Mastering Real Estate Valuation Techniques

Mastering Real Estate Valuation Techniques

Unlock the secrets behind property value. Our guide explores key real estate valuation techniques professionals use to determine what a property is worth.

Domingo Valadez

Oct 26, 2025

Blog

Figuring out what a piece of real estate is really worth is part art, part science. Professionals don't just pull a number out of thin air; they use established, time-tested methods to arrive at a property's market value. The three heavyweights in this field are the Sales Comparison Approach, the Cost Approach, and the Income Approach.

Each one gives you a different angle on a property's value, and a seasoned appraiser knows which one to lean on depending on the situation.

Unlocking a Property's True Worth

Think of an appraiser as a detective and the property's value as the mystery to be solved. Valuation techniques are the tools in their toolkit, each one designed to uncover clues that lead to the final conclusion: the property's true market worth. Nailing this number is crucial whether you're buying, selling, getting a loan, or insuring the asset. Get it wrong, and you could be leaving a pile of cash on the table or, worse, overpaying significantly.

Just like a detective wouldn't use the same investigative method for every case, an appraiser has to pick the right valuation tool for the job. You wouldn't value a church the same way you value a duplex, and that’s where these different strategies come into play.

The Three Core Investigative Strategies

At the heart of almost every property appraisal are three foundational techniques. Each is best suited for a specific type of property or "case."

- Sales Comparison Approach: This is the one most people are familiar with. It’s like checking what your neighbor's house sold for. You look at recent sales of similar properties—often called "comps"—to figure out a reasonable price for the one you're evaluating. It's the bread and butter for valuing single-family homes.

- Cost Approach: What if the property is totally unique, like a custom-built factory or a brand-new school? There are no comps to compare it to. In that case, you switch to the Cost Approach. The logic is simple: a property is worth what it would cost to build an identical replacement from the ground up, minus any wear and tear (depreciation).

- Income Approach: For an investor, a property isn't just a building; it's a money-making machine. The Income Approach views real estate through this lens, calculating its value based on the cash flow it produces. This is the go-to method for commercial properties like office buildings, shopping centers, and apartment complexes.

A skilled appraiser rarely relies on just one method. They'll often use two or even all three, then weigh the results in a process called reconciliation. This lets them blend the different perspectives to arrive at a single, well-supported, and defensible final value.

Getting a handle on these core methods is the first real step toward making smarter real estate decisions. Whether you're a first-time homebuyer or a seasoned investor, knowing how value is determined gives you a serious advantage.

Overview of Core Valuation Methods

To give you a quick reference, here’s a simple breakdown of the three main valuation techniques, what they’re based on, and where they work best.

This table helps illustrate that there’s no single "best" method—the right approach always depends on the property itself. Now, let's dive into the nuts and bolts of each one.

The Sales Comparison Approach Explained

If you’ve ever browsed Zillow or Redfin to see what your neighbor's house sold for, you already understand the logic behind the sales comparison approach. It's the most common and intuitive way to value a property, especially single-family homes, and it works a lot like pricing a used car. You wouldn’t pay top dollar for a sedan without first seeing what similar models with roughly the same mileage and features have sold for recently.

This entire method is built on a simple economic idea: the principle of substitution. In plain English, it means a savvy buyer won't pay more for a home than it would cost to buy a similar one down the street. The value of your house is directly tied to the recent sale prices of other houses just like it.

To make this work, an appraiser has to play detective and hunt for "comparables," or "comps." These are recently sold properties that are a close match to the home being valued (the "subject property"). A good set of comps is the foundation of a reliable appraisal.

Finding and Analyzing Comps

The hunt for good comps is a methodical process. Of course, the perfect comp—an identical house next door that sold yesterday—almost never exists. So, appraisers have to find the next best thing by focusing on a few key criteria:

- Location: Comps need to be from the same neighborhood or a very similar one that shares the same schools, parks, and general market vibe.

- Timing of Sale: Real estate moves fast. The best comps are those that sold within the last three to six months. A sale from a year ago might as well be from a different era.

- Property Characteristics: This is the nitty-gritty: square footage, the number of bedrooms and bathrooms, lot size, the quality of construction, and the home's overall condition.

- Unique Features: Does one home have a pool? A finished basement? A three-car garage? These extras are major points of comparison that can swing the value.

"The use of historical sales data is fundamental in real estate valuation, particularly in the sales comparison approach, which is the most commonly applied method worldwide. Identifying recent sales of similar properties and adjusting for differences in size, location, and condition are essential steps to accurately estimate a property's value." To learn more about how historical data shapes appraisals, you can read insights from the experts at pacificappraisers.com.

The Art and Science of Adjustments

Finding a few solid comps is just the first step. Since no two homes are identical, the appraiser has to make adjustments to level the playing field. This is where their experience and judgment really shine.

Think of it this way: if a comp has a brand-new, gourmet kitchen but your property has an older one, the appraiser will subtract the value of that upgrade from the comp's sale price. On the flip side, if your property has an extra bathroom that the comp lacks, they'll add the value of that bathroom to the comp's sale price.

The goal of all these tweaks is to answer one question: "What would the comparable property have sold for if it were exactly like my property?"

After making these adjustments across several comps, the appraiser is left with a range of adjusted values. They'll then weigh the evidence, giving more importance to the comps that needed the fewest or smallest changes. From this careful analysis, they'll form a final, defensible opinion of the property's market value.

Getting to the Heart of the Cost Approach

So, what happens when you need to value a one-of-a-kind property? Think about a brand-new custom home, a church, or a public library. You can’t just look up recent sales of similar buildings, because there aren't any. This is exactly where the Cost Approach shines.

It’s built on a simple, yet powerful idea: a property's value shouldn't be more than what it would cost to build an equivalent one from the ground up today. It’s a nuts-and-bolts method that provides a logical answer when comparable sales are off the table.

At its core, this approach is like reverse-engineering a property's value. You figure out the cost to construct a brand-new replacement, add the value of the land, and then subtract any loss in value from aging and wear—a concept called depreciation. It’s a "sum-of-the-parts" formula that gives a clear, defensible value for unique real estate.

The Cost Approach Formula in Action

The calculation itself is pretty straightforward. An appraiser systematically works through three key components to build the property's value piece by piece.

The formula looks like this:

Value = Land Value + (Replacement Cost of Improvements) – Accumulated Depreciation

This method forces you to look at the tangible, physical reality of the property—the cost of materials, the condition of the structure, and the value of the land itself. It’s less about market buzz and more about what the property is physically worth, making it essential for new construction and special-purpose buildings.

It's Not Just Wear and Tear: The 3 Types of Depreciation

Depreciation is easily the most complex part of the Cost Approach. It’s not just about a roof getting old. It’s a catch-all term for any factor that makes the existing property less valuable than a brand-new, modern version.

Appraisers have to pinpoint and put a number on three distinct types of depreciation to get an accurate valuation.

- Physical Deterioration: This is the one we all think of first. It’s the visible wear and tear—a leaky roof, peeling paint, a cracked foundation, or an ancient HVAC system. It’s the natural decay that happens over time.

- Functional Obsolescence: This is about outdated design. Imagine a five-bedroom house with only one bathroom, a warehouse with ceilings too low for modern forklifts, or just a terribly awkward floor plan. The building might be in great shape, but its design no longer meets what people want or need today.

- External Obsolescence: This type of depreciation comes from factors completely outside the property's boundaries, stuff the owner has zero control over. This could be a new landfill opening up nearby, a highway expansion that brings constant traffic noise, or a major local company closing its doors, hurting the whole neighborhood's property values.

The Income Approach: When Property Is a Business

When an investor looks at a building, they don't just see bricks and mortar; they see a business. That's the whole idea behind the Income Approach to real estate valuation. This method treats a property as a cash-generating asset, which is why it's the gold standard for valuing commercial real estate like office buildings, apartment complexes, and retail centers.

The logic is beautifully simple: a property is worth what it can earn. This approach cuts through the noise and focuses purely on financial performance, translating an income stream into a clear, tangible value. For any investor, it answers the most important question of all: "How much money will this make me?"

The Metrics That Matter Most

To figure that out, we need to get comfortable with two key metrics that are the lifeblood of this valuation method: Net Operating Income (NOI) and the Capitalization Rate (Cap Rate).

The first piece of the puzzle is the Net Operating Income (NOI). Think of it as the property's pure, unadulterated profit before you account for any loan payments. For a deeper dive, check out this guide on understanding Net Operating Income (NOI).

You calculate NOI by taking all the income a property brings in (from rent, parking fees, etc.) and subtracting all the day-to-day operating expenses—things like property taxes, insurance, and maintenance. Crucially, things like mortgage payments and income taxes are left out of this equation.

Key Takeaway: NOI gives you an apples-to-apples way to compare the raw profitability of different properties, regardless of how they are financed. It’s all about the property’s performance.

With the NOI figured out, you need the second piece: the Capitalization Rate, or Cap Rate. This number represents the expected rate of return on an investment property in a specific market. It’s not just pulled out of thin air; you find it by looking at what similar properties in the area have recently sold for and what their NOI was.

So, if you see that comparable buildings are trading at a 7% Cap Rate, that tells you what the market expects to earn from that type of asset, in that location, right now.

Putting It All Together: From Income to Value

Once you have both the NOI and the Cap Rate, the formula to determine the property's value is incredibly powerful yet straightforward.

Property Value = Net Operating Income (NOI) / Capitalization Rate (Cap Rate)

Let's walk through a quick example. Imagine a small office building that generates an annual NOI of $100,000. After researching the local market, you find that the going Cap Rate for similar buildings is 8% (or 0.08).

Here’s the math:

$100,000 / 0.08 = $1,250,000

This result tells us that, in this market, investors are willing to pay $1.25 million for a property that produces $100,000 in annual income. It’s a direct link between profit and price. You can explore this concept further in our guide to the income capitalization approach.

This isn't a new concept, either. Historical real estate data goes back decades—as far as the 1930s for commercial properties—giving appraisers a deep well of information to analyze market trends and cycles. This kind of long-term data is essential for producing valuations that stand the test of time.

How To Choose The Right Valuation Method

Knowing the different real estate valuation techniques is a great start, but the real expertise comes from knowing exactly when to use each one. This is where the pros really shine. The secret to an accurate valuation isn't just about crunching numbers; it's about matching the right method to the right property.

Think of it like being a doctor. You wouldn't prescribe the same treatment for a broken bone as you would for the flu. Each valuation method is a specialized tool, and using the wrong one for the job will give you a misleading, and frankly, useless number. The property itself tells you which tool to pull out of the bag.

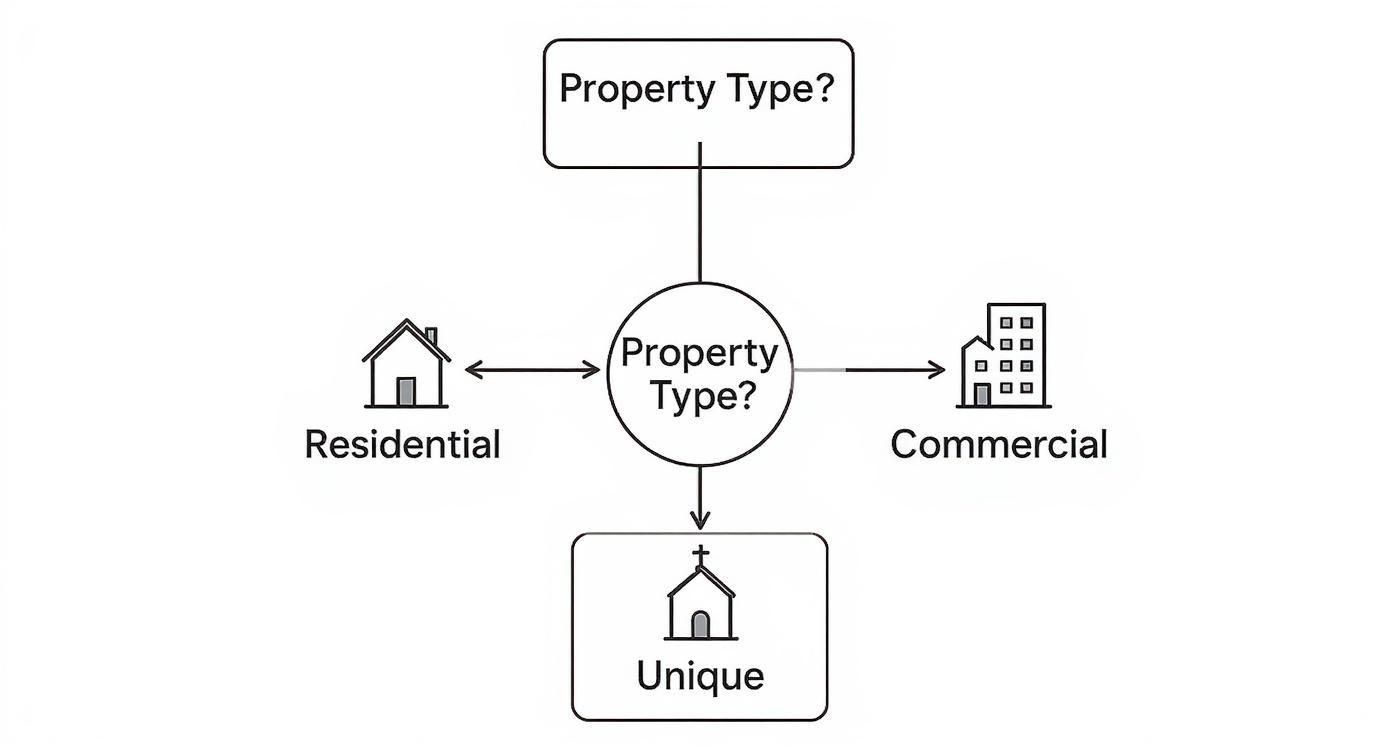

This decision tree gives you a quick visual cheat sheet for pairing common property types with their best-fit valuation method.

As you can see, the property's core function—whether it’s a family home, a business hub, or a one-of-a-kind structure—is the biggest clue you have for picking the right approach.

Matching Valuation Method to Property Type

To make this even clearer, let's break down which method works best for different properties and, more importantly, why.

This table shows how the most reliable and available data for a given property type naturally leads you to the best valuation method.

The Logic Behind The Choices

The reasoning for these pairings really just boils down to common sense and following the data.

- For Residential Properties, the Sales Comparison Approach is the undisputed champion. There's a constant stream of single-family homes and condos being bought and sold, which creates a huge pool of recent, relevant data. Nothing beats a direct, apples-to-apples market comparison.

- For Commercial Properties, it’s all about the Income Approach. Nobody buys an office building or a retail strip for its charming architecture; they buy it for the cash flow. Valuing these assets based on their Net Operating Income (NOI) and market cap rates gets right to the heart of their economic purpose.

- For Unique Properties, the Cost Approach is your best friend. How do you value a brand-new fire station or a custom-built factory? There are no comps and no rental income to analyze. The only logical way to determine its worth is to figure out what it would cost to build it again from the ground up.

The Final Step: Reconciliation

Now, in the real world, a professional appraiser almost never hangs their hat on a single number from a single method. They're more thorough than that. They often use two, or even all three, approaches to get a complete picture. This final step is called reconciliation.

Reconciliation is where the appraiser's judgment and experience come into play. It involves weighing the values from the different approaches and deciding which one is the most credible for that specific property to arrive at a final, defensible estimate of value.

For instance, when appraising a duplex, an appraiser would lean heavily on the Sales Comparison Approach. But they'd absolutely run the numbers for the Income Approach, too. Seeing how those two values line up (or don't) helps them reconcile a final, more robust valuation. It’s a crucial reality check.

What About Those Instant Online Estimates? A Look at AVMs

In an age where you can get an answer to almost anything in seconds, it was only a matter of time before technology took a crack at real estate valuation. This is where Automated Valuation Models (AVMs) enter the picture. They’re the engines behind those instant home value estimates you see plastered all over popular property websites.

At their core, AVMs are sophisticated algorithms that chew through huge volumes of public data—recent sales records, tax assessments, square footage, and bed/bath counts—to spit out a probable value almost instantly.

Think of it like getting a quick health screening. It’s fast and gives you a useful snapshot, but you wouldn’t skip a full physical with your doctor based on it. AVMs offer a great starting point, but they have some serious blind spots.

Where They Shine and Where They Falter

AVMs are incredibly powerful, but you have to know their limits if you're going to use them effectively. They're brilliant at processing mountains of data but completely miss the subtle, real-world details that truly define a property's worth.

Here’s a simple breakdown of what they can and can’t do:

- Pro: Lightning Speed. An AVM delivers an estimate in the time it takes to load a webpage, making it perfect for initial research.

- Con: No Eyes on the Ground. The algorithm has no idea you just spent $50,000 on a stunning kitchen remodel or that the roof is on its last legs. It can't "see" condition, which is a massive factor in value.

- Pro: Massive Data Pool. AVMs tap into extensive public records, giving you a bird's-eye view of the broader market.

- Con: Struggles with Uniqueness. In rural areas with few sales or neighborhoods full of one-of-a-kind homes, AVMs just don't have enough comparable data to work with. This often leads to wildly inaccurate figures.

An AVM provides a data-driven baseline, but it lacks the critical judgment and on-site inspection of a licensed appraiser. It's a valuable first look, not the final word on value.

AVMs Aren't Just for Zillow

It's not just consumers who rely on these models. Governments and major financial institutions use even more complex versions for large-scale market analysis.

Take the Federal Housing Finance Agency (FHFA), for example. It maintains the House Price Index (HPI), a powerful tool that tracks home price movements by analyzing repeat mortgage transactions on the same properties all the way back to 1975. Economists and policymakers lean on this data to understand market trends. You can see how it works on the official FHFA website.

This marriage of AI and real estate is popping up elsewhere, too, from marketing tools like real estate virtual staging software that can enhance a home's appeal to mortgage underwriting systems.

In the end, AVMs are just one tool in an increasingly sophisticated toolbox. They bring incredible efficiency to the table, but they always need a layer of human expertise to make sense of the numbers.

Answering Your Top Property Valuation Questions

Once you've got the three main valuation methods down, you'll find that a few practical questions almost always pop up. It's one thing to understand the theory, but it's another to apply it confidently when you're dealing with a real property and real money.

Let’s clear up some of the most common points of confusion I hear from both new and seasoned property owners.

What's the Real Difference Between an Appraisal and a CMA?

This is easily one of the most frequent questions, and for good reason. Both an appraisal and a Comparative Market Analysis (CMA) often rely on the same core principle—comparing similar sold properties. But that's where the similarities end. Their purpose, and more importantly, their legal standing, are worlds apart.

Think of it this way: a CMA is an informal estimate of value, usually put together by a real estate agent to help a seller land on a smart listing price. An appraisal, on the other hand, is a formal, legally defensible opinion of value prepared by a state-licensed professional.

A CMA is a fantastic tool for getting a feel for the market. An appraisal is what the bank requires to sign off on a mortgage because it carries legal weight and follows a strict, standardized process.

How Often Should I Get My Property Re-Valued?

There’s no hard-and-fast rule here; it all boils down to your specific goals. You'll almost certainly need a formal appraisal for major financial events. Think selling, refinancing a mortgage, settling an estate, or for certain tax situations.

For those of us holding investment properties, it's just good business to do an informal review at least once a year. This helps you track how your asset is performing, stay on top of local market shifts, and make smarter decisions about your portfolio's future.

What Kills a Property's Value?

It's just as important to know what can drag a property's value down as it is to know what builds it up. Appraisers are trained to spot these negative factors, which they usually group into three buckets of what they call depreciation.

Here’s what they look for:

- Physical Deterioration: This is the obvious stuff—the wear and tear. We're talking about a roof that's seen better days, a clunky old HVAC system, or foundation issues. It's the physical decay of the property itself.

- Functional Obsolescence: This is when a property's design is just plain outdated or impractical by modern standards. A classic example is a five-bedroom house with only one bathroom. The layout just doesn't function well for today's buyer.

- External Obsolescence: This one is completely out of your control. These are negative factors outside the property lines that hurt its value. Think of a noisy new highway built right behind the backyard or a factory moving in down the street.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.