Property Management Software Comparison Guide

Property Management Software Comparison Guide

Our property management software comparison helps you choose the right platform. Compare features, pricing, and real-world use cases for top solutions.

Domingo Valadez

Aug 16, 2025

Blog

Choosing the right platform in a property management software comparison is more than just a tech upgrade. It's a core business decision that can fundamentally change how you operate. The best software for you really hinges on your portfolio size, the types of properties you manage, and where you want to take your business, helping you shift from constantly putting out fires to proactively managing your assets.

Why Choosing Property Management Software Is Critical

If you're still wrestling with spreadsheets and manual data entry, you know how hard it is to scale. The right software acts as a central hub for your entire portfolio, bringing tenant communication, financial tracking, and maintenance requests into one unified system. This integration breaks down information silos and lifts the administrative weight that holds so many businesses back.

This isn't just about making life easier; it’s about securing your spot in a booming market. The global property management software market is expected to jump from USD 27.95 billion in 2025 to a staggering USD 54.16 billion by 2032. That kind of growth signals a massive industry shift toward automation, making software a must-have to keep up. You can discover more insights about these market trends on globenewswire.com.

Key Evaluation Criteria for Your Comparison

To help you make a smart choice, I'll be comparing each platform using the same core criteria. Getting a handle on these pillars will make it much clearer which solution actually fits your day-to-day needs.

- Core Features: We’ll dig into the essentials, like accounting, tenant screening, and how they handle maintenance workflows.

- Pricing and Scalability: I'll look at the real costs and whether the software can grow alongside your portfolio without breaking the bank.

- Usability and Support: A platform is useless if your team can't figure it out. We’ll assess the user experience and the quality of customer support.

- Integrations and Security: We'll see how well each platform plays with other tools you might be using and how seriously they take data protection.

The real goal here is to find a platform that solves today's headaches while paving the way for tomorrow's growth. The 'best' software is simply the one that fits your business, whether you’re managing five single-family homes or a 500-unit apartment building.

Ultimately, this property management software comparison is built to give you clarity. By breaking down the real strengths and weaknesses of each option, you can feel confident in your decision, knowing it’s grounded in what these platforms can actually deliver for your business and your bottom line. I’ll lay it all out with detailed, side-by-side analyses to make this tough decision a whole lot simpler.

What Really Matters in Property Management Software?

When you're trying to pick the right software, a simple feature checklist won't cut it. Two platforms can both claim they have "accounting tools," but how they actually work in the real world can be night and day. A proper property management software comparison has to go deeper than the sales pitch.

It’s all about the details. Understanding the nuance is the difference between a tool that creates more work and one that genuinely makes your life easier and your business safer. Let's dig into the most important functions and what you should really be looking for.

Getting the Money Right: Accounting and Financial Tools

Your accounting system is the engine of your entire operation. This isn't just about seeing what came in and what went out; it’s about staying compliant and keeping your numbers straight. The biggest dividing line you’ll find is between basic bookkeeping and full-blown trust accounting.

- Standard Bookkeeping: This works perfectly fine if you're a landlord managing your own properties. It’s built for simple profit-and-loss tracking.

- Trust Accounting: If you manage properties for other people, this is non-negotiable. This feature keeps owner funds, security deposits, and your operating cash in separate digital "buckets," preventing commingling—a massive legal and financial risk.

A platform with solid trust accounting will automatically handle the ledgers for each owner and property. This makes sure every dollar is accounted for and turns what could be a nightmare of an end-of-month reporting process into a few simple clicks.

The single biggest mistake a new or growing property management company can make is picking a software without true trust accounting. It’s a compliance bomb waiting to go off, and cleaning up the mess can take months and lead to serious legal trouble.

More Than a Score: Tenant Screening and Onboarding

Pretty much every platform says it does tenant screening, but the quality of that screening varies wildly. A basic check might just pull a credit score, leaving you to do the rest of the legwork. A truly powerful system gives you the full story on an applicant.

What you want are direct integrations with the big three credit bureaus—TransUnion, Equifax, and Experian. That way, you get a detailed credit history, not just a score. A top-tier platform will bundle that with:

- Nationwide Eviction History: This is a huge red flag you can't afford to miss.

- Criminal Background Checks: Gives you a more complete picture of who you're renting to.

- Income Verification: The best tools can connect directly to an applicant's bank (with their permission, of course) to confirm their income. This all but eliminates the risk of fraudulent pay stubs.

The difference is real. A simple check might give a thumbs-up to a tenant who looks good on paper, while a comprehensive screening would have uncovered a pattern of late payments and a past eviction, saving you thousands in lost rent and legal fees.

Maintenance Workflows: From Manual to Automated

Maintenance is another area where the software's depth makes all the difference. A basic platform might just give tenants a form that sends you an email. A fully automated system, on the other hand, can run the entire process for you.

Think about this common scenario: it’s 10 PM and a tenant reports a leaky pipe.

- With a Basic System: An email lands in your inbox. In the morning, you have to call your plumber, play phone tag with the tenant to schedule a time, and then manually enter the invoice once the job is done.

- With an Automated System: The tenant submits a work order in their online portal. The software instantly categorizes it, alerts your preferred plumber, and lets the vendor coordinate directly with the tenant. When the work is finished, the plumber uploads their invoice to a vendor portal for your approval.

The automated system takes you out of the middle, gets repairs done faster, and keeps a perfect digital record of everything. It's not just about efficiency; it boosts tenant satisfaction. In fact, property managers using these systems report an 84% increase in tenant happiness. Quick responses and clear communication are what keep good tenants around, and that directly impacts your bottom line.

Comparing the Leading Property management Platforms

Now we get to the heart of the matter: a direct, feature-by-feature comparison of the top property management software. The right choice hinges on understanding not just what a platform does, but who it's designed for. After all, a feature that's a lifesaver for a large multifamily operator might just be expensive overhead for a landlord with a few single-family homes.

This breakdown is designed to give you that critical context. We're going to move past generic pro-and-con lists to dig into the specific scenarios where each of these platforms really comes into its own. By looking at established industry leaders and modern challengers side-by-side, you'll get the detailed perspective you need to build a confident shortlist.

AppFolio: The All-In-One Powerhouse for Growth

AppFolio is often the first name that comes to mind for mid-to-large-sized portfolios, and there's a good reason for that. It’s built as a complete ecosystem, aiming to handle every single facet of property management within one unified interface. This is its greatest strength and what truly sets it apart.

Instead of relying on third-party services bolted on, AppFolio has developed most of its core functions in-house. This includes seriously robust accounting with corporate and trust account capabilities, advanced marketing and leasing tools, and even utility management services. The user experience is consistently praised, earning it a 4.6-star rating on G2, which speaks volumes about its usability despite its powerful feature set.

However, this all-in-one approach doesn't come cheap. AppFolio generally has higher minimum monthly fees and per-unit costs, making it a serious investment for smaller operators. It’s really built for property management companies with 50 or more units that need a professional-grade, scalable system to manage growth across diverse property types like residential, commercial, and student housing.

Buildium: A Flexible Solution for Mixed Portfolios

For property managers who need a blend of power and flexibility, Buildium presents a compelling alternative. It offers a similarly comprehensive set of features, covering everything from online rent collection and maintenance requests to tenant screening and solid accounting.

Where Buildium really stands out is its slightly more modular design. It provides strong core functionality but gives you the option to add on services like property inspections and eLeasing as your needs evolve. This lets managers tailor the platform to their specific operations without paying for a bunch of features they'll never touch. Its reporting capabilities are also top-notch, giving you deep insights into portfolio performance.

One of Buildium's biggest advantages is its laser focus on community association management. For anyone handling HOAs or condo associations, its specialized tools for tracking violations, managing board communications, and dealing with association fees are a game-changer that many competitors just don't offer.

This makes Buildium a fantastic choice for managers with mixed portfolios. If your business juggles a combination of residential rentals and community associations, Buildium provides the specialized tools for both under one roof—a massive operational win.

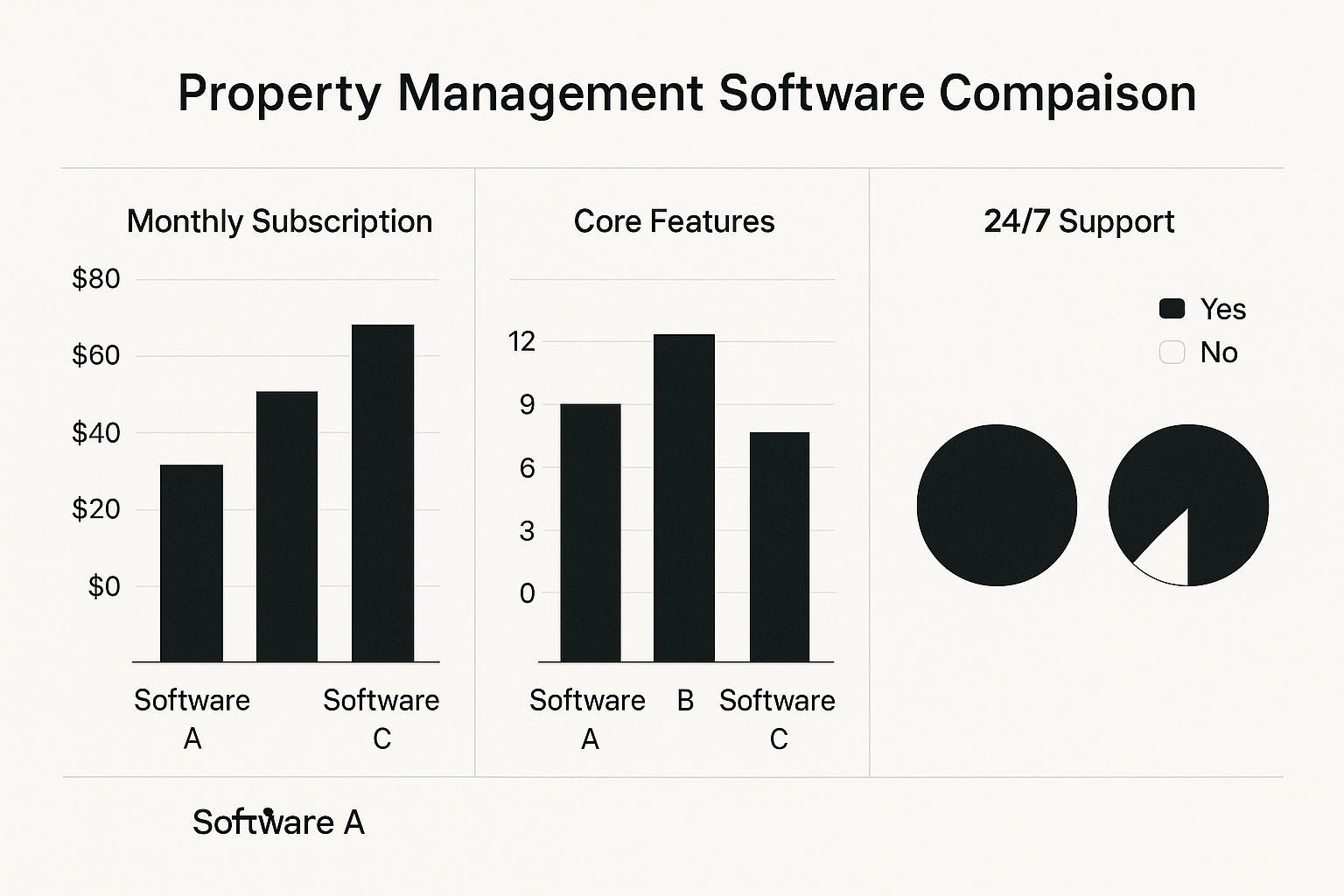

To see how these platforms measure up on core metrics, the chart below compares their costs, key features, and support options.

This visual breakdown clearly shows the trade-off between cost and feature depth, helping you pinpoint the solution that fits your budget and operational complexity.

TenantCloud: The Accessible Choice for DIY Landlords

On the other end of the spectrum, we have TenantCloud, a platform built from the ground up for smaller landlords and those just getting their feet wet. Its biggest draw is its affordability; it even offers a free tier for managing up to 75 units with all the basic functions. This makes the barrier to entry practically non-existent.

TenantCloud handles the essentials quite well. You get online rent collection, maintenance request tracking, and straightforward financial reporting. It has a simple, clean interface that’s easy to get the hang of—perfect for someone who doesn’t need or want the complexity of an enterprise-level system. Users seem to agree, giving it a 4.3-star rating on Capterra for its no-fuss approach.

The trade-offs, of course, come with its limitations:

* Limited Accounting: It lacks the sophisticated trust accounting needed if you're managing properties on behalf of other owners.

* Fewer Integrations: It doesn't connect with as many third-party tools, which can put a cap on your automation potential.

* Basic Reporting: The financial reports are fine for tax time but don't offer the deep analytical tools found in more advanced platforms.

TenantCloud is the ideal solution for the DIY landlord managing their own properties. If you have fewer than 20 units and just need a simple, cost-effective way to get organized, collect rent, and handle maintenance, it’s an outstanding choice that won't empty your wallet.

At-a-Glance Feature Comparison of Top PMS Platforms

To make sense of the key differences, it helps to see the core offerings laid out side-by-side. This table provides a high-level comparison of what each platform brings to the table, who it serves best, and how it's priced.

This quick overview highlights the distinct purpose of each software. As you can see, the "best" choice is entirely dependent on your business model—from hands-on landlord to large-scale investment manager.

Homebase: The Specialist for Real Estate Syndicators

While most platforms are busy with the day-to-day operations of property management, Homebase has carved out a unique niche by zeroing in on investment management. It's built for real estate sponsors and syndicators who need to manage deals, raise capital, and communicate with investors—a critical function that traditional PMS tools often gloss over.

Homebase provides a secure investor portal where sponsors can share deal documents, manage subscriptions, and handle distributions. Its features are tailor-made for the syndication lifecycle, including tools for KYC/AML checks, accreditation verification, and e-signatures for legal documents. The real value here is centralizing investor relations, which for many is a chaotic mess of spreadsheets, email chains, and Dropbox folders.

With a flat-fee pricing model of $250/month for unlimited deals and investors, Homebase is designed to grow with a syndicator’s business. It’s not meant to replace AppFolio or Buildium for day-to-day property operations. Instead, it’s either a complementary tool or the primary platform for firms whose main business is capital and investment management, not just rent collection. It's helpful to see these platforms within the broader ecosystem of the best business process automation tools that can streamline different parts of your operation.

Making Your Final Decision

This comparison reveals a clear pattern: there is no single "best" platform. There's only the platform that best fits your specific business model, both for today and for where you plan to be tomorrow.

Here’s a quick guide to help you decide based on our analysis:

1. For Large-Scale Growth: If you're managing over 50 units and need an all-in-one system with top-tier support to scale professionally, AppFolio is a top contender.

2. For Mixed Portfolios: If you're juggling a combination of residential properties and community associations and need a flexible, powerful platform, Buildium has the specialized tools you're looking for.

3. For DIY Landlords: If you own and manage a small portfolio and your priorities are affordability and simplicity, TenantCloud gives you all the essentials without the high cost.

4. For Real Estate Syndicators: If your main game is raising capital and managing investor relations, Homebase is the specialized platform built for your exact workflow.

By matching your real-world needs to the core strengths of each software, you can choose a partner that won’t just solve today's problems but will also support your long-term success.

Analyzing Platform Security and Data Compliance

It’s easy to get caught up in fancy features and slick dashboards when you’re doing a property management software comparison. But if a platform can’t protect your data, none of that matters. Security and compliance aren't just technical details for the IT department; they're massive business risks. One data breach can trigger crippling financial penalties, drag you into legal battles, and shatter the trust you’ve built with clients and tenants.

Think about the sheer volume of sensitive information you handle every day—from tenant social security numbers to owner financial statements. Protecting that data is non-negotiable. When you’re looking at software, you have to dig deeper than the marketing promises and really investigate the security architecture. That means understanding how the platform encrypts data, both when it's moving and when it's stored, and what they do to keep unauthorized eyes out.

Understanding Deployment Models and Their Security Implications

How the software is actually set up—in the cloud, on your office servers, or a bit of both—has a huge impact on your security and how much control you have. Each approach has its own pros and cons, and you need to find the one that matches your company's comfort level with risk.

- Cloud-Based (SaaS): This is the go-to for most operators. The software provider handles all the servers, security patches, and updates. It’s incredibly convenient, but it also means you’re putting a whole lot of trust in their security measures.

- On-Premises: With this model, you install and run the software on your own servers. You get total control over your data, but that also means you're on the hook for every bit of security, maintenance, and system updates. It's a heavy lift.

- Hybrid Model: This approach tries to give you the best of both worlds. You might use the cloud for everyday tasks but keep your most sensitive data stored locally on your own servers, striking a balance between convenience and control.

The market is definitely telling a story here. While the global property management software market was valued near USD 6.0 billion in 2025, it’s the hybrid deployment models that are growing the fastest, with a projected CAGR of 13.9%. This trend shows a clear industry-wide push to balance operational agility with ironclad data security. The catastrophic 2024 Real Estate Wealth Network breach, which exposed over 1.5 billion records, was a brutal reminder of the risks and has only accelerated the demand for tougher cybersecurity. You can explore the full analysis of market trends and security demands on mordorintelligence.com.

A platform's security is only as strong as its weakest link. A crucial but often overlooked feature is user access control. The ability to set granular permissions—ensuring a leasing agent can't access owner financials, for instance—is essential for minimizing internal risks.

Core Security Features You Cannot Overlook

Beyond how it’s deployed, any software worth considering needs to have a few non-negotiable security features built in. A solid defense is all about layers, protecting your data from different kinds of threats.

When you’re making your choice, make sure the platform checks these boxes:

- Two-Factor Authentication (2FA): This simple step adds a critical barrier against unauthorized logins.

- Regular Security Audits: Good software companies aren't afraid to have their security tested by outside experts and will share the results.

- Compliance Certifications: Look for official stamps of approval like SOC 2. It shows the company is serious about handling data securely and privately.

- Secure Document Storage: All those leases, applications, and financial reports need to be encrypted and stored in a secure vault.

In the end, choosing a platform is also choosing a security partner. Don't be shy about asking direct questions about their security protocols and what their plan is if a breach ever happens. The time you spend on this due diligence is an investment in your company’s future stability and reputation.

How to Choose the Right Software for Your Portfolio

Picking the right property management software isn't about finding the one with the longest feature list. It's about finding the one that actually fits how you work. The "best" platform is the one that solves your biggest headaches without adding new ones. This decision is all about matching the right tool to your specific job.

The market is exploding for a reason—everyone has different needs. Recent reports show the property management software market is expected to jump from USD 5.32 billion in 2025 to a massive USD 16.83 billion by 2035. This isn't just about convenience; it's also about staying compliant. As regulations like fair housing laws get more complex, operators are turning to software to manage risk. Choosing a platform that takes these rules seriously is no longer optional.

Finding the Right Fit for You

To cut through the noise, think about which of these profiles sounds most like you. Knowing who you are as an operator makes it much easier to narrow down the options.

- The DIY Landlord (1-15 Properties): You're hands-on with a small portfolio. What you need is simplicity and a tool that won't break the bank. Your main goals are to get rent paid on time, track your expenses, and manage the occasional maintenance call without getting bogged down in complex software. A platform like TenantCloud is built for this—it gives you the essentials, often for free or a very low cost.

- The Growth-Focused Manager (50-500+ Units): You're running a professional operation and need a system that can keep up as you grow. Advanced trust accounting, built-in marketing tools, and serious automation are at the top of your list. You need something that can handle volume and complexity, which is where a powerhouse like AppFolio really shines.

- The Real Estate Investment Sponsor: Your world revolves around managing investors, not tenants. You're focused on raising capital, communicating with your partners, and handling distributions for your deals. A specialized platform like Homebase is your best bet, since it’s designed specifically for the syndication lifecycle with features like a secure investor portal. This is a complex niche, and our guide on real estate investment management can give you a much deeper dive.

Your Step-by-Step Decision Framework

Once you know your type, use this simple framework to make a smart, confident choice. This will take you from a long list of possibilities to the one perfect fit.

- Define Your Must-Haves and Budget: Before you even look at a website, write down the top five things you absolutely cannot live without. Is it rock-solid trust accounting? A polished owner portal? A specific integration? Then, set a realistic monthly budget you're comfortable with.

- Create Your Shortlist: Armed with your must-haves, go back through the comparisons in this guide and pick 2-3 platforms that seem like a good match for your persona and budget.

- Schedule Live Demos: This is the most important step. Don't settle for a pre-recorded webinar. Get a live person on a call who can walk you through the software and answer questions about your specific workflow.

Pro Tip: During the demo, pick your most annoying, time-consuming daily task and ask them to show you exactly how their software solves it. If they stumble or can't give you a clear answer, that’s a major red flag.

- Ask the Tough Questions: Dig deeper than just features. Ask about their data migration process—how do you get your information into their system? What's the average wait time for a customer support ticket? Are there hidden fees for setup or training? A smooth onboarding experience is just as important as the software itself. As you nail down your core platform, you might also look at other tools to boost your marketing, like these AI social media content generators for real estate.

Following these practical steps will help you tune out the marketing hype and find a software partner that genuinely makes your business run better.

The Nitty-Gritty: Answering Your Final Software Questions

Okay, you've narrowed down the field. Now it's time to get practical. Moving from a big-picture comparison to the specifics of cost, setup, and how a platform will fit into your daily workflow is the final hurdle. Let's dig into the common questions I hear from managers and landlords right before they make their choice.

Getting clear answers here is non-negotiable. This is where you uncover hidden fees, potential setup nightmares, or realize a platform just doesn't align with where you want your business to be in a few years.

What’s This Actually Going to Cost Me?

The price tag on property management software is all over the map, depending entirely on the size of your portfolio and the features you actually need. Most companies use one of a few pricing models, so it's important to figure out which one makes the most sense for your cash flow.

- Per-Unit-Per-Month: This is probably the most common. You’ll pay a small, predictable fee for each unit you manage, usually somewhere between $1 to $3 per unit.

- Flat Monthly Fee: Lots of platforms have tiered plans. You pay a set price each month, maybe $50 to $400, which covers a certain number of units or unlocks specific features.

- Percentage of Rent: Some services tie their fee directly to your revenue, taking a small slice of the rent you collect. This can be great because their cost scales with your income.

But please, don't stop at the subscription fee. You absolutely have to ask about the other costs. Are they going to charge you for setup? For migrating your data? What about training your team or unlocking that advanced accounting module you need? The only way to truly compare apples to apples is by calculating the total cost of ownership.

How Painful Is the Setup Process?

Getting a new system up and running can be as simple as a few hours of setup or as complex as a multi-week project. It really depends on the platform. No matter what, you're looking at three main stages: getting your data in, configuring the system to your liking, and training your team.

A messy transition can bring your operations to a grinding halt, so you need to grill potential vendors on their onboarding support. Find out if you get a dedicated person to walk you through it. Ask them exactly what data formats they can import so you don't have to re-enter years of tenant and lease info by hand. A vendor with a well-oiled, supportive onboarding process is worth its weight in gold.

The thing most people forget about implementation is the people. You can have the best software in the world, but it’s useless if your team isn’t trained well and doesn’t actually want to use it. Make sure any vendor you consider has solid training resources.

Will This Software Play Nicely with My Other Tools?

Yes, for the most part. Modern platforms are built to connect with the other software you’re already using through an API (Application Programming Interface). This is a game-changer for efficiency because it means you aren't stuck typing the same information into five different systems.

A few of the most common integrations you'll want to look for are:

* Accounting Software: Direct links to tools like QuickBooks or Xero.

* Listing Services: Pushing your vacancies out automatically to sites like Zillow and Apartments.com.

* Smart Home Technology: Connecting with smart locks, thermostats, and other devices that make your properties more attractive.

Before you sign anything, make a list of your can't-live-without tools. Then, confirm the new software has a direct integration or at least a flexible API you can work with. This step ensures your new platform becomes the central hub of your operations, not just another siloed piece of tech.

Managing real estate investments involves more than just tenants and maintenance; it requires clear communication and streamlined processes for your capital partners. Homebase provides the specialized tools real estate syndicators need to manage deals, raise capital, and deliver exceptional investor experiences.

Discover how Homebase can simplify your investment management today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.