Essential Real Estate Compliance Checklist: Your Guide to Legal Success

Essential Real Estate Compliance Checklist: Your Guide to Legal Success

Master real estate compliance with our comprehensive checklist. Learn proven strategies for managing documentation, trust funds, and regulations while minimizing risks and maintaining legal excellence.

Domingo Valadez

Feb 13, 2025

Blog

Understanding Real Estate Compliance Fundamentals

Real estate compliance requires following a set of federal, state and local regulations that govern property transactions. Having a clear compliance checklist helps real estate professionals conduct transactions properly and protect both themselves and their clients.

Key Elements of a Real Estate Compliance Checklist

A solid compliance checklist needs to cover several important areas. It should verify property details like address and transaction type. The checklist must also confirm the correct jurisdiction, since rules can vary significantly between locations.

Environmental regulations are another essential component, including checks for hazardous materials and energy efficiency standards. The checklist should include a thorough property tax review to check for liens or unpaid taxes. Verifying title deeds and ownership is critical to ensure the buyer receives clear title to the property.

Importance of Data in Real Estate Compliance

Good record-keeping is essential for showing compliance with regulations. Research shows that 68% of real estate brokerages have compliance problems due to inadequate data management. For more information, see data's impact on real estate compliance. Organized records that are easy to access during audits help demonstrate proper compliance.

The Role of Technology in Compliance

Modern software helps real estate professionals manage compliance more effectively. Tools like Homebase provide features for document storage, automated workflows, and reporting. This automation improves accuracy while giving agents more time to focus on clients. Regular monitoring through technology helps catch potential compliance issues early. A well-designed tech system creates lasting compliance benefits.

Managing Trust Funds and Financial Compliance

Managing trust funds properly is essential for real estate professionals. This section covers the key aspects of handling client funds and maintaining financial compliance, with practical guidance on implementing effective systems and processes.

Segregating and Protecting Client Funds

The foundation of trust fund management is keeping client money completely separate from business operating accounts. Just like having two distinct bank accounts - one for your business and another solely for client funds. This clear separation helps prevent mixing of funds and ensures client money stays protected if business financial issues arise.

Implementing Foolproof Accounting Procedures

Accurate accounting is vital when managing trust funds. Every transaction needs clear documentation and regular account reconciliation helps catch issues early. Modern tools like Homebase can help automate these processes while reducing manual errors.

Creating Audit-Ready Documentation Systems

Good documentation proves compliance during audits. Your system should make finding any transaction record quick and simple. Keep organized digital copies of bank statements, deposit slips, and related communications. A clear paper trail builds client trust and makes audits smoother. Trust fund violations commonly occur due to poor record-keeping - for example, California regulators often find inadequate beneficiary records in trust accounts. Learn more at Agora Real.

Automating Compliance Tasks While Maintaining Oversight

While software helps with efficiency, human review remains essential. Use technology to assist with compliance tasks but don't rely on it entirely. Regular manual reviews of automated reports and periodic internal audits help ensure ongoing regulatory adherence. This balanced approach reduces risks while maintaining high standards.

Establishing Trust Fund Protocols

Written protocols create a framework for consistent trust fund handling. Document every step from receiving to disbursing client funds. Include guidance for specific situations like disputed funds or overdrawn accounts. Clear procedures help staff understand their roles and support a culture of compliance. Following these practices carefully helps real estate professionals maintain client trust and manage funds appropriately.

Documentation and Record-Keeping Requirements

Good record-keeping forms the foundation of real estate compliance. Beyond just avoiding penalties, proper documentation helps build trust with clients and makes your business run smoothly. A well-designed real estate compliance checklist puts documentation at the forefront.

Building a Solid Record-Keeping System

Your record-keeping approach needs to be organized, easy to access, and secure. This means having clear systems for both paper and digital files. Homebase can help manage digital documents and streamline workflows by creating a central hub for important information.

- Digital Storage: Set up cloud storage or secure servers for digital document copies

- Paper Files: Keep organized physical copies as backup and for documents needing original signatures

- File Organization: Create a clear system to quickly find specific documents

Managing Different Document Types

Each type of document needs specific handling procedures. For example:

- Contracts: Store digital copies with backups and ensure all parties have signed versions

- Financial Records: Keep detailed transaction records including statements and receipts

- Disclosure Forms: Make all client disclosures easily accessible

- Communications: Track all transaction-related emails and calls

Tools and Best Practices

The right technology makes record-keeping much easier. Homebase offers features like automated storage, e-signatures, and audit tracking. Other key practices include:

- Regular Backups: Back up both digital and paper files to prevent data loss

- Access Rules: Set clear rules about who can access sensitive information

- Storage Timeline: Define how long to keep different documents to avoid clutter while staying compliant

Good documentation turns what could be a burden into a business advantage. With proper systems, you'll be ready for audits and can focus on growing your business and serving clients well. Remember - careful record-keeping is essential for running a compliant real estate operation.

Implementing Compliance Training and Monitoring

A solid real estate compliance checklist depends entirely on proper staff training and execution. Regular training sessions and monitoring help maintain high standards and can give your brokerage a strong competitive advantage.

Creating Engaging Compliance Training Programs

Make compliance training interactive and practical rather than a tedious annual requirement. Use real-world examples, case studies, and scenarios that show how compliance rules apply in daily work. Add game-like elements to increase participation and help staff retain key concepts. When training is engaging, agents better understand and apply compliance principles.

Monitoring Compliance Without Micromanaging

The key is finding the right balance between oversight and agent independence. Set up systems to track essential compliance activities like document completion and trust fund handling without creating distrust. Digital tools like Homebase can automate monitoring and flag potential issues early, reducing the need for constant manual checks.

Utilizing Technology for Effective Tracking

Modern compliance tools simplify monitoring and reporting. For example, Homebase provides central dashboards to track training completion, document submissions, and compliance tasks. This makes it easier to keep records organized and ensure everyone meets their requirements. The data also helps demonstrate compliance during audits and shows where improvements are needed.

Building a Culture of Compliance

Strong compliance comes from a workplace culture that values doing things right. Encourage open discussion about compliance matters and set clear expectations. Recognize staff who consistently meet compliance standards. When everyone takes ownership of compliance, it becomes a natural part of daily operations rather than a burden.

Technology Solutions for Compliance Management

Managing real estate compliance has become simpler with modern technology. Many leading brokerages now use software tools to handle compliance tasks and reduce risk. Using digital systems helps firms follow their real estate compliance checklist more accurately and efficiently.

Choosing the Right Compliance Management Software

The right software makes a big difference in compliance success. Key features to look for include automated workflows, document storage, and reporting tools. For example, automated systems can ensure proper sequencing of required steps like disclosures and verifications. This helps prevent mistakes and maintains alignment with the real estate compliance checklist. Secure document storage also makes audit preparation much easier.

Integration Strategies for Enhanced Workflows

For technology to work well, it needs to connect smoothly with existing systems like CRM and transaction platforms. This prevents data from getting stuck in separate silos. When compliance software links to CRM, it can automate client onboarding and required communications. This coordinated approach helps teams follow the real estate compliance checklist without missing steps.

Staff Training and Technology Adoption

Proper training is essential for staff to use new systems effectively. Providing thorough initial training and ongoing support helps employees feel confident with the software and use it to improve their work. This includes teaching specific features and being available to answer questions as they come up. Learn more: How to master modern compliance management solutions.

Measuring ROI and Implementation Timelines

Understanding costs and benefits helps justify technology investments. Track key metrics like reduced violations, improved efficiency, and cost savings to show the software's value. Having realistic timelines for implementation sets proper expectations. Some companies report a 20% reduction in compliance costs after adding dedicated software.

Leveraging Automation for Key Compliance Tasks

Automation helps manage many compliance requirements efficiently. Features like automated deadline reminders, document generation, and reporting reduce manual work while improving accuracy. For instance, automated alerts help ensure teams meet deadlines for licenses, disclosures and other requirements in the real estate compliance checklist. This frees up compliance staff to focus on strategic work like assessing risks and developing policies.

Key Takeaways and Action Steps

Understanding real estate compliance is critical for your brokerage's success. Here's how to put that knowledge into action with a practical real estate compliance checklist.

Prioritizing Compliance Implementation

Start by examining your current compliance status and identifying gaps between your practices and regulatory requirements. Just like inspecting a building's foundation, this assessment helps prevent future issues. Focus first on critical areas like trust fund handling and fair housing practices, then create a plan for other updates.

- Step 1: Complete an internal compliance review

- Step 2: Identify top priorities based on risk levels

- Step 3: Create an implementation timeline with specific deadlines

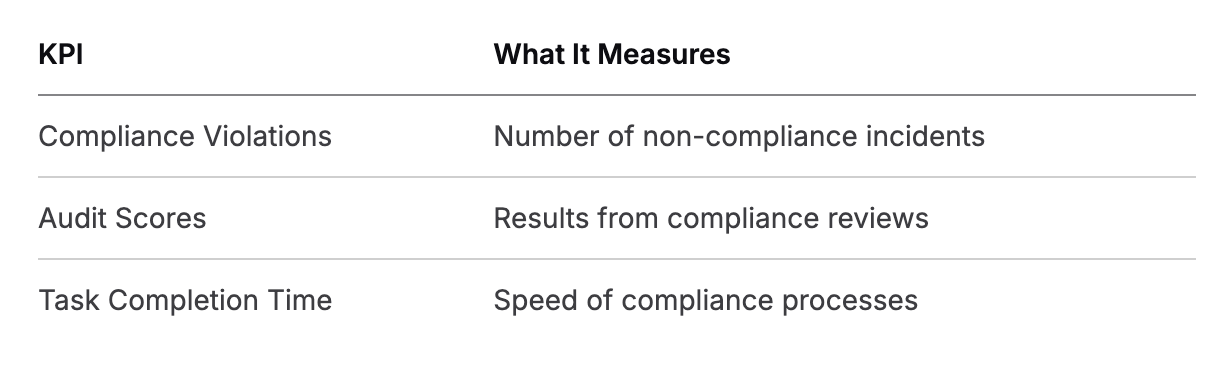

Measuring Compliance Success with KPIs

Track your compliance program's effectiveness using Key Performance Indicators (KPIs). These metrics help show the real impact of your compliance efforts, similar to measuring marketing results. Focus on key data points like violation numbers, audit performance, and task completion times.

Maintaining Compliance with Regular Checkups

Think of compliance like regular car maintenance - it needs ongoing attention to prevent problems. Set up a schedule to review policies, conduct internal audits, and update training materials. Regular reviews help you stay current with changing regulations and avoid costly penalties.

Using Technology for Better Compliance

The right technology makes compliance management simpler and more efficient. Homebase handles many routine compliance tasks automatically, letting your team focus on growing the business. With features like automated workflows, document management, and reporting tools, Homebase helps keep your real estate compliance checklist current.

Want to make compliance work better for your business? Discover how Homebase can support your compliance needs.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.