Top Business Process Automation Benefits in 2025

Top Business Process Automation Benefits in 2025

Discover the key business process automation benefits shaping real estate in 2025. Learn how automation enhances efficiency and gains a competitive edge.

Domingo Valadez

Aug 13, 2025

Blog

In the competitive world of real estate syndication, efficiency isn't just an advantage; it's essential for survival and growth. Many firms are still bogged down by manual, repetitive tasks: endless data entry, cumbersome investor communications, and complex compliance tracking. This manual approach not only consumes valuable time but also introduces risks of human error, slows down deal velocity, and ultimately caps your potential. For those relying on older methods, it's become clear why spreadsheets will never be a true CRM (From Grids to Growth: Why Spreadsheets Will Never Be a True CRM).

Business process automation (BPA) offers a powerful solution, transforming these operational bottlenecks into streamlined, scalable systems. By automating key workflows, syndicators can reclaim their time, reduce operational friction, and focus on high-value activities like finding deals and building investor relationships.

This article explores the top business process automation benefits, providing actionable insights specifically for real estate operators. We'll show you how platforms like Homebase are making these benefits accessible, enabling you to manage more deals and investors with less effort and setting a new standard for operational excellence.

1. Increased Operational Efficiency

One of the most significant business process automation benefits is a dramatic improvement in operational efficiency. Automation streamlines workflows by taking over manual, time-consuming tasks, freeing your team to focus on strategic activities that drive growth rather than administrative drudgery. This shift from manual to automated processes allows your business to handle a greater volume of work in less time, all while minimizing human error and upholding consistent quality standards.

In real estate syndication, this means transforming cumbersome, multi-day processes into seamless, automated sequences. An automated system acts as a digital checklist, ensuring no critical step is missed, from initial KYC/AML checks to the final distribution of executed documents. This creates a highly reliable and scalable operational foundation.

Real Estate Syndication Example

Consider the manual process of onboarding a new investor. It often involves days of back-and-forth emails to collect accreditation letters, send and track subscription agreements, and provide wiring instructions. This method is not only slow but also prone to costly errors and can create a frustrating experience for your investors.

An automated workflow, however, condenses this entire timeline into mere minutes. An interested investor simply clicks an "Invest Now" button on your deal page, fills out a secure online form, and the system instantly generates pre-filled subscription documents. These are then sent for e-signature, and upon execution, the platform automatically delivers wiring instructions, notifying you only when the funds are ready to be received.

Key Insight: By automating investor onboarding, you can reduce the time-to-close from days to minutes, significantly improving the investor experience and allowing you to manage multiple capital raises concurrently without overwhelming your team.

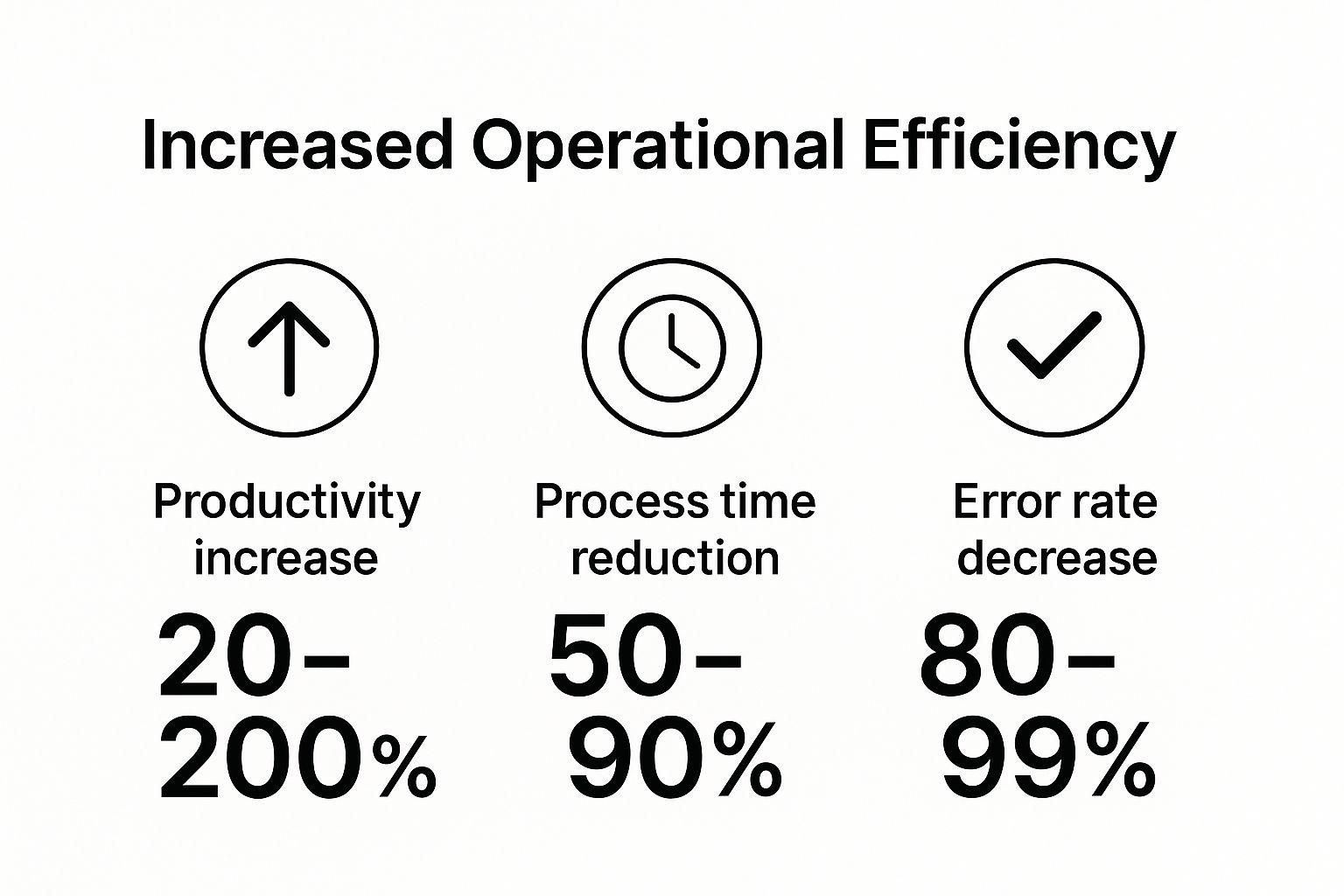

The following infographic highlights the powerful impact automation can have on key efficiency metrics.

These statistics demonstrate how automation directly translates into tangible gains, cutting process times by up to 90% while nearly eliminating errors.

How Homebase Implements This

Homebase provides a centralized investor portal that automates the entire fundraising workflow, embodying the principles of peak operational efficiency. The platform allows you to:

- Create Professional Deal Rooms: Quickly launch data rooms with all necessary due diligence documents.

- Automate Compliance: Seamlessly manage KYC/AML verification and investor accreditation.

- Streamline Subscriptions: Facilitate secure e-signatures on all offering documents.

This high level of automation reduces the typical investor onboarding time by over 80%. This efficiency empowers sponsors to close deals faster and scale their operations effectively. To dive deeper into specific workflows, you can explore this real estate workflow automation guide.

2. Substantial Cost Reduction

Another one of the core business process automation benefits is the direct and substantial reduction in operational costs. Automation achieves this by minimizing the need for manual labor in repetitive tasks, reducing the frequency of expensive human errors, and optimizing the use of your resources. This leads to a powerful return on investment (ROI) as reduced expenditures flow directly to your bottom line, boosting profit margins.

In real estate syndication, these savings are realized by automating high-volume processes like investor communications, distributions, and tax document preparation. By automating these functions, you can scale your portfolio and investor base without a proportional increase in administrative headcount, directly lowering your general and administrative (G&A) expenses.

Real Estate Syndication Example

Consider the quarterly distribution and reporting process for a real estate asset. Manually, this involves calculating each investor's pro-rata share, preparing individual statements, processing payments, and answering a wave of inbound inquiries. This is a labor-intensive, error-prone process that can cost hundreds of hours per year in staff time, especially as your investor count grows.

With an automated system, you simply input the total distributable cash amount. The platform then instantly calculates each investor's share based on their equity, generates professional-looking statements, and initiates ACH transfers through an integrated system. Investors are automatically notified and can access their documents 24/7 through a secure portal, drastically reducing administrative follow-up.

Key Insight: Automating financial processes like distributions and tax reporting not only cuts direct labor costs but also minimizes the risk of costly mistakes, such as incorrect payments or compliance reporting errors, which can damage investor trust and lead to financial penalties.

How Homebase Implements This

Homebase is designed to drive down the operational costs associated with managing real estate investments. Its platform provides an all-in-one solution that eliminates the need for multiple, disconnected software subscriptions and reduces the administrative burden on your team. Homebase helps you reduce costs by:

- Automating Investor Distributions: Calculate and execute distributions in minutes, not days, saving significant administrative time.

- Streamlining Tax Season: Automatically generate and distribute K-1s and other tax documents to all investors through the portal.

- Centralizing Communications: Reduce the time spent answering individual emails by using a centralized platform for all updates and documents.

This integrated approach allows sponsors to manage larger portfolios with a leaner team, translating directly into lower overhead and higher net returns for both the sponsor and the investors.

3. Enhanced Accuracy and Quality Control

Another of the core business process automation benefits is the significant improvement in accuracy and quality control. Human error is an inherent risk in any manual process, from simple data entry mistakes to complex miscalculations. Automated systems, however, execute tasks with consistent, machine-level precision every single time, drastically reducing errors and ensuring that outputs meet exact quality standards. This reliability eliminates the need for costly rework and enhances overall compliance.

In the high-stakes world of real estate syndication, accuracy is not just a preference; it's a legal and financial necessity. Errors in calculating investor distributions, managing cap tables, or executing legal documents can lead to severe financial penalties and damage to your reputation. Automation builds a layer of protection, ensuring every calculation is correct and every document is flawlessly managed according to predefined rules.

Real Estate Syndication Example

Consider the process of calculating and distributing quarterly investor returns. Manually, this involves pulling data from multiple spreadsheets, calculating each investor's pro-rata share based on their equity, accounting for any fees or preferred returns, and then initiating individual payments. A single misplaced decimal or incorrect formula could lead to thousands of dollars in errors, creating a nightmare scenario of clawbacks and investor disputes.

An automated system handles this entire process with perfect accuracy. It connects directly to your financial data, applies the correct distribution waterfall logic automatically, and generates precise payment schedules. The system can even initiate ACH or wire transfers, providing a complete, error-free workflow that ensures investors are paid correctly and on time, every time.

Key Insight: Automating financial calculations and distributions removes the risk of human error, guaranteeing 100% accuracy and compliance. This builds trust with your investors and protects your firm from costly financial and reputational damage.

This level of precision is why leading companies across industries rely on automation. For example, Aetna's claims processing automation achieved 99.5% accuracy rates, while Johnson & Johnson's automated manufacturing ensures total compliance with strict FDA standards.

How Homebase Implements This

Homebase embeds accuracy and quality control directly into its platform, automating the most error-prone aspects of real estate syndication. This ensures your operations are not just efficient but also meticulously precise. The platform helps you:

- Automate Distribution Waterfalls: Easily model and execute complex distribution waterfalls with complete accuracy, eliminating manual calculation errors.

- Maintain a Dynamic Cap Table: Automatically update your capitalization table in real-time as new investors subscribe or ownership stakes change.

- Generate Flawless Reports: Produce professional, error-free investor statements and K-1 tax forms with the click of a button.

By leveraging Homebase, you can ensure that every financial and administrative task is performed with the highest degree of accuracy, safeguarding your deals and reinforcing investor confidence. For more on this, see how our platform can simplify your real estate syndication.

4. Improved Employee Satisfaction and Productivity

Another crucial business process automation benefit is the positive impact it has on your team's morale and overall productivity. By automating mundane, repetitive tasks, you empower your employees to move away from tedious administrative work and focus on higher-value, creative, and strategic initiatives that contribute directly to business growth. This shift not only provides greater job satisfaction but also leads to improved morale, reduced turnover, and a more engaged workforce.

In the competitive world of real estate syndication, your team's expertise is your greatest asset. Automation allows them to apply their skills to building investor relationships, analyzing new deal opportunities, and developing growth strategies instead of manually chasing signatures or compiling reports. This fosters a more dynamic and fulfilling work environment where employees feel valued for their strategic contributions, not their administrative speed.

Real Estate Syndication Example

Imagine your investor relations team spending hours each month manually compiling and sending out distribution notices and K-1 tax forms. This repetitive process is not only time-consuming but also mentally draining and offers little professional growth. It’s a classic example of a high-volume, low-value task that can lead to burnout and dissatisfaction.

With an automated system, the entire process is streamlined. The platform can automatically calculate distributions based on ownership percentages, generate professional-looking statements, and securely deliver them to each investor through their portal. Similarly, at tax time, K-1s can be uploaded and distributed with just a few clicks, freeing up your team to handle complex investor inquiries and nurture key relationships.

Key Insight: Automation transforms your team from administrative processors into strategic relationship managers. By eliminating tedious tasks, you boost job satisfaction, reduce the risk of burnout, and retain top talent focused on growing your portfolio.

This transition empowers your team to use their industry knowledge where it matters most, creating a more sustainable and productive operational model.

How Homebase Implements This

Homebase is designed to remove the administrative burden from your team, allowing them to perform at their best. Our platform automates key investor management tasks, directly contributing to higher employee satisfaction:

- Automated Distributions: Effortlessly calculate, track, and manage investor payouts, eliminating hours of manual spreadsheet work.

- Centralized Document Management: Securely distribute K-1s, reports, and updates through the investor portal, saving time and reducing administrative stress.

- Streamlined Communications: Use automated updates and a centralized CRM to keep investor communications organized and efficient.

By handling these repetitive duties, Homebase frees your team to focus on strategic activities like nurturing investor relationships and sourcing new deals. This shift improves both productivity and job satisfaction, creating a more motivated and effective team.

5. Enhanced Customer Experience and Service

Another of the core business process automation benefits is the ability to deliver a superior customer experience. Automation elevates service quality by ensuring faster response times, providing 24/7 availability for routine tasks, and maintaining consistency across every interaction. By automating standard inquiries and processes, you free up your team to provide high-touch, personalized support for more complex investor needs.

For real estate syndicators, this means creating a seamless and professional journey for every investor, from their first point of contact to their final distribution. An automated platform ensures investors always have access to their documents, receive timely updates, and can get answers to common questions instantly, fostering trust and encouraging repeat investments.

Real Estate Syndication Example

Imagine an investor has a question about their K-1 tax form or wants to review their initial subscription agreement on a Sunday afternoon. In a manual system, they would send an email and wait, possibly until Monday or Tuesday, for your team to find the document and respond. This delay can create anxiety and diminish confidence.

With an automated investor portal, the experience is transformed. The investor can log into their secure, personalized dashboard at any time, day or night, and instantly access all their documents, view performance updates, and find answers to frequently asked questions. The system provides immediate, on-demand service without any manual intervention from your team.

Key Insight: Automation empowers investors with self-service capabilities, providing them with instant access to the information they need, when they need it. This builds a foundation of transparency and trust, significantly enhancing the overall investor experience.

This level of service not only satisfies current investors but also creates a powerful reputation that attracts new capital.

How Homebase Implements This

Homebase delivers a premium investor experience by providing a centralized, automated portal that serves as the single source of truth for all investment-related information. Our platform enhances service by allowing you to:

- Offer a Professional Investor Dashboard: Give investors 24/7 access to their documents, investment performance, and communication history.

- Automate Communications: Send out automated, branded updates for capital calls, distributions, and quarterly reports to ensure consistent and timely information flow.

- Streamline Inquiries: The portal allows investors to find answers and documents on their own, reducing administrative workload and improving response times.

This automated, self-service environment ensures every investor receives the same high-quality, professional experience, strengthening relationships and encouraging long-term loyalty.

6. Superior Scalability and Business Growth

Another of the core business process automation benefits is the creation of a framework for superior scalability and sustainable growth. Automation provides the foundation for rapid business scaling by enabling your firm to handle increased workloads, more complex deals, and a larger investor base without proportional increases in staffing or overhead. This operational flexibility allows you to respond quickly to market opportunities and manage multiple capital raises simultaneously.

For a real estate sponsor, this means you can confidently pursue more deals knowing your back-office systems can handle the volume. Instead of being a bottleneck, your operations become a strategic asset that supports expansion. An automated system can manage hundreds or even thousands of investors with the same precision and efficiency as it manages a dozen, ensuring a consistent, professional experience for everyone.

Real Estate Syndication Example

Imagine your firm successfully closes a 50-unit multifamily deal and now has the opportunity to acquire a 200-unit portfolio. Manually, this fourfold increase in scale would require hiring more administrative staff to manage the surge in investor communications, documentation, and compliance checks. This hiring process is slow, expensive, and adds long-term fixed costs to your business.

With an automated platform, however, scaling to meet this demand is seamless. The system can instantly handle the increased volume of investor onboarding, document distribution, and communication without any degradation in performance. You can launch the new deal room, process subscription agreements, and manage capital calls for the larger offering just as easily as you did for the smaller one, allowing you to seize the growth opportunity without hesitation.

Key Insight: Automation decouples your business growth from your headcount. It allows you to scale your deal flow and assets under management exponentially, while your operational costs grow only minimally, dramatically improving profitability.

This principle of scalable risk management through technology is being applied across many high-stakes industries. Beyond the realm of real estate, the principles of enhanced compliance and risk management through automation are universally applicable; for instance, consider how AI is transforming processes in the legal sector with AI-powered legal case management solutions.

How Homebase Implements This

Homebase is built on a cloud-native architecture designed for infinite scalability, allowing your operations to grow alongside your ambitions. The platform ensures you are never limited by your back-office capacity. Homebase helps you scale by:

- Handling Unlimited Investors: Manage an ever-growing pool of investors without performance issues or additional per-user fees.

- Supporting Concurrent Deals: Run multiple capital raises at the same time through a single, centralized dashboard.

- Providing On-Demand Infrastructure: Leverage a robust system that can process high volumes of documents and communications effortlessly.

This built-in scalability ensures that as you find more opportunities, Homebase provides the operational horsepower to execute on them, turning growth from a challenge into an advantage.

7. Improved Compliance and Risk Management

Navigating the complex web of regulations is a critical challenge, and another of the key business process automation benefits is the ability to bolster compliance and mitigate risk. Automated systems enforce standardized procedures, ensuring that every action adheres to regulatory requirements like SEC guidelines and internal policies. This systematic approach minimizes the risk of human error, which can lead to costly penalties and reputational damage.

For real estate syndicators, this means creating an unbreakable chain of compliance. Automation builds a comprehensive and immutable audit trail for every investor interaction and transaction. From verifying accreditation status to ensuring proper disclosures are delivered and signed, an automated system ensures you meet regulatory standards consistently and can prove it to auditors at a moment's notice.

Real Estate Syndication Example

Consider the process of verifying an investor's accreditation status. Manually, this involves collecting sensitive documents via email, storing them in potentially insecure folders, and relying on a team member to correctly interpret and record the verification. This process is not only inefficient but also riddled with security and compliance risks, from data breaches to incorrect assessments that could jeopardize the entire offering.

An automated compliance workflow removes these vulnerabilities. An investor uploads their verification documents directly into a secure, encrypted portal. The system can then use integrated verification services or guide your team through a standardized review process, time-stamping every action and creating a clear, auditable record. This ensures every investor in a 506(c) offering is properly vetted according to SEC rules, protecting the sponsor from severe regulatory consequences.

Key Insight: Automation transforms compliance from a manual, error-prone task into a systematic, auditable, and reliable process, safeguarding your firm against regulatory scrutiny and building trust with your investors.

How Homebase Implements This

Homebase embeds compliance directly into the investment workflow, providing a robust framework for risk management. The platform is designed to help sponsors meet their regulatory obligations with confidence. It allows you to:

- Standardize Accreditation: Automate the collection and verification of investor accreditation, with secure document storage and a clear audit trail.

- Enforce Offering Rules: Set specific investment minimums and maximums that are automatically enforced by the system.

- Maintain Comprehensive Records: Generate detailed reports and maintain an always-on audit trail for every investor and every transaction, simplifying compliance reviews.

By integrating these features, Homebase helps ensure that your fundraising activities are not just efficient but also rigorously compliant. Learn more about how to manage your investors with a focus on security and compliance.

Business Process Automation Benefits Comparison

Take the Next Step: Automate and Scale Your Real Estate Business

Throughout this guide, we have explored the extensive list of business process automation benefits that can fundamentally reshape a real estate syndication firm. The journey from manual, time-consuming tasks to streamlined, automated workflows is not just about adopting new technology; it's about strategically positioning your business for sustained success and market leadership. The evidence presented is compelling and clear.

By automating core functions, you unlock a powerful chain reaction. Increased operational efficiency directly leads to substantial cost reductions, freeing up capital for new acquisitions or investor distributions. Simultaneously, enhancing accuracy through automation minimizes the risk of costly errors, reinforcing the quality and reliability of your operations. This meticulous approach strengthens your compliance framework, providing a solid foundation for risk management in an ever-changing regulatory landscape.

From Bottlenecks to Breakthroughs

The impact of automation extends far beyond financial metrics. It directly addresses two of the most critical assets in any real estate syndication business: your team and your investors. By eliminating tedious administrative work, you can significantly improve employee satisfaction and productivity, allowing your talented team to focus on high-value activities like deal analysis and building relationships.

This shift has a direct and positive effect on the investor experience. Automated communication, streamlined reporting, and faster distributions create a seamless, professional journey for your capital partners. This not only enhances satisfaction and builds loyalty but also becomes a key differentiator, making it easier to raise capital for future deals. Ultimately, the cumulative effect of these business process automation benefits is superior scalability, allowing you to grow your portfolio without being constrained by manual processes.

Your Action Plan for Automation

The path forward is about making a decisive shift from managing processes to managing growth. The question is no longer if you should automate, but how you can start implementing it effectively. Begin by identifying the most significant bottlenecks in your current operations. Is it investor onboarding? Monthly distributions? Or compiling K-1s? Pinpoint these high-friction areas and prioritize them for automation.

Embracing these concepts is crucial for any syndicator aiming to thrive, not just survive. Mastering automation allows you to build a resilient, efficient, and scalable business model that can withstand market fluctuations and seize opportunities faster than the competition. It empowers you to spend less time buried in administrative tasks and more time on the strategic initiatives that truly drive growth: finding great deals and serving your investors.

Ready to experience these business process automation benefits firsthand? If you're tired of administrative bottlenecks and ready to scale your syndication business with a powerful, affordable, and easy-to-use platform, explore Homebase. Designed by syndicators for syndicators, Homebase provides all the tools you need to automate your fundraising, investor relations, and deal management so you can focus on growing your portfolio.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.