Your Guide to Commercial Property Financing Options

Your Guide to Commercial Property Financing Options

Explore the best commercial property financing options for your investment. This guide breaks down conventional loans, SBA programs, and bridge financing.

Domingo Valadez

Aug 20, 2025

Blog

Securing the right funding for a commercial property isn't a one-size-fits-all process. You'll find a whole spectrum of commercial property financing options, from the bank loan everyone knows about to more creative, less-traveled paths. Each one has its own quirks and advantages, tailored for different investors, properties, and financial game plans. Getting a handle on these choices is your first real step toward a successful deal.

Decoding Your Commercial Financing Choices

Trying to find the right loan for a commercial property can feel like you've been dropped into a maze without a map. Let's fix that. This guide will be your compass, cutting through the jargon and complexity of the commercial property financing world.

Think of it this way: you wouldn't use a sledgehammer to hang a picture frame. The same logic applies here; the loan that works for a massive warehouse won't be the right fit for a small retail space. This is more important than ever right now, as the global commercial real estate market is bouncing back in a big way. In fact, over 66 percent of markets are currently in a 'buy' phase—a peak we haven't seen since 2016.

What's driving this? A big part of it is the serious housing shortage in many countries, which is pushing up demand for rental properties and making them a much more attractive investment. You can dive deeper into the full recovery cycle analysis to really get a feel for where the market is headed.

Your Path to the Right Loan

To make a smart decision, you have to know the lay of the land. We've structured this guide to build your understanding from the ground up, so you can confidently spot the perfect financing for your project. We'll cover all the major players:

- Conventional Mortgages: The tried-and-true option from banks and credit unions.

- Government-Backed Programs: Loans like the SBA 504 and 7(a), designed to make lending less risky for banks.

- Bridge and Hard Money Loans: Your go-to for short-term, fast-cash needs when an opportunity can't wait.

- Alternative Financing: Less common but powerful options like seller financing and conduit loans.

By the time you're done with this guide, you'll have a solid framework for sizing up each of these commercial property financing options and matching them to your specific property, your finances, and your long-term goals.

My aim here is to give you more than just dry definitions. We'll get into the real-world pros, cons, and best-case scenarios for every loan type. That way, you can walk into a lender's office knowing exactly what you need to close the deal and get your next venture off the ground.

Mastering Traditional Commercial Mortgages

When you hear "commercial property loan," this is probably what you're picturing. Traditional commercial mortgages, offered by banks and credit unions, are the bread and butter of real estate financing. Think of them as the business equivalent of a home mortgage, but they play by a very different set of rules.

With your home loan, the bank cared most about your personal income and credit score. For a commercial mortgage, the property itself is the star of the show. Lenders are laser-focused on one question: does this property generate enough cash flow to cover the loan payments and all its own expenses? This is a fundamental shift that dictates the entire process.

It’s a good time to be asking these questions, too. The market is looking up. A recent Deloitte survey shows a massive jump in optimism within the commercial real estate world. Last year, only 27% of industry pros thought market fundamentals would improve; this year, that number skyrocketed to 68%. Even better for borrowers, 69% now expect capital to be easier to come by. You can dig into all the details in their full CRE outlook report.

Key Metrics Lenders Live By

To get a traditional loan, you have to learn to speak the bank’s language. That means understanding the two core metrics they use to decide if your deal is a winner or a dud. These aren't just suggestions; they're the pillars of the underwriting process.

- Loan-to-Value (LTV) Ratio: This is simple math: the loan amount divided by the property’s appraised value. For commercial deals, lenders are more conservative than in residential. They’ll typically only lend between 65% and 80% of the property’s value. That means you need to bring a significant down payment to the table—usually 20% to 35%.

- Debt-Service Coverage Ratio (DSCR): This is the ultimate health check for your property's finances. The bank will take your property's Net Operating Income (NOI) and divide it by your total annual loan payments. A DSCR of 1.0x means you’re breaking even, with just enough income to cover the debt. That’s too close for comfort for a lender. They need to see a cushion, typically demanding a DSCR of 1.25x or higher.

A DSCR below 1.25x is a massive red flag. It tells a lender that one unexpected vacancy or a major repair could immediately put you in danger of missing a payment.

Comparison of Traditional Commercial Loan Features

The specific terms you'll be offered can vary quite a bit depending on what kind of property you're buying. Lenders view a stable, multi-tenant apartment building very differently from a more specialized, single-tenant retail space. This table gives you a general idea of what to expect.

As you can see, the perceived risk of the property type directly influences how much a bank is willing to lend and for how long.

The Pros and Cons of Going Traditional

Like any financing route, conventional mortgages have clear upsides and downsides. You need to weigh them carefully to see if this is the right fit for your investment strategy and, just as importantly, your timeline.

Advantages of Traditional Mortgages:

* Best Rates: They almost always offer the most competitive interest rates you can find.

* Longer Payback Periods: With amortization schedules stretching out 25 or even 30 years, your monthly payments are kept as low as possible.

* Stability: Fixed-rate options give you predictable payments, making it much easier to budget and forecast your returns for years to come.

Disadvantages to Consider:

* Tough Scrutiny: The underwriting process is deep and demanding, requiring a mountain of paperwork.

* It's a Slow Process: Don't expect a quick closing. It can easily take 45 to 90 days from application to funding, so forget about using these for a time-sensitive deal.

* High Bar for Entry: Lenders want to see a strong personal credit history, deep financial reserves, and often, a proven track record of managing similar properties.

Building a Bulletproof Loan Application

Think of your loan application not as a pile of forms, but as a business plan you're pitching to an investor. Your job is to make the lender feel completely confident in both you and the property.

Start with a solid business plan that lays out your vision. Who are your target tenants? How will you market the property? Who is handling day-to-day management? Back this up with well-researched financial projections that detail everything from expected rents and vacancy rates to operating expenses and planned upgrades.

When you present a clear, data-driven story, you show the lender you’re a serious, professional operator, not just another borrower. That level of preparation is what separates a smooth approval from a long and frustrating denial.

Unlocking Your Property with Government-Backed Loan Programs

For a lot of small business owners, getting a traditional commercial mortgage can feel like hitting a brick wall. Lenders often want to see huge down payments and near-perfect credit, which can be a tough pill to swallow. This is where government-backed loan programs come into play.

They aren't direct lenders, but they act as a powerful partner for both you and the bank. Think of the U.S. Small Business Administration (SBA) as the ultimate co-signer. The government doesn't cut you a check. Instead, it guarantees a huge chunk of your loan for the bank, which drastically lowers their risk if you can't pay it back. That guarantee gives lenders the confidence to say "yes" to loans they might otherwise turn down, opening the door for more businesses to finally own their own space.

Two programs really stand out in this area: the SBA 7(a) and the SBA 504. They both help businesses get into real estate, but they're built for different jobs—kind of like having a versatile multi-tool and a specialized power saw in your workshop.

The SBA 7(a) Loan: The All-Purpose Workhorse

The SBA 7(a) is the most popular and flexible loan in the SBA's toolkit. It’s a true jack-of-all-trades. You can use it to buy commercial property, but you can also use it to refinance old debt, purchase equipment, or even just get some working capital.

When it comes to real estate, there’s one big rule: your business has to occupy at least 51% of the property. This is to make sure the program is helping owner-operators, not just passive real estate investors. Its biggest strength is that versatility; you can bundle a building purchase with other critical business needs all into one loan package.

The SBA 504 Loan: The Fixed-Asset Specialist

The SBA 504 loan, on the other hand, is a specialist. It’s designed for one main purpose: financing major fixed assets like land, buildings, and heavy-duty, long-term machinery. You can't touch these funds for things like inventory or payroll.

The 504 program is structured in a really unique way. It's not one loan, but two loans working together:

- A Senior Lender Loan: A traditional bank or credit union funds up to 50% of the total project cost.

- A CDC Loan: A non-profit Certified Development Company (CDC)—which is licensed by the SBA—provides a second loan for up to 40% of the cost.

- Your Contribution: This is the best part. You, the business owner, typically only need to put down 10%.

This structure is the secret sauce behind the 504's main appeal: an incredibly low down payment. By only requiring 10% down, it frees up your cash so you can invest it back into running and growing your business instead of sinking it all into real estate equity.

The Good, The Bad, and The Paperwork

These government-backed options have some amazing upsides, but they come with trade-offs you absolutely need to know about before you dive in.

Why Business Owners Love SBA Loans:

* Lower Down Payments: A 10-15% down payment is pretty standard here, which is a world away from the 20-35% you’d need for most conventional loans.

* Longer Repayment Terms: With terms stretching up to 25 years for real estate, you end up with lower, much more manageable monthly payments.

* More Accessible: That government guarantee makes it possible for good businesses who might not tick every single box for a traditional mortgage to get approved.

The Reality Check: What to Prepare For:

* The Paperwork is No Joke: SBA applications are legendary for being document-heavy. You'll need to be organized and pay close attention to every detail.

* The Timeline is Longer: Because there's an extra layer of government approval, closing can take more time than a conventional loan—often 60 to 120 days.

* Strict Eligibility Rules: You have to be a for-profit business, meet the SBA's definition of "small," and clearly show why you need the loan.

At the end of the day, an SBA loan is a strategic move. If you have a solid business plan but just don't have that huge down payment saved up, the benefits can completely change the game for your company. The trick is to find an experienced SBA-preferred lender who knows the ropes and can guide you through the process.

Using Bridge and Hard Money Loans for Speed

In commercial real estate, sometimes the perfect deal pops up with an impossibly tight deadline. A traditional mortgage might take 60 days to close, and by then, the opportunity is long gone. This is exactly where bridge and hard money loans come into play. Think of them as the sprinters in a world of long-distance runners.

They are, quite literally, a temporary financial bridge. You use one to snap up a property quickly, giving you the time to get your ducks in a row before refinancing into a more stable, long-term loan once the dust settles. Speed and flexibility are the name of the game here.

Prioritizing Property Over Paperwork

So, how do they move so fast? It’s simple: unlike a bank that pores over every line of your financial history, short-term lenders are laser-focused on the property itself. They’re less concerned with your credit score and more interested in the building's current value and—critically—what it could be worth after you work your magic.

This asset-first approach slashes the underwriting time. If the deal makes sense and the property value provides a good safety net for the loan, they can often get cash in your hands in a matter of days, not months.

This makes them incredibly powerful commercial property financing options for a few specific situations:

- Fix-and-Flip Projects: You find a distressed property, and you need capital now to buy it, renovate it, and sell it for a profit. A hard money loan gets you in the door.

- Winning Competitive Bids: In a hot market, sellers love certainty. An offer backed by financing that can close in 10 days often beats a higher offer that's stuck waiting on a slow-moving bank.

- Stabilizing a Property: Imagine you buy a commercial building that's only half-leased. A bridge loan can cover your costs while you find new tenants, boost the property's income, and make it attractive for a much better long-term loan down the road.

The crucial thing to remember is that these loans are a strategic tool, not a forever-home for your financing. You absolutely must have a clear "exit strategy"—a concrete plan to refinance into a traditional mortgage or sell the property before the loan is due.

The Trade-Off: High Cost for High Speed

This incredible speed doesn't come for free. In fact, it comes at a significant premium. Bridge and hard money loans are far more expensive than a conventional loan, and you need to go in with your eyes wide open.

Here's what to expect:

- Higher Interest Rates: If a bank is offering 6-8% on a traditional loan, a hard money lender might be charging anywhere from 10% to 15%, sometimes even more.

- Upfront Points: Lenders charge origination fees called "points," which are a percentage of the loan amount paid at closing. Be prepared to pay 2 to 5 points, which can easily add tens of thousands of dollars to your costs.

- Shorter Terms: These are not 30-year mortgages. The repayment clock is ticking fast, with terms usually ranging from just six months to two years. This puts the pressure on to get your project done and refinanced quickly.

Is This Expensive Tool Right for You?

Jumping into a hard money loan requires some serious soul-searching and a calculator. The high costs only make sense if the deal on the other side promises a substantial return.

Before you even think about signing the paperwork, you need to answer a few questions honestly:

- Is the potential profit big enough? Your numbers have to be rock-solid. The profit margin needs to be wide enough to easily absorb the hefty interest rates and fees and still leave you with a healthy return.

- Is my exit strategy solid? Do you have a realistic, well-thought-out plan to either sell the property or refinance into a conventional loan? "Hoping" you can refinance isn't a plan.

- Have I vetted the lender? The private lending world has its share of sharks. Work only with reputable, experienced lenders. Ask for references, look at their past deals, and make sure they have a track record of being a good partner.

At the end of the day, these loans are a specialized part of a real estate investor's toolkit. They give you the power to seize fleeting opportunities, but they demand a sharp pencil, a clear plan, and a direct path to long-term financial stability.

Exploring Creative and Alternative Financing

While traditional bank loans and government-backed programs are the mainstays of commercial real estate, they're not the only game in town. Sometimes, a property or a borrower just doesn't fit neatly into the standard lending box. This is where creative and alternative financing options come into play, opening doors that conventional lenders might have shut.

Diving into these alternatives means shifting your mindset. Instead of just checking boxes on a lender's rigid application, you're often stepping into direct negotiations, partnering with the seller, or even pooling money with a crowd of investors. Let's break down some of the most powerful strategies.

1. Conduit Loans (CMBS): The Investor's Mortgage

Think of a conduit loan like this: a lender takes a whole bunch of different commercial mortgages, bundles them together, and sells them off to investors as a single package called a Commercial Mortgage-Backed Security (CMBS).

Because the ultimate buyers are investors on Wall Street, the loan approval process is laser-focused on one thing: the property's ability to generate cash. They care less about your personal credit score and more about the building's occupancy rates and income statements.

- Who It's For: These loans are a great fit for stable, income-producing properties. Think fully leased office towers, bustling shopping centers, or large apartment complexes with a long history of happy tenants.

- The Big Advantage: You'll often find very competitive interest rates, and most CMBS loans are non-recourse. That's a huge deal—it means if the loan goes south, the lender can only go after the property, not your personal assets.

- The Main Catch: Rigidity. Once that loan is bundled and sold, it's set in stone. Trying to prepay the loan or sell the property early can be incredibly difficult and trigger some eye-watering penalties.

2. Seller Financing: A Win-Win Negotiation

Seller financing is exactly what it sounds like. Instead of going to a bank for a mortgage, you negotiate a deal to make your payments directly to the person selling you the property. This transforms a rigid, bureaucratic process into a flexible, one-on-one negotiation.

This can be a game-changer when credit markets are tight or if you're buying a unique property that banks might not understand. For a deeper dive, exploring various vendor financing options can show just how creative these arrangements can get. The seller gets a steady income stream and a quicker sale, while the buyer might secure a lower down payment and terms tailored to their specific situation.

Crucial Takeaway: The success of seller financing hinges on a well-drafted promissory note and mortgage agreement. It's not a handshake deal. Both you and the seller absolutely need experienced real estate attorneys to make sure the terms are clear, fair, and legally bulletproof.

This strategy is more relevant now than ever. A staggering 20 percent—that's roughly $957 billion—of all commercial mortgage debt in the U.S. is coming due in the next year. With refinancing so tough, many sellers might jump at the chance for a creative financing deal to avoid getting stuck with their own maturing loan.

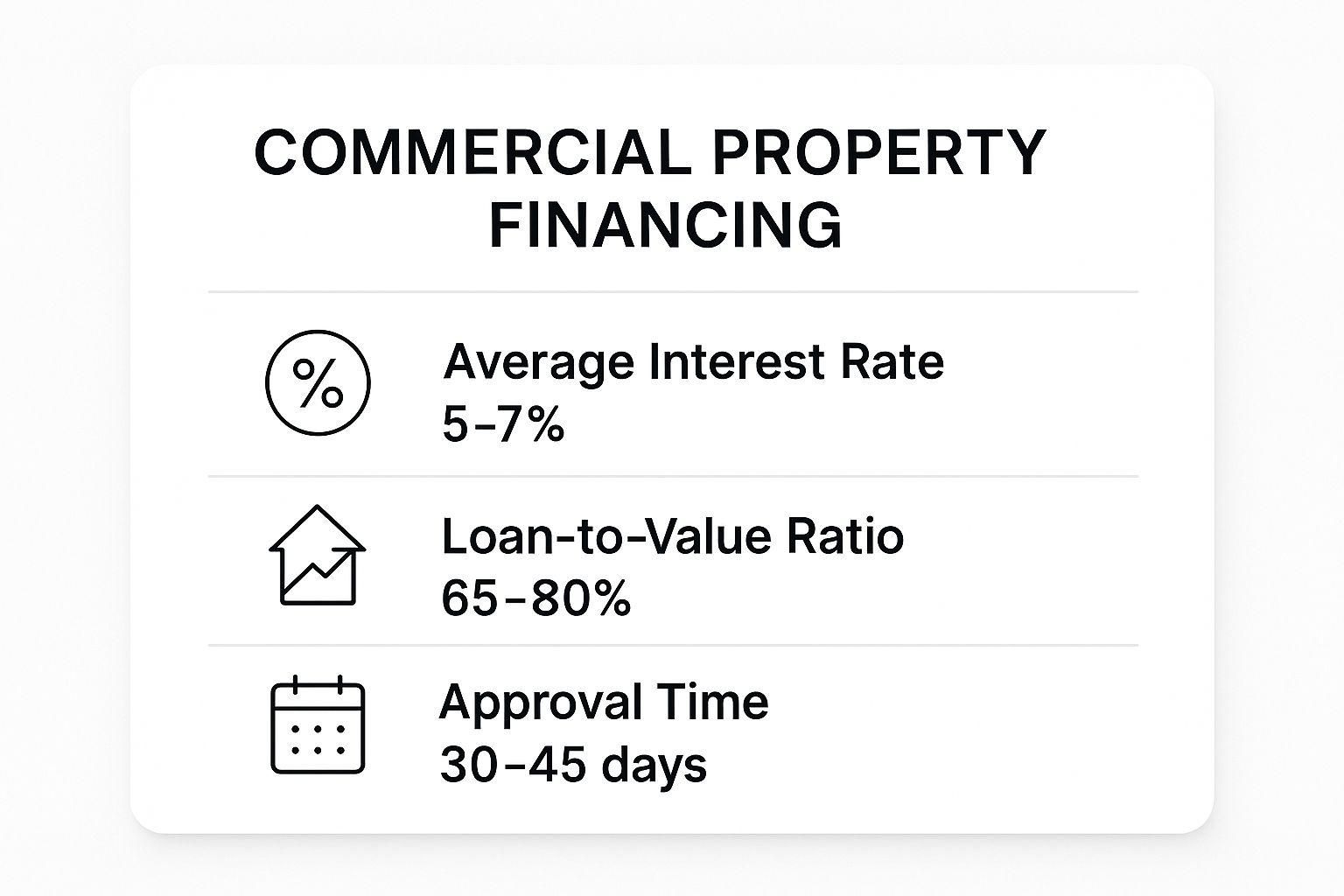

The image below gives you a sense of typical commercial financing benchmarks, which can be a helpful reference point when you're negotiating terms with a seller.

As you can see, seller financing can help you bypass some of the biggest hurdles in traditional lending, like strict Loan-to-Value (LTV) limits and long, drawn-out approval timelines.

3. Real Estate Crowdfunding: The Modern Capital Pool

Real estate crowdfunding is the new-school way to pool money for a property deal. Online platforms connect property developers (called sponsors) who need cash with a large group of individual investors who are ready to put in smaller amounts of capital.

It’s basically a 21st-century version of a real estate syndicate. Instead of having to find a few wealthy partners for a multi-million dollar deal, a sponsor can raise the same amount from hundreds of different investors online.

There are two main ways to get involved:

- Equity Investing: You buy a small piece of the property itself. You become a part-owner, sharing in the potential profits (and the risks) when the property is eventually sold or refinanced.

- Debt Investing: You’re essentially acting like the bank. You lend money to the project and get paid back with fixed interest payments over a set period. This is generally seen as a lower-risk way to play the game.

For everyday investors, crowdfunding tears down the high barrier to entry for commercial real estate. For developers, it opens up a massive new source of capital, making it a fantastic tool for getting projects off the ground.

To help you keep these options straight, here's a quick comparison.

At-a-Glance Guide to Financing Options

Each of these creative financing routes offers a unique set of benefits and trade-offs. The key is understanding which tool is the right one for your specific deal and your long-term goals.

Choosing the Right Financing for Your Investment

Knowing the different types of commercial property loans is a great start, but the real skill is matching the right one to your specific deal. There’s rarely a single “perfect” loan. Instead, the goal is to find the smartest fit for your project’s unique DNA, and that requires a brutally honest look at your situation.

Think of it like putting together a puzzle. You need to align four critical pieces. Each one will push you toward certain loan types and away from others that could turn into expensive mistakes. Getting this alignment right is the last, and most important, hurdle to clear before securing your capital.

The Four Pillars of Your Financing Decision

Before you even think about talking to a lender, sit down and map out these four key areas. Your answers will give you a clear roadmap, pointing you directly toward the most logical financing path for your deal.

- Property Type and Condition: What are you actually buying? Is it a stable, fully-leased office building humming along smoothly, or a vacant warehouse that needs to be taken down to the studs? A turnkey property is a prime candidate for a traditional mortgage, while a heavy value-add project is practically begging for the speed and flexibility of a bridge loan.

- Your Financial Strength: Lenders are going to put your finances under a microscope. How strong is your financial position, both personally and for your business? If you’re sitting on a hefty down payment of 20-35% and have excellent credit, conventional loans are well within your grasp. If you have less cash but a strong, profitable business, an SBA loan might be a much better route.

- Project Timeline: How fast do you need to get to the closing table? If you’re in a bidding war or the seller needs to cash out yesterday, a traditional bank loan that can take 60-90 days simply won’t cut it. This is exactly the scenario where faster, more expensive options like bridge or hard money loans earn their keep.

- Your Ultimate Investment Goal: What's the endgame here? Are you a business owner buying a property you plan to operate out of for the next 20 years? Or are you an investor looking to renovate and sell the property in 18 months? Your long-term strategy, including a solid grasp of all the real estate investment tax benefits, will be a huge factor in your financing choice.

The right loan for a buy-and-hold investor focused on long-term cash flow is fundamentally different from the loan needed by a developer who requires short-term capital for a fix-and-flip project. Misaligning your loan with your goal is a recipe for financial strain.

By walking through these pillars, you stop being a passive observer of loan products and start making strategic decisions. This framework turns a confusing menu of financing options into a clear, logical choice tailored specifically to your investment, ensuring you get not just any financing, but the right financing.

Your Top Commercial Real Estate Financing Questions, Answered

Jumping into commercial property financing can feel like learning a new language. You're bound to have questions, and getting straight answers is key before you lock into a loan. Let's break down some of the most common things investors ask.

What's a Normal Down Payment for a Commercial Loan?

Forget the 3% down you see with some home loans. When it comes to commercial real estate, you need more skin in the game. Most lenders will ask for a down payment between 20% and 30% of the purchase price.

Why the big jump? It all comes down to how lenders view risk. They see commercial properties as pure investments, so they want proof that you're seriously committed. A substantial down payment shows you have enough equity to handle a slow leasing period or an unexpected market dip. The final number will depend on the deal itself—the property type, the strength of your financials, and the specific loan you're after.

How Much Does My Personal Credit Score Really Matter?

Your personal credit score is on the checklist, but it doesn't carry the same weight it does when you're buying a house. With commercial deals, the star of the show is the property itself and its power to make money.

A solid credit history signals that you're a reliable borrower, which definitely helps build a lender's trust. But even a perfect score can't rescue a deal if the property's financials are weak. On the flip side, if the building has a rock-solid list of tenants and fantastic cash flow, a lender might be willing to overlook a less-than-stellar credit score.

Think of it this way: Your personal credit gets you in the door, but the property’s income is what closes the deal.

What Is DSCR, and Why Are Lenders Obsessed with It?

You’ll hear this acronym a lot: DSCR, or Debt-Service Coverage Ratio. It's one of the single most important numbers in commercial lending, and it's actually pretty simple. It measures whether the property brings in enough cash to comfortably pay its mortgage.

Here's the math:

Net Operating Income (NOI) / Total Annual Debt Payments = DSCR

A DSCR of 1.0x is the break-even point—you have just enough income to cover the debt, but nothing left over. Lenders hate breaking even; they want to see a safety net. That’s why the industry standard is a DSCR of 1.25x or higher. This shows them your property can handle its debt payments and still have a cash cushion for whatever comes its way.

Can I Finance a Mixed-Use Property?

Absolutely. Financing properties that blend commercial and residential space—like apartments above a storefront—is very common.

Lenders simply look at the deal piece by piece. They'll scrutinize the lease terms of your commercial tenants and check the occupancy rates for the residential units. The final loan terms will reflect the combined income and perceived risk from both sides of the property.

Ready to manage your real estate deals and investor relations without the spreadsheet chaos? Homebase is an all-in-one platform built to handle fundraising, reporting, and communications for one simple flat fee. See how we can support your growth at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Define Mezzanine Debt Your Guide to the Real Estate Capital Stack

Blog

Unlock bigger deals with less equity. Our guide helps define mezzanine debt, showing syndicators how to use it to bridge funding gaps and maximize leverage.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.