Real Estate Syndication Platform: Pro Tips for Success

Real Estate Syndication Platform: Pro Tips for Success

Discover how top investors use our real estate syndication platform to unlock exclusive deals and boost returns effortlessly.

Domingo Valadez

May 6, 2025

Blog

The Evolution of Real Estate Syndication Platforms

For decades, commercial real estate investment was an exclusive club, reserved for the wealthy. Building a portfolio of properties like multifamily apartments or office buildings required substantial capital, extensive networks, and complex legal processes. This effectively excluded individual investors from participating in this potentially lucrative market.

However, the rise of real estate syndication platforms has significantly altered this dynamic, democratizing access and creating opportunities for a broader spectrum of investors. These platforms are not simply online listings; they represent a fundamental shift in how real estate investment operates. This evolution has simplified the process, making it easier for individual investors to participate in large-scale projects.

Historically, real estate syndication was a complicated undertaking, involving extensive paperwork, in-person meetings, and manual processes. This traditional approach made tasks like due diligence, investment tracking, and distributing returns cumbersome and inefficient. Today’s technology-driven platforms are transforming this landscape. Modern platforms offer a more streamlined, transparent, and accessible experience for both sponsors and investors.

Real estate syndication itself has a long history, dating back to the early 20th century. Wealthy investors formed partnerships to finance large-scale projects, pooling their capital and sharing the associated risks and rewards.

From Paper to Platform: A Digital Transformation

The shift from traditional real estate syndication to the digital age has been substantial. Managing investments once meant sorting through mountains of physical documents and relying on spreadsheets for tracking performance. Now, sophisticated platforms have digitized these tasks.

These platforms provide intuitive dashboards that give investors real-time access to crucial information. This empowers investors to monitor their investments easily and make more informed decisions.

Empowering Investors, Enabling Sponsors

The impact of these platforms goes beyond simply improving accessibility. They also empower sponsors by automating many of the tedious administrative tasks associated with managing a syndication. This includes automating workflows for activities like fundraising, investor onboarding (including KYC/AML checks), and the distribution of returns.

This automation frees up sponsors to concentrate on their core expertise: identifying and managing profitable real estate opportunities. Furthermore, the increased transparency and streamlined communication fostered by these platforms cultivates trust and strengthens relationships between sponsors and investors.

This collaborative environment contributes to a more efficient and successful investment experience for all involved. Real estate syndication platforms offer a valuable combination of access, efficiency, and transparency, paving the way for continued growth in the real estate investment market.

Must-Have Features That Separate Winners From Losers

Choosing the right real estate syndication platform can significantly impact your success, whether you're a sponsor or an investor. Not all platforms are created equal. Understanding the key features that distinguish a truly valuable platform is crucial. This section explores these must-have features, offering insights from experienced investors and sponsors.

Essential Features for Investors

A winning real estate syndication platform should provide investors with a seamless and transparent experience. This starts with an intuitive investor portal. Easy access to investment details, performance reports, and tax documents is key. Secure digital signing and fund transfer capabilities are also essential for streamlined transactions.

The following features empower investors to stay informed and actively manage their investments:

- Intuitive Dashboard: Investors need a clear overview of their investments, including performance metrics and upcoming distributions.

- Secure Document Management: Secure and easy access to all relevant documents, like operating agreements and financial reports, is a must.

- Transparent Communication Tools: Direct messaging or platform forums facilitate clear communication between investors and sponsors.

- Automated Distribution Tracking: Investors should easily track returns and distributions without manual calculations.

Critical Features for Sponsors

For sponsors, efficiency and automation are paramount. A robust platform simplifies complex tasks, allowing sponsors to focus on deal identification and management. Key features include automated fundraising workflows, investor onboarding tools, and integrated reporting for compliance and distributions. This streamlines operations and reduces administrative burden.

Consider these essential features for sponsors:

- Automated Fundraising Workflows: Streamlined processes for collecting investor information, verifying accreditation, and managing subscriptions are crucial for efficient fundraising. Integrated Know Your Customer (KYC) and Anti-Money Laundering (AML) checks simplify investor onboarding.

- Investor Relationship Management (IRM): Centralized communication and document sharing tools are crucial for building strong investor relationships. This could include personalized email campaigns or automated updates.

- Comprehensive Reporting and Analytics: Real-time access to performance data, financial reports, and investor activity provides valuable insights for data-driven decisions.

- Seamless Integration With Other Tools: Connecting with existing accounting software or Customer Relationship Management (CRM) systems enhances efficiency.

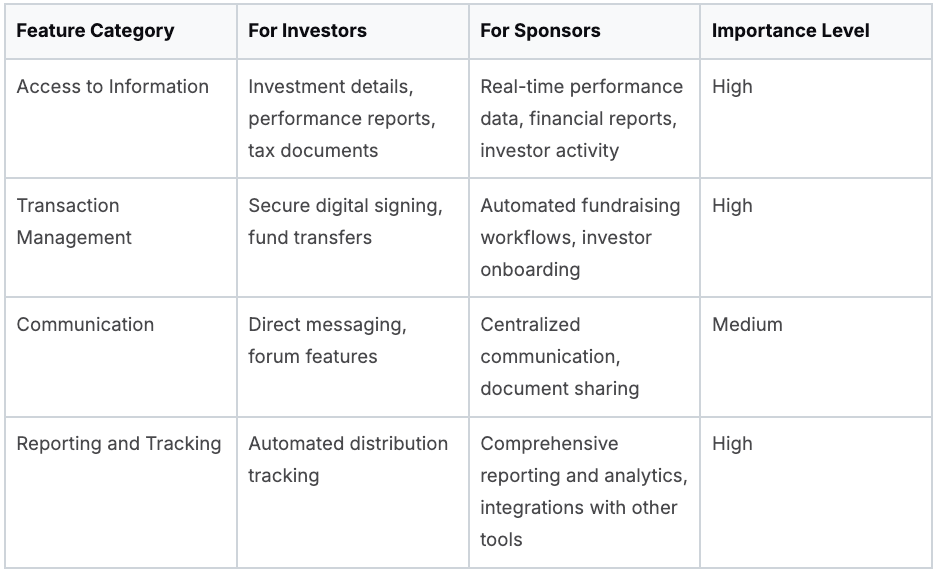

To help summarize the features discussed, let's look at the table below:

Essential Real Estate Syndication Platform Features A comparison of must-have features across different types of real estate syndication platforms

This table highlights the critical features needed by both investors and sponsors for a successful syndication experience. The importance level assigned emphasizes the crucial role each feature plays.

Features That Truly Deliver Value

While flashy features can be appealing, practical value is paramount. For example, while complex waterfall calculations are important, a platform that makes these calculations difficult to understand hinders transparency. A valuable platform prioritizes clarity and usability, ensuring even complex processes are accessible.

Furthermore, reliable customer support is essential. Sponsors and investors need prompt and effective assistance when issues arise. A platform with readily available and knowledgeable support significantly improves the overall experience. Choosing a real estate syndication platform is a crucial decision. By focusing on these essential features, sponsors and investors can select a platform that empowers them to achieve their investment goals.

Navigating the Legal Landscape of Syndication Platforms

Real estate syndication platforms offer compelling investment opportunities. However, understanding the legal framework governing these platforms is essential for both sponsors and investors. This knowledge helps mitigate potential risks and ensures a secure investment experience. This section explores the key legal aspects of real estate syndication platforms.

Understanding Securities Regulations

Real estate syndications are typically structured as securities offerings. This places them under the jurisdiction of both federal and state securities laws. Regulation D is a key regulation in this area. It provides exemptions from full registration requirements for specific private offerings, a common structure for real estate syndications. This allows for more efficient capital raising.

However, complying with Regulation D requires careful attention to detail. Sponsors must adhere to specific rules regarding investor accreditation, disclosure requirements, and restrictions on advertising and general solicitation. Failing to meet these requirements can lead to legal complications.

The Impact of the JOBS Act

The Jumpstart Our Business Startups (JOBS Act) of 2012 significantly impacted the real estate syndication landscape. It eased certain regulations around raising capital, particularly from accredited investors. This broadened the pool of potential investors in private real estate deals.

The JOBS Act also promoted increased transparency and accessibility in real estate investments. It opened up syndication opportunities, previously limited to institutional investors, to a wider range of individuals. This democratization of investment access has been a key outcome of the legislation.

Investor Accreditation and Verification

Verifying investor accreditation is crucial for compliance. Syndication platforms use various methods to ensure investors meet the necessary financial criteria. These methods include reviewing income documentation, tax returns, and net worth statements.

Thorough verification processes are essential for platform compliance and investor protection. Robust procedures protect all parties involved and help maintain the integrity of the investment process.

Best Practices and Red Flags

Maintaining a compliant real estate syndication requires proactive measures. Best practices include:

- Thorough due diligence on all parties

- Transparent disclosure of all fees and risks

- Strict adherence to applicable securities laws

By following these practices, sponsors build trust with investors and foster a more secure environment.

However, investors should also be aware of potential red flags. These include:

- Inadequate disclosure of investment risks

- Unrealistic projections of returns

- Overly complex fee structures

Recognizing these warning signs can help investors avoid potentially problematic deals. Understanding the legal landscape empowers investors to make informed decisions and mitigate risk. Choosing a platform that prioritizes compliance is paramount for a secure and successful investment experience.

The Mechanics of Automated Distribution Systems

Real estate syndication platforms are changing how profits are distributed, moving beyond cumbersome spreadsheets and slow payments. These systems offer automation and transparency, benefiting both sponsors and investors. This section explores how these automated distribution systems work.

Streamlining Complex Calculations

A core function of these platforms is their ability to handle complex profit distribution calculations. These platforms manage preferred returns, waterfall structures, and other intricate financial models with accuracy. For example, a platform can automatically calculate an investor's preferred return before distributing remaining profits according to the agreed-upon waterfall structure. This automation minimizes errors and ensures fair profit sharing.

In real estate syndication, profit distribution follows a predetermined split between the general partner (GP) and limited partners (LPs). This split can vary, from 50/50 to 90/10, based on the partnership agreement. In an 80/20 split, for instance, LPs receive 80% of the cash flow and capital gains, while the GP receives the remaining 20%. Regular distributions, often quarterly or monthly, ensure consistent updates and payments to investors. Learn more about how distribution works in real estate syndication here.

This automation saves sponsors considerable time and resources, allowing them to concentrate on property management and investor relationships. It also gives investors clear insight into how their returns are calculated, building trust and transparency.

Integrating With Banking Systems

Top real estate syndication platforms integrate directly with banking systems. This integration enables automated payments to investors' accounts, eliminating manual processes and reducing delays. This connection also simplifies tax reporting by automatically generating the necessary documentation. This, in turn, streamlines year-end tasks for both sponsors and investors.

Real-Time Visibility and Reporting

These platforms offer investors real-time access to their investment performance and distribution history. Detailed reporting dashboards provide investors with the ability to track their returns and monitor the overall syndication progress. This transparency boosts investor confidence and satisfaction.

The Benefits of Automated Distribution

Using automated distribution systems offers several advantages for sponsors:

- Improved Investor Satisfaction: Timely and precise payments enhance investor satisfaction.

- Increased Efficiency: Automation streamlines administrative tasks and reduces manual work.

- Enhanced Transparency: Clear, accessible reporting fosters trust with investors.

- Reduced Errors: Automated calculations minimize the potential for human error.

Understanding these mechanics helps sponsors choose the right real estate syndication platform for their distribution needs. Investors can also confidently participate in syndications knowing their returns are handled efficiently and transparently. Evaluating a platform's distribution capabilities is a vital part of due diligence before entering any partnership.

Battle-Tested Platforms: An Unfiltered Comparison

Choosing the right real estate syndication platform can feel overwhelming. Marketing materials often highlight impressive features, but how do these translate to real-world performance? This section offers a practical comparison of leading platforms, cutting through the marketing to focus on what truly matters.

Key Comparison Criteria

This comparison focuses on the most crucial aspects for both sponsors and investors:

- Fee Structures: We'll analyze different fee models, from flat monthly rates to performance-based structures, and show how they impact your potential returns.

- Minimum Investment Thresholds: Understanding minimum investment requirements helps you find platforms that align with your available capital and investment goals.

- Deal Quality: We’ll examine the types of deals available on each platform, looking at factors like property type, location, and historical performance.

- Customer Support Responsiveness: Responsive and knowledgeable support is invaluable, especially when dealing with complex transactions or unexpected issues.

- User Interface and Experience: A user-friendly platform simplifies tasks and improves the overall experience for both sponsors and investors.

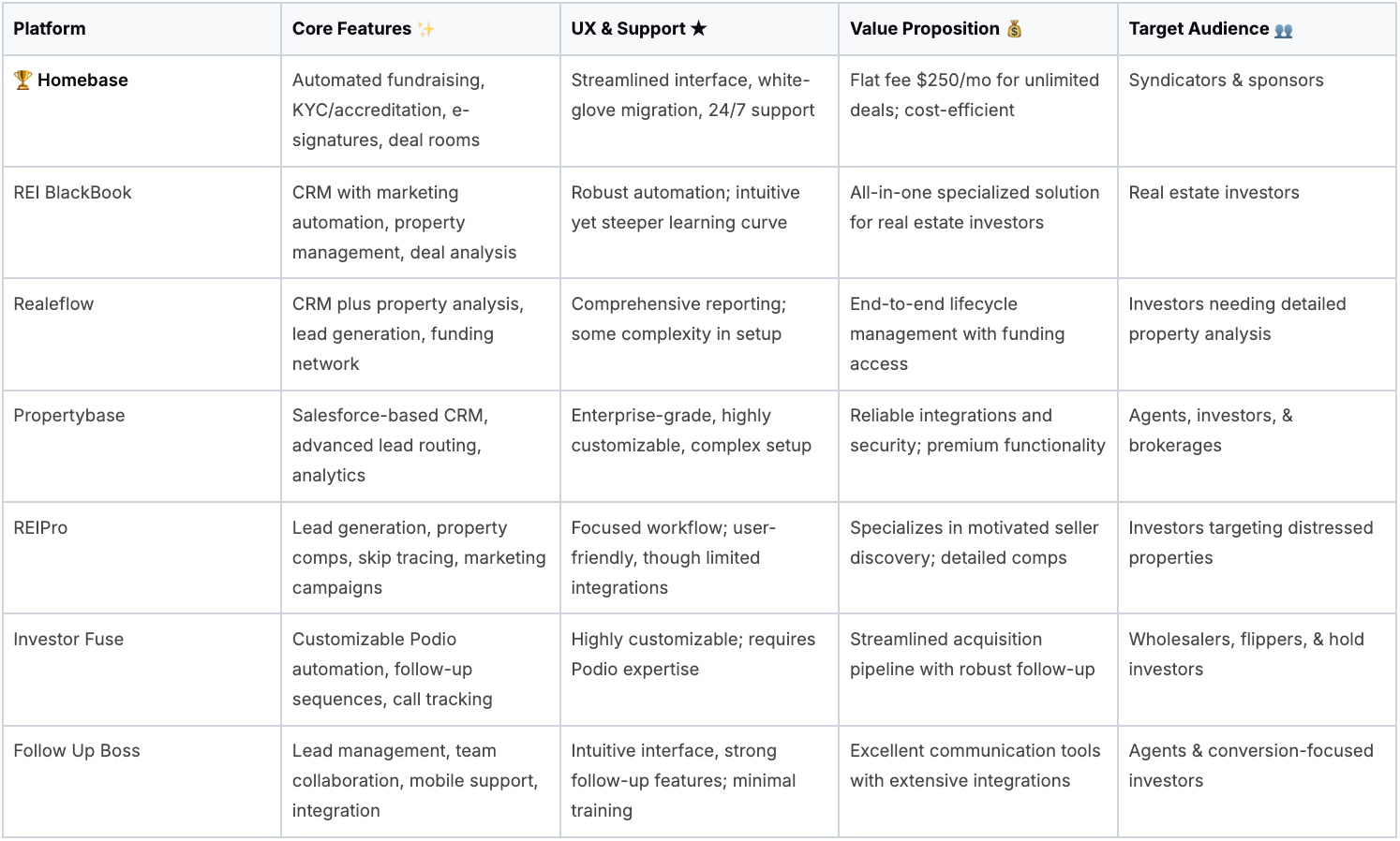

To help you compare real estate syndication platforms side-by-side, we’ve compiled the following table:

Real Estate Syndication Platform Comparison

A detailed comparison of leading real estate syndication platforms by features, costs, and user experience

This table offers a starting point for your own research. Remember, the “best” platform depends on your individual needs and priorities. For a more in-depth look at real estate syndication, check out this helpful guide: How to Master Real Estate Syndication Investments.

Hidden Strengths and Weaknesses

Beyond the obvious features, some key differences often hide in the fine print. For instance, some platforms specialize in certain property types, like multifamily or self-storage, while others offer more diverse investment options.

Sponsor vetting also varies significantly between platforms. Some platforms conduct extensive due diligence, while others have less stringent requirements. This has a direct impact on deal quality and risk assessment.

Finally, consider scalability. Some platforms are best for managing a few small deals, while others are designed for larger, more complex syndications. Choosing a platform that can grow with you is essential for long-term success.

Matching Platforms to Investor Profiles

Different platforms cater to different investor profiles. Some focus on high-net-worth individuals, providing access to exclusive deals with higher minimums. Others aim to offer opportunities for a wider range of investors, with lower entry points and diversified portfolios.

Sponsor requirements also differ. Some platforms offer streamlined migration services, making it easier to transition from other systems. Others provide comprehensive educational resources and training to help sponsors navigate real estate syndication.

By carefully considering these factors, both sponsors and investors can find a real estate syndication platform that truly meets their needs and sets them up for success. Don't rely solely on marketing materials. Do your research, talk to current users, and take advantage of free trials or demos before making a decision. This will lead to a more informed and successful experience.

Choosing Your Perfect Platform Match

Finding the right real estate syndication platform isn't simply about checking off features on a list. It's about finding a partner aligned with your specific investment goals and how you operate. This requires carefully considering your needs, understanding what the platform excels at, and performing thorough due diligence.

Defining Your Needs and Goals

Before you dive into platform demos, clearly define your objectives. Are you a sponsor looking to streamline fundraising and investor relations? Or are you an investor seeking transparent access to diversified real estate investment opportunities? Identifying your priorities will guide you through the platform selection process.

For instance, a sponsor focused on a high volume of deals needs a platform with robust automation and efficient investor onboarding. An investor looking for long-term passive income, however, might prioritize platforms with detailed performance reporting and regular distributions.

Evaluating Platform Capabilities

After identifying your needs, evaluate potential real estate syndication platforms using these key criteria:

- User Interface and Experience: Is the platform intuitive and easy to navigate for both sponsors and investors? A user-friendly design improves efficiency and reduces frustration.

- Automation Features: Does the platform automate key tasks like fundraising workflows, investor verification, and distribution calculations? This frees up valuable time for managing deals and investor relationships.

- Communication Tools: Does the platform facilitate clear and effective communication between sponsors and investors? Secure messaging, document sharing, and investor portals are essential for maintaining transparency and building trust.

- Reporting and Analytics: Does the platform offer comprehensive reporting on investment performance, financial metrics, and investor activity? Access to real-time data empowers both sponsors and investors to make sound decisions.

- Security and Compliance: Does the platform prioritize security and adhere to all industry regulations? Robust security measures and compliant practices protect both sponsors and investors.

Due Diligence: Beyond the Sales Pitch

Don't rely only on marketing brochures or polished demos. Conduct thorough due diligence by:

- Talking to Current Users: Get direct feedback from existing sponsors and investors about their experiences with the platform. Their insights can highlight hidden strengths and weaknesses not evident in presentations.

- Testing the Platform: Use free trials or demos to explore the platform's functionality. This hands-on approach will provide a realistic understanding of its capabilities and usability.

- Negotiating Terms: Don't hesitate to negotiate terms that safeguard your interests, especially regarding fees and contract duration. A collaborative platform partner will be receptive to discussing flexible arrangements.

Scalability and Support: Planning for Growth

Think about the long-term implications of your platform choice. Can the platform scale to support your growth as your portfolio expands? Does the provider offer dependable customer support to help you overcome challenges?

Also, consider platform integration capabilities. Can it integrate with your existing CRM, accounting software, or other essential tools? Seamless integrations enhance efficiency and eliminate data silos.

Choosing the right real estate syndication platform is a crucial investment in your future success. By defining your needs, thoroughly evaluating your options, and performing diligent research, you can find a platform that helps you achieve your investment goals.

Ready to experience a user-friendly real estate syndication platform? Explore Homebase today and discover how we can streamline your operations, build stronger investor relationships, and maximize your returns.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.