What Is a Syndicate in Real Estate?

What Is a Syndicate in Real Estate?

Learn what a syndicate in real estate is and how it works. Our guide covers how to invest, the key roles, benefits, and risks for passive investors.

Domingo Valadez

Sep 14, 2025

Blog

Ever driven past a huge apartment complex or a shiny new office building and wondered who actually owns a place like that? For most of us, the idea of buying a multi-million dollar property on our own is a non-starter. This is where real estate syndication comes into the picture.

Simply put, a syndicate in real estate is a group of investors who pool their money together to buy a property far larger than any of them could afford alone. It's a way to break down a massive real estate deal into bite-sized investment shares, giving everyday investors a chance to own a piece of institutional-quality real estate.

Your Introduction to Real Estate Syndication

Think of it like this: you and your friends want to buy a yacht. You can’t afford it by yourself, but if you all pitch in, you can become fractional owners. Real estate syndication works on the same principle, just on a much bigger scale.

At the center of it all is a professional real estate operator, often called the "sponsor" or "syndicator." This is the expert who does the heavy lifting. They find the promising property, put together a solid business plan to improve it (and increase its value), and then open up the opportunity for investors like you to provide the capital. In return, you get a slice of the ownership and, more importantly, a share of the profits.

Why Syndication Is Gaining Momentum

This isn't just a clever way to buy big buildings; it's a strategic move in the current market. We're seeing a perfect storm of housing shortages and incredibly strong rental demand, which is pushing property values and cash flow upward.

In fact, some forecasts predict rental growth in hot markets could hit 7% annually through 2025. This powerful trend makes group investing a really smart way to get in on large-scale residential and commercial projects that are positioned to do well. If you're interested in the numbers, you can learn more about the market outlook for real estate syndication in 2025.

Consider this guide your roadmap. We’re going to pull back the curtain and show you exactly how a real estate syndicate works from the inside.

We’ll cover:

- The Key Players: Understanding the distinct roles of the deal sponsor versus the investors.

- The Deal Structure: A look at how the legal entities are set up and how profits get split.

- Benefits and Risks: A no-nonsense breakdown of the upside and what to watch out for.

- Finding Opportunities: Practical tips for how to find and vet your first potential deal.

By the time we're done, you’ll see how this strategy can help you build real wealth in real estate, without ever having to fix a leaky toilet yourself.

Understanding the Key Players in a Syndicate

A successful real estate syndicate isn't just a transaction; it's a strategic partnership. To really grasp how these deals come together, you first have to understand the two essential roles at the heart of every syndicate: the Sponsor and the Investors.

Think of it as a professional sports team. You have the coach who designs the plays and manages the game, and you have the team owners who provide the funding to make it all happen. Both are absolutely critical for a win.

The Sponsor or General Partner

The Sponsor, often called the General Partner (GP), is the "coach" of the deal. They are the active, on-the-ground expert who orchestrates everything from start to finish. This is the person or company that finds the property, puts the deal together, and manages the asset until it's sold.

Their job is incredibly hands-on and covers a lot of ground:

- Deal Sourcing: They're the ones hunting for promising properties and crunching the numbers to see if a deal makes sense.

- Due Diligence: Once a property is under contract, the GP does the heavy lifting—inspecting the building, verifying the financials, and researching the market.

- Securing Financing: They are responsible for getting the loan. This is a crucial step that involves working with lenders and understanding the nuances between roles like a Loan Officer Vs Mortgage Broker to secure the best financing terms.

- Asset Management: After the deal closes, the Sponsor manages the property. This means overseeing renovations, marketing vacant units, and handling day-to-day operations to execute the business plan.

- Investor Relations: The GP finds the investors to fund the deal, provides them with regular performance updates, and manages all financial distributions.

In short, the Sponsor does all the work and takes on the primary responsibility for the project's success. You can get a deeper understanding of the definition of a General Partner in real estate and their legal duties to see just how comprehensive this role is.

The Investors or Limited Partners

On the other side are the investors, who are known as Limited Partners (LPs). If the Sponsor is the coach, the LPs are the "team owners" who provide the capital needed to acquire the asset and execute the game plan. Their role is designed to be completely passive.

The core value proposition for a Limited Partner is the ability to invest in high-value real estate assets without the burden of landlord responsibilities. Their primary contribution is financial capital.

By pooling their money, LPs get to own a piece of a large-scale property that would likely be out of reach for them individually. In return for their investment, they receive a share of the cash flow and profits from the sale. A huge benefit is that their liability is generally limited to the amount they invested, which protects their personal assets if the deal goes south.

This clear division of labor is what makes a syndicate in real estate so effective. It allows everyone to focus on what they do best, aligning the expertise of the Sponsor with the capital of the Investors toward the shared goal of a profitable investment.

Sponsor vs Investor Roles in a Real Estate Syndicate

To make the distinction crystal clear, let's break down the key differences in responsibility and involvement between the Sponsor and the Investors.

This table neatly summarizes the give-and-take in a syndication. The Sponsor takes on the work and the risk in exchange for a larger share of the upside, while Investors trade control for a passive, professionally managed investment opportunity.

The Lifecycle of a Syndication Deal

Every real estate syndication deal follows a distinct, five-stage journey. It’s a process that takes an idea from a back-of-the-napkin sketch all the way to a profitable sale. Once you understand this flow, the whole concept of syndication becomes much clearer.

Think of it this way: the sponsor, or General Partner, is constantly sifting through the market. They might look at hundreds of potential properties before finding one that truly has the right potential. That’s where the real work begins.

Stage 1: Deal Sourcing and Underwriting

This is the foundation of the entire deal. First comes deal sourcing, which is the hunt for the right property. A good sponsor isn’t just browsing Zillow; they’re tapping into their network to find off-market deals or properties with hidden value that others have missed.

Once a promising property is identified, the underwriting begins. This is a deep, numbers-driven analysis where the sponsor builds a financial model for the property. They'll project income, map out expenses, and forecast potential returns. It’s an intense stress test of their assumptions—what happens if vacancies climb or construction costs spike? The vast majority of deals don't make the cut; often, fewer than 1% of properties reviewed will ever move forward.

Stage 2: Capital Raising

With a solid deal under contract, the sponsor shifts gears to raising money from investors (the Limited Partners). This is where the syndicate in real estate actually comes together. The sponsor puts together a detailed investment summary, sometimes called a Private Placement Memorandum (PPM), which lays out the entire business plan. It covers everything from the renovation strategy to the financial projections and potential risks.

Investors then get to review the opportunity, ask tough questions, and decide if it's the right fit for their capital. A smooth and successful capital raise is a huge vote of confidence, not just in the property itself but in the sponsor's credibility and track record.

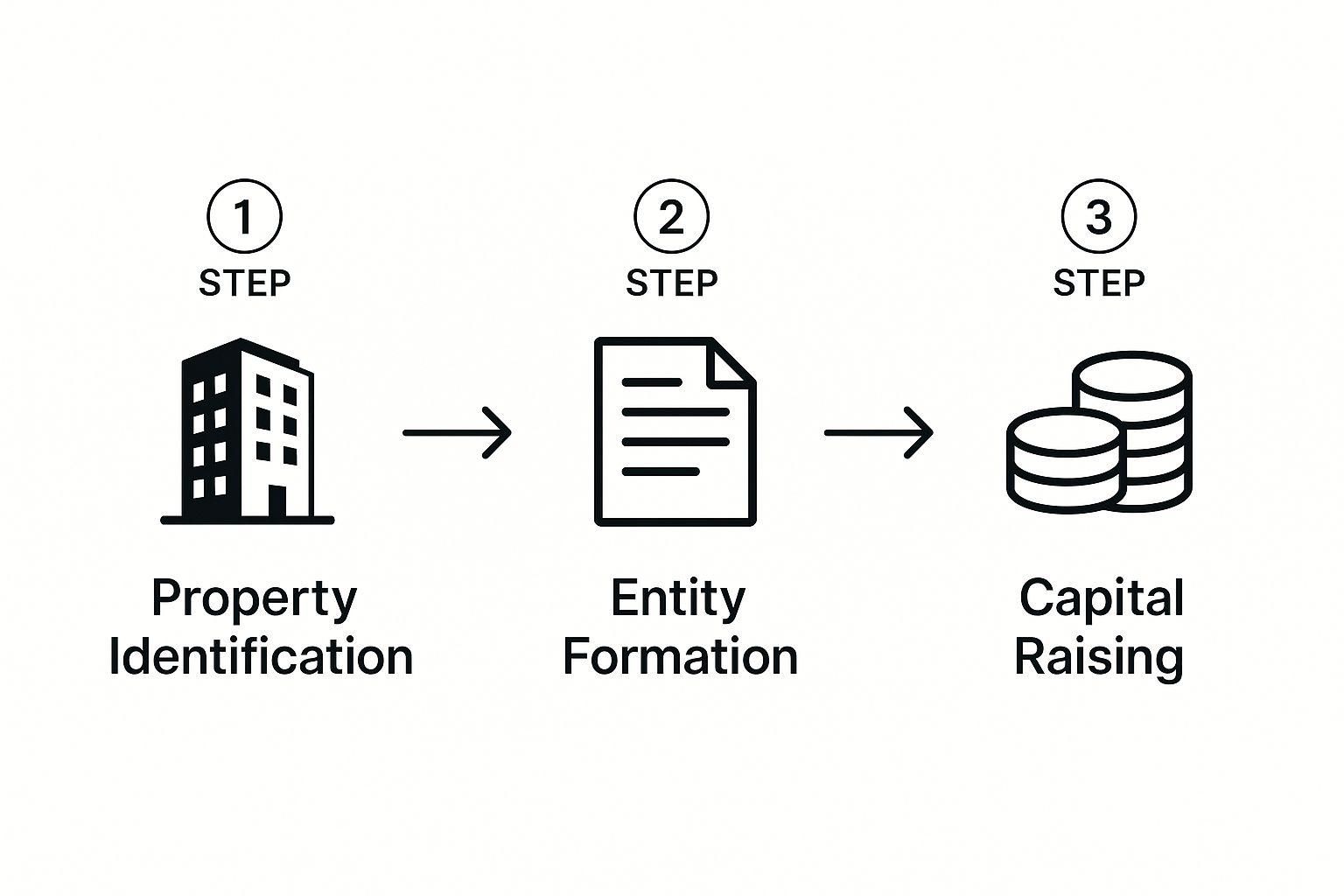

The basic flow for getting the deal structured and funded is captured well in this visual.

As you can see, it's a logical progression: find the asset, create the legal company to own it, and then bring in investor capital to fund the purchase.

Stage 3: Acquisition

Once the money is raised and the bank loan is approved, it’s time to close the deal. The acquisition phase is a flurry of legal and financial activity. Lawyers are finalizing loan documents, the title company is ensuring a clean transfer, and funds are wired. The moment the deal is closed, the syndication officially owns the property.

This is the point of no return. The business plan is no longer a forecast; it's a reality. The sponsor has the keys, and now they have to deliver on the promises made to their investors.

Stage 4: Asset Management

This is the long haul—the part where the real value is created. The asset management phase typically lasts three to seven years, and it’s when the sponsor executes the business plan they pitched to investors.

Depending on the strategy, this might involve:

* Renovating units to justify higher rents.

* Bringing in professional property management to tighten up operations and cut costs.

* Launching new marketing efforts to attract better tenants and reduce vacancies.

Throughout this period, the sponsor is in charge of everything. They provide investors with regular updates on performance and, if the property is cash-flowing, distribute the net income—usually every quarter.

Stage 5: The Exit

Finally, we have the exit. This is the sale of the property, which happens once the business plan is complete and the sponsor feels the market is right. The goal, of course, is to sell the asset for a lot more than what the syndication paid for it.

When the property sells, the proceeds are used to pay off the mortgage first. The rest is then split between the investors and the sponsor according to the profit-sharing structure (the "waterfall") that was agreed upon at the very beginning. For investors, a successful exit means getting their initial investment back, plus their share of the profits. This final step marks the successful completion of the syndication's lifecycle.

Weighing the Rewards and Risks of Syndication

Real estate syndication can be a game-changer for building wealth, but let’s be clear: it’s not a magic bullet. Like any investment, it’s a balancing act between incredible potential and real risks. Getting a firm grip on both sides of this equation is the first step every smart investor should take.

First, let's talk about why so many people are drawn to this model.

The biggest pull is access. A syndicate in real estate lets you buy a slice of a multi-million dollar apartment building or a sprawling commercial complex—assets that are usually way out of reach for individual investors. It’s your ticket to playing in the big leagues with institutional-grade properties that often deliver more stable and impressive returns.

Then there's the beauty of it being a truly passive investment. The sponsor, or syndicator, does all the heavy lifting. They're the ones hunting down the deal, wrangling the financing, overseeing renovations, and managing the property day-to-day. You get the benefits of real estate ownership without ever having to take a tenant’s late-night call about a leaky faucet.

The Compelling Benefits of Group Investing

Beyond just getting in the door, syndication is a powerful tool for diversification. Instead of putting all your eggs in one basket with a single-family rental, you can spread your capital across several deals in different cities or property types. It’s a classic strategy for reducing risk.

Here’s what really makes it shine for investors:

- Professional Management: You’re not just buying a property; you’re buying into a professional operation. You get the syndicator's years of experience, their deep network of contacts, and their proven track record for making properties perform.

- Economies of Scale: Bigger properties simply run more efficiently. Think lower per-unit operating costs and better deals from contractors, property managers, and lenders. Those savings go straight to the bottom line.

- Strong Potential Returns: A well-run syndication is designed to generate returns from two sources: consistent rental income (cash flow) during the holding period and a nice payday from appreciation when the property is sold.

By pooling resources, investors gain access to a level of real estate typically reserved for large institutions. The structure is designed to align the sponsor's success directly with the investors' financial gains.

Understanding the Inherent Risks

Now, let's look at the other side of the coin. It's crucial to go in with your eyes wide open. The most significant risk is simply market risk. An economic downturn could hit, interest rates could spike, or a new apartment complex could be built next door, all of which can hurt property values and rental income.

Operational risk is another big one. The entire investment hinges on the sponsor's ability to pull off their business plan. If they mismanage the property, blow the renovation budget, or can't keep the units filled, the deal can quickly go south. Your money is tied to their performance.

Finally, you have to consider liquidity risk. This isn't like selling a stock. Once you invest in a syndication, your capital is locked in for the long haul—often for 3 to 7 years. You can't just cash out if you suddenly need the money. This long-term commitment means you need to be absolutely sure you won't need those funds unexpectedly.

The best way to protect yourself is through relentless due diligence on the sponsor and a healthy dose of skepticism when analyzing the deal's numbers.

Alright, you've got the theory down. Now for the exciting part: moving from textbook knowledge to finding and vetting your very first deal. This is where the rubber meets the road and your journey as a sharp, passive investor really kicks off.

Finding a promising syndicate in real estate means knowing where to look and, more critically, how to analyze what you find. The best opportunities aren't always plastered on billboards; they often come through trusted networks and niche platforms.

- Online Investment Platforms: Crowdfunding sites have really opened up the world of syndication, creating a marketplace where you can browse deals from all sorts of different sponsors.

- Your Professional Network: Don't underestimate the power of your own contacts. Your accountant, lawyer, or other real estate pros in your circle can be an incredible source for introductions to reputable sponsors.

- Real Estate Investment Clubs: These groups, whether local or national, are fantastic for meeting sponsors face-to-face and learning from investors who are already in the trenches.

First, Vet the Sponsor (Not the Property)

Before you even glance at a property's pro forma, you need to put the sponsor under a microscope. I can't stress this enough: the sponsor's experience and integrity are the single most important factors in a deal's success. You're not just investing in a building; you're betting on the team running the show.

Get specific with your questions. Ask them about their history. Have they seen a full market cycle, including a downturn? A sponsor who's only ever ridden a rising market might not have the chops to handle tough times. Demand to see their track record—past deals, projected vs. actual returns—and ask for references from past investors. Then actually call them.

Then, Do Your Homework on the Deal Itself

Once you feel good about the sponsor, it’s time to dig into the deal. This means scrutinizing the market, the property, and the sponsor’s business plan with a healthy dose of skepticism. A great market can salvage a mediocre deal, but a weak market can drown even the best-laid plans.

For instance, some markets just have better fundamentals. Right now, Texas is a standout for real estate syndication in the United States for 2025. Why? It's got a rock-solid economy, explosive population growth, and business-friendly policies that investors love. If you want to dig deeper, you can explore insights on why Texas is a top market for syndication.

Your main job during due diligence is to poke holes in the sponsor’s assumptions. Are their projected rent bumps realistic for that specific neighborhood? Is the renovation budget airtight, or are there glaring omissions that could lead to cost overruns?

Finally, get your hands on all the legal documents. Pay very close attention to the fee structure and the profit-sharing waterfall. You want to see that the sponsor's interests are aligned with yours. They should only hit their big payday after you, the investor, have gotten your preferred return. Catching a red flag in the fine print can save you from a world of headache later.

Your Questions Answered: A Real Estate Syndication FAQ

Jumping into your first real estate syndicate is a big move, and it's completely normal to have a few questions swirling around. In fact, it’s a great sign—it means you're doing your homework. Think of this as the final pre-flight check before takeoff; you’ve picked your destination, now it’s time to double-check the details for a smooth ride.

Let's walk through some of the most common questions I hear from new investors. My goal is to give you clear, straightforward answers so you can move forward with total confidence.

Do I Have to Be an Accredited Investor?

This is usually the first question on everyone's mind. The short answer? Most of the time, yes. The vast majority of syndications you'll see, especially those advertised to the public, fall under Securities and Exchange Commission (SEC) rules that require you to be an accredited investor.

So, what does that mean? Generally, you need to hit one of these financial benchmarks:

* An annual income over $200,000 (or $300,000 with your spouse) for the past two years, with the expectation of the same this year.

* A net worth topping $1 million, not including the value of your primary home.

Now, there are exceptions. Some private deals operate under different SEC exemptions that allow a limited number of "sophisticated" investors who aren't accredited. A sophisticated investor is someone the SEC believes has the financial knowledge to understand the risks involved. But don't assume you qualify—these are strict legal standards, so always confirm the specific requirements for any deal you're looking at.

What Kind of Returns Can I Realistically Expect?

No one has a crystal ball, but a good sponsor will lay out clear target projections to help you size up the opportunity. A typical syndicate in real estate is designed to generate returns in a couple of different ways, and sponsors use a few key metrics to paint the picture.

You’ll frequently see projections that look something like this:

* Cash-on-Cash Return: This is the money in your pocket each year from the property's cash flow, divided by your initial investment. A common target here is 6-10% annually from rental income.

* Internal Rate of Return (IRR): A more complex metric that considers not just how much money you make, but when you make it over the entire project timeline. Sponsors often aim for an IRR between 12-20%.

* Equity Multiple: This one is simple: it tells you how much your money is expected to grow. An equity multiple of 1.7x to 2.2x means you could get back between $1.70 and $2.20 for every dollar you put in when the property is sold.

Remember, these are just targets. Your job is to kick the tires and ask tough questions. Do the assumptions behind those numbers—like rent growth and expense budgets—feel grounded in the reality of that specific market?

How and When Do Investors Actually Get Paid?

Investor payouts in a syndicate usually happen in two distinct phases. First up are the regular cash flow distributions.

Once the property manager collects all the rent and pays the bills—mortgage, taxes, insurance, maintenance—the leftover cash is typically distributed to investors, often on a quarterly basis.

The second, and usually much larger, payout comes when the property is sold or refinanced. This is the big "capital event" where you get your original investment back, plus your share of the profits from the property’s increased value.

The exact way those profits are split is spelled out in the legal documents in what's called a "waterfall" structure. It's a fancy term for a simple concept: it defines the order in which money flows to everyone involved, ensuring investors get paid first.

What Are the Most Common Fees to Look For?

A sponsor puts in a ton of work to find, manage, and eventually sell a property, and they get compensated for that expertise. Their compensation comes from a combination of fees and a slice of the profits. It's absolutely critical that you understand this structure to make sure their goals are aligned with yours.

Here are the fees you'll almost always see:

* Acquisition Fee: A one-time fee for all the upfront work of finding and closing the deal. It's usually 1-3% of the purchase price.

* Asset Management Fee: An ongoing fee for overseeing the property and making sure the business plan is on track. This is typically 1-2% of the property's monthly or annual revenue.

* Disposition Fee: When the property sells, the sponsor gets a fee for handling the entire sale process, usually around 1-2% of the final sale price.

Beyond these standard fees, the sponsor also earns a "promote" or "carried interest." This is their share of the profits, but here's the key: they typically only get paid after all investors have received their initial capital back, plus a pre-agreed-upon minimum return. It’s a powerful way to make sure everyone is rowing in the same direction.

Ready to manage your real estate syndication deals more efficiently? Homebase provides an all-in-one platform to handle fundraising, investor relations, and reporting, so you can focus on finding great deals and growing your portfolio. Learn more about Homebase and simplify your syndication business today!

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.