Your Guide to the Real Estate Syndication Structure

Your Guide to the Real Estate Syndication Structure

Explore the complete real estate syndication structure. This guide breaks down legal entities, waterfall distributions, and investor roles for your next deal.

Domingo Valadez

Dec 12, 2025

Blog

Ever wondered how investors get into those massive, multi-million dollar real estate deals? The kind of apartment complexes or office buildings you couldn't possibly buy on your own? The answer is often a real estate syndication.

At its core, a syndication is just a way for a group of investors to pool their money and expertise to buy a property together. It’s a formal partnership between a Sponsor—the expert who finds and manages the deal—and a group of passive Investors who provide most of the cash. This structure opens the door to high-value real estate that would otherwise be out of reach for individuals.

Understanding the Core Components of Syndication

Think of a real estate syndication as a team sport. It’s a structured partnership designed to acquire and run a big asset, and it all hinges on two key roles: the Sponsor and the Investor. Each player has a very different job, but they work together to make the deal a success. While there are many options for real estate investor financing, syndication is one of the most powerful ways to bring a big project to life.

The Sponsor: The Deal Quarterback

The Sponsor, often called the General Partner (GP) or operator, is the hands-on manager who runs the entire show. They're the quarterback—they find the deal, draw up the business plan, and execute it from day one until the property is sold.

A sponsor's job is intense. They're usually required to put up 5-20% of the equity themselves, which shows they have real "skin in the game." Their list of duties is long:

- Deal Sourcing and Underwriting: This means hunting down good properties and running the numbers to make sure the investment is sound.

- Capital Raising: They're responsible for finding and bringing in the investors needed to fund the purchase.

- Asset Management: After the deal closes, they oversee everything—from renovations and leasing to the day-to-day operations of the property.

- Investor Relations: The sponsor handles all communication, sending out regular updates, managing profit distributions, and answering any questions.

In exchange for all this work and expertise, sponsors are compensated with fees and a larger share of the profits. This extra profit share is often called the "promote," which they typically earn after investors get their initial capital back plus a preferred return.

The Investor: The Passive Capital Partner

The Investor, also known as a Limited Partner (LP), is the one who provides the majority of the money. They are the financial backers who trust the sponsor to turn their capital into a solid return.

Investors typically fund 80-95% of the total equity needed for the deal. Their role is almost entirely financial, making it a great way to get the benefits of real estate ownership without any of the headaches of being a landlord.

The core appeal for an investor is passive income and equity growth. They can participate in large-scale commercial real estate deals with no day-to-day management responsibilities, limiting their liability to the amount of capital they invest.

Choosing the Right Legal Framework for Your Deal

Think of the legal entity for your syndication as the foundation of a house. It’s not just a formality; it dictates liability, shapes how the deal operates, and controls how money moves from the property back to your investors. Get this right, and you've built a financial fortress around everyone's personal assets—including your own.

This framework is what turns a handshake agreement into a secure, professional investment. When you're bringing in capital from multiple people, this structure sets the official rules of the game and, more importantly, shields everyone from the business's risks.

The Limited Liability Company (LLC)

By far, the most common and versatile structure you'll see in real estate syndication today is the Limited Liability Company (LLC). It’s the go-to for good reason: it gives you the liability protection of a corporation but with the tax benefits and flexibility of a partnership.

In an LLC setup, the Sponsor is called the "Manager," and the investors are the "Members." The most critical feature is that the LLC is its own legal person, completely separate from its owners. If the property runs into a lawsuit or financial trouble, the personal assets of the members and the manager are generally off-limits.

The Limited Partnership (LP)

Another long-standing option is the Limited Partnership (LP). It accomplishes a similar goal—protecting passive investors—but the roles are a bit more rigid and formally defined.

In an LP, there are two clear-cut roles:

- General Partner (GP): This is you, the Sponsor. You have full control over the project but also unlimited personal liability for its debts and obligations.

- Limited Partners (LPs): These are your passive investors. Their risk is capped at the exact amount they invested, but they get zero say in the day-to-day decisions.

LPs still have their place, especially in larger deals involving institutional money or complex sponsor teams. However, the modern flexibility of the LLC has made it the preferred choice for most syndicators. When you're putting a deal together, it's always smart to have a solid grasp of the different types of businesses so you can pick the one that truly fits the project.

Comparing LLC and LP Structures for Syndication

To make the choice clearer, let's break down how these two common structures stack up against each other side-by-side.

Ultimately, the LLC's blend of protection and operational freedom is why it has become the industry standard for most independent real estate syndicators.

The Two-Tiered LLC: A Popular and Protective Structure

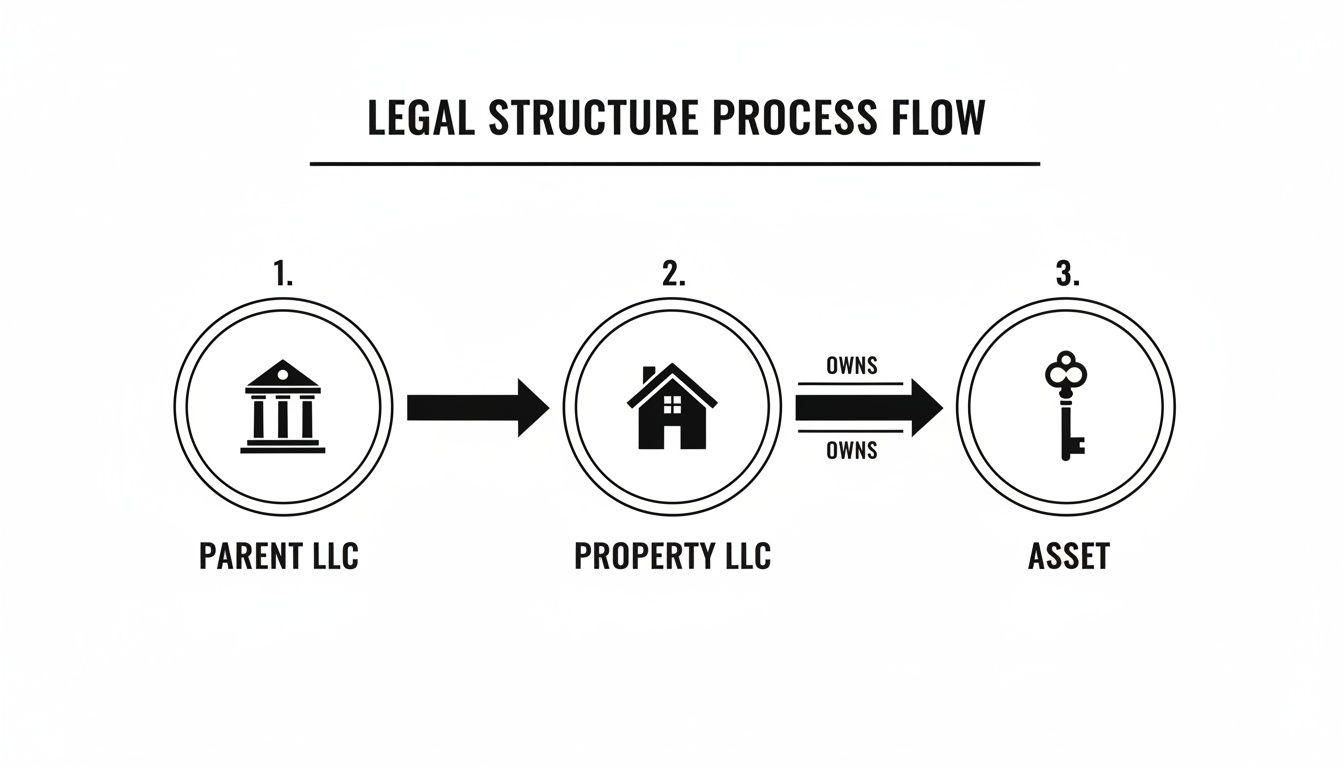

Many seasoned sponsors add an extra layer of armor by setting up a two-tiered LLC structure. It might sound complicated at first, but the strategy is simple and incredibly effective at insulating the asset.

Here’s a quick breakdown of how it works:

- Property LLC: A brand new LLC is created for one purpose only: to own the real estate. This is the entity whose name is on the deed and the mortgage.

- Parent LLC (or Manager LLC): The Sponsor forms a second, separate LLC. This Parent LLC acts as the official Manager of the Property LLC, and all the investors become members of this Parent LLC.

This two-tiered approach creates a firewall between the property itself and the management of the deal. If a lawsuit ever targets the Sponsor's management activities, it's contained within the Parent LLC, keeping the actual real estate asset protected.

This setup is also a game-changer for sponsors running multiple deals. You can use your one Parent LLC to manage several different Property LLCs, keeping each investment and its finances neatly separated and organized.

In these models, the goal is to pool capital from many investors, with minimums often starting in the $25,000 to $50,000 range. Typically, the sponsor contributes 10-20% of the required equity, and the investors fund the rest. Everyone then shares in the cash flow and profits, usually after a preferred return is paid out, making it possible for individuals to get a piece of large-scale commercial real estate deals they couldn't access on their own.

How Money Flows Through the Distribution Waterfall

The distribution waterfall is really the financial heart of any real estate syndication. Think of it as a pre-negotiated roadmap that dictates exactly who gets paid, when they get paid, and how much. The name itself is a fantastic analogy: cash flows into the top bucket, and only when that bucket is full does it spill over into the next one, and so on down the line.

This structure is built on one core principle: protecting the investors' capital first. Before a sponsor can touch their bigger share of the profits (the "promote"), investors must get their initial investment back, plus a pre-agreed minimum return. It’s a powerful way to make sure everyone is pulling in the same direction—toward a successful, profitable deal.

Let's walk through how cash actually moves through this cascade, tier by tier.

Tier 1: Return of Capital

The first and most important bucket to fill is the Return of Capital. All cash flow from the property—whether from monthly rents or a big event like a refinance or sale—goes straight to the Limited Partners (LPs) until they have gotten 100% of their initial investment back.

You can think of this as simply paying back the loan from your investors. The sponsor (GP) gets zero from this bucket. It ensures that the very first dollar of profit is used to make the investors whole.

Tier 2: The Preferred Return

Once every investor has their original capital back, the waterfall flows into the second tier: the Preferred Return, or "pref" for short. This is the minimum annual return investors are promised before the sponsor starts sharing in any of the upside.

The pref essentially acts as a hurdle. A common preferred return is between 6-8%. So, if the deal produces an 8% cash-on-cash return for the year, investors get that full 8%. If it only hits 5%, they get that 5%, and the unpaid 3% often accrues, meaning it rolls over to be paid out from future profits.

This is a critical feature for aligning interests. The sponsor is highly motivated to clear this hurdle, because they don't see their big payday until the investors have received their pref.

Tier 3: The Catch-Up and Profit Split

After the investors have received their full return of capital and their cumulative preferred return, the real profit-sharing can finally begin. This is where the sponsor gets rewarded for putting the deal together and executing the business plan successfully. This slice of the profits is often called the "promote" or "carried interest."

At this stage, any remaining profits are split. A very common arrangement is a 70/30 split, where 70% of the excess profits go to the investors (LPs) and 30% goes to the sponsor (GP). That 30% is the sponsor's reward for their expertise, risk, and hard work in managing the asset.

The promote is the sponsor's performance bonus. It's a disproportionate share of the upside that is only earned after the investors have been paid their base return, creating a powerful incentive for the sponsor to maximize the deal's profitability for everyone involved.

For a deeper dive into how these calculations work in practice, you can explore our detailed guide on the real estate waterfall model.

The diagram below shows how a standard legal structure helps facilitate this flow of money from the property up to the investors.

This simple flow chart shows how a parent company, managed by the sponsor, controls the separate LLC that holds title to the property. This creates a clean and protected chain of ownership that dictates how cash flows.

Tying It All Together with a Numerical Example

Let's put some numbers to this to see how it works in the real world.

- Total Investor Capital:$1,000,000

- Preferred Return:8%

- Profit Split:70% to LPs, 30% to GP

Let's say the property is sold, generating a total profit of $1,500,000. Here’s how the waterfall would distribute that cash:

- Return of Capital: The first $1,000,000 goes right back to the investors. They are now whole.

- Preferred Return: Next, the investors get their 8% pref. Assuming the deal was held for one year, that's $80,000 ($1,000,000 x 8%).

- Remaining Profit: We now have $420,000 left to split ($1,500,000 - $1,000,000 - $80,000).

- The 70/30 Split:Investors (LPs) receive 70% of the remaining profit: $294,000.Sponsor (GP) receives their 30% promote: $126,000.

In this scenario, the investors' total take is $1,374,000 on their initial $1M investment. The sponsor earns $126,000 for knocking it out of the park and exceeding the return hurdles.

Navigating Critical SEC Rules and Investor Laws

When you bring outside money into a real estate deal, you’re doing more than just buying a building—you’re selling a security. That’s probably the single most important legal concept any sponsor can learn. The moment you take capital from passive investors, you fall under the watchful eye of the U.S. Securities and Exchange Commission (SEC). Getting this wrong can have serious consequences.

Now, don't panic. This doesn't mean you need a law degree to syndicate a deal. The vast majority of sponsors operate under specific exemptions the SEC has created to make this process manageable. The go-to framework for this is called Regulation D. It’s essentially a set of rules that lets you raise capital without the nightmare of a full-blown public registration.

Within Reg D, there are two paths that nearly every real estate syndicator takes: Rule 506(b) and Rule 506(c). Your choice between them boils down to one simple question: How are you going to find your investors?

Understanding Rule 506(b) vs Rule 506(c)

Think of Rule 506(b) as the "friends and family" or "private network" route. Under this rule, you can raise an unlimited amount of cash and even include a certain number of non-accredited (but still sophisticated) investors. The catch? You absolutely cannot publicly advertise the deal. This means no social media blasts, no website banners, no public presentations. You must have a genuine, pre-existing relationship with every potential investor before you ever mention the deal.

On the flip side, Rule 506(c) is the "go public" option. It gives you the freedom to market your deal far and wide—post it on LinkedIn, run ads, shout it from the rooftops. The trade-off is huge, though. Every single person who invests must be an accredited investor, and the burden is on you, the sponsor, to take reasonable steps to formally verify their status.

The core takeaway is simple: your marketing strategy dictates your investor pool. If you want the freedom to advertise to the world, you can only accept accredited investors. If you want to include sophisticated investors who may not meet the accredited definition, you must keep your fundraising strictly within your private network.

Who Is an Accredited Investor?

So what does "accredited investor" actually mean? It’s a formal definition created by the SEC to identify people who, in their view, have the financial savvy and capacity to handle the risks of private investments. While the rules get tweaked now and then, the main criteria are:

- The Income Test: An individual who has earned over $200,000 (or $300,000 jointly with a spouse) in each of the last two years and expects to do the same this year.

- The Net Worth Test: An individual with a net worth exceeding $1 million, alone or with a spouse. This calculation specifically excludes the value of your primary home.

- The Professional Test: Certain licensed professionals, like those holding a Series 7, 65, or 82 license, now qualify based on their expertise.

In a 506(c) offering, verifying this isn't a casual conversation. It’s a formal process that often involves collecting sensitive documents like tax returns, bank statements, or getting a signed letter from an investor's CPA or attorney.

Your Legal Document Arsenal

No matter which path you take, a professional syndication is built on a foundation of solid legal documents. These aren't just boilerplate paperwork; they are the operating manual for your investment and your first line of defense if things go sideways.

- Private Placement Memorandum (PPM): This is the master disclosure document for the entire deal. It lays out everything: the property details, your business plan, the financial projections, your track record, and—critically—a comprehensive list of all the risks involved. A well-drafted PPM is non-negotiable.

- Operating Agreement: This is the internal rulebook for the LLC that owns the property. It governs the relationship between the sponsor (the manager) and the investors (the members). It spells out voting rights, management fees, and the all-important distribution waterfall, leaving no room for ambiguity.

- Subscription Agreement: This is the official contract an investor signs to join the deal. It’s where they state how much they’re investing, confirm they understand the terms, and formally attest that they meet the necessary qualifications (like their accreditation status). This document legally binds them to the offering.

Your Step-by-Step Syndication Setup Checklist

Knowing the theory behind a real estate syndication structure is one thing; actually building one from the ground up is another beast entirely. To get it right, you need a clear, repeatable roadmap. This checklist is designed to be that guide, walking you through the essential steps from finding a killer deal to bringing your investors across the finish line.

Think of this as your high-level game plan. Following it helps you sidestep common pitfalls and transform a promising idea into a professional, legally-sound offering that investors will trust.

Phase 1: Foundational Deal and Team Setup

Long before you even think about raising a dollar, you have to nail the fundamentals. This first phase is all about making sure the deal is solid and surrounding yourself with the right professionals who will have your back.

- Find and Underwrite the Property: It all starts with the asset. The success of your entire syndication lives and dies by the quality of the deal. You need to perform exhaustive due diligence and underwriting to build a conservative, data-driven business plan and realistic financial projections.

- Assemble Your A-Team: You can't do this alone, period. Get your core advisors on board early, because their expertise will shape your entire legal and financial framework. Your non-negotiable team members include:A securities attorney who will draft your offering documents and keep you on the right side of the SEC.A real estate attorney to manage the nuts and bolts of the property transaction.A CPA or tax advisor to help you navigate the tax implications and choose the best entity structure.

- Create the Legal Entity: With your attorney's guidance, you'll form the legal entity—almost always a Limited Liability Company (LLC)—that will officially own the property. This is a critical move that protects you from liability and creates the formal investment vehicle for the deal.

Phase 2: Legal and Financial Structuring

Once the deal is vetted and your team is in place, it’s time to build the legal and financial architecture. This is where your syndication goes from a back-of-the-napkin idea to a formal investment opportunity investors can actually participate in.

This phase is not a DIY project. It demands expert legal guidance. The documents created here are the legally binding contracts that protect both you and your investors, spelling out every rule of the game from how profits are split to the final exit strategy.

Draft Core Legal Documents:

Your securities attorney takes the lead here, creating the full suite of legal paperwork. This typically includes:

* Private Placement Memorandum (PPM): This is the master disclosure document. It lays out the entire offering, your business plan, and every conceivable risk involved.

* Operating Agreement: Think of this as the internal rulebook for your LLC. It defines management roles, fees, voting rights, and the all-important distribution waterfall.

* Subscription Agreement: This is the contract investors sign to officially commit to the deal. It confirms their investment amount and their accreditation status.

Set Up Syndication Finances:

Open a dedicated bank account for the property-holding LLC. This is absolutely crucial for keeping investor capital separate from your personal or other business funds. It ensures clean accounting and transparency from day one. Every dollar raised and every property expense must flow through this dedicated account.

Phase 3: Capital Raising and Closing

With your legal framework buttoned up, you're finally ready to raise money. This last phase is all about marketing your deal, officially bringing investors on board, and moving toward a successful close.

- Map Out Your Capital Raising Plan: First, decide on your strategy, which will be dictated by your chosen SEC exemption (likely Rule 506(b) or 506(c)). If you go with a 506(b), you'll be tapping into your existing network of pre-qualified contacts. A 506(c) lets you advertise publicly, but it comes with the strict requirement of verifying every single investor’s accredited status.

- Onboard Investors and Collect Funds: As investors commit, you'll get the subscription agreements signed and start collecting their capital into the LLC’s bank account. Using a platform like Homebase can make this part much smoother by handling documents, e-signatures, and accreditation checks all in one place.

- Close on the Property: Once all the investor capital is in the bank, you'll work with your real estate attorney and title company to finalize the purchase. Congratulations—you've officially closed the deal and launched your syndication

Common Questions About Syndication Structures

As you start digging into real estate syndications, you're bound to have questions. It’s a powerful way to invest, but there are a lot of moving parts. Getting a handle on the details is what separates a confident investor from a hesitant one.

Think of this section as your practical, no-nonsense FAQ. We’ll break down the key differences you need to know, talk about what happens when things don't go perfectly to plan, and get into the nuts and bolts of fees and liquidity.

What Is the Difference Between a Syndication and a Real Estate Fund?

This is easily one of the most common points of confusion, but the distinction is actually pretty simple. It all boils down to what you know and when you know it.

A real estate syndication is all about a single, specific deal. Sponsors find a property, put it under contract, and then raise money from investors for that exact asset. When you invest, you know you’re backing the apartment complex at 123 Main Street. You get to see the pro forma, the business plan, and the location before you write a check.

A real estate fund, on the other hand, works more like a "blind pool." A fund manager raises a big pot of money first, with the promise to go out and buy properties that fit a certain strategy (like "value-add multifamily in the Southeast"). Investors commit capital based on the manager's track record and investment thesis, not on a specific pre-identified asset.

In short: with a syndication, you’re investing in a property. With a fund, you’re investing in a manager's ability to find good properties down the road.

What Happens If a Syndication Deal Underperforms?

This is the big one—the question that gets right to the heart of risk. The good news is that the whole real estate syndication structure, especially the waterfall, is built to protect the Limited Partners (LPs) when a deal hits a rough patch.

The sponsor’s profit is intentionally the last to be paid and the first to get cut. Here’s how it usually works if performance lags:

- The Preferred Return Comes First: Any cash flow the property generates goes directly to investors until they’ve received their "pref," which is typically a 6-8% annual return. The sponsor sees nothing until this is paid.

- Unpaid Pref Builds Up: If there isn’t enough cash to pay the full preferred return in a given quarter or year, the unpaid amount usually accrues. It becomes a debt the sponsor owes the investors, which must be paid from future profits before the sponsor can ever get their share (the promote).

- Capital Is Returned Before Profits: In a worst-case scenario where the property has to be sold for less than expected, the sale proceeds go to the LPs first to return their original capital. The sponsor only gets paid after all investors have been made whole.

This structure forces the sponsor and investors to be on the same team. The sponsor doesn’t make their real money unless the investors make theirs first.

Can I Sell My Share in a Real Estate Syndication?

The honest answer? It’s tough. An ownership stake in a syndication is an illiquid investment. Unlike stocks, there’s no public market where you can just click a button and sell your shares. This is something you absolutely need to be comfortable with before getting into a deal.

You should always go into a syndication planning to hold your investment for the full projected timeline, which is typically 3-7 years.

If an emergency pops up and you absolutely have to sell early, the process is laid out in the deal's Operating Agreement. You'll almost always run into a few hurdles:

- Sponsor Approval: The sponsor has to sign off on any transfer. They want to make sure the new investor is a good fit.

- Right of First Refusal (ROFR): The sponsor or the other LPs in the deal usually get the first crack at buying your shares before you can offer them to an outsider.

- Finding Your Own Buyer: It's on you to find a qualified buyer that the sponsor is willing to bring into the partnership.

Because it's not a simple process, trying to exit early often means you’ll have to sell your stake at a discount.

What Are the Typical Fees in a Syndication?

Sponsors do a ton of work finding, managing, and eventually selling a major real estate asset, and they get paid for that work. These fees are completely separate from their performance-based profit split (the "promote") and should be spelled out clearly in the deal's legal documents.

While fees can vary from deal to deal, you'll almost always see these three:

- Acquisition Fee: A one-time fee paid to the sponsor when the deal closes. It covers their work in finding the property, doing the due diligence, and getting the deal across the finish line. It's usually 1-3% of the purchase price.

- Asset Management Fee: An ongoing, annual fee for overseeing the investment. This isn't about day-to-day property management; it’s about executing the business plan, managing the property manager, and handling investor communications. This fee is often 1-2% of the property's gross revenue.

- Disposition Fee: A one-time fee paid to the sponsor when the property is sold. It compensates them for the work involved in marketing and closing the sale. This is typically 1-2% of the final sale price.

A good, transparent sponsor will list every single fee in the Private Placement Memorandum (PPM). This way, you know exactly how they’re getting paid and when, long before you invest.

Ready to manage your next deal with a platform built for modern sponsors? Homebase simplifies everything from fundraising and investor onboarding to distributions and reporting. See how we can help you close deals faster and build stronger investor relationships by visiting our website.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.