Joint Venture Partnerships: A Real Estate Sponsor's Guide

Joint Venture Partnerships: A Real Estate Sponsor's Guide

Explore how joint venture partnerships unlock real estate growth. Learn deal structures, roles, governance, and key agreements for profitable collaborations.

Domingo Valadez

Oct 24, 2025

Blog

At its core, a joint venture is simply a strategic partnership. It’s an arrangement where two or more separate parties agree to pool their resources to accomplish a specific goal. In real estate, this isn't a full-blown merger; the partners keep their own business identities but team up for a single development or investment.

What Exactly Is a Real Estate Joint Venture?

Think of it like this: you have two master builders. One is a brilliant architect with incredible construction skills, but no land and limited funds. The other owns a prime piece of real estate and has deep pockets but doesn't know the first thing about developing it. On their own, neither can build the skyscraper. But together? They can create something spectacular that was impossible for them to achieve individually.

This is the essence of a real estate joint venture. It’s about leveraging combined strengths—capital, expertise, connections—for a single, time-bound project. It's a temporary alliance, not a permanent corporate marriage. Each partner brings something vital to the table, whether it’s cash, market know-how, development experience, or operational muscle. In exchange, they all share in the project's risks and, hopefully, its rewards.

For a real estate sponsor, this model is one of the most powerful tools for scaling a business.

Scaling Ambitions Through Collaboration

Imagine a sponsor who has a great track record with small multifamily properties. They've found a fantastic opportunity to build a 100-unit apartment complex, but the project requires $5 million in equity—far more than they can raise on their own.

This is where a joint venture comes in. By partnering with a capital provider, like a family office or an institutional investor, the sponsor gets the funding they need to make the deal happen. The capital partner, in turn, gets to invest in a promising project with an experienced operator they trust. It’s a classic win-win.

This kind of synergy unlocks massive potential, allowing sponsors to:

- Enter New Markets: Team up with a local sharpshooter who knows the terrain, the politics, and the players in an unfamiliar city.

- Tackle Larger Projects: Gain access to the institutional-level capital required for bigger, more complex, and often more profitable developments.

- Share Financial Risk: Spread the financial exposure of a large project across multiple partners, making ambitious deals far less daunting.

A joint venture allows partners to achieve a specific strategic goal, like entering a new market or launching a new project, by creating a single legal entity where each party owns a share.

The power of this model really shines during uncertain times. In 2020, as the global economy faltered, traditional M&A deals took a nosedive, but joint venture activity actually increased by 6%. This shows just how resilient and valuable JVs are as a flexible strategy for growth, even when the market is shaky. You can dive deeper into these trends in the context of cross-border joint ventures.

How to Structure Your Joint Venture Partnership

Choosing the right legal framework for your joint venture is like picking the foundation for a skyscraper. It has to be strong enough to support the entire project and protect everyone involved. This single decision shapes everything from personal liability and tax obligations to who has the final say in big decisions. It’s absolutely critical to get this right from day one.

The good news? Most real estate deals stick to a few tried-and-true structures.

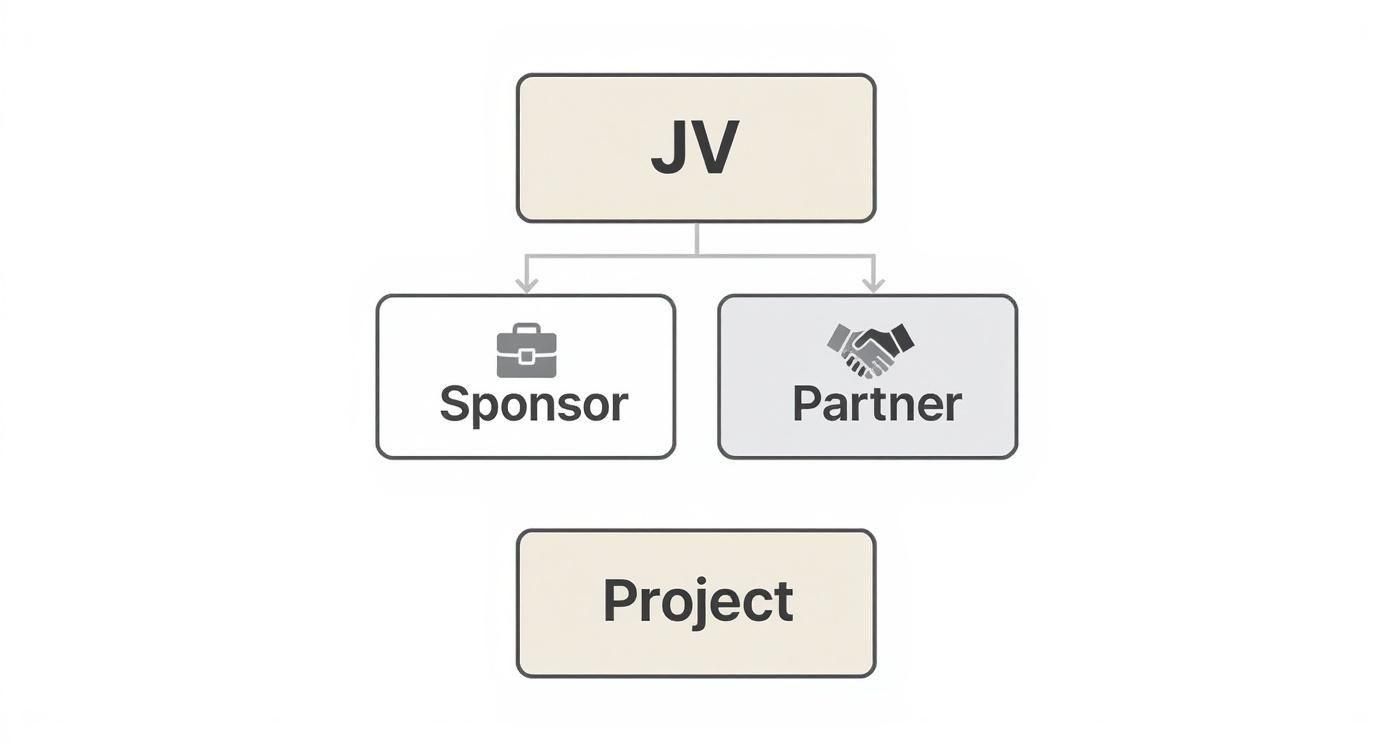

This diagram shows the classic setup. The sponsor and the capital partner come together to form a brand new, single-purpose entity that will own and operate the property.

This approach is smart because it legally isolates the project. It creates a clean box around the deal, shielding the partners' other assets and making everyone's roles crystal clear.

The Go-To Choice: The Limited Liability Company

For the vast majority of real estate JVs, the Limited Liability Company (LLC) is the undisputed champion. Think of it as the best of both worlds—it gives you the liability protection of a corporation but with the tax benefits and operational freedom of a partnership.

This structure is so popular for one main reason: it builds a legal firewall between the project's debts and your personal wealth. If the deal goes sideways, creditors can typically only pursue the assets inside that specific LLC, not your personal home or savings. Plus, LLCs offer pass-through taxation, which means profits and losses flow directly to the members, neatly avoiding the "double taxation" headache that corporations can face.

Other Structural Options

While the LLC is king, it's worth knowing about a couple of other options you might encounter. They offer different trade-offs in terms of protection and complexity that could make sense in specific scenarios.

- Corporation: This is the most formal and rigid option, often reserved for massive, institutional-grade ventures with a large pool of investors. A C-Corp or S-Corp provides ironclad liability protection but brings more regulatory hurdles and potential tax inefficiencies (especially for C-Corps).

- General Partnership: The simplest to form, sometimes with just a handshake or a basic agreement. But don't let the simplicity fool you—it offers zero liability protection. Each partner is personally on the hook for 100% of the partnership's debts. This makes it far too risky for almost any real estate transaction.

To help you see the differences side-by-side, here’s a quick comparison of how these three structures stack up against each other.

Comparing Joint Venture Legal Structures

As you can see, the LLC consistently hits the sweet spot for most real estate sponsors, balancing robust protection with operational ease.

Choosing the right entity is a foundational decision that impacts risk, taxes, and governance. While partnerships are simple, the LLC's blend of liability protection and tax flexibility makes it the industry standard for protecting sponsors and investors alike.

Ultimately, your goal is to match the legal structure to your project's scale, its risk profile, and the financial objectives of everyone at the table. This isn't a decision to make on your own—always bring in experienced legal and tax advisors to help you build a secure foundation for your venture.

Defining Roles for a Smooth Partnership

Every successful joint venture I’ve seen runs on one thing above all else: clarity. Without a rock-solid understanding of who does what, even the most promising real estate deals can fall apart, bogged down by confusion and conflict.

It's a bit like building a house. You need an architect to draw up the blueprints and a general contractor to bring them to life. If they both start grabbing hammers and trying to frame walls without a clear plan, you're not getting a house—you're getting a disaster. The same goes for a real estate JV.

The Operating Partner: The Sponsor

This is your "boots on the ground" expert, the person often called the sponsor or the general partner. They are the active force behind the project, taking charge of the day-to-day work to make sure the business plan actually happens. Their expertise is what transforms a pile of investor capital into a profitable, well-run asset.

Let’s say you’re building a new apartment complex. The sponsor is the one doing the heavy lifting:

- Acquisition: They're the ones who find the deal, kick the tires during due diligence, and negotiate the purchase.

- Entitlements: They navigate the maze of city hall to get all the right permits, zoning changes, and legal approvals.

- Execution: They manage the architects, oversee the construction crews, and direct the property management team once it's built.

- Reporting: They keep the money partner in the loop with regular, transparent updates on how things are going.

The sponsor is the engine of the project, plain and simple. We cover this role in-depth in our guide to understanding what a general partner in our detailed guide.

The Capital Partner: The Investor

On the other side of the table, you have the capital partner. Think of them as the financial fuel for the project. They provide the lion's share of the equity needed to buy the land and build the property. While they are absolutely essential, their role is typically more hands-off.

Their focus is on oversight, not on swinging a hammer. Their responsibilities usually boil down to:

- Funding: Supplying the cash as it's needed at different stages of the project.

- Major Decisions: Weighing in and giving the final "yes" or "no" on big-ticket items, like a major budget change or a decision to sell.

- Monitoring: Keeping an eye on the sponsor’s performance and making sure the project is tracking against its financial projections.

The sponsor steers the ship, but the capital partner charts the course and makes sure there's enough fuel for the journey. They put their trust in the sponsor's operational skill but hold onto the right to veto critical strategic moves.

At the end of the day, spelling all of this out in the joint venture agreement isn't just a good idea—it's non-negotiable. This written clarity keeps everyone in their own lane and ensures the partnership moves forward smoothly toward its common goal.

Getting the Fine Print Right: Key Terms in Your JV Agreement

A joint venture agreement is far more than a legal formality. Think of it as the operational playbook for your entire partnership. This is where you move from friendly handshakes to the nitty-gritty, legally-binding rules that will dictate how the project runs, from day one until the final sale.

A thoughtfully drafted agreement doesn't just set the terms; it anticipates future friction points and lays out a clear roadmap for resolving them. It’s all about protecting everyone involved.

Essentially, this document becomes the project’s constitution. It defines everyone's rights, spells out responsibilities, and most importantly, dictates how the money flows. Nailing these key terms from the outset is the single best thing you can do to prevent disputes and keep the venture on track.

Capital Contributions and Funding

This is where it all begins. This section of the agreement needs to be crystal clear about who is putting in what, and when. And it’s not just about the initial cash needed to close the deal; a good agreement always plans for future financial needs.

A solid funding clause will specify:

* Initial Contributions: The exact dollar amount each partner commits to the project at closing. No ambiguity allowed.

* Capital Calls: The process for bringing in more money if the project hits a snag or goes over budget. This part should detail everything—how much notice is required, the deadline for funding, and what happens if a partner can't or won't meet the call.

You simply can’t afford to be vague here. Fuzzy language around funding obligations is a classic recipe for conflict that can blow up a deal when you can least afford it.

Profit Distributions and Waterfalls

This is usually the most intensely negotiated part of the entire agreement, and for good reason—it’s about how everyone gets paid. A distribution waterfall is a tiered system that dictates the order and priority of how cash flow and profits are paid out. It's almost never a simple 50/50 split. Instead, it's designed to reward partners based on the risk they took and the project's overall success.

A common waterfall structure works like this: first, the capital partner gets their initial investment back. Next, they receive a "preferred return," which is a predetermined minimum annual return on their money. Only after those hurdles are met are the remaining profits split with the sponsor. This model works because it aligns everyone's interests—the investor gets their capital protected, and the sponsor is incentivized to hit it out of the park.

Governance and Major Decisions

So, who calls the shots? The governance section clarifies decision-making power. While the sponsor is in charge of the day-to-day grind, the capital partner will absolutely want a say in what are known as "major decisions."

These are the big, project-altering choices that typically require both partners to agree. They often include:

* Selling or refinancing the property.

* Approving the annual budget or any significant deviation from it.

* Selecting key players like the general contractor or property management firm.

* Making any substantial changes to the original business plan.

Defining these triggers up front is a win-win. It keeps the sponsor from feeling micromanaged while giving the capital partner the assurance that their investment is safe from any sudden solo moves.

Exit Strategies and Deadlines

Every partnership needs a planned finale. The exit strategy clause maps out the conditions for dissolving the joint venture and selling the asset. This section should set a target hold period and, crucially, include a mechanism for breaking a stalemate if partners can't agree on when to sell.

A common tool for this is a Buy-Sell clause. This provision gives one partner a structured way to buy out the other in the event of a deadlock, ensuring there's always a path forward.

Ultimately, hashing out these terms reflects how sophisticated strategic partnerships have become. A recent report analyzing over 5,000 programs found that 73% of businesses now tie their partnership goals directly to their long-term corporate strategy. They see them as powerful engines for growth. You can learn more about how leading firms are generating growth through partnerships on Bridge.partners.

Weighing the Pros and Cons of Joint Ventures

Let’s be honest: no business strategy is a magic bullet, and joint venture partnerships are certainly no exception. While they can unlock some truly incredible opportunities for growth, they also bring their own set of complexities and risks to the table.

Going into a potential JV means having a clear-eyed view of both the powerful advantages it offers and the pitfalls that could easily derail the project. A successful partnership is all about maximizing the good stuff while getting ahead of the challenges right from the start.

This balanced perspective is key. It's what allows you to structure an agreement that plays to everyone's strengths and builds in safeguards against the most common points of friction.

The Upside: Access and Shared Burdens

The biggest draw of a joint venture is simple: it lets you do things you couldn’t possibly do on your own. By pooling resources, sponsors can punch way above their individual weight class, opening the door to a whole new tier of projects.

The main advantages usually boil down to a few core things:

- Access to Capital: This is often the big one. A partnership can bring in the millions in equity you need to acquire a larger asset or fund a major development—projects that would otherwise be completely out of reach.

- New Markets and Expertise: Want to break into a new city? Teaming up with a local expert is the fastest, most effective way to do it. Your partner brings the street-level knowledge and relationships, while you bring the deal structure and operational know-how.

- Risk Mitigation: Spreading the financial risk across multiple parties just makes bigger, more ambitious projects feel more manageable. Instead of one sponsor shouldering 100% of the potential downside, the burden is shared. That alone can make it easier to secure financing and, frankly, sleep better at night.

The Downside: Misalignment and Conflict

While the benefits are compelling, the risks are just as real. A partnership, by definition, brings together different people, companies, and cultures. That can be fertile ground for disagreement if you’re not careful. Knowing what to watch for is the first step in preventing these issues from blowing up.

The single biggest risk in any joint venture is a fundamental misalignment of goals. If one partner is focused on long-term cash flow and the other wants a quick, profitable flip, conflict isn't a matter of if, but when.

Here are some common challenges you should anticipate:

- Differing Objectives: It's common for partners to have conflicting timelines, appetites for risk, or even different visions for the property.

- Control Disputes: Disagreements over major decisions—like when to sell or how much to spend on renovations—can lead to total gridlock, paralyzing the project.

- Unequal Contributions: If one partner feels like they're pulling all the weight, resentment can build up fast and poison the relationship.

- Complex Exits: Getting out of a partnership can be messy and contentious without a clear, pre-defined exit strategy baked into the JV agreement from day one.

Best Practices for a Successful Partnership

Great joint venture partnerships don’t happen by accident. They're the result of serious planning, open communication, and an agreement that's built to last. The foundation for a strong partnership is laid long before anyone signs on the dotted line, starting with due diligence that digs much deeper than a balance sheet.

You have to really investigate a potential partner’s reputation, their history of success (and failure), and whether your values and work styles actually mesh. Think of it like hiring a C-suite executive—you wouldn’t just glance at their resume. You’d interview them multiple times, check every reference, and get a feel for their character. A partner with deep pockets but a reputation for being difficult can sink a project faster than a lack of capital.

Establish Crystal Clear Communication

Once you’ve joined forces, communication becomes the oxygen that keeps the venture alive. Most disagreements don’t stem from bad intentions; they come from unspoken assumptions and a lack of clarity. That’s why you need to set up a communication plan from day one to keep everyone on the same page and solve problems before they blow up.

This plan should spell out:

* Meeting Cadence: How often will you formally connect? Set a schedule for weekly, bi-weekly, or monthly meetings to review progress and hash out issues.

* Reporting Standards: What do reports look like, and when are they due? Define the format for financial and operational updates so there are no surprises.

* Decision-Making Channels: Who answers day-to-day questions? How are major, strategic decisions escalated and approved?

A partnership without a communication plan is like a construction project without blueprints. Everyone might be working hard, but they’re not building the same thing. The result is almost always costly mistakes and frustrating delays.

Build a Bulletproof Agreement

At the end of the day, your joint venture agreement is your most critical safeguard. It needs to be thorough, clear, and legally airtight. While a handshake is a nice symbol of trust, a detailed contract is what ensures that trust survives when things get complicated.

For sponsors looking to bring more efficiency to their operations, learning about optimizing investment partnership management can provide a real edge. The right tools can help maintain the transparency and organization that complex deals demand.

Ultimately, your agreement should serve as a practical roadmap for the entire lifecycle of the project, from the first capital call to the final exit. This is what creates a truly strong foundation for a profitable and lasting partnership.

Common Questions About Joint Ventures

Even when you’ve got the basics down, a few nagging questions always seem to surface when it's time to get serious about a joint venture partnership. Getting straight answers to these common sticking points can be the difference between moving forward with confidence and getting stuck in analysis paralysis.

Let's tackle a few of the questions we hear most often from real estate sponsors.

What Is the Most Common Reason Joint Ventures Fail?

Nine times out of ten, a joint venture fails because of a misalignment of objectives. It sounds simple, but this is the root of almost every partnership disaster, and it's usually compounded by poor communication. The problem almost always begins with a vague joint venture agreement that leaves too much room for interpretation.

Think about it: if the sponsor is playing the long game for steady cash flow, but the capital partner is laser-focused on a quick flip in three years, their goals are fundamentally at odds. When a market shift forces a tough decision, that core conflict will erupt. Without a crystal-clear process for resolving disputes baked into the agreement, these disagreements can stall a project indefinitely.

How Are Profits Typically Split in a Real Estate JV?

Forget a simple 50/50 split; that's almost never how it works in the real world. Instead, profits flow through a structure called a distribution waterfall. This is a tiered system designed to pay back capital first and then reward each partner based on the risk they took and the project's performance.

A typical waterfall structure might look something like this:

1. Return of Capital: First, all available cash flow goes to the capital partner until they’ve gotten 100% of their initial investment back.

2. Preferred Return: After that, the capital partner gets their "pref," which is a predetermined annual return on their money (say, 8%). This is their reward for putting up the cash.

3. Profit Split: Only after those first two hurdles are cleared do the remaining profits get divided. This final split is negotiated upfront and often favors the sponsor as a reward for their sweat equity and successful management.

Can I Enter a Joint Venture with Multiple Partners?

Absolutely. Multi-partner JVs are common, especially on larger, more ambitious deals that need a blend of capital sources and specialized skills. You might see a big development project bring together a sponsor, a primary institutional equity partner, and a construction expert, all under one JV umbrella.

But be warned: every partner you add to the deal multiplies the complexity.

With every new partner at the table, the need for an exceptionally detailed and clear joint venture agreement grows exponentially. You have to nail down the exact roles, responsibilities, capital contributions, and voting rights for each party. Leaving any of this ambiguous is a recipe for disaster.

Juggling the fundraising, investor communications, and legal paperwork for a joint venture can feel like a full-time job in itself. Homebase is an all-in-one platform built to take that work off your plate. We give you professional deal rooms, secure e-signatures for legal docs, and automated investor updates and distributions. We handle the administrative headaches so you can focus on what you do best—finding and closing great deals.

See how Homebase can streamline your next venture at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.