Borrow money for investment guide: borrow money for investment strategies

Borrow money for investment guide: borrow money for investment strategies

Discover when and how to borrow money for investment with real estate syndication insights, debt options, risk analysis, and strategies to maximize returns.

Domingo Valadez

Dec 9, 2025

Blog

Let's cut right to the chase. You borrow money for an investment for one simple reason: you're confident the asset will earn you more than what the debt costs you. This strategy is called using leverage, and it's the engine that drives growth and profits for nearly every successful real estate syndicator.

Why You Should Borrow Money for Investment

Think about using a pry bar to lift a massive boulder. On your own, you can't budge it. But with the right tool—the right leverage—you can move something far bigger than yourself. In real estate, debt is that tool.

It allows you to take control of a large, income-generating asset by putting down just a fraction of its total price. This is the single most important reason syndicators borrow money.

The whole game revolves around a concept called positive leverage. This is the sweet spot you hit when the income from your property (think rent checks) is higher than the cost of the loan you used to buy it. When you get this right, debt isn't just a way to buy a building; it's a tool that actively juices your returns.

The Power of Positive Leverage

Let's say you have $1 million ready to invest. You could go out and buy a $1 million property with all cash. That’s one way to do it.

But what if you used that same $1 million as a down payment on four different $1 million properties? Suddenly, you control a $4 million portfolio. That’s the kind of amplification that sophisticated investors live by.

Using debt this way is a powerful wealth-building accelerator. Here's how it works:

- Boosted Returns on Equity: Because your initial cash investment is smaller, the returns you make look much bigger on a percentage basis. Your money is working harder for you.

- Smarter Diversification: Instead of putting all your eggs in one basket, borrowing allows you to spread your capital—and your risk—across several properties or even different markets.

- Access to Bigger Deals: Debt opens the door to institutional-grade assets that would normally be out of reach. These larger properties often come with better cash flow and more appreciation potential.

This isn't some niche trick; it's a fundamental part of modern finance. Just look at the bigger picture. The International Monetary Fund's Global Debt Monitor recently showed total global debt hitting a record of nearly $323 trillion. A huge chunk of that—about 143% of global GDP—is private debt from corporate borrowing. If you want to dig deeper, you can explore more about these global debt trends and their implications to see just how common this strategy is.

The goal isn’t just to buy property. It's to make your capital work smarter and harder. Borrowing is the mechanism that turns a good deal into a great one.

Of course, with great power comes great responsibility. The line between a successful syndicator and one who gets wiped out is often drawn by how wisely they use debt. This guide is for the practitioner who's ready to move past the theory and master the real-world art of borrowing to build a stronger, more profitable portfolio.

Navigating Your Investment Loan Options

When you decide to borrow for an investment, you'll quickly find yourself in a sea of financial products, each with its own jargon and rulebook. It's a lot like a mechanic's toolbox. You wouldn't use a sledgehammer to fix a watch; you need the right tool for the job. Learning your loan options is about knowing exactly which tool to grab for your specific real estate deal.

Picking the wrong financing can easily sink a fantastic project. On the flip side, the right structure can supercharge your returns and insulate you from risk. The goal isn't to find the "best" loan in a vacuum, but the best loan for your strategy—whether that's a turnkey, stabilized asset or a gut-renovation project.

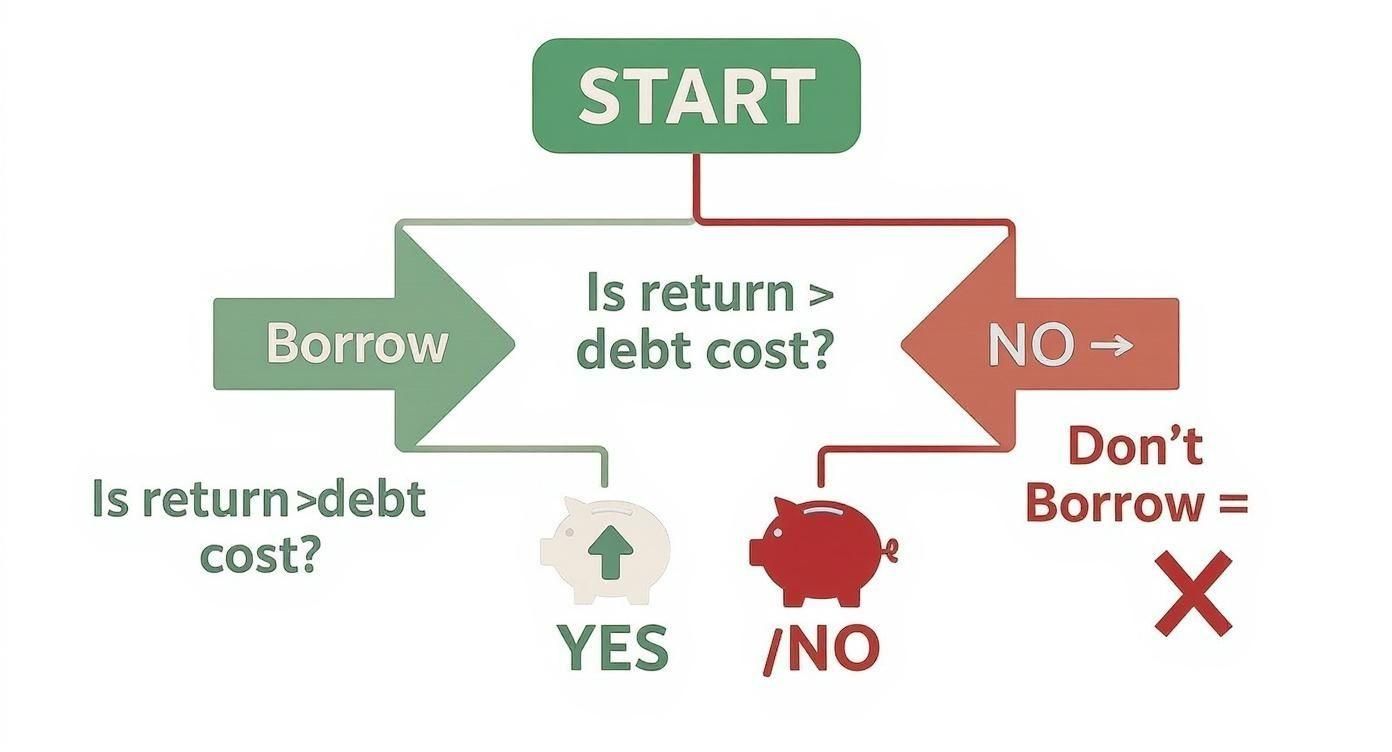

The decision always boils down to one simple question: does borrowing actually make sense for this deal? This flowchart gets right to the heart of that logic.

As you can see, the core principle is dead simple. You should only take on leverage when you’re confident your investment will generate a return higher than the total cost of that debt.

Understanding the Capital Stack

Before we get into the different loan types, we need to talk about the capital stack. This is just a fancy term for the pecking order of who gets paid back—and when—if a property is sold or, worse, foreclosed on.

Think of it as a totem pole. The person at the bottom is the most secure, while the one at the very top faces the most risk.

- Senior Debt: This is the base of the totem pole. It’s the safest position for a lender because they have the first claim on the property. Because of this security, it comes with the lowest interest rate.

- Junior (or Subordinate) Debt: These are the pieces in the middle, like mezzanine loans. They sit right behind the senior lender in the repayment line, so they take on more risk and, in turn, demand higher interest rates.

- Equity: This is the top of the totem pole. Equity investors get paid last, after every single lender has been made whole. They shoulder the most risk, but that’s balanced by the potential for the highest returns.

Comparing Investment Loan Products for Real Estate Syndicators

To help you choose the right financing for your project, this table compares the key features of the most common debt instruments available to syndicators.

Each of these products serves a different purpose. Your job is to match the tool to the specific needs of your deal's business plan.

A Closer Look at Senior Debt

Senior debt is the lifeblood of most real life estate deals. It’s the foundational financing that everything else is built upon. The two main players in this space are traditional bank loans and bridge loans.

Traditional Bank Loans

This is your bread-and-butter financing. It’s built for stabilized, cash-flowing properties that have a proven history of income and occupancy. Think of a well-managed apartment complex that’s been sitting at 95% occupancy for years.

Lenders like traditional banks, credit unions, or CMBS (Commercial Mortgage-Backed Securities) originators love these loans because the risk is so low. Key features generally include:

- Longer Terms: Typically 5, 7, or 10 years.

- Lower Interest Rates: A direct reflection of the lower risk profile.

- Lower Leverage: You’ll often see these cap out around 65-75% Loan-to-Value (LTV).

- Tough Underwriting: Lenders will comb through the property’s historical financials.

This is the perfect loan for a long-term buy-and-hold strategy where predictable, steady cash flow is the name of the game.

A stabilized property doesn't need fancy, expensive financing. It needs reliable, cost-effective debt that lets the asset do its job—generate consistent income. A traditional bank loan is the perfect fit.

Bridge Loans

Now, let’s flip the script. Imagine you’re buying a property that’s a mess—a classic value-add play. Occupancy is in the gutter, the rents are way below market, and it needs a complete overhaul. A traditional bank won't even look at it because the current cash flow is nowhere near enough to cover a loan.

This is exactly where a bridge loan comes in.

Bridge loans are short-term financing designed to "bridge" the gap between a property's rundown present and its stabilized, profitable future. For anyone tackling a ground-up build, it's also worth understanding the full range of property development finance options available.

Key features of a bridge loan include:

- Shorter Terms: Usually 1 to 3 years.

- Higher Interest Rates: The lender needs to be compensated for taking on the risk of an unproven business plan.

- Higher Leverage: Often based on Loan-to-Cost (LTC), which lets you finance the purchase and a chunk of the renovation budget.

- Flexible Underwriting: Lenders care less about the property's past and more about your business plan and its future potential.

The strategy is simple: once your renovations are done, you’ve leased up the property, and cash is flowing, you refinance out of the expensive bridge loan and into a cheap, long-term traditional loan.

Filling the Gaps with Junior Debt

Sometimes, the senior loan and your investors' equity just aren't enough to get a deal done. That's when you might look to junior debt to fill that hole in the capital stack. Just remember, these are riskier positions for a lender, and they come with a much higher price tag.

Two of the most common options here are mezzanine debt and preferred equity. While they work in similar ways, their legal structures are different. Both sit above the senior loan but below your common equity, allowing you to push total leverage up to 85-90%. But they come at a steep cost—often a high interest rate plus a piece of the deal's profits. You should only consider these tools if you’re chasing a home-run return that can justify the expense.

To get a fuller picture of how all these pieces fit together, our guide on commercial property financing options offers a much more detailed breakdown.

Understanding the True Cost of Leverage

The interest rate is what everyone talks about when you get a loan. It’s the flashy number that grabs all the attention. But if you only focus on the rate, you're missing the bigger picture. It's like judging an iceberg by its tip—the real danger lies just beneath the surface.

To really get a handle on leverage, you have to look past that advertised percentage and calculate the all-in cost of the debt. Smart syndicators learn to see the whole board, not just one piece.

Beyond the Interest Rate

That "true cost" of a loan is packed with other fees and expenses that lenders add on top of the base interest. These aren't just minor details; they are hard costs that will absolutely eat into your returns if you’re not careful.

- Origination Fees: This is the lender's fee for putting the deal together, usually 1-2% of the loan amount. On a $5 million loan, that’s an immediate $50,000 to $100,000 off the top.

- Legal and Closing Costs: You're on the hook for the lender’s legal team, title insurance, appraisals, and a slew of other third-party reports. This can easily tack on tens of thousands of dollars to your closing statement.

- Prepayment Penalties: Thinking of selling or refinancing early? Not so fast. Lenders often hit you with a hefty fee to protect their expected return. This can be a fixed percentage or a complex formula like yield maintenance, potentially costing hundreds of thousands.

Forgetting to bake these costs into your model is a classic rookie mistake. A loan that looks cheap on paper can become incredibly expensive once you account for all the extras.

Stress Testing Your Investment Model

You have to think like a risk manager, not just an optimist. That means preparing for the worst, not just hoping for the best. This is where stress testing comes in. It's the process of building a financial model that can take a punch and keep standing.

Ask the tough "what if" questions to find your deal's breaking point. What happens if the interest rate on your floating-rate loan jumps by 2%? What if a major local employer packs up and leaves, and your vacancy rate shoots from 5% to 15%?

A solid model anticipates these scenarios. This is especially true in today's market, where private debt has become a go-to financing source. Direct lending, for example, has boomed because it gives investors a senior, more secure position in the capital stack, proving its resilience even in a down market. For a deeper analysis of private market trends, it's worth seeing how these dynamics are playing out.

Your pro forma shouldn't be a sales pitch; it should be a battle plan. It must realistically account for potential setbacks and prove the deal can survive them.

To build that battle plan, you need to have a few critical metrics down cold. These are the numbers every lender will be laser-focused on.

Calculating Key Risk Metrics

Let's ground this with a real-world example: a 100-unit multifamily acquisition. Your underwriting needs to go much deeper than a simple cash flow projection. You need to focus on two key indicators of financial health that tell the real story.

Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio (DSCR) is, without a doubt, the most important metric on a lender’s checklist. It’s a simple but powerful measure of how much cash flow the property is generating compared to what it owes on the mortgage each year.

The formula is straightforward: DSCR = Net Operating Income (NOI) / Total Debt Service

Most lenders will want to see a DSCR of 1.25x or higher. What this means is that for every $1.00 of your mortgage payment, the property is bringing in $1.25 of net income. That extra 25% is the lender’s safety cushion. If your DSCR ever dips below 1.0x, it means you're officially losing money every month.

Break-Even Occupancy

Another vital sign for your deal is its Break-Even Occupancy. This tells you the absolute minimum occupancy rate you need to maintain to cover all your operating expenses and your loan payments.

Here’s the calculation: Break-Even Occupancy = (Operating Expenses + Total Debt Service) / Gross Potential Income

If your property's break-even is 80%, you know you have a 20% vacancy buffer before the property starts bleeding cash. A lower break-even point signals a much safer investment, giving you and your lender more breathing room to handle unexpected vacancies without spiraling toward default.

How to Prepare Your Deal for a Lender

Trying to borrow money for investment isn’t just about filling out an application. It’s about building a case. You need to tell a compelling, data-driven story that proves to a lender that your deal is a winner—and that you’re the right sponsor to pull it off.

Think of it like pitching a blockbuster movie. You need a great script (the deal), a talented director and cast (your team), and a rock-solid budget that shows exactly how everyone gets paid. To get that "yes," you have to present a professional loan package that answers every question before it's even asked.

A sloppy, incomplete submission is the fastest way to land your deal in the trash. Your loan package is your first impression, and it has to project confidence and meticulous preparation.

Crafting a Compelling Loan Package

Your loan package is much more than a folder of documents; it's the entire narrative of your deal. It needs to walk the lender through the opportunity, your strategy, and the numbers that back it all up. At their core, lenders are in the business of managing risk. Your job is to systematically de-risk the deal in their eyes.

Every top-tier loan package should include these key elements:

- Executive Summary: This is your one-to-two-page highlight reel. It should concisely cover the property, the structure of the deal, your loan request, and the key financial metrics. Think of it as your elevator pitch on paper—make it punchy and powerful.

- Detailed Pro Forma: This is where you get into the financial weeds. Include multi-year cash flow projections, a line-by-line capital expenditure (CapEx) budget, and clearly stated assumptions for things like rent growth and operating expenses.

- Sponsor Bio & Track Record: Why should they bet on you? This is where you sell yourself. Showcase your experience, highlight wins on similar projects, and provide a schedule of real estate owned (SREO) to prove your credibility.

- Market and Submarket Analysis: Lenders need to see you’ve done your homework. Back up your story with hard data on local demographics, employment trends, and recent sales and rent comparables. Show them why this market is the right place to be.

- Property Information: Include the current rent roll, at least three years of historical profit and loss (P&L) statements, and a detailed property description, complete with high-quality photos.

A well-prepared loan package doesn’t just answer a lender's questions—it prevents them from having to ask in the first place. It demonstrates foresight, professionalism, and a deep understanding of the deal.

Building Strategic Lender Relationships

While a polished loan package is crucial, the most successful syndicators know that lending is a relationship business. Don't just blast your deal out to a dozen random lenders. It's far more effective to cultivate long-term, strategic partnerships with the right capital providers.

This approach changes the dynamic completely. Instead of a one-off transaction, it becomes an ongoing collaboration. When a lender truly understands your business model and trusts your ability to execute, they become a partner who can help you scale. That trust often translates into better terms, faster closings, and a reliable source of capital for your next deal.

Working with Commercial Loan Brokers

For many sponsors, especially those just starting out or tackling complex deals, a great commercial loan broker is a game-changer. Think of them as your guide and advocate in the capital markets. They have deep relationships with a wide network of lenders and know the specific appetites and underwriting quirks of each one.

A skilled broker does more than just find you a loan. They:

1. Frame Your Story: They know exactly how to position your deal to attract the right kind of attention from the right lenders.

2. Create a Competitive Process: By taking your deal to multiple qualified lenders at once, they generate competition that drives better pricing and terms for you.

3. Troubleshoot Issues: Problems always pop up during underwriting. A good broker can run interference, anticipate roadblocks, and help you navigate them smoothly.

Their expertise not only helps you secure financing more efficiently but often on better terms than you could find on your own. This frees you up to focus on what you do best: finding and closing great real estate deals. The right financing partner, whether a direct lender or a broker, is a cornerstone of any strategy to borrow money for investment effectively.

Balancing Debt and Equity in Your Capital Stack

As a syndicator, every dollar of debt you bring into a deal sends a powerful signal to your limited partners (LPs). It’s a direct reflection of your strategy and directly shapes their risk and potential reward. Getting this balance right between debt and equity—what we call the capital stack—isn't just a financial exercise. It’s the very foundation of investor trust.

The pull to maximize leverage is always there. After all, layering in more debt can make the numbers on paper look fantastic, amplifying returns for your equity investors. A higher loan-to-value (LTV) ratio means your investors' cash goes further, which can supercharge their projected cash-on-cash returns and internal rate of return (IRR). A good deal can suddenly look like a home run.

But that amplified return comes with an equal dose of amplified risk. More debt means higher fixed mortgage payments that are due every single month, whether your tenants pay rent or not. It also means your break-even occupancy creeps up, leaving you with a much thinner margin for error. A sudden dip in the market or a surprise capital expense can wipe out that safety buffer in a heartbeat, putting your investors' capital at risk.

Aligning Your Strategy with Investor Expectations

The art is in structuring a capital stack that perfectly matches your business plan and, just as importantly, your investors' appetite for risk. Are you working on a deeply discounted, value-add project with a clear path to stabilization? A higher-leverage approach might make perfect sense, as the potential upside justifies the added risk.

On the other hand, if you're acquiring a stabilized asset for long-term cash flow, a more conservative, lower-leverage structure is often the smarter play. It provides a much larger cushion against market swings and appeals to investors who care more about capital preservation than hitting grand-slam returns.

Your job as the sponsor is to communicate this strategy with complete transparency. Your offering documents need to lay it all out in plain English:

- The total amount of debt you’re taking on.

- The specific loan terms—interest rate, maturity date, and any recourse provisions.

- A clear-eyed look at the risks that come with this level of leverage, backed up by realistic stress testing.

This level of detail shows you've done your homework. It tells investors you've thoughtfully engineered a deal that’s both aggressive in its pursuit of returns and intelligent in how it manages risk.

Your capital stack isn't just a spreadsheet of numbers; it's a statement about your investment philosophy. It tells your investors exactly how you plan to protect their capital while working to grow it.

Communicating Your Strategy and Executing Flawlessly

Effectively managing these complex debt structures is one thing; managing your investor relationships is another. While the lender is focused on the property, your investors are betting on you. Keeping them in the loop, handling their paperwork, and delivering distributions on time is what builds the kind of trust that brings them back for your next deal.

This is the operational side of the business where so many sponsors get bogged down in the details. Modern platforms like Homebase were built to automate these critical but time-consuming tasks. By centralizing investor communications, document management, and distributions, you can get back to focusing on what really matters: executing the business plan that generates returns.

The global financing environment is always in flux. For example, the World Bank recently highlighted a trend where low- and middle-income countries are seeing traditional bank loans dry up, forcing them to turn to bond markets and other institutions for funding. You can discover more insights on these global debt shifts on worldbank.org. This underscores a universal truth for any investor: having access to diverse and reliable capital is non-negotiable. By balancing your capital stack with care and using the right tools to manage your operations, you put yourself in a position to thrive in any market.

Navigating Legal and Tax Implications

When you borrow money for an investment, you’re playing in the big leagues. And when you mix that borrowed money with capital from outside investors, the game gets even more complex. You’re now dealing with a whole new set of legal, regulatory, and tax rules that you absolutely cannot ignore.

Getting this part right isn't just about dodging penalties. It's about building a solid foundation for your deal, one that protects you, reassures your investors, and sets you up for the best possible outcome.

Staying on the Right Side of the SEC

The second you take a dollar from another investor, you’ve got the attention of the Securities and Exchange Commission (SEC). When you combine debt with investor equity in a syndication, you have to be meticulous about following SEC rules, most commonly Regulation D.

Messing this up is not an option. The consequences can be severe, from hefty fines to being banned from raising capital in the future. This is why you must have experienced securities counsel in your corner. They'll help you structure the offering correctly, ensuring everything is transparent, compliant, and rock-solid for your limited partners.

How Debt Becomes a Tax-Saving Powerhouse

While compliance is about playing good defense, the tax code is where you go on offense. For real estate investors, debt is one of the most powerful tools available for sheltering income and supercharging after-tax returns. It all boils down to two key advantages: mortgage interest deductions and depreciation.

Smart investors don’t just look at pre-tax returns. They understand that the real game is won after taxes, and debt is a key player in minimizing your tax burden.

First, the interest you pay on your mortgage is almost always 100% tax-deductible. This is huge. It directly reduces your property's taxable income, often turning a property that's spitting out cash into one that shows a loss on paper for tax purposes.

Then there's depreciation. The IRS lets you write off the value of the building (but not the land) over 27.5 years for residential properties. This is a "phantom" expense—you get the tax break without a single dollar leaving your pocket.

When you combine the power of interest deductions with depreciation, the tax savings can be massive, letting you and your investors keep far more of the cash flow. This is precisely why savvy real estate operators use debt so strategically. Your legal and tax advisors aren't just a cost; they're your most valuable partners in this part of the game.

Common Questions Syndicators Ask About Debt

When you're putting a deal together, borrowing money is part of the territory. So are the questions that come with it. Let's walk through some of the most common hurdles every real estate syndicator has to clear.

These aren't just academic questions—they are practical, real-world decisions you'll face on almost every single deal. Getting them right is essential to building a successful and resilient investment.

What's a Good LTV for a Real Estate Deal?

There's no single magic number for the "right" loan-to-value (LTV) ratio. Think of it as a dial you can turn to balance risk and reward.

Cranking the LTV up to 80-85% can seriously juice your returns because it minimizes the amount of equity you have to raise. This aggressive approach often makes sense for a value-add project where you have a clear plan to force appreciation quickly.

On the other hand, a more conservative LTV, say 65-70%, gives you a much bigger safety net. Your monthly debt payments are lower, which boosts your Debt Service Coverage Ratio (DSCR) and makes the entire deal more durable if the market softens or you hit a rough patch with vacancies. For a stabilized, cash-flowing property, this is usually the smarter play.

The best LTV is simply the one that fits your business plan and your appetite for risk. It’s a tool you use to either maximize your upside or protect your downside.

Can I Get a Loan if My Personal Credit Isn't Perfect?

Yes, you often can, especially when it comes to commercial real estate. While a lender will certainly look at your personal credit, they care a lot more about two other things: the strength of the deal itself and your track record as a sponsor.

If you bring a lender a property that has solid cash flow, a well-reasoned business plan, and can comfortably cover its debt payments, they're focused on the asset's ability to perform. Your experience executing similar deals successfully also speaks volumes. A great deal with strong fundamentals can absolutely make up for a personal credit score that's less than stellar.

How Does Recourse vs. Non-Recourse Debt Affect Me?

This is one of the most important clauses you'll find in any loan document. The difference is huge, and it all comes down to a simple question: if the deal fails, what can the lender come after?

- Non-Recourse Debt: The lender’s claim is limited to the property itself (the collateral). Your personal assets—your home, your savings, other investments—are off-limits.

- Recourse Debt: The lender can seize the property and come after your personal assets to cover any remaining debt. This puts your entire net worth on the line.

For syndicators, getting non-recourse debt is almost always the goal. It insulates you from a single deal going sour and is a critical point to fight for in any loan negotiation.

Ready to manage your syndication's capital stack and investor relations without the chaos? Homebase streamlines everything from fundraising and compliance to distributions and updates, all on one simple platform. Learn how Homebase can help you focus on closing more deals.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.