cushion for debt holders. However, significant losses can cascade down the capital stack, impacting mezzanine debt and even senior debt holders in extreme cases.

Recognizing Warning Signs and Adapting Strategies

Savvy investors continuously monitor market conditions and watch for warning signs within each capital position. These warning signs can include declining property values, increasing vacancy rates, rising interest rates, or a weakening economy.

Recognizing these signs allows investors to adjust their investment approach proactively. For example, in a rising interest rate environment, investors may shift their focus from floating-rate debt to fixed-rate debt to lock in borrowing costs and protect themselves from future rate hikes. Similarly, if property fundamentals are weakening in a specific market, investors may reduce their exposure to common equity in that market and explore opportunities in more stable sectors.

Practical Investment Scenarios and Portfolio Objectives

Let's consider how investors can use the capital stack to achieve specific portfolio objectives. An investor seeking stable income and lower risk might focus on senior debt positions. While the potential returns are lower, the consistent income stream and lower risk profile make it a suitable choice for conservative investors.

An investor targeting higher returns with a greater risk tolerance might allocate a larger portion of their portfolio to common equity. This position offers the potential for significant upside, aligning with the goals of growth-oriented investors.

Experienced investors often combine positions across the capital stack to achieve a balanced portfolio. They might blend senior debt, mezzanine debt, and common equity to diversify risk and optimize returns.

To understand the various risk and return characteristics associated with each layer of the capital stack, let's examine the following table:

This table illustrates the general risk-return profiles across different layers of the real estate capital stack. By understanding these dynamics, investors can better position themselves for success in any market environment. For real estate sponsors looking to streamline their operations, consider exploring platforms like Homebase. These platforms can simplify deal management, investor relations, and fundraising, allowing sponsors to focus on maximizing returns across the capital stack.

Capital Stack Strategies That Win in Any Market

The real estate capital stack is a dynamic structure. Smart investors know they need to adjust their approach to it as market conditions fluctuate. By looking at winning strategies from the past, we can discover practical approaches for positioning within the real estate capital stack, no matter the current market cycle.

Adapting to Market Dynamics

Savvy real estate investors know the importance of shifting their capital strategies when market conditions change. This means responding to changes in interest rates, tightening credit markets, and shifts in property fundamentals.

For example, when interest rates rise, borrowing costs increase, affecting projects that rely heavily on debt. In these situations, investors might prioritize deals with less leverage or consider other financing options like mezzanine debt or preferred equity. For more on raising capital, check out this helpful guide: How to Master Real Estate Capital Raising. Also, when credit markets tighten, securing financing becomes more difficult. Investors may have to increase their equity contributions or focus on projects with strong pre-leasing or pre-sales to ease lender concerns.

Evaluating Risk-Return Profiles

A key skill in navigating the capital stack is evaluating the best risk-return profile for each layer in different markets. In a strong market with solid property fundamentals, investors may be more open to higher risk in the common equity layer, aiming for big returns from property appreciation.

However, during a downturn or uncertain times, focusing on the lower-risk layers of the capital stack, like senior debt, becomes more attractive. This protective approach preserves capital and offers a steady income, even if property values fall. The goal is to align the chosen layer of the capital stack with the investor’s risk tolerance and the current market conditions.

Identifying Early Warning Signs

Successful real estate investors are skilled at spotting early signs of market shifts. These signs depend on the market and property type. Common indicators include declining rental rates, rising vacancy rates, slowing sales activity, or an increase in distressed properties.

Recognizing these signs early lets investors proactively adjust their capital stack strategies. They might decrease exposure to certain property types or locations, boost equity positions in stable markets, or explore other investment strategies.

Creative Capital Structuring and Optionality

Maintaining optionality while minimizing downside risk is a sign of a sophisticated real estate investor. This involves structuring deals with built-in flexibility and backup plans to adapt to market changes. One approach is to incorporate contingent equity or performance-based incentives that benefit everyone involved. For example, a developer could offer a larger share of profits to investors if the project outperforms certain benchmarks. This attracts investors while reducing downside risk.

Another strategy involves creative financing like participating debt or convertible debt. These blend debt and equity, providing downside protection with potential upside gains. By strategically combining capital stack layers and including flexible terms, investors can optimize returns and lessen potential losses, regardless of market conditions.

Ready to improve your real estate syndication process? Check out Homebase, an all-in-one platform to simplify fundraising, investor relations, and deal management.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.