KYC and KYB A Guide for Real Estate Syndicators

KYC and KYB A Guide for Real Estate Syndicators

Master KYC and KYB in real estate syndication. Our guide explains the processes, benefits, and compliance steps to secure your investments and build trust.

Domingo Valadez

Sep 19, 2025

Blog

When you boil it down, the difference between KYC (Know Your Customer) and KYB (Know Your Business) is pretty simple: you're either verifying a person or a company.

Think of KYC as the essential background check on an individual who wants to invest in your deal. On the other hand, KYB is the much deeper dive you take when an entity—like an LLC or a family trust—is the investor. In that case, you need to understand who really owns and controls it. Both are absolutely critical for running a secure and legitimate real estate syndication.

What Are KYC and KYB in Real Estate Syndication?

For syndicators, KYC and KYB are more than just industry jargon; they're your fundamental risk management toolkit. These are the steps you take to confirm your investors are exactly who they say they are, whether they're individuals writing a personal check or a complex business entity. Don't see them as just another administrative task—they are your primary shield against fraud, money laundering, and other financial crimes.

Let's use a familiar analogy. Say you're leasing apartments. The process of screening a tenant—checking their ID, verifying their income, running a background check—is a lot like KYC. It’s direct, person-focused, and ensures you know who is living in your building.

Now, imagine you’re leasing a massive commercial space to a large corporation. You wouldn't just shake the CEO's hand and call it a day. You'd vet the entire business. That's KYB. You’d dig into the company’s registration, map out its ownership structure, and pinpoint the key people who actually profit from it. These individuals are known as the Ultimate Beneficial Owners (UBOs), and identifying them is crucial to knowing who you're truly doing business with.

To make this crystal clear, let's break down the key differences in a simple table.

KYC vs KYB At a Glance

This table offers a quick comparison, showing what you're looking at when verifying an individual investor versus a business entity in your syndication.

Essentially, while KYC is about verifying a single person's identity, KYB is about peeling back the layers of a corporate onion to see who is really inside.

The Core Distinction for Syndicators

In the world of real estate syndication, this distinction is everything. Your capital might come from high-net-worth individuals, but it's just as likely to come from family trusts, partnerships, or LLCs set up specifically for investing. Each requires a different approach.

- KYC is for the individual. It’s about collecting and validating personal details, like a driver's license and a utility bill.

- KYB is for the business. This means digging into corporate filings, identifying the UBOs, and making sure the business is legitimate—not just a shell company designed to hide something.

At the end of the day, both KYC and KYB serve the same ultimate purpose: to build a secure, transparent, and compliant investment environment. By properly vetting every single participant, you protect your deal, your reputation, and every other investor who has placed their trust in you.

Why Compliance Is Non-Negotiable for Syndicators

If you're a real estate syndicator, it's tempting to see KYC and KYB as just another administrative hoop to jump through. That’s a massive mistake. These processes aren't just suggestions or industry best practices—they are hard-and-fast requirements rooted in federal law, designed to keep the entire financial system clean.

Think of them as the essential guardrails for your business. They keep you, your investors, and your deals on a safe and legal track.

This all comes down to two major pieces of legislation: the Bank Secrecy Act (BSA) and the USA PATRIOT Act. The names might make you think they only apply to Wall Street banks, but their scope is far wider. Anyone who handles significant amounts of capital, including real estate syndicators, falls under their purview. Their mission is simple: to stop money laundering and prevent funds from flowing to criminal or terrorist organizations.

At the end of the day, these laws mean you have to be able to prove you know exactly who is investing in your deals. That's why thorough KYC and KYB diligence isn't optional. It’s a legal duty to make sure the money coming into your syndication is legitimate.

The Real-World Consequences of Cutting Corners

What happens if you don't take this seriously? The fallout isn't just a minor slap on the wrist; it can be catastrophic for your business and your career.

Syndicators who fail to do their homework on investors can face some truly grim outcomes:

- Crippling Fines: We're not talking about small penalties. Financial fines can soar into the millions of dollars, enough to completely wipe out a syndication business.

- Reputation in Tatters: Word gets around fast when a syndicator gets hit with regulatory violations. The trust you've worked so hard to build with investors can evaporate overnight, making it next to impossible to raise capital for future projects.

- Serious Legal Trouble: In the most severe cases, non-compliance can escalate to criminal charges. This puts your personal assets and even your freedom on the line.

The bottom line is this: a rock-solid verification process is one of the foundational pillars of a successful syndication business. It’s what protects you from legal disasters, keeps your investors safe, and ensures your operation has a future.

More Than a Burden—A Business Advantage

Instead of seeing compliance as a burden, flip the script. Treat it as a strategic advantage that builds incredible trust with the right kind of investors. When a sophisticated partner sees that you have a professional, buttoned-up process for KYC and KYB, it sends a powerful signal. It tells them you’re a serious operator who runs a tight ship.

This confidence not only makes them more likely to invest in the first place but also turns them into repeat partners for your future deals.

The industry is clearly moving in this direction. The global market for KYC software was valued at USD 1.48 billion and is projected to explode to USD 16.01 billion by 2033. This isn't just a trend; it's a fundamental shift toward better, more reliable verification tools.

Knowing why compliance matters is half the battle; the other half is having the right tools. Exploring top compliance management solutions can help you turn this legal necessity into one of your greatest business strengths.

Your Step-by-Step Guide to the KYC Process

A solid KYC (Know Your Customer) process isn't just a box to check; it’s your roadmap for verifying individual investors without scaring them away with a mountain of paperwork. Think of it as a methodical way to confirm who an investor is and get a feel for their risk profile before they commit to your deal. The real goal here is a smooth, professional onboarding that builds trust right from the start while keeping the regulators happy.

At the heart of this entire process is what’s officially known as a Customer Identification Program (CIP). This is simply the series of steps you take to be reasonably certain your investors are who they say they are. A strong CIP is your first line of defense against fraud and is absolutely non-negotiable.

Stage 1: Data Collection and Verification

The first move is always to gather the essential details from your potential investor. But this isn't just about collecting information—it’s about proving it's real.

- Collect Identifying Information: This is the baseline stuff the law requires. You'll need the investor’s full legal name, date of birth, residential address, and an identification number, which for U.S. investors is typically their Social Security Number.

- Verify Identity Documents: Next, you have to back that information up with a reliable, independent source. This usually means getting a clear, unexpired copy of a government-issued photo ID, like a driver's license or passport. Many modern platforms can handle this for you, using tech to quickly confirm the document is legitimate.

- Cross-Reference and Screen: Finally, you run the investor’s information against several official watchlists. These checks include sanction lists (like the one from OFAC) and lists of Politically Exposed Persons (PEPs). This is a critical step to make sure you aren’t accidentally getting into business with someone linked to illegal activities.

A slick verification process does more than just keep you compliant. It's a huge part of the investor experience. If this stage is full of delays and confusing requests, you risk investors walking away before you even get a chance to close the deal.

Stage 2: Risk Assessment and Due Diligence

Once you’ve confirmed an investor's identity, you need to figure out how much risk they might represent. Not every investor is the same, so your level of scrutiny shouldn't be either. This is where your due diligence should adapt to the situation.

This brings us to two key ideas: Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD).

- Standard Customer Due Diligence (CDD): This is your default setting for the average investor. After the initial ID check, you'll just perform periodic check-ins to make sure their information is still accurate and their risk level hasn't changed.

- Enhanced Due Diligence (EDD): This is a much deeper dive reserved for investors who raise a few red flags. Someone might be considered high-risk if they are a PEP, are investing from a high-risk country, or have a convoluted source of funds. EDD means you dig much deeper into their background and where their money is coming from to head off any potential trouble.

By matching your diligence to the investor's specific risk level, you build a compliance system for your KYC and KYB obligations that is both smart and efficient.

Navigating the Complexities of KYB Verification

While verifying an individual is pretty straightforward, tackling Know Your Business (KYB) is a whole different ballgame. It's less like checking a driver's license and more like untangling a complex web of legal structures. You’re not just confirming one person's identity; you're mapping out an entire corporate family tree to find out who really calls the shots.

This is where you move past a simple ID check and into serious corporate due diligence. The mission is to peel back the layers of a legal entity—whether it's an LLC, a partnership, or a trust—to make sure it's legitimate, stable, and not just a smokescreen for shady activities.

Uncovering the Ultimate Beneficial Owners

The toughest part of any KYB check is digging down to the Ultimate Beneficial Owners (UBOs). These are the actual people who own, control, or profit from a company, even if their names aren't on the company website or the front door.

Imagine a family trust wants to invest $500,000 in your new multifamily deal. The trust itself is just a legal shell. Your job, under KYB rules, is to look inside that shell and identify every single person who has a major ownership stake (usually 25% or more) or significant control over its decisions.

It’s a multi-step process that feels a bit like detective work:

* Confirm Legal Status: First, you have to confirm the business is a real, registered entity that's in good standing with the state.

* Analyze Corporate Documents: This means getting your hands on articles of incorporation, partnership agreements, or trust documents to see how the ownership is structured on paper.

* Map the Ownership Chain: For more complicated setups, you might have to trace ownership up through various parent companies or holding entities until you finally get to the real human beings at the top.

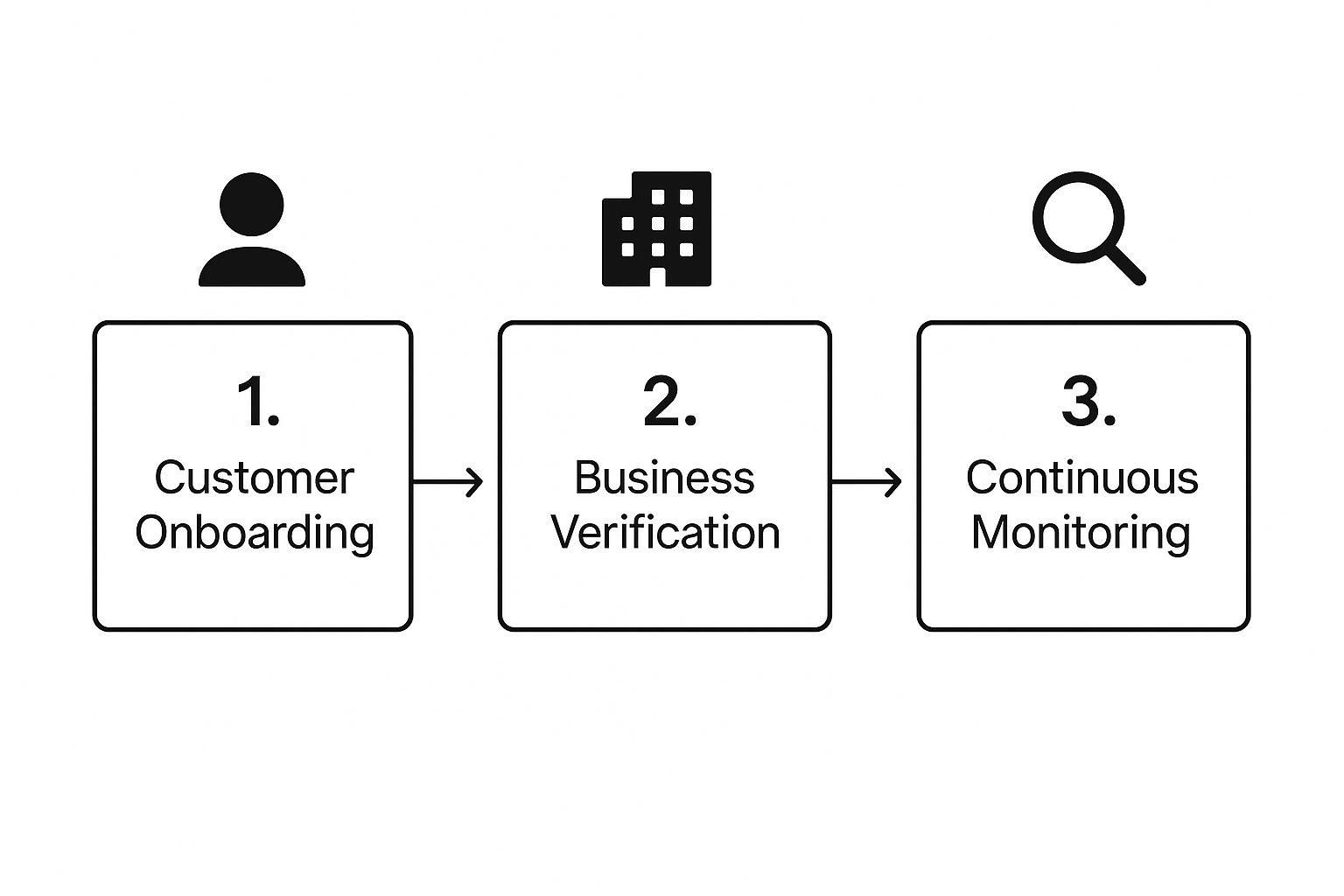

This infographic gives a good high-level look at the compliance workflow, from the moment you onboard an investor to ongoing monitoring.

As you can see, that initial check is just the beginning of a much larger, ongoing compliance effort.

Mitigating Risks Hidden in Plain Sight

So, why all this effort? Because complex, confusing corporate structures are the classic hiding spot for dirty money and high-risk individuals. A solid KYB process is your best defense against accidentally letting financial crime into your syndication.

Failing to identify UBOs isn't just a regulatory headache; it's a massive business risk. If you don't know who your partners truly are, you have no way of knowing what financial or reputational trouble they might bring to your deal.

There's a reason the financial industry is throwing so much money at this problem. Global spending on Anti-Money Laundering (AML) and KYC data services is expected to reach USD 2.9 billion. And compliance budgets have been growing at a rate of 22% year-over-year for the last five years. You can learn more about these compliance spending trends to see just how seriously the industry is taking this.

For a real estate syndicator, this all boils down to one thing: a strong KYB process isn't just about checking a box. It’s about building a foundation of trust and security for your business, ensuring that every dollar invested is clean and every partner is who they say they are. Getting both kyc and kyb right isn't optional; it's the bedrock of sustainable growth.

The Strategic Advantage of Seamless Compliance

It’s easy to look at KYC and KYB as just another regulatory hoop to jump through. But that’s a massive missed opportunity. For savvy real estate syndicators, treating compliance as a chore means you're leaving a powerful business asset on the table.

Think about it from an investor’s perspective. When a sophisticated investor considers your deal, one of the first things they’ll notice is your process. A clunky, disorganized onboarding experience is a red flag. It quietly suggests your entire operation might be amateurish.

On the other hand, a smooth, secure, and professional verification workflow tells them you’re a serious operator who respects their time and takes security seriously. It builds instant credibility before they've even signed a single document.

Building Trust and Reducing Friction

A frictionless onboarding process is absolutely critical for turning an interested prospect into a funded partner. Every confusing request or unnecessary delay is another chance for that investor to get frustrated and walk away. A tight, efficient system gets their capital into your deal faster.

That first impression sticks. When you prove you run a tight ship from day one, you build a foundation of trust that pays dividends for the life of the syndication. It not only helps you close the current deal but also makes it far easier to attract those same investors for your next project.

The real value of seamless compliance lies in its ability to transform a mandatory process into a tool for attraction and retention. It signals to high-quality investors that you are a reliable steward of their capital, making your deals inherently more appealing.

Protecting Your Capital and Reputation

Beyond simply looking good to investors, strong KYC and KYB processes are your first line of defense. Every partner you bring into a deal becomes part of the ecosystem. Failing to vet them properly puts your existing investors—and your own capital—at risk from individuals or entities involved in fraud or other illicit activities.

This isn't just a hypothetical problem; it's a growing global concern. The market for KYC services, covering both individuals and businesses, was valued at USD 6.73 billion and is expected to hit USD 14.39 billion by 2030. That explosion in growth, detailed in this in-depth market analysis on MordorIntelligence.com, shows just how seriously the world is taking verification.

One bad actor can cause serious reputational damage or catastrophic financial loss. By using the right tools to automate these checks, you create a secure and scalable operation. For a closer look at what's available, check out our guide on KYC verification software. Ultimately, robust compliance makes your entire syndication a safer, more attractive place for long-term growth.

Common Questions Syndicators Have About KYC and KYB

Even once you get the hang of the basics, applying KYC and KYB in the real world can bring up some tricky situations. Let's walk through a few of the most common questions we see from syndicators to help you navigate compliance with confidence.

What Specific Documents Do I Actually Need?

The paperwork you’ll need depends on whether you're vetting an individual or a business. Getting this part right is the bedrock of a solid, defensible compliance program.

For an individual investor (KYC), the list is pretty straightforward:

* Government-Issued Photo ID: A clear, unexpired copy of a driver’s license or passport is the standard here.

* Proof of Address: A recent utility bill, bank statement, or lease agreement usually does the trick.

* Identification Number: For U.S. investors, this is their Social Security Number. For others, it's a similar national ID number.

When a business invests (KYB), the checklist gets longer. You have to verify the entity itself and the people behind it:

* Business Formation Documents: This means getting copies of the articles of incorporation, partnership agreements, or trust documents that legally created the entity.

* Proof of Business Address: A utility bill or official mail in the company’s name works perfectly.

* Tax Identification Number: In the U.S., this is the company’s Employer Identification Number (EIN).

* UBO Information: You'll need all the individual KYC documents listed above for every Ultimate Beneficial Owner who meets the ownership threshold.

How Do I Handle Investors from Other Countries?

Vetting international investors definitely adds a few extra steps, but the core principles of KYC and KYB don’t change. The real challenge is navigating different types of identity documents and staying on top of global regulations.

First off, you’ll need to accept and verify foreign government-issued IDs, like national identity cards or passports. It's incredibly important to use a verification service that can authenticate documents from around the world—it’s the only reliable way to spot sophisticated forgeries.

You also have to screen international investors against global sanctions lists, not just the ones here at home. That means checking watchlists from organizations like the United Nations, the European Union, and the UK's Office of Financial Sanctions Implementation (OFSI), on top of the U.S. Treasury's OFAC list. This broader check ensures you don't accidentally get into business with someone from a sanctioned country or an individual flagged for global financial crime.

When you start accepting international capital, your due diligence has to go global, too. A purely domestic compliance mindset creates a massive blind spot, leaving you exposed to a complex web of international sanctions that could put your entire deal at risk.

Can I Use a Third-Party Tool for This?

Absolutely. In fact, trying to manage KYC and KYB by hand is a recipe for inefficiency and mistakes, especially as your syndication business scales. The pros rely on specialized software.

These platforms give you a few huge advantages:

1. Automated Document Verification: They can instantly analyze an ID to confirm it's authentic, catching fakes that would easily fool the human eye.

2. Instant Watchlist Screening: Good software can run an investor's name against dozens of global sanctions and PEP lists in seconds—a job that would take a person hours.

3. Simplified UBO Identification: For KYB, the best platforms can tap into corporate registries to help you map out complex ownership structures and pinpoint the key individuals you need to vet.

Using a trusted verification tool doesn't just save a ton of time; it creates a clean, auditable record of your due diligence. If a regulator ever comes knocking, you'll have a clear trail proving you did your job. It turns compliance from a manual headache into a professional, scalable system.

Ready to stop wrestling with spreadsheets and clunky compliance workflows? Homebase provides an all-in-one platform that simplifies investor verification, fundraising, and deal management. See how we can help you build a more professional and scalable syndication business at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Founder's Guide to Real Estate Partnership Agreements

Blog

Build airtight real estate partnership agreements. Our guide covers key clauses, LLC vs. LP structures, and negotiation tactics for successful syndications.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.