Unlocking the Triple Net Lease Meaning for Syndicators

Unlocking the Triple Net Lease Meaning for Syndicators

What is the true triple net lease meaning for investors? Our guide demystifies NNN leases, breaking down the benefits, risks, and underwriting for syndicators.

Domingo Valadez

Feb 13, 2026

Blog

So, what exactly is a triple net lease?

You'll often hear it called an NNN lease, and it's a common setup in commercial real estate. In simple terms, it's a lease agreement where the tenant agrees to pay for the three main operating costs of a property, on top of their regular rent.

These "three nets" are property taxes, building insurance, and common area maintenance (CAM). This arrangement passes most of the day-to-day financial and operational duties from the landlord right over to the tenant.

What a Triple Net Lease Means for Investors

For investors and syndicators, a triple net lease boils down to two powerful words: predictability and passivity.

Think of it like this: you own a high-performance car that you lease out. With an NNN lease, the person driving it doesn't just pay you a monthly fee—they also cover the gas, insurance, and all the repairs. Your job is simply to collect a check, a steady payment that shows up without you having to stress about the operational details.

This hands-off approach is precisely why NNN leases are a favorite in the commercial real estate world. They give landlords an income stream that feels a lot like a bond but comes with the potential upside of owning a physical asset. The market reflects this appeal; in 2023, net lease transaction volume hit a massive $85 billion. For a deeper dive into market performance, SVN.com offers some great insights on NNN properties.

The Appeal for Real Estate Syndicators

This structure is a game-changer for real estate syndicators. When you can pass the management of taxes, insurance, and maintenance to the tenant, you unload a huge administrative weight. This frees you up to focus on the things that actually grow your business.

Instead of chasing down vendors or reviewing insurance policies, you can spend your time on what matters:

* Sourcing new deals to expand your portfolio.

* Building strong investor relationships and raising more capital.

* Scaling your operations without needing to hire a huge management team.

The real beauty of it is the clean, streamlined cash flow. It makes calculating and distributing returns to your limited partners incredibly simple. You’re not wrestling with fluctuating monthly expenses; you're getting a clear, net rental income. This makes financial projections and investor reporting a breeze, letting you build a bigger, more robust portfolio with far less operational friction.

Decoding The Structure Of Net Leases

You'll hear the term "triple net lease" thrown around a lot in real estate circles, but it's important to know it's not a one-size-fits-all agreement. The term really just signals that the tenant is taking on the three main operating expenses of a property. Think of these "nets" as layers of financial responsibility being shifted from the landlord's plate to the tenant's.

To really get what a triple net lease is all about, let's pull back the curtain on each of those "nets" the tenant agrees to cover on top of their base rent.

The Three Nets Explained

At its heart, an NNN lease is built on the tenant paying for three specific cost categories. This move is what shifts a huge chunk of the operational and financial risk away from the property owner and onto the tenant.

- Net 1 Property Taxes: The first "N" is for the real estate taxes levied on the property. In a triple net deal, the tenant pays these taxes directly to the municipality or reimburses the landlord. This is a big deal for landlords—if property taxes shoot up, it's the tenant who absorbs the hit, protecting the owner's projected income.

- Net 2 Building Insurance: The second "N" covers the insurance premiums for the building itself. The tenant is on the hook for the policy that protects the asset from things like fires, floods, or other disasters. This insulates the landlord from rising insurance costs and saves them the administrative headache of managing the policy.

- Net 3 Common Area Maintenance (CAM): The final "N" is for Common Area Maintenance, or CAM. This is usually the most unpredictable of the three and covers all the costs to keep the property's shared spaces in good shape. We're talking about everything from landscaping and snow removal to repaving the parking lot and keeping the exterior lights on.

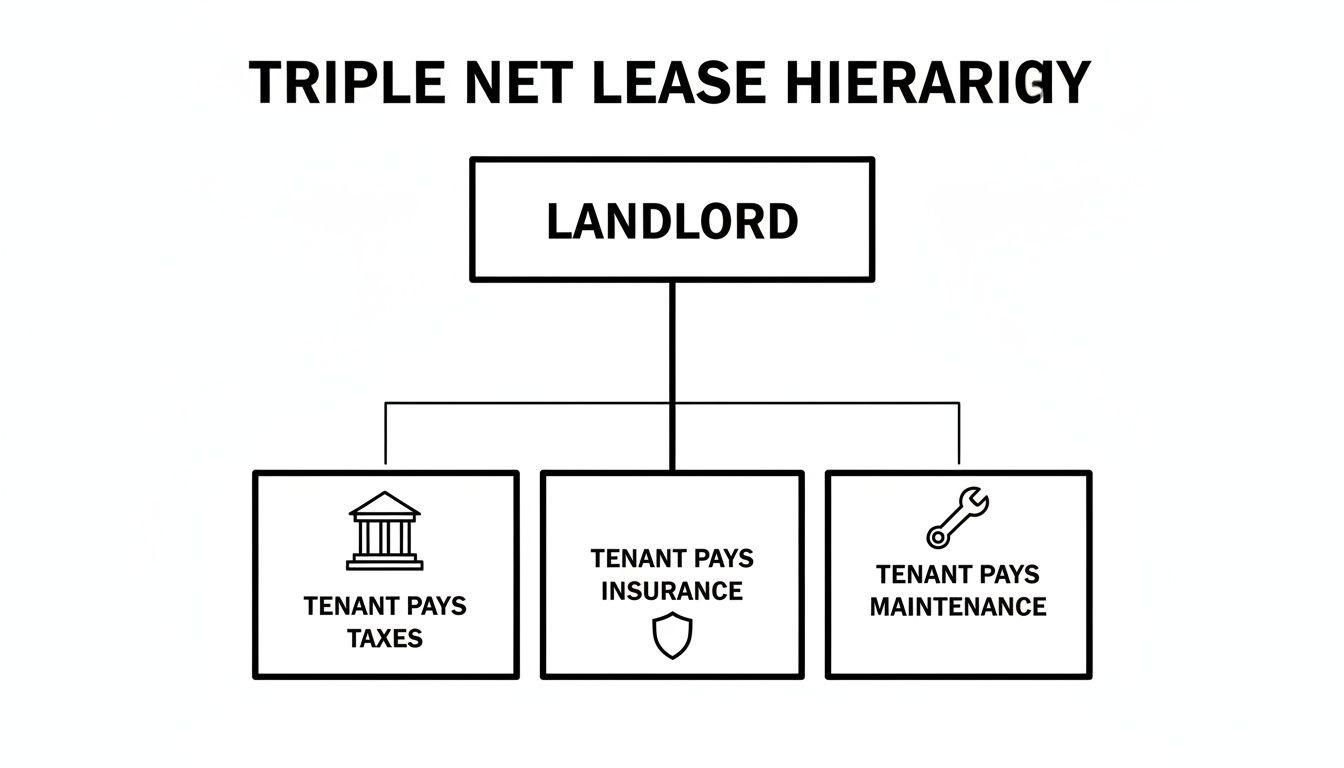

This flowchart gives you a clean visual of how these duties flow from the landlord to the tenant in a standard NNN setup.

As you can see, the tenant takes care of the core operating costs, which is what allows the landlord to enjoy a much more predictable, hands-off stream of rental income.

Comparing Net Lease Variations

Here’s where you have to be careful. The term "NNN" gets used pretty loosely out in the wild. You might find a lease that's marketed as "triple net," but when you dig into the fine print, you discover the landlord is still responsible for major structural work, like replacing the roof or fixing the foundation.

This is exactly why any serious syndicator or investor needs to understand the subtle but critical differences between the types of net leases.

The single most important thing to remember is to ALWAYS read the lease agreement. Simple labels like triple net, full service, or modified gross, which are commonly used by brokers and landlords, will often conflict with the actual terms of the lease.

To help clear things up, here’s a straightforward look at how responsibilities usually get divided up across the most common net lease structures.

Net Lease Variations Landlord vs Tenant Responsibilities

The table below breaks down the typical division of labor. As you move from left to right, you can see more and more responsibility shifting from the landlord to the tenant.

As the chart makes clear, an Absolute NNN Lease is the holy grail for passive ownership. In this scenario, the tenant is responsible for literally everything—right down to the studs and the slab. For real estate syndicators, getting these distinctions right during due diligence is absolutely non-negotiable. It's the only way to accurately forecast your cash flow and understand what you're truly signing up for.

Why Syndicators Are Drawn to NNN Properties

For a real estate syndicator, a triple net lease isn't just a lease structure—it's the blueprint for a more efficient and scalable business. The appeal really comes down to three things that perfectly match the goals of pooling investor capital: predictability, passivity, and the ability to grow.

NNN leases are a fantastic engine for generating consistent, reliable cash flow. Since the tenant is on the hook for the fluctuating costs of taxes, insurance, and maintenance, the syndicator's income stream is clean and predictable. This stability is the bedrock of providing steady distributions to investors.

Predictability and Passive Operations

Most NNN leases are long-term, often spanning 10 to 20 years, and they usually have rent increases baked right in. This gives you a clear roadmap of future revenue, which makes financial modeling much simpler. It also makes it far easier to communicate expected returns to investors, building the trust and confidence needed to get a deal done.

Even better, the operational side of things is incredibly passive, and that's a syndicator's most valuable asset. Offloading the day-to-day property management frees up an enormous amount of time and mental energy.

Instead of fielding late-night calls about a broken HVAC unit or disputing a property tax assessment, a syndicator can focus on high-value activities. This includes sourcing the next great acquisition, nurturing investor relationships, and focusing on strategic portfolio growth.

This hands-off approach makes the triple net lease a synonym for operational freedom. To fund these deals, syndicators often use various commercial real estate loans, which are typically easier to get when the bank sees a predictable income stream from a creditworthy tenant.

The Strategic Path to Scalability

When you combine predictable income with minimal management, you create the perfect environment for scaling a portfolio. A small team can effectively manage a large and geographically diverse collection of NNN properties without getting swamped by the operational headaches you’d find in multifamily or industrial real estate.

This scalability is a huge reason the sector has so much momentum. For syndicators, NNN properties can act as a strategic hedge. A single-tenant deal might offer 6-8% starting returns, trading some potential for high income growth for a much higher degree of stability compared to other core assets.

By taking advantage of the NNN model, syndicators can build a robust, resilient portfolio designed for long-term wealth creation for themselves and their investors.

A Practical Checklist for Underwriting NNN Deals

Understanding the theory behind a triple net lease is one thing, but putting your capital at risk is a completely different ballgame. Every successful syndicator I know leans on a disciplined underwriting process to tell the difference between a great opportunity and a potential train wreck. This checklist is your framework for putting any NNN deal that comes across your desk under the microscope.

Think of underwriting as building your investment case. You're the lead detective, and every document, number, and market stat is a piece of evidence. Your job is to poke holes in the deal's story and see if it holds up—all to protect your capital and your investors' money. Before you even start, it's critical to know how to value a commercial property on its own merits.

Digging Into the Tenant's Financials

With a single-tenant NNN property, you’re not just buying a building; you’re buying an income stream guaranteed by one company. That makes the tenant’s financial health the absolute bedrock of the deal. Don't just get dazzled by a big brand name.

- Publicly Traded Tenants: For a Starbucks or a Walgreens, you've got a wealth of information at your fingertips. Pull their public financial statements, read through earnings call transcripts, and check their credit ratings from agencies like Moody's or S&P. You’re looking for a solid history of profitability.

- Private or Franchisee Tenants: This is where the real digging begins. You’ll need to request and analyze several years of their financial statements. Keep a close eye on their revenue trends, profit margins, and how much debt they’re carrying. Is their business on solid ground?

A long-term lease is worthless if the company backing it goes under. A great lease with a weak tenant isn't a safe investment—it's just a ticking clock.

Dissecting the Fine Print of the Lease

The lease agreement is the rulebook for your investment. Never, ever rely on the marketing brochure or a broker’s summary. Your job is to get into the weeds and verify every single detail that affects your bottom line.

The real triple net lease meaning is buried in the legal clauses. A deal can be pitched as "NNN" but still stick the landlord with a massive bill for a new roof if you don't catch it in the fine print.

Pay extra attention to these three areas:

- Lease Term and Options: How many years are actually left on the clock? You want a long primary term—think 10+ years—for stability. Then, look at the renewal options. Are they fair, or do they give the tenant all the power?

- Rent Bumps: How does your income grow over time? Look for scheduled rent increases, like 2% annually or adjustments tied to the Consumer Price Index (CPI). Without them, inflation will eat your returns alive.

- Landlord Responsibilities: This is where you confirm it's a true NNN lease. Comb through the document for any clause that makes the landlord responsible for big-ticket items like the structure, foundation, or parking lot. You can see the financial impact of these details when calculating triple net lease reimbursements.

Looking Beyond the Lease: Property and Market Fundamentals

At the end of the day, you're still buying a physical piece of real estate. The building and its location have an "intrinsic value" that exists completely separate from the current tenant. This is your safety net if the tenant ever leaves.

You have to ask yourself a few key questions:

* Is this a prime location with great visibility and high traffic counts?

* What's the local economy like? Are people moving in or out?

* If the tenant vacates, how easily could I re-lease this building? A generic retail box on a busy corner is a lot easier to fill than a custom-built, highly specialized facility in the middle of nowhere.

Navigating the Hidden Risks of NNN Investments

The steady, predictable income from NNN properties is incredibly appealing, but "predictable" should never be mistaken for "risk-free." Any experienced syndicator knows that even the most seemingly bulletproof deals have landmines. Overlooking these risks is the quickest way to erode investor trust and tank your returns.

The elephant in the room is always tenant default. With a single-tenant property, you live in a world of extremes—your occupancy is either 100% or 0%. If that tenant goes dark, your cash flow dries up instantly, but the mortgage bill, of course, keeps coming.

This vacancy risk bleeds directly into the second major headache: the pain of re-tenanting the property. Many NNN buildings are purpose-built for a specific brand, think of a distinctively shaped fast-food joint or a purpose-built auto shop. Finding another tenant who can slot perfectly into that custom space can be a long, costly search that often demands a hefty budget for renovations.

The Trade-Off for Stability

Another risk that every investor needs to get comfortable with is the limited upside. That same long-term lease providing all that wonderful stability also puts a hard ceiling on your potential for growth. It's not like a value-add apartment building where you can force appreciation with renovations and market-rate rent hikes. A triple net lease puts you on a fixed schedule.

Those built-in rent bumps, often just 1-2% annually, can sometimes struggle to keep up with real-world inflation. This means your actual, inflation-adjusted returns might actually shrink over the life of the lease. This reality makes NNN deals a tough sell for investors who are chasing high-octane growth.

The core trade-off with a triple net lease is accepting a lower, more predictable ceiling on returns in exchange for a higher floor of income security. Your home runs are rare, but so are your strikeouts—assuming your tenant stays in the game.

Sensitivity to Market Forces

Finally, it's crucial to understand that NNN properties can act a lot like long-term bonds, making them very sensitive to shifts in interest rates. When rates go up, the fixed income stream from your lease suddenly looks less appealing next to newer investments offering higher yields. This can put downward pressure on your property's market value, which becomes a real problem if you need to sell.

In the wake of COVID, many sponsors have tweaked their playbooks to hedge against these risks. Instead of going all-in on a single tenant, some are diversifying portfolios while structuring leases with built-in rent bumps of 1.5-2.6% compounded or tying them to the CPI over 10-20 year terms. This approach gives you more protection from a single default, but it’s not a magic bullet. Tenants may balk at the higher costs, and you're still dealing with capped earnings. You can learn more about how NNN lease strategies have evolved for industrial properties.

NNN Investing: What's Hot and What's Not

The world of triple net investing isn't standing still. Far from it. The core appeal—that steady, hands-off income stream—is as strong as ever, but the types of properties delivering that income are definitely changing. If you’re a syndicator, staying ahead of these shifts is how you spot the real opportunities and build a portfolio that can weather any storm.

The biggest game-changer? E-commerce, without a doubt. The online shopping boom has created an almost insatiable appetite for industrial NNN properties. We're talking about sprawling distribution centers and nimble last-mile delivery hubs. These have become the darlings of the institutional investment world, often backed by long-term leases from the giants of retail and logistics.

The New Safe Havens: Recession-Resistant Properties

Beyond the logistics boom, there’s a noticeable shift toward tenants who thrive even when the economy gets rocky. Investors are actively seeking out properties that house businesses providing essential, everyday services—the things people need no matter what.

This trend is putting a spotlight on a few key property types:

- Medical Offices: Think dialysis centers and urgent care clinics. With an aging population and a constant need for healthcare, these tenants are about as reliable as they come.

- Quick-Service Restaurants (QSRs): Fast-food chains, especially those with a strong drive-thru game, often do even better when people are watching their wallets. They offer an affordable and convenient option that holds up well in a downturn.

- Discount Retailers: Dollar stores and other value-oriented shops are magnets for budget-conscious consumers, making them incredibly stable NNN tenants.

In the end, it doesn't matter if the building is a traditional storefront or a state-of-the-art logistics hub. The strategy behind the NNN lease remains the same. You're still building a real estate portfolio based on predictable cash flow and low-touch management, effectively shielding investor capital from market swings.

Got Questions About Triple Net Leases? We've Got Answers.

Even after you've got the basics down, a few questions always seem to surface when you're digging into a potential NNN deal. Let's tackle some of the most common ones that syndicators and investors run into.

Are All NNN Leases The Same?

Absolutely not, and this is a make-or-break detail. People throw around the term "NNN lease" as a catch-all, but the only thing that matters is what's written in the lease agreement itself.

Think of an Absolute NNN lease as the holy grail of passive ownership—the tenant pays for everything, right down to the structural components. But most of what you'll see are standard triple net leases where the landlord is still on the hook for major capital expenses like the roof or foundation. That's a huge difference that can ambush your returns if you aren't paying attention.

Always get your hands on the actual lease and read it. A broker might sell you on a "hands-off NNN deal," but the fine print could reveal landlord duties that completely change your financial model and net operating income.

Who Pays for Structural Repairs?

This is probably the biggest gray area in NNN leases. In a true Absolute NNN lease, the tenant handles all structural work—we're talking roof, foundation, the whole nine yards. In your more typical triple net lease, those big-ticket items fall squarely on the landlord's shoulders.

The difference for underwriting is night and day. A deal where you might have to fork over $200,000 for a new roof in five years is a totally different ballgame than one where the tenant bears that cost.

What Happens if a Triple Net Tenant Goes Bankrupt?

This is the number one risk in any single-tenant NNN investment, period. If your tenant goes belly-up and leaves, your cash flow instantly dries up. Your occupancy plummets from 100% to 0% in the blink of an eye, but your mortgage lender still expects their check every month.

When that happens, you have a couple of tough choices:

* Find a new tenant: This takes time and money, and it can be especially challenging if the building was purpose-built for the previous occupant.

* Sell the building: Trying to sell a vacant commercial property is a tough road. You're almost always looking at a steep discount to move it.

This is precisely why you can't skimp on tenant due diligence. A lease is only as valuable as the company backing it, which makes a deep dive into their financial health the bedrock of any sound NNN investment.

Ready to streamline your next real estate syndication? Homebase is the all-in-one platform designed to simplify fundraising, investor relations, and deal management. See how you can focus on closing more capital, not chasing signatures, by visiting https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Definition of Repositioning: definition of repositioning in investing

Blog

Learn the definition of repositioning in multifamily real estate with practical strategies, models, and risk insights to boost profits.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.