NOI in Real Estate A Guide to Maximizing Property Value

NOI in Real Estate A Guide to Maximizing Property Value

Unlock property value with our guide to NOI in real estate. Learn the formula, strategies to increase it, and how it drives your investment success.

Domingo Valadez

Nov 11, 2025

Blog

If you’re serious about investing in income-producing real estate, there's one metric you absolutely have to master: Net Operating Income, or NOI. It’s the single most important number for figuring out if a property is actually profitable.

Think of it as the property's annual profit before you factor in mortgage payments or income taxes. It boils down to a simple idea: how much money does the asset itself generate?

What Is NOI in Real Estate and Why It Matters

Let's say you own an apartment building. All the rent you collect from tenants is your income, but that’s not what you pocket at the end of the day. You have a long list of bills to pay—property taxes, insurance, maintenance, landscaping, and management fees. NOI tells you what’s left after you pay all those necessary, day-to-day costs.

By stripping away the financing (mortgage) and personal tax details, NOI reveals the raw, operational performance of the building.

This is precisely why investors live and breathe by this number. It creates a level playing field, giving you an apples-to-apples way to compare the financial health of one property to another, no matter how the current owners financed it or what their tax bracket looks like.

The Bedrock of Property Analysis

For anyone involved in real estate syndication, from passive investors to active sponsors, a rock-solid understanding of NOI is non-negotiable. It's the foundational number that anchors nearly every major decision you'll make throughout the life of an investment.

Here’s why it’s so critical:

* It Drives Property Value: NOI is the engine that powers a property's market value. Investors use it to determine the capitalization (cap) rate, which is the key to figuring out what a property is worth. A higher NOI generally means a higher valuation.

* It Unlocks Financing: When you go to a bank for a loan, the lender’s first question will be about the NOI. They need to see that the property generates enough cash to comfortably cover the mortgage payments. A strong, stable NOI is your ticket to getting a loan on favorable terms.

* It Measures Performance: As a syndicator, tracking NOI is like checking the pulse of your investment. It’s the clearest indicator of whether your business plan is working and if the asset is hitting the financial targets you promised investors.

Net Operating Income is a fundamental metric used worldwide in commercial real estate to assess the profitability of income-generating properties, calculated as total income minus operating expenses, excluding debt service and capital expenditures. Learn more about how real estate NOI is calculated on rensair.com.

Getting Ready to Calculate

To truly get a handle on NOI, you first have to understand its two building blocks. The first is Gross Operating Income (GOI), which is all the money a property could make, adjusted for real-world factors like empty units. The second piece is Operating Expenses (OpEx), which covers all the costs required to keep the lights on and the property running smoothly.

In the next sections, we’ll dive into each of these components and walk through the exact formula for calculating this essential metric.

Calculating NOI with a Step-by-Step Example

Alright, let's roll up our sleeves and move from theory to practice. This is where you really start to get a feel for NOI in real estate. The formula itself is simple, but the real skill lies in understanding what goes into each part of the equation.

At its heart, the calculation is just this:

Net Operating Income (NOI) = Gross Operating Income (GOI) – Total Operating Expenses (OpEx)

Think of it like the property’s annual paycheck before you, the owner, pay the mortgage or taxes. It's the pure, unvarnished measure of how well the asset is performing on its own. Let’s walk through each piece of this formula one by one.

Step 1: Identify Gross Operating Income

First things first, you need to figure out all the money the property brings in. This isn't just the rent—it's everything.

We start with the Gross Potential Rent (GPR). This is the absolute best-case scenario, the total amount of rent you'd collect if every single unit was rented out at full market price for all 12 months. It's a great number to know, but it's not reality.

From there, we have to make some adjustments to get a more realistic picture.

- Vacancy Loss: No building is 100% full all the time. People move out. You have to account for the income you'll lose from empty units. A 5% to 10% vacancy rate is a common assumption, but you have to check your local market.

- Concessions and Bad Debt: This bucket catches two things: rental discounts you offer to attract tenants (like "one month free") and, unfortunately, rent that you're owed but can't collect.

After subtracting those items from your GPR, you have your Effective Gross Income (EGI).

But we're not done yet. Most properties have other ways of making money beyond just rent. This is called ancillary income, and you need to add it all in. This can be anything from fees for parking spots and laundry machines to pet fees and storage units.

Once you add that ancillary income to your EGI, you finally have your Gross Operating Income (GOI).

Step 2: Calculate Total Operating Expenses

Now for the other side of the ledger: all the money that goes out. We need to add up every cost associated with keeping the lights on and the property running smoothly. These are your operating expenses (OpEx).

Here are the usual suspects you'll see on an expense sheet:

- Property Taxes: One of the biggest line items and completely unavoidable.

- Property Insurance: You need this to cover everything from a slip-and-fall to a fire.

- Utilities: Even if tenants pay their own utilities, the property still has costs for common areas like hallways, the office, and outdoor lighting.

- Repairs & Maintenance: This is your budget for the day-to-day grind of fixing leaky faucets, patching holes in the wall, and general upkeep.

- Property Management Fees: If you're not managing the property yourself, you'll pay a third-party company, typically 3-10% of your EGI, to handle operations.

- Administrative & Marketing: This covers everything from advertising vacant units and running background checks to legal fees and office supplies.

Knowing what not to include is just as important. Operating expenses are strictly about the property's day-to-day functions.

Here’s what you must exclude from your OpEx calculation:

- Debt Service: Your mortgage payment (principal and interest) is a financing cost, not an operating one.

- Capital Expenditures (CapEx): Big, expensive, one-off projects like replacing the roof or repaving the parking lot are not OpEx. They are handled separately.

- Depreciation: This is an accountant's tool for tax purposes—a "non-cash" expense that doesn't actually come out of your bank account.

- Income Taxes: The owner's income tax bill is personal and has nothing to do with the property's operational health.

A Practical NOI Calculation Example

Let's tie this all together and run the numbers for a hypothetical 10-unit apartment building. Seeing the math laid out line by line makes it click.

Below is a simple breakdown of how you’d calculate the NOI in real estate for this property.

Sample NOI Calculation for a 10-Unit Apartment Building

So, there you have it. In this example, the property's annual NOI is $125,320. This single number is the most important metric for understanding the asset's raw profitability. It's the foundation for everything else, from figuring out what the property is worth to securing a loan.

How NOI Drives Property Valuation and Cap Rates

Now that you have a firm grip on how to calculate a property’s Net Operating Income, let’s connect that number to what really matters: its market value. NOI in real estate isn't just a number on a spreadsheet; it's the engine that powers a property's worth. Understanding this relationship is what separates the novices from the pros who consistently build wealth.

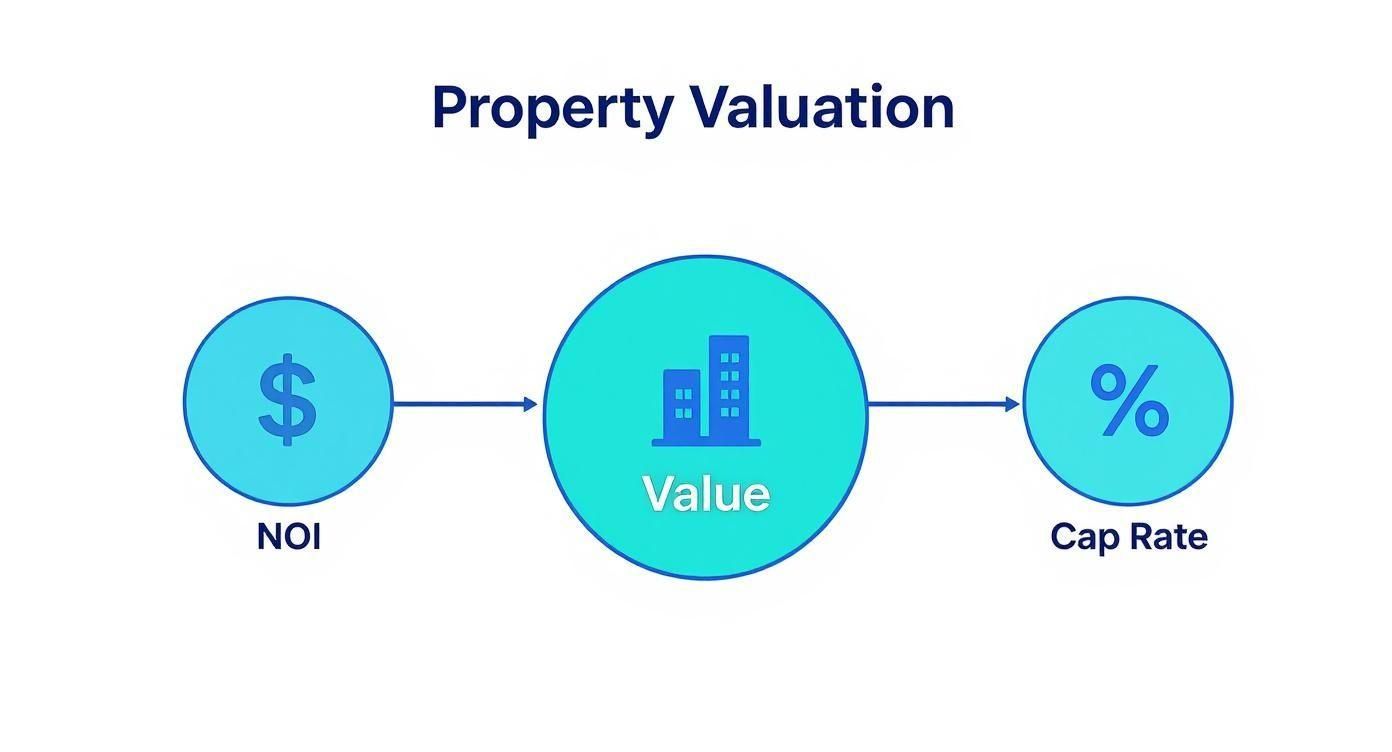

Think of it this way: your property's NOI is like horsepower. The more horsepower you can generate (a higher NOI), the more valuable and sought-after your asset becomes. The tool we use to translate that horsepower into a dollar value is the capitalization rate, or cap rate.

The cap rate is simply a snapshot of the market's expectation for an annual return on an all-cash purchase. It’s a measure of perceived risk and growth potential for a certain type of property in a specific area.

The Fundamental Valuation Formula

The beautiful thing is that the connection between value, NOI, and cap rate is captured in one of real estate’s most powerful formulas:

Property Value = Net Operating Income (NOI) / Capitalization (Cap) Rate

This simple equation tells you everything. For any given cap rate, a bigger NOI means a bigger property value. If your NOI drops, your valuation follows suit. It’s a direct, undeniable link.

Let’s use an analogy. Imagine the cap rate is the expected yield on a bond. A 5% cap rate means investors in that market are looking for a 5% annual return from the property's net income. If your building generates an NOI of $100,000, the market will peg its value at $2,000,000 ($100,000 / 0.05). It's a clean, straightforward way to see how the market prices an income stream.

If you want to dive deeper into how this works, check out our detailed guide on the income capitalization approach.

The Power of Forced Appreciation

This is where the real magic happens for hands-on investors and syndicators. Because you have direct control over your property's income and expenses, you can literally "force" its value higher by increasing the NOI. Even small, smart operational tweaks can have an explosive multiplier effect on your property’s valuation.

Here's a powerful example that brings this to life:

Let's stick with our property that has a $100,000 NOI in a 5% cap rate market, giving it a $2,000,000 value. Now, say you implement a new utility bill-back system (a RUBS program) that increases your annual NOI by just $5,000.

- New NOI: $105,000

- Market Cap Rate: 5%

- New Property Value: $105,000 / 0.05 = $2,100,000

Think about that. By adding a mere $5,000 to your net income, you created $100,000 in new equity. That’s a 20x multiplier on a simple operational fix. This is the core principle of forced appreciation, and it's how fortunes are made in commercial real estate. Every single dollar you can add to the NOI has a magnified impact on the bottom line.

Market Dynamics and NOI Growth

Of course, the broader market plays a role. The health of the economy influences investor confidence, which in turn moves cap rates. Keeping an eye on sector-wide NOI growth gives you a benchmark for your own property's performance.

For instance, recent data for U.S. commercial real estate shows a mixed bag. Same-store NOI for Real Estate Investment Trusts (REITs) has slowed overall, but the story varies by asset class. The industrial sector’s same-store NOI jumped 5.8%, residential grew 3.2%, and retail saw a 3.7% improvement. Meanwhile, office properties experienced a 0.7% decline. You can find more details on these REIT performance trends on spglobal.com.

This data really hammers home the importance of operational excellence. You can't control market-wide cap rates, but you can absolutely control your property's NOI. By relentlessly managing revenues and expenses, you can outperform the market and build value, even when the broader economy has other plans.

Analyzing Pro Forma NOI and Avoiding Common Mistakes

When you're digging into a potential real estate deal, you'll always come across the pro forma NOI. This isn't a look back at what the property has done; it's the seller's forecast of what it could do in the future. Think of it as their sales pitch in spreadsheet form.

Your job, as a sharp investor, is to put on your detective hat. Is this pro forma a credible roadmap to future profits, or is it a work of fiction? A solid pro forma will look optimistic but still be grounded in reality. An overly aggressive one, however, can lure you into a disastrous investment built on a foundation of wishful thinking.

Decoding the Pro Forma

At its core, a pro forma is simply a forecast of a property's future income and expenses, which gives you a projected NOI in real estate analysis. The deal sponsor uses this to justify their purchase price and to lay out their game plan for improving the property and boosting its value.

But let's be honest—sellers are always going to present their property in the best possible light. This can easily lead to projections that are more hopeful than realistic. That's why you have to scrutinize every single line item and really stress-test the assumptions behind those numbers.

A pro forma is an educated guess, not a guarantee. The difference between a successful and a failed investment often lies in an investor's ability to distinguish between reasonable assumptions and wishful thinking.

This is where the relationship between NOI, the Cap Rate, and overall property value becomes crystal clear. They're all directly connected.

As you can see, if you change one of these variables, it directly impacts the others. That’s why getting the NOI projection right is absolutely essential for a proper valuation.

Common Underwriting Mistakes to Watch Out For

Even experienced investors can get tripped up by a few common underwriting traps. When you're looking at a seller's pro forma, be on high alert for these red flags. They often signal an operator who is either too optimistic or just plain inexperienced.

Here are three of the most frequent mistakes I see:

- Unrealistic Rent Growth Projections: Is the seller claiming they can achieve 5-7% annual rent growth when the market has historically only seen 2-3%? That’s a massive red flag. Always, always double-check their rent growth numbers against actual market data from truly comparable properties in the immediate area.

- Underestimating Vacancy and Other Losses: A pro forma might plug in a 3% vacancy rate, but what if the market average for that type of property is closer to 7%? It seems like a small difference, but it dramatically inflates the income projections. You have to verify the assumptions for vacancy, concessions, and bad debt to make sure they're in line with what's actually happening on the ground.

- Miscategorizing Capital Expenditures (CapEx): This one is a classic sleight of hand. A seller might bury a huge, one-time expense—like a brand new roof—in the "repair and maintenance" line item. This makes the historical NOI look much better by hiding a major capital cost. Just remember: CapEx is not an operating expense and needs to be accounted for separately, "below the line."

Presenting these financial metrics clearly is vital when you're trying to get partners on board. For a good look at how these numbers are typically packaged, you can find some excellent real estate pitch deck templates that model effective investor communication.

Building Your Own Credible Forecast

Here’s the bottom line: never, ever take a seller's pro forma at face value. The smartest move is to use their numbers as a starting point, then roll up your sleeves and build your own underwriting model from scratch.

This means doing your own homework. Get on the phone with local property managers, pore over the rent rolls of competing properties, and get actual quotes for things like insurance and property taxes. When you replace the seller's rosy assumptions with your own hard-earned data, you create a much more conservative and reliable forecast. This diligent process is your single best defense against overpaying for a property that can't perform.

Proven Strategies to Increase Your Property's NOI

Knowing how to calculate NOI in real estate is just the starting line. The real money is made by actively pushing that number higher. When you grow your NOI, you directly force the property's appreciation and build serious equity.

Luckily, the math is simple. There are only two ways to make it happen: get more money coming in, or spend less money going out.

This isn’t about sitting back and watching the rent checks roll in. It’s about running your property like a true business, constantly hunting for operational tweaks that fatten your bottom line. Every single dollar you add to the NOI has a multiplier effect on your property's total value, which is why these strategies are the bedrock of any successful value-add investment.

Driving Revenue Growth

The most straightforward path to a healthier NOI is to increase the income your property generates. This goes way beyond simply bumping up the rent every year. It’s about finding—and monetizing—every single income stream hidden within your asset.

Here are a few of the most effective tactics to get your revenue climbing:

- Strategic Unit Renovations: Think new kitchen countertops, in-unit laundry, or modern vinyl plank flooring. These kinds of upgrades give you the justification you need for a significant rent increase. The trick is to pick the renovations that give you the biggest bang for your buck in your specific market.

- Implement a Utility Bill-Back System (RUBS): A Ratio Utility Billing System is a game-changer. It lets you pass a fair portion of the property's utility costs—like water, sewer, and trash—directly to tenants. This move alone can pull thousands of dollars out of your expense column and drop them right into your net income.

- Introduce New Ancillary Income Streams: Get creative and look for untapped opportunities. Could you charge for premium reserved parking? Add rentable storage units? What about a monthly pet fee? These small, recurring charges might not seem like much on their own, but they stack up to a massive boost in annual revenue.

These are the core plays in any value-add business plan. They take some upfront cash and effort, but the payoff is a far more profitable and valuable property for years to come.

Reducing Operating Expenses

On the flip side of the coin, cutting costs is every bit as powerful as growing income. Every dollar you save on operating expenses is a dollar of pure profit that goes straight to your NOI. This takes disciplined management and a sharp eye for waste.

It’s a classic mistake: operators get so focused on chasing higher rents that they completely ignore the "leaky bucket" of bloated expenses. A disciplined attack on costs often delivers faster and more reliable NOI gains than waiting for the market to allow for rent hikes.

Here are some of the most powerful cost-saving measures to consider:

- Install Energy-Efficient Systems: Swap out old light fixtures for LEDs in common areas, install low-flow toilets, or add smart thermostats to vacant units. These green upgrades don't just slash utility bills; they're also a great marketing tool for environmentally-conscious tenants.

- Negotiate Smarter Vendor Contracts: Never let contracts for landscaping, trash removal, or insurance auto-renew without a fight. Make it a yearly habit to get competitive bids from multiple vendors. You’ll be amazed at how much you can save by ensuring you’re getting the best service for the best price.

- Appeal Your Property Taxes: For most properties, taxes are one of the biggest line-item expenses. If you suspect your property has been over-assessed, hiring a tax appeal specialist can lead to thousands of dollars in annual savings. It’s often well worth the fee.

- Focus on Proactive Maintenance: Don't wait for things to break. A solid commercial-grade maintenance checklist helps you catch small issues before they become catastrophic, budget-busting repairs. This proactive approach is one of the best ways to protect your NOI from surprise hits.

This two-pronged attack on both revenue and expenses creates an incredible synergy. Even with shifting interest rates, the global real estate investment community is zeroing in on properties with clear potential for NOI growth. In fact, nearly 75% of investors are planning to increase their real estate holdings, all chasing assets that can beat inflation and deliver reliable cash flow. Properties managed with a sharp, disciplined strategy to maximize NOI will be the ones that attract the most capital and command the highest prices in any market.

Common Questions About NOI in Real Estate

Even after you've got the basics down, the real-world application of NOI in real estate can get a little murky. This is where we clear up the common points of confusion that I see trip up investors all the time.

Getting these details right isn't just academic—it's absolutely critical for accurate underwriting and making confident investment decisions. Let's dig into the questions that pop up constantly on calls and during deal analysis.

What Is the Difference Between NOI and Cash Flow?

This is, hands down, the question I hear the most. While they're related, Net Operating Income and Cash Flow tell two completely different stories about a property's financial health.

Think of NOI as a measure of the property's pure operational performance, totally separate from its financing. It answers one simple question: "How profitable is the building itself, just from running its day-to-day business?"

Cash flow, on the other hand, is the actual money left over for investors to put in their pockets after every single bill is paid. It answers the real-world question: "After everything is settled, how much cash did we actually generate?" The calculation for cash flow picks up right where NOI leaves off.

To get from NOI to cash flow, you have to subtract two major expenses that NOI ignores:

* Debt Service: This is your mortgage payment, including both principal and interest. It’s often the biggest expense that NOI doesn't account for.

* Capital Expenditures (CapEx): These are the funds you have to set aside for big-ticket replacements—things like a new roof, replacing HVAC systems, or repaving the parking lot.

The easiest way to remember it is: Cash Flow = NOI - Debt Service - CapEx Reserves. This is why a property can have a fantastic NOI but still have negative cash flow if it's saddled with too much debt.

Is a Higher NOI Always Better?

In general, yes. A higher Net Operating Income is almost always a sign of a healthier, more profitable, and ultimately more valuable property. It means you're doing a great job maximizing revenue, keeping expenses in check, or, in the best-case scenario, acing both.

But—and this is a big but—the pursuit of a higher NOI has to be strategic. For example, an operator could artificially juice the NOI by putting off essential maintenance, which would slash expenses in the short term. The number might look great on a report for a quarter or two, but this kind of neglect eventually catches up to you, damaging the asset and leading to much bigger, more expensive headaches down the road.

The goal isn't just a higher NOI; it's a sustainable higher NOI. Real value is created through smart, long-term operational improvements, not by playing short-sighted accounting games.

A savvy operator is always focused on creating durable NOI growth through things like strategic renovations that command higher rents, finding new ancillary income streams, and implementing smart expense controls.

How Do Capital Expenditures Affect NOI?

This is another critical point that trips up a lot of new investors. Let’s make it crystal clear: Capital Expenditures (CapEx) do not affect NOI.

Remember, NOI is a measure of operations. Operating expenses are the routine, day-to-day costs of keeping the lights on—things like paint, lightbulbs, and cleaning supplies. CapEx, on the other hand, represents major, infrequent investments that improve the property or extend its life, like a new roof or replacing all the windows in a building.

Here’s a simple way to think about the difference:

* Operating Expense: Fixing one leaky faucet in one unit.

* Capital Expenditure: Re-plumbing the entire building.

While CapEx is a very real cash expense that hits your bottom line and your overall budget, it sits "below the line" in your financial analysis. It's not part of the NOI calculation. Misclassifying a major capital project as a simple operating expense is a classic way some operators try to artificially inflate a property's NOI, so be on the lookout for that.

What Does a Negative NOI Mean?

If you see a negative Net Operating Income, it means the property's operating expenses are higher than all the income it generates. Put simply, the property is losing money just by existing, even before you factor in a single dollar for the mortgage.

This is a massive red flag. It points to a property in serious operational distress, likely suffering from massive vacancy, terrible mismanagement leading to out-of-control expenses, or a painful combination of both.

A property with a negative NOI is a heavy-lift, turnaround project. Any investor taking it on would need a rock-solid, well-funded business plan to either dramatically boost revenue, slash expenses, or both. For most investors, a negative NOI is a clear signal to either proceed with extreme caution or just walk away. It represents a high-risk situation where the asset can't even support its own basic operations.

At Homebase, we know that managing a successful real estate syndication involves much more than just crunching numbers. Our platform is built to handle the heavy lifting of investor relations, fundraising, and deal management, freeing you up to focus on what really matters: executing your business plan and boosting that all-important NOI. Learn how Homebase can help you streamline your next deal.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.