12 Best Compliance Management Software for 2025

12 Best Compliance Management Software for 2025

Discover the 12 best compliance management software solutions for 2025. In-depth reviews for real estate syndication, GRC, and enterprise needs.

Domingo Valadez

Aug 12, 2025

Blog

In today's complex regulatory landscape, especially within specialized fields like real estate syndication, staying compliant isn't just a requirement-it's a critical business function. Manual tracking with spreadsheets and endless email chains is a recipe for errors, inefficiency, and significant risk. The right compliance management software transforms this challenge into a streamlined, automated process, safeguarding your operations and building investor trust.

A crucial element of modern compliance management involves meticulous record-keeping, and understanding the best practices for maintaining compliance with workplace entry logs can be invaluable, especially for firms managing physical assets or office locations. This attention to detail extends across all regulatory obligations, from SEC filings to investor accreditation and reporting. With a market flooded with options, from niche tools to enterprise-level GRC (Governance, Risk, and Compliance) suites, how do you choose?

This guide cuts through the noise. We will provide an in-depth analysis of the 12 best compliance management software options available, focusing on their specific strengths, practical use cases for real estate syndication, and honest limitations. We've done the heavy lifting to move beyond marketing claims, offering a clear view of how each platform functions in a real-world setting. Each review includes screenshots and direct links, so you can evaluate the options for yourself. Whether you're a growing syndicator or part of a large enterprise, this resource is designed to help you identify the perfect solution to protect and scale your business.

1. Homebase

Homebase solidifies its position as a top-tier choice by offering an all-in-one, purpose-built platform specifically designed to master the complexities of real estate syndication. It distinguishes itself by integrating compliance management directly into the core workflows of fundraising and investor relations, transforming it from a burdensome task into a seamless, automated process. For syndicators seeking a robust system that grows with them, Homebase provides an unparalleled combination of power, simplicity, and affordability.

The platform was engineered by real estate operators to solve their own challenges, a background that is evident in its intuitive design. This focus ensures every feature directly addresses a syndicator's real-world needs, from initial capital raising to final distributions, making it one of the best compliance management software solutions available for this niche.

Why Homebase is Our Top Pick

Homebase earns its spot by centralizing every critical function of real estate syndication into a single dashboard. This eliminates the need for disjointed systems like spreadsheets, separate e-signature tools, and generic CRM software. Its automated workflows for Know Your Customer (KYC) checks and accreditation verification are deeply integrated, ensuring regulatory requirements are met efficiently without disrupting the investor onboarding experience. The platform’s ability to manage secure document distribution, complete with e-signatures, creates an auditable trail that is invaluable during compliance reviews and tax season.

Key Features & Analysis

- Integrated Compliance Workflows: Automatically handle KYC and accreditation verification as part of the investor onboarding process, reducing manual effort and error.

- Centralized Investor Portal: Offers a professional, secure deal room where investors can review offering documents, e-sign agreements, and track their investment's performance.

- Automated Fundraising & Distributions: Streamlines the entire capital lifecycle, from raising funds via a branded portal to calculating and executing investor distributions.

- White-Glove Migration: Homebase provides dedicated support to move your existing deals and investor data onto their platform, minimizing downtime and ensuring a smooth transition.

Pricing & User Experience

Homebase offers a refreshingly simple pricing model: a flat $250 per month for unlimited deals and investors. This predictable, scalable fee structure is a significant advantage for both new and established syndicators, removing financial penalties for growth. The user interface is clean and intuitive, designed to reduce the learning curve. Coupled with its 24/7 customer support, the platform delivers a premium experience from onboarding to daily operations.

Real-World Impact: Syndicators can shift their focus from administrative chaos to strategic growth. Instead of manually tracking accreditation statuses in a spreadsheet or chasing signatures via email, Homebase automates these critical compliance checkpoints, freeing up valuable time to find deals and nurture investor relationships.

Pros & Cons

Website:https://www.homebasecre.com/

2. G2

While not a compliance software itself, G2 is an indispensable starting point for any real estate syndicator’s vendor selection process. It is a massive B2B software marketplace that aggregates verified user reviews, allowing you to compare and contrast dozens of the best compliance management software options based on real-world feedback. For a syndication firm needing to benchmark different platforms against specific needs like investor reporting or SEC regulation tracking, G2 provides the necessary data.

Its powerful filtering system is a key advantage. You can narrow down the extensive Governance, Risk & Compliance (GRC) category by company size, user satisfaction ratings, specific features, and even compliance frameworks relevant to real estate finance, like SOX. This helps you move from a broad list to a manageable shortlist of qualified vendors.

Using G2 Effectively

The platform’s side-by-side comparison grids are particularly useful for visualizing feature differences between top contenders. For instance, you can directly compare how two different platforms handle audit trail logging or policy management.

G2 excels at cutting through marketing jargon by providing access to unfiltered reviews from actual users. This peer-driven insight is crucial for understanding a platform's true strengths and weaknesses before committing to a demo.

Key Considerations

- Best For: Initial research, vendor shortlisting, and comparing features using verified user data.

- Pricing: G2 provides price range estimates, but exact quotes almost always require contacting the vendor directly for a demo.

- Pros: Deep volume of current, verified reviews; excellent comparison tools and filtering.

- Cons: Category can be broad, mixing niche tools with enterprise GRC suites; pricing data is often not transparent.

Access the GRC Category on G2: https://www.g2.com/categories/governance-risk-compliance

3. Capterra

Similar to G2, Capterra is a comprehensive software marketplace that serves as an excellent research hub for discovering the best compliance management software. It offers broad coverage of tools suited for SMB and mid-market real estate syndication firms, making it particularly useful for those who find enterprise-focused platforms overwhelming. Its strength lies in its user-friendly interface and curated lists that help accelerate the initial vendor discovery process.

Capterra’s filtering capabilities are robust, allowing syndicators to narrow their search by specific features, deployment type (cloud vs. on-premise), pricing model, and even by industry. This allows a firm to quickly find solutions that align with its operational structure and budget constraints, such as identifying cloud-based tools with free trial options that handle regulatory change management.

Using Capterra Effectively

The platform’s curated “Shortlist” and “Top Picks” reports are a major advantage. These reports use a data-backed methodology to highlight top-rated products in the compliance category, giving you a pre-vetted starting point and saving significant research time.

Capterra excels at simplifying the initial search phase with clear pricing badges (like "Free Trial" or "Free Version") and intuitive comparison tools, making it easy to build a practical list of potential vendors for demos.

Key Considerations

- Best For: Fast vendor discovery, comparing SMB-focused tools, and finding software with transparent pricing models like free trials.

- Pricing: Capterra is free to use for buyers. It often provides pricing bands and highlights free versions, though specific quotes require vendor contact.

- Pros: Easy-to-use filters for building a vendor list quickly; good for discovering emerging and mid-market compliance software.

- Cons: Enterprise-level feature depth can vary widely between listings; some higher-ranked listings may be paid placements.

Access the Compliance Category on Capterra: https://www.capterra.com/compliance-software/

4. Gartner Peer Insights

Similar to G2 but with a distinct enterprise focus, Gartner Peer Insights provides analyst-curated market research alongside verified user reviews. For a growing real estate syndication firm concerned with scaling its compliance operations, this platform offers a valuable perspective on how the best compliance management software performs in large, complex corporate environments. It moves beyond simple feature lists to provide a strategic view of a vendor's market position and long-term viability.

The platform’s strength lies in its highly structured review process and its focus on specific markets, such as "Corporate Compliance and Oversight Solutions." This allows syndicators to evaluate tools through the lens of large-scale governance, risk, and compliance (GRC) strategies, which is critical when planning for significant portfolio growth and attracting institutional capital.

Using Gartner Peer Insights Effectively

Focus on the platform's "Product Comparison" and "Alternatives" tabs within a specific market category. This provides a Gartner-vetted list of direct competitors, helping you understand the established players and emerging challengers relevant to your needs, such as managing complex fund structures or adhering to multiple regulatory frameworks.

Gartner Peer Insights is unparalleled for validating a vendor's enterprise-readiness. The reviews from practitioners at large corporations offer high-signal insights into a platform’s ability to handle scale, integration complexity, and robust security requirements.

Key Considerations

- Best For: Validating enterprise-grade solutions, understanding market leaders, and accessing reviews from large-scale practitioners.

- Pricing: Access to full, in-depth reviews and analyst reports often requires a Gartner subscription or creating a free user account.

- Pros: High-quality, verified reviews from enterprise users; strong focus on corporate governance and oversight; analyst-backed market context.

- Cons: Skewed towards larger vendors, making it less useful for finding niche or SMB-focused tools; many full reviews are gated behind a login.

Access the Corporate Compliance Category on Gartner: https://www.gartner.com/reviews/market/corporate-compliance-and-oversight-solutions

5. AWS Marketplace

For real estate syndication firms deeply integrated with Amazon Web Services, AWS Marketplace is a powerful procurement hub. It allows you to purchase, deploy, and manage a wide range of GRC and compliance tools with the significant advantage of consolidated billing through your existing AWS account. This streamlined process removes friction from vendor onboarding and financial management, a key benefit for tech-forward syndicators.

Unlike a pure review site, AWS Marketplace is transactional. It features standardized product pages detailing pricing, usage models, and support information, bringing a level of transparency often missing in the B2B software space. This makes it an efficient platform for evaluating and deploying some of the best compliance management software designed for cloud-native environments, which is increasingly relevant as firms adopt cloud-based investor portals and data rooms.

Using AWS Marketplace Effectively

The "Private offers" feature is particularly valuable for syndication firms, enabling negotiated pricing and terms directly with software vendors. This enterprise procurement workflow can lead to significant cost savings and customized contracts that align with your firm's specific compliance and operational needs.

AWS Marketplace excels at simplifying the procurement lifecycle for companies already operating within the AWS ecosystem. The ability to find, try, and buy compliance software with unified billing and deployment streamlines what is often a complex, multi-step process.

Key Considerations

- Best For: AWS-centric firms looking to simplify procurement and consolidate billing for cloud-native compliance tools.

- Pricing: Often provides transparent, upfront pricing, including pay-as-you-go and annual subscriptions. Private offers allow for custom quotes.

- Pros: Consolidated AWS billing and simplified procurement; private pricing negotiations; faster vendor onboarding and deployment.

- Cons: Strongly AWS- and cloud-oriented, making it less useful for on-premise setups; some software listings may require seller approval before use.

Access AWS Marketplace:https://aws.amazon.com/marketplace

6. Microsoft AppSource

For real estate syndication firms deeply embedded in the Microsoft ecosystem, AppSource is the go-to marketplace for finding compliance solutions. It specializes in business applications that integrate directly with Microsoft 365, Dynamics 365, and Azure. This focus on native integration means you can discover and deploy tools that leverage your existing identity, data, and security infrastructure, significantly reducing implementation friction and IT overhead.

The platform’s strength lies in its ability to surface specialized apps that extend Microsoft's own compliance capabilities. Syndicators can find solutions for specific needs, such as tracking investor communications for FINRA compliance within Outlook or managing legal documents within SharePoint. This makes it an excellent resource for finding the best compliance management software that complements your current Microsoft-based workflows rather than replacing them.

Using AppSource Effectively

Utilize the "Compliance & Legal" category filter to immediately narrow the vast marketplace. Look for apps with clear pricing indicators, free trials, and a high number of positive reviews. Pay close attention to the publisher details and any available case studies to gauge the vendor's reliability and expertise in regulated industries like real estate finance.

The tight integration with Microsoft Entra ID (formerly Azure AD) is a major security and administrative benefit. It allows for seamless single sign-on (SSO) and centralized user management, ensuring that only authorized team members can access sensitive compliance data.

Key Considerations

- Best For: Firms heavily invested in Microsoft 365, Azure, or Dynamics 365 seeking integrated, add-on compliance tools.

- Pricing: Varies widely, from free trials and per-user subscriptions to "Contact me" for enterprise quotes. The platform clearly indicates the purchasing model for each app.

- Pros: Tight integration with Microsoft cloud and identity infrastructure; straightforward tenant deployment.

- Cons: Quality and security depth vary widely by vendor; some apps are services or point solutions rather than full GRC suites.

Access the Compliance Category on AppSource:https://appsource.microsoft.com/en-us/marketplace/apps?category=compliance-legals

7. Salesforce AppExchange

For real estate syndication firms already built on the Salesforce platform, the AppExchange is a critical resource. It functions as Salesforce’s dedicated app marketplace, offering a wide array of specialized applications designed to extend the platform’s core capabilities into compliance management. Instead of a single monolithic solution, it provides point solutions for specific needs like audit trail management, data privacy, permissions governance, and policy attestations that integrate directly with your existing CRM data.

This native integration is the AppExchange’s primary advantage. Syndicators can find tools that work with their existing investor, property, and financial data models without complex migrations. Listings feature user ratings, release information, and crucially, a security review status, providing an initial layer of vetting for any app you consider adding to your tech stack. This makes it one of the best compliance management software ecosystems for Salesforce-centric firms.

Using Salesforce AppExchange Effectively

Leverage the curated collections and categories, such as those for privacy or financial services compliance, to quickly find relevant apps. It's essential to treat the AppExchange as a starting point; always schedule demos and conduct a proof-of-concept to ensure an app meets your specific workflow for investor relations or regulatory reporting.

The AppExchange’s key value is its ability to plug compliance gaps directly within your primary operating system. This avoids data silos and allows you to build a customized, integrated compliance framework piece by piece.

Key Considerations

- Best For: Syndication firms standardized on Salesforce needing to add specific compliance functions.

- Pricing: Varies widely from free and freemium apps to enterprise-level subscriptions requiring a direct quote.

- Pros: Deep, native integration with Salesforce data and workflows; all listings undergo a security review.

- Cons: Many are point solutions, potentially requiring multiple apps to build a complete program; quality and scope can vary significantly between vendors.

Access the Salesforce AppExchange:https://appexchange.salesforce.com/

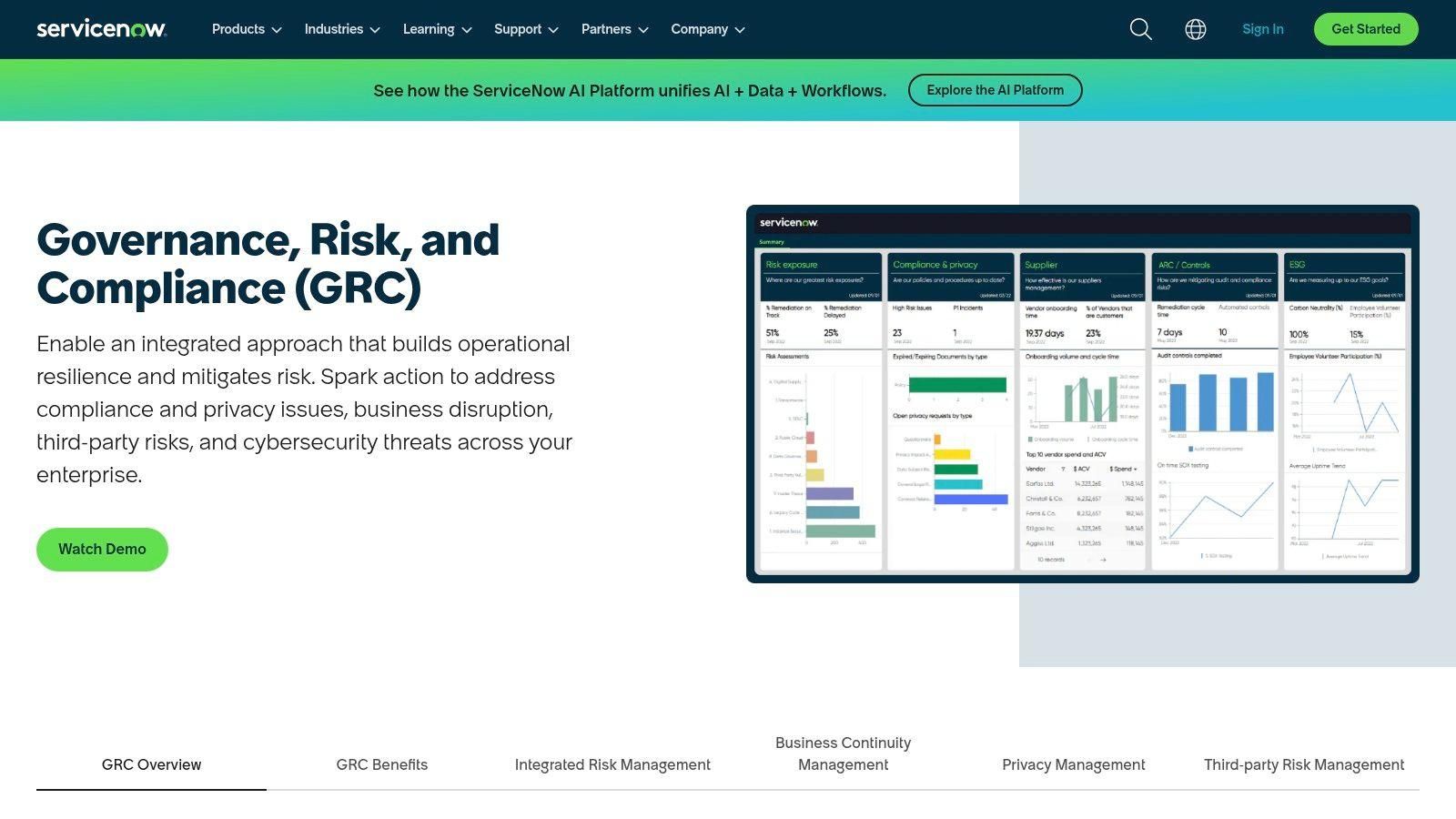

8. ServiceNow

For large-scale real estate syndication firms or those operating within a parent company that requires enterprise-level oversight, ServiceNow offers a powerful, integrated Governance, Risk, and Compliance (GRC) solution. It excels at connecting compliance obligations not just to policies but directly to the underlying IT assets and operational workflows, making it one of the best compliance management software choices for complex, technology-driven organizations. This platform transforms compliance from a siloed checklist into a unified, automated business function.

Its core strength lies in its ability to automate control testing and provide continuous monitoring across the entire organization. For a syndicator, this means that controls related to data privacy (like investor PII) or financial reporting can be linked to the specific IT systems that manage them. When a system configuration changes, compliance teams are automatically alerted to potential issues, providing a proactive rather than reactive stance on risk.

Using ServiceNow Effectively

Leverage the platform’s integrated nature by connecting the GRC module with IT Service Management (ITSM) and Security Operations (SecOps) if they are in use. For instance, an identified compliance gap from an audit finding can automatically generate a ticket for the IT team to remediate, with the entire lifecycle tracked within a single system.

ServiceNow’s single data model and workflow engine provide unparalleled visibility and automation, allowing compliance activities to be embedded directly into day-to-day business and IT processes. This eliminates manual handoffs and ensures accountability.

Key Considerations

- Best For: Large syndication firms or enterprises needing to integrate compliance management deep into IT and operational workflows.

- Pricing: Enterprise-level pricing requires direct consultation and is customized based on the modules and number of users.

- Pros: Exceptional workflow automation capabilities; provides a unified platform for GRC, IT, and security; highly scalable for complex compliance programs.

- Cons: High cost and significant implementation effort; overkill for smaller firms and likely requires dedicated internal resources to manage.

Access ServiceNow GRC: https://www.servicenow.com/products/governance-risk-and-compliance.html

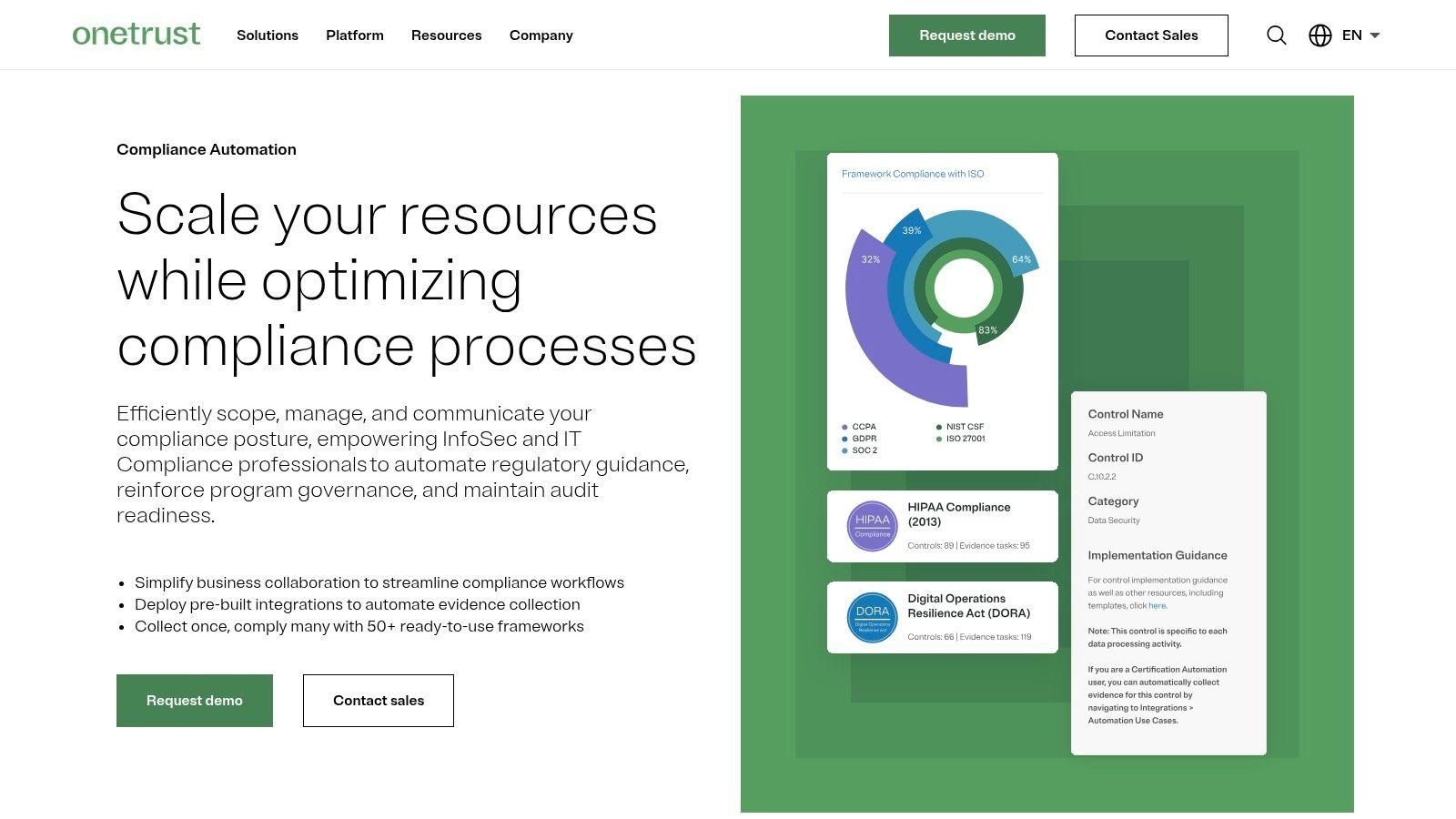

9. OneTrust

OneTrust offers a powerful compliance automation platform designed around a "collect once, comply many" philosophy. For real estate syndicators managing diverse investor pools and navigating multiple regulatory landscapes, this approach is invaluable. The platform excels at mapping controls and evidence across over 50 different compliance frameworks, from data privacy laws like GDPR to security standards like SOC 2. This makes it one of the best compliance management software choices for firms looking to centralize and streamline their efforts.

The system’s strength lies in its ability to automate evidence collection through direct integrations with your existing tech stack. Instead of manually chasing down screenshots or reports for an audit, OneTrust can pull the necessary data automatically. This shared evidence framework drastically reduces redundant work when you need to demonstrate compliance with more than one standard, such as satisfying both a lender's security requirements and an investor's privacy expectations.

Using OneTrust Effectively

Leverage the platform’s pre-built templates and guidance content, which translates complex legal and technical controls into actionable requirements. For a growing syndication, this built-in expertise can bridge the gap between regulatory mandates and practical implementation, saving significant time and consulting fees.

OneTrust is particularly effective for firms with significant data privacy and security obligations, allowing them to consolidate overlapping requirements into a single, unified compliance program.

Key Considerations

- Best For: Syndicators needing to comply with multiple frameworks, especially those related to data privacy and security.

- Pricing: Pricing is entirely quote-based and depends on the specific modules and usage levels required.

- Pros: Extensive framework coverage with deep content resources; excellent automated evidence collection and framework mapping.

- Cons: Can be expensive and may require dedicated internal resources to fully leverage its automation capabilities.

Access OneTrust Compliance Automation:https://www.onetrust.com/products/compliance-automation/

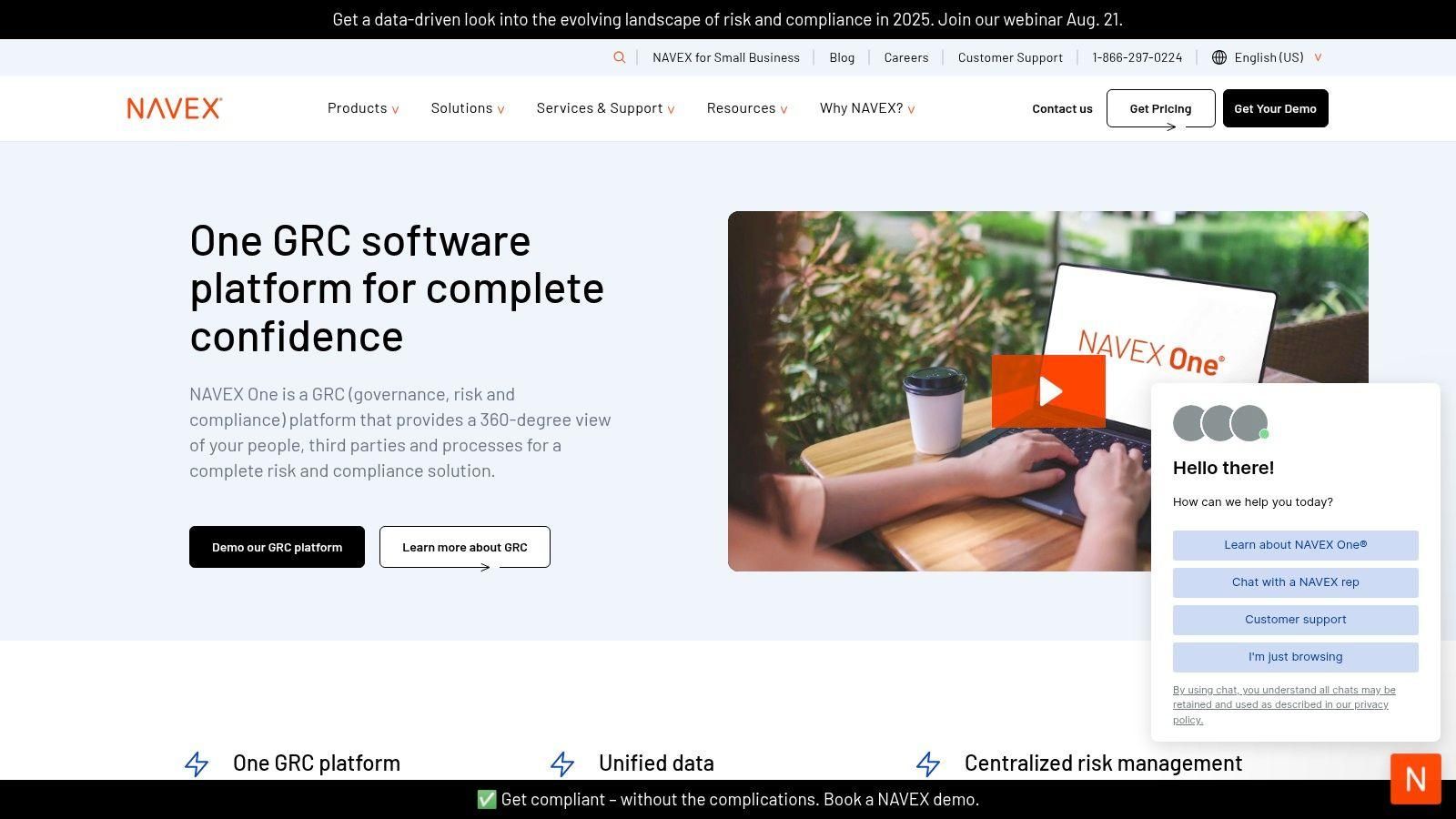

10. NAVEX One

NAVEX One offers an integrated platform that bundles several critical compliance functions into a single ecosystem. This makes it a powerful option for syndication firms looking to consolidate their compliance efforts, moving from disparate point solutions to a unified strategy. The platform combines policy management, ethics training, third-party risk assessment, and incident management, providing a holistic view of the firm’s compliance posture.

For a growing real estate syndication, NAVEX One can help standardize processes across the organization. For example, its policy lifecycle management ensures that investor communication policies are consistently updated and acknowledged, while its whistleblower and case management tools provide a secure channel for reporting potential issues, a key component for maintaining investor trust and regulatory adherence.

Using NAVEX One Effectively

Leverage the integrated analytics to connect dots between different risk areas. For instance, you can correlate data from third-party due diligence on a contractor with incident reports to identify high-risk vendor relationships. This comprehensive approach is a core benefit of using an integrated suite, and you can learn more about its place in the ecosystem of modern compliance management solutions.

NAVEX One stands out as one of the best compliance management software options for firms seeking a mature, all-in-one system. It transitions compliance from a reactive checklist to a proactive, integrated business function.

Key Considerations

- Best For: Established firms needing a comprehensive, integrated risk and compliance suite that covers training, policy, and incident management.

- Pricing: Custom quote-based pricing. The comprehensive nature of the suite means the total cost will likely be higher than individual point solutions.

- Pros: Mature, widely adopted compliance suite; strong training and reporting capabilities; integrated platform view of risk.

- Cons: Broad suite may lead to a higher total cost; requires significant implementation and change management to realize full value.

Access the NAVEX One Platform:https://www.navex.com/en-us/platform/

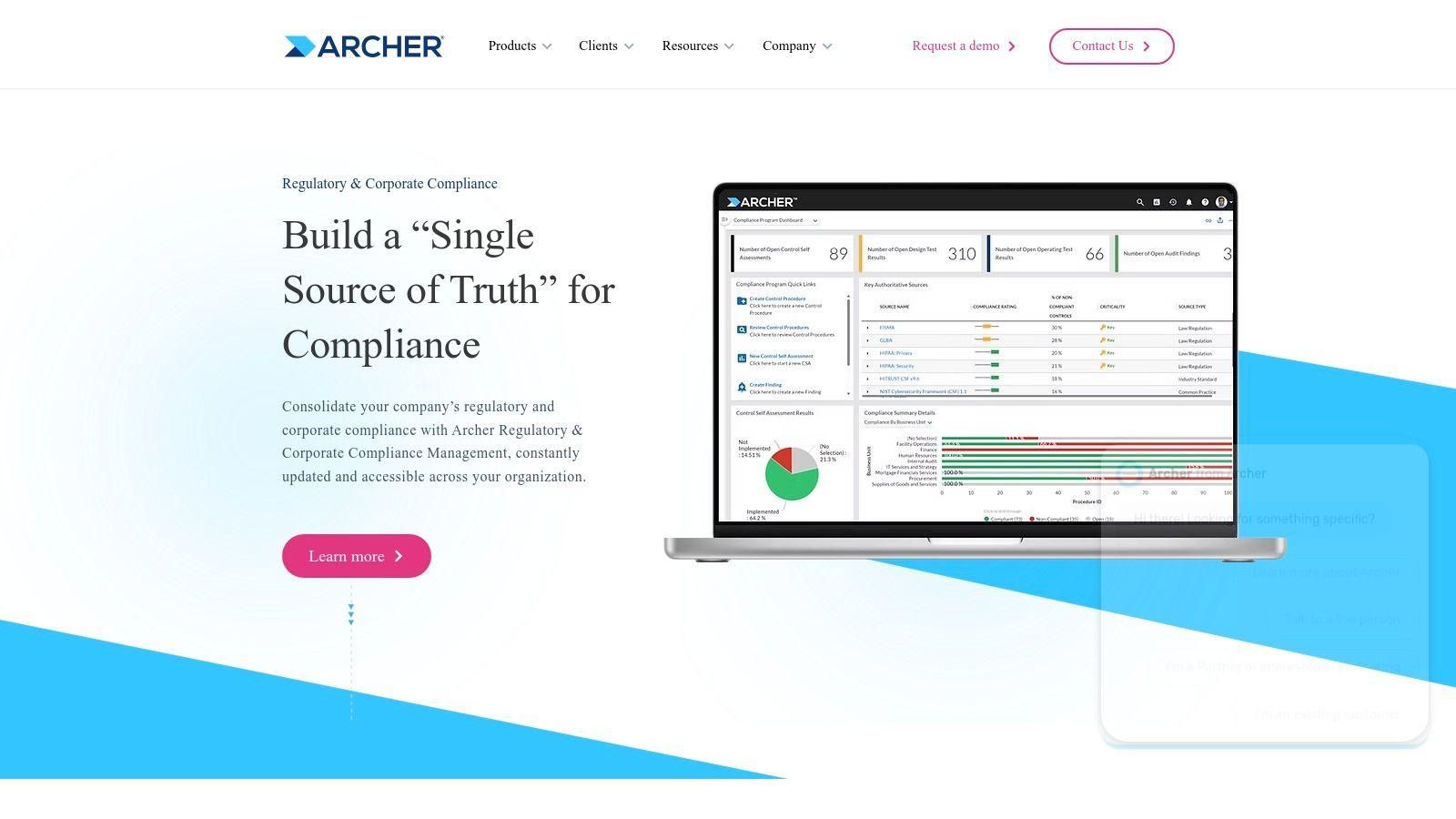

11. Archer

Archer is a heavyweight enterprise Governance, Risk, and Compliance (GRC) platform designed for large organizations operating in heavily regulated industries. For a growing real estate syndication firm that has scaled significantly, Archer provides the infrastructure to centralize complex regulatory obligations, automate control testing, and manage firm-wide policies. It offers a single, authoritative repository for all compliance-related data, from regulatory feeds to internal control evidence.

Its strength lies in its ability to manage the entire compliance lifecycle. The platform uses automated workflows to streamline tasks like control testing, issue identification, and remediation tracking, reducing manual effort and improving audit readiness. With add-ons for specific domains like privacy management (e.g., CCPA, GDPR), financial controls relevant to SOX, and even emerging areas like AI governance, Archer is one of the best compliance management software options for firms with enterprise-level needs.

Using Archer Effectively

The platform’s user-specific reporting dashboards are a key feature. A compliance officer can have a high-level view of regulatory risks and control effectiveness, while a fund manager can see a dashboard tailored to the compliance status of their specific assets. This customization ensures that stakeholders get relevant information without being overwhelmed by data.

Archer excels at creating a unified compliance framework that connects regulatory requirements directly to internal policies and controls. This mapping provides clear lineage, making it easier to demonstrate compliance to auditors and regulators.

Key Considerations

- Best For: Large, established syndication firms or funds managing complex portfolios across multiple jurisdictions with heavy regulatory burdens.

- Pricing: Pricing is entirely enterprise-based and requires direct consultation and a quote. It is not publicly disclosed.

- Pros: Deep and established GRC capabilities; strong for complex regulatory environments; highly customizable workflows and dashboards.

- Cons: Implementation is resource-intensive and can be complex; pricing structure is not transparent and geared towards large enterprises.

Access Archer's Compliance Solutions:https://www.archerirm.com/reg-corp-compliance-management

12. IBM OpenPages

IBM OpenPages is a powerful, enterprise-grade GRC platform designed for large organizations navigating complex regulatory landscapes. For a substantial real estate syndication firm or a fund manager with a sophisticated portfolio, it provides an institutional-level framework for managing compliance. Its core strength lies in its modular approach, allowing firms to implement specific solutions for policy management, regulatory change tracking, or internal controls without deploying the entire suite at once.

The platform excels at centralizing compliance data, enabling you to map regulations directly to internal controls and policies. This creates a clear audit trail and simplifies demonstrating compliance with financial regulations like those from the SEC. Its ability to integrate with regulatory intelligence feeds from sources like Thomson Reuters or Wolters Kluwer automates the overwhelming task of tracking regulatory updates.

Using IBM OpenPages Effectively

A key use case for a large syndicator is leveraging the policy lifecycle management module. You can automate the entire process from policy creation and review to distribution and employee attestation, ensuring every team member acknowledges critical compliance documents. This documented process is invaluable during audits.

IBM OpenPages is one of the best compliance management software options for firms that require a highly structured and scalable system. It moves beyond simple task management to create an interconnected web of regulations, risks, controls, and policies.

Key Considerations

- Best For: Large-scale real estate funds and syndicators with complex compliance needs and dedicated GRC teams.

- Pricing: Enterprise-level pricing requires direct consultation and is tailored to specific module deployments.

- Pros: Robust, scalable data model; strong capabilities for financial services; modular design allows for phased implementation.

- Cons: Significant deployment effort and cost; likely too complex and expensive for smaller syndication firms.

Access IBM OpenPages:https://www.ibm.com/products/openpages/regulatory-compliance

Top 12 Compliance Software Feature Comparison

Choosing the Right Compliance Partner for Growth

Navigating the landscape of compliance management software can feel overwhelming. We've explored everything from broad discovery platforms like G2 and Capterra, which are excellent starting points for market research, to massive enterprise-grade Governance, Risk, and Compliance (GRC) suites like NAVEX One and Archer. While these powerful GRC systems offer immense capabilities, their complexity, lengthy implementation cycles, and significant cost often represent overkill for the specific, nuanced needs of a real estate syndication business.

The key takeaway from our deep dive is this: selecting the best compliance management software is not about finding a one-size-fits-all "winner." It's about conducting a strategic self-assessment of your firm's unique scale, operational workflows, and growth trajectory. The ideal solution is one that fits your current processes while providing the scaffolding to support your future ambitions without burdening you with unnecessary features or exorbitant fees.

Recapping Your Options and Making a Strategic Choice

For real estate syndicators, the decision-making process boils down to a few core pathways. You can begin with discovery platforms and peer review sites to get a lay of the land, but this is merely the first step. The true choice is between adapting a generic, large-scale GRC platform or adopting a purpose-built solution designed for your industry.

Enterprise tools like IBM OpenPages or ServiceNow are built for large corporations managing a vast array of global regulatory frameworks. While incredibly robust, they require significant customization and dedicated internal teams to manage. For a syndicator focused on SEC regulations, investor relations, and capital management, this approach is like using a sledgehammer to crack a nut; it's powerful but inefficient and unwieldy for the task at hand.

Key Factors for Real Estate Syndicators

When evaluating your options, move beyond generic feature lists and focus on the practical realities of running your syndication business. Here are the most critical factors to guide your decision:

- Investor Experience: Does the platform provide a professional, secure, and intuitive portal for your investors? A clunky or confusing interface can erode investor confidence before a deal even closes. Look for features like a branded portal, easy document access, and clear communication tools.

- Workflow Automation: Your primary compliance burdens involve fundraising, investor onboarding, and ongoing reporting. The right software should automate accreditation verification, facilitate e-signatures for subscription documents, and streamline the distribution and K-1 delivery processes.

- Specialized vs. General: Does the software understand the language and flow of real estate syndication? A platform that treats a real estate investor the same as a retail customer will create more work for you, not less. A purpose-built tool will have these specialized workflows already built in.

- Scalability and Cost: Consider both your current needs and your five-year plan. A solution should grow with you, allowing you to manage more investors, more deals, and more complex capital stacks without forcing a costly and disruptive migration to a new system down the road.

Ultimately, the most effective compliance strategy for a growing real estate syndication firm is to adopt a tool that acts as a central operational hub. It should not only tick the compliance boxes but also enhance efficiency, elevate the investor experience, and free up your most valuable asset: your time. This allows you to shift your focus from administrative minutiae to high-value activities like finding new deals, nurturing investor relationships, and strategically growing your portfolio.

Ready to move beyond generic tools and adopt a platform built specifically for the demands of real estate syndication? Discover how Homebase combines robust compliance management with an all-in-one investor portal to streamline your operations and accelerate your growth. See why top syndicators trust Homebase to manage their entire deal lifecycle, from fundraising to distributions.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.