Definition mezzanine loan: A Guide to Hybrid Financing - definition mezzanine loan explained

Definition mezzanine loan: A Guide to Hybrid Financing - definition mezzanine loan explained

Explore the definition mezzanine loan and how it sits in the capital stack. Learn when to use this hybrid financing to bridge gaps and grow portfolios.

Domingo Valadez

Dec 30, 2025

Blog

A mezzanine loan is a unique type of financing that’s part debt, part equity. Think of it as the strategic middle layer of funding that sits between a traditional bank loan and your own cash, bridging the gap to get a real estate deal over the finish line.

Understanding the Mezzanine Loan Definition

To really get what a mezzanine loan is, it helps to picture a real estate deal’s funding structure like a high-rise building. The senior debt—your primary mortgage from a bank—is the solid foundation. It's the biggest, most secure piece of the financing puzzle. At the very top is the penthouse: the common equity, which is your skin in the game and your investors' capital.

Mezzanine financing builds out the crucial floors in between. It's a form of subordinate debt, meaning the mezzanine lender only gets paid back after the senior lender is made whole. Because this position is riskier than a standard mortgage, mezzanine lenders charge higher interest rates, often somewhere in the 9% to 20% range.

Bridging the Funding Gap

Real estate sponsors and syndicators often turn to mezzanine loans when their senior loan and equity contributions just aren't enough to cover the total project cost. Mezzanine loans are a critical layer in the real estate capital stack, specifically designed to fill funding gaps.

By definition, this hybrid financing acts as subordinate debt. It comes into play when the senior mortgage taps out, which usually happens around a 55-65% loan-to-value (LTV). For more background on how different entities, like REITs, can act as mezzanine lenders, there's some great information available from legal experts like Frost Brown Todd.

The main job of a mezzanine loan is to increase your leverage and cut down on the amount of cash equity you, the sponsor, need to bring to the table. This lets you keep more ownership and, hopefully, boost the returns for your investors.

A Quick Comparison

To see where mezzanine financing really fits, it helps to compare it directly against the other main layers of the capital stack. This table breaks down its unique role.

Mezzanine Loan vs Senior Debt vs Common Equity

As you can see, each layer has a distinct risk profile, cost, and set of rights. The mezzanine loan occupies a crucial middle ground, offering a powerful tool for sponsors who know how to use it effectively.

Where Mezzanine Loans Fit in the Capital Stack

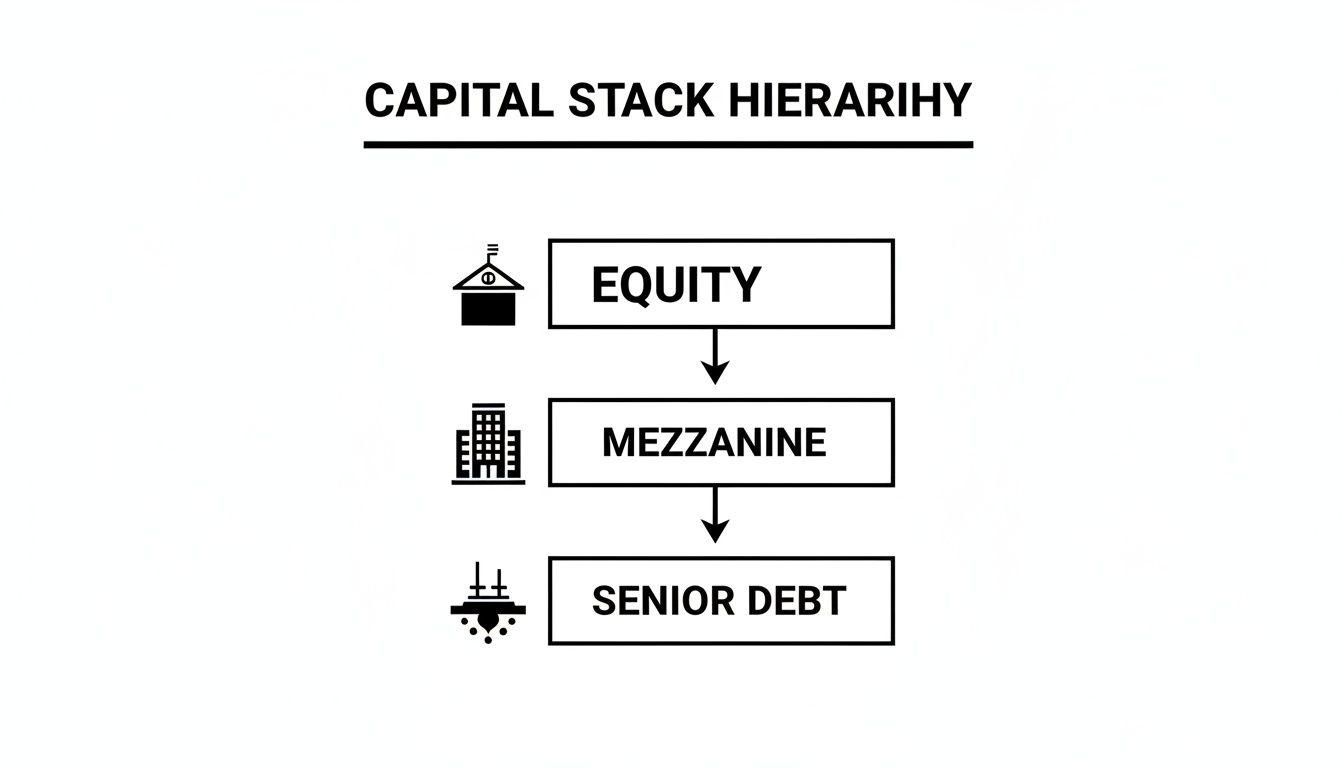

To really get your head around what a mezzanine loan is, you have to see where it lives in a deal's financial structure. We call this the capital stack, and it's basically the funding blueprint for any real estate project. Think of it as a layered cake, with each layer representing a different type of money with its own risk profile and repayment priority.

Imagine you're building a tower with blocks. The most stable, heaviest blocks go on the bottom, and the lighter, riskier ones go on top. The capital stack is built the same way—the most secure money sits at the base, and the riskiest capital sits at the very top.

The Pecking Order of Capital

This structure is all about who gets paid first. When cash flow comes in from the property, or when you eventually sell or refinance, there's a strict pecking order. This is often called the "payment waterfall" because money flows down, and each layer has to be completely paid off before the next one gets a single drop.

This visual gives you a clear picture of how it all stacks up.

As you can see, the capital at the bottom—the senior debt—is the safest, which is why it's also the cheapest. As you climb the stack, both the risk and the potential return for the lender or investor go up.

Breaking Down the Layers

Let’s walk through each piece of the stack, starting from the bedrock and working our way up.

- Senior Debt: This is the foundation. It's the main mortgage you get from a bank, and it's secured by a first-lien position on the actual property. In a worst-case scenario, the senior lender gets paid first and has the power to foreclose. It's the safest seat in the house.

- Mezzanine Debt: Now we get to our star player. The mezzanine loan is slotted right above the senior debt, meaning it's "subordinate" to it. Here’s the key difference: it isn't secured by the property itself. Instead, it’s secured by a pledge of the ownership equity in the LLC that owns the property. This riskier position means the lender charges a higher interest rate to make it worth their while.

- Preferred Equity: Moving up another rung, you'll find preferred equity. This is technically an equity investment, not debt, but it comes with a fixed, negotiated rate of return. "Pref" investors get paid after all the debt is handled but before the common equity investors see any profits.

- Common Equity: Welcome to the penthouse. This is the sponsor's and investors' own cash in the deal. As the last in line to get paid, common equity holders take on the most risk. But they also get the biggest reward—they capture all the remaining profits after everyone else has been paid. For a more detailed look, check out our full guide to the real estate capital stack.

By agreeing to be second in line for repayment, the mezzanine lender is taking on significantly more risk than the senior lender. In return for that risk, they command a much higher return, which often comes from a mix of cash interest and other perks that boost their overall yield.

For a syndicator, this is where the magic happens. A well-placed mezzanine loan can take your total leverage from the standard 65% LTV all the way up to 85-90%. This is a game-changer. It means you have to raise far less equity from investors, which can make the difference between getting a deal done and watching it fall apart.

Decoding the Mezzanine Loan Term Sheet

When you get a mezzanine loan term sheet, you're not just looking at a piece of paper—you're reading the playbook for a critical part of your capital stack. This document is where the lender spells out everything, from the interest rate you'll pay to what happens if the project doesn't go exactly as planned.

For a real estate syndicator, getting these terms right is non-negotiable. It's the difference between a deal that propels you forward and one that puts your entire equity position in jeopardy. Let's break down what you'll find inside.

Core Financial Terms You Must Know

The financial terms are the engine of the deal. They directly impact your cash flow, your project's profitability, and the lender's ultimate return. Misunderstanding these can lead to some very expensive lessons.

Here are the key financial metrics you’ll be negotiating:

- Interest Rate: Don't expect senior debt pricing here. Mezzanine rates are higher to compensate for the added risk. You'll typically see a blended rate made up of two pieces: a cash interest portion paid monthly and a Payment-In-Kind (PIK) portion. PIK interest isn't paid in cash; it just gets tacked onto the loan balance and comes due when the loan matures.

- Loan-to-Value (LTV) and Loan-to-Cost (LTC): Mezzanine lenders care about the combined leverage. A common setup might involve a senior loan at 60% LTV with a mezzanine loan layered on top, bringing the total leverage to 80%. This combined LTV is what the lender underwrites to.

- Loan Term: Mezzanine financing is not long-term capital. It's designed to bridge a gap. Most mezz loans have terms between three and seven years, aligning with the sponsor's business plan for a value-add or development project. This gives you enough runway to stabilize the asset and then refinance or sell.

These terms are precisely why mezzanine debt is such a powerful tool. Syndicators can often secure total leverage of 80-90%, which dramatically reduces their sponsor equity requirement to just 10-20% of the deal. While interest rates are steep, often landing between 12-20%, the ability to do more deals with less of your own capital is the trade-off. To see how this plays out in different scenarios, you can find great examples in various guides on mezzanine financing strategies.

Understanding Structural Components and Lender Rights

Beyond the raw numbers, the term sheet gets into the mechanics of the loan and the lender’s rights. This is where the power dynamic is really defined. One of the most significant structural elements you might see is an equity kicker.

An equity kicker, sometimes called a warrant, is a feature that gives the mezzanine lender a small slice of ownership or a share of the profits when you sell or refinance. Think of it as a "sweetener" that boosts the lender's total return beyond just the interest rate. It also gives them some upside, aligning their interests more closely with yours.

Other crucial structural terms to watch for include:

- Interest-Only Payments: Most mezzanine loans are structured with interest-only payments. This means you’re only servicing the interest during the loan's term, which frees up cash flow for renovations or operations. The full principal amount is then due in a lump sum at maturity.

- Prepayment Penalties: You need to know your exit options. Many mezz loans have a "lock-out" period where you can't repay the loan early at all. Others will allow it but charge a stiff penalty, often a percentage of the outstanding balance. If your business plan includes an early exit, negotiating flexible prepayment terms is absolutely critical.

To help you get a clearer picture, here’s a look at the typical components you'll find in a mezzanine term sheet and what they mean for you as a syndicator.

Typical Mezzanine Loan Term Sheet Components

This table isn't exhaustive, but it covers the main levers that will be pulled during your negotiation. Understanding these points is the first step toward structuring a mezzanine deal that works for you, not just for your lender.

A Real-World Example: Putting Mezzanine Financing to Work

Theory is one thing, but to really get a feel for how a mezzanine loan works, you have to see it in action. Let’s walk through a classic real estate syndication scenario—a multifamily value-add deal—and run the numbers to see how this kind of financing can completely change the game for a sponsor.

Picture this: a sponsor finds an underperforming apartment complex that's ripe for a turnaround. The business plan is simple: buy it, renovate the units and common areas, and stabilize the property at a higher value.

Here's how the deal pencils out:

- Acquisition Price:$20,000,000

- Renovation Budget:$5,000,000

- Total Project Cost:$25,000,000

The sponsor goes to a bank to get their senior loan. True to form, the bank is conservative and agrees to finance 60% of the total project cost.

Building the Initial Capital Stack

First, let's figure out that senior loan. Sixty percent of the $25 million total cost gets the sponsor a senior loan of $15,000,000. That's a good start, but it leaves a $10,000,000 hole that needs to be plugged with equity. Raising that much cash from investors is a heavy lift and would seriously water down the sponsor's ownership.

This is exactly the spot where a mezzanine loan shines. Instead of trying to raise the entire $10 million from limited partners, the sponsor brings in a mezzanine lender to fill that gap in the middle of the capital stack.

The lender agrees to provide a $5,000,000 mezzanine loan, which covers another 20% of the total project cost. Just like that, the entire structure of the deal has changed.

By layering in this mezzanine piece, the sponsor has successfully increased the project's total leverage from 60% to 80% (60% senior + 20% mezzanine). The equity needed to close the deal is instantly cut in half.

This kind of strategic financing is why the mezzanine market is growing so rapidly. The global sector is projected to nearly double from $212.58 billion in 2025 to $420.79 billion by 2034, as sponsors and lenders alike see the value. You can find more insights on this expanding market over on DealRoom.net.

The Final Deal Structure

With the mezzanine loan secured, the capital stack looks completely different—and a lot more efficient for the sponsor. Let's look at the before-and-after.

Capital Stack Without Mezzanine Loan:

- Senior Debt: $15,000,000 (60%)

- Required Equity: $10,000,000 (40%)

- Total: $25,000,000

Capital Stack With Mezzanine Loan:

- Senior Debt: $15,000,000 (60%)

- Mezzanine Loan: $5,000,000 (20%)

- Required Equity: $5,000,000 (20%)

- Total: $25,000,000

By bringing in that mezzanine piece, the sponsor cut their equity requirement from $10 million down to just $5 million. This means they can keep a larger ownership stake, maintain more control, and potentially supercharge the returns for both themselves and their investors. This is a perfect playbook for how a smart piece of financing can make a good deal a great one.

Navigating Lender Relationships and Key Risks

When you add a mezzanine loan into the mix, you’re not just getting more capital—you’re bringing another powerful player to the negotiating table. This move can give you some serious leverage, but it also introduces new complexities and risks that every real-estate syndicator needs to get their head around.

The biggest risk with mezzanine financing boils down to what happens if you default. A senior lender forecloses on the actual brick-and-mortar property. A mezzanine lender, on the other hand, comes after something much closer to home: your ownership stake in the LLC that owns the property.

This is done through a process called a UCC foreclosure, and it's typically much, much faster than a standard real estate foreclosure. We’re talking weeks, not months. If you miss payments or trip a covenant, you could lose control of your entire project before you know it. The mezz lender essentially steps into your shoes, taking over the project, the asset, and the senior debt that comes with it.

The Intercreditor Agreement Explained

So, how do you keep the peace between these two powerful lenders? It all comes down to a critical legal document: the intercreditor agreement.

Think of this agreement as the official rulebook that dictates how the senior and mezzanine lenders will coexist. As the sponsor, you're right in the middle of this negotiation, and the terms hammered out here can make or break your deal's stability. It outlines exactly what each lender can and can't do, especially when things go sideways.

A well-crafted intercreditor agreement provides a clear roadmap for handling trouble. A bad one can spark a conflict that puts the whole project in jeopardy.

Two of the most crucial clauses you’ll see are:

- Cure Rights: This gives the mezzanine lender the right to step in and "cure" a default on the senior loan—basically, making a missed payment on your behalf. This is a lifeline for the mezz lender, stopping the senior lender from foreclosing and wiping out their entire position.

- Standstill Provisions: This forces the mezzanine lender to "stand still" and hold off on exercising their own foreclosure rights for a set period if the senior loan is in default. It gives the senior lender breathing room to work out a solution with you without feeling the heat from the lender below them.

As a sponsor, your job is to push for an intercreditor agreement that lays out a fair and predictable process. You want the mezzanine lender to have solid cure rights, but you also need the senior lender to be comfortable with a reasonable standstill period. It’s a balancing act that protects your project from collapsing under pressure.

Managing these lender dynamics isn’t just about dotting i's and crossing t's on a legal document. It's a fundamental part of a smart mezzanine financing strategy. Get this right, and you can protect your equity, stay in control, and build a capital stack that's both powerful and resilient.

Answering Your Mezzanine Loan Questions

Alright, let's wrap this up by hitting some of the most common questions that come up when sponsors start thinking about mezzanine financing. Getting these practical points clear is crucial before you decide to bring this kind of capital into your next deal.

Is a Mezzanine Loan Considered Debt or Equity?

This is the million-dollar question, and the answer is: it’s both. Think of it as a true hybrid.

On paper and for accounting purposes, a mezzanine loan is absolutely debt. It has a loan agreement, a maturity date, and you’re expected to make interest payments. But that's where the similarities end. Its behavior and position in the deal give it a strong equity-like feel. Because it sits behind the senior mortgage, it takes on more risk, and its return expectations are higher.

In fact, senior lenders often see it as a form of "hard" equity. From their perspective, it's just another layer of capital cushioning their loan from potential losses, which they love. Features like an "equity kicker"—warrants that let the lender convert their debt into actual ownership—blur the lines even further.

What Happens If a Borrower Defaults on a Mezzanine Loan?

This is where things get really interesting and why the details matter so much. When you default on a senior mortgage, the bank forecloses on the property itself. That’s a long, drawn-out legal process.

A mezzanine loan default is completely different. The lender doesn't go after the physical building. Instead, they foreclose on the collateral you gave them: the pledge of your ownership interests in the LLC that owns the property.

This is done through a UCC foreclosure, which is governed by the Uniform Commercial Code. It's shockingly fast compared to a traditional foreclosure, sometimes taking just a few weeks. The result? The mezzanine lender effectively steps into your shoes, taking over the company that owns the asset. They become the new sponsor, subject to the existing senior loan.

To put it bluntly, a mezzanine lender doesn't take your property; they take over your entire position as the property's owner. This powerful remedy is why negotiating favorable terms and understanding default provisions is absolutely critical for any sponsor.

When Should a Syndicator Consider Using a Mezzanine Loan?

You should think about mezzanine debt when you're facing a classic funding gap—that space between what your senior lender will give you and the total equity you've raised. It’s an incredibly useful tool, especially for value-add or opportunistic projects where you need more leverage to make the numbers work for your investors.

At its core, it's a move for capital efficiency. You bring in a mezz loan when you want to:

* Keep more of the deal for yourself. By using debt instead of more equity, you minimize dilution and hold onto a larger slice of the ownership pie.

* Maintain control. Bringing in fewer equity partners often means fewer cooks in the kitchen.

* Get a deal done. Sometimes, it's the only way to close on a great opportunity that has a hefty equity requirement.

How Does Mezzanine Financing Compare to Preferred Equity?

This is another common point of confusion. Both mezzanine debt and preferred equity live in that same middle space between senior debt and common equity, but they are very different animals.

Mezzanine financing is legally structured as debt. It's secured by that powerful pledge of ownership, giving the lender a clear and swift path to take control in a default.

Preferred equity, on the other hand, is an equity investment, plain and simple. It gets paid back before the common equity (your and your investors' money), but it doesn't have the same foreclosure hammer that a mezz lender does. If things go sideways, their remedies are usually much weaker and more complicated to enforce.

From a tax standpoint, the interest on a mezzanine loan is a deductible business expense, which is a nice perk. The returns paid to preferred equity investors are treated as profit distributions. For the capital provider, a mezzanine loan offers more security; for the sponsor, preferred equity can sometimes offer a bit more flexibility if the deal hits a rough patch.

At Homebase, we know how challenging it can be to structure deals with multiple layers of capital. Our platform helps you manage everything from fundraising to investor relations, so you can focus on executing your business plan, not on administrative headaches. Learn how Homebase can streamline your next real estate syndication.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.