Financial Modelling Real Estate: Win Deals with financial modelling real estate

Financial Modelling Real Estate: Win Deals with financial modelling real estate

Explore financial modelling real estate techniques to structure deals, forecast returns, and secure financing with confidence.

Domingo Valadez

Feb 16, 2026

Blog

So, what exactly is real estate financial modeling? At its core, it's the practice of building a sophisticated spreadsheet that projects the financial future of a property investment. Think of it as creating a numerical business plan—a detailed roadmap that shows how a deal is expected to perform from the day you buy it to the day you sell it.

This isn't just about crunching numbers; it's about making smart, data-backed decisions before putting millions of dollars on the line.

Your Investment Flight Simulator

The best way to understand a financial model is to think of it as a flight simulator for an investment. Pilots don't just jump into a new jet and hope for the best. They spend countless hours in a simulator, testing the plane against engine failures, terrible weather, and a dozen other worst-case scenarios. They get to "crash" without any real-world consequences, learning critical lessons each time.

A real estate financial model does the exact same thing for a property deal. It lets you "fly" the investment through different economic storms—a recession, rising interest rates, unexpected vacancies—before you ever commit a single dollar of capital. This numerical story is the heart of any professional investment pitch, taking the conversation far beyond pretty pictures of the property.

Turning Raw Data into a Financial Story

Every investor, from a first-timer to a seasoned pro, wants to know the answer to one fundamental question: "How much money can I make, and what are the risks?" A good financial model is built to answer precisely that. It acts like an engine, taking in raw data and assumptions and spitting out a clear, compelling financial narrative.

Here’s a look at how that engine actually works:

- Raw Inputs: It all starts with the ground-truth data. This includes things like the current rent roll, historical utility bills, property taxes, and the terms you've been quoted for a loan.

- Key Assumptions: Next, you layer on your educated guesses about the future. What do you expect rent growth to be year-over-year? How will expenses inflate? And, crucially, what do you think the market will look like when you're ready to sell (your exit cap rate)?

- The Model's Engine: The spreadsheet takes all this information and runs it through a web of interconnected formulas, projecting cash flows month by month and year by year over your planned holding period.

- Actionable Outputs: The final result is a clean summary of the most important performance metrics—the IRR, equity multiple, and cash-on-cash return. These numbers tell the complete financial story of the investment.

This structured approach transforms a jumble of facts and figures into a cohesive forecast you can actually use.

Why It’s the Bedrock of Real Estate Syndication

For anyone raising capital from investors, the financial model is more than just an analytical tool. It's a trust-building machine. When you pitch a deal, your potential partners need to see that you've done your homework and kicked the tires on every part of the investment.

A detailed, well-constructed model instantly signals professionalism and foresight. It proves you've rigorously vetted the opportunity and aren't just selling a dream.

A great model doesn't just show investors the sunny-day scenario. It shows them you've planned for rain. By stress-testing your assumptions—seeing what happens if rents soften or interest rates rise—you build the confidence needed to raise capital effectively.

Ultimately, financial modeling is what separates guessing from professional investing. It gives you the power to compare different deals on an apples-to-apples basis, negotiate smarter terms with sellers and lenders, and communicate your investment thesis with clarity and conviction. It’s the single most important skill for turning a promising property into a profitable venture.

Choosing the Right Financial Model for Your Deal

Not all real estate deals are the same, so the spreadsheets you use to analyze them shouldn't be either. Relying on a single, one-size-fits-all model is a bit like trying to build a house with only a hammer—you're going to run into trouble. Picking the right tool for the job is the first, most crucial step toward building a projection that you, and your investors, can actually trust.

Each type of financial model is designed to tell a specific story. For a syndicator, matching the model to the deal isn't just a technicality; it’s about credibility. It proves you understand the unique risks and rewards of your strategy, whether you're buying a turnkey apartment building or building one from the dirt up.

Let's walk through the four essential model types you'll encounter.

Acquisition Models for Stable Assets

Think of an acquisition model as the perfect tool for a "plug-and-play" property. This model is built for stabilized, cash-flowing assets—a fully leased apartment building, an occupied office tower, or a humming industrial warehouse. Its main job is to analyze the existing income stream and project how it will perform under your ownership.

The heart of this model is the property’s current financial history, mainly the rent roll and operating statements. You’re not trying to reinvent the wheel here; you're just forecasting how to make that wheel spin a little faster and more profitably.

- Key Focus: Analyzing in-place cash flow and projecting modest, market-driven growth.

- Critical Inputs: Verified rent roll, historical operating statements (T12), and solid market rent comps.

- Main Question Answered: "Given its current performance and where the market is headed, what returns can we realistically expect from this asset?"

This model is less about a dramatic transformation and more about smart, steady optimization. It's the go-to workhorse for core and core-plus real estate strategies.

Development Models for Ground-Up Construction

If an acquisition model is for a stable asset, a development model is like writing a story from a blank page. It starts with nothing but a piece of land and has to map out every single cost and revenue stream until the property is built, leased up, and sold or refinanced. This model is, by nature, entirely forward-looking and packed with assumptions.

Unlike an acquisition model that leans on historical data, a development model has to create a financial future from scratch. It navigates a complex timeline with distinct phases—pre-development, construction, and lease-up—each with its own financial quirks.

The hallmark of a development model is the "S-Curve" schedule for construction costs. This visualizes how capital gets drawn over time, which is absolutely vital for calculating interest carry and understanding the total cash needed before the project ever generates a single dollar of income.

This model is non-negotiable for any ground-up project where forecasting construction budgets and lease-up speed is the name of the game.

Value-Add and Rehab Models

Let's stick with the car analogy. If an acquisition model is for buying a perfectly running car and a development model is for building one from parts, the value-add model is for the restoration project. It’s built for properties that are tired, dated, or just plain mismanaged and need a significant capital injection to shine. Think of an older apartment complex begging for new kitchens or a retail center with terrible curb appeal.

This model has a very clear "before and after" structure. It meticulously tracks the renovation budget and then models the financial lift—like higher rents and lower vacancy—that you expect to get from all those improvements. It’s a story of transformation told through numbers.

Operating Pro Formas for Asset Management

Finally, we have the operating pro forma. This isn't really an underwriting tool for buying a deal; it’s your command center after you own the property. It’s a highly detailed, often monthly, forecast that pits your budget against what’s actually happening on the ground.

Think of it as the dashboard for your investment. It helps you track performance, spot problems early (like expenses running hot), and make smarter decisions throughout the hold period. For pros, this is a critical piece of financial modelling real estate toolkits, ensuring the property stays on track with the original business plan you pitched to investors.

Comparing Real Estate Financial Model Types

To make it even clearer, let's break down how these four models stack up. Each is designed for a specific scenario, focusing on different goals and inputs.

Choosing the right model from the start sets the foundation for a clear, defensible, and ultimately more successful real estate investment.

The Core Components of a Real Estate Pro Forma

To build a financial model that actually works in the real world, you have to master its engine: the pro forma. You can think of it as the central nervous system of your entire deal analysis. It’s what connects every assumption to every potential outcome, weaving together the complete financial story of an investment from the day you buy it to the day you sell it.

This story always follows a clear narrative. It begins with your initial assumptions, moves through the year-by-year operational forecast, and ends with the key metrics that tell you whether the deal is a winner. Getting these components right is non-negotiable. After all, the old saying "garbage in, garbage out" is the unbreakable law of financial modelling real estate.

The Inputs and Assumptions Tab

Every solid financial model starts with a dedicated "Inputs" or "Assumptions" tab. This is your command center—a single, organized place where every variable driving the model is laid out. Separating your inputs from your calculations isn't just a good idea; it's a critical best practice that keeps your model clean, flexible, and easy for you (and your partners) to understand.

This is where you'll map out the bedrock facts of the deal:

* Acquisition Details: Purchase price, closing costs, and the acquisition date.

* Financing Terms: Loan amount, interest rate, amortization period, and any lender fees.

* Capital Expenditures: The upfront renovation budget plus the ongoing reserves for future big-ticket repairs.

* Growth Assumptions: Your best-educated guesses for rent growth, expense inflation, and market vacancy rates.

When all these variables are in one spot, testing different scenarios becomes effortless. Wondering how a 50-basis-point jump in interest rates will hit your returns? Just change one cell on this tab, and the entire model updates instantly. You can see this in action by grabbing our guide at https://www.homebasecre.com/posts/real-estate-pro-forma-template-excel.

The Pro Forma Cash Flow Statement

Once your assumptions are locked in, they flow directly into the pro forma cash flow statement. This is the heart of the model. It lays out a year-by-year (sometimes month-by-month) forecast of the property’s financial performance over your planned hold period. It’s where the investment story truly unfolds in numbers.

The pro forma follows a standard, logical sequence, subtracting all costs from income to get to the bottom line.

- Potential Gross Income (PGI): The total rent you’d collect if the property were 100% occupied.

- Effective Gross Income (EGI): Your PGI after accounting for vacancy and tenants who don't pay.

- Net Operating Income (NOI): The EGI minus all operating expenses—think property management, taxes, insurance, and repairs.

- Cash Flow Before Debt Service: What's left of the NOI after setting aside money for capital projects.

- Cash Flow After Debt Service: The actual cash in your pocket after paying the mortgage.

Net Operating Income (NOI) is arguably the single most important figure in the entire pro forma. It shows you the raw, unlevered profitability of the asset itself, and it’s the primary driver of the property's value.

Just look at the multifamily sector today for a real-world example of why assumptions matter. With U.S. construction starts projected to be 74% below their 2021 peak and 30% under pre-pandemic levels by mid-2025, a major supply-demand imbalance is brewing. This dynamic lets savvy syndicators confidently model robust NOI growth—often 4-6% annually—for properties in the right markets.

The Returns Summary

The final act of your financial story is the Returns Summary. This section takes all the detailed yearly cash flows from the pro forma and boils them down into a handful of powerful, easy-to-digest metrics. This is the dashboard your investors and lenders will look at first to get a quick read on the deal's potential.

Of course, a truly robust pro forma also means having a firm grasp on all income streams and expenses, including tax implications. Factoring in things like these 8 Crucial Tax Deductions for Real Estate Investors can have a major impact on your final numbers.

The key metrics you'll always find here include:

* Internal Rate of Return (IRR): The annualized rate of return on the entire investment.

* Equity Multiple: A simple measure of how many times you get your initial equity back. A 2.0x multiple means you doubled your money.

* Cash-on-Cash Return: The annual pre-tax cash flow you receive divided by the total cash you invested.

* Cap Rate (on Exit): The projected NOI in the year of sale divided by the projected sale price.

These three pieces—Inputs, Pro Forma, and Returns—are linked in a seamless chain. Rock-solid assumptions lead to a believable pro forma, which in turn generates the compelling returns you need to raise capital and get deals done.

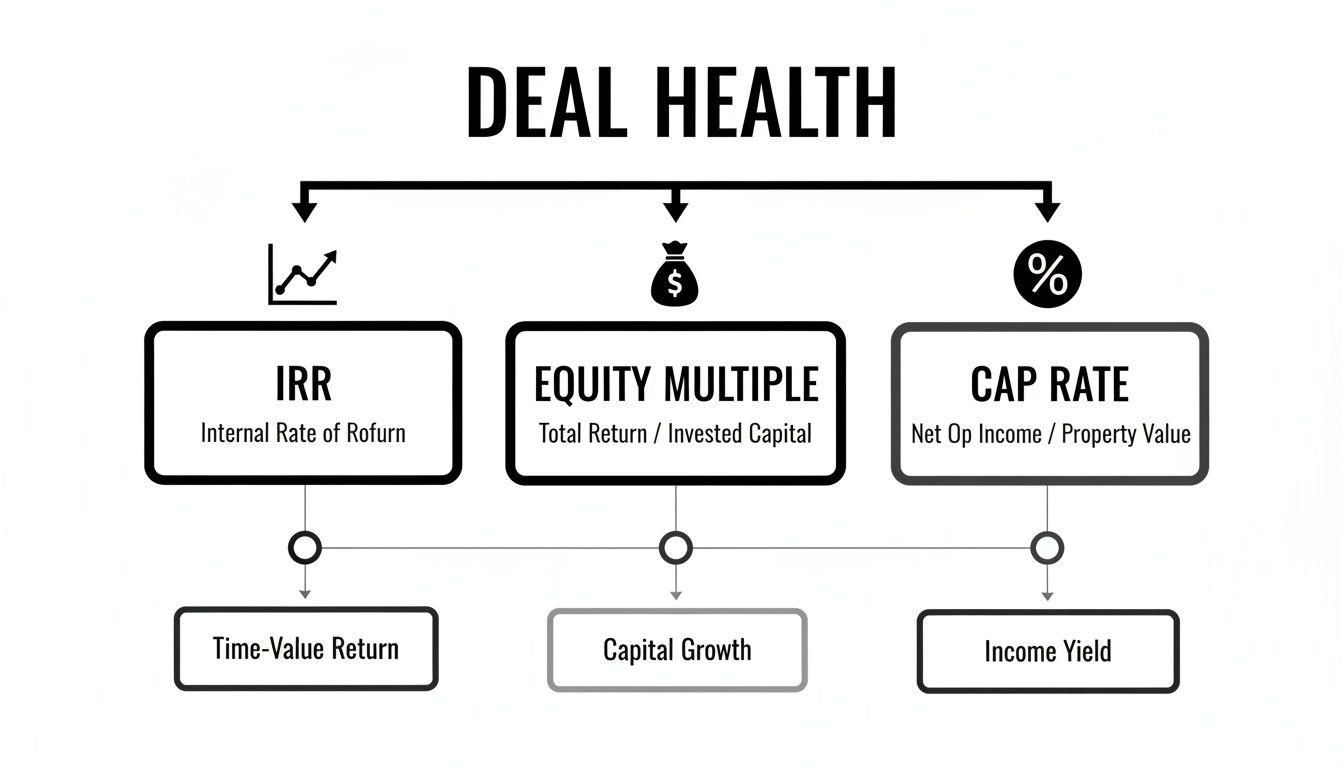

Decoding the Key Metrics Investors Actually Care About

A great financial model can spit out a ton of numbers, but when you're in front of investors trying to raise capital, only a few really matter. These key metrics are the universal language of real estate deals. They slice through the complexity of a 10-year forecast to give investors and lenders the bottom line. If you're a syndicator, you have to speak this language fluently.

These aren't just numbers on a spreadsheet; they're the vital signs of your deal's health. Each metric tells a slightly different part of the story, and knowing how they work together is what separates the pros from the amateurs. They answer the big questions: How hard is our money working? How much total profit are we going to make? And is this deal better than other options out there?

Internal Rate of Return (IRR): The Speed of Your Return

The Internal Rate of Return (IRR) is everywhere in real estate, but it's also one of the most commonly misunderstood metrics. Put simply, IRR tells you the annualized rate of return you can expect, factoring in every dollar that comes in and goes out over the entire life of the investment.

Think of it as the deal's average yearly growth rate. What makes it so powerful is that it respects the time value of money—the simple fact that a dollar today is worth more than a dollar a year from now. This makes it perfect for comparing a three-year value-add project against a seven-year stabilized hold. A higher IRR usually signals that your capital is working more efficiently over time.

Equity Multiple: The Total Profit Story

While IRR tells you how fast your money grows, the Equity Multiple tells you how much it grows in total. It’s a simple, powerful gut-check on profitability. You just divide the total cash you get back by the total cash you put in.

- An Equity Multiple of 1.0x means you got your money back—you broke even.

- An Equity Multiple of 2.0x means you doubled your money.

- An Equity Multiple of 1.8x means for every $1 you invested, you got back $1.80.

This metric is refreshingly direct. It answers the first question every investor has: "If I put in $100,000, what's the total I'll get back?" It doesn't care how long it took, which is why it's the perfect partner to IRR. A quick flip might have a great IRR but a low Equity Multiple, while a long-term hold could be the exact opposite.

The best investors look at IRR and Equity Multiple side-by-side. A high IRR shows your capital is efficient, but a strong Equity Multiple proves you’re actually building significant wealth. The sweet spot is finding a deal that delivers on both.

Cash-on-Cash Return and Cap Rate

Two other metrics give you a crucial, real-time snapshot of performance. The Cash-on-Cash Return is your "mailbox money" metric. It measures the annual cash flow you receive before taxes against the total cash you invested, telling you exactly how much passive income the property is generating each year.

Meanwhile, the Capitalization Rate (Cap Rate) measures the property's unlevered annual return—its Net Operating Income (NOI)—as a percentage of its current value. For quickly sizing up a deal, knowing how to calculate cap rate is a fundamental skill.

Looking at the broader market, global private real estate has been on a tear, with values rising for five straight quarters heading into Q2 2025. For multifamily sponsors, this means financial models need to be sharper than ever. Imagine modeling a $50M equity raise where rising demand causes cap rates to compress from 6.5% to 5.8%. That shift alone could boost your equity multiples from 1.8x to 2.2x over five years. You can dive deeper into these trends with Nuveen's global real estate outlook.

Modeling Deal Structures and Investor Waterfalls

A powerful financial model does more than just spit out return projections. It’s your sandbox for structuring the entire deal. This is where you translate the legal partnership agreement into cold, hard numbers, showing exactly how every dollar flows from the property, past the lender, and finally into the pockets of your investors and your firm.

When you get good at this, you can design deals that aren't just profitable, but are also fair and compelling enough to attract capital partners in the first place.

Two parts of the model are absolutely crucial and notoriously tricky: the debt financing and the equity waterfall. Botch these, and your projections are useless. Get them right, and you have a clear roadmap for the deal's financial life.

Building the Debt Schedule

Before any investor sees a dime, the bank gets paid. Always. Modeling your debt correctly is the first step to understanding what cash is actually left over. This isn't just about plugging in an interest rate; it requires a detailed amortization schedule that breaks down every single payment into its principal and interest components over the life of the loan.

Different loans demand different approaches:

- Senior Debt with Amortization: This is your classic, bread-and-butter loan. Your model has to accurately show the interest portion of the payment shrinking over time as the principal portion grows.

- Interest-Only (IO) Loans: These are common for value-add projects where you need to maximize cash flow early on. The model must show payments covering only interest for a set period, then smoothly transition to a fully amortizing schedule or account for a massive balloon payment at the end.

A metric your model absolutely must calculate is the Debt Service Coverage Ratio (DSCR). Lenders live and die by this number. It’s a simple calculation: Net Operating Income (NOI) divided by your total annual debt payments.

Most lenders won’t even talk to you unless your property can hit a DSCR of 1.25x or higher. This gives them a 25% safety cushion, ensuring the income can cover the mortgage with room to spare. A model that tracks DSCR year-over-year shows lenders you’re speaking their language and take their risk seriously.

Structuring the Equity Waterfall

Once the lender is happy, the remaining cash flow belongs to the equity holders. The equity waterfall is the roadmap that dictates how those profits get split between the limited partners (LPs), who bring most of the cash, and the general partner (GP) or sponsor—that’s you.

It's called a "waterfall" for a reason. Cash flows down, filling one bucket at a time before spilling over to the next. Each bucket represents a performance hurdle. When a hurdle is cleared, the way profits are split changes, usually in your favor. This is how you earn your promote (also called carried interest)—the outsized share of profits that rewards you for finding the deal and making it work.

Here’s a breakdown of a very common waterfall structure:

- Return of Capital: First things first. 100% of all cash flow goes straight to the LPs until every penny of their original investment is returned.

- Preferred Return: After they're whole, LPs continue to receive 100% of the cash flow until they've earned their "pref," which is a cumulative preferred return (say, 8% per year) on their investment.

- GP Catch-Up: This tier isn't in every deal, but it's common. Once the LPs have their capital back plus their pref, the GP might get a higher split of the profits for a while to "catch up" to a certain percentage of the total profits paid out so far.

- Promote Split: Now for the good part. After all prior hurdles are met, the remaining cash is split at the final promoted ratio, something like 70% for the LPs and 30% for the GP.

This structure gets everyone pulling in the same direction. As the sponsor, you’re highly motivated to blow past the initial hurdles to get to that lucrative promote tier. When you win, your investors win bigger. A clean, easy-to-follow waterfall in your model is non-negotiable for building investor trust.

The infographic below shows the high-level metrics that really drive these distributions and signal a deal’s health.

Think of IRR, Equity Multiple, and Cap Rate as the vital signs of an investment. Investors use them for a quick check-up on a deal's potential, and their strength directly influences how they feel about the fairness and upside of your proposed deal structure.

Building Models That Inspire Investor Confidence

Nothing kills a deal faster—or damages your credibility more—than a sloppy financial model riddled with errors. The difference between a simple back-of-the-napkin calculator and a professional-grade underwriting tool is how it's built and, more importantly, how it holds up under pressure.

To win over investors, your model needs to tell a clear, defensible story. It’s less about just plugging in numbers and more about demonstrating foresight and a disciplined approach to managing risk. Think of it this way: a messy, hard-to-follow spreadsheet hints at a messy, disorganized operator.

Best Practices for Model Integrity

To build a model that can stand up to serious scrutiny, you need to bake in a few non-negotiable habits from the start. These practices aren't just for show; they prevent mistakes, make your work easy to audit, and turn stress-testing from a headache into a simple exercise.

- Centralize Your Assumptions: Every key variable—from the purchase price and loan terms to rent growth and vacancy rates—should live on a single "Inputs" or "Assumptions" tab. This creates one source of truth, making it dead simple to run different scenarios just by changing a few cells.

- Color-Code Everything: Create a simple, consistent color key. A classic system is blue for hard-coded inputs, black for formulas, and green for links to other tabs. This visual shorthand instantly tells anyone (including your future self) how the model works.

- Never Hard-Code Numbers in Formulas: This is the golden rule of financial modelling real estate. A formula should only refer to other cells (like =A1*B1), never contain a raw number (like =A1*1.03). When you follow this rule, your entire model updates dynamically whenever an assumption changes.

The Art of Stress-Testing Your Projections

A truly professional model doesn't just paint a rosy picture. It anticipates what could go wrong. This is where you prove to investors that you’ve thought just as much about the downside as you have about the upside. The real question isn't "how good can it get?" but "how bad can it get before the deal breaks?"

A model that only shows the upside is a sales pitch. A model that stress-tests for the downside is a business plan. Answering the tough 'what-if' questions proactively builds immense trust and demonstrates that you are a prudent steward of investor capital.

There are two primary ways to do this. Sensitivity analysis isolates a single variable—like the exit cap rate or the floating interest rate—and shows you how wiggling it up and down impacts your IRR and equity multiple.

Scenario analysis is bigger picture. It bundles multiple changes together to model a specific economic event, like a "recession scenario" that includes lower rent growth, higher vacancy, and a wider exit cap rate all at once.

Showing an investor that your deal still works (or at least survives) under pressure is one of the most powerful things you can do. This is especially crucial in today's market. For instance, with European commercial transactions hitting €188.8 billion in 2024—a 13.7% increase from last year—the market is full of both opportunity and volatility. As you can see from these emerging global real estate trends from PwC, having a model that can account for these kinds of market shifts is no longer a nice-to-have; it's a necessity.

Got Questions About Real Estate Modeling? We've Got Answers.

As you start digging into the nuts and bolts of financial modeling in real estate, a few questions always seem to pop up. Let's tackle some of the most common ones that syndicators and investors ask.

What Software Should I Be Using?

Look, there are specialized platforms out there, but let's be real: Microsoft Excel is still king. It's the undisputed industry standard for a reason.

Its flexibility is unmatched, everyone knows how to use it (more or less), and its functions are powerful enough for almost any deal you can throw at it. While some big institutional players might lean on Argus for heavy-duty valuation, Excel is the tool you'll build everything on. It's the foundation.

Seriously, How Long Does It Take to Build a Good Model?

This is the classic "it depends" answer, but it's true. The complexity of the deal drives the timeline.

If you're looking at a simple, stabilized apartment building, a seasoned analyst could probably knock out a solid acquisition model in a few hours. But if you're talking about a ground-up development? That's a different beast entirely. A model with detailed construction draws, complex debt structures, and a multi-tiered equity waterfall could easily take a few days of focused work to build, test, and audit properly.

The goal isn't speed, it's confidence. A rushed model is a house of cards. The extra hours you spend building a clean, error-free spreadsheet will pay you back tenfold by preventing disastrous mistakes and giving your investors peace of mind.

Is It Cheating to Use a Template?

Not at all—in fact, you absolutely should. Why reinvent the wheel? Starting with a well-built template saves a ton of time and, more importantly, dramatically reduces the chances of a busted formula throwing off your entire analysis.

But here’s the critical part: never, ever treat a template like a "black box." You have to get under the hood and understand precisely how every calculation works. A template is your starting point, not your destination. Your job is to adapt and customize it until it perfectly reflects the unique story of your deal.

How Do I Know My Assumptions Aren't Just Wishful Thinking?

This is where the art of underwriting meets the science of data. Getting your assumptions right is everything, and it means doing your homework.

- Hit the Phones: Talk to local brokers. They have the real-time, on-the-ground intel on what things are actually renting for, what vacancy looks like, and what similar properties just sold for.

- Dig Into the Past: Get the property's T12 (trailing 12 months) financial statements. This isn't just a suggestion; it's essential for grounding your expense projections in reality.

- Lean on Property Managers: These folks are in the trenches. They can give you the unvarnished truth about what it really costs to run a building, from landscaping to unexpected repairs.

- Read Up: Dive into market reports from reputable research firms. This data will help you back up your assumptions about big-picture trends like rent growth and economic forecasts.

At the end of the day, a defensible model is built on conservative assumptions that are stress-tested and supported by evidence from multiple, independent sources.

At Homebase, we know that a bulletproof financial model is just the first step. After you've underwritten the deal, our platform is there to help you manage the entire syndication, from raising capital in a professional deal room to sending out investor updates and distributions. We handle the admin so you can focus on what you do best: finding and closing great deals. Learn how Homebase streamlines real estate syndication.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

How Do You Value Commercial Real Estate? A Modern Sponsor's Guide

Blog

Discover how do you value commercial real estate with a sponsor-focused guide. Master NOI, cap rates, and DCF to spot profitable investments.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.