How Do You Value Commercial Real Estate? A Modern Sponsor's Guide

How Do You Value Commercial Real Estate? A Modern Sponsor's Guide

Discover how do you value commercial real estate with a sponsor-focused guide. Master NOI, cap rates, and DCF to spot profitable investments.

Domingo Valadez

Feb 15, 2026

Blog

If you want to value commercial real estate, there's one number you absolutely have to nail: the Net Operating Income (NOI). Before you even think about applying cap rates or diving into complex discounted cash flow models, you need a crystal-clear picture of the property's real-world profitability. Get this wrong, and the rest of your analysis is built on a shaky foundation.

Mastering Net Operating Income: The Foundation of CRE Valuation

Anyone new to the game might think valuing a property is just a simple matter of income minus expenses. But seasoned sponsors and syndicators know the real work—and the real money—is in the details. A precise NOI calculation is what separates a smart, profitable deal from a dud propped up by flimsy assumptions. It’s the single most critical figure you’ll show your investors.

Your job is to look past the seller's pro forma, which is almost always dressed up to look its best. Arriving at a trustworthy NOI is a meticulous process of digging, verifying, and adjusting every single line item.

From Gross Potential Rent to Effective Gross Income

It all starts with the Gross Potential Rent (GPR). Think of this as the property's theoretical maximum income—what it could make if every unit was rented at the full market rate, 24/7, 365 days a year, with no one ever moving out. It’s your ceiling, not your reality.

From that ceiling, we have to get back to earth. This brings us to Effective Gross Income (EGI), which is simply your GPR after you subtract losses from vacancy and bad debt. A classic rookie mistake is just accepting the seller’s stated vacancy rate. Don't do it. Smart sponsors dive into submarket data and the property's actual history to land on a conservative, market-supported vacancy factor, which often falls between 5% and 10% for multifamily deals.

But rent isn't the only money coming in the door. You have to factor in all the other income streams that boost the EGI:

- Parking Fees: Reserved spots, garages, or monthly permits.

- Laundry Facilities: Revenue from coin-op or card-based machines.

- Storage Units: On-site storage closets or cages rented to tenants.

- Pet Fees: That monthly "pet rent" or one-time fees.

- Utility Reimbursements: Using a RUBS system to bill back tenants for water, sewer, or trash.

These little streams add up. Forgetting them means you're undervaluing the asset. If you're looking for a more detailed breakdown, you can learn more about what is Net Operating Income in our dedicated guide.

Uncovering True Operating Expenses

This is where great underwriting makes all the difference. Operating expenses are all the day-to-day costs of keeping the lights on and the property running. It's crucial to remember that this does not include your mortgage payment (debt service), major capital improvements, or depreciation.

Key Takeaway: The goal isn't just to copy and paste last year's expenses. You need to build a forward-looking, stabilized budget. For example, property taxes are almost guaranteed to be reassessed higher after you buy the property.

You need to track down realistic numbers for all the standard operating expenses:

- Property Management Fees: Usually 3-5% of EGI.

- Property Taxes: Never trust the seller's number. Call the local assessor's office and get a post-sale estimate.

- Insurance: Get fresh quotes. Rates have been climbing, so last year’s premium is irrelevant.

- Utilities: What isn't billed back to tenants is on you—gas, electric, water, sewer, and trash.

- Repairs & Maintenance: Your ongoing budget for the small stuff that breaks.

- General & Administrative: The costs of doing business, like legal and accounting fees.

One of the most common—and dangerous—underwriting mistakes is underestimating replacement reserves. This is the cash you need to sock away for the big-ticket items that will eventually fail, like roofs, HVAC systems, or parking lot repaving. While it isn't an "operating expense" in the purest accounting sense, any lender and all sophisticated investors will demand you include it. A good rule of thumb is to budget $250-$350 per unit per year for a standard multifamily asset. Skip this, and you’re setting yourself up for a painful cash-flow surprise down the road.

To see how this all comes together, let's walk through a practical example. Here’s a sample NOI calculation for a hypothetical 100-unit apartment complex.

Sample NOI Calculation for a 100-Unit Multifamily Property

As you can see, the final NOI of $1,280,600 is the result of a detailed, step-by-step process. This is the figure that truly represents the property's earning power and serves as the bedrock for all other valuation methods.

Using Cap Rates for Income Capitalization

So, you've painstakingly calculated your Net Operating Income (NOI). Now what? That number is the engine of your deal, but you need a way to translate its horsepower into a concrete property value. This is where the Income Capitalization Approach comes in, and for syndicators, it’s the bread and butter of valuation.

This method hinges on one of the most talked-about metrics in commercial real estate: the capitalization rate, or cap rate.

A cap rate is far more than a simple percentage. It’s a snapshot of the market’s collective opinion on a property, bundling risk, investor demand, and growth expectations into a single, powerful figure. Essentially, it tells you the unlevered rate of return you could expect if you bought the property with all cash.

What the Cap Rate Is Really Telling You

Think of the cap rate as a barometer for risk and investor appetite. A low cap rate means investors are willing to pay a high price for every dollar of income the property generates. You see this in hot markets like Austin or San Diego, where a stable, Class A building might trade at a 4.5% cap rate. The market is betting on safety and future rent growth.

On the other hand, a high cap rate suggests more perceived risk or tempered growth prospects. A Class C property in a slower, secondary market might trade at an 8% cap rate. This higher return is the market’s way of compensating an investor for taking on potential headaches—maybe an older building, a shaky tenant roster, or a flat local economy. For a savvy sponsor, this could be a red flag or the exact value-add opportunity you’ve been hunting for.

Expert Insight: Remember, a cap rate is inherently forward-looking. It’s not just about today's performance but about what investors believe the property will do tomorrow. A low cap rate signals strong confidence in future NOI growth.

The Direct Capitalization Formula in Action

The beauty of this approach is its simplicity, which is why it’s so widely used. The formula is a classic:

Market Value = Net Operating Income (NOI) / Capitalization Rate (Cap Rate)

Let’s walk through a real-world scenario. You're underwriting a 150-unit, Class B apartment community. After digging through the financials and making your adjustments, you’ve landed on a stabilized NOI of $1,100,000.

Now for the cap rate. You've done your homework—scouring recent sales comps, talking to local brokers, and reading every market report you can get your hands on. You conclude that 5.5% is the right market cap rate for this asset.

Plugging it in is easy:

- Market Value = $1,100,000 / 0.055

- Indicated Value = $20,000,000

Just like that, you have a solid, data-driven starting point for your valuation. Of course, knowing how to navigate cap rates is crucial, as the right rate can vary dramatically between an apartment complex and, say, a data center.

Why Small Shifts Have a Million-Dollar Impact

Don't let the simple math fool you. The cap rate is the most sensitive lever in your entire valuation model. A seemingly tiny tweak can swing the property's value by millions, fundamentally changing your offer price, your financing, and the returns you can promise investors.

Let’s go back to our deal with the $1,100,000 NOI. What if the market sentiment cools off a bit, or you discover some deferred maintenance that makes this property slightly less desirable than the comps? You decide a more conservative cap rate of 6.0%—just a 50-basis-point change—is more appropriate.

- Scenario 1 (Original): Cap Rate = 5.5% -> Value = $20,000,000

- Scenario 2 (Slightly Higher Risk): Cap Rate = 6.0% -> Value = $18,333,333

That half-point difference just vaporized over $1.6 million in value. This is exactly why experienced sponsors obsess over their cap rate assumptions. Your ability to defend your chosen rate with hard data is what separates a professional underwriting from a hopeful guess. It builds credibility with lenders and, most importantly, trust with your investors.

When to Use the Cost Approach

Most of the time, we lean heavily on income and sales comps to figure out what a commercial property is worth. But those methods have a major blind spot: they need existing data from similar properties to work.

So, what do you do when that data just isn't there? How do you pin a value on a brand-new development, a building you’re gut-renovating, or a one-of-a-kind asset with no true market equivalent?

This is exactly when the Cost Approach becomes your go-to tool.

Instead of looking at what other properties are selling for or how much income they generate, this method comes at it from a different angle. It asks a simple question: what would it cost to build a similar property from the ground up today? The whole idea rests on the principle of substitution—a smart buyer isn't going to pay more for an existing property than it would cost to buy a similar piece of land and build a new, modern equivalent.

Think of it as a reality check. It keeps you from overpaying relative to what it would cost to just start fresh.

Breaking Down the Components of the Cost Approach

The formula for the Cost Approach looks simple on paper, but getting the numbers right takes some serious digging. It all boils down to three key pieces that you need to figure out separately.

The formula is:

Market Value = Land Value + Replacement Cost of Improvements - Accumulated Depreciation

Let’s pull each of those components apart to see how this works in the real world.

- Determining Land Value: First, you have to establish what the land itself is worth, assuming it's vacant and ready for its "highest and best use." Since land doesn't really depreciate, we typically value it using the sales comparison approach—looking at what similar empty lots have sold for recently in the area.

- Calculating Replacement Cost: This is the real meat of the analysis. You're estimating the total cost to construct a building of similar size, quality, and function using today's materials, labor rates, and building codes. It's important to note this isn't the reproduction cost (an exact, historical replica) but the replacement cost (a modern, functional equivalent).

- Subtracting Depreciation: Here’s where it gets tricky and a bit subjective. No existing building is perfect, so you have to account for any loss in value. This isn't just about age; it covers all forms of depreciation.

The Three Flavors of Depreciation

In the Cost Approach, "depreciation" is a catch-all term for anything that makes the property less valuable than a brand-new version. To get an accurate valuation, you need to consider all three types.

- Physical Deterioration: This is the most straightforward kind—the actual wear and tear on the building over time. We're talking about things like a leaky roof, crumbling asphalt in the parking lot, or an HVAC system on its last legs. Some of this is curable (it makes financial sense to fix), and some is incurable (the cost to fix is more than the value it adds).

- Functional Obsolescence: This is about a loss in value due to outdated design or features that just don't cut it in today's market. A classic example is a multifamily building with a terrible floor plan, a warehouse with ceilings that are too low for modern logistics, or an office with electrical systems that can't handle today's tech demands.

- External (or Economic) Obsolescence: This depreciation comes from factors completely outside the property line. It’s almost always incurable. Think about a major employer in town shutting down, the city rezoning the lot next door for something undesirable, or a spike in crime rates in the neighborhood.

A Practical Tip: The cost approach really shines for new-build multifamily syndications or unique assets where comps are thin. For instance, imagine you're underwriting a new development. You might acquire the land for $2 million (based on comps for vacant parcels), then budget $200/sq ft for construction of a 100,000 sq ft complex ($20 million). If the property is only a couple of years old, you might apply a 5% depreciation (subtracting $1 million), bringing your value to $21 million.

This is especially useful for deals still under development, particularly in growing suburban areas where sales data hasn't caught up. Appraisers often rely on services like RSMeans data from Gordian, which by 2023 showed U.S. multifamily hard costs had climbed by 15% year-over-year to $180-$220/sq ft. You can explore more about these valuation models and how they apply.

By carefully putting a value on the land, estimating the full replacement cost, and then methodically subtracting for every type of depreciation, you can build a solid valuation from the ground up—even when the other methods leave you guessing.

Grounding Your Valuation with the Sales Comparison Approach

While income and cost analyses are critical, no valuation is complete until it's pressure-tested against the real world. This is where the Sales Comparison Approach comes in. You’ll often hear it called the "comps" method, and it provides a powerful, straightforward answer to the most important question: what are similar properties actually selling for right now?

For a syndicator, this is far more than just an academic exercise or a box to check for an appraiser. It's your direct line into market sentiment. It’s what keeps your carefully crafted NOI and cap rate assumptions from floating off into fantasy land, tethering them to tangible, recent deals.

More Than Just Finding Nearby Sales

The basic idea is simple: find recently sold properties that look and feel like your target asset and use their sale prices as a benchmark. Easy, right? Not so fast. The real skill lies in selecting truly comparable properties and then methodically adjusting for the inevitable differences. Just pulling the three closest sales isn't nearly enough.

A lazy comparison can lead you to drastically overpay for a deal or, just as bad, put in an offer so low you're not even taken seriously. You have to compare apples to apples, and that means digging into the details.

Start by building a tight set of criteria for what makes a property a solid comp:

- Property Type and Class: A Class A multifamily building needs to be compared to other Class A assets, not the tired Class C property down the street.

- Location and Submarket: A building on a main commercial artery is a completely different animal from one on a quiet side street, even if they're only a few blocks apart. The submarket dynamics matter immensely.

- Size and Unit Mix: Are you looking at a 50-unit garden-style complex? Then compare it to others in that range, not a 200-unit high-rise. The unit mix—the ratio of studios to one- and two-bedrooms—also needs to line up.

- Date of Sale: The market is constantly in motion. A sale from 18 months ago might as well be from another era. You want sales from the last six months if you can get them, and almost never look past twelve.

The Art of Making Defensible Adjustments

Here’s the thing: no two properties are ever identical. Once you've found the best possible comps, the real work begins. You have to make adjustments to account for the differences between each comp and your property. This is where you put a dollar value on specific features.

The standard way to do this is with an adjustment grid. You'll systematically add or subtract value from the comp’s sale price to normalize it against your target asset.

A Quick Rule of Thumb: If the comparable property is superior to your subject property in some way (e.g., it has a pool and yours doesn't), you subtract the value of that feature from the comp's price. If the comp is inferior (e.g., it has an older roof), you add value to its price.

You're essentially asking, "What would the comp have sold for if it were more like my property?"

Key areas for adjustment almost always include:

- Property Condition: Factor in the age and condition of big-ticket items—the roof, HVAC systems, parking lot, windows.

- Amenities: Put a price on features like a swimming pool, a modern fitness center, covered parking, or in-unit laundry.

- Location Specifics: Adjust for nuanced differences in visibility, traffic counts, or proximity to key employers and retail corridors.

- Financing Terms: Was it an all-cash deal? Was there unusual seller financing involved? These can skew the sale price and need to be adjusted to reflect a typical market transaction.

Let's walk through a quick example. Your target is a 100-unit building with no pool. One of your best comps is a nearly identical 100-unit building that just sold for $15 million, but it has a beautiful resort-style pool. You dig into contractor quotes and broker opinions and determine that pool adds about $300,000 in value. To make it a true "apples-to-apples" comparison, you adjust its sale price downward to $14.7 million.

When you repeat this process across three to five solid comps, a tight, defensible value range for your property will start to emerge, giving you real confidence as you prepare your offer.

Synthesizing the Data for a Defensible Final Value

After you've run the numbers through the income, cost, and sales comparison approaches, you’ll be looking at three different valuations. It's a classic rookie mistake to just average them out or, even worse, cherry-pick the most optimistic one. A professional valuation is never a single, isolated number; it's a thoughtful reconciliation of all the data you've gathered.

This final step is called reconciliation, and it’s where the science of your analysis meets the art of the deal. You’re not just crunching numbers anymore. You’re building a cohesive and defensible story about what the property is truly worth, which is the cornerstone of explaining how to value a commercial property to your investors.

Weighing Each Valuation Approach

The heart of reconciliation lies in assigning a specific weight to each of the three valuation methods. This isn't guesswork; it directly reflects the nature of the property you're analyzing and the quality of the data you could find for each approach. The weights you assign will change from one deal to the next.

For instance, if you're looking at a stabilized, income-producing asset like a multifamily apartment complex, the Income Approach is king. Why? Because the primary motivation for buying that property is its consistent cash flow.

Here’s a realistic breakdown of how you might weigh the approaches for a standard Class B multifamily deal:

- Income Approach:70-80% weight. This method gets the heaviest weighting because it directly reflects the investment thesis for a cash-flowing asset.

- Sales Comparison Approach:20-30% weight. This provides a critical, market-based reality check on your income assumptions. Are other, similar buildings trading at values that support your NOI and cap rate?

- Cost Approach:0-10% weight. For an older, existing building, what it would cost to build a new one today is often irrelevant. It gets very little, if any, weight.

That logic completely flips if you're valuing a vacant plot of land for development. In that scenario, the Sales Comparison Approach (what have similar parcels sold for?) and the Cost Approach (what will it cost to build?) would carry almost all the weight. The Income Approach would be nearly zero since there's no income yet.

Key Takeaway: The weighting process is your justification for the final value. It demonstrates to lenders and investors that you've considered the property from all angles and are relying on the most relevant data for that specific asset class and business plan.

Building a Narrative for Investors

Your valuation is more than just a number on a spreadsheet; it's the foundation of the story you tell your investors. This is where you translate your technical analysis into a compelling narrative that builds confidence and gets your deal funded.

When you present your deal in the investor portal, you can’t just say, “We think it’s worth $20 million.” You need to walk them through your logic, clearly and concisely.

- Show Your Work: Clearly state the NOI you arrived at and the cap rate you used. More importantly, explain why you chose that cap rate based on specific market data and recent transactions.

- Present the Comps: Don't just list the comps. Highlight the key sales you used and explain the adjustments you made for things like location, age, or amenities. This proves your valuation is grounded in reality, not just wishful thinking.

- Justify the Final Value: Explain how you reconciled the different approaches and why you weighted them the way you did for this specific property.

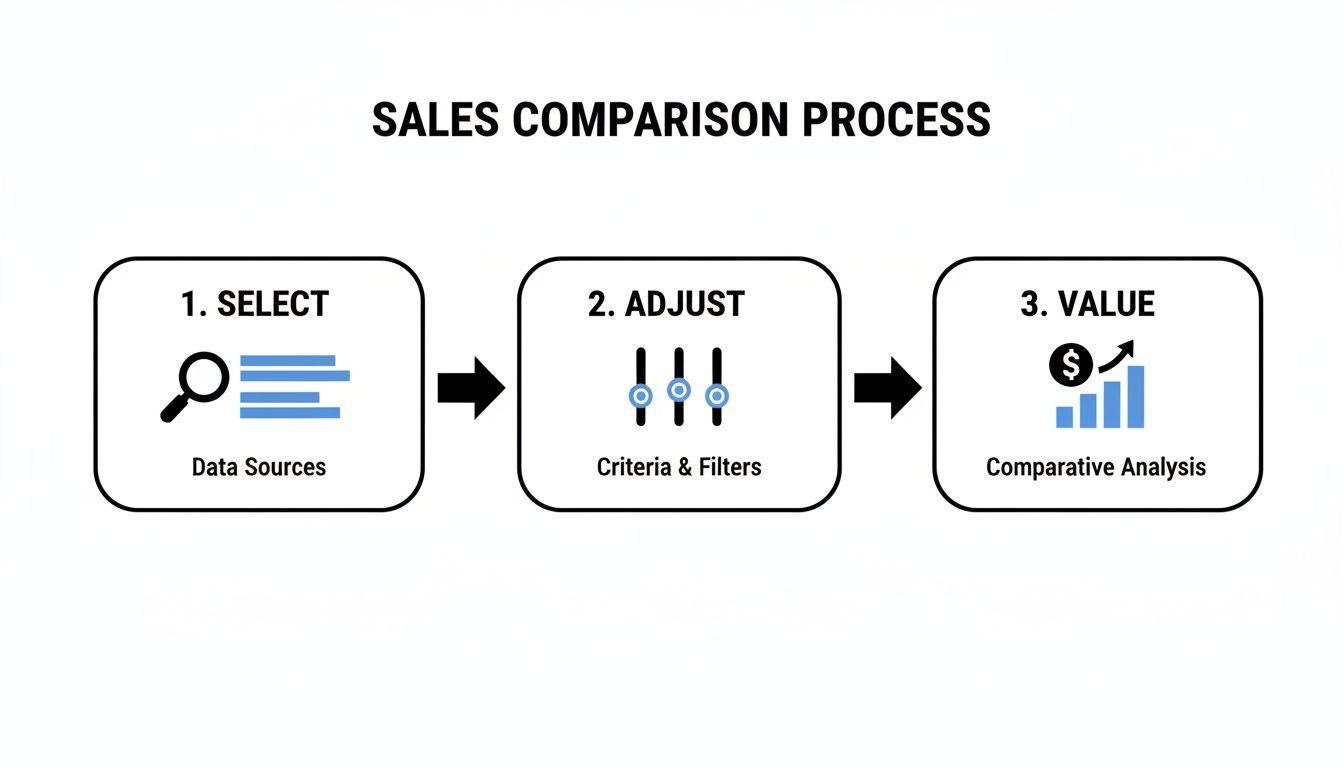

This flowchart illustrates the sales comparison process, which is a key part of grounding your valuation in real-world market activity.

This process of selecting comparable properties, adjusting for differences, and arriving at a value is what gives your final number credibility. It's all about demonstrating a rigorous, data-driven approach.

From Analysis to Action

Ultimately, the goal is to arrive at a single, defensible point of value. After assigning your weights, the final calculation is straightforward.

Let's imagine your analysis produced these three distinct values:

- Income Approach Value:$10,500,000

- Sales Comparison Value:$10,000,000

- Cost Approach Value:$11,500,000 (This is often higher for older buildings, reflecting new construction costs)

Now, let's apply the weights we discussed for a stabilized multifamily property:

- ($10,500,000 x 80%) + ($10,000,000 x 20%) + ($11,500,000 x 0%) = $10,400,000

Your reconciled Final Market Value is $10.4 million. This is the number you can stand behind with confidence because it’s supported by a logical, well-documented process. By presenting this clear rationale, you’re not just selling a deal; you’re building long-term trust with your capital partners.

Answering the Tough CRE Valuation Questions

Once you have the core valuation methods down, the real world throws you curveballs. What happens when the Fed starts tinkering with interest rates? How do you properly frame a value-add deal to investors? Nailing these nuances is what separates the pros from the rookies.

Get these right, and you'll build immediate credibility with lenders and investors, proving you’ve stress-tested the deal from every conceivable angle.

How Do Interest Rates Affect Valuations?

The link between interest rates and commercial real estate values isn't just theoretical—it's direct and has serious teeth. When the Federal Reserve hikes rates, the cost of borrowing goes up for everyone, and that sends ripples through every property valuation.

Higher interest rates mean bigger monthly mortgage payments. Simple as that. This eats directly into a property's cash flow, which in turn lowers the price a buyer can justify paying. On top of that, this pressure almost always forces cap rates to expand. Investors demand higher returns to offset their own increased cost of capital and the general sense of risk.

Remember, a rising cap rate with a flat Net Operating Income (NOI) will always push a property's value down.

A Note From Experience: Think of it this way: when debt is cheap, buyers can afford to get aggressive on pricing. When debt gets expensive, they have to pay less to hit the same return targets, which forces sellers to get realistic about their asking price.

"As-Is" Value vs. "As-Stabilized" Value

For any syndicator chasing value-add deals, understanding the difference between these two valuations is non-negotiable. They are two completely different snapshots in the life of your investment.

- 'As-Is' Valuation: This is what the property is worth the day you buy it. It's based on the current, messy rent roll, the actual operating expenses, and all the deferred maintenance you need to fix. This is the number your lender will use to size your acquisition loan.

- 'As-Stabilized' Valuation: This is the projected value of the property after you’ve worked your magic. It’s a future-looking number that assumes you've completed all the renovations, leased up the vacant units, and successfully pushed rents to market levels. You'll use this valuation to show investors the deal's potential and to secure your permanent or takeout financing.

Laying out both valuations clearly in your investor materials is crucial for transparency. It paints a clear "before and after" picture, showing investors exactly how you plan to create value.

What Are the Most Common Valuation Mistakes?

I've seen plenty of otherwise solid deals get torpedoed by basic underwriting mistakes. Knowing what these traps are is the best way to avoid falling into them yourself.

The number one culprit is overly optimistic projections. This usually looks like assuming rent growth that blows past market trends or plugging in expense figures that are way too low. Always treat the seller's pro forma with extreme skepticism—it's a sales brochure, not a reliable underwriting document.

Another classic error is grabbing bad comps to justify a high price. A sale from 18 months ago in a different economic climate, or a property from a much nicer submarket, is not a relevant data point. Finally, a huge red flag is when an analyst just picks the valuation method that spits out the highest number. A truly defensible valuation triangulates the results from multiple methods to arrive at a single, well-supported conclusion.

Ready to put down the spreadsheets and focus on the deal? Homebase is the all-in-one platform built to handle the busywork of real estate syndication. We help you create professional deal rooms, manage fundraising, and handle investor relations and distributions, so you can focus on what you do best. Learn more about how Homebase works and see it in action.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

General Partners And Limited Partners Explained

Blog

A clear guide to general partners and limited partners. Understand the key roles, responsibilities, and financial structures in real estate syndication.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.