What Is Gross Rent Multiplier for Investors

What Is Gross Rent Multiplier for Investors

Discover what is gross rent multiplier and how this simple real estate metric helps you quickly evaluate investment properties and make smarter decisions.

Domingo Valadez

Aug 9, 2025

Blog

When you're first getting into real estate investing, especially in the multifamily space, you hear a lot of different terms and metrics thrown around. It can feel overwhelming. But one of the most useful, back-of-the-napkin tools you'll ever use is the Gross Rent Multiplier, or GRM.

Think of it this way: GRM is a quick-and-dirty way to gauge how a property's price stacks up against the income it brings in. It answers the simple question, "How many years of gross rent would it take to pay for this property?" It’s your first filter, helping you quickly spot which deals are worth a closer look and which ones you can toss aside.

Decoding the Gross Rent Multiplier

Imagine you're sorting through a hundred property listings. You don't have time for a full-blown financial model on each one. This is exactly where the GRM shines. It’s not the tool you use to make your final decision, but it's absolutely critical for that initial screening process. It helps you focus your time and energy where it matters most.

A First Look at Value

At its core, the GRM distills a property’s value down to one simple, comparable number. The lower the GRM, the better the deal might be, because it suggests the price is more reasonable relative to the rent it collects. This allows you to rapidly compare different properties, even if their prices and rental incomes vary wildly.

For example, let's say a property sells for $200,000 and pulls in $9,000 in gross rent per year. Its GRM would be 22.22 ($200,000 ÷ $9,000). This means, in theory, it would take just over 22 years of collecting rent to cover the purchase price. You can find a more academic breakdown of this concept on Wikipedia's detailed page.

Key Takeaway: A lower GRM is generally a good sign. It points to a faster payback period from rental income alone, which often signals a potentially stronger investment right out of the gate.

To help you get a firm grasp on this, here's a quick breakdown of the Gross Rent Multiplier.

Gross Rent Multiplier At A Glance

This table shows how the GRM simply connects a property's price to its potential income, giving you a powerful, at-a-glance comparison tool.

The Role of GRM in Investment Analysis

Think of the GRM as the triage nurse in an emergency room. Its job is to quickly assess the situation and prioritize who needs immediate, in-depth attention. It’s the very first step in your due diligence.

The metric is especially powerful for:

- Rapidly filtering through a long list of potential deals.

- Comparing similar properties in the same neighborhood to see which one is priced more attractively.

- Flagging potentially undervalued assets that deserve a much deeper dive into the numbers.

By starting with the GRM, you can efficiently cut through the noise. Instead of getting bogged down analyzing dozens of properties, you can quickly narrow your focus to the handful that truly meet your initial criteria, saving you an incredible amount of time and effort.

How to Calculate GRM Like a Pro

Ready to run the numbers yourself? The Gross Rent Multiplier formula is refreshingly simple, but its power lies in the details. Getting the inputs right is what separates a quick hunch from a genuinely useful first-pass analysis.

The formula itself is as straightforward as it gets:

GRM = Property Price / Gross Annual Rent

This quick calculation gives you a single number, a powerful yardstick for comparing different investment opportunities. But to wield it like an expert, you need to understand exactly what goes into those two variables.

Nailing the Property Price

First up is the Property Price. This is usually the asking price—the number on the for-sale sign. If you're sizing up a potential deal, you'll start with the seller's list price.

If you're evaluating a property you already own or trying to get a ballpark value for another one, you might use a recent appraisal or a comparable market analysis (CMA) instead. The key is to use a realistic, current market value.

Defining Gross Annual Rent

This is where many investors trip up. Gross Annual Rent is the total potential income a property can generate in one year before a single expense is taken out. Think of it as the absolute top-line revenue.

To calculate it properly, you have to look beyond just the rent checks. Seasoned analysts always include all rental-related income streams—things like parking fees, laundry machine revenue, and storage unit charges. This gives you a much more complete picture of the property's earning potential. This all-in approach is critical, because as real estate experts often point out, the GRM doesn't account for expenses at all, so it can't tell you how long it will take to truly pay off a property.

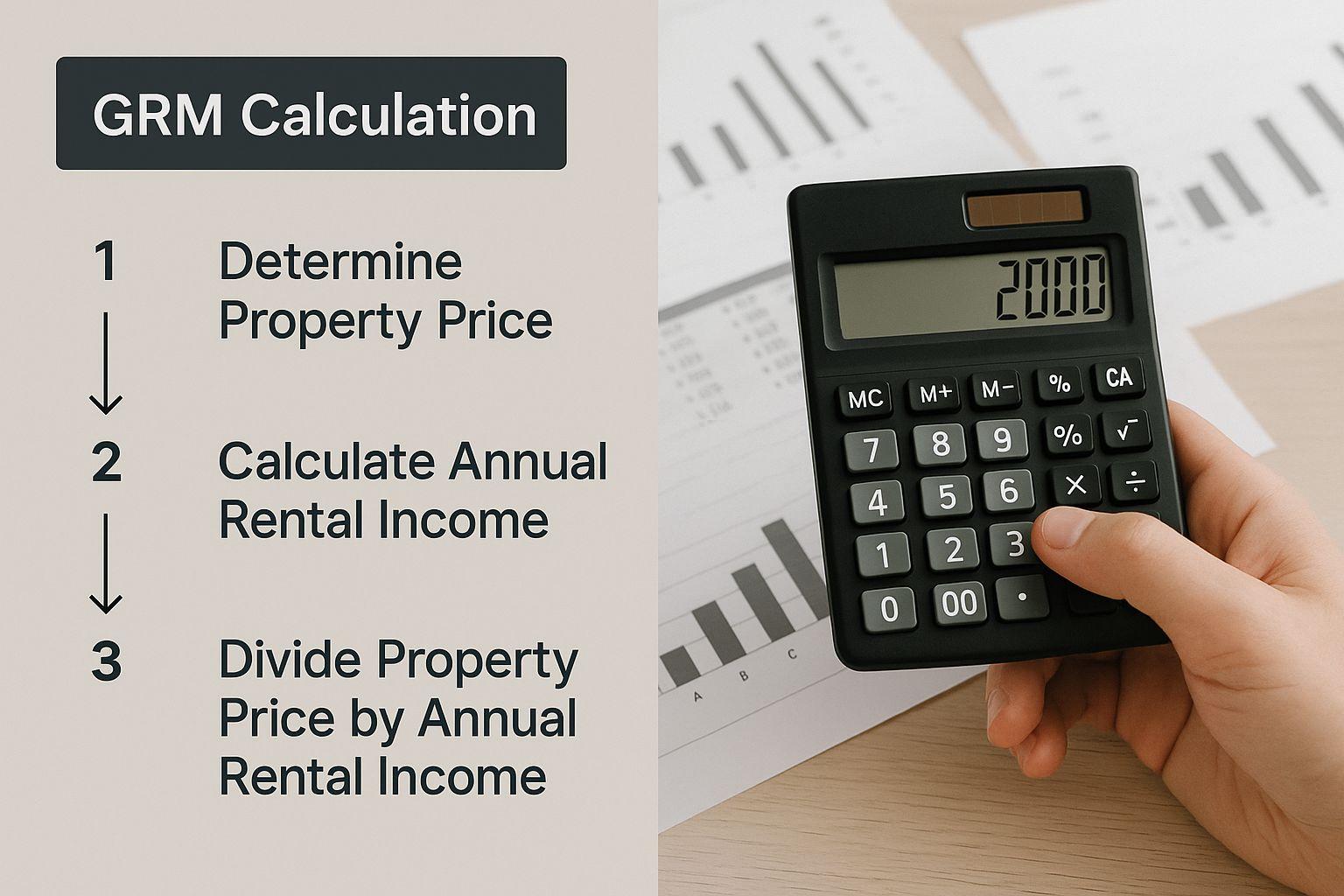

This image breaks down the steps to get an accurate GRM calculation.

As you can see, a precise GRM starts with gathering the property's price and all sources of gross income before you even touch the calculator.

Let's Walk Through an Example

Imagine you're eyeing a small four-plex apartment building. Here’s how you’d break down its GRM:

- Find the Property Price: The building is on the market for $1,200,000.

- Calculate Gross Annual Rent:Each of the four units rents for $2,000 per month.Monthly Base Rent: 4 units x $2,000 = $8,000Additional Income: The property also has four parking spots rented for $50/month each (another $200) and a coin-op laundry that brings in about $100/month.Total Monthly Gross Income: $8,000 + $200 + $100 = $8,300Total Annual Gross Rent: $8,300 x 12 months = $99,600

- Calculate the GRM:GRM = $1,200,000 / $99,600GRM = 12.05

In this case, the property has a GRM of 12.05. Now you have a concrete number you can use to compare this four-plex directly against other similar properties in the neighborhood to see if it’s priced competitively.

What Is a Good Gross Rent Multiplier?

So, you've calculated a GRM. Now for the million-dollar question: is that number actually any good?

The honest answer is, it depends. There’s no magic number that universally defines a "good" Gross Rent Multiplier. It's a moving target, shifting dramatically based on the property’s location, its type, and the current market climate.

Think of it like a runner’s time in a race. A 15-second 100-meter dash is incredible for a third-grader but wouldn't get an Olympian past the qualifying heats. Context is everything. The same is true for GRM.

As a general rule of thumb, investors are on the hunt for a lower GRM. A smaller number suggests you'll recoup the property's purchase price faster through gross rents. In other words, the price is more attractive relative to the income it pulls in.

Context Is King with GRM

A GRM that looks like a fantastic deal in Cleveland could be a screaming red flag in San Francisco. The number is meaningless without local context. You absolutely have to compare your target property's GRM to the average GRM for similar properties right there in the same neighborhood.

The local economic scene is a huge factor. For instance, let's say a U.S. multifamily property is priced at $300,000 per unit and brings in $43,200 in gross annual rent. That gives you a GRM of about 6.95. Now, hop over to a prime European capital with a severe housing shortage, and you might see GRMs soaring above 15. This reflects sky-high property values that far outpace what landlords can charge in rent. You can dig deeper into these market variations by exploring the data on Stessa.com.

Key Insight: Never, ever evaluate a GRM in a vacuum. Your most important job is to benchmark it against local "comps." This is the only way to get a real feel for whether a deal is overpriced, a potential bargain, or sitting right at fair market value.

To give you a practical starting point, here are some general benchmarks investors often refer to. Just remember to take them with a grain of salt, as local conditions can and will change these ranges.

- GRM of 4-7: This range often gets investors excited. It can signal a potentially strong investment where the price is low compared to the rental income, possibly leading to great cash flow. But be careful—it could also point to a property in a high-risk area or one that needs a ton of work.

- GRM of 8-11: This is widely seen as a solid, average range in many healthy markets. It suggests a balanced relationship between the property's price and its rental income, which is typical for stable, desirable areas.

- GRM of 12+: When you see a GRM this high, it's time to proceed with caution. It suggests the property is expensive for the rent it generates, likely meaning a much longer payback period and thinner profit margins. This might only make sense in a red-hot market where you're banking on significant appreciation.

GRM as a Comparative Tool

The real magic of the GRM is using it to compare similar properties side-by-side. Imagine you're looking at two duplexes on the exact same street.

Duplex A:

* Price: $800,000

* Gross Annual Rent: $70,000

* GRM: 11.4

Duplex B:

* Price: $850,000

* Gross Annual Rent: $80,000

* GRM: 10.6

At first glance, Duplex B looks more expensive with its higher price tag. But its lower GRM tells a different story—it’s actually the better value based on the income it produces. This quick calculation instantly shows you which property is worth a closer look, especially when you start factoring in the various real estate investment tax benefits that can boost your returns.

The Hidden Strengths and Weaknesses of GRM

No single metric can ever tell you the full story of a real estate investment, and a true understanding of the gross rent multiplier means knowing both its powers and its limitations. The GRM’s greatest strength is its sheer speed. It’s the perfect back-of-the-napkin tool for rapidly sifting through dozens of properties to find the few that actually deserve a closer look.

In a hot market, that speed gives you a serious edge. You can calculate a property's GRM in seconds with just two numbers, letting you instantly toss out overpriced listings and focus your time and energy on the real opportunities. This quick-filter approach helps you build momentum and spot potentially undervalued assets before the competition even gets their calculator out.

The Big Advantage: Speed and Simplicity

The GRM offers a wonderfully simple yardstick for comparing wildly different properties. Whether you’re sizing up a small duplex or a larger apartment building, the GRM creates a level playing field for that crucial first-pass comparison.

Think of it as an investor's "gut check." It’s an accessible starting point, especially for newcomers to real estate analysis, that helps build an intuitive feel for property values relative to their income potential. You can even use it to set clear investment rules, like deciding to only look at properties with a GRM between 8 and 11, which keeps your strategy consistent.

The Major Blind Spot: Operating Expenses

But here's the catch: the GRM's simplicity is also its most glaring weakness. It has a massive blind spot because it completely ignores operating expenses.

Critical Drawback: The Gross Rent Multiplier only looks at gross income. It tells you nothing about property taxes, insurance, maintenance costs, management fees, or utilities—all the real-world expenses that eat into your actual profit.

This omission can be dangerously misleading. A property might show an attractive, low GRM, making it look like a fantastic deal on paper. But if its operating expenses are through the roof, that "bargain" could quickly become a money pit with terrible—or even negative—cash flow. For instance, an older building might have a low GRM but need a new roof and HVAC system, a costly reality the GRM will never, ever show you.

This is exactly why you have to treat the GRM as a starting point, not the finish line. It helps you ask the right questions, but it doesn't give you the final answers. After you've flagged a property with a promising GRM, your very next step must be to dig into the real numbers, which means calculating a more revealing metric like the cap rate.

GRM Advantages vs Disadvantages

To truly get a handle on when—and when not—to use the GRM, it helps to see its pros and cons laid out side-by-side.

Ultimately, the GRM is a valuable tool as long as you respect its limits. It’s for identifying possibilities, not for making final investment decisions.

GRM vs. Cap Rate: A Practical Comparison

In the world of real estate analysis, investors often talk about Gross Rent Multiplier (GRM) and Capitalization Rate (Cap Rate) in the same breath. While they're related, they are definitely not the same thing. Think of them as a classic one-two punch for quickly evaluating a deal.

GRM is the fast, initial jab—it’s a quick-and-dirty screening tool to see if a property is even in the right ballpark. The Cap Rate, on the other hand, is the powerful follow-up hook. It’s a much more detailed financial deep dive that gets you closer to the property’s actual profitability.

The fundamental difference between them boils down to what they measure. GRM gives you a high-level view by using gross income, which means it completely ignores a property's operating expenses. In contrast, the Cap Rate paints a much sharper picture of profitability because it uses Net Operating Income (NOI)—that’s the gross income after you've subtracted all the costs of running the building.

From Gross Potential to Net Reality

When you use the Gross Rent Multiplier, you have to accept its biggest limitation: it’s blind to costs. A property might boast a wonderfully low GRM, but it could be an operational money pit, saddled with sky-high property taxes, ancient plumbing that needs constant work, or outrageous insurance premiums. The GRM won't flag any of that.

This is exactly where the Cap Rate proves its worth. It forces you to get real and account for every single predictable operating expense:

- Property Taxes

- Insurance Premiums

- Maintenance and Repairs

- Utilities (if paid by the owner)

- Property Management Fees

By using NOI, the Cap Rate tells you how efficiently a property is turning gross rent into actual, spendable profit. For instance, a market with high GRMs, like Dane County, Wisconsin, which saw an average GRM of 10.9 in 2023, suggests that properties are pricey relative to their income. In a market like that, drilling down to the Cap Rate isn't just a good idea—it's essential.

The Bottom Line: GRM shows you what a property could earn in a perfect, expense-free world. The Cap Rate shows you what it's actually earning in the real world.

A Side-by-Side Property Showdown

Let's walk through a practical example using the same duplex to see how these two metrics work together to tell a complete story.

Property Details:

* Purchase Price: $1,000,000

* Gross Annual Rent: $90,000

* Annual Operating Expenses: $35,000 (taxes, insurance, maintenance, etc.)

Step 1: The GRM Analysis (The Quick Filter)

First up, let's run the quick GRM calculation:

* GRM = $1,000,000 / $90,000 = 11.1

Depending on the local market, a GRM of 11.1 might seem average or a little on the high side. But based on this number alone, it probably passes the initial sniff test and seems worth a closer look.

Step 2: The Cap Rate Analysis (The Deep Dive)

Now, it’s time to dig deeper. First, we need to calculate the Net Operating Income (NOI):

* NOI = $90,000 (Gross Rent) - $35,000 (Expenses) = $55,000

With the NOI in hand, we can find the Cap Rate:

* Cap Rate = $55,000 / $1,000,000 = 5.5%

A 5.5% Cap Rate provides a much more sober perspective on the investment's actual performance. This is the figure you can use to compare the deal apples-to-apples against other investment opportunities, whether they're in real estate or not. It tells you how hard your capital is really working for you.

As you can see, a deal with a decent GRM can quickly look less attractive once its real-world expenses are factored in. This is why these two metrics are most powerful when used together.

Putting GRM to Work in Real-World Scenarios

Knowing the formula for Gross Rent Multiplier is one thing. Actually using it to make smart, fast decisions is what really counts. Let's walk through a couple of real-world situations to see how experienced investors use GRM to their advantage.

Imagine you're an investor, let's call her Alex, who wants to break into a new market. She's got a list of 50 potential multifamily properties, and there's no way she can do a full, deep-dive analysis on every single one. That would take weeks. This is where GRM becomes her best friend.

Alex uses GRM as a high-speed filter. She takes the asking price and the gross annual rent for each property and calculates the multiplier. In this particular market, she's decided anything with a GRM over 12 is too high. In less than an hour, she's slashed her list of 50 properties down to just eight contenders. Now, she can dedicate her time and resources to the deals that actually stand a chance of penciling out.

Comparing Two Duplexes on the Same Block

GRM is also incredibly useful for direct, head-to-head comparisons. Let's say a small-scale buyer named Sarah is trying to decide between two nearly identical duplexes right down the street from each other.

- Duplex A: Asking price is $500,000, and it brings in $48,000 in gross annual rent.

- Duplex B: Asking price is a bit higher at $525,000, but its gross annual rent is $55,000.

Just looking at the price, Duplex A seems like the obvious choice because it's cheaper. But hold on. A quick GRM calculation reveals the real story:

Duplex A GRM: $500,000 / $48,000 = 10.42

Duplex B GRM: $525,000 / $55,000 = 9.55

Even with its higher price, Duplex B has a much lower GRM. This is a strong signal that it offers more bang for the buck relative to its income. Sarah now knows that Duplex B is likely the better investment and where she should focus her due diligence efforts.

Finding the Data You Need

Of course, to make these quick calculations, you need solid numbers. When you're assessing a deal, the rental income is the foundation. While you can sometimes find properties with assured rental income, most of the time you'll have to do some digging yourself.

Your first step should be to ask the listing agent for a current rent roll. To get a feel for the broader market, connect with a local real estate agent who specializes in investment properties. They live and breathe this stuff. You can also pull recent sales of comparable properties (comps) from public records or the MLS to figure out the average GRM for that specific neighborhood. This gives you a benchmark, making it much easier to spot a genuinely good deal when it comes across your desk.

Answering Your Top Questions About Gross Rent Multiplier

Once you start plugging the Gross Rent Multiplier into your real-world analysis, you're bound to have questions. It happens to everyone. Let's walk through some of the most common ones that pop up for investors so you can feel confident using this metric.

Think of this as your go-to cheat sheet for applying GRM the right way and steering clear of the usual traps.

Can I Use Monthly Rent to Calculate GRM?

Technically, you could, but you absolutely shouldn't. The industry standard is to always use gross annual rent, and for good reason. Using the annual figure gives you a much more stable, big-picture look at a property's income stream. More importantly, it's the only way to make fair, apples-to-apples comparisons.

Here’s why it matters: an annual GRM of 8 is the same as a monthly GRM of 96 (that’s 8 x 12). If you’re looking at a property with a monthly GRM of 96 and comparing it to market comps using the standard annual GRM of 8, you'll think you've found a wildly overpriced deal when they're actually identical. To avoid massive valuation mistakes, just stick to the annual calculation. It keeps things consistent.

Does a Low GRM Automatically Mean It’s a Good Investment?

Not always. It's easy to get excited by a low GRM, but sometimes it’s a warning sign, not a green flag. An unusually low number could be signaling a property that’s saddled with sky-high operating costs, has a ton of deferred maintenance, or sits in a neighborhood with serious issues like high crime or vacancy rates.

Key Insight: A low GRM can be a wolf in sheep's clothing. Because the metric completely ignores expenses and the property's physical condition, it can't tell you if you've found a genuine bargain or a money pit in disguise. Always treat a low GRM as a signal to start digging, not a license to buy.

Your immediate next step should be to roll up your sleeves and dive into thorough due diligence. That means scrutinizing the operating statements and getting a professional property inspection, no exceptions.

Where Can I Find the Average GRM for My City?

Getting your hands on reliable, local GRM data is what makes this metric truly powerful. Without local context, the number is meaningless. Here are the best places to look:

- Real Estate Agents: Find an agent who lives and breathes investment properties in your target market. They have boots-on-the-ground knowledge and can pull fresh data directly from the MLS.

- Market Reports: Check for reports from real estate analytics firms that publish data on your city or region.

- Do It Yourself: You can calculate your own benchmark. Gather sales data on recent "comps" (comparable properties) from public records or online listings. Just take their sale prices and divide them by their estimated gross annual rents.

Ready to manage your real estate deals and investors without the spreadsheets and headaches? Homebase offers an all-in-one platform to handle fundraising, reporting, and investor relations seamlessly. Learn more about how we can help you scale your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking Property Value with a Rent Roll Example

Blog

Explore our comprehensive rent roll example to see how investors analyze property income, identify risks, and uncover hidden value in real estate deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.