Cap rate calculation rental property: A Practical Guide to Smart Investments

Cap rate calculation rental property: A Practical Guide to Smart Investments

Master the cap rate calculation rental property with a clear guide to NOI, market data, and underwriting strategies that boost returns.

Domingo Valadez

Dec 28, 2025

Blog

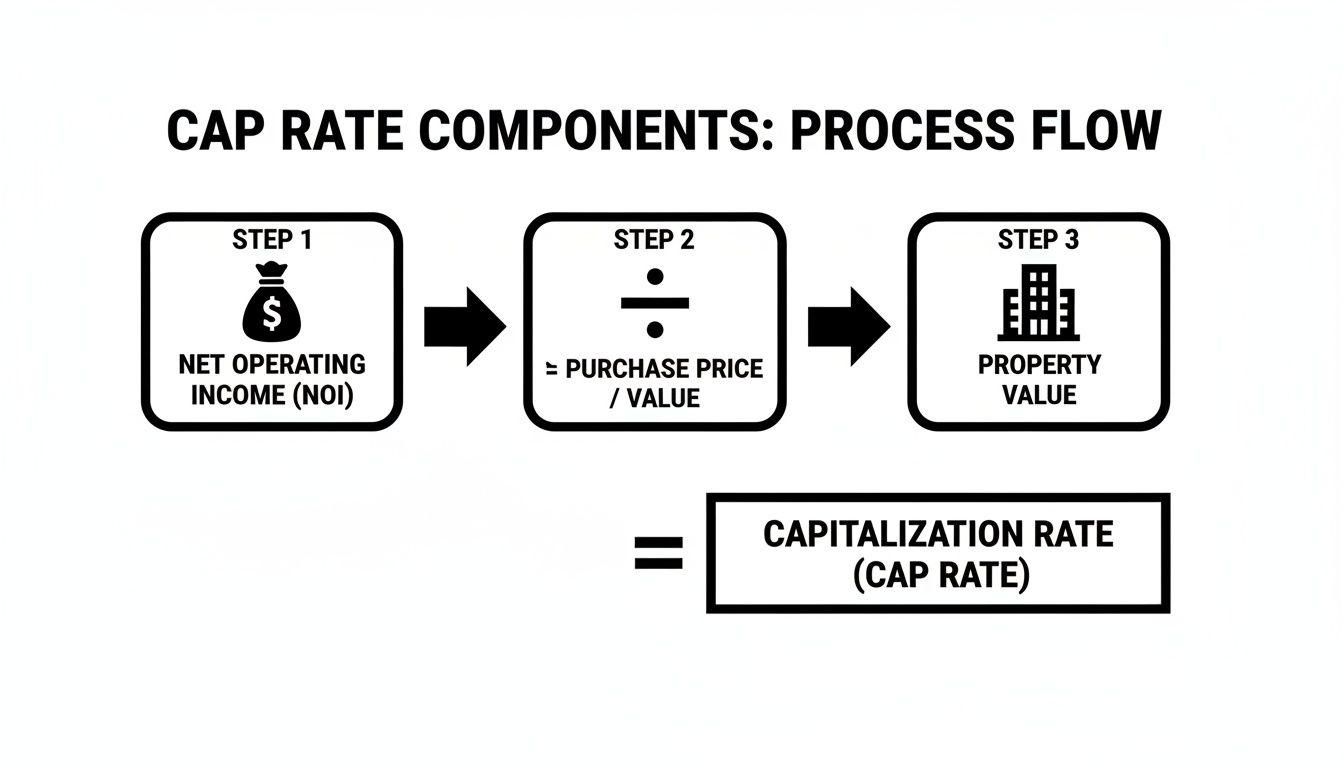

At its core, calculating the cap rate for a rental property is pretty simple: you just divide the Net Operating Income (NOI) by the property's market value. But don't let that fool you—this single number is one of the most powerful tools in an investor's arsenal, giving you a quick, clean look at an asset's potential annual return before you even think about a loan.

Why Cap Rate Is Your Most Important Metric

Let's get one thing straight: the cap rate isn't just another piece of financial jargon. It’s the metric that separates the pros from the amateurs. When I'm looking at a deal or talking to a potential partner, the cap rate is the common language we use to instantly communicate value and risk. Nailing your cap rate calculation for a rental property is fundamental to making smart, confident investment decisions.

The beauty of the cap rate is that it measures the unlevered rate of return. It shows you exactly how profitable a property is based purely on its own operations, completely separate from any financing. This is crucial because it isolates the asset's performance, giving you a true measure of its income-generating power.

Understanding Market Dynamics

Cap rates are never set in stone; they breathe with the market, shifting with interest rates, investor demand, and the overall economic climate. A lower cap rate generally points to a less risky, more stable asset in a high-demand area. On the other hand, a higher cap rate often signals more risk but also the potential for a much juicier return.

Just look at the multifamily market for a perfect example of this in action. The bull run from a few years back pushed cap rates down to historic lows, averaging just 4.5% between 2020 and 2022. But as the market shifted, cap rates shot up by roughly 125 basis points between 2022 and 2024, landing at an average of 5.75%—the highest we’ve seen since 2014. These swings tell you a story about what’s happening in the broader economy.

A deal's cap rate is a direct reflection of market sentiment. Mastering this metric is non-negotiable for anyone underwriting deals because it tells you whether you're buying at, above, or below the current market value.

Of course, the cap rate is just one piece of the puzzle. It's a fantastic starting point, but for a truly comprehensive view, you'll want to look at it alongside other metrics. That's why it's also a good idea to learn how to calculate return on investment (ROI) to get the full financial picture of a potential deal.

Nailing Down Your Net Operating Income

The cap rate formula looks simple on paper, but its value is entirely dependent on the quality of the numbers you plug into it. This is where a sharp investor's real work begins: calculating a property’s Net Operating Income (NOI) with absolute precision. Getting this part wrong can quickly turn what looks like a great deal into a money pit. A rock-solid NOI calculation is the bedrock of any sound real estate investment.

First, forget a simple "income minus expenses" approach. A professional analysis always starts with the Gross Potential Rent (GPR). This is the absolute maximum income you could collect if every single unit was rented out at full market rate for the entire year. It’s your theoretical ceiling—the property's total earning power before real-world factors kick in.

Of course, no property ever stays 100% occupied. That’s why the next step is to account for vacancy and credit loss. Don't just pull a number out of thin air. Dig into the property's history and the submarket data. If the local vacancy average is 5%, you'd be fooling yourself to underwrite the deal at 2% just to make the numbers look better. A realistic vacancy factor is your first line of defense against overpaying.

This entire process, from potential income to the final value, is a critical path for any serious investor.

As the diagram shows, a meticulously calculated NOI is the essential bridge connecting a property's income to its actual market value.

Hunt for Every Income Source

Beyond the monthly rent checks, experienced investors know to look for other income streams that can pad the top line. These are easy to overlook but can make a real difference to your NOI.

- Amenity Fees: This includes things like pet fees, reserved parking spots, or charges for using a premium fitness center.

- Utility Reimbursements: Using a system like RUBS (Ratio Utility Billing System) allows you to pass some utility costs back to tenants, reducing your expense load.

- Ancillary Services: Think coin-operated laundry rooms, on-site storage units, or even package-handling services.

These smaller streams add up, giving you a much more accurate picture of the property's total earning potential. For a deeper look into the components of this critical figure, this guide on what is Net Operating Income is a great resource.

Pinpointing Your True Operating Expenses

With your total income tallied, it's time to subtract your operating expenses. This is another area where you simply can't afford to be sloppy. These are all the costs that are necessary to keep the property running day-to-day.

An operating expense is a recurring cost required for the ongoing management and maintenance of the property. It’s crucial not to confuse these with one-time capital expenditures, which are handled very differently.

Here’s a quick checklist of the must-haves:

* Property Taxes: Don't just use the current bill. Anticipate a potential reassessment after the sale, which could significantly increase this number.

* Insurance: Get actual quotes for both property and liability coverage. Don't rely on the seller's old policy.

* Management Fees: Even if you plan to manage it yourself, you must underwrite the deal with a professional management fee (usually 4-10% of gross income). This proves the investment stands on its own and ensures the deal still works if you ever need to hire out.

* Repairs & Maintenance: This covers the routine stuff—fixing leaky faucets, patching drywall, etc. A good rule of thumb is 5-10% of gross income, but you need to adjust this based on the property’s age and condition.

* Utilities: Account for any utilities you, the landlord, are responsible for, like water for common areas or trash collection.

* Administrative & Marketing: This bucket includes the costs of advertising vacant units, legal fees, and other general overhead.

What Not to Include in Operating Expenses

Knowing what to exclude from your NOI calculation is just as important as knowing what to include. Throwing these items into the mix is one of the most common rookie mistakes, and it will completely skew your cap rate.

- Debt Service: Your mortgage payments (principal and interest) are a financing cost, not an operating one. Cap rate is meant to measure the property’s performance independent of how you choose to finance it.

- Capital Expenditures (CapEx): These are the big-ticket items—a new roof, an HVAC replacement, repaving the parking lot. These are accounted for separately, often through a "replacement reserve" fund in your overall financial model.

- Depreciation: This is a "phantom" expense used for tax purposes. It's a non-cash item and has no bearing on the actual cash flow your property generates.

By building your NOI from the ground up—starting with Gross Potential Rent, layering in all other income, and then subtracting a complete and realistic list of operating expenses—you get a figure you can actually trust. That precision is what makes the cap rate a truly powerful tool for evaluating a rental property's potential.

Putting The Cap Rate Formula To Work In The Real World

Okay, you've done the hard work and have a solid Net Operating Income (NOI) figured out. Now for the payoff. The classic cap rate calculation for a rental property is simple on the surface: Cap Rate = NOI / Property Value. But the real art and science come from applying this formula to different deals and truly understanding what the result is telling you.

This isn't just a math problem. It’s a powerful tool for comparing wildly different investment opportunities. A shiny, turnkey apartment building will have a completely different cap rate story than a gritty, value-add property that needs a ton of work. The context is everything.

Different Strategies, Different Numbers

Let's walk through two very different scenarios to see how the cap rate calculation plays out in practice. This will really highlight how your investment strategy shapes your returns and potential.

Scenario A: The Stabilized Class B Apartment Complex

Picture a well-run, 100-unit apartment building in a solid neighborhood. It’s humming along at 95% occupancy with rents just a hair under the market average. It's a steady, predictable asset.

- Property Value:$15,000,000

- Annual NOI:$750,000

- Cap Rate Calculation: $750,000 / $15,000,000 = 5.0%

A 5.0% cap rate like this is pretty standard for a stable, low-risk property. You're not buying a lot of headaches, so the immediate return is consistent but won't knock your socks off. The game plan here is usually about making small operational tweaks and riding the wave of long-term appreciation.

Scenario B: The Value-Add Portfolio

Now, let's look at a portfolio of three smaller buildings, for a total of 50 units. The current management is asleep at the wheel, maintenance has been ignored, and the rents are a good 20% below what they should be.

- Property Value:$5,000,000

- Current Annual NOI:$250,000

- Cap Rate Calculation: $250,000 / $5,000,000 = 5.0%

Hold on—the cap rate is the same? Exactly. On paper, based on today's numbers, it's identical. But this is where experience comes in. The real story is the potential the current numbers don't show. A sharp investor buys this deal based on its future NOI, not the mess it is today.

Cap Rate Calculation Across Different Properties

This table offers a comparative look at how NOI and property value create different cap rates for two distinct investment strategies, illustrating where the risk and opportunity lie in each.

While the initial cap rates match, the journey for each investor is completely different. One is a marathon, the other is a sprint to create value.

Thinking In Terms Of "Going-In" vs. "Exit" Cap Rates

This brings us to a concept that’s absolutely critical for any real estate syndicator or serious investor: the difference between your "going-in" cap rate and your projected "exit" cap rate. The going-in rate is the return based on the price you pay today. The exit rate is your educated guess on what the next buyer will pay for the stabilized property when you sell in a few years.

Your entire investment thesis lives in the gap you create between your going-in cap rate and your exit cap rate. A great value-add plan forces the property's value up, letting you sell at a lower (more desirable) cap rate on a much, much higher NOI.

Let's go back to our value-add deal. After you've completed your renovations and brought in professional management, you've successfully boosted the NOI to $400,000. You look around and see that similar stabilized properties in the area are selling for a 5.5% cap rate.

- Projected Stabilized Value: $400,000 / 0.055 = $7,272,727

You bought the property at a 5.0% cap based on its terrible performance, but you created over $2.2 million in value by improving its operations. This is the core of the value-add strategy. To really get a handle on this, it pays to move beyond just cap rates and focus on mastering various real estate property valuation methods. By projecting both your entry and exit points, you can map out the entire lifecycle of the investment and show your partners exactly how the deal is designed to perform.

How to Interpret What Your Cap Rate Is Telling You

So, you’ve run the numbers and have a cap rate. Great. But what does that number actually tell you? This is where the real skill comes in—the kind that separates the pros from the rookies.

A cap rate isn't just a number on a spreadsheet; it's a story about risk, opportunity, and what the rest of the market thinks about a property. Without the right context, a 6% cap rate could be a home run in one part of town and a total dud just a few miles away.

Risk, Reward, and the Cap Rate Seesaw

The first thing to get is the inverse relationship between cap rate and risk. It's a fundamental concept.

Generally, a lower cap rate signals a safer, more stable investment. Picture a shiny, new Class A building in a prime downtown area with rock-solid tenants. Investors line up to buy assets like that, and they're willing to pay a premium for the stability. This high demand pushes the price up, which in turn pushes the cap rate down.

On the flip side, a higher cap rate usually points to higher perceived risk. Maybe it’s an older building in a C-class neighborhood, or a property that needs a ton of work. The higher potential return is your reward for taking on the extra risk, the headaches, and the work required to turn it around.

Your Deal vs. The Market: Finding Your Bearings

A property's cap rate is pretty useless in a vacuum. Its true power is unlocked when you compare it to the market cap rate—the going rate for similar properties in that specific area. This is your reality check, your benchmark for figuring out if a deal is priced fairly.

- Property Cap Rate > Market Cap Rate: This could be a huge opportunity or a massive red flag. It might mean the current owner is running the property poorly (a classic value-add play!), or it could signal a deep-seated problem with the building that everyone else has already seen. You need to find out which one it is.

- Property Cap Rate < Market Cap Rate: This usually means one of two things: the property is performing exceptionally well, or (more likely) it's overpriced. If you're paying a premium, you better have a very good reason. Is it in a truly superior location? Is it in immaculate condition compared to everything else on the market?

Here's a simple way to think about it: A property listed at a 5.5% cap in what you know is a 6.5% market is overpriced. The sweet spot is finding a property in that 6.5% market that's currently operating at a 7.5% cap because of fixable problems. That's where you make your money.

How the Broader Economy Changes the Game

Cap rates don't exist in a bubble. They're heavily influenced by what's happening in the wider economy, especially with interest rates.

When interest rates are low, borrowing is cheap, and investors are often comfortable accepting lower returns (and therefore, lower cap rates). But when interest rates climb, debt becomes more expensive. To make a deal pencil out, investors need to see higher returns to compensate, which puts upward pressure on cap rates across the board.

We’re seeing this exact scenario unfold in the single-family rental (SFR) market right now. Average SFR cap rates hit 6.8% in the second quarter of 2024, the highest they’ve been since early 2018. That’s a massive jump of 149 basis points from the low of 5.3% back in late 2021. This shift shows that investors are demanding higher yields to offset today's more expensive financing. You can dive deeper into this trend in the Q3 2024 SFR report from Arbor.

Learning to read between the numbers transforms a cap rate from a simple metric into a powerful diagnostic tool. It allows you to quickly size up a deal, understand its place in the market, and spot the difference between a genuine opportunity and an overpriced asset.

Common Cap Rate Calculation Mistakes to Avoid

A precise cap rate calculation for a rental property is your first line of defense against a bad deal. I’ve seen it happen time and again—even experienced investors make simple errors that throw off their entire analysis, causing them to overpay for an asset or completely misjudge its risks. Getting this right is fundamental to protecting your capital and building credibility with any partners you bring to the table.

The number one mistake, hands down, is confusing Net Operating Income (NOI) with cash flow. Newcomers especially tend to subtract the mortgage payment (debt service) when calculating NOI. This is the cardinal sin of underwriting.

Why? Because the cap rate is an unlevered metric. It’s designed to measure the property's raw profitability, completely separate from how you finance it. Including debt service artificially tanks your NOI, making the property look less profitable and resulting in a cap rate that's just plain wrong. Always remember the bright line: NOI = Income - Operating Expenses. Your mortgage payment lives below that line.

Underestimating Your True Expenses

Another classic trap is being too optimistic about your expenses. A seller's pro forma financials are a sales document, and they will almost always downplay or conveniently omit certain costs to make the numbers look better. It's your job to dig deeper.

- Forgetting Management Fees: Planning to self-manage? Great. But you still need to underwrite a professional management fee, typically 4-10% of gross income. This proves the investment can stand on its own two feet and ensures the numbers still pencil out if you ever decide to (or have to) hire a pro.

- Unrealistic Vacancy Rates: Plugging in a 2% vacancy rate when the local market average is 7% is just wishful thinking. Your vacancy assumption has to reflect the reality of your specific submarket, property class, and unit mix.

- Ignoring Maintenance & Reserves: Things break. Roofs leak. HVAC units die. Failing to budget for both routine repairs and major capital expenditures is a rookie move. A solid starting point is to set aside 5-10% of your gross income for these costs, and you should adjust that figure based on the property's age and current condition.

A flawed NOI is the foundation of a bad investment. If your expense assumptions are wrong, every subsequent calculation—from cap rate to cash-on-cash return—will be wrong, too. Diligence here is non-negotiable.

Misinterpreting Market Conditions

Finally, a calculation is useless without context. The cap rate you arrive at only has meaning when compared to the broader market. And that market is always moving.

For example, the entire commercial real estate sector has been repricing due to major shifts in interest rate policy. In Q4 2023, the average cap rate for U.S. office properties was 6.54%, but it’s projected to climb to 7.39% in 2024 as the market continues to adjust. These shifts in one asset class put pressure on others, including multifamily.

You can find more data on these trends in reports like CBRE's Cap Rate Survey. Ignoring these macro-level shifts and using outdated market comps to evaluate a deal is a surefire way to misjudge its true value.

Common Questions I Hear About Cap Rates

When you're getting started with real estate underwriting, a few questions about cap rates always seem to pop up. It’s totally normal. Nailing down these concepts is key to building the confidence you need to analyze deals and talk them through with partners or investors.

Let's walk through the ones I hear most often.

How Does My Mortgage Payment Affect the Cap Rate?

Here’s the short answer: it doesn’t. And that’s by design.

The cap rate is what we call an "unlevered" metric. It's built to measure a property's raw, fundamental profitability, completely separate from any financing. The formula (NOI / Value) deliberately leaves out the mortgage payment (your debt service).

This is a huge advantage because it lets you compare different properties on a true apples-to-apples basis, regardless of how one investor might finance their deal versus another. Once you're ready to analyze a deal with your specific loan, you'll turn to other metrics like the Cash-on-Cash Return.

Should I Use Cap Rate for a Fix-and-Flip?

Probably not. Cap rate is really a tool for evaluating the ongoing income from a stabilized asset—think a fully leased apartment building or a commercial rental. It shines when you're looking at long-term cash flow.

A fix-and-flip is a different animal altogether. Your goal isn't annual income; it's a quick pop of profit from a sale.

For a flip, you’ll want to lean on metrics that actually measure the success of that specific strategy. Your go-to’s will be After Repair Value (ARV) and Return on Investment (ROI), since they directly track the profit you make from the renovation and sale.

What’s the Real Difference Between Cap Rate and ROI?

I like to explain it like this: cap rate is a snapshot, while ROI is the whole movie.

- Cap Rate tells you the property's income yield for a single year, based on its current market value. It’s an annual health check.

- Return on Investment (ROI) is the big picture. It measures your total return—that means rental income plus appreciation—over the entire time you own the property, all compared to what you put in. It's the ultimate measure of a project's profitability from the day you buy to the day you sell.

At Homebase, we build tools to help syndicators manage their deals from start to finish. Our all-in-one platform is designed to get rid of the busywork—streamlining fundraising, investor relations, and distributions so you can focus on what you do best: closing deals. If you're looking to simplify your next syndication, come see what we're all about.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking the Triple Net Lease Meaning for Syndicators

Blog

What is the true triple net lease meaning for investors? Our guide demystifies NNN leases, breaking down the benefits, risks, and underwriting for syndicators.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.