What Is a Promoter in Real Estate and How Do They Work

What Is a Promoter in Real Estate and How Do They Work

Understand what is a promoter in real estate, their key responsibilities, legal duties, and how to evaluate them before you invest in a project.

Domingo Valadez

Dec 15, 2025

Blog

So, what exactly is a real estate promoter? Think of them as the orchestrator of a development project—the one person who takes a raw idea and turns it into a physical reality. They are the true entrepreneur at the heart of the deal, the visionary who sees a thriving apartment complex where others just see an empty lot.

The Architect of Opportunity

A promoter is far more than just a manager. They are the driving force who gets a project off the ground, often risking their own capital and reputation to breathe life into a new development.

Their role is most critical in the earliest, most fragile stages of a project's lifecycle. They are the ones who transform a concept scribbled on a napkin into a tangible, valuable asset.

From Concept to Reality

The journey starts with a spark: identifying a promising opportunity. This might be a parcel of land zoned for new construction or an old warehouse perfect for a loft conversion. Once the vision is clear, the real work begins.

Here's what a promoter handles right out of the gate:

* Acquiring Land: They find the property, negotiate the terms, and secure the purchase.

* Securing Approvals: This means diving into the complex world of zoning laws, city permits, and other government hurdles.

* Raising Capital: They are responsible for finding the money, whether it's from private investors, banks, or their own funds.

* Assembling the Team: They hand-pick the architects, engineers, contractors, and other experts needed to get the job done.

Many promoters develop deep expertise in a specific niche, like large-scale multi-family real estate projects, where their specialized knowledge is invaluable.

A promoter doesn't just manage a project; they create it from nothing. They are the central point of gravity, pulling together the people, capital, and resources needed to build something tangible and profitable. Their vision and execution are the foundation upon which the entire development rests.

Ultimately, the promoter's job is to make sure all these moving parts come together seamlessly. They aim to deliver the project on time and on budget, ensuring that investors, partners, and future tenants are all satisfied. This crucial groundwork paves the way for everything that follows.

What Does a Real Estate Promoter Actually Do?

A real estate promoter is far more than just the person who finds a good deal. Think of them as the project's central nervous system—the ultimate project manager, financial architect, and legal navigator, all rolled into one. Their hands-on involvement is absolutely critical from the first day to the last.

In the fast-paced world of real estate, the promoter is the one who breathes life into a project. They take a raw concept and drive it all the way to completion, often shouldering the financial risks and sweating every single detail. Their core job involves making the tough decisions, meticulously planning the build, and securing the money—either from their own pockets or from investors. For a deeper dive into this pivotal role, check out the breakdown from Copernicus Credit.

The Pre-Construction Grind

Long before a single shovel hits the ground, the promoter is already deep in the trenches. This is where the initial vision gets a serious reality check, and the groundwork for success (or failure) is laid.

This stage is all about:

* Feasibility Studies: This isn't just a quick look at the numbers. It's a rigorous analysis of market demand, projected costs, and potential profitability. We're talking everything from deep demographic research to granular comparisons of local rental rates.

* Land Acquisition: Finding the right piece of land is an art. The promoter has to identify the perfect spot, negotiate the purchase, and close the deal, which requires sharp negotiation chops and a solid grasp of property law.

* Securing Entitlements: This is the often-painful process of navigating the maze of local government approvals. It means dealing with zoning changes, pulling permits, and getting environmental clearances—a bureaucratic gauntlet that can easily take months, if not years.

Structuring and Funding the Deal

Once the project looks viable and the land is locked down, the promoter puts on their financial architect hat. Their mission is to build a "capital stack" that can fund the entire project, from pouring the foundation to running the marketing campaigns.

A promoter’s ability to structure a deal that attracts both lenders and equity investors is arguably their most critical skill. They have to balance risk and reward to create a financial model that works for everyone.

This part of the job involves several key steps:

1. Debt Financing: This means sitting down with banks and other lenders to secure construction loans. It’s not as simple as asking for money; it requires detailed financial projections and an airtight business plan.

2. Equity Fundraising: Here's where the promoter truly "promotes." They need to find and secure capital from private investors, family offices, or institutional partners by selling them on the vision and the potential returns.

3. Legal Structuring: Working closely with attorneys, the promoter sets up the legal entities—usually an LLC or LP—that will own the property. This structure is crucial as it governs the entire relationship between the promoter and their investors.

As the project finally moves into construction, the promoter's role shifts yet again. They become the master overseer, managing budgets, pushing timelines, and coordinating with contractors to bring the vision to life, right through to marketing and ultimately leasing or selling the completed property.

Promoter vs. Developer vs. Sponsor: Distinguishing Key Roles

In the world of real estate, it's easy to get the terms promoter, developer, and sponsor mixed up. They often get used interchangeably, which can muddy the waters for investors trying to figure out who’s who in a deal.

While their roles can certainly overlap—and sometimes one person wears all three hats—each has a distinct function. Nailing down these differences is crucial for understanding a deal's structure and knowing exactly who is steering the ship.

Let's use a movie production analogy. The promoter is like the executive producer. They're the one who discovers the "script" (the deal), lines up the financing from the studio (raises capital), and gets the project off the ground. They are the initial visionary, the one who conceives of the entire project and takes the first big risks.

The developer is the on-set director. They take the promoter's vision and make it a reality. Their focus is on the ground-level execution—managing construction, coordinating with contractors, and making sure the physical building comes to life as planned. A promoter might hire a developer or be one themselves, but the developer's job is all about the physical creation of the asset.

The Specialized Role of the Sponsor

This brings us to the sponsor, a term you’ll hear constantly in real estate syndications. A sponsor is a specific type of promoter who is organizing a group investment. They're the ones who find the deal, structure it all legally, and then raise money from passive investors to close on the property.

In a syndication, the sponsor takes on the role of the General Partner (GP). They actively manage the asset on behalf of the investors, who are the Limited Partners (LPs). This means they handle everything from acquisition and day-to-day operations to the eventual sale. You can dive deeper into the specific duties of a real estate sponsor in our detailed guide.

In short: 'Promoter' is the big-picture term for the entrepreneur driving a project. 'Developer' is the hands-on builder. 'Sponsor' is the specific title for a promoter who syndicates a deal, managing investor capital as the General Partner.

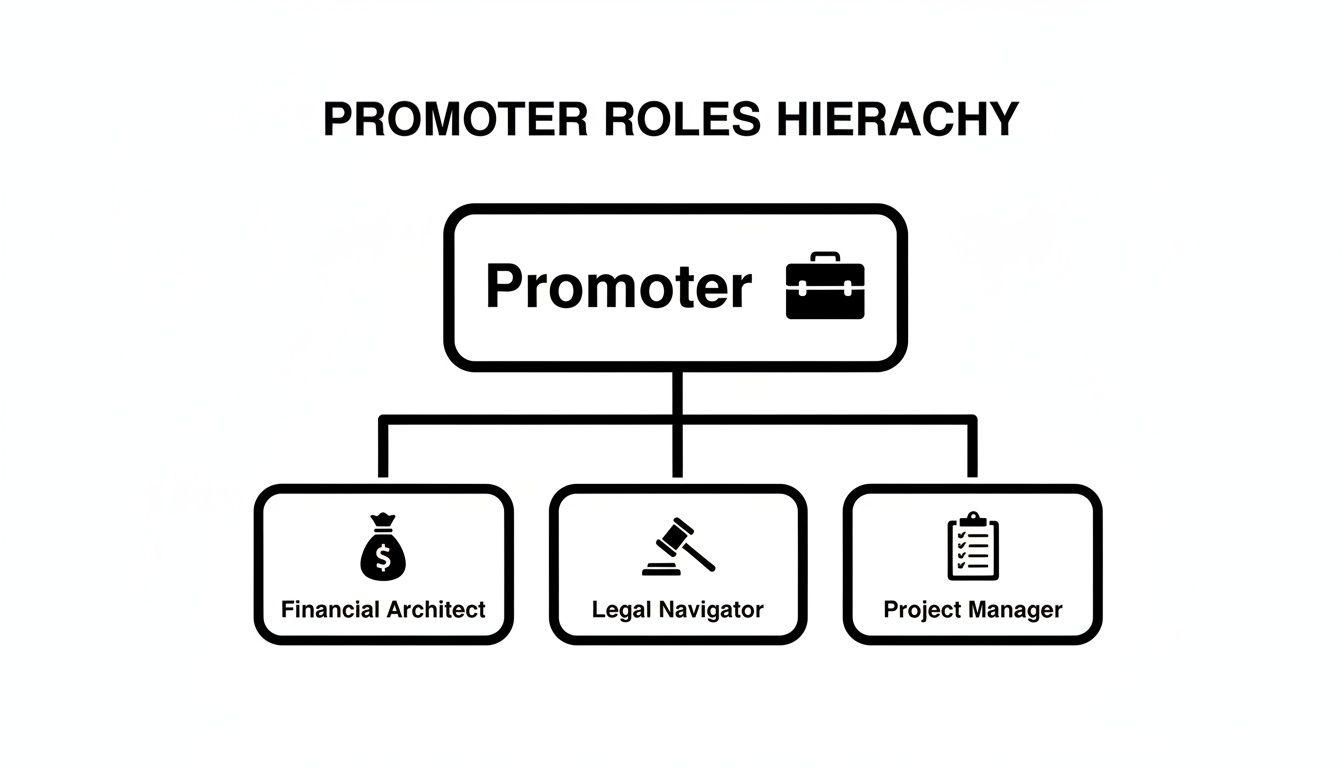

The promoter is often the central figure who orchestrates the entire project, as this chart shows.

As you can see, the promoter often oversees the financial, legal, and operational aspects, bringing all the pieces together.

Comparing Roles: Promoter vs. Sponsor vs. Developer

To put a finer point on it, here's a side-by-side breakdown. Understanding the core focus of each role helps you ask smarter questions when you're doing your due diligence.

So, what's the bottom line? Every sponsor is a promoter, but not every promoter is a sponsor. A promoter could fund a project with their own cash or bring in a single institutional partner. In that scenario, they aren't "sponsoring" a deal for a group of passive investors.

These distinctions are more than just semantics—they define who is ultimately accountable for your capital and the project's success.

The Legal Framework and Liabilities Promoters Face

A real estate promoter’s role is about much more than just a great idea and the drive to get it built. It's a position governed by a serious legal framework designed to protect everyone from individual homebuyers to major investors. These aren't just suggestions, either. They're hard-and-fast rules, and ignoring them can quickly turn a promising project into a legal quagmire.

This legal structure is the bedrock of trust in the market. It ensures a promoter’s goals are tied directly to the interests of the people putting up the capital, holding them accountable for everything from financial transparency to the quality of the final construction.

Key Consumer Protection Regulations

All over the world, governments are putting consumer-focused laws in place to fight fraud and make sure projects actually get finished. A great example of this is India's Real Estate (Regulation and Development) Act of 2016 (RERA), which lays out a promoter's duties in very specific terms.

Under RERA, for instance, promoters are required to deposit 70% of the money collected from buyers into a separate escrow account. This single rule was a game-changer, designed to stop the common practice of diverting funds that had previously contributed to up to 80% of stalled projects. RERA also dictates that promoters can’t take more than a 10% advance payment without a formal, written sales agreement in place.

Financial and Fiduciary Duties

Even without specific laws like RERA, promoters have what are known as fiduciary duties, especially when they're raising money from investors. In simple terms, this means they have a legal obligation to act in the best interests of their financial partners.

This boils down to a few core responsibilities:

- Full Disclosure: Promoters have to be an open book. They must provide completely transparent and accurate information about the project’s risks, its financials, and its progress. Hiding the truth or misrepresenting facts can lead to serious legal trouble.

- No Self-Dealing: It’s a huge red flag if a promoter uses investor money for personal benefit or gets into deals that create a conflict of interest. This is strictly forbidden unless it's fully disclosed and approved by the investors.

- Prudent Management: Promoters are expected to manage the project’s money and operations with care, avoiding waste and negligence.

The core principle is simple: the promoter is a steward of other people's money. This legal relationship demands a high standard of care, honesty, and transparency throughout the entire project lifecycle, from initial fundraising to final sale.

Liability for Construction and Defects

A promoter’s job isn’t over once the keys are handed to the new owner. They are often on the hook legally for structural defects and shoddy workmanship for a set period after the building is completed. This is often called the "defect liability period," and it’s there to protect buyers from hidden problems that might not show up right away.

For promoters working in places like New South Wales, Australia, knowing how to handle construction issues is absolutely essential. A project can run into problems that require navigating NSW building disputes and other regional laws, so it's a key part of a promoter's risk management plan. This post-completion responsibility forces a much-needed focus on quality right from day one.

How Real Estate Promoters Get Paid

For any investor, understanding how a promoter gets paid is non-negotiable. Their compensation isn't a simple salary; it's a structure built to reward performance and align their interests directly with yours. Think of it less like a paycheck and more like a partnership, where the biggest rewards come only after the project succeeds.

This model is designed to compensate the promoter for the immense upfront risks they take on—everything from finding the deal and tying up the property to spending months (or years) raising capital. It's the "skin in the game" that motivates them to push the project across the finish line profitably.

Common Compensation Structures

A promoter’s compensation usually comes in layers, not one lump sum. These fees are paid out at different stages of the project, matching their cash flow to the deal's timeline.

Here’s a breakdown of the typical fees you'll see:

* Acquisition Fee: This is a one-time fee for the work of finding, underwriting, and closing the deal. It's usually 1-2% of the property’s final purchase price.

* Development Fee: If it's a construction or major renovation project, this fee covers the promoter's overhead for managing the entire development process. It's often calculated as a percentage of the total project cost.

* Asset Management Fee: This is an ongoing annual fee, typically 1-2% of the equity raised or the total assets under management. It pays the promoter for the day-to-day work of managing the property and making sure the business plan stays on track after the deal closes.

The Power of the Promote

While fees cover the overhead, the real prize for a promoter is the "promote," also known as carried interest. This is their outsized share of the profits, but it only kicks in after investors get their initial capital back, plus a preferred return.

The promote is the ultimate alignment tool. It means the promoter makes their serious money only after the investors have made theirs. Their financial success is directly tied to your returns.

This is usually handled through a "distribution waterfall." It's a simple concept: imagine filling a series of buckets, one after the other.

- Return of Capital: The first bucket to be filled is the investors'. All initial profits flow to them until 100% of their original investment is paid back.

- Preferred Return: The next bucket is the "pref." Investors receive a predetermined return (say, 8% annually) on their capital. This is their reward for taking the risk before the promoter gets a major payout.

- The Promote Kicks In: Only after those first two buckets are full does the waterfall spill over into the next. The remaining profits are then split between the investors and the promoter, but now the promoter gets a much larger share (the promote).

For example, a common structure after the first two hurdles are cleared is a 70/30 split, where 70% of profits go to investors and 30% goes to the promoter. This structure gives the promoter a powerful incentive to not just meet the performance targets, but to blow past them. Their biggest payday only arrives when the project is an undeniable home run for everyone involved.

Your Due Diligence Checklist for Evaluating a Promoter

Before you even think about writing a check, let this sink in: the success or failure of a real estate deal often rests squarely on the promoter's shoulders. A top-notch promoter can take a good project and make it great, but a weak one can sink even the most promising deal. Doing your homework on them isn't just a good idea—it's the single most important thing you can do to protect your money.

Think of this checklist as your roadmap. It's designed to help you cut through the sales pitch and really figure out who you’re about to partner with.

Scrutinize Their Track Record

The best crystal ball for predicting future success is past performance. Don't just accept their highlight reel; it's time to dig deep into their actual history.

- Project Completion: Have they actually finished projects of a similar size and type? Ask to see a portfolio. If they're pitching a 100-unit apartment syndication, you want to know they've done more than just flip a few single-family homes.

- Budget and Timeline: How did those past deals go? Were they on schedule and on budget? A history of major delays or consistent cost overruns is a massive red flag.

- Investor Returns: This is the big one. Did their past investors actually get the returns they were promised? A promoter who consistently hits their projections and makes their partners money is what you're looking for.

Verify Legal and Financial Standing

A promoter's background should be an open book. If they get defensive or hesitant when you ask for documentation, that’s your cue to head for the exit.

You need to run background checks on the promoter and their key team members. Look for any history of bankruptcies, lawsuits, or run-ins with regulators. The SEC’s complaint against promoters of a Ponzi scheme is a sobering reminder of what’s at stake when this step is skipped. A clean legal record is non-negotiable.

Beyond that, you have to gauge their financial stability. A promoter with solid financial backing is in a much better position to navigate the inevitable bumps in the road without putting your capital in jeopardy.

The single most important question you can ask is about their “skin in the game.” You want to see that the promoter is investing a meaningful amount of their own cash right alongside you—usually 5-10% of the total equity. This isn't just a good sign; it ensures their interests are perfectly aligned with yours.

Analyze the Deal Documents

The legal paperwork is where the verbal promises get turned into legally binding agreements. Get comfortable with the private placement memorandum (PPM) and the operating agreement, and seriously consider having an attorney review them with you.

- Fee Structure: Is their compensation reasonable and in line with what's typical for these kinds of deals? Pay close attention to acquisition fees, asset management fees, and the promote structure itself.

- Reporting and Communication: Does the agreement spell out exactly when and how you’ll get updates? Vague promises of "regular updates" aren't good enough.

- Risk Factors: Every deal has risks. A good PPM will lay them out clearly and honestly. If the "Risk Factors" section feels light or glosses over potential problems, they're not being transparent.

By systematically going through this checklist, you shift from being a passive investor to an informed one. You'll have the confidence that you're not just investing in a property, but in a capable and trustworthy real estate promoter who knows how to get the job done.

Common Questions About Real Estate Promoters

Even with a solid understanding of the basics, a few specific questions always pop up when people try to get their heads around the role of a real estate promoter. Let's tackle some of the most frequent ones to clear up any lingering confusion.

Can a Single Person Be a Promoter?

Absolutely. A promoter isn't always a big, faceless corporation. It can be a single individual, a small group of partners, or a larger company. The structure really just depends on the size and complexity of the deal.

For a smaller project like a single-family home flip or a small multifamily acquisition, it’s common to see an individual promoter working through their own LLC. But when you get into massive, multi-phase developments, you'll almost always find a more formal corporate entity driving the project.

What Does "Skin in the Game" Mean for a Promoter?

This is a big one. "Skin in the game" simply refers to how much of their own money the promoter has personally invested in the deal, right alongside their investors. Think of it as the ultimate sign of confidence.

When a promoter puts up a meaningful amount of their own capital—often 5-10% of the total equity needed—their financial success is directly tied to the investors'. It’s powerful proof that they truly believe in the project and aren't just gambling with other people's money.

How Is a Promoter Regulated in the United States?

In the U.S., the regulation of promoters (or "sponsors," as they're more commonly known) is a patchwork of federal and state rules. There isn’t one single agency that oversees everything.

At the federal level, the SEC gets involved in how they raise capital from investors, with specific rules like Regulation D setting the guidelines. On the local side of things, promoters have to navigate state real estate laws, city zoning ordinances, and specific building codes. It's a much more fragmented system than in some other countries, which means promoters need to be experts at staying compliant across several different jurisdictions.

For any promoter, juggling investor relations, fundraising, and sending out distributions can quickly become a full-time job. Homebase is an all-in-one platform built to make life easier for real estate syndicators. From setting up a professional deal room to automating payouts, you can manage your entire back office in one place. Find out how you can streamline your operations and focus on raising capital by visiting their website.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.