General Partners And Limited Partners Explained

General Partners And Limited Partners Explained

A clear guide to general partners and limited partners. Understand the key roles, responsibilities, and financial structures in real estate syndication.

Domingo Valadez

Feb 14, 2026

Blog

At the heart of every real estate syndication are two key players: the General Partner (GP) and the Limited Partners (LPs). One actively runs the show, and the other provides the fuel—the investment capital—to make it happen.

Think of it like making a movie. The GP is the director, responsible for every single detail from scouting locations and hiring actors to managing the budget and final production. The LPs? They're the executive producers who provide the funding to bring the director's vision to life.

The Two Sides of a Real Estate Partnership

The GP/LP relationship is truly a symbiotic one. The GP brings the real estate expertise, the deal-making savvy, and the operational muscle. The LPs bring the capital needed to acquire and improve the property.

This structure is what makes the private equity real estate world go 'round. It allows skilled operators (GPs) to tackle much larger, more ambitious projects than they could ever fund on their own. At the same time, it gives passive investors (LPs) a ticket into institutional-quality real estate deals without the headache of being a landlord.

Simply put, a great GP can't get far without trusting LPs, and all the capital in the world won't save a deal with a weak GP at the helm.

Defining the Core Roles

The line between a GP and an LP is drawn in bright, bold ink for a reason. Each has a very distinct role to play.

A General Partner is the hands-on sponsor who lives and breathes the deal. Their job is to orchestrate the entire investment from start to finish.

- Sourcing and Underwriting: This means finding the diamond-in-the-rough properties and running the numbers to make sure the deal actually makes sense.

- Capital Raising: Pitching the deal to investors and getting the investment commitments needed to close.

- Asset Management: This is the day-to-day grind of overseeing property management, executing renovations, and making the business plan a reality.

- Reporting: Keeping the LPs in the loop with regular updates on how the property is performing.

Limited Partners, true to their name, have a much more limited, passive role. Their main job is to provide capital. In fact, their involvement in the day-to-day operations is legally restricted to protect them from liability.

The recent volatility in investment levels, as tracked by firms like S&P Global, shows just how crucial it is for GPs to build trust and clearly communicate their value.

The core principle is simple: GPs work in the business, while LPs invest on the business. This division of labor allows each party to focus on what they do best, creating alignment toward a shared goal of financial success.

For a quick reference, here’s how the two roles stack up side-by-side.

GP vs LP At a Glance

This table provides a high-level overview, but as we'll see, the details of risk, responsibility, and reward are where this partnership truly takes shape.

Understanding Your Legal and Financial Stakes

Beyond the day-to-day work, the real dividing line between a general partner and a limited partner is drawn by the legal and financial structure of the deal. This framework is deliberately designed to balance risk and reward, creating a stark difference in what each person stands to gain—and potentially lose.

The single biggest difference comes down to liability. For a General Partner, the stakes couldn't be higher. They shoulder unlimited liability, which is a legalese way of saying their personal assets could be on the line if the partnership racks up debts or faces lawsuits that the property’s value can’t cover. This personal exposure is the price they pay for having complete control of the investment.

Limited Partners, on the other hand, have a built-in safety net: limited liability. Their financial risk is strictly capped at the exact amount of money they invested. If a deal completely implodes, an LP can lose every dollar they put in, but creditors can't come knocking for their personal bank accounts, their house, or anything else. This protection is what makes passive investing in real estate possible for so many people.

The Fiduciary Duty of a General Partner

With the GP’s immense power comes a serious legal responsibility known as fiduciary duty. This isn't just a friendly handshake agreement; it's a binding legal obligation to act only in the best financial interests of the Limited Partners.

This duty legally requires the GP to:

- Act with loyalty and care: They must always put the partnership's financial success ahead of their own personal gain.

- Avoid conflicts of interest: No self-dealing or making decisions that benefit them at the expense of their investors.

- Communicate transparently: LPs must be kept in the loop about the investment's performance and any significant information that could impact it.

Breaching this duty can land a GP in serious legal hot water. It gives LPs a powerful backstop against mismanagement or outright fraud, ensuring the captain of the ship is always sailing toward the same destination as the passengers.

A General Partner’s unlimited liability and fiduciary duty create a powerful alignment of interests. The GP is motivated to perform well not only to earn their share of the profits but also to protect their own personal financial well-being.

Common Legal Structures

To make this all official, real estate syndications are almost always set up as specific legal entities that formally define these roles and protections. The two structures you’ll see most often are:

- Limited Partnership (LP): This is the classic setup. It has at least one GP with unlimited liability and one or more LPs with limited liability. Simple and effective.

- Limited Liability Company (LLC): This structure is incredibly popular for good reason. Often, the GP will form an LLC for their own entity to shield its members. The investment vehicle itself is also frequently an LLC. In this model, the GP is the "managing member" and the LPs are "non-managing members," which achieves a very similar liability shield for everyone involved.

These legal structures are the foundation that makes the whole GP/LP model work. They give passive investors the confidence they need to write big checks, while empowering the sponsor to get out there and execute the business plan.

What a GP and LP Actually Do

Enough with the legal jargon. Let's talk about what the roles of a general partner and a limited partner actually look like day-to-day. When you see how their responsibilities play out across the life of a real estate deal, the whole "active vs. passive" distinction really clicks.

For a General Partner, the work is an intense, hands-on marathon that starts long before investors ever see a deal. GPs are constantly in motion—networking with brokers, analyzing markets, and building the relationships that uncover off-market opportunities. Once they zero in on a promising property, the real number-crunching begins as they build complex financial models to project returns and identify every possible risk.

And that's just the prelude. From there, the GP takes the reins and drives the entire transaction forward.

The General Partner's Active Journey

A GP’s life is a whirlwind of finance, operations, and real estate law. They're the project quarterback, and their playbook covers every stage of the deal.

- Deep-Dive Due Diligence: The GP is on the ground leading the charge—walking the property, pouring over financials, reviewing every lease, and making sure everything is legally sound.

- Raising Capital: This is where they put on their fundraising hat. They create compelling investment decks, host webinars, and have countless one-on-one calls to bring LPs on board and secure the equity needed.

- Closing the Deal: They’re the central hub, coordinating between lawyers, lenders, and sellers to navigate the complex process of actually acquiring the property.

- Executing the Business Plan: Once the deal is closed, the real work begins. The GP manages the day-to-day operations, oversees property renovations, handles tenant relations, and works tirelessly to optimize the asset’s performance according to the plan.

The Limited Partner's Passive Role

The Limited Partner's role, by contrast, is much more focused and strategic. It’s all about smart capital allocation and oversight, not getting bogged down in the daily grind. Think of it as a journey of careful evaluation and then patient monitoring.

An LP’s primary job is to vet two things: the General Partner and the deal itself. This means doing their own homework on the GP's track record, picking apart the investment strategy, and making sure the business plan holds water.

Once they're confident, their involvement becomes almost entirely financial. They review and sign the subscription documents, wire their investment, and then take a step back, trusting the GP to execute. From that point on, their main "activity" is simply keeping an eye on the investment's progress through the regular reports and updates the GP provides.

The classic dynamic is simple: GPs are the drivers, and LPs are the passengers who provide the fuel. But the road is changing, and today's LPs are starting to ask for a turn at the map.

This traditional relationship is evolving. A growing number of LPs want more control and are actively seeking co-investment opportunities, which allow them to invest directly into a deal alongside the main fund. This isn't just a hunch; the data backs it up. Recent surveys show that 88% of limited partners plan to put up to 20% of their portfolios into co-investments in the near future.

As detailed in this private equity outlook, this shift is a big deal. It means smart GPs need to be ready to offer these kinds of structures if they want to attract the best capital partners.

How Everyone Gets Paid: The Distribution Waterfall

When it comes to a real estate deal, few things are more important than understanding how the money flows. For both general partners and limited partners, the entire financial structure is built to align everyone's interests. The goal is simple: reward the GP for strong performance while making sure the LPs who put up the capital get paid first. This is all handled through a combination of standard fees and a profit-sharing model known as the distribution waterfall.

Let's start with the fees. General Partners do a ton of heavy lifting, and they're compensated for that work. These fees are always laid out clearly in the deal's legal documents, so there are no surprises. They typically include:

- Acquisition Fee: A one-time fee, usually 1-2% of the purchase price, paid to the GP for the monumental effort of finding, underwriting, and actually closing the deal.

- Asset Management Fee: An ongoing fee, often 1-2% of the collected rent, that covers the day-to-day oversight of the property and the execution of the business plan.

- Disposition Fee: A fee paid when the property is sold, typically 1% of the sale price, for managing a successful exit.

These fees cover the GP's operational costs and expertise, but the real incentive—the thing that truly aligns everyone—is how the profits are split.

The Journey of a Dollar Through the Waterfall

After all the property expenses, mortgage payments, and GP fees are paid, the cash that’s left over is distributed to investors. But it doesn't just get split evenly. It flows through a very specific, tiered structure called the distribution waterfall.

Think of it like a series of buckets stacked on top of each other. You have to fill the top bucket completely before any water can spill over into the next one down. This setup is designed to protect the LPs and make sure they get paid first.

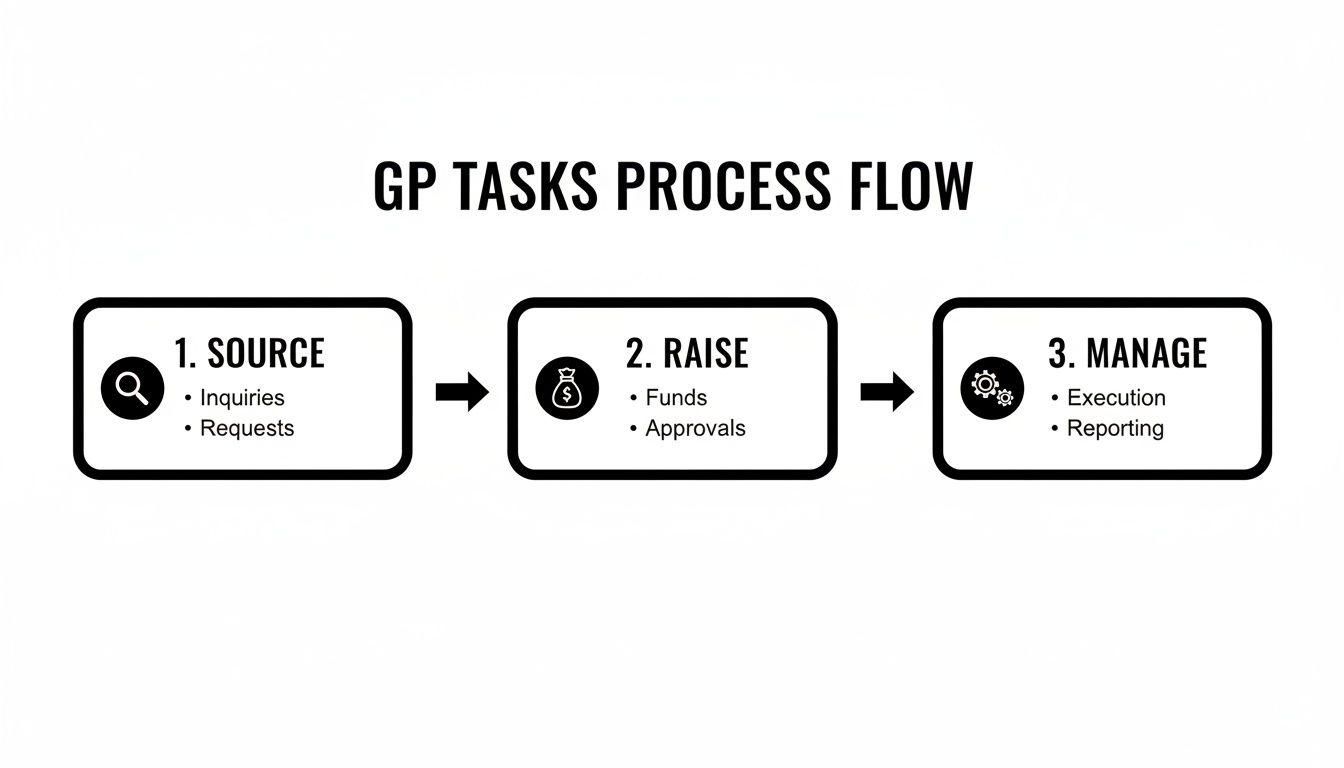

The flowchart below shows the core responsibilities of a GP, all of which are aimed at generating the profits that will ultimately pour into this waterfall.

The entire process, from sourcing the deal to managing it, is all about making the property profitable enough to create those distributions.

Here’s how the money typically moves through the waterfall, step by step:

- Return of Capital: The very first bucket to be filled is the LPs' initial investment. 100% of distributable cash goes directly to the Limited Partners until every dollar of their original capital is returned. The GP gets nothing from profits at this stage.

- Preferred Return: Once the LPs have their initial investment back, the next bucket is the preferred return (often called the "pref"). This is a set return threshold, commonly 6-8% per year, that acts as a minimum hurdle. All cash flow continues to go to the LPs until this return is paid.

- The Catch-Up: Some deals include a "catch-up" tier. Here, the GP might get a much larger share of the profits for a short time until their share of the profits "catches up" to a specific ratio, like 20%.

- The Split (Carried Interest): After all the previous tiers are filled, we finally get to the profit split. The remaining money is divided between the LPs and the GP. A common split is 80/20 or 70/30, with the LPs getting the larger share. The GP’s portion is called "carried interest" or the "promote"—this is their reward for a successful venture.

The distribution waterfall is the ultimate mechanism for aligning interests. It contractually ensures that the General Partner only makes significant money after their Limited Partners have received their capital back plus a solid preferred return.

Example of a Simple Distribution Waterfall

To make this more concrete, let's look at a simplified waterfall structure. The table below shows how profits might be distributed in a typical deal with an 8% preferred return and an 80/20 split.

This tiered structure is what incentivizes a GP to not just meet expectations, but to knock it out of the park. Their biggest payday only comes after they’ve delivered great returns to their investors.

For a more detailed breakdown, you can explore our complete guide on how to build a real estate waterfall model. Understanding this model is key to understanding the financial heart of any partnership between general partners and limited partners.

Building Trust Through Transparent Communication

A great asset is only half the battle in a successful real estate syndication. The other half—the part that turns a one-off deal into a long-term partnership—is built on a foundation of absolute trust between general partners and limited partners. This isn't about blind faith; it's earned through exceptional communication and operational transparency, starting from the very first document an investor sees.

It all begins with the legal framework that underpins the deal. Think of the Private Placement Memorandum (PPM) as the investment’s complete story. It's a comprehensive disclosure that lays out everything an LP needs to know: the business plan, the market deep-dive, the potential risks, and a clear look at the GP's track record. It sets the stage so LPs can make a fully informed decision.

Then comes the Operating Agreement, which is the official rulebook for the partnership. This is the legally binding contract that spells out the rights, responsibilities, and financial mechanics for everyone involved. It gets into the nitty-gritty of the distribution waterfall and voting rights. These documents aren't just formalities; they are the non-negotiable pillars of a professionally run syndication.

Mastering Ongoing Investor Relations

Once the deal is funded and closed, the real work of communication begins. The relationship between a GP and their LPs isn't a sprint; it's a marathon. Nurturing it requires a proactive and consistent game plan. Dropping off the map or sending sporadic updates is a surefire way to erode the confidence you worked so hard to build.

To keep that trust strong, GPs should make these a priority:

- Regular, Detailed Updates: Monthly or quarterly reports should be the standard. Don't just send a high-level summary. Include the real meat: financial statements, progress against the business plan, leasing updates, and even photos of any capital improvements. Show, don't just tell.

- Timely Tax Reporting: Getting K-1s out the door well ahead of tax deadlines is a huge sign of professionalism and respect for your investors' time. Nothing frustrates an LP faster than a late K-1.

- Accessibility and Responsiveness: Being available to answer questions and address concerns promptly demonstrates that you value your partners and their peace of mind.

Trust is the currency of real estate syndication. Every investor update, financial report, and distribution payment is a deposit into that account. Consistently delivering on these builds the confidence needed for LPs to reinvest in future deals.

To foster these strong relationships and ensure accountability, General Partners absolutely must stick to robust financial reporting best practices. It's what gives limited partners the confidence they need.

Using Technology to Build Confidence

Trying to manage communications for dozens of LPs with spreadsheets and email is a recipe for disaster. It's inefficient and riddled with opportunities for error. This is where modern investor portals like Homebase change the game, creating a seamless and professional experience that builds trust at every single touchpoint.

A good platform centralizes everything. We're talking secure document signing, streamlined capital calls, automated ACH distributions, and a permanent, organized archive of all reports. This doesn't just save the GP a mountain of administrative work; it gives LPs a single, secure place to find all their investment information, boosting their confidence in you and your operation.

Digging into Advanced Deal Structures and Modern Trends

The classic playbook for real estate partnerships is changing. As the private real estate world gets more sophisticated, the old, rigid lines between general partners and limited partners are starting to blur. Today’s investors are savvier and expect more flexibility, and smart GPs are responding with creative structures that offer better liquidity options and ways to create value over the long haul.

Two of the biggest shifts we’re seeing are the rise of GP-led secondaries and continuation vehicles. In the past, if an LP needed to cash out before an asset was sold, they were pretty much on their own to find a buyer. That’s not always the case anymore. A GP can now step in and orchestrate a sale of partnership interests, giving LPs a clean exit while bringing fresh capital into the deal to keep the business plan moving forward.

Why Continuation Vehicles Are Gaining Traction

Continuation vehicles are the next evolution of this idea. Imagine a situation where a GP has a trophy asset that's performing incredibly well. Instead of being forced to sell it at the end of a fund's life, they can use a continuation fund to essentially buy the property from their original fund.

This creates a brilliant win-win scenario. LPs who are ready to take their profits and run have a clear path to do so. At the same time, the LPs who still believe in the asset (along with the GP) can roll their equity into the new vehicle and ride the wave of future growth. It’s a powerful way to hold onto your best assets for longer.

This isn't just a niche strategy; it's becoming mainstream. The secondary market has exploded, and GP-led deals now account for a staggering 44% of all transaction volume. If you want to see the data for yourself, the latest investor survey from Adams Street Partners highlights just how big this trend has become.

These aren't just minor tweaks to the old model. We're witnessing a fundamental shift away from the traditional ten-year fund cycle toward something far more dynamic and investor-focused. GPs who can get comfortable with these tools will have a serious edge in attracting and keeping capital.

For those interested in exploring different ways to invest directly in a business like real estate, it's worth understanding the mechanics of Direct Participation Program (DPP) investments.

Diving Deeper: Your GP & LP Questions Answered

When you're getting into the nitty-gritty of a real estate deal, a lot of specific questions pop up. Let's tackle some of the most common ones we hear from both general partners and limited partners.

Can a Limited Partner Lose More Than Their Investment?

The short answer is no. This is one of the biggest protections for an LP—your potential loss is legally capped at the exact amount you invested. It's a foundational principle called limited liability.

Unlike the General Partner, whose personal assets could be on the line, an LP's personal finances are completely walled off from the partnership's debts or any legal troubles it might face.

The only time this wouldn't be the case is if an LP decides to personally guarantee a loan for the project. But that’s a separate, voluntary agreement and not a built-in risk of being a limited partner.

What Is a Preferred Return and Why Does It Matter?

Think of the preferred return, or "pref," as a hurdle. It's a minimum rate of return that the Limited Partners are entitled to before the General Partner starts taking a cut of the profits. In simple terms, it's the investors' "first dibs" on the money coming out of the deal.

For instance, a deal with an 8% pref means all available cash flow goes to the LPs until they’ve earned an 8% annualized return on their capital. Only after that threshold is met does the GP get to participate in the profit-sharing.

This structure is absolutely critical. It aligns everyone's interests and motivates the GP to make sure the property performs well enough to hit those initial targets for their investors first.

How Can a General Partner Be Removed?

Removing a General Partner is a big deal, and it's not something that happens on a whim. The rules for how this can happen are spelled out in detail within the partnership's operating agreement.

This is almost always a "for cause" situation, meaning it’s reserved for serious issues like proven fraud, gross negligence, or a major violation of the agreement. It's a difficult process that typically requires a majority or supermajority vote from all the Limited Partners to move forward. This gives investors a powerful check and balance while keeping the partnership stable.

Juggling these complex relationships, legal structures, and communication lines is where the real work of a syndicator lies. Platforms like Homebase are built to make this easier, handling everything from secure document signing to automated distributions. It gives you the operational backbone you need to build and maintain trust with your partners.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking the Triple Net Lease Meaning for Syndicators

Blog

What is the true triple net lease meaning for investors? Our guide demystifies NNN leases, breaking down the benefits, risks, and underwriting for syndicators.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.