Define Mezzanine Debt Your Guide to the Real Estate Capital Stack

Define Mezzanine Debt Your Guide to the Real Estate Capital Stack

Unlock bigger deals with less equity. Our guide helps define mezzanine debt, showing syndicators how to use it to bridge funding gaps and maximize leverage.

Domingo Valadez

Feb 17, 2026

Blog

Mezzanine debt is a powerful, hybrid financing tool that’s part debt, part equity. For real estate syndicators, it’s the secret sauce that can help bridge the gap between what a traditional bank will lend and the cash you've raised from investors. It lets you tackle bigger deals without having to bring a mountain of cash to the table.

What Is Mezzanine Debt in Real Estate?

Let's say you've found a great commercial property, but the senior lender—the bank—is only willing to finance 65% of the deal. You’re left to cover the remaining 35%. Instead of raising all of that from your equity partners, you could use a mezzanine loan to fund a chunk of it, maybe 10-15% of the total project cost.

This is why it's called "mezzanine" financing; it sits right in the middle of the capital stack, that layered structure of funding for a real estate deal. Because of its unique position, it's a bit riskier than a standard mortgage but less risky than a straight equity investment.

The security for the loan is also different. A senior lender gets a first-position lien on the actual property. A mezzanine lender, on the other hand, takes a different kind of collateral.

A mezzanine loan is typically secured by a pledge of the ownership interests in the LLC that owns the property. If you default, the mezz lender doesn't foreclose on the building; they foreclose on your company and can take control of the entire project.

This unique structure is what allows you to boost your purchasing power without diluting your ownership stake as much as you would by simply raising more equity.

To provide a quick overview, here are the core characteristics of mezzanine debt summarized in a table.

Mezzanine Debt at a Glance

Ultimately, this table shows how mezzanine debt offers a tailored solution for sponsors needing that extra bit of capital to get a deal over the finish line.

The Role in the Capital Stack

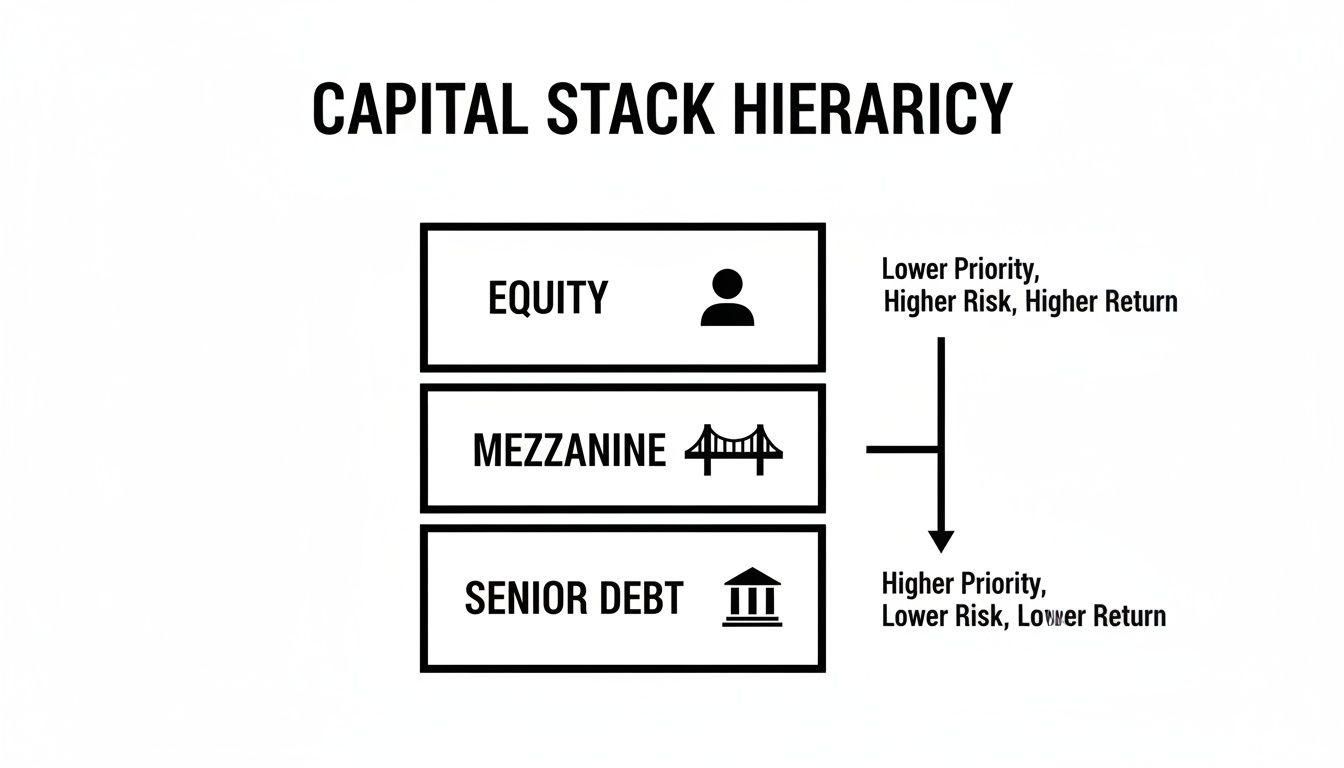

Picture the capital stack as a pyramid of funding sources. At the wide, stable base, you have senior debt—it’s the safest position, so it gets paid back first. At the very top point is common equity, which carries the most risk but also reaps the biggest rewards if things go well.

Mezzanine debt slots right in between those two. This placement in the middle is what makes it so useful:

- Fills the Gap: It gives you access to more capital than a senior lender alone is willing to provide, helping you close what might otherwise be an impossible funding gap.

- Protects Your Equity: By filling that gap with debt instead of raising more equity, you and your initial investors get to keep a larger piece of the ownership pie.

- Juices the Returns: More leverage, when used wisely, can significantly magnify the potential return on equity (ROE) for everyone on the common equity side of the deal.

At its core, mezzanine debt is a flexible financing option that helps syndicators scale up and take on bigger, more ambitious projects. To see how it fits into the wider world of funding, check out this complete guide to real estate financing options for a broader perspective.

How the Real Estate Capital Stack Works

Think of the financing for a commercial real estate deal like a layered cake. Each layer is a different type of capital, and each comes with its own set of rules, risks, and potential rewards. We call this structure the capital stack, and getting a handle on its hierarchy is non-negotiable for any serious real estate sponsor.

The order of these layers is everything—it dictates who gets paid first and, more importantly, who gets paid last if things go sideways.

At the very bottom, you have the largest and safest layer: senior debt. This is your standard loan from a bank or traditional lender, secured by a first-position lien on the property itself. Because these lenders take on the least amount of risk—they’re first in line to get their money back from a sale or foreclosure—they also charge the lowest interest rates.

Just above senior debt is where our focus lies: mezzanine debt. It’s a unique hybrid, riskier than a bank loan but much safer than straight equity. This position in the middle of the stack is exactly where it gets its name and its distinct characteristics.

This diagram shows how it all fits together, illustrating the relationship between risk and priority for each capital type.

As you can see, moving up the stack from senior debt to equity means taking on more risk, but it also comes with the potential for much greater returns.

The Layers of Risk and Return

The capital stack isn't just some abstract diagram; it's a legally binding structure that controls the flow of cash and the balance of power in any deal. Every position has a specific risk-return profile that’s determined entirely by its payment priority—a pecking order locked in by loan documents and intercreditor agreements.

Here’s a simple breakdown of who gets paid when:

- Senior Debt: These guys get paid first, period. Lenders receive their scheduled principal and interest payments before anyone else touches a dime. If the deal goes into default, they have the first claim on the property.

- Mezzanine Debt: The mezz lender is second in line. They only receive payments after the senior lender has been made whole. Their collateral isn’t the property itself, but rather the ownership shares of the entity that owns the property.

- Equity (Preferred and Common): Paid last. Equity investors only see a return after every single debt obligation has been met. Common equity holders are at the very back of the line, but they also have the highest potential upside if the deal is a home run.

The core principle is simple: the higher the risk, the higher the required return. A senior lender might be happy with a 5-7% return, while a mezzanine lender will target something in the 12-20% range to compensate for their junior position.

This hierarchy is absolutely critical. For a deeper dive into how these layers work together, you might find our detailed guide on the real estate capital stack useful.

Why This Matters for Syndicators

For a syndicator, mastering the capital stack is how you strategically engineer a deal. Mezzanine debt is the perfect tool for bridging the gap between what a senior lender will give you and the equity you have to raise, allowing you to boost leverage without excessively diluting ownership.

For instance, senior lenders often cap their loans at a 60-65% loan-to-value (LTV), leaving you with a major funding gap. A mezzanine loan can step in and provide another 5-25% of the total financing. This lets you close bigger deals and scale your portfolio more aggressively because you don't have to raise as much equity from investors—which, in turn, can dramatically amplify their potential returns.

Decoding Mezzanine Loan Terms and Economics

Okay, we've seen where mezzanine debt sits in the capital stack. Now, let's get into the part that really matters: the money. The terms and economics of a mezz deal are where the rubber meets the road, and it’s not as simple as a standard loan with a single interest rate.

Mezzanine lenders build their returns using several different components, all designed to compensate them for taking on that extra risk of sitting behind the senior mortgage. To negotiate these deals effectively, you have to speak their language. The lender is typically aiming for an all-in return somewhere between 12-20%, and they get there using a few key levers you'll see on any term sheet.

The Building Blocks of a Mezzanine Loan

To really define mezzanine debt, you have to understand how lenders piece together their return. Think of it less like a simple interest rate and more like a custom-built financial instrument. It's usually a blend of current payments, deferred interest, and a slice of the final profits.

- Cash Interest (The "Coupon"): This is the most straightforward piece. It’s the interest you pay in cash, usually every month. This "current-pay" portion gives the lender a steady, predictable cash flow stream throughout the life of the loan.

- PIK Interest (Payment-In-Kind): This is the "pay-me-later" interest. Instead of cutting a check, this interest gets tacked onto the principal loan balance. It accrues over time and is paid back in a lump sum when the property is sold or refinanced. This is a great tool for sponsors because it preserves the property's cash flow for operations or renovations.

- The Equity Kicker: This is the lender’s reward for a job well done. It’s a share of the project's upside, often structured as a percentage of the profits when the asset is sold. The kicker aligns the lender’s interests with yours—they make more money when you make more money—and it's often the component that gets them over the finish line to their target return.

This combination is precisely what makes mezzanine debt so appealing to certain types of investors. Those hunting for higher yields love the structure; as detailed in a report from Ascendant Global, the mix of a contractual coupon, PIK growth, and a share of the upside creates a powerful, risk-adjusted return. For syndicators, it provides a flexible way to fill a funding gap while bringing sophisticated capital to the table.

The All-Important Intercreditor Agreement

Beyond the numbers, there’s one document that can make or break a mezzanine deal: the intercreditor agreement. This is the legally binding contract that spells out the relationship between the senior lender and the mezzanine lender. It defines everyone's rights, remedies, and obligations.

Think of the intercreditor agreement as the rulebook for a peaceful coexistence. It dictates what happens if the borrower defaults, who gets to make key decisions, and how the mezzanine lender can protect its investment without stepping on the senior lender's toes.

Without a solid intercreditor agreement, you’re just asking for trouble. This document is critical because it establishes the protocols for worst-case scenarios. For instance, it typically gives the mezzanine lender the "right to cure" a default on the senior loan—meaning they can step in and make a mortgage payment on your behalf to prevent the senior lender from foreclosing and wiping out their position. It's a non-negotiable part of the process, and you absolutely need experienced legal counsel to get it right.

Weighing the Pros and Cons for Real Estate Sponsors

Mezzanine debt can feel like a secret weapon in a real estate sponsor's financing arsenal, but it’s definitely a double-edged sword. On one hand, it can bridge a critical funding gap and juice your returns. On the other, it brings a new level of cost and risk to the table.

For the right deal, it’s a game-changer. For the wrong one, it can be a deal-breaker. You have to understand both sides of the coin before deciding if it’s the right fit for your capital stack.

The Upside: What Sponsors Gain

So, why would anyone take on such expensive debt? The main draw is simple: it lets you do bigger deals and make more money without giving away the farm. For a sponsor focused on scaling their portfolio, that’s incredibly powerful.

- More Firepower, Less Equity: A senior lender might only fund 65-75% of your deal. Mezzanine financing can fill that gap, pushing your total loan-to-cost up to 80-85%. This means you can tackle larger projects than your equity raise would otherwise allow.

- Keep Your Own Cash in Your Pocket: Instead of digging deeper into your own funds or trying to raise a massive equity round, a mezz loan can cover the difference. That frees up your personal capital for the next opportunity, spreading your risk across multiple deals.

- Hold Onto More of the Deal: Every time you bring in a new equity partner, you're slicing the ownership pie into smaller pieces. Mezzanine debt is debt, not equity. You and your original investors get to keep a larger ownership stake, which means a bigger share of the profits when you exit.

When you look at it this way, it’s easy to see the appeal. You preserve equity for yourself and your limited partners, which magnifies your potential upside if the project performs well.

The Downside: The Risks and Costs Involved

Of course, all that leverage and flexibility doesn't come cheap—or without strings attached. The trade-off for mezzanine financing is a higher price tag, more complicated paperwork, and a very real threat to your control of the entire project.

The single biggest risk with mezzanine debt is the pledge of your ownership interest. If you default, the mezz lender doesn't have to go through a slow, painful mortgage foreclosure. They can execute a UCC foreclosure on your equity, effectively taking over your position as the owner and controlling the entire deal. This can happen astonishingly fast.

Beyond that cliff-edge risk, there are other serious drawbacks to consider:

- It’s Expensive Capital: Mezzanine loans aren't cheap. You're typically looking at all-in rates in the 12-20% range. That hefty interest payment can seriously squeeze your property's cash flow and eat into your final profits.

- Hello, Lawyers: The paperwork is no joke. The intercreditor agreement, which spells out the rights of the senior and mezzanine lenders, is a beast of a document. You’ll need sharp, experienced legal counsel to make sure you don't get boxed into a corner.

- Someone Looking Over Your Shoulder: Mezzanine lenders are very protective of their position. They often demand restrictive covenants that limit your freedom to operate. You might need their sign-off on major leases, capital projects, or even a potential sale of the property.

At the end of the day, using mezzanine debt is a strategic gamble. You're betting that the amplified returns will more than make up for the higher costs and the risk of losing control if things go south.

When to Use Mezzanine Debt in Your Deals

Knowing what mezzanine debt is solves only half the puzzle. The real skill is knowing exactly when to pull this tool out of your toolbox. This isn't your everyday hammer; it’s a specialized instrument for specific situations where its unique blend of leverage and cost gives you a strategic edge.

Mezzanine debt shines brightest when your senior loan just can't get you all the way to the finish line. For a real estate sponsor, recognizing these moments is the key to unlocking deals that might otherwise be out of reach and can seriously accelerate your portfolio's growth.

Bridging the Acquisition Funding Gap

The classic and most frequent use for mezzanine debt is getting a deal across the closing table. Let's say you've found the perfect property, but your senior lender is holding firm on a loan-to-cost (LTC) of 65%. That leaves a pretty hefty 35% gap you need to fill with equity.

Instead of trying to raise every last dollar from investors and watering down your own returns, you could bring in a mezzanine loan to cover another 10-15% of the cost. Suddenly, your equity requirement drops to a much more manageable 20-25%.

This is a game-changer in competitive markets where you need to move fast and don't have time to syndicate the entire equity check. It gives you the capital certainty you need to close the deal with confidence.

Using mezzanine debt to bridge an acquisition gap allows you to secure a property with less upfront equity, preserving capital for future deals and magnifying potential investor returns on the current one.

Funding Value-Add Renovations

Value-add projects are another place where mezzanine financing really proves its worth. Your business plan hinges on pouring capital into renovations to boost the property's net operating income (NOI), but the senior loan often won't cover those future funding needs or "soft costs."

This is exactly where a mezzanine loan slots in perfectly:

- Renovation Capital: It can provide the cash needed for everything from unit upgrades and common area facelifts to complete system overhauls.

- Lease-Up Reserves: It can act as a financial cushion to cover operating shortfalls while you're executing the renovations and leasing up the property, before it's stabilized and cash-flowing properly.

By financing these improvements, you can execute your business plan, force appreciation, and set yourself up to refinance the entire capital stack. The goal is to pay off the more expensive mezz loan with a brand-new, larger senior loan based on the property's much higher stabilized value. Think of it as a short-term bridge to long-term wealth creation.

How to Secure Mezzanine Financing for Your Project

If you're looking for mezzanine financing, don't walk into your local bank. This isn't a standard mortgage product they keep on the shelf. You'll need to tap into a network of specialized capital providers who are comfortable with this unique slice of the capital stack.

We're talking about players like private equity firms, dedicated debt funds, and even some insurance companies. These are sophisticated investors looking for well-structured deals with a compelling story. Finding the right fit is everything. For example, if you were developing a property in Paris, your first move would be to identify the Top Real Estate Investors in France who have an appetite for this type of financing.

Preparing Your Pitch

Putting together your loan package is your first—and most important—test. Remember, a mezzanine lender sits behind the senior bank, so they dig deep into the details. Your job is to build a rock-solid case that shows you can execute your plan and deliver the returns needed to pay everyone back.

A winning package needs to tell a complete story. Here’s what lenders will expect to see:

- A Detailed Business Plan: Go beyond the numbers. What's the story of this property? What's your value-add strategy, and why is this the right market for it?

- Credible Financial Projections: Your pro forma needs to be bulletproof. Use conservative assumptions for rent growth, expenses, and your exit cap rate. Lenders will stress-test these numbers, so make sure they hold up.

- A Clear Exit Strategy: Spell out exactly how the lender gets their money back. Is it through a sale of the stabilized asset or a refinance? Be specific.

- Sponsor Experience: Highlight your track record. Have you successfully executed similar projects? Lenders need to be confident in your team’s ability to navigate the inevitable challenges.

Lenders are not just underwriting the real estate; they are underwriting you. Your credibility and experience as a sponsor are just as important as the numbers in your spreadsheet.

The due diligence process will be intense. Expect a thorough examination of the legal, financial, and operational aspects of your deal. One final, crucial piece of advice: hire an experienced real estate attorney. Navigating mezzanine loan documents and intercreditor agreements is not a DIY project. Their expertise is absolutely essential to protect your interests and get the deal across the finish line.

Common Questions About Mezzanine Debt

Even after you get the hang of the theory, a lot of practical questions pop up when you're actually thinking about using mezzanine debt on a real estate deal. Let's tackle some of the most common ones we hear from sponsors.

Is Mezzanine Debt Secured or Unsecured?

This is a really important distinction. Mezzanine debt is secured, but in a very different way than a standard mortgage. Your senior loan is secured by a first-position lien on the actual brick-and-mortar property.

A mezzanine loan, on the other hand, is secured by a pledge of the ownership interests in the company (your LLC) that holds the title to the property. If you default, the mezz lender doesn't foreclose on the building directly. Instead, they foreclose on your ownership stake and can take control of the entire project.

Why Is Mezzanine Debt So Expensive?

It all comes down to risk. Think about where mezzanine debt sits in the capital stack—it's subordinate to the senior lender. This means that in a foreclosure, the mezz lender only gets paid after the senior bank is made completely whole.

This second-in-line position is inherently riskier. If the property's value drops, the mezzanine lender’s capital is the first slice of debt to get wiped out after the equity is gone. To compensate for taking on that extra risk, lenders demand a much higher return, typically in the 12-20% range.

Can I Pay Off a Mezzanine Loan Early?

That depends entirely on what you negotiate in your loan agreement. Most mezzanine loans come with some form of prepayment restrictions, and you'll often see terms like these:

- Lock-out Periods: A specific time frame at the beginning of the loan where you are flat-out prohibited from prepaying.

- Prepayment Penalties: Fees you'll have to pay if you decide to sell or refinance the property before a certain date.

These clauses are in there to protect the lender's anticipated yield on their investment. You need to scrutinize these prepayment terms, because they can have a massive impact on your exit strategy and the deal's final profitability. For most value-add business plans, the ability to refinance and get that expensive mezz loan off your books is a critical step.

At Homebase, we provide the tools to manage your entire capital stack, from raising equity to handling distributions. Our platform helps you streamline investor relations so you can focus on executing deals, not wrestling with spreadsheets. Learn how Homebase can simplify your next syndication.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Financial Modelling Real Estate: Win Deals with financial modelling real estate

Blog

Explore financial modelling real estate techniques to structure deals, forecast returns, and secure financing with confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.