Real Estate Investment Tax Benefits: 7 Top Strategies

Real Estate Investment Tax Benefits: 7 Top Strategies

Discover key real estate investment tax benefits and learn how to maximize deductions, depreciation, and 1031 exchanges to boost your profits.

Domingo Valadez

Jun 17, 2025

Blog

Maximize Your Returns: Exploring Real Estate Tax Advantages

Real estate investment tax benefits can significantly impact your bottom line. This listicle provides actionable strategies to leverage these advantages effectively. We'll cover seven key tax benefits for real estate investors, offering practical examples and clear steps for implementation. Understanding these benefits is crucial for maximizing profits and achieving your financial objectives. Whether you're a seasoned real estate syndicator, a multifamily investor, or a real estate sponsor, this guide offers valuable insights to optimize your tax strategy. These benefits can help you reduce your tax burden and reinvest more capital, accelerating your wealth-building journey.

This article specifically focuses on these seven key real estate investment tax benefits:

- Depreciation Deduction: Offsetting income with the "wear and tear" of your property.

- 1031 Like-Kind Exchange: Deferring capital gains taxes when selling and reinvesting.

- Mortgage Interest Deduction: Deducting the interest paid on your property loans.

- Cost Segregation: Accelerating depreciation deductions for faster tax savings.

- Opportunity Zone Deferral: Reinvesting capital gains into designated zones for tax benefits.

- Real Estate Professional Status: Potentially deducting real estate losses against other income.

- Business Expense Deductions: Deducting operational costs associated with your real estate activities.

By understanding and implementing these strategies, you can unlock significant financial advantages. Let's explore these real estate investment tax benefits in detail.

1. Depreciation Deduction

One of the most powerful real estate investment tax benefits is depreciation. This allows investors to deduct a portion of a property's cost each year, representing its wear and tear, effectively reducing taxable income. This benefit isn't a cash outlay, making it particularly attractive for boosting investment returns. Understanding the tax implications is crucial when maximizing returns on real estate investments, as it is with other investments like CD taxes. Learn more about CD taxes: Complete Guide to Maximizing Your Returns from Certificate-of-Deposit Calculator.

How Depreciation Works

The IRS sets specific depreciation periods: 27.5 years for residential properties and 39 years for commercial properties. This means you can deduct a portion of your property's cost (excluding land) over these respective periods, even if the property's market value is appreciating. This creates a valuable shield against taxes, especially in the early years of ownership.

Examples of Depreciation in Action

- Residential Rental: A $275,000 rental home (excluding land value) generates a $10,000 annual depreciation deduction.

- Commercial Office Building: A $390,000 commercial office building provides a $10,000 yearly depreciation deduction.

- Large-Scale Investment: An investor in a large apartment complex can significantly reduce taxable income - often by $50,000 or more annually - through depreciation.

Maximizing Depreciation Benefits

- Cost Segregation Study: Conduct a cost segregation study to identify building components that can be depreciated over shorter periods, accelerating deductions.

- Accurate Appraisals: Ensure accurate separation of land value from structure value using professional appraisals. This maximizes the depreciable basis.

- Detailed Records: Maintain detailed records of all improvements and their respective depreciable lives. This is crucial for accurate tax reporting.

- Depreciation Recapture: Consider the potential impact of depreciation recapture when planning your exit strategy.

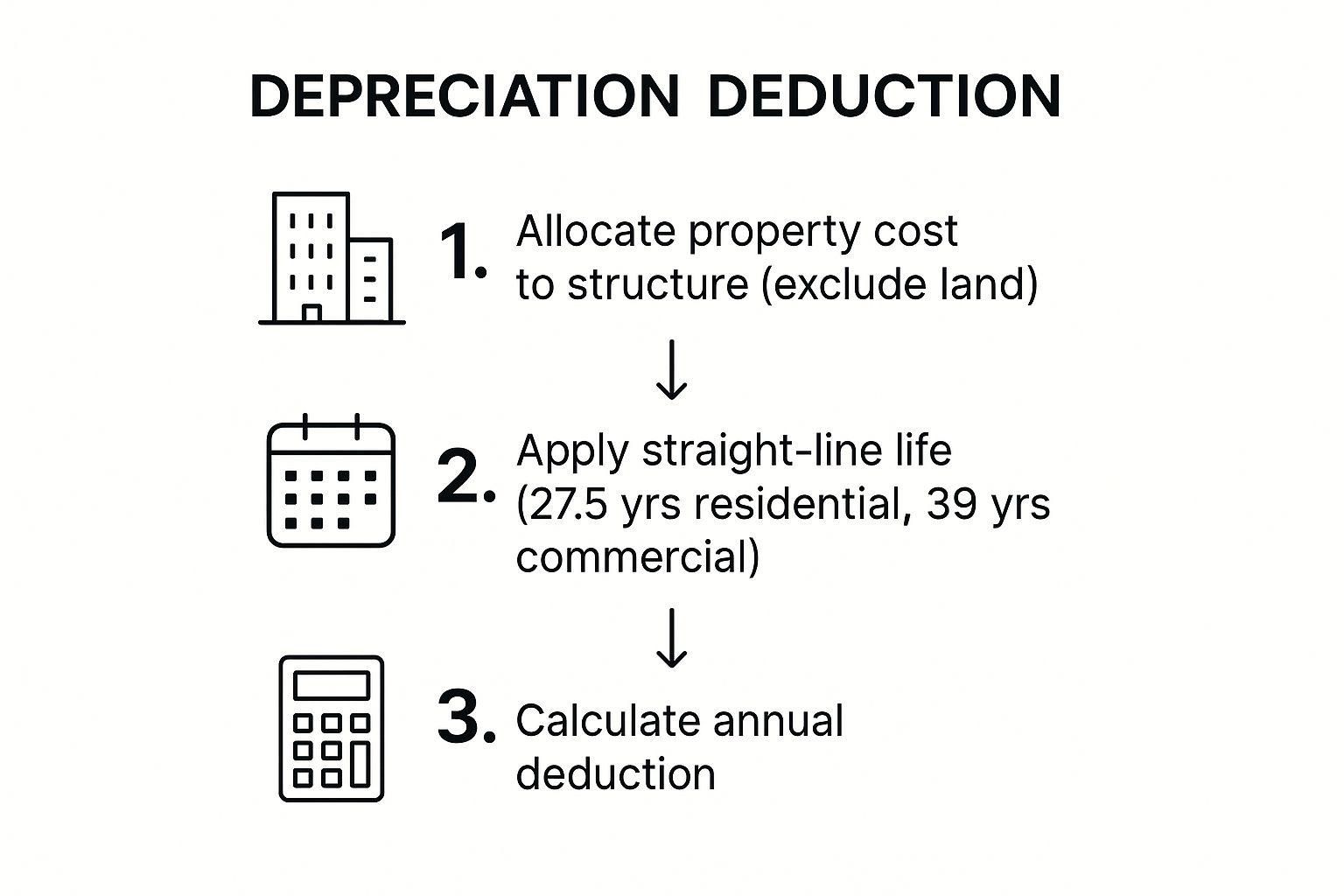

The following infographic illustrates the basic steps involved in calculating depreciation:

This infographic provides a simplified three-step process for calculating depreciation: allocate the property cost to the structure, apply the correct straight-line life based on the property type, and finally calculate the annual deduction. By following these steps and maintaining proper documentation, real estate investors can leverage depreciation to effectively reduce their tax burden and enhance their investment returns.

2. 1031 Like-Kind Exchange

One of the most powerful tools in a real estate investor's arsenal is the 1031 like-kind exchange. This strategy, rooted in Section 1031 of the Internal Revenue Code, allows investors to defer capital gains taxes on the sale of an investment property by exchanging it for another of equal or greater value. While often referred to as a "tax-free exchange," it's important to note that taxes are deferred, not eliminated. This deferral can significantly amplify long-term wealth building by allowing reinvested capital to grow unburdened by immediate tax liabilities. This strategy is particularly advantageous for those seeking to scale their real estate investments. Similar to leveraging tax advantages on other investments, such as understanding CD taxes, optimizing 1031 exchanges is crucial for maximizing real estate investment returns.

How 1031 Exchanges Work

A 1031 exchange involves selling a relinquished property and acquiring a replacement property within specific timeframes. Investors must identify potential replacement properties within 45 days of the sale of the relinquished property. The acquisition of the replacement property must then be completed within 180 days of the relinquished property's sale date. A qualified intermediary (QI) is essential for facilitating the exchange and holding funds between transactions.

Examples of 1031 Exchanges in Action

- Upgrading Property: An investor exchanges a $500,000 duplex for an $800,000 apartment building, deferring over $100,000 in capital gains. This allows them to control a larger asset and potentially generate higher cash flow.

- Diversifying Holdings: A commercial property owner exchanges retail space for an industrial warehouse to diversify their portfolio and mitigate risk.

- Portfolio Growth: A real estate mogul builds a $50 million+ portfolio over decades through sequential 1031 exchanges, consistently reinvesting and deferring taxes.

Maximizing 1031 Exchange Benefits

- Early Planning: Begin identifying potential replacement properties before listing the current property to ensure a smooth transition and adherence to deadlines.

- Qualified Intermediary: Engage a qualified intermediary experienced in 1031 exchanges to manage the complex process and ensure compliance.

- Backup Options: Consider Delaware Statutory Trusts (DSTs) as backup replacement options if identifying a suitable direct property proves challenging.

- Advance Planning: Plan exchanges well in advance to navigate the strict 45-day identification and 180-day acquisition timelines.

- Expert Advice: Consult with tax professionals and real estate attorneys for complex transactions, particularly multi-property or reverse exchanges. This ensures all legal and tax requirements are met.

3. Mortgage Interest Deduction

One of the most significant real estate investment tax benefits is the mortgage interest deduction. This allows investors to deduct the interest paid on loans used for acquiring, constructing, or improving rental properties. Unlike mortgage interest on a personal residence, which has limitations, interest paid on investment property loans is generally fully deductible as a business expense against rental income. This deduction directly reduces your taxable income, enhancing your overall return on investment.

How Mortgage Interest Deduction Works

The IRS considers mortgage interest on investment properties a legitimate business expense. You can deduct the interest paid on loans secured by the property, including mortgages for purchases, construction loans, and even certain home equity loans used for property improvements. This deduction can significantly offset rental income, thereby lowering your tax liability.

Examples of Mortgage Interest Deduction in Action

- Individual Investor: An investor with a $300,000 mortgage at a 6% interest rate can deduct $18,000 annually in mortgage interest.

- Commercial Property Owner: A commercial property owner with a $1.5 million loan at 5% interest can deduct $75,000 annually.

- Real Estate Portfolio: An investor with a portfolio of multiple properties can generate $150,000 or more in annual interest deductions, substantially impacting their tax burden.

Maximizing Mortgage Interest Deductions

- Detailed Records: Maintain meticulous records of all mortgage payments, clearly separating principal and interest portions. This is crucial for accurate tax reporting.

- Interest-Only Loans: In the early years of ownership, consider interest-only loans. These maximize interest deductions, though they require careful long-term financial planning.

- Home Equity Loans: Track interest paid on home equity loans used specifically for investment property improvements. These can also be deductible.

- Passive Activity Loss Limitations: Understand the passive activity loss (PAL) rules. If your rental real estate activities generate a loss, you may not be able to deduct the full amount if you are considered a passive investor. Consult a tax professional for guidance on PAL limitations and how they might affect your specific situation. Careful planning can help you strategically use deductions to minimize your tax burden within the PAL framework.

4. Cost Segregation

Cost segregation is a powerful tax strategy specifically designed for real estate investors. It accelerates depreciation by identifying building components that can be depreciated over shorter timeframes (5, 7, or 15 years) than the standard 27.5 years for residential or 39 years for commercial properties. This strategy significantly reduces current tax liability and enhances cash flow, offering real estate investors a substantial financial advantage. To learn more about mortgage options, here's a helpful resource: Mortgage information.

How Cost Segregation Works

Cost segregation involves a detailed engineering-based study of a property to classify its various components into the appropriate depreciation categories. This allows investors to maximize depreciation deductions in the early years of ownership, boosting real estate investment tax benefits. This meticulous analysis ensures that every possible deduction is identified and utilized.

Examples of Cost Segregation in Action

- Large Apartment Complex: A $2 million apartment complex implemented a cost segregation study and realized over $400,000 in first-year depreciation. This significantly reduced the investor's tax burden and freed up cash flow.

- Medical Office Building: The owner of a medical office building utilized cost segregation to accelerate depreciation, resulting in $150,000 of tax savings. This improved the property's overall profitability.

- Self-Storage Facility: A self-storage facility investor leveraged cost segregation to offset income from other business ventures. This strategic move optimized their overall tax strategy.

Maximizing Cost Segregation Benefits

- Qualified Professionals: Engage qualified cost segregation firms with engineering expertise to ensure a comprehensive and accurate study. This is essential for maximizing benefits.

- Strategic Timing: Consider the timing of the study to maximize current-year tax benefits related to real estate investment tax benefits. Proper planning is key to effectiveness.

- Bonus Depreciation: Combine cost segregation with bonus depreciation rules for the most impactful acceleration. This can significantly amplify the tax savings.

- Recapture Planning: Factor future depreciation recapture into your long-term investment strategy. This helps avoid unexpected tax liabilities upon sale.

- High-Income Applicability: Cost segregation is particularly beneficial for high-income investors in top tax brackets seeking significant tax reductions.

5. Opportunity Zone Deferral

Opportunity Zones offer significant tax advantages for real estate investors seeking to minimize their tax burden while contributing to designated economically distressed communities. By investing capital gains into Qualified Opportunity Funds (QOFs), investors can defer, reduce, and potentially eliminate capital gains taxes. This strategy allows for reinvestment of profits into long-term growth opportunities while mitigating tax liabilities.

How Opportunity Zone Deferral Works

Investors who realize capital gains can defer paying taxes on those gains by reinvesting them into a QOF within 180 days. These funds invest in businesses and real estate projects located within designated Opportunity Zones. The deferred capital gains are then held until the QOF investment is sold, or December 31, 2026, whichever comes first. Additional tax benefits accrue the longer the investment is held within the QOF. Real estate syndications can also leverage these benefits, allowing investors to pool resources for larger projects. Learn more about real estate syndication tax benefits.

Examples of Opportunity Zone Investing

- Tech Entrepreneur: A tech entrepreneur sells company stock for a $5 million profit and reinvests the gains into a QOF focused on multifamily development in an Opportunity Zone.

- Seasoned Investor: A real estate investor defers $1 million in capital gains from a property sale by investing in a QOF specializing in Opportunity Zone commercial real estate projects.

- Development Company: A development company constructs affordable housing within a Detroit Opportunity Zone, utilizing QOF investments to finance the project and benefit from the tax incentives.

Maximizing Opportunity Zone Benefits

- Thorough Due Diligence: Research Opportunity Zones and QOFs thoroughly, focusing on growth potential and alignment with investment goals.

- Experienced Fund Managers: Partner with reputable and experienced Opportunity Fund managers with proven track records.

- Substantial Improvement Test: Understand the substantial improvement requirement, often referred to as the "double the basis" test, which mandates significant upgrades to existing properties within the Zone.

- Long-Term Strategy: Plan for a long-term hold (at least 10 years) to maximize the tax benefits, including potential elimination of taxes on QOF investment appreciation.

- Geographic Diversification: Consider diversifying investments across multiple Opportunity Zones to spread risk and capture varied growth opportunities.

By understanding and strategically utilizing Opportunity Zone deferral, real estate investors can significantly reduce their tax burden, while simultaneously contributing to the revitalization of economically disadvantaged communities. This powerful tool offers a unique combination of financial and social impact.

6. Real Estate Professional Status

One of the most significant real estate investment tax benefits for active investors is the Real Estate Professional Status (REPS). This designation allows qualifying individuals to deduct rental real estate losses against other income, such as wages or business profits. Typically, rental losses are considered passive and can only offset passive income. Achieving REPS unlocks substantial tax savings for those deeply involved in real estate. Understanding these tax implications is just as crucial as understanding the nuances of other investment strategies, such as CD taxes.

How Real Estate Professional Status Works

The IRS defines strict criteria for REPS. You must meet both of these tests:

- More than Half Test: More than half of your personal services during the year must be performed in real property trades or businesses in which you materially participate.

- 750-Hour Test: You must perform more than 750 hours of services in real property trades or businesses in which you materially participate.

Material participation requires significant involvement in the activity, meeting one of seven IRS-defined tests.

Examples of Real Estate Professional Status in Action

- Real Estate Agent with Rentals: A licensed agent working 40+ hours weekly selling real estate also manages their rental portfolio. Meeting both the time tests, they offset $75,000 in passive losses against their commission income.

- Former Executive Turned Investor: Leaving the corporate world, a former executive dedicates themselves full-time to real estate, managing multiple properties and renovations. This full-time involvement allows them to claim REPS and saves them over $40,000 annually in taxes.

- Husband-Wife Team: A husband focuses on property acquisitions while his wife manages the properties, their combined hours exceeding the 750-hour requirement and qualifying for REPS when filing jointly.

Maximizing Real Estate Professional Status Benefits

- Detailed Time Logs: Maintain meticulous daily time logs of all real estate activities. Include property management, tenant communication, repairs, research, and even real estate education.

- Spouse's Activities: If married filing jointly, consider your spouse's real estate activities. Combining hours can be crucial for meeting the requirements.

- Grouping Activities: Properly group your rental activities for material participation. Incorrect grouping can inadvertently disqualify you.

- Professional Advice: Consult with a qualified tax professional specializing in real estate before claiming REPS. The rules are complex, and professional guidance is essential.

Achieving Real Estate Professional Status offers significant tax advantages for those actively engaged in real estate investment. Meticulous planning and accurate record-keeping are vital for maximizing these benefits and reducing your tax burden.

7. Business Expense Deductions

One of the most significant real estate investment tax benefits is the ability to deduct ordinary and necessary business expenses. These deductions directly reduce your taxable rental income, boosting your bottom line. Expenses can range from routine repairs and maintenance to professional services, advertising, and travel related to your rental property. Understanding these deductions is crucial for maximizing real estate investment tax benefits, just as crucial as comprehending the tax implications of other investments.

How Business Expense Deductions Work

The IRS allows deductions for expenses directly related to the operation and management of your rental property. These must be "ordinary and necessary" - meaning common and accepted practices within the real estate industry. Maintain meticulous records, including receipts and invoices, to substantiate these deductions during tax season.

Examples of Deductible Business Expenses

- Repairs and Maintenance: A rental property owner deducts $15,000 annually for repairs, maintenance, and management fees. This includes expenses like plumbing repairs, landscaping, and cleaning services.

- Home Office Deduction: A real estate investor claims a home office deduction for a portion of their home used exclusively and regularly for property management activities. This can cover expenses like rent, utilities, and depreciation allocated to the home office space.

- Property Management Fees: Investors utilizing property management companies can deduct the fees paid for their services.

- Travel Expenses: A property manager deducts vehicle expenses, including mileage, parking, tolls, and other costs incurred while traveling for property-related business, such as visiting properties, meeting with tenants, or attending industry events. They can also deduct phone bills and professional development costs.

Maximizing Business Expense Deductions

- Detailed Records: Keep detailed receipts and records for all business expenses. Organize these records by category and property to streamline tax preparation.

- Separate Repairs from Improvements: Distinguish between repair expenses (deductible immediately) and capital improvements (depreciated over time). This ensures accurate deduction application.

- Mileage Tracking: Track mileage for all property-related travel diligently. Use a mileage tracking app or maintain a detailed logbook.

- Home Office Considerations: Explore the home office deduction if you manage properties from home. Accurately calculate the percentage of your home used for business purposes.

- Capitalization Rules: Understand capitalization rules for major improvements. These are added to the property's basis and depreciated over time rather than deducted immediately. This knowledge allows for strategic tax planning.

By meticulously tracking and categorizing all eligible business expenses, real estate investors can significantly reduce their taxable rental income and enhance their overall investment returns. Leveraging these deductions is a key strategy for maximizing the profitability of real estate ventures.

Real Estate Investment Tax Benefits Comparison

Strategic Tax Planning for Real Estate Success

Maximizing real estate investment tax benefits is crucial for long-term financial success. This article explored seven key strategies: depreciation deduction, 1031 exchanges, mortgage interest deduction, cost segregation, opportunity zone deferral, real estate professional status, and business expense deductions. By understanding and implementing these strategies, you can significantly reduce your tax burden and boost your returns.

Key Takeaways for Real Estate Investors

- Depreciation: Accelerated depreciation methods can significantly reduce your taxable income in the early years of ownership.

- 1031 Exchanges: Deferring capital gains through like-kind exchanges allows you to reinvest profits into larger assets, fueling portfolio growth.

- Mortgage Interest: Deducting mortgage interest lowers your taxable income, improving cash flow.

- Cost Segregation: This specialized technique can front-load depreciation deductions, providing substantial tax savings in the initial years.

- Opportunity Zones: Investing in designated opportunity zones offers tax deferral and potential elimination of capital gains on future appreciation.

- Real Estate Professional Status: Qualifying for this status can unlock significant deductions against other income, minimizing your overall tax liability.

- Business Expenses: Meticulous tracking and deduction of all legitimate business expenses related to your real estate investments is paramount.

Implementing Your Tax Strategy

These real estate investment tax benefits represent powerful tools for wealth creation. However, tax laws are complex. Consulting with a qualified real estate tax advisor is essential for personalized guidance tailored to your individual circumstances. A proactive approach to tax planning is key. By integrating these strategies into your overall investment plan, you can position yourself for significant tax advantages and increased profitability.

Maximizing Benefits, Minimizing Hassles

Successfully navigating these tax benefits can seem daunting. Careful planning and accurate record-keeping are essential for maximizing their impact. Consider using tools and resources that can streamline the process. Properly implemented, these strategies can transform your real estate ventures. They can create a substantial positive impact on your long-term financial goals.

Remember, strategic tax planning is not about avoiding taxes; it's about legally minimizing your tax liability to maximize your investment returns. By proactively managing your taxes, you can accelerate wealth building and secure a stronger financial future.

Streamline your real estate syndication and unlock the full potential of these tax benefits with Homebase. From fundraising and investor relations to deal management, Homebase simplifies the complexities of real estate investing, allowing you to focus on maximizing your returns. Visit Homebase today to learn more.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

12 Essential Types of Real Estate Investment to Explore in 2026

Blog

Discover the 12 key types of real estate investment, from syndication to REITs. This guide covers risk, returns, and how to get started.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.