A Guide to Real Estate Investment Management

A Guide to Real Estate Investment Management

Unlock the secrets of real estate investment management. Learn proven strategies for building a profitable property portfolio with our expert guide.

Domingo Valadez

Aug 15, 2025

Blog

Think of real estate investment management as being the general manager for a portfolio of income-generating properties. It's the professional, strategic oversight required to make sure every asset is performing at its absolute best to maximize returns. This involves the entire lifecycle, from scouting and acquiring new properties to optimizing their performance and, eventually, deciding on the perfect time to sell.

What Is Real Estate Investment Management

Let's stick with that sports team analogy for a moment. Imagine your properties are the players on a championship team. The team’s success isn't just about raw talent; it hinges on a savvy general manager who scouts new players, develops the current roster, and makes strategic trades. That’s the core of real estate investment management—a specialized discipline focused on steering a property portfolio toward peak financial performance.

This isn't just about fixing leaky faucets or finding tenants. That's property management. Investment management is the high-level decision-making that guides an investment's entire journey, from beginning to end. A manager in this space analyzes market trends, sources promising deals, lines up financing, and sets the strategic direction for each asset to make sure it aligns with the investor's bigger financial picture.

The Key Players On The Field

Great real estate investment management is a team sport. It requires a few distinct roles working together seamlessly to get the job done.

- The Investor (The Team Owner): This is the person or group putting up the capital. They have a specific return they want to achieve, and they're trusting the management team to make it a reality.

- The Asset Manager (The General Manager): This is the strategic brain of the operation, overseeing the entire portfolio from a 30,000-foot financial view. They craft the overall strategy, manage the money, and make the big calls on what to buy, when to renovate, and when to sell.

- The Property Manager (The Head Coach): This role is all about the day-to-day, on-the-ground execution for a specific property. They're the ones collecting rent, handling maintenance requests, and managing tenant relationships to bring the asset manager's vision to life.

This clear structure ensures that the high-level financial strategy actually drives the daily operational decisions. It creates a straight line from the investor's goals right down to how each property is run.

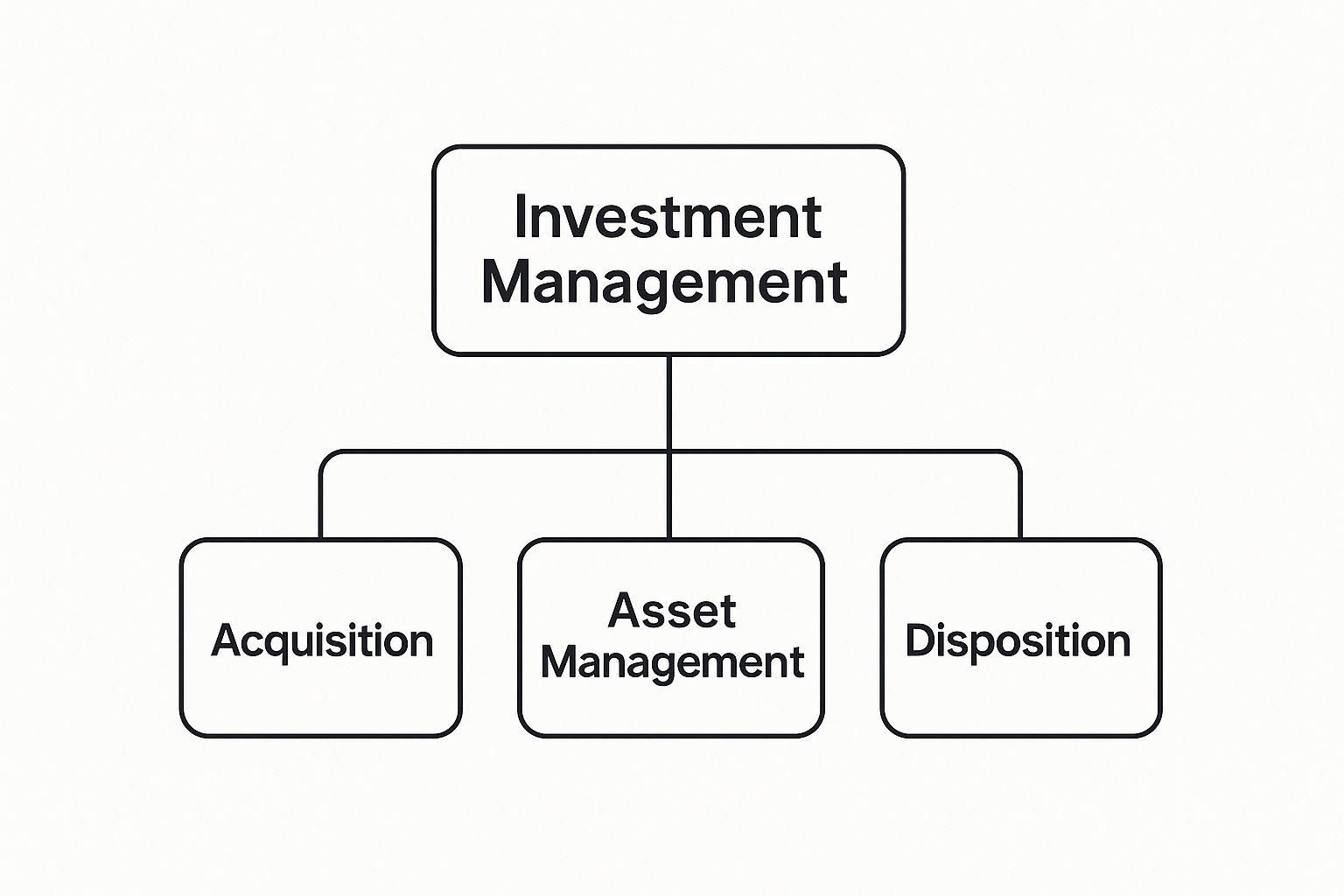

To truly understand how this works, it helps to break down the process into its core functions. The entire lifecycle of an investment property can be viewed through four distinct stages, each with its own set of activities and goals.

Core Functions in Real Estate Investment Management

As the table shows, each stage builds on the last, creating a continuous cycle of acquiring, improving, and monetizing assets. This disciplined approach is what separates casual landlords from professional investors building resilient, high-growth portfolios.

The process is a constant loop of buying smart, managing actively to boost value, and selling strategically to lock in those gains. This structured methodology is the foundation of any successful real estate portfolio. For anyone new to this world, getting a handle on the basics is crucial, which is why checking out some real estate investment tips for beginners can be incredibly helpful.

At its core, real estate investment management transforms passive property ownership into an active, strategic enterprise. It's the difference between merely owning a building and running a sophisticated, income-generating business.

By understanding this framework, you can start to see how professional oversight adds real, tangible value at every step. It’s not just about the old "buy low, sell high" cliché; it's about the detailed, non-stop process of value creation that happens in between.

Building a Winning Property Investment Strategy

A successful real estate portfolio doesn’t happen by accident. It's the direct result of a disciplined, forward-thinking strategy.

Think of it like an architect designing a skyscraper. You wouldn't just start pouring concrete without a detailed blueprint, and the same goes for real estate investment management. Every single decision, from buying a property to eventually selling it, has to be guided by a clear, intentional plan.

This strategic framework is what truly separates sophisticated investors from casual landlords. It's all about setting clear goals, spotting the right opportunities, and mapping out a path to generate returns while keeping a close eye on risk. If you're focusing on residential properties, it's worth digging into a comprehensive strategy guide for investing in rental property to get a deeper feel for the specifics.

A winning strategy really comes down to four essential pillars that work together to create and protect value.

Pillar 1: Finding and Buying the Right Assets

The first step is always about finding and securing the right properties. Top-tier investment managers don't just browse online listings. They dive deep, conducting exhaustive market analysis and due diligence to uncover assets that have real, untapped potential. This is where financial modeling becomes your best friend.

Managers run the numbers to project future cash flows, estimate the potential net operating income (NOI), and calculate key performance metrics like the internal rate of return (IRR) and cash-on-cash return. This data-driven process takes the emotion out of the decision, making sure every purchase is backed by solid financial logic.

For instance, a manager might spot a Class B apartment building in a neighborhood that's on the upswing. On the surface, it might look ordinary. But their models could show that with a few smart upgrades and better management, they could bump up the rents by 15% in just two years, creating a ton of value.

Pillar 2: Creating Value Through Hands-On Management

Buying the property is just the opening act. The second pillar is all about actively creating value where it didn't exist before. This is where you transform an average property into a high-performing asset through smart capital improvements and operational wizardry.

This could mean a few different things:

* Strategic Renovations: Think modernizing kitchens and bathrooms in a multifamily building to justify higher rents.

* Operational Tweaks: Bringing in new property management software to slash administrative costs and make life easier for tenants.

* Repositioning the Asset: Taking an older office building and rebranding it to attract a whole new wave of tenants, like tech startups or creative agencies.

The end goal is to physically and operationally upgrade the property to boost its income and, in turn, its overall market value.

A great property isn't just bought; it's made. The most successful managers are experts at seeing a property not for what it is, but for what it could become with the right investment and vision.

This hands-on approach is at the very core of real estate investment management and is a huge driver of investor returns.

Pillar 3: Diversifying Your Real Estate Portfolio

The third pillar is portfolio management. This is the art of balancing different property types, geographic locations, and risk levels to build a collection of investments that can weather any storm. If your entire portfolio is tied up in one city or one type of property, you're exposed if that specific market or sector takes a hit.

Smart diversification is your shield against volatility. A well-balanced portfolio might include a mix of:

1. Core Assets: These are your stable, low-risk properties, like a fully leased office building in a prime downtown spot.

2. Value-Add Assets: Properties that need some work to boost their value, like that apartment complex we talked about earlier.

3. Opportunistic Assets: These are higher-risk, higher-reward plays, like building from the ground up or completely overhauling a distressed hotel.

By blending these strategies, you can generate steady cash flow from your core assets while chasing bigger growth with your value-add and opportunistic plays. It’s a balanced approach that helps smooth out returns and protects your portfolio from market surprises.

Pillar 4: Managing Risk Before It Becomes a Problem

Finally, the fourth pillar is all about getting ahead of potential threats. Good risk management isn't about avoiding risk—that's impossible. It's about understanding it, pricing it, and having a plan to deal with it. Managers are constantly scanning the horizon for headwinds that could impact their portfolio.

Here are some common risks and how pros handle them:

By proactively spotting these and other potential issues, investment managers can build contingency plans to protect the portfolio's value. This kind of foresight is what creates lasting value and delivers dependable returns, no matter what the market is doing. Together, these four pillars provide a powerful framework for success.

Navigating Global Real Estate Market Trends

Great real estate investment management is about having two kinds of vision at once. You need a microscope to examine the fine details of a specific property, but you also need a telescope to see the larger forces shaping the entire market. While your day-to-day work is on the ground, your best strategies will always be informed by powerful global trends. It's how you spot opportunities before everyone else does and sidestep risks before they become problems.

Think of the global market like a massive weather system. You wouldn't plan an outdoor wedding without checking the forecast, right? In the same way, you shouldn't acquire a new building without understanding the broader economic climate. Things like shifting interest rates, new technology, and changing demographics create powerful currents that can either lift your portfolio to new heights or drag it underwater. A sharp manager knows how to read these signs and make smart local moves.

The World is More Connected Than Ever

No real estate market is an island. A shift in lending policies in Europe can absolutely ripple across the Atlantic and affect investor confidence in North America. Likewise, a boom in Asian manufacturing can create a surge in demand for industrial warehouse space all over the world. This deep interconnectedness means that having a purely local perspective is no longer enough for effective real estate investment management.

For instance, the explosive demand for data centers isn't just a local fad—it's a global megatrend driven by our digital lives. The same goes for the push toward sustainable, green buildings, which has become a non-negotiable for major investors everywhere. Managers who keep a close eye on these international shifts can position their portfolios to ride these long-term waves of growth. To really get a handle on the market, staying up-to-date on trends is essential, as detailed in this guide on Dubai Real Estate Market Trends.

Following the Money: Global Transaction Momentum

One of the best ways to take the market's temperature is to look at direct transaction volume. By tracking where the money is flowing, we can see which regions are heating up and where investors are feeling confident. Recent data paints a clear picture of renewed optimism.

In a single recent quarter, direct real estate transactions worldwide hit US$179 billion, which is a 14% jump from the previous year. This wasn't just one hot market skewing the numbers; it was a broad-based recovery.

- The Americas led the way, surging 18% to US$99 billion.

- EMEA (Europe, Middle East, & Africa) saw a solid 6% increase to US$49 billion.

- Asia Pacific also showed strong growth, rising 15% to US$31 billion.

This isn't just a list of numbers; it’s a map of investor confidence. It tells a story about where capital is finding the best returns and which markets are seen as stable bets for the future. For an investment manager, this kind of intel is gold. It helps you confirm your strategies and pinpoint the next big hotspot.

"Understanding global capital flows is like having a satellite view of the investment landscape. It reveals the major currents of investor demand, allowing managers to anticipate market shifts rather than just reacting to them."

At the end of the day, a global perspective gives you the context you need to make sound decisions at the local level. It helps you figure out if a local boom is part of a real, sustainable international trend or just a temporary bubble waiting to pop. This strategic foresight is what separates the good managers from the great ones—turning global data into a powerful local advantage. When you can see the whole chessboard, you're in a much better position to make winning moves with every piece.

Uncovering Opportunities in Regional Markets

While it's crucial to keep an eye on the global picture, the real magic in real estate investment management happens on a much smaller scale. This is where big-picture trends collide with on-the-ground reality, creating unique pockets of opportunity for managers who know exactly where to look. Every market has its own economic pulse, its own demographic shifts, and its own unique supply-and-demand dynamics.

Think of it like being a chef. Knowing that "fruit" is in season is helpful, sure. But a truly great chef knows that strawberries are hitting their peak in one valley while citrus is thriving in another. It’s the same in real estate. A skilled investment manager digs deeper than continental trends to pinpoint the specific countries and cities where conditions are ripe for growth. This is how you turn general market knowledge into profitable investments.

A Closer Look at European Market Dynamics

Europe is a fantastic example of why regional analysis is so powerful. It’s not one big, uniform market; it's a mosaic of distinct economies, each marching to the beat of its own drum. Recent data shows a significant rebound, but the recovery isn't happening everywhere at once.

The European real estate market recently saw a notable jump, with investment volumes climbing 46% in the fourth quarter compared to the previous year. Total returns improved to 4.8%, the highest they've been in two years. This momentum was backed by positive capital growth of 0.6%, which is a clear sign that investor confidence is returning. You can discover more about the European real estate outlook from Aberdeen.

But here’s the key: this comeback isn't happening evenly across the board. The data shows that certain property types are performing much better than others, giving smart managers clear signals on where to focus their attention.

Pinpointing Sector-Specific Opportunities

When you really dive into the numbers, you start to see where the action is. Savvy managers use this kind of detailed data to spot specific sectors that are primed for growth—often long before the rest of the market catches on.

Here’s a look at how this targeted approach plays out in the real world:

* Industrial and Logistics: The e-commerce boom continues to fuel this sector, making it a consistent top performer. An investor might look for warehouse development opportunities near major transport hubs in a country with a strong manufacturing base.

* Hospitality Revival: With tourism bouncing back, hotels in popular city-break destinations are showing incredible signs of life. A manager could find an underperforming hotel in a great location and reposition it to capture this renewed demand.

* Residential Niches: Think beyond traditional apartments. Specialized assets like student housing near universities or senior living facilities in areas with aging populations can offer incredibly stable, long-term returns.

This kind of sector-specific thinking allows managers to build a portfolio that capitalizes on precise, localized trends instead of just following generic strategies.

The most valuable opportunities are often hidden in plain sight, revealed only by a deep understanding of local market fundamentals. It’s about connecting the dots between rental growth, market liquidity, and demographic shifts to find assets with untapped potential.

At the end of the day, successful real estate investment management is all about this constant translation. It's about taking high-level global data and applying it with surgical precision to regional and local markets. It’s the art of seeing the big picture while making expertly informed decisions on the ground, one property at a time.

The Art of Capital Raising and Fund Management

Having a great eye for properties is only half the battle in real estate investment management. The other, arguably more crucial half, is actually getting the money to buy and improve those assets. This is where fundraising and fund management come in, a field that’s part financial wizardry, part relationship-building. After all, without capital, the most promising deal is just an idea on a spreadsheet.

Think of yourself as a film producer. You might have the perfect script (the property deal), but you need to convince executive producers (your investors) to fund the movie. You have to sell them on the vision, show them a clear path to a box-office hit, and build enough trust to get the project green-lit. A real estate manager does the same thing: structuring the deal, creating the investment vehicle, and clearly communicating the strategy to their capital partners.

Structuring Deals and Attracting Capital

Before you can even think about raising a single dollar, you have to structure the investment. This means setting up a legal entity—usually an LLC or a limited partnership—that will actually own the property. This structure is critical because it defines the entire relationship between you (the General Partner) and your investors (the Limited Partners), laying out everything from how profits are split to who has the final say on major decisions.

Once the structure is in place, you build your case. This is done through a detailed pitch deck or a formal private placement memorandum (PPM). This document is the cornerstone of your fundraising, and it needs to be convincing. It should lay out:

- The Investment Thesis: A simple, clear story explaining the opportunity and why it’s a smart move right now.

- Financial Projections: The hard numbers. Detailed models showing anticipated cash flow, return on investment (ROI), and your plan for a profitable exit.

- Risk Factors: Full transparency. A frank discussion of what could go wrong and how you plan to handle it.

This isn’t just about the numbers. It’s about building confidence and showing investors you’re a professional they can trust with their money.

Navigating the Current Fundraising Environment

Right now, the market is sending some mixed signals. The relationship between the number of available deals and the amount of capital ready to be deployed is a bit of a paradox. We're seeing more deals happening, but raising the money for them has gotten tougher.

For instance, global private real estate deal value recently climbed 11% to $707 billion, the first increase in three years. You’d think that would mean fundraising is booming, but it's the opposite. Global fundraising for closed-end funds actually plummeted 28% to $104 billion—the lowest it’s been in over a decade. Debt fundraising took an even bigger hit, dropping by 44%.

This tells us something important: having a great deal on the table isn't enough anymore. In a tight capital market, investors are flocking to managers with sterling track records, deep relationships, and an absolutely bulletproof strategy.

This kind of environment really separates the seasoned pros from the newcomers. Managers who have weathered storms before, consistently delivered returns, and always kept communication lines open are the ones who can still raise capital when everyone else is struggling.

For a deeper look into mastering this side of the business, our real estate fund management playbook is a great resource. It reinforces that top-tier real estate investment management is as much about managing money and trust as it is about managing buildings.

How Technology Is Shaping Modern Investment

The world of real estate investment management is finally moving past dusty spreadsheets and decisions based on gut feelings. A new wave of digital tools is completely changing the game, giving managers a level of precision, speed, and insight that was hard to imagine just a decade ago. For today's investment managers, technology isn't just a nice-to-have—it's what separates the leaders from the laggards.

Think of it as the difference between navigating with a paper map and using a live GPS. The map might get you there eventually, but the GPS gives you real-time traffic, finds the most efficient route, and warns you about problems ahead. This is exactly what technology does for real estate professionals; it empowers them to make smarter, data-backed decisions that drive better performance and healthier returns.

From Manual Processes to Automated Workflows

One of the biggest wins from this tech shift has been the automation of tedious, time-consuming administrative work. Modern software platforms can now handle everything from distributing investor reports to managing compliance paperwork, often with just a few clicks. This automation frees up a massive amount of time, letting managers get back to what they do best: sourcing great deals and building winning strategies.

For instance, with a centralized platform, an investment manager can:

- Streamline Fundraising: Set up professional deal rooms where potential investors can review documents and sign agreements electronically, from anywhere.

- Simplify Investor Relations: Automate quarterly updates and dividend distributions, so every investor gets the right information at the right time.

- Enhance Transparency: Offer investors a secure portal they can access 24/7 to check on their portfolio’s performance and track their returns.

This move toward automation isn't just about efficiency. It also dramatically improves the investor experience, which is key for building the trust and long-term relationships that this business runs on.

The Rise of Data-Driven Decision Making

Beyond just automating old tasks, technology is unlocking powerful new ways to analyze properties and markets. Tools like predictive analytics and artificial intelligence are quickly becoming indispensable for modern real estate investment management. These systems can sift through mountains of data to spot trends and forecast performance with surprising accuracy.

Technology is transforming portfolio oversight from a reactive, backward-looking exercise into a proactive, forward-looking discipline. It allows managers to anticipate market shifts instead of just responding to them.

Imagine being able to use a tool that analyzes demographic shifts, local economic data, and historical rent growth to pinpoint the next neighborhood that's about to take off. This isn't science fiction anymore; it’s how top-tier managers are getting an edge. These tools can run different scenarios, helping you weigh the potential risk and reward of a big renovation or a new acquisition before you spend a single dollar.

By bringing these tools into their workflow, managers can reduce risk, uncover opportunities others miss, and build portfolios that are more resilient and profitable. The bottom line is that technology isn't just changing the tools of the trade—it’s changing the entire game.

Common Questions About Investment Management

Alright, let's talk about the practical side of things. Once you start digging into real estate investment management, a few key questions always pop up. We’ve covered the strategies and the tech, but now it’s time to address the questions that come up when the rubber meets the road.

Think of this as the final Q&A before you sign the paperwork. It’s about making sure you’re crystal clear on the details that matter most.

How Much Capital Is Needed To Start?

This is probably the first question on everyone's mind. The honest answer? It depends entirely on how you decide to invest. There's no one-size-fits-all number.

- Direct Ownership: If you're buying a property outright, you'll need a hefty down payment—usually 20-25% of the purchase price. Don't forget to budget for closing costs and any immediate repairs, too.

- Real Estate Syndication: This is a fantastic way to get into bigger deals without needing a massive pile of cash. You pool your money with other investors, which can lower your individual contribution to as little as $25,000 for a piece of a high-quality asset.

- REITs (Real Estate Investment Trusts): For the absolute lowest barrier to entry, REITs are your answer. You can buy shares in these publicly-traded companies just like you would a stock, meaning you can get started with just a few hundred dollars.

What Are Typical Management Fees?

Knowing how the manager gets paid is critical. It tells you a lot about their incentives and what you can expect from the deal's structure. These fees are how the management team is compensated for their work finding the deal, running the property, and eventually selling it.

A good fee structure should align the manager's interests with yours. Simply put, when you make money, they make money. This creates a powerful shared incentive to see the property succeed.

In a typical syndication or private fund, you'll usually see a few common fees:

1. Acquisition Fee: This is a one-time fee for finding, vetting, and closing the deal. It's generally around 1-2% of the property's purchase price.

2. Asset Management Fee: Think of this as the ongoing oversight fee. It's typically an annual charge of 1-2% of the equity you've invested or a percentage of the property's revenue.

3. Promote/Carried Interest: This is the manager's share of the profits. After all investors get their initial capital back plus a predetermined "preferred return," the manager earns a piece of the remaining profits—often around 20%.

Getting a handle on these details demystifies the whole process. It turns abstract concepts into real-world knowledge you can use to make smarter investment decisions.

Ready to stop wrestling with spreadsheets and start scaling your real estate business? Homebase provides an all-in-one platform to manage your deals, investors, and fundraising with professional ease. Discover how Homebase can streamline your operations today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.