General Partner Definition: Roles & Duties

General Partner Definition: Roles & Duties

Discover the general partner definition and explore key roles and responsibilities. Click to learn more!

Domingo Valadez

Mar 29, 2025

Blog

Understanding the General Partner Definition

A general partner holds a critical position in various business structures, especially partnerships. Truly understanding the general partner definition involves more than just the title; it requires a firm grasp of the related responsibilities, liabilities, and overall implications. This section explores the core aspects of being a general partner, offering a helpful overview for anyone considering this important business role.

Responsibilities and Liabilities of a General Partner

General partners actively participate in the daily management and decision-making processes of a business. They guide operations, strategy, and the overall direction of the company. This active involvement translates to significant authority and control within the partnership.

However, this authority also carries substantial responsibility. General partners assume unlimited liability for the business's debts and obligations. This means their personal assets are at risk if the business incurs debts it can't cover.

For instance, if the partnership is sued, general partners could be held personally responsible for any resulting judgments. This level of liability makes it essential for potential general partners to fully comprehend the risks and structure the partnership accordingly.

General partners in various partnership types, including general partnerships, limited partnerships (LPs), or limited liability partnerships (LLPs), share management duties and financial responsibilities. In a general partnership, all partners are general partners, sharing equal responsibility for business operations and liabilities. This structure is common among professionals like doctors and lawyers who prefer to manage their practices while also sharing resources and expertise. Learn more about general partnerships here. This shared responsibility highlights the need for clear communication and a solid working relationship among the general partners.

The Importance of Partnership Agreements

Considering the significant responsibilities and liabilities involved, formalizing the partnership through a comprehensive agreement is critical. A well-written partnership agreement outlines each general partner's contributions, responsibilities, and how profits will be shared.

It also addresses vital aspects like decision-making processes, how disputes will be resolved, and procedures for adding or removing partners. This document acts as a guiding document for the partnership, directing operations and providing a framework for handling potential disagreements.

Modern Business Dynamics and the General Partner

While the fundamental definition of a general partner remains consistent, modern business dynamics influence its practical application. New business models and evolving legal frameworks have added complexity to the role.

For example, the increasing use of LLPs provides a degree of personal liability protection for general partners, reducing some traditional risks. The rising complexity of business operations often requires general partners to possess specialized skills and knowledge, emphasizing professional development and continuous learning within the role. This adaptation to the modern business world ensures the general partner's continued relevance and influence in commerce.

The Legal Landscape of General Partnerships

Understanding the definition of a general partner requires a close look at the legal frameworks governing these partnerships. This involves examining partnership agreements, statutory requirements, and legal precedents that shape the rights and responsibilities of general partners. These legal structures can differ significantly based on location.

Navigating Partnership Agreements

A partnership agreement forms the bedrock of any general partnership. This legally binding document outlines the partners' contributions, responsibilities, and how profits are shared. It serves as a crucial guide for partners on key operational aspects of the business.

The agreement also specifies the decision-making process, dispute resolution mechanisms, and the procedures for admitting new partners or removing existing ones. A comprehensive and well-drafted partnership agreement is essential to prevent future disagreements and safeguard the interests of all involved.

Statutory Requirements and Variations

Legal requirements for forming and running a general partnership vary considerably between jurisdictions. These differences can encompass required documentation, registration processes, and ongoing compliance obligations. A clear understanding of these regional nuances is crucial for operating within the bounds of the law.

For instance, some jurisdictions may mandate formal registration with a government body, while others may recognize partnerships based solely on a written agreement. Likewise, reporting and disclosure requirements can differ, impacting the administrative workload for the partnership. The very concept of general partners is defined and regulated through diverse legal systems worldwide. In France, partnerships fall under the French Commercial Code, with Article 1832 of the Civil Code specifically addressing the responsibility and liability of general partners. In India, the Indian Partnership Act of 1932 stipulates a formal contract as a prerequisite for a legally recognized partnership. You can delve deeper into this topic here. These variations underscore the importance of carefully considering the specific legal environment when establishing a general partnership.

Contractual Obligations and Compliance

General partners are bound by the terms outlined in their partnership agreement and the relevant partnership laws within their jurisdiction. This includes adhering to specific contractual obligations regarding financial contributions, operational duties, and the overall management of the business.

Moreover, maintaining ongoing compliance with legal requirements is crucial for preserving the partnership's legal status. This involves fulfilling reporting obligations, maintaining accurate records, and adhering to any relevant industry-specific regulations. Failing to meet these requirements can expose both the partnership and the general partners to legal repercussions and financial risks. Therefore, a thorough understanding and diligent fulfillment of these legal and contractual obligations is paramount for the long-term success and stability of the partnership.

General vs. Limited Partners: What Really Matters

While we've established the definition of a general partner, it's important to understand how this role differs from a limited partner. This distinction is fundamental to the structure and operation of many investment partnerships, impacting daily operations, financial exposure, and decision-making power.

Liability: A Key Difference

Perhaps the most significant difference lies in the nature of liability. General partners assume unlimited liability, meaning their personal assets are at risk to cover business debts. Limited partners, however, enjoy limited liability. Their risk is capped at their investment amount.

This difference in liability has significant implications for the financial security of both types of partners. It's a critical factor to consider when structuring a partnership.

For example, if a partnership faces a lawsuit exceeding its assets, a general partner might be required to use personal funds to settle the debt. A limited partner's loss, in contrast, would be limited to their initial investment. This protection makes limited partner status attractive to passive investors.

Control and Management

General partners have active management roles, making key business decisions and overseeing daily operations. They are the driving force behind the partnership's strategic direction and execution.

Limited partners, conversely, adopt a more passive role. They contribute capital but do not participate in the day-to-day management of the business. This allows them to benefit from potential investment returns without the burden of operational responsibilities.

This division of responsibility is a defining characteristic of limited partnerships. It concentrates decision-making power with the general partners, often streamlining operations.

Profit Sharing and Compensation

Profit sharing also differs. General partners typically receive a larger share of the profits, reflecting their increased responsibility and active involvement. This often includes carried interest, a percentage of the profits above a certain threshold.

Limited partners receive a portion of the profits according to their investment, but typically less than general partners. Their returns are directly tied to the partnership's financial performance.

This division of profits incentivizes general partners to maximize returns while providing a return on investment for limited partners. For more information on this dynamic, you might be interested in this article: LP vs. GP: Definitive Guide to Investment Partnership Dynamics.

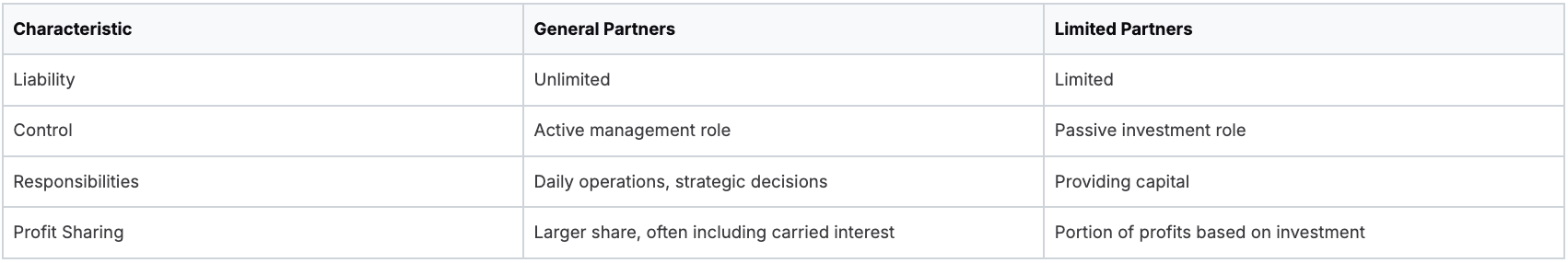

To further clarify the distinctions, let's examine a table summarizing the key differences:

General Partners vs. Limited Partners Comparison

This table provides a side-by-side comparison of the key differences between general partners and limited partners across multiple dimensions including liability, control, and responsibilities.

As the table highlights, general and limited partners have distinctly different roles and responsibilities within a partnership. Understanding these differences is crucial for structuring a successful and mutually beneficial venture.

Finding the Right Balance

The distinct roles of general and limited partners are designed to be complementary. General partners provide expertise and management, while limited partners supply the necessary capital. This balance allows partnerships to combine resources effectively and pursue shared goals.

However, clearly defining roles and expectations is essential to avoid conflicts and misunderstandings. This clarity ensures smooth partnership operations and contributes to long-term success. Open communication and a well-defined partnership agreement are vital for achieving this balance.

The General Partner's Role in Investment Funds

In the world of investment funds, particularly private equity and venture capital, the general partner (GP) plays a vital leadership role. This goes beyond a simple definition, encompassing a wide array of responsibilities and directly impacting the fund's overall performance. Let's explore the multifaceted role of the GP, from setting investment strategy to fostering strong investor relationships.

Investment Decision-Making and Strategy

At the heart of the GP's role lies the responsibility for making informed investment decisions. This involves identifying promising investment opportunities, performing thorough due diligence, structuring deals, and actively managing the fund's investment portfolio. The GP charts the overall investment strategy, guiding the fund's direction with the aim of maximizing investor returns. This strategic leadership demands deep market knowledge and a keen ability to evaluate both risks and opportunities.

For example, a venture capital fund GP might concentrate on early-stage tech companies. A private equity GP, on the other hand, could target more established businesses demonstrating strong growth potential. This targeted approach ensures alignment between the fund's investments, stated objectives, and target market.

Creating Value in Portfolio Companies

The GP's role extends beyond simply making investments. They actively work to cultivate value within their portfolio companies. This might involve offering strategic guidance to management teams, assisting with operational improvements, and opening doors to valuable industry networks.

The GP's experience and connections become invaluable resources for these portfolio companies, fostering growth and increasing their overall worth. This active engagement sets the GP apart from passive investors. Furthermore, the GP continually monitors portfolio company performance, adapting strategies as needed and ultimately determining the optimal time to exit investments. This ongoing oversight is critical for achieving the fund’s financial targets and maximizing returns for investors.

Managing Investor Relations

The GP serves as the main point of contact for the fund's investors, known as limited partners (LPs). Cultivating and nurturing strong investor relationships is a critical aspect of the GP's responsibilities. This includes delivering regular performance updates, transparent communication regarding investment strategy, and promptly addressing any investor inquiries.

Trust and open communication are essential for building positive relationships with LPs. The GP also bears the responsibility of raising capital for the fund, showcasing its potential to investors and securing financial commitments. Effective communication and a strong track record are vital for successful fundraising. General partners in limited partnerships, particularly within private equity and venture capital, manage day-to-day operations. These GPs drive investment decisions and steer the overall fund strategy. They receive management fees and a share of the profits, known as carried interest, often around 20% or other negotiated percentages. Learn more about general partners here.

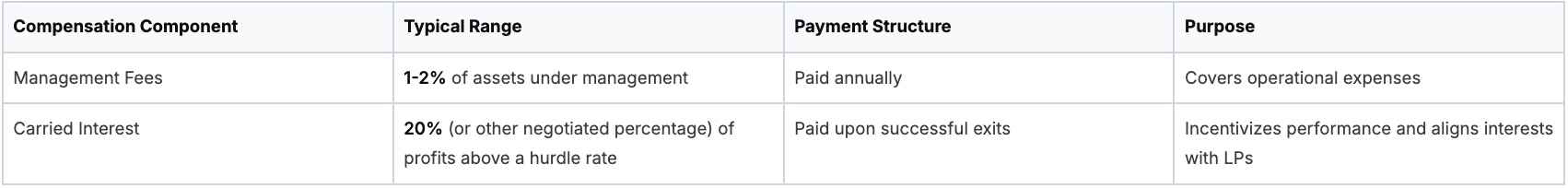

Compensation Structures: Management Fees and Carried Interest

GP compensation typically comprises two main elements: management fees and carried interest. Management fees, calculated as a percentage of the fund's assets under management, offer a consistent income stream to cover operational costs. Carried interest, typically around 20%, represents a share of the fund's profits earned after achieving a specific hurdle rate.

This structure incentivizes strong GP performance, directly linking earnings to the fund's success. It also aligns the interests of the GP and the LPs, establishing a shared goal of maximizing returns.

Let's take a closer look at the typical compensation structure for general partners:

General Partner Compensation Structure

This table outlines the typical compensation components for general partners in investment funds, including management fees and carried interest arrangements.

The combination of management fees and carried interest creates an attractive compensation package, drawing top talent to the GP role. However, it also underscores the vital importance of performance and accountability in managing investment funds.

Managing Risk as a General Partner

The role of a general partner carries significant responsibilities, including the often daunting prospect of unlimited liability. This means a general partner's personal assets are at risk if the business encounters financial trouble. This section explores how general partners can effectively manage and mitigate these risks, protecting their personal finances while maintaining control of the partnership.

Understanding the Scope of Liability

Unlimited liability covers all business debts. This includes loans, legal judgments, and unpaid taxes. For instance, if a partnership defaults on a loan, creditors can pursue the general partner's personal assets to cover the outstanding balance. This level of exposure highlights the critical need for comprehensive risk management strategies.

Insurance: A First Line of Defense

Several insurance policies can help mitigate the risks associated with being a general partner. Professional liability insurance, also known as errors and omissions insurance, protects against claims of negligence or mistakes in provided professional services. General liability insurance covers common business risks such as property damage or customer injuries.

Directors and Officers (D&O) insurance protects against lawsuits alleging mismanagement or breaches of fiduciary duty. These insurance policies provide essential financial protection against potential claims, safeguarding personal assets.

Contractual Protections: Shifting and Sharing Risk

Well-crafted partnership agreements can also limit a general partner’s liability. Indemnification clauses can shift the responsibility for certain liabilities to the partnership itself. Forming a Limited Liability Company (LLC) provides the management structure of a general partnership with the limited liability protection of a corporation.

Clearly defined roles and responsibilities within the partnership agreement can help prevent misunderstandings and disputes, indirectly reducing risk.

Navigating Joint and Several Liability

General partners often face joint and several liability. This means each partner is individually liable for the entire debt, even if another partner incurred the debt. If one general partner mismanages funds, for example, all partners are held equally responsible. Choosing trustworthy and competent partners is therefore paramount.

Proven Risk Mitigation Strategies

Experienced general partners often emphasize the importance of proactive risk management. This involves a multi-faceted approach:

- Due Diligence: Thorough research and investigation are crucial before entering any business venture.

- Financial Planning: Developing realistic budgets and financial projections can help anticipate potential challenges.

- Legal Counsel: Consulting with experienced attorneys ensures legal compliance and protects the interests of the partners.

- Regular Monitoring: Closely tracking business performance and addressing financial concerns promptly are essential.

- Open Communication: Maintaining open communication with partners and stakeholders helps build trust and facilitates problem-solving.

These proactive strategies, combined with appropriate insurance and legal safeguards, create a resilient partnership equipped to handle financial challenges. By implementing these strategies, general partners can effectively manage risks, protecting their personal assets while successfully leading the business.

The True Pros and Cons of General Partnership

Becoming a general partner offers unique advantages, but it's also essential to understand the potential drawbacks. A clear understanding of both sides will help you determine if this role aligns with your overall goals and risk tolerance.

Advantages of Being a General Partner

The role of a general partner comes with several key advantages:

- Strategic Control: General partners have significant influence over a business's direction. They actively participate in decision-making, shaping the company's strategy and operational execution. This direct involvement can be highly rewarding for those seeking an active leadership role.

- Profit Participation: General partners typically receive a larger share of the profits than limited partners or employees. This profit sharing reflects their increased responsibility and risk. This potential for higher earnings can be a strong incentive.

- Tax Efficiencies: Partnerships often benefit from favorable tax treatment. Profits and losses are passed through directly to the partners, avoiding the double taxation often seen with corporations. This can result in significant tax savings.

Disadvantages of Being a General Partner

While the potential rewards can be significant, several challenges come with being a general partner:

- Unlimited Liability: This is arguably the biggest drawback. General partners are personally liable for the business's debts. This means their personal assets are at risk if the business incurs liabilities it cannot cover. This risk underscores the importance of diligent financial management and comprehensive insurance coverage.

- Conflict Resolution Demands: Disagreements among partners are inevitable. General partners need strong conflict resolution skills to navigate disputes and maintain productive working relationships. Clearly defined roles and responsibilities within the partnership agreement can help minimize potential conflicts.

- Business Continuity Obstacles: The departure or unexpected loss of a general partner can significantly disrupt operations. A well-defined succession plan is crucial for ensuring business continuity and protecting the interests of all partners. Without proper planning, the business could face operational challenges or even dissolution.

Making an Informed Decision

The decision to become a general partner requires careful consideration. It’s essential to assess your personal risk tolerance, financial goals, and desired level of involvement in the business. Seeking guidance from legal and financial professionals is invaluable for navigating the complexities of partnership agreements and liability structures.

By fully understanding the pros and cons and making informed choices, you can approach the general partner role with confidence, maximizing its potential while mitigating its inherent risks.

Are you a real estate syndicator looking to streamline your operations and investor management? Homebase offers a comprehensive platform to simplify fundraising, investor relations, and deal management. Learn more about how Homebase can help you grow your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.