Your Complete Guide to Loans to Invest in Real Estate

Your Complete Guide to Loans to Invest in Real Estate

Discover the best loans to invest in real estate. Our guide explains financing options, lender requirements, and how to secure funding for your next deal.

Domingo Valadez

Dec 10, 2025

Blog

Using a loan to buy real estate is how most investors get in the game. It's the classic way to control a big asset without putting up all the cash yourself, and when done right, it can seriously boost your returns. Think of it as a lever—the right financing can turn a decent deal into a home run.

This guide is your roadmap. We'll walk through all the financing tools out there, from the standard bank loans everyone knows to the more creative options for complex deals.

How to Finance Your Real Estate Investments

Securing financing isn't just a box to check on your way to closing. It's a strategic move that fundamentally shapes your investment's risk and potential reward. The guiding principle is actually quite simple: your goal for the property should drive your financing choice. A quick flip and a long-term rental portfolio demand completely different kinds of loans.

This is more true now than ever. The commercial real estate world is in a state of flux, with a recent report showing an eye-popping USD 300 billion in commercial loans coming due in just the second half of a single year. That kind of pressure, mixed with unpredictable interest rates, has opened the door for private credit funds to become major players alongside traditional banks. You can get a deeper look at these market shifts from the experts at MSCI.com.

My goal here is to help you cut through the noise. We're going to cover:

- The main loan options you'll encounter, from conventional to hard money.

- More advanced tools like mezzanine debt and preferred equity.

- Exactly what lenders look for so you can build a solid application.

- A step-by-step walkthrough for getting your loan across the finish line.

First, let's start with a bird's-eye view of the most common loan types and where they fit best. This table is a great starting point for figuring out which path makes sense for your next project.

Choosing the right loan isn't just about getting the money. It's about matching your capital to your business plan to get the best possible return while keeping your risk in check.

Quick Guide to Real Estate Investment Loans

This table gives you a quick rundown of the main loan types you'll encounter. Think of it as a cheat sheet to help you quickly identify which financing tool aligns with your specific investment goal.

Now that you have the basic landscape, we can dive deeper into what makes each of these options tick.

Understanding Your Primary Loan Options

Picking the right loan for a real estate deal is a lot like choosing the right tool for a construction job. You wouldn't use a sledgehammer to hang a picture, and you certainly wouldn't take out a 30-year mortgage for a three-month house flip. The first, most crucial step is to understand your core financing options and figure out how to choose the right home loan for your specific strategy.

Every type of financing is designed for a different purpose, a different kind of borrower, and a different timeline. When you know the main loan categories inside and out, you can align your capital with your business plan much more effectively, cutting down on costs and boosting your potential returns.

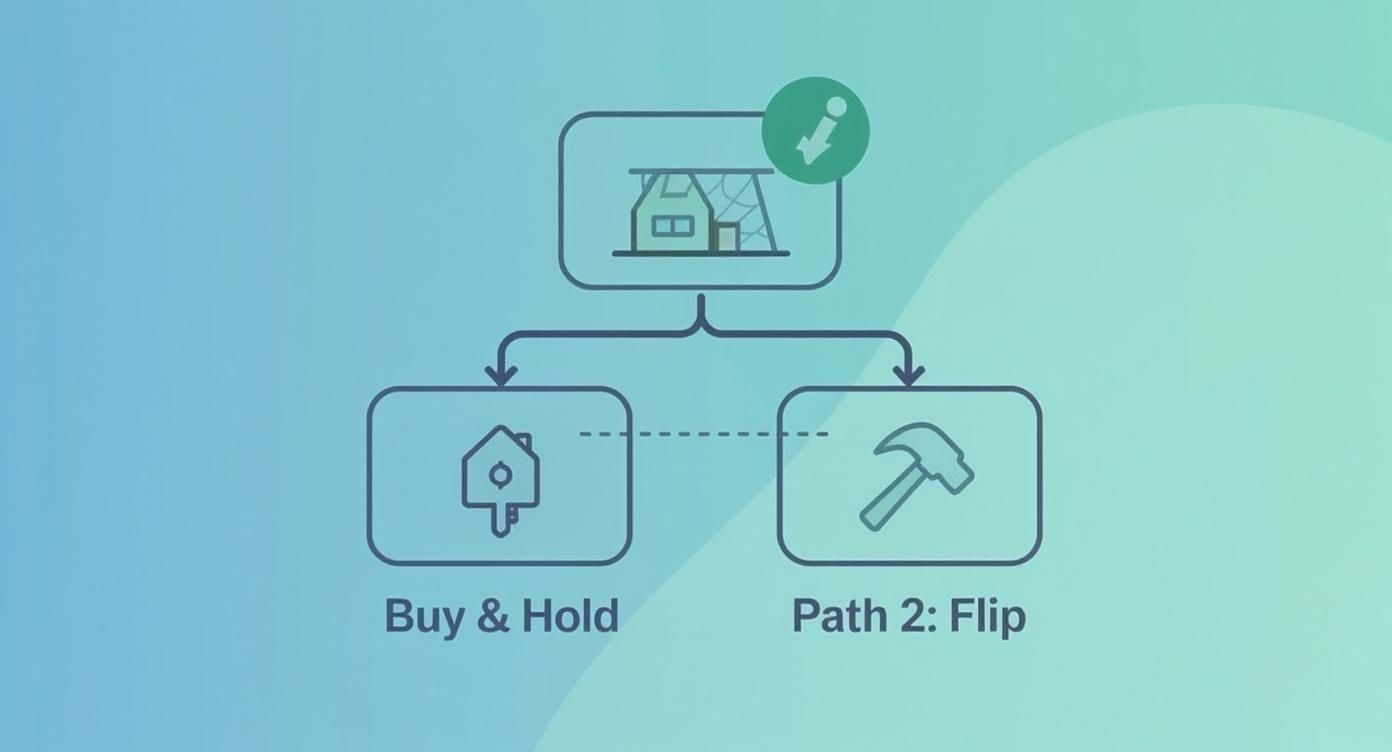

This decision tree shows how your core strategy—whether you plan to buy and hold for cash flow or flip for a quick profit—immediately sends you down different financing paths.

As you can see, the path splits right away depending on your end goal. This leads you to completely different loan products built for either long-term stability or short-term gains.

Comparing Key Real Estate Investment Loan Options

To make sense of the landscape, it helps to see these options side-by-side. Each loan type has its own sweet spot, and understanding the trade-offs between speed, cost, and terms is what separates savvy investors from the rest. This table breaks down the essentials.

Ultimately, the "best" loan is the one that fits your project's specific needs and timeline like a glove. Now, let's dig into the details of what makes each of these tick.

Agency Loans: Fannie Mae And Freddie Mac

When you hear people talk about a standard, long-term loan for a stable, income-producing property, they're almost always talking about an Agency Loan. These are the mortgages backed by government-sponsored enterprises like Fannie Mae and Freddie Mac, and they form the backbone of the financing world for multifamily properties.

Think of these as the "marathon runners" of real estate lending. They aren't built for speed, but they have incredible endurance.

- Best For: Stabilized, cash-flowing multifamily properties with 5+ units.

- Typical Terms: You'll see long amortization periods, often up to 30 years, and predictable fixed interest rates. Loan-to-value (LTV) ratios usually land between 70-80%.

- The Catch: The underwriting process is notoriously slow and thorough, often taking 60-90 days or even longer. Lenders will put everything under a microscope, from the property's historical financials to your personal track record.

If you're a buy-and-hold investor who values stability and predictable cash flow above all else, these loans are your go-to.

Bridge Loans

So, what happens when you find a great deal but the property isn't quite ready for permanent financing? Maybe it needs some light renovations, or the occupancy is too low to qualify for an Agency loan. This is where the Bridge Loan comes in. As the name implies, it literally bridges the gap between buying the property and securing long-term debt.

A bridge loan is like a short-term rental for your capital. You're not planning to stay long, but it gets you exactly what you need, right when you need it, allowing you to reposition an asset for a better future.

Once you’ve executed your business plan—renovating units, raising rents, and getting occupancy up—the property's value and income will have increased. At that point, you can easily refinance out of the short-term bridge loan and into a much cheaper, long-term Agency loan.

Hard Money Loans

If a bridge loan is a short-term rental, then a Hard Money Loan is a speedboat. These loans are incredibly fast, asset-focused, and come from private lenders instead of traditional banks. Their main selling point is speed—it's possible to get funded in as little as 7-14 days.

Of course, that kind of velocity comes at a price. Interest rates are much higher, often in the 10-15% range (or more), with very short terms of just 6-24 months. Lenders care less about your personal credit and more about the property's after-repair value (ARV), making this the perfect tool for house flippers or investors who need to close on a deal yesterday.

Construction Loans

For anyone building from the ground up or taking a property down to the studs for a complete overhaul, the Construction Loan is the purpose-built solution. It works differently than a standard mortgage. Instead of getting all the money at once, funds are paid out in stages, called "draws," as you hit specific construction milestones.

This structure protects the lender, ensuring their money is actually being used to create the asset they're lending against. They'll need to see detailed architectural plans, budgets, and timelines, and will send inspectors to verify progress before releasing the next chunk of cash. Once the project is finished and leased up, the construction loan is usually paid off by refinancing into a permanent, long-term mortgage.

Taking Your Financing to the Next Level

Once you start eyeing bigger deals—the kind that go beyond a simple duplex or a small apartment building—your financing options really open up. The standard mortgages that got you started are still important, but seasoned investors learn to layer different kinds of capital to pull off major acquisitions and ground-up developments.

Getting a handle on these more sophisticated strategies is what separates the pros from the amateurs, especially as the market shifts. We're seeing a big uptick in new commercial real estate loans, fueled by more creative deal structures and a flood of money from private credit lenders. With so much capital on the sidelines, sponsors who know how to creatively finance a deal are in the driver's seat. You can get a deeper dive into these commercial real estate trends from Deloitte's 2024 outlook.

Let's break down three of the most powerful tools you'll find in an advanced real estate investor's toolkit: portfolio loans, mezzanine debt, and preferred equity.

Streamline and Scale with Portfolio Loans

Picture this: you own five different rental properties. That means five different mortgages, five different monthly payments, and five different sets of paperwork to track. It's a logistical nightmare. This is exactly the problem a portfolio loan is designed to solve.

A portfolio loan lets you bundle multiple properties together under a single loan. It's a game-changer for a few key reasons:

- Simplified Management: You go from juggling multiple payments to making just one. This cleans up your books and frees up a ton of administrative time.

- Power in Numbers: The loan is secured by the entire group of properties, a concept called cross-collateralization. If one property has a down month, the strong performance of the others keeps the loan stable in the lender's eyes.

- Better Terms: Walking into a bank with a diversified portfolio of assets makes you a much stronger borrower. You can often negotiate better interest rates and more flexible terms than you ever could with a single-property loan.

This is the perfect move for an investor who has built a solid collection of assets and is ready to optimize their debt structure to keep growing.

Think of a portfolio loan like creating a mutual fund with your properties. Instead of managing a bunch of individual stocks, you're now managing one consolidated investment vehicle. It makes everything easier to track and scale.

Mezzanine Debt: Bridging the Gap in the Middle

So, you've found a great deal, but the senior loan from the bank only covers, say, 70% of the cost. You need more cash to close, but you don't want to dilute your own equity stake too much. This is where mezzanine debt comes in.

To get how it works, you have to understand the capital stack—think of it as the layers of funding in a real estate deal.

- Senior Debt (The Foundation): This is your main mortgage, typically making up 60-75% of the total financing. It’s the safest position for a lender, so it gets the lowest interest rate.

- Mezzanine Debt (The Middle Layer): This slice of financing sits right on top of the senior debt, filling the gap between the mortgage and the equity. It's riskier for the lender, so it comes with a much higher interest rate, often in the 10-15% range.

- Sponsor Equity (The Top Layer): This is the cash you and your investors put into the deal. It’s the last to get paid back, making it the riskiest position, but it also has the highest potential upside.

What's really interesting is how mezzanine debt is secured. It isn't a lien on the property itself. Instead, the lender gets a pledge of the ownership interest in the LLC or company that owns the property. If you default, they don't foreclose—they can simply take over your ownership of the company.

Preferred Equity: A Hybrid Cousin to Mezzanine Debt

Preferred Equity is another popular tool for filling that same funding gap, but it operates in a slightly different way. While it also sits between the senior debt and the common equity in the capital stack, it’s not technically a loan—it's an equity investment.

Here’s the crucial difference:

- Mezzanine lenders are creditors. They are owed fixed interest payments, period.

- Preferred equity investors are partners in the deal. They get a fixed rate of return (called a "preferred return") that gets paid out before you (the sponsor) and your other common equity investors see a single dollar of profit.

This structure gives the preferred equity investor a priority claim on any cash flow the property generates. If things go well, they get their agreed-upon cut first. If the property struggles, they still get paid before any other equity holders. Because of this priority position, it's less risky than common equity but riskier than debt, with returns that typically land somewhere between the two.

How Lenders Will Evaluate Your Deal

If you want to secure the best financing for a real estate investment, you have to learn to see your deal through the lender's eyes. They aren't investors in the same way you are. Their primary job is to manage risk, and their entire underwriting process boils down to one simple question: "How certain are we to get paid back?"

To answer that, they analyze every deal through three core pillars. Think of it as a three-legged stool—if one leg is weak, the whole thing gets dangerously wobbly.

The First Pillar: The Borrower

Before a lender even glances at the property details, they look at you. They need to be confident that the person steering the ship is experienced, financially sound, and reliable.

- Experience and Track Record: Have you done this before? A history of successful projects, from acquisition to exit, speaks volumes and gives them immense confidence.

- Financial Health: Expect them to comb through your personal financial statement. They're looking for strong liquidity (cash on hand) and a healthy net worth to ensure you can weather unexpected storms without missing a payment.

- Creditworthiness: Your credit score is a direct measure of your financial discipline. A clean history shows you honor your obligations, which is exactly what a lender wants to see.

The truth is, a strong sponsor can often get a borderline deal across the finish line, while a weak one can make even a great property look unfundable.

The Second Pillar: The Property

Next, the asset itself goes under the microscope. The property is their collateral—the ultimate safety net if things go wrong. They need to be absolutely sure it’s a quality asset capable of producing reliable income.

Here’s what they’ll dig into:

- Location and Market: Is the property located in a growing area with real demand drivers, like job growth and a rising population? A great building in a declining market is a red flag.

- Physical Condition: Lenders don't just take your word for it. They'll commission third-party appraisals and property condition reports to identify any deferred maintenance or hidden structural problems.

- Tenant Quality and Lease Strength: For commercial assets, the tenant roster is everything. Are the tenants reputable businesses on long-term, stable leases? A building filled with creditworthy tenants is a much safer bet.

A lender’s primary concern is the property's ability to generate enough cash to comfortably cover the debt payments. Everything else is secondary to this fundamental principle.

The Third Pillar: The Deal Itself

Finally, the lender scrutinizes the actual numbers of your transaction. This is where the deal has to stand on its own two feet with cold, hard math. Two metrics are king here: Loan-to-Value (LTV) and Debt Service Coverage Ratio (DSCR).

The Loan-to-Value (LTV) ratio simply compares the loan amount to the property's appraised value. It shows the lender how much of an equity "cushion" you have protecting their position if values dip.

- Formula: LTV = (Loan Amount / Appraised Property Value) x 100

- Example: On a $1,000,000 property, a $750,000 loan results in a 75% LTV. This means you have 25% equity, or "skin in the game."

For most commercial properties, lenders typically cap LTV between 65% and 80%, depending on the market and asset type.

The Debt Service Coverage Ratio (DSCR) is arguably the most important number on the entire application. It measures whether the property's income is sufficient to cover its mortgage payments. For a deeper dive, check out our guide on the real estate Debt Service Coverage Ratio and how it works.

- Formula: DSCR = Net Operating Income (NOI) / Total Debt Service

- Example: If your property’s NOI is $125,000 a year and your total mortgage payments are $100,000, your DSCR is 1.25x.

Lenders want to see a healthy buffer, usually requiring a minimum DSCR of 1.20x to 1.35x. In our example, the 1.25x means the property generates 25% more cash than needed to pay the debt—a margin of safety that can absorb vacancies or unforeseen expenses.

Mastering these three pillars allows you to build a compelling case that anticipates and answers a lender’s questions before they even have to ask.

A Practical Guide to Securing Your Loan

Knowing the different types of loans is one thing, but actually getting one is where the rubber meets the road. Securing a loan isn't some arcane art; it's a step-by-step process. If you approach it with a clear plan, you'll dramatically improve your odds of not just getting approved, but landing the best possible terms.

The secret? Preparation. Lenders see a flood of applications every day. When yours lands on their desk, a polished, comprehensive loan package immediately tells them you're a serious, professional operator. It’s your first impression—make it a great one. This isn't about salesmanship; it's about proving you've got a low-risk, high-confidence opportunity on your hands.

Assembling Your Winning Loan Package

Before you even pick up the phone to call a lender, you need your story straight and the paperwork to prove it. Think of your loan package as the ultimate business plan for your property. It should anticipate and answer every single question a lender might have before they even ask.

Your package absolutely must include these key pieces:

- Executive Summary: This is your one-page hook. It needs to quickly lay out the deal, your business plan, the loan amount you're requesting, and why you’re the right person to pull it off.

- Pro Forma Financials: This is your financial crystal ball. It has to show detailed projections for income, expenses, and crucial metrics like Net Operating Income (NOI) and cash flow for at least the next five years.

- Sponsor Biography: This is where you sell yourself. Detail your track record in real estate, showcase past wins on similar projects, and build unshakable confidence in your ability to manage this asset.

- Personal Financial Statement: This is a simple snapshot of your personal assets, liabilities, and net worth. It shows the lender you have the financial muscle to backstop the deal if things go sideways.

A well-crafted loan package does more than just present data; it tells a compelling story. It should clearly articulate the opportunity, define the strategy, and prove you have the expertise to deliver on your promises.

From Outreach to Closing

Once your package is buttoned up, it’s time to get out there. This next phase is all about finding the right financial partners, haggling over terms, and clearing the final hurdles of due diligence and closing. Every step demands precision and crystal-clear communication.

Here's a practical roadmap to get you from A to Z:

- Identify and Approach Lenders: Don't just walk into your local bank. Do your homework and find lenders who specialize in your exact asset class and deal size. A good commercial mortgage broker can be worth their weight in gold here; they already have the relationships and know who’s actively lending on deals like yours.

- Negotiate the Term Sheet: Once a lender shows interest, they’ll send over a non-binding term sheet. This document outlines the proposed loan amount, interest rate, term, and other key conditions. This is your moment to negotiate. Don’t be afraid to push for better terms on things like prepayment penalties or reserve requirements.

- Navigate Due Diligence: After you sign the term sheet, the lender's underwriting team takes the reins. They'll order third-party reports (appraisal, environmental, property condition) and go through your loan package with a fine-tooth comb. Be ready to respond quickly to their requests for more information.

- Finalize and Close: Once due diligence is complete and gets the green light, you'll receive a final loan commitment. From there, it’s a matter of working with the lawyers to finalize the loan documents and get to a successful closing.

The market for these loans is still humming. Global real estate investment recently hit about USD 739 billion over a trailing year—a 19% year-over-year jump—which signals strong investor confidence and plenty of cash in the debt markets. You can dig into more of these global investment trends at JLL.com. In this competitive environment, building strong relationships with brokers and lenders is everything. It can turn what feels like a one-off transaction into a lasting partnership.

Using Leverage to Manage Risk and Maximize Returns

In real estate, leverage is the ultimate double-edged sword. It's the art of using other people's money—specifically, a lender's—to control a large, valuable asset with a surprisingly small amount of your own cash. When it works, it can dramatically amplify your returns. But get it wrong, and it will magnify your risk just as quickly.

The trick isn't to avoid debt. It's to use it wisely.

Let’s run a quick example to see its power in action. Imagine you buy a $500,000 property that spits out $25,000 in net cash flow each year. If you paid all cash, your annual return is a straightforward 5% ($25,000 / $500,000).

Now, let's bring in a lender. You get a loan for 80% of the purchase price ($400,000), which means you only need to bring $100,000 to the table. After making your $20,000 debt payment for the year, your net cash flow is $5,000. While the dollar amount is smaller, your cash-on-cash return is still 5% ($5,000 / $100,000). But here's the kicker: you now have $400,000 of your own capital freed up to chase other deals.

Managing the Risks of Leverage

While the upside is compelling, the risks are just as real. A market dip that would be a minor headache in an all-cash deal can quickly spiral into a full-blown crisis when you have a monthly mortgage payment breathing down your neck.

This is what separates seasoned investors from the ones who get wiped out during a downturn. It’s all about understanding these risks and structuring your financing to protect your investment and align with your business plan.

Your loan is a tool, not just a transaction. The right terms provide the flexibility to execute your strategy, while the wrong ones can force you into bad decisions. Always structure your debt to serve your asset, not the other way around.

Key Risks and How to Mitigate Them

Successfully using loans to invest in real estate means having a clear game plan for the most common financial threats you'll face.

- Interest Rate Risk: This is the big one, especially with variable-rate loans. A sudden spike in rates can decimate your cash flow practically overnight. The classic way to hedge against this is by purchasing an interest rate cap. Better yet, whenever you can, lock in long-term, fixed-rate debt on stabilized assets. Sleep better at night.

- Refinancing Risk: Every loan eventually comes due. If credit markets are tight when it's your turn to refinance, you could get stuck with terrible terms or, in a worst-case scenario, find no new financing at all. The best defense? Don’t use short-term debt for a long-term hold. And start talking to lenders 6-12 monthsbefore your loan matures.

- Covenant Risk: Many commercial loans come with strings attached called covenants. These are rules you have to follow, like maintaining a minimum Debt Service Coverage Ratio (DSCR) or a certain occupancy level. If you breach a covenant, the lender can technically call a default. You can steer clear of this by being conservative with your financial projections and keeping a healthy cash reserve on hand for unexpected vacancies or big-ticket repairs.

To efficiently manage your rental portfolio and optimize returns, leveraging technology is crucial; discover the best property management apps to streamline your operations. At the end of the day, smart management is your first and best line of defense against the risks that come with leverage.

Got Questions? We've Got Answers

Stepping into the world of real estate financing can feel like learning a new language. The good news is that most investors run into the same questions and roadblocks. Let's clear up a few of the most common ones so you can move forward with confidence.

What’s the Easiest Real Estate Investment Loan to Get?

When you need to move fast and don't fit the traditional lending box, hard money loans are usually the path of least resistance. The approval process is built around the deal itself—specifically, the property's after-repair value (ARV)—not your personal tax returns or credit score.

Because the underwriting is asset-based, you can often get funded in just 7-14 days. But "easy" isn't free. The trade-off is higher interest rates and fees. Think of it as a specialized tool: perfect for short-term projects like a house flip, where your goal is to get in, add value, and get out before the high costs add up.

How Much Skin in the Game Do I Need for an Investment Property?

Forget the low down payments you see for primary homes. For an investment property, lenders want to see you have some serious skin in the game.

Expect to bring a down payment of at least 20% for a conventional loan. For bigger commercial deals or if you're a newer investor, don't be surprised if the lender asks for 25-30% or even more.

Lenders aren't just being difficult. A bigger down payment signals you're a committed, serious partner in the deal. It lowers their risk, which in turn can help you secure a better rate.

That extra equity also gives everyone a cushion, protecting the investment if the market takes a temporary dip.

Can I Roll Renovation Costs Into My Purchase Loan?

Absolutely. In fact, combining the purchase and rehab financing into a single loan is a smart move for any value-add investor. It streamlines everything and saves you the headache of finding a second, more expensive loan for the construction work.

Here are the go-to options for a one-stop-shop loan:

- Construction Loans: The classic choice for ground-up projects or major gut renovations. The bank releases funds in draws as you hit specific construction milestones.

- Hard Money Loans: A favorite for flippers. These are often structured to cover a percentage of the purchase price and 100% of the renovation budget, with the loan amount tied to the future ARV.

- FHA 203(k) Loans: A government-backed loan for smaller residential properties (one to four units). It’s designed to wrap the purchase and renovation costs into one mortgage.

Ready to streamline your next deal? With Homebase, you can manage fundraising, investor relations, and distributions all in one place. Stop wrestling with spreadsheets and focus on what you do best—closing deals. Learn more and get started today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

How Do You Value Commercial Real Estate? A Modern Sponsor's Guide

Blog

Discover how do you value commercial real estate with a sponsor-focused guide. Master NOI, cap rates, and DCF to spot profitable investments.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.